Professional Documents

Culture Documents

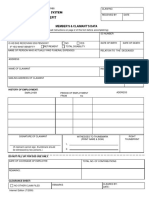

Retail Accounts - Checklist of Requirements For Pag-IBIG Housing Loan (COR, HQP-HLF-067, V03)

Uploaded by

johnghie0 ratings0% found this document useful (0 votes)

564 views2 pagesCHECKLIST OF PAG-IBIG HOUSING LOANS

Original Title

Retail Accounts - Checklist of Requirements for Pag-IBIG Housing Loan (COR, HQP-HLF-067, V03)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCHECKLIST OF PAG-IBIG HOUSING LOANS

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

564 views2 pagesRetail Accounts - Checklist of Requirements For Pag-IBIG Housing Loan (COR, HQP-HLF-067, V03)

Uploaded by

johnghieCHECKLIST OF PAG-IBIG HOUSING LOANS

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

PL/AL - Purchase of Lot or Adjoining Lots CH - Construction of House

PRU - Purchase of Residential Unit, Townhouse or

Condominium Unit inclusive of a parking slot

HI - Home Improvement

PLCH - Purchase of Lot and Construction of House R - Refinancing

CHECKLIST OF REQUIREMENTS FOR Pag-IBIG HOUSING LOAN

(Retail Accounts)

I. DOCUMENTS REQUIRED UPON LOAN APPLICATION

1. Housing Loan Application (2 copies) with recent ID photos of borrower

2. Membership Status Verification Slip (MSVS)

3. Income Documents:

For Locally Employed, any of the following:

a. Notarized Certificate of Employment and Compensation (Employers format) and for government employees

one (1) month payslip, within 3 months prior to date of loan application

b. Latest Income Tax Return (ITR) for the year immediately preceding the date of loan application, with

attached W2 form, stamped received by the BIR/Certificate of Tax Withheld (BIR Form No. 2316)

For Self Employed/Other Sources of Income, any of the following:

c. ITR, Audited Financial Statements, and Official Receipt of tax payment from bank supported with DTI

Registration and Mayors Permit/Business Permit

d. Commission Vouchers reflecting the issuers name and contact details (for the last 12 months)

e. Bank Statements or passbook for the last 12 months (in case income is sourced from foreign remittances,

pensions, etc.)

f. Copy of Lease Contract and Tax Declaration (if income is derived from rental payments)

g. Certified True Copy of Transport Franchise issued by appropriate government agency (LGU for tricycles,

LTFRB for other Public Utility Vehicle or PUVs)

h. Certificate of Engagement issued by owner of business

i. Other document that would validate source of income

For Overseas Filipino Workers (OFW), any of the following:

j. Employment Contract (with English translation if in foreign language)

k. Original Employers Certificate of Income (with English translation if in foreign language). If document

submitted is photocopy, it shall be duly certified/initialed by Pag-IBIG Fund Information Officer assigned in

the country where the member works.

l. Other Proofs of Income, whether original or photocopy, shall be duly certified/initialed by Pag-IBIG Fund

Information Officer assigned in the country where the member works.

4. Photocopy (back-to-back) of one (1) valid primary ID of Principal Borrower and Spouse, Co-Borrower and

Spouse, Seller and Spouse and Developers Authorized Representative and Attorney-In-Fact, if applicable.

5. Authorization to Conduct/Credit Background Investigation

6. For OFW members, Special Power of Attorney notarized prior to date of departure or duly certified and

authenticated by the Philippine Embassy or Consulate in the country where the member is staying, if abroad. If

SPA is without the red ribbon of Consulate Office, the SPA must have a duly stamped notarial seal.

7. Insurance Coverage

a. Health Statement Form (Medical Questionnaire)

OFW members over 60 years old

Loans over P2.0 M to P6.0 M and for borrowers aged up to 60 years old

b. Health Statement Form (Medical Questionnaire) and Full Medical Examination

Borrowers over 60 years old

8. Marriage Contract (For all married borrower/s, co-borrower/s, spouse, family member/s included on the

computation of aggregate income)

9. Birth Certificate or any proof of relationship, if with co-borrower/s or family member/s included on the

computation of aggregate income

10. Certified True Copy of Transfer Certificate of Title (TCT) (latest title)

11. For Condominium Unit, Certified True Copy of present TCT and CCT

12. Photocopy of Updated Tax Declaration and Updated Real Estate Tax Receipt

13. Location Plan and Vicinity Map

14. For new member or member with less than the required number of contributions, photocopy of Pag-IBIG Fund

Receipt (PFR) representing lump sum payment of contributions.

15. Approved letter request to re-avail of a Pag-IBIG housing loan (for member/s with housing loan that was

foreclosed, cancelled, bought back due to default or subjected to dacion en pago).

ADDITIONAL REQUIREMENTS DEPENDING ON

LOAN PURPOSE

PL/AL PRU PLCH CH HI R

1. Building Plans, Specification and Bill of Materials duly

signed by the Licensed Civil Engineer or Architect,

Building Permit

2. Contract to Sell or similar agreement between the buyer

and seller. If the Seller is a Developer, submits the

following documents

a. Certificate of Registration, License to Sell, Development

Permit, and Secretarys Certificate

b. Photocopy of back to back valid primary ID from

Corporate Secretary

3. Statement of Account on outstanding loan balance,

indicating loan purpose

4. Any of the following documents:

a. Official Receipt for the past 12 months

b. Subsidiary Ledger

c. Any valid proof of payment for the past 12 months

X

x

x

x

x

x

x

x

x

x

x x

x

x

LEGEND:

HQP-HLF-067

(Revised/ August 2012)

II. DOCUMENTS REQUIRED PRIOR TO LOAN RELEASE

1. TCT/CCT in the name of the borrower/co-borrower/s (if applicable) with proper mortgage annotation in favor of

Pag-IBIG Fund (Owners Duplicate Copy)

2. Certified true copy of TCT/CCT in the name of the borrower/co-borrower/s (if applicable) with proper mortgage

annotation in favor of Pag-IBIG Fund (RDs copy)

3. For properties that are subject of an heirs lien under Section 4 Rule 74 of the Rules of Court, surety bond (not an

heirs bond) that shall answer for the payment of the outstanding loan obligation still due to the Fund in the event

that another person including an heir of the registered owner would lay a claim against the property offered as

security

4. Photocopy of New Tax Declaration and Updated Real Estate Tax Receipt in the name of borrower and

co-borrower, if applicable

5. Loan Mortgage Documents

a. Loan and Mortgage Agreement duly registered with Registry of Deeds with original RD stamp

b. Deed of Absolute Sale duly registered with Registry of Deeds with original RD stamp (for PL, PLCH and

PRU)

c. Duly accomplished/notarized Promissory Note

d. Disclosure Statement on Loan Transaction

6. Building Plans/Electrical/Sanitary Permits duly approved by the building officials (for PLCH, CH and HI)

7. Occupancy Permit (for PRU (new), PLCH, CH and HI)

8. Collection Servicing Agreement with Authority to Deduct Loan Amortization or Post Dated Checks, if applicable

9. Proof of Billing Address

The Pag-IBIG Fund reserves the right to request additional documents to facilitate loan evaluation process.

You might also like

- CHECKLIST OF REQUIREMENTS NHA and PagIBIG MTO REVISEDDocument4 pagesCHECKLIST OF REQUIREMENTS NHA and PagIBIG MTO REVISEDrichardNo ratings yet

- POEA Standard Employment Contract For Various Skills FilledDocument3 pagesPOEA Standard Employment Contract For Various Skills FilledMarc Adrian Padillo0% (1)

- MOA Draft InternalDocument2 pagesMOA Draft InternalCarlo Ibrahim MaderazoNo ratings yet

- Downloadable Forms - Reqs of Substitution - Waiver of RightsDocument1 pageDownloadable Forms - Reqs of Substitution - Waiver of Rightsembies100% (1)

- Subscriber Request Form 2019Document1 pageSubscriber Request Form 2019john kingNo ratings yet

- Conditional Contract Land SaleDocument3 pagesConditional Contract Land SaleAnastacio VergaraNo ratings yet

- Pag-IBIG Fund Revised GuidelinesDocument8 pagesPag-IBIG Fund Revised GuidelinesjoNo ratings yet

- SSS R3 Contribution Collection List in Excel FormatDocument2 pagesSSS R3 Contribution Collection List in Excel FormatChristopher Daniels0% (2)

- GAP-F01 PhilGAPDocument2 pagesGAP-F01 PhilGAPAngelitoNo ratings yet

- Mortgage Commitment LetterDocument3 pagesMortgage Commitment Letterolboy92No ratings yet

- Traditional Life PlanDocument2 pagesTraditional Life PlanGladys EreveNo ratings yet

- Advance Receipt BlankDocument1 pageAdvance Receipt BlankRajesh VermaNo ratings yet

- CERTIFICATION OF LIST OF EMPLOYEES - v1Document1 pageCERTIFICATION OF LIST OF EMPLOYEES - v1Mary Divina FranciscoNo ratings yet

- Contract To Sell1Document1 pageContract To Sell1Maria Jessica DemataNo ratings yet

- 2022 Authority To Sell Amended Between Seller AgentsDocument2 pages2022 Authority To Sell Amended Between Seller Agentsxelasisa1963No ratings yet

- Real Estate ContractDocument3 pagesReal Estate Contractjodine bongcawilNo ratings yet

- Busla 1Document13 pagesBusla 1Just Jhex100% (1)

- PAL Holdings Annual Report Provides Business OverviewDocument126 pagesPAL Holdings Annual Report Provides Business OverviewLian Blakely CousinNo ratings yet

- POEA Standard Employment Contract For Various SkillsDocument3 pagesPOEA Standard Employment Contract For Various SkillsMarc Adrian Padillo100% (1)

- Lbac Form 2021Document14 pagesLbac Form 2021Zyreen Kate CataquisNo ratings yet

- Deed of Absolute SaleDocument2 pagesDeed of Absolute SalegilbertNo ratings yet

- Documentation of OwnershipDocument12 pagesDocumentation of OwnershipventuristaNo ratings yet

- Broker Accreditation ContractDocument2 pagesBroker Accreditation ContractMiriam RamirezNo ratings yet

- Funeral bpn-103 PDFDocument2 pagesFuneral bpn-103 PDFHazel SabadlabNo ratings yet

- Sales Agent and BrokerDocument5 pagesSales Agent and BrokervylletteNo ratings yet

- Selling Price P 700.00 Per Square Meter OnlyDocument1 pageSelling Price P 700.00 Per Square Meter OnlyUNEXPECTED100% (1)

- Contract to Sell PropertyDocument7 pagesContract to Sell PropertyPanyang Bianca Perlado - MascariñasNo ratings yet

- Broker Agent Agreement TemplateDocument1 pageBroker Agent Agreement Templatecandie marangaNo ratings yet

- ALVEO CHECKLIST - Indiv LocalDocument1 pageALVEO CHECKLIST - Indiv LocalLiv ValdezNo ratings yet

- Property Return Slip: Lgu Form No. 12Document3 pagesProperty Return Slip: Lgu Form No. 12ma. vidiaNo ratings yet

- Authority To Sell PropertyDocument2 pagesAuthority To Sell PropertyDivine Angel CabralesNo ratings yet

- Real Estate Contract SaleDocument4 pagesReal Estate Contract SaleSwanie Tijamo100% (1)

- MC 54 PDFDocument6 pagesMC 54 PDFMarvis Garcia DellosaNo ratings yet

- DOAS - Sps. Albert Del Mundo and Angelita Del Mundo (T-222781)Document4 pagesDOAS - Sps. Albert Del Mundo and Angelita Del Mundo (T-222781)jurispazNo ratings yet

- Deed of Absolute Sale for Property in Talisay City, CebuDocument2 pagesDeed of Absolute Sale for Property in Talisay City, CebuLDNo ratings yet

- HOA Board Candidate CertificateDocument2 pagesHOA Board Candidate CertificateJohn Chezter V. CarlitNo ratings yet

- MOA - Grandland Tungkop Minglanilla - v4Document3 pagesMOA - Grandland Tungkop Minglanilla - v4carlgerNo ratings yet

- Streamer Talent Management ContractDocument9 pagesStreamer Talent Management ContractAngelo Harvey TipaneroNo ratings yet

- Acknowledgement ReceiptDocument1 pageAcknowledgement ReceiptReyshanne Joy B MarquezNo ratings yet

- Memorandum of AgreementDocument2 pagesMemorandum of AgreementPaolo HechanovaNo ratings yet

- Online Auction Scrap Material DisposalDocument8 pagesOnline Auction Scrap Material DisposalDeepakNo ratings yet

- Cancellation of Rem-Kumala MendozaDocument2 pagesCancellation of Rem-Kumala MendozaNicolo Jay PajaritoNo ratings yet

- 1706Document2 pages1706May Chan Cuyos100% (1)

- Deed of Absolute Sale Title TransferDocument2 pagesDeed of Absolute Sale Title TransferAlen HilarioNo ratings yet

- Deed of SaleDocument3 pagesDeed of SaleTeacher Matthew100% (1)

- Earnest Money Receipt AgreementDocument2 pagesEarnest Money Receipt AgreementLIZETTE REYESNo ratings yet

- Scholarship Application Form: (Completed Application Due On or Before February 15, 2012 Via Email Only)Document2 pagesScholarship Application Form: (Completed Application Due On or Before February 15, 2012 Via Email Only)Amanda DinhNo ratings yet

- Undergraduate/Graduate Scholarship For The Study in Science, Technology, Engineering or Mathematics (STEM)Document4 pagesUndergraduate/Graduate Scholarship For The Study in Science, Technology, Engineering or Mathematics (STEM)Md. Amanur RahmanNo ratings yet

- Lighthouse MOADocument4 pagesLighthouse MOAAdor HurtadoNo ratings yet

- Land Lease AgreementDocument1 pageLand Lease AgreementMark Ranel RamosNo ratings yet

- Letter of IntentDocument1 pageLetter of IntentInji Sammakieh Nsouli100% (1)

- Maersk Sealand Destination Charges PDFDocument20 pagesMaersk Sealand Destination Charges PDFPIPOL TVNo ratings yet

- ABC/FMRDocument14 pagesABC/FMRIgnacio Benjamín FuentesNo ratings yet

- Philippines Cagayan Gas SlipDocument1 pagePhilippines Cagayan Gas SlipJaleann EspañolNo ratings yet

- DEED OF SALE ApayaoDocument2 pagesDEED OF SALE ApayaoStephanie Escasiñas ToledoNo ratings yet

- Affidavit (Sample) : This Is A Sample. Please Prepare Pursuant To The Actual Situation of The CompanyDocument2 pagesAffidavit (Sample) : This Is A Sample. Please Prepare Pursuant To The Actual Situation of The CompanyAlmira SalsabilaNo ratings yet

- HQP-HLF-002 Checklist of Requirements For RL - PenconDocument1 pageHQP-HLF-002 Checklist of Requirements For RL - Penconmaxx villaNo ratings yet

- Pag-IBIG housing loan requirementsDocument4 pagesPag-IBIG housing loan requirementsDanzen SenolosNo ratings yet

- FLH050-6 Cor - W3Document2 pagesFLH050-6 Cor - W3Alipot Bacud TabulaNo ratings yet

- Pag-IBIG Home Loan Requirements ChecklistDocument2 pagesPag-IBIG Home Loan Requirements ChecklistFirmament DevelopmentNo ratings yet

- 4 Berkencotter vs. Cu Unjieng G.R. No. 41643, July 31, 1945Document3 pages4 Berkencotter vs. Cu Unjieng G.R. No. 41643, July 31, 1945faith.dungca02No ratings yet

- Fundamentals of Bookkeeping: Ucpb Savings Bank Operations DivisionDocument71 pagesFundamentals of Bookkeeping: Ucpb Savings Bank Operations DivisionJames ToNo ratings yet

- ProjectDocument42 pagesProjectPiyush JindalNo ratings yet

- Bankruptcy Complaint Challenges Mortgage LienDocument58 pagesBankruptcy Complaint Challenges Mortgage LienArlin J. Wallace100% (2)

- Chapter 1 BANKING AND FINANCIAL INSTITUTION OVERVIEWDocument11 pagesChapter 1 BANKING AND FINANCIAL INSTITUTION OVERVIEWchristian achico100% (7)

- Bar Questions in Sales, Lease, Agency, and PartnershipDocument75 pagesBar Questions in Sales, Lease, Agency, and PartnershipReuel RealinNo ratings yet

- What Is Housing?Document8 pagesWhat Is Housing?Psy Giel Va-ayNo ratings yet

- Elizabeth-Marina-Salazar Campos Initial Disclosure 2021 02-10-6023bb5439a82Document84 pagesElizabeth-Marina-Salazar Campos Initial Disclosure 2021 02-10-6023bb5439a82Morenita ParelesNo ratings yet

- University Tower Sample ComputationDocument4 pagesUniversity Tower Sample ComputationDexter AlilinNo ratings yet

- RA 7279 Urban Development and Housing Act (UDHA) of 1992Document15 pagesRA 7279 Urban Development and Housing Act (UDHA) of 1992RoselynGutangBartoloNo ratings yet

- 24 Disbursement ChecklistDocument1 page24 Disbursement ChecklistArul Johnson100% (1)

- Rural Vs CADocument2 pagesRural Vs CALA AINo ratings yet

- Deposition BOA Transcript of Michele Sjolander Multiple SalesDocument25 pagesDeposition BOA Transcript of Michele Sjolander Multiple SalesJoe Esquivel100% (3)

- The Indiantown Cogeneration ProjectDocument11 pagesThe Indiantown Cogeneration Projectbubbles180167% (3)

- Baks in FranceDocument53 pagesBaks in FranceEva RouchutNo ratings yet

- Long Term Notes PayableDocument11 pagesLong Term Notes PayableMuhammad Zikri ErnansyaNo ratings yet

- Consci Empowering People Transforming BusinessesDocument3 pagesConsci Empowering People Transforming BusinessesPooja ChavanNo ratings yet

- Robles VS CaDocument2 pagesRobles VS CaLeo TumaganNo ratings yet

- Mortgage Servicing Fraud ForumDocument125 pagesMortgage Servicing Fraud Forumautumngrace100% (1)

- State Sen. Eric Lesser 2018 SFIDocument16 pagesState Sen. Eric Lesser 2018 SFIDusty ChristensenNo ratings yet

- ADocument154 pagesARaouf ChNo ratings yet

- Self Help GroupsDocument18 pagesSelf Help Groupsykbharti101No ratings yet

- Sales 2020Document100 pagesSales 2020Dhanica Panganiban100% (1)

- Project WorkDocument27 pagesProject WorkSanthu SaravananNo ratings yet

- 69 Spells MenuDocument22 pages69 Spells MenuLyn63% (8)

- Rural Rental Housing Loans (Section 515) : Program BasicsDocument2 pagesRural Rental Housing Loans (Section 515) : Program BasicsSUPER INDUSTRIAL ONLINENo ratings yet

- Circle Office-Ara, 2nd Oor, Regal Complex, Near Raman Maidan, Ara, Bhojpur, BiharDocument1 pageCircle Office-Ara, 2nd Oor, Regal Complex, Near Raman Maidan, Ara, Bhojpur, BiharKoneDallerNo ratings yet

- First Amended Complaint Plaintiff)Document49 pagesFirst Amended Complaint Plaintiff)tmccand0% (2)

- Prudential Regulations For Banks: Banking Supervision DepartmentDocument39 pagesPrudential Regulations For Banks: Banking Supervision DepartmentscoutaliNo ratings yet

- Rural BankDocument1 pageRural BankAlondra AranNo ratings yet