Professional Documents

Culture Documents

The Following Data Shall Serve As A Sample of AJ Davis' Customer Base

Uploaded by

Juliana TerrellOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Following Data Shall Serve As A Sample of AJ Davis' Customer Base

Uploaded by

Juliana TerrellCopyright:

Available Formats

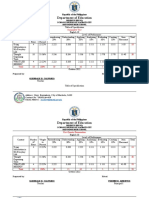

This document consists of a summary of an exploratory data analysis for AJ Davis

Department Stores. AJ Davis seeks to know more about their customers which pay via credit.

We will assess the location, income, household size, years lived at household and credit balance.

The following data shall serve as a sample of AJ Davis customer base:

Location

Income

($1000) Size Years

Credit

Balance($)

Urban 54 3 12 4016

Rural 30 2 12 3159

Suburban 32 4 17 5100

Suburban 50 5 14 4742

Rural 31 2 4 1864

Urban 55 2 9 4070

Rural 37 1 20 2731

Urban 40 2 7 3348

Suburban 66 4 10 4764

Urban 51 3 16 4110

Urban 25 3 11 4208

Urban 48 4 16 4219

Rural 27 1 19 2477

Rural 33 2 12 2514

Urban 65 3 12 4214

Suburban 63 4 13 4965

Urban 42 6 15 4412

Urban 21 2 18 2448

Rural 44 1 7 2995

Urban 37 5 5 4171

Suburban 62 6 13 5678

Urban 21 3 16 3623

Suburban 55 7 15 5301

Rural 42 2 19 3020

Urban 41 7 18 4828

Suburban 54 6 14 5573

Rural 30 1 14 2583

Rural 48 2 8 3866

Urban 34 5 5 3586

Suburban 67 4 13 5037

Rural 50 2 11 3605

Urban 67 5 1 5345

Urban 55 6 16 5370

Urban 52 2 11 3890

Urban 62 3 2 4705

Urban 64 2 6 4157

Suburban 22 3 18 3579

Urban 29 4 4 3890

Suburban 39 2 18 2972

Rural 35 1 11 3121

Urban 39 4 15 4183

Suburban 54 3 9 3730

Suburban 23 6 18 4127

Rural 27 2 1 2921

Urban 26 7 17 4603

Suburban 61 2 14 4273

Rural 30 2 14 3067

Rural 22 4 16 3074

Suburban 46 5 13 4820

Suburban 66 4 20 5149

Location:

Using Minitab, we are able to deduce the following distribution of customer locations:

URBAN: 42% SUBURBAN: 30% RURAL: 28%

The majority of AJ Davis credit customers appear to be Urban, based on the sample provided.

Size:

We now assess the statistics relevant to household size. It should be possible to correlate the size

of a household to other factors such as credit carried, location and income. Speaking strictly

about size, the results indicate that there is a Mean or average household size of 3.42. The

Standard Deviation indicates that the size has a spread, from house to house, on average of

1.739. The Variance of 3.024 importantly shows on average, how far above or below from the

Mean any household size might be. The Minimum size of households is and must be 1 for this

analysis. The First Quartile (Q1) is 2, which indicates that 25% of the households contain less

than 2 individuals. The Median is similar to the Mean (3.420) but reports lower at 3.000. This is

important because it demonstrates that the data is skewed positively, or to the right. There is a

tendency for larger households in this data set. The Third Quartile (Q3) is 5, which indicates that

75% of the households contain less than 5 individuals. The Maximum number of persons in any

household measured is 7.

Variable Mean StDev Variance Minimum Q1 Median Q3 Maximum Range

Size 3.420 1.739 3.024 1.000 2.000 3.000 5.000 7.000 6.000

Years present at Household:

This will be similar in appearance to size of household but will measure longevity of presence in

the market in question. We will be able to compare the time living at a household to other factors

7 6 5 4 3 2 1 0

16

14

12

10

8

6

4

2

0

Size

F

r

e

q

u

e

n

c

y

Mean 3.42

StDev 1.739

N 50

Histogram of Size

Normal

such as income, location and credit carried. Speaking strictly about years, we see a Mean of

12.38 years lived at each household. The Standard Deviation between households tends to be

5.103 years. Typically, the time spent at a location will vary from house to house by just over 5

years. The Variance of 26 years indicates there may be many households with little time spent at

this location, as well as many with a large amount of time spent at the location. At Minimum, 1

year is spent at a household in this data set. The First Quartile (Q1) is 9, which indicates that

25% of the households have been present for less than 9 years. The Median is 13, which is larger

than the Mean and indicates negative skewness which indicates households may be spending less

time in the area, over time. The Third Quartile (Q3) is 16. From this, we learn that less than 75%

of the houses have been in the area for more than 16 years. The Maximum time any household

has been present is 20 years.

Variable Mean StDev Variance Minimum Q1 Median Q3 Maximum

Years 12.380 5.103 26.036 1.000 9.000 13.000 16.000 20.000

20 15 10 5 0

14

12

10

8

6

4

2

0

Years

F

r

e

q

u

e

n

c

y

Mean 12.38

StDev 5.103

N 50

Histogram of Years

Normal

Income:

Using similar analysis, we will be able to measure the relevant statistics regarding customer

income. It will be possible to compare income to location, amount of credit, house size and

length of time spent in an area. For now, we will analyze the basic information relating to

income. It should be noted that these figures are per $1000.

The Mean of these households is 43.48, which means average income is $43,480. The

Standard Deviation from this average is 14.55, showing a $14,550 sway from house to house.

This is a 33% difference in income between each house, on average. The Variance is quite large

at 211.72, which indicates a very wide spread in high and low incomes. The minimum household

income reported is $21,000 from two Urban households. The First Quartile (Q1) indicates that

25% of the households earn less than $30,000 (30.0). The Median is lower than the Mean,

resulting in positive skewness. The Third Quartile (Q3) indicates that 75% of households earn

less than $55,000. The Maximum income reported was $67,000.

Variable Mean StDev Variance Minimum Q1 Median Q3 Maximum

Income ($1000) 43.48 14.55 211.72 21.00 30.00 42.00 55.00 67.00

70 60 50 40 30 20 10

7

6

5

4

3

2

1

0

Income ($1000)

F

r

e

q

u

e

n

c

y

Mean 43.48

StDev 14.55

N 50

Histogram of Income ($1000)

Normal

Credit Balance:

The study specifically requests all households to be carriers of Credit Balances. We will be able

to compare who uses the most credit based on location, household size, income and deduce

whether living in the home longer or shorter impacts the amount of credit carried. The basic facts

pertaining to Credit are as follows: The Mean, or average balance carried is $3,964. The

Standard Deviation is $933 from account to account. For some reason, the Variance measures

871,411, which indicates very unpredictable usage, if it is accurate. The Minimum amount of

credit carried is $1,864. The First Quartile (Q1) indicates that 25% of all households carry less

than $3109. The Median is larger than the Mean at $4090, which indicates negative skewness.

The Third Quartile (Q3) is $4748, meaning that 75% of houses carry less than $4748. The

Maximum amount of credit carried is $5,678.

Variable Mean StDev Variance Minimum Q1 Median Q3 Maximum

Credit Balance($) 3964 933 871411 1864 3109 4090 4748 5678

6000 5000 4000 3000 2000

14

12

10

8

6

4

2

0

Credit Balance($)

F

r

e

q

u

e

n

c

y

Mean 3964

StDev 933.5

N 50

Histogram of Credit Balance($)

Normal

Comparison of Categories:

The data shall depict the connection between any two categories. As AJ Davis appears to be

motivated to learn about their customers who carry credit, all categories will compare to credit.

Amount of Credit vs Income:

The amount of credit and the income of the household appear to be related. Analysis reveals that

as income increases, so too does the amount of credit. Note that this represents all households in

all locations.

70 60 50 40 30 20

6000

5000

4000

3000

2000

Income ($1000)

C

r

e

d

i

t

B

a

l

a

n

c

e

(

$

)

Scatterplot of Credit Balance($) vs Income ($1000)

The following charts depict location as a factor in credit balance and income:

Overlaid Locations:

Individual Locations:

Overall, it is observed that rural customers earn lower incomes but carry lesser amounts of credit,

respectively. Urban customers carry a wider range of credit, and are in the middle range of

income, though much greater than rural and slightly lower than suburban.

70 60 50 40 30 20

6000

5000

4000

3000

2000

Income ($1000)

C

r

e

d

i

t

B

a

l

a

n

c

e

(

$

)

Rural

Suburban

Urban

Location

Scatterplot of Credit Balance($) vs Income ($1000)

60 50 40 30 20

6000

5000

4000

3000

2000

60 50 40 30 20

6000

5000

4000

3000

2000

Rural

Income ($1000)

C

r

e

d

i

t

B

a

l

a

n

c

e

(

$

)

Suburban

Urban

Scatterplot of Credit Balance($) vs Income ($1000)

Panel variable: Location

Amount of Credit vs. Household Years:

This is a wide distribution however, there appears to be a trend where ultimately the longer a

household exists, the more credit it carries up to a certain point.

Amount of Income vs. Household Years:

The data shows that over time, income is decreasing.

20 15 10 5 0

6000

5000

4000

3000

2000

Years

C

r

e

d

i

t

B

a

l

a

n

c

e

(

$

)

Scatterplot of Credit Balance($) vs Years

20 15 10 5 0

70

60

50

40

30

20

Years

I

n

c

o

m

e

(

$

1

0

0

0

)

Scatterplot of Income ($1000) vs Years

Although income tends to decrease over time, credit balances actually increase slightly over that

same time span. Credit balances increase with both time and income which suggests credit is

inescapable in relation to the reduction in income and will always increase with an increase in

income.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Dasha TransitDocument43 pagesDasha Transitvishwanath100% (2)

- Clinic Management System (24 PGS)Document24 pagesClinic Management System (24 PGS)pranithNo ratings yet

- CIPP ModelDocument36 pagesCIPP ModelIghfir Rijal TaufiqyNo ratings yet

- Significance of Vaiseshika's PragabhavaDocument5 pagesSignificance of Vaiseshika's Pragabhavavskanchi0% (1)

- Windows Server 2016 Editions ComparisonDocument4 pagesWindows Server 2016 Editions ComparisonmasterredhardNo ratings yet

- Fluorescent sensors for detection of heavy metalsDocument36 pagesFluorescent sensors for detection of heavy metalskawtherahmedNo ratings yet

- Nektar Impact LX25 (En)Document32 pagesNektar Impact LX25 (En)Camila Gonzalez PiatNo ratings yet

- PLC 2 Ladder DiagramDocument53 pagesPLC 2 Ladder DiagramAnkur GuptaNo ratings yet

- MC145031 Encoder Manchester PDFDocument10 pagesMC145031 Encoder Manchester PDFson_gotenNo ratings yet

- How To Prepare Squash Specimen Samples For Microscopic ObservationDocument3 pagesHow To Prepare Squash Specimen Samples For Microscopic ObservationSAMMYNo ratings yet

- Imports System - data.SqlClient Imports System - Data Imports System PartialDocument2 pagesImports System - data.SqlClient Imports System - Data Imports System PartialStuart_Lonnon_1068No ratings yet

- MVC ImpDocument4 pagesMVC ImpsrinathmsNo ratings yet

- How to trade forex like the banksDocument34 pagesHow to trade forex like the banksGeraldo Borrero80% (10)

- Table of Specification ENGLISHDocument2 pagesTable of Specification ENGLISHDonn Abel Aguilar IsturisNo ratings yet

- Roman Questions II PDFDocument738 pagesRoman Questions II PDFjlinderski100% (3)

- Tracer Survey of Bsit Automotive GRADUATES BATCH 2015-2016 AT Cebu Technological UniversityDocument8 pagesTracer Survey of Bsit Automotive GRADUATES BATCH 2015-2016 AT Cebu Technological UniversityRichard Somocad JaymeNo ratings yet

- 4idealism Realism and Pragmatigsm in EducationDocument41 pages4idealism Realism and Pragmatigsm in EducationGaiLe Ann100% (1)

- Unit 2 Technological Change Population and Growth 1.0Document33 pagesUnit 2 Technological Change Population and Growth 1.0knowme73No ratings yet

- Shaft design exercisesDocument8 pagesShaft design exercisesIvanRosellAgustíNo ratings yet

- A Comparative Marketing Study of LG ElectronicsDocument131 pagesA Comparative Marketing Study of LG ElectronicsAshish JhaNo ratings yet

- SiargaoDocument11 pagesSiargaomalouNo ratings yet

- 0418 w08 QP 1Document17 pages0418 w08 QP 1pmvarshaNo ratings yet

- IS BIOCLIMATIC ARCHITECTURE A NEW STYLE OF DESIGNDocument5 pagesIS BIOCLIMATIC ARCHITECTURE A NEW STYLE OF DESIGNJorge DávilaNo ratings yet

- Propaganda and Counterpropaganda in Film, 1933-1945: Retrospective of The 1972 ViennaleDocument16 pagesPropaganda and Counterpropaganda in Film, 1933-1945: Retrospective of The 1972 ViennaleDanWDurningNo ratings yet

- © Call Centre Helper: 171 Factorial #VALUE! This Will Cause Errors in Your CalculationsDocument19 pages© Call Centre Helper: 171 Factorial #VALUE! This Will Cause Errors in Your CalculationswircexdjNo ratings yet

- Charny - Mathematical Models of Bioheat TransferDocument137 pagesCharny - Mathematical Models of Bioheat TransferMadalena PanNo ratings yet

- SYS600 - Visual SCIL Application DesignDocument144 pagesSYS600 - Visual SCIL Application DesignDang JinlongNo ratings yet

- HistoryDocument45 pagesHistoryRay Joshua Angcan BalingkitNo ratings yet

- Proportions PosterDocument1 pageProportions Posterapi-214764900No ratings yet

- Procedural Text Unit Plan OverviewDocument3 pagesProcedural Text Unit Plan Overviewapi-361274406No ratings yet