Professional Documents

Culture Documents

Omparison of Home Loan / Housing Loan Interest Rates by Indian Banks - 2014

Uploaded by

gaurav0690 ratings0% found this document useful (0 votes)

34 views3 pagesHome loan interest rate an comparison

Original Title

Omparison of Home Loan

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentHome loan interest rate an comparison

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

34 views3 pagesOmparison of Home Loan / Housing Loan Interest Rates by Indian Banks - 2014

Uploaded by

gaurav069Home loan interest rate an comparison

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

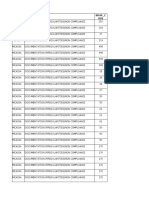

OMPARISON OF HOME LOAN / HOUSING LOAN INTEREST RATES BY

INDIAN BANKS - 2014

(Check Lowest Rate of Interest charged by Banks in India / Minimum Rate of Interest charged by Indian Banks. Best

Home Loan Interest)

Which Banks Charges the Lowest Interest on Home Loans / Housing Loans

in 2014 ?

Best Rate of Interest on Housing Loans in India ? Comparative Housing

Loan Interest Rates. Latest Home Loan Interest by Banks in India

Different banks charge different interest rates for Housing / Home

Loans. The rate of interest also vary based on (a) the quantum of the loan;

(b) period for which loan is intended to be availed etc. It becomes

extremely important for the consumers who wish to avail Housing Loan

that they are able to get the loan at lowest rate of interest so that they can

save on EMI.

It is not possible to give the name of one bank which charges the lowest rate

of interest for all tenures and all levels of loan amount. Moreover, these

rates are frequently changed by banks and that too without informing

media. Sometimes the details are not even updated on the website or they

are so confusing that it becomes impossible to decipher the

details. Therefore, we are giving below a broad idea as to the banks which

are charging lowest rate of interest in a particular category. Readers are

advised to check the same by clicking on the link of relevant bank from

where they intend to avail the loan and they check the websites of the

following banks too to ensure that they get the best deals. [The following

rates have been updated in the second week of August 2014)

Name of Bank Tenure of Loan/Amount of Loan Rate of

Interest

State Bank of India For Women Borrowers

Upto Rs. 75.00 Lakhs

Above Rs. 75.00 Lakhs

For Other Borrowers

Upto Rs. 75.00 Lac

Above Rs. 75.00 Lac

10.10%

10.25%

10.15%

10.30%

Canara Bank upto Rs. 75 lakh

Above Rs. 75 lakh

10.20%

10.45%

Indian Bank Upto Rs. 75 Lakhs

Above Rs. 75 Lakhs

10.25%

10.50%

Bank of Baroda Upto Rs. 30 Lakhs

Above Rs. 30 Lakhs

Upto Rs. 75 Lakhs & Above Rs. 75 Lakhs

10.25%

10.25%

10.25%

Central Bank of India Upto Rs. 75 Lakhs

Above Rs. 75 Lakhs

10.25%

10.50%

Dena Bank

Upto Rs. 75 Lakhs

Above Rs. 75 Lakhs

10.25%

10.50%

Oriental Bank Of Commerce Upto Rs. 75 Lakhs

Above Rs.75 Lakhs - Rs. 3 Crore

10.25%

10.75%

Axis Bank Loan up to Rs. 75 Lac

Loan above Rs. 75 Lac

10.25%

10.50%

Corporation Bank upto Rs. 50 Lakh

Above Rs. 50 Lakhs

10.25%

10.50%

IDBI Bank 10.25%

Bank of India Limits upto Rs. 75 Lac

For limits over Rs.75 Lacs & above

10.20%

10.45%

State Bank of Hyderabad Upto Rs. 30 Lakhs

Above Rs. 30 Lakhs

10.50%

10.75%

United Bank of India Upto Rs. 25 Lakhs

Above Rs. 25 Lakhs & upto Rs. 75 Lakhs

10.50%

10.55%

10.80%

Above Rs. 75 lakhs & upto Rs. 150 Lakhs

Punjab and Sind Bank Upto Rs. 30 lakhs

Above Rs. 30 Lakhs & upto Rs. 75 lakhs

Above Rs. 75 lakhs

10.50%

10.75%

11.00%

Allahabad Bank Above Rs. 30 lakhs and upto Rs. 75

lakhs

Above Rs. 75 lakhs and upto 300 Lakhs

Above Rs. 300 Lac and upto Rs. 500 Lac

10.25%

10.25%

10.50%

You might also like

- Student Activity Packet SC-6.1Document3 pagesStudent Activity Packet SC-6.1Chassidy AberdeenNo ratings yet

- Rural Bank Case StudyDocument37 pagesRural Bank Case StudyRusselle Guste IgnacioNo ratings yet

- Intrest Rate StructureDocument12 pagesIntrest Rate StructureMohit KumarNo ratings yet

- Ritesh HDFCDocument51 pagesRitesh HDFCRitesh VarmaNo ratings yet

- Home Loans Interest Rates: Agents Login Insurance DealsDocument4 pagesHome Loans Interest Rates: Agents Login Insurance DealsPrasoon SinghNo ratings yet

- Fixed Deposit Interest Rates - Best FD Rates of Top Banks in IndiaDocument15 pagesFixed Deposit Interest Rates - Best FD Rates of Top Banks in IndiaebeanandeNo ratings yet

- Fixed Deposit Interest Rates - Compare Latest FD Interest Rates 2023 PDFDocument11 pagesFixed Deposit Interest Rates - Compare Latest FD Interest Rates 2023 PDFomkar kothuleNo ratings yet

- Iimportant Financial InformationDocument6 pagesIimportant Financial InformationSwarup DeshbhratarNo ratings yet

- Savings RateDocument19 pagesSavings RateDhara KotechaNo ratings yet

- Indian Oversea Bank and Development Credit Bank of India: Presented by Group 10Document13 pagesIndian Oversea Bank and Development Credit Bank of India: Presented by Group 10Karan GujralNo ratings yet

- State Bank of India (SBI) Personal Loan: Eligibility Criteria Loan Amount Documents RequiredDocument3 pagesState Bank of India (SBI) Personal Loan: Eligibility Criteria Loan Amount Documents RequiredMojahed AhmarNo ratings yet

- Sbi Home LoanDocument20 pagesSbi Home LoanbijjubhaiNo ratings yet

- Car Loan Interest RateDocument9 pagesCar Loan Interest RateOnkar ChavanNo ratings yet

- Banking TermsDocument21 pagesBanking TermsShashank ChandraNo ratings yet

- Banking TermsDocument21 pagesBanking Termsakumar_277No ratings yet

- Fixed DepositsDocument2 pagesFixed DepositsNarendrapratap1No ratings yet

- Banking Theory and Practice: Digital Assignment 1Document5 pagesBanking Theory and Practice: Digital Assignment 1muthu kumaranNo ratings yet

- 3.BANKING SECTOR - Nishtha ChhabraDocument83 pages3.BANKING SECTOR - Nishtha ChhabraHarshal FuseNo ratings yet

- SME LoanDocument17 pagesSME LoanrajNo ratings yet

- SXXDocument3 pagesSXXMojahed AhmarNo ratings yet

- L1 BankingDocument38 pagesL1 BankingdjroytatanNo ratings yet

- SBI Supply and Demand AnalysisDocument19 pagesSBI Supply and Demand Analysisbilva joshiNo ratings yet

- Bank RD Interest Rates (General Public) Senior Citizen RD RatesDocument3 pagesBank RD Interest Rates (General Public) Senior Citizen RD RatesKushal MpvsNo ratings yet

- Auto Loan IndustryDocument38 pagesAuto Loan IndustryVinay SinghNo ratings yet

- All Bank Interest RatesDocument6 pagesAll Bank Interest RatesSanket ChouguleNo ratings yet

- Home Loan EMI Fall Due To Rate Cut: Lender Interest Rate (%) Processing Fee Max Tenure (Yrs)Document2 pagesHome Loan EMI Fall Due To Rate Cut: Lender Interest Rate (%) Processing Fee Max Tenure (Yrs)Rajesh KumarNo ratings yet

- What Is Bank Rate?Document2 pagesWhat Is Bank Rate?Narender HoodaNo ratings yet

- Financial Institutions and Markets: Case Study: Banking ProductsDocument10 pagesFinancial Institutions and Markets: Case Study: Banking ProductsSai Dinesh BilleNo ratings yet

- CRR of Bank Alflah: What Is Bank Rate?Document3 pagesCRR of Bank Alflah: What Is Bank Rate?Mirza HuzaifaNo ratings yet

- Axis BankDocument7 pagesAxis BankKaranPatilNo ratings yet

- High Credit RatingDocument2 pagesHigh Credit RatingRajesh KumarNo ratings yet

- Loan Against FD Is Cheaper Is More Flexible Than A Personal LoanDocument2 pagesLoan Against FD Is Cheaper Is More Flexible Than A Personal LoanRajesh KumarNo ratings yet

- HDFC CASE STUDY Part 2Document53 pagesHDFC CASE STUDY Part 2sourav khandelwalNo ratings yet

- Repo Rate NotesDocument7 pagesRepo Rate NotesAmol DhumalNo ratings yet

- Ashutosh Eco11Document27 pagesAshutosh Eco11ashish664No ratings yet

- Home Loan Interest Rates 24052011Document3 pagesHome Loan Interest Rates 24052011Nitin TyagiNo ratings yet

- What Is A Repo Rate?Document14 pagesWhat Is A Repo Rate?Sumit SumanNo ratings yet

- Repo Rate & Reverse Repo Rate: Submitted To: Submitted By: Manish Sir Nandani SharmaDocument11 pagesRepo Rate & Reverse Repo Rate: Submitted To: Submitted By: Manish Sir Nandani SharmaVishal KhandelwalNo ratings yet

- Questionnaire For Bank (PNB)Document13 pagesQuestionnaire For Bank (PNB)Abhishek PathakNo ratings yet

- Current AffairsDocument49 pagesCurrent AffairsRubak BhattacharyyaNo ratings yet

- Repo RateDocument3 pagesRepo RaterajzzeshNo ratings yet

- Mutual FundsDocument23 pagesMutual FundsAnanya Dutt.GNo ratings yet

- Hat Is SLRDocument5 pagesHat Is SLRIndu GuptaNo ratings yet

- Change in CRR, SLR, Repo Rate, Bank Rate and Their Relation With Inflation in IndiaDocument10 pagesChange in CRR, SLR, Repo Rate, Bank Rate and Their Relation With Inflation in IndiaAanshi PriyaNo ratings yet

- This Festive Season - Some Lenders Have Waived Processing FeeDocument2 pagesThis Festive Season - Some Lenders Have Waived Processing FeeRajesh KumarNo ratings yet

- Short Term InvestmentDocument16 pagesShort Term Investmentluckey racerNo ratings yet

- Borrow Against Fixed Deposit: Rate of InterestDocument2 pagesBorrow Against Fixed Deposit: Rate of InterestRajesh KumarNo ratings yet

- Repo Rate, SLR, CRRDocument3 pagesRepo Rate, SLR, CRRdhuvad.2004No ratings yet

- Differentiate Between Repo Rate and Reverse Repo Rate in Respect of Monetary Control ToolDocument3 pagesDifferentiate Between Repo Rate and Reverse Repo Rate in Respect of Monetary Control ToolAryan DevNo ratings yet

- Banking & InsuranceDocument44 pagesBanking & InsuranceBhurabhai MaliNo ratings yet

- Meta Title: EMI For Personal Loan of Rs 10 Lakh Meta Description: A Personal Loan Obtained From A Bank or NBFC Can BeDocument4 pagesMeta Title: EMI For Personal Loan of Rs 10 Lakh Meta Description: A Personal Loan Obtained From A Bank or NBFC Can BeParag ShrivastavaNo ratings yet

- Economics Banking ProjectDocument15 pagesEconomics Banking ProjectCJKNo ratings yet

- Silver Saving AccountDocument14 pagesSilver Saving AccountAgarwal Devu DivyanshuNo ratings yet

- HDFC Bank We Understand Your WorldDocument5 pagesHDFC Bank We Understand Your Worldaaashu77No ratings yet

- Bank RatesDocument3 pagesBank RatesJamessapna BondNo ratings yet

- Axis Bank-Vehicle LoanDocument45 pagesAxis Bank-Vehicle LoansonamNo ratings yet

- Banking Terms: 1. What Is A Repo Rate?Document25 pagesBanking Terms: 1. What Is A Repo Rate?abhilkoNo ratings yet

- SBI Commercial and International BankDocument14 pagesSBI Commercial and International BankSefy BastianNo ratings yet

- AnubhavbaseratepptDocument12 pagesAnubhavbaseratepptChandan SinghNo ratings yet

- Fixed Deposit Interest Rates - Best FD Rates of Top Banks in India 2022Document12 pagesFixed Deposit Interest Rates - Best FD Rates of Top Banks in India 2022pitax31866No ratings yet

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysFrom EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNo ratings yet

- All You Need to Know About Payday LoansFrom EverandAll You Need to Know About Payday LoansRating: 5 out of 5 stars5/5 (1)

- Applicability: Business Organisation Types of IncomeDocument3 pagesApplicability: Business Organisation Types of Incomegaurav069No ratings yet

- TaxMaster12-13 v1.0Document13 pagesTaxMaster12-13 v1.0Anupam BaliNo ratings yet

- As 22 Deferred TaxDocument4 pagesAs 22 Deferred Taxgaurav069No ratings yet

- TDS Rate Chart AY 2014-15Document1 pageTDS Rate Chart AY 2014-15gaurav069No ratings yet

- List of Gazetted Holidays For All Central Government Employees For The Year 2014Document1 pageList of Gazetted Holidays For All Central Government Employees For The Year 2014gaurav069No ratings yet

- Income Tax SlabDocument2 pagesIncome Tax Slabgaurav069No ratings yet

- Basic Savings Bank Deposit AccountDocument3 pagesBasic Savings Bank Deposit Accountgaurav069No ratings yet

- Comparison of Car LoanDocument2 pagesComparison of Car Loangaurav069No ratings yet

- What Are Fixed Deposit Accounts in India or Term DepositsDocument2 pagesWhat Are Fixed Deposit Accounts in India or Term Depositsgaurav069No ratings yet

- Determination of Residential StatusDocument1 pageDetermination of Residential Statusgaurav069No ratings yet

- FD Interest Rate of Bank in India2014Document2 pagesFD Interest Rate of Bank in India2014gaurav069No ratings yet

- Types of Bank Accounts in IndiaDocument4 pagesTypes of Bank Accounts in Indiagaurav069No ratings yet

- Non Resident Indians Under FEMADocument4 pagesNon Resident Indians Under FEMAgaurav069No ratings yet

- Principle of InsurancesDocument1 pagePrinciple of Insurancesgaurav069No ratings yet

- Mutual FundsDocument7 pagesMutual Fundsgaurav069No ratings yet

- InsuranceDocument1 pageInsurancegaurav069No ratings yet

- Principle of InsurancesDocument1 pagePrinciple of Insurancesgaurav069No ratings yet

- Due Date For Filing of Return of Income IndiaDocument1 pageDue Date For Filing of Return of Income Indiaamit2201No ratings yet

- Bank DefinationDocument2 pagesBank Definationgaurav069No ratings yet

- Ratio Analysis Formula GuideDocument2 pagesRatio Analysis Formula GuideMuhammed KhalidNo ratings yet

- PaymentReceipt 1Document2 pagesPaymentReceipt 1hugoiasdNo ratings yet

- Customer No.: 21058097 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressDocument4 pagesCustomer No.: 21058097 IFSC Code: DBSS0IN0811 MICR Code: Branch Addresskiran gangurdeNo ratings yet

- Musharaka by Muhammad Zubair UsmaniDocument48 pagesMusharaka by Muhammad Zubair UsmaniGoharYasinNo ratings yet

- Solutions To Self-Test ProblemsDocument25 pagesSolutions To Self-Test ProblemsEvelyn Purnama SariNo ratings yet

- IndusInd BankDocument67 pagesIndusInd BankCHITRANSH SINGHNo ratings yet

- Test Paper: Chapter-1: Cost of CapitalDocument13 pagesTest Paper: Chapter-1: Cost of Capitalcofinab795No ratings yet

- Flipping Notes EbookDocument51 pagesFlipping Notes Ebookarjunfoto19No ratings yet

- Lesson 5 - Basic Financial Accounting & Reporting: Lesson 5 - 1 Recording Business TransactionsDocument7 pagesLesson 5 - Basic Financial Accounting & Reporting: Lesson 5 - 1 Recording Business TransactionsJulliene Sanchez DamianNo ratings yet

- Submitted By:-Trishna Das ID: - 18IUT0180002: A Presentation On The Topic of MarketingDocument17 pagesSubmitted By:-Trishna Das ID: - 18IUT0180002: A Presentation On The Topic of MarketingTrishna DasNo ratings yet

- Act CH 9 QuizDocument4 pagesAct CH 9 QuizLamia AkterNo ratings yet

- SBI GUC FormatDocument3 pagesSBI GUC FormatVikkuNo ratings yet

- Chanda Kochhar SlidesDocument28 pagesChanda Kochhar SlidesPrabha IyerNo ratings yet

- Ias 16 PpeDocument40 pagesIas 16 PpeziyuNo ratings yet

- Activity 1.3 - Think Like An AuditorDocument2 pagesActivity 1.3 - Think Like An AuditorIan Christian Alangilan BarrugaNo ratings yet

- Concurrent Review Data - May 2021Document1,069 pagesConcurrent Review Data - May 2021Tamilmani SubramaniyanNo ratings yet

- MI CH 1. The Fundamental of CostingDocument4 pagesMI CH 1. The Fundamental of CostingPonkoj Sarker TutulNo ratings yet

- Chapter 9 Lecture Notes 2Document11 pagesChapter 9 Lecture Notes 2Hannah Pauleen G. LabasaNo ratings yet

- Chapter 14 - SolutionsDocument17 pagesChapter 14 - SolutionsHolly EntwistleNo ratings yet

- Askari Bank Personal Loan CBD Excel SheetDocument4 pagesAskari Bank Personal Loan CBD Excel Sheetsumbul imranNo ratings yet

- UntitledDocument9 pagesUntitledRexi Chynna Maning - AlcalaNo ratings yet

- 0205 ReposedDocument45 pages0205 ReposedLameuneNo ratings yet

- Business Communication ProjectDocument20 pagesBusiness Communication ProjectTehreem ZafarNo ratings yet

- Income Taxes: Sri Lanka Accounting Standard - LKAS 12Document46 pagesIncome Taxes: Sri Lanka Accounting Standard - LKAS 12Sineth NeththasingheNo ratings yet

- Cash Journal in Sap: Configuration PathDocument7 pagesCash Journal in Sap: Configuration PathVijay RamNo ratings yet

- Term Paper On Financial Statement AnalysisDocument5 pagesTerm Paper On Financial Statement Analysisbujuj1tunag2100% (1)

- Financial Institutions Ch-1Document28 pagesFinancial Institutions Ch-1Shimelis Tesema100% (1)

- Compound Interest Installment PDFDocument36 pagesCompound Interest Installment PDFnileshmpharmNo ratings yet