Professional Documents

Culture Documents

Abakada Vs Ermita

Uploaded by

nikiboigenius0 ratings0% found this document useful (0 votes)

44 views2 pagesabakada vs ermita pdf

disclaimer: not mine

Original Title

Abakada vs Ermita

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentabakada vs ermita pdf

disclaimer: not mine

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

44 views2 pagesAbakada Vs Ermita

Uploaded by

nikiboigeniusabakada vs ermita pdf

disclaimer: not mine

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

ABAKADA GURO PARTY LIST versus

THE HONORABLE EXECUTIVE SECRETARY

EDUARDO ERMITA

G.R. No. 168056 01 September 2005

FACTS:

ABAKADA Guro Party List assail the constitutionality of R.A.

No. 9337, a VAT reform Act enacted on May 24, 2005 which

is a consolidation of three legislative bills namely, House Bill

Nos. 3555 and 3705, and Senate Bill No. 1950. They question

the constitutionality of Sections 4, 5 and 6 of said Act,

amending Sections 106, 107 and 108, respectively, of the

National Internal Revenue Code (NIRC). Section 4 imposes a

10% VAT on sale of goods and properties, Section 5 imposes a

10% VAT on importation of goods, and Section 6 imposes a

10% VAT on sale of services and use or lease of properties. In

collective, granted the Secretary of Finance the authority to

ascertain: a. whether by 12/31/05, the VAT collection as a

percentage of the 2004 GDP exceeds 2.8% or b. the national

government deficit as a percentage of the 2004 GDP exceeds

1.5%. If either condition is met, the Secretary of Finance must

inform the President who, in turn, must impose the 12% VAT

rate (from 10%) effective J anuary 1, 2006.

Petitioners maintained that Congress abandoned its exclusive

authority to fix taxes and that RA 9337 contained a uniform

proviso authorizing the President upon recommendation by the

DOF Secretary to raise VAT to 12%.

Senator Pimentel maintained that RA 9337 constituted undue

delegation of legislative powers and a violation of due process

since the law was ambiguous and arbitrary. Same with

Represenative Escudero.

Thereafter, a petition for prohibition was filed on J une 29,

2005, by the Association of Pilipinas Shell Dealers, Inc., et al.,

assailing the constitutionality of R.A. No. 9337, contending

that some provisions of said VAT reform was arbitrary,

oppressive and confiscatory. According to them, the contested

sections impose limitations on the amount of input tax that may

be claimed. They also argue that the input tax partakes the

nature of a property that may not be confiscated, appropriated,

or limited without due process of law. Petitioners further

contend that like any other property or property right, the input

tax credit may be transferred or disposed of, and that by

limiting the same, the government gets to tax a profit or value-

added even if there is no profit or value-added.

Respondents countered that the law was complete, that it left

no discretion to the President, and that it merely charged the

President with carrying out the rate increase once any of the 2

conditions arise.

Respondents manifest that R.A. No. 9337 is the anchor of the

governments fiscal reform agenda. A reform in the value-

added system of taxation is the core revenue measure that will

tilt the balance towards a sustainable macroeconomic

environment necessary for economic growth.

ISSUE:

Is R.A. No. 9337 unconstitutional as there was undue

delegation?

RULING:

It has been said that taxes are the lifeblood of the government.

In this case, it is just an enema, a first-aid measure to

resuscitate an economy in distress. The Court is neither blind

nor is it turning a deaf ear on the plight of the masses. But it

does not have the panacea for the malady that the law seeks to

remedy. As in other cases, the Court cannot strike down a law

as unconstitutional simply because of its yokes.

Constitution allows as under exempted delegation the

delegation of tariffs, customs duties, and other tolls, levies on

goods imported and exported. VAT is tax levied on sales of

goods and services which could not fall under this exemption.

Hence, its delegation if unqualified is unconstitutional.

Legislative power is authority to make a complete law. Thus, to

be valid, a law must be complete in itself, setting forth therein

the policy and it must fix a standard, limits of which are

sufficiently determinate and determinable. No undue

delegation when congress describes what job must be done

who must do it and the scope of the authority given. (Edu v

Ericta) The Secretary of Finance was merely tasked to

ascertain the existence of facts. All else was laid out. It was

mainly ministerial for the secretary to ascertain the facts and

for the president to carry out the implementation for the VAT.

They were agents of the legislative department.

Therefore, there was no delegation but mere implementation of

the law.

Justice Angelina Sandoval Gutierrez in her concurring and

dissenting opinion:

R.A. No. 9337, in granting to the President the stand-by authority to

increase the VAT rate from 10% to 12%, the Legislature abdicated

its power by delegating it to the President. This is constitutionally

impermissible. The Legislature may not escape its duties and

responsibilities by delegating its power to any other body or

authority. Any attempt to abdicate the power is unconstitutional and

void, on the principle that potestas delegata non delegare potest.

In the present case, the President is the delegate of the Legislature,

endowed with the power to raise the VAT rate from 10 % to 12% if

any of the following conditions, to reiterate, has been satisfied: (i)

value-added tax collection as a percentage of gross domestic product

(GDP) of the previous year exceeds two and four-fifths percent (2

4/5%) or (ii) National Government deficit as a percentage of GDP of

the previous year exceeds one and one-half percent (1 '%).

At first glance, the two conditions may appear to be definite

standards sufficient to guide the President. However, to my mind,

they are ineffectual and malleable as they give the President ample

opportunity to exercise her authority in arbitrary and discretionary

fashion.

That the President's exercise of an authority is practically within her

control is tantamount to giving no conditions at all. I believe this

amounts to a virtual surrender of legislative power to her. It must be

stressed that the validity of a law is not tested by what has been done

but by what may be done under its provisions.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Trump Indictment Georgia 081423Document96 pagesTrump Indictment Georgia 081423CBS News Politics88% (73)

- Con Law Canned AnswersDocument48 pagesCon Law Canned AnswersMegan AndrusNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ateneo 2007 Criminal ProcedureDocument69 pagesAteneo 2007 Criminal ProcedureJingJing Romero98% (55)

- Full Texts of Cases Under Administrative LawDocument116 pagesFull Texts of Cases Under Administrative LawnikiboigeniusNo ratings yet

- Pierson and Gillen Letter To District Attorney With Exhibits 03.26.2023Document20 pagesPierson and Gillen Letter To District Attorney With Exhibits 03.26.2023The FederalistNo ratings yet

- Philippine Politics and Governance MidtermDocument3 pagesPhilippine Politics and Governance MidtermAngelo Bernardino100% (1)

- Transmital Letter For CCP On Cash AdvanceDocument1 pageTransmital Letter For CCP On Cash AdvancenikiboigeniusNo ratings yet

- Letter Head Commission On AuditDocument1 pageLetter Head Commission On AuditnikiboigeniusNo ratings yet

- Revised Rules of ProcedureDocument24 pagesRevised Rules of ProcedurenikiboigeniusNo ratings yet

- BSP Papal CoinDocument1 pageBSP Papal CoinisluvhimNo ratings yet

- Stonehill Vs DioknoDocument2 pagesStonehill Vs DioknojelyneptNo ratings yet

- Live-View Remote: Rm-Lvr1Document16 pagesLive-View Remote: Rm-Lvr1nikiboigeniusNo ratings yet

- EXPANDED WITHHOLDING TAX Tax Base in The Computation of 1% EWT and 6% Creditable VAT - The 1% Expanded Creditable Withholding Tax Imposed UnderDocument1 pageEXPANDED WITHHOLDING TAX Tax Base in The Computation of 1% EWT and 6% Creditable VAT - The 1% Expanded Creditable Withholding Tax Imposed UndernikiboigeniusNo ratings yet

- DAP Separate Opinion SAJ Antonio T. CarpioDocument27 pagesDAP Separate Opinion SAJ Antonio T. CarpioHornbook RuleNo ratings yet

- Memo To All SAs & ATLs On The Audit Observations oDocument14 pagesMemo To All SAs & ATLs On The Audit Observations onikiboigeniusNo ratings yet

- Coa C2014-003Document53 pagesCoa C2014-003Mark Lester Lee AureNo ratings yet

- Fraud Audit and Investigation Office0001Document1 pageFraud Audit and Investigation Office0001nikiboigeniusNo ratings yet

- Monetization of Leave Credits PDFDocument1 pageMonetization of Leave Credits PDFnikiboigeniusNo ratings yet

- Commission On Audit: Transmittal of Technical Evaluation ReportDocument1 pageCommission On Audit: Transmittal of Technical Evaluation ReportnikiboigeniusNo ratings yet

- GAA 2013 General ProvisionsDocument107 pagesGAA 2013 General ProvisionsnikiboigeniusNo ratings yet

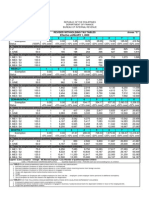

- 2015 BIR Withholding Tax TableDocument1 page2015 BIR Withholding Tax TableJonasAblangNo ratings yet

- RMC No. 23-2007-Government Payments WithholdingDocument7 pagesRMC No. 23-2007-Government Payments WithholdingWizardche_13No ratings yet

- AutobahnDocument2 pagesAutobahnnikiboigeniusNo ratings yet

- Fina L CCP AOM 2013 01 SubsidyDocument6 pagesFina L CCP AOM 2013 01 SubsidynikiboigeniusNo ratings yet

- Recoletos Law Center Notes On LaborDocument33 pagesRecoletos Law Center Notes On LabornikiboigeniusNo ratings yet

- David vs. ArroyoDocument5 pagesDavid vs. ArroyoDeus Dulay93% (14)

- Republic of The Philippines Commonwealth Ave., Quezon City: Commission On AuditDocument4 pagesRepublic of The Philippines Commonwealth Ave., Quezon City: Commission On AuditnikiboigeniusNo ratings yet

- Consti1 Course OutlineDocument22 pagesConsti1 Course OutlinenikiboigeniusNo ratings yet

- Environmental RationaleDocument97 pagesEnvironmental Rationalegoannamarie7814No ratings yet

- ATENEO EvidenceDocument51 pagesATENEO Evidencevanessa pagharion100% (9)

- Political LawDocument15 pagesPolitical LawRaymund Flores100% (1)

- Labor LawDocument17 pagesLabor LawRaymund Flores100% (2)

- Law On Natural Resources Reviewer PDFDocument108 pagesLaw On Natural Resources Reviewer PDFKrisLarrNo ratings yet

- Judicial Affidavit RuleDocument10 pagesJudicial Affidavit RulenikiboigeniusNo ratings yet

- Ada-Songor Lagoon (Site For Salt Industry) Vesting Act, 1992Document4 pagesAda-Songor Lagoon (Site For Salt Industry) Vesting Act, 1992Maame Ekua Yaakwae AsaamNo ratings yet

- CIT Vs Ople Digest For PrintingDocument4 pagesCIT Vs Ople Digest For PrintingJaniceNo ratings yet

- Argument On Behalf of RespondentDocument21 pagesArgument On Behalf of RespondentSuraj PradhanNo ratings yet

- University of Nigeria, Nsukka.: An Assignment Submitted in Partial Fulfillment of The Requirements of The Course GSP 101Document17 pagesUniversity of Nigeria, Nsukka.: An Assignment Submitted in Partial Fulfillment of The Requirements of The Course GSP 101Queen GathaNo ratings yet

- G.R. No. 208566 November 19, 2013 BELGICA vs. Honorable Executive Secretary Paquito N. OCHOA JR, Et Al, RespondentsDocument4 pagesG.R. No. 208566 November 19, 2013 BELGICA vs. Honorable Executive Secretary Paquito N. OCHOA JR, Et Al, RespondentsgbaquiNo ratings yet

- Solution Manual For Molecular Cell Biology 8th Edition Harvey Lodish Arnold Berk Chris A Kaiser Monty Krieger Anthony Bretscher Hidde Ploegh Angelika Amon Kelsey C MartinDocument33 pagesSolution Manual For Molecular Cell Biology 8th Edition Harvey Lodish Arnold Berk Chris A Kaiser Monty Krieger Anthony Bretscher Hidde Ploegh Angelika Amon Kelsey C Martinpicheywitlingaip34100% (51)

- Treaty-Making in The Philippines: What Is A Treaty?Document12 pagesTreaty-Making in The Philippines: What Is A Treaty?Oliver Ong-SalinoNo ratings yet

- Neri vs. SenateDocument200 pagesNeri vs. Senatecmv mendozaNo ratings yet

- How A Bill Becomes A LawDocument16 pagesHow A Bill Becomes A LawGilbert VasquezNo ratings yet

- Handbook For Members Final-IsmailDocument29 pagesHandbook For Members Final-IsmailAli AlviNo ratings yet

- Rodriguez Vs Gella, 92 Phil 603 PDFDocument13 pagesRodriguez Vs Gella, 92 Phil 603 PDFdominicci2026No ratings yet

- Congressional Salaries and AllowancesDocument14 pagesCongressional Salaries and AllowancesJon-Michael EngardNo ratings yet

- G.R. No. L-4043 May 26, 1952 CENON S. CERVANTES, Petitioner, vs. THE AUDITOR GENERAL, Respondent. Facts of The CaseDocument2 pagesG.R. No. L-4043 May 26, 1952 CENON S. CERVANTES, Petitioner, vs. THE AUDITOR GENERAL, Respondent. Facts of The CaseJohñ Lewis FerrerNo ratings yet

- EO-GA-21 Expanding Open Texas COVID-19Document8 pagesEO-GA-21 Expanding Open Texas COVID-19Amber NicoleNo ratings yet

- Meyer Vs NebraskaDocument4 pagesMeyer Vs NebraskaistefifayNo ratings yet

- Rending of VirginiaDocument643 pagesRending of VirginiaNorman Lee AldermanNo ratings yet

- International Association of Machinists ConstitutionDocument198 pagesInternational Association of Machinists ConstitutionLaborUnionNews.comNo ratings yet

- HIST168 Quiz 3Document4 pagesHIST168 Quiz 3Syaiful 9507No ratings yet

- It Is The Legislative Authorization To Allocate Funds For Specified Purposes. A. Obligation B. Appropriation C. Allotment D. CommitmentDocument3 pagesIt Is The Legislative Authorization To Allocate Funds For Specified Purposes. A. Obligation B. Appropriation C. Allotment D. CommitmentMaria TheresaNo ratings yet

- Cabinet PS CAS No. 33 42 of 2018 Okiya Omtata Okoiti Another vs. PSC Others NairobiDocument98 pagesCabinet PS CAS No. 33 42 of 2018 Okiya Omtata Okoiti Another vs. PSC Others NairobiMackenzie MutisyaNo ratings yet

- Time Inside The Red BorderDocument748 pagesTime Inside The Red Borderlancelim100% (1)

- Statcon Cases1Document219 pagesStatcon Cases1Erole John AtienzaNo ratings yet

- The Constitution of The United Republic of Tanzania, 1977Document142 pagesThe Constitution of The United Republic of Tanzania, 1977Kessy JumaNo ratings yet

- Philippine Politics and Governance 6Document6 pagesPhilippine Politics and Governance 6Juan Jaylou AnteNo ratings yet

- The DECODED Illuminati's Protocols of The Learned Elders of ZionDocument5 pagesThe DECODED Illuminati's Protocols of The Learned Elders of ZionGregory Hoo60% (5)

- Ang-Angco v. Castillo 9 Scra 619 1963Document2 pagesAng-Angco v. Castillo 9 Scra 619 1963Rodeo Roy Seriña DagohoyNo ratings yet