Professional Documents

Culture Documents

Inventory Model EOQ Reorder Point Backorders

Uploaded by

manan_09Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Inventory Model EOQ Reorder Point Backorders

Uploaded by

manan_09Copyright:

Available Formats

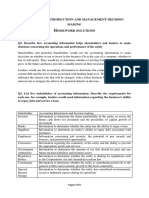

Inventory Model

1. The daily demand for a commodity is approximately 100 units. Every time an order is placed, a

fixed cost K of 100 is incurred. The daily holding cost h per unit inventory is 2 Pence. If the lead

time is 12 days, determine the economic order quantity and the reorder point.

Solution

We know that

K = 100 per order

D = 100 units/day

h = 0.02 per unit per day

L = 12 days

Using equation (1), the EOQ is

y* = 221001000021000KDh==. units

And the cycle time is

t0* = y*/D = 1000/100 = 10

Because in this case L > t0, the reorder point is calculated as

R = (L-t0) D = (12-10) 100 = 200 units

The above calculation shows that it is most economical to order 1000 units of the commodity

when the inventory level for this commodity reaches 200 units.

2. Suppose the North-west Electronics Company has a product for which the assumptions of the

EOQ inventory model with backorders are valid. Information obtained by the company is as

follows:

The annual demand D = 2000 units/year

The cost per order K = 25

The holding cost rate h = 10 per unit per year

The backorder cost p = 30 per unit per year

Work out the optimal order quantity y*, the optimal backorder level b*, and the cycle time T.

Solve:

The optimal order quantity

y* = *2200025/10 (10+30)/30+ = 115.47 units 115 units

The optimal backorder level

b* = 10/(10+30) 115 = 28.75 units 29 units

The cycle time for place orders

T = y*/D = 115/2000 = 0.0575 year

Since there are 250 working days in a year, the cycle time is 0.0575250 = 14.4 working days.

The total annual cost for operating the inventory is

TC = holding cost

+ setup cost

+ shortage cost

= 10(115-29)2/(2115)

+ 200025/115

+ 29230/(2115)

= 322 + 435 + 110 = 867/year

If the company had chosen to prohibit backorders and had adopted the regular EOQ model, the

recommended inventory decision would have been

y* = (2200025/10) = 100 units

3. Beauty Bar Soap is produced on a production line that has an annual capacity of 60,000 cases.

The annual demand is estimated 26,000 cases, with the demand rate essentially constant

through out the year. The cleaning, preparation, and setup of the production line cost

approximately $135. The manufacturing cost per case is $4.50, and the annual holding cost is

figured at a 24% rate. Thus the holding cost per case per year is h = 0.24 $4.50 = $1.08. What is

the recommended production quantity?

Solve:

We know that

P = 60,000 cases/year

D = 26,000 cases/year

K = $135 per run

h = $1.08 per case per year

So, yDKhPPD===22260001351086000060000260003387. cases

The total annual cost according to y* is

TC* = 22260001351083400060000DKhPDP=.= $2073

The cycle time between production runs is

T = y*/D = 3387/26000 = 0.1327 year

Considering that there are 250 working days in a year,

T = 250 0.1327 33 working days

Thus, we should plan a production run of 3387 units about every 33 working days.

4. R & B beverage company has a soft drink product that has a constant annual demand rate of

3600 cases. A case of the soft drink costs R & B $3. Ordering costs are $20 per order and holding

costs are 25% of the value of the inventory. R & B has 250 working days per year, and the lead

time is 5 days. Identify the following aspects of the inventory policy:

a. Economic order quantity

b. Reorder point

c. Cycle time

5. Nick's Camera Shop carries Zodiac instant print film. The film normally costs Nick $3.20 per roll,

and he sells it for $5.25. Nick's average sales are 21 rolls per week. His annual inventory holding

cost rate is 25% and it costs Nick $20 to place an order with Zodiac. If Zodiac offers a 7%

discount on orders of 400 rolls or more and a 10% discount for 900 rolls or more, determine

Nick's optimal order quantity.

6. Suppose the Higley Radio Components Company has a product for which the assumptions of

theinventory model with backorders are valid. Information obtained by the company is as

follows:

D = 2000 units per year

I = 0.20

C = $50 per unit

Ch = IC = (0.20)($50) = $10 per unit per year

C0 = $25 per order

The company is considering the possibility of allowing some backorders to occur for the product.

The annual backorder cost has been estimated to be $30 per unit per year. Using equations

(7.26) and (7.27), we have

115

30

30 10

10

) 25 )( 2000 ( 2

*

Q

and

29

30 10

10

115 *

S

If this solution is implemented, the system will operate with the following properties:

Maximum inventory = Q S = 115 29 = 86

Cycle time = 4 . 14 ) 250 (

2000

115

) 250 (

D

Q

T working days

The total annual cost is

322 $ ) 10 (

) 115 ( 2

) 86 (

cost Holding

2

435 $ ) 25 (

115

2000

cost Ordering

110 $ ) 30 (

) 115 ( 2

) 29 (

cost Backorder

2

Total cost = $867

If the company had chosen to prohibit backorders and had adopted the regular EOQ model, the

recommended inventory decision would have been

100 000 , 10

10

) 25 )( 2000 ( 2

* Q

This order quantity would have resulted in a holding cost and an ordering cost of $500 each or a total

annual cost of $1000 $867 = $133 or 13.3% savings in cost from the no-stockout EOQ model. The

preceding comparison and conclusion are based on the assumption that the backorder model with an

annual cost per backordered unit of $30 is a valid model for the actual inventory situation. If the

company is concerned that stockouts might lead to lost sales, then the savings might not be enough to

warrant switching to an inventory policy that allowed for planned shortages.

You might also like

- Productivity and Reliability-Based Maintenance Management, Second EditionFrom EverandProductivity and Reliability-Based Maintenance Management, Second EditionNo ratings yet

- Trends in Operations Management and Productivity ConceptDocument43 pagesTrends in Operations Management and Productivity ConceptDranreb MagalongNo ratings yet

- CHAPTER 11 Inventory ModelDocument24 pagesCHAPTER 11 Inventory ModelmulunehNo ratings yet

- Inventory ManagementDocument72 pagesInventory ManagementgeorgeNo ratings yet

- CHAPTER 11 Inventory ModelDocument24 pagesCHAPTER 11 Inventory ModelmulunehNo ratings yet

- Chapter 4-Inventory Management PDFDocument19 pagesChapter 4-Inventory Management PDFNegaNo ratings yet

- SchedulingDocument20 pagesSchedulingShivansh SainiNo ratings yet

- 7.chapter 5 Capacity PlanningDocument16 pages7.chapter 5 Capacity Planningopio jamesNo ratings yet

- Aggregate Planning - FinalDocument36 pagesAggregate Planning - FinalShailu Sharma100% (1)

- ISYE 3450 Homework 1Document2 pagesISYE 3450 Homework 1Brandon HarrisNo ratings yet

- 21 Chapter 13Document25 pages21 Chapter 13Fajar Pitarsi DharmaNo ratings yet

- Assignment 5 - Capacity PlanningDocument1 pageAssignment 5 - Capacity Planningamr onsyNo ratings yet

- Inventory Models Guide for BusinessesDocument24 pagesInventory Models Guide for BusinessesRichard Sinchongco Aguilar Jr.No ratings yet

- Taguchi'S Quality Loss FunctionDocument17 pagesTaguchi'S Quality Loss FunctionAvi Barua100% (1)

- Inventory Management - Lecture 15.04.2015Document56 pagesInventory Management - Lecture 15.04.2015Asia Oleśków SzłapkaNo ratings yet

- 7.0 Inventory ManagementDocument24 pages7.0 Inventory Managementrohanfyaz00No ratings yet

- Ch5 Capacity PlanningDocument8 pagesCh5 Capacity PlanningJess JerinnNo ratings yet

- Chapter Seven: Basic Accounting Principles & Budgeting FundamentalsDocument35 pagesChapter Seven: Basic Accounting Principles & Budgeting FundamentalsbelaynehNo ratings yet

- MRP, Jit, ErpDocument26 pagesMRP, Jit, ErpRupendra TripathiNo ratings yet

- Silo - Tips - Chapter 5 Aggregate Planning PDFDocument57 pagesSilo - Tips - Chapter 5 Aggregate Planning PDFnitinsachdeva21No ratings yet

- Assignment 2: Problem 1Document3 pagesAssignment 2: Problem 1musicslave960% (1)

- Cognitive ErgonomicsDocument27 pagesCognitive ErgonomicsShenlandNo ratings yet

- Defining and Measuring ProductivityDocument4 pagesDefining and Measuring ProductivityFadhil HerdiansyahNo ratings yet

- Inventory ControlDocument31 pagesInventory ControlAshish Chatrath100% (1)

- Solving Facility Location Problems with Center of Gravity and P-Median ApproachesDocument30 pagesSolving Facility Location Problems with Center of Gravity and P-Median ApproachesAbhishek PadhyeNo ratings yet

- CH15 Operations SchedulingDocument37 pagesCH15 Operations SchedulingChristian John Linalcoso Arante50% (2)

- OPERATIONS RESEARCH: INTRODUCTION AND LINEAR PROGRAMMINGDocument145 pagesOPERATIONS RESEARCH: INTRODUCTION AND LINEAR PROGRAMMINGEzzaddin Sultan100% (1)

- Optimize Inventory Costs with EOQ and EPQ ModelsDocument40 pagesOptimize Inventory Costs with EOQ and EPQ Modelswagdy87No ratings yet

- Time Study of A Furniture Industry A Case StudyDocument5 pagesTime Study of A Furniture Industry A Case StudyKhalfi PipinNo ratings yet

- Single Channel Queue ModelsDocument14 pagesSingle Channel Queue ModelsZharlene SasotNo ratings yet

- Module 1 - Introduction and Management Decision Making - Homework SolutionsDocument4 pagesModule 1 - Introduction and Management Decision Making - Homework SolutionsAbelNo ratings yet

- Operations Management FundamentalsDocument129 pagesOperations Management FundamentalsSai Charan RajNo ratings yet

- CHAPTER - 3 (A) : ASSEMBLY Systems & LINE BalancingDocument48 pagesCHAPTER - 3 (A) : ASSEMBLY Systems & LINE BalancingshivaNo ratings yet

- Assignment Concept Check #2Document1 pageAssignment Concept Check #2steveshowmanNo ratings yet

- XYZ Car Engine Forecasting AccuracyDocument4 pagesXYZ Car Engine Forecasting AccuracyDavid García Barrios100% (1)

- Ch08 - InventoryDocument111 pagesCh08 - InventoryjosephdevaraajNo ratings yet

- Chapter 2Document37 pagesChapter 2zelalem tesseraNo ratings yet

- Silo Manufacturing Corporation SMC - Part A, Part B Managing With Economic Order QuantityDocument10 pagesSilo Manufacturing Corporation SMC - Part A, Part B Managing With Economic Order QuantitysivaNo ratings yet

- Pom Inventory ProblemsDocument8 pagesPom Inventory ProblemsSharath Kannan0% (2)

- Sheet 3 Charting and Diagram Chapter 9Document12 pagesSheet 3 Charting and Diagram Chapter 9AhmedAhmed100% (2)

- Chapter 4 Inventory MGTDocument26 pagesChapter 4 Inventory MGTRamadan DestaNo ratings yet

- INTERNATIONAL UNIVERSITY – VNU HCMC SCHOOL OF BUSINESS FINAL EXAM PROBLEMS FOR CHAPTER 9 AND 12 LAYOUT STRATEGY AND INVENTORY MANAGEMENTDocument20 pagesINTERNATIONAL UNIVERSITY – VNU HCMC SCHOOL OF BUSINESS FINAL EXAM PROBLEMS FOR CHAPTER 9 AND 12 LAYOUT STRATEGY AND INVENTORY MANAGEMENTThanh Ngân0% (2)

- Assignment 2Document3 pagesAssignment 2Sodhani AnkurNo ratings yet

- Chapter 4 Single Item Probabilistic DemandDocument92 pagesChapter 4 Single Item Probabilistic DemandQuỳnh NguyễnNo ratings yet

- Solved 1 Create A Service Blueprint of The Refinancing Process WhyDocument1 pageSolved 1 Create A Service Blueprint of The Refinancing Process WhyDoreenNo ratings yet

- Dps 502 Inventory Management Feb 23 2012Document153 pagesDps 502 Inventory Management Feb 23 2012jaminkwadNo ratings yet

- Inventory ControlDocument26 pagesInventory ControlhajarawNo ratings yet

- What Is Inventory?: Parts and Materials Available Capacity Human ResourcesDocument35 pagesWhat Is Inventory?: Parts and Materials Available Capacity Human ResourcesHaider ShadfanNo ratings yet

- 8, 9 Rank Order ClusteringDocument19 pages8, 9 Rank Order ClusteringAkash Tripathi100% (1)

- Assignment - Operations & Production PDFDocument60 pagesAssignment - Operations & Production PDFJionstNo ratings yet

- Ch-05 Material Inventory Controls (Online Class)Document6 pagesCh-05 Material Inventory Controls (Online Class)shayan zamanNo ratings yet

- Optimal inventory order sizes and profits for four sweater stylesDocument7 pagesOptimal inventory order sizes and profits for four sweater stylesJyothi VenuNo ratings yet

- Product & Process LayoutDocument37 pagesProduct & Process Layoutmeghp8074No ratings yet

- American Box Company Case AnalysisDocument9 pagesAmerican Box Company Case AnalysisPranav JainNo ratings yet

- PPIC-6-REVIEW-Order Quantity Example 18 Maret 2020 PDFDocument80 pagesPPIC-6-REVIEW-Order Quantity Example 18 Maret 2020 PDFDaffa JNo ratings yet

- Plant LayoutDocument13 pagesPlant LayoutLukka KarthikNo ratings yet

- Unit5 Part I InventoryDocument100 pagesUnit5 Part I InventoryMounisha g bNo ratings yet

- Inventory ManagementDocument87 pagesInventory ManagementMaruf AitizzoNo ratings yet

- Crystal Sparkle Co. capacity planning problemsDocument6 pagesCrystal Sparkle Co. capacity planning problemsvita sarasi100% (1)

- Examples of Inventory ManagementDocument17 pagesExamples of Inventory ManagementtasbihnihadNo ratings yet

- PROBABILITYDocument45 pagesPROBABILITYmanan_09No ratings yet

- D D C N: ConfidentialDocument4 pagesD D C N: Confidentialmanan_09No ratings yet

- Normal DistributionDocument4 pagesNormal Distributionmanan_09No ratings yet

- Trigonometric Formulae and IdentitiesDocument7 pagesTrigonometric Formulae and Identitiesmanan_09No ratings yet

- Final L6 2009 SchmeDocument7 pagesFinal L6 2009 Schmemanan_09No ratings yet

- DE Differential Equations GuideDocument8 pagesDE Differential Equations Guidemanan_09No ratings yet

- P, Q, Where P Q, Have Mean: ConfidentialDocument3 pagesP, Q, Where P Q, Have Mean: Confidentialmanan_09No ratings yet

- Chapter4 - Continuous Probability Distribution - EasyDocument12 pagesChapter4 - Continuous Probability Distribution - Easymanan_09No ratings yet

- Chapter3 - Discrete Probability Distribution - EasyDocument10 pagesChapter3 - Discrete Probability Distribution - Easymanan_09No ratings yet

- Topic: Probability: S N E NDocument7 pagesTopic: Probability: S N E Nmanan_09No ratings yet

- I. Description of Data: Chapter - 1: StatisticsDocument10 pagesI. Description of Data: Chapter - 1: Statisticsmanan_09No ratings yet

- Data DescriptionDocument103 pagesData Descriptionmanan_09No ratings yet

- Moisture ManagementDocument5 pagesMoisture ManagementSombis2011No ratings yet

- Technical Data Speedmaster CX 104Document2 pagesTechnical Data Speedmaster CX 104Vinh Lê HữuNo ratings yet

- Lesson 1.5: Measurements of Directions and Angles: Unit IDocument12 pagesLesson 1.5: Measurements of Directions and Angles: Unit ICarlo CabanusNo ratings yet

- Cloning of CELLDocument43 pagesCloning of CELLsashaikh1213No ratings yet

- Convection: Example 3.1Document5 pagesConvection: Example 3.1MChobind RivaldoNo ratings yet

- ChecklistsDocument1 pageChecklistsnotme2120No ratings yet

- 19174the Rise of Industrial Big Data WP Gft834Document6 pages19174the Rise of Industrial Big Data WP Gft834em01803257No ratings yet

- Eb4069135 F enDocument13 pagesEb4069135 F enkalvino314No ratings yet

- Đánh giá chế độ ăn kiêng: Nhịn ăn gián đoạn để giảm cân- wed HarvardDocument14 pagesĐánh giá chế độ ăn kiêng: Nhịn ăn gián đoạn để giảm cân- wed HarvardNam NguyenHoangNo ratings yet

- Unit-I EsDocument53 pagesUnit-I Eschethan.naik24No ratings yet

- Equations 2Document8 pagesEquations 2Patrick ValdezNo ratings yet

- How To Use Dr. Foster's Essentials: Essential Oils and BlendsDocument5 pagesHow To Use Dr. Foster's Essentials: Essential Oils and BlendsemanvitoriaNo ratings yet

- Structural Notes SampleDocument14 pagesStructural Notes SampleNicole FrancisNo ratings yet

- EBARA FS513CT-R0E pump manualDocument6 pagesEBARA FS513CT-R0E pump manualApriliyanto Rahadi PradanaNo ratings yet

- Durango GS 6-7 Helitack OutreachDocument4 pagesDurango GS 6-7 Helitack OutreachdcgmNo ratings yet

- Traxonecue Catalogue 2011 Revise 2 Low Res Eng (4!5!2011)Document62 pagesTraxonecue Catalogue 2011 Revise 2 Low Res Eng (4!5!2011)Wilson ChimNo ratings yet

- Discrete Variable Probability Distribution FunctionsDocument47 pagesDiscrete Variable Probability Distribution FunctionsJanine CayabyabNo ratings yet

- Motherboards Tuf z270 Mark 2Document70 pagesMotherboards Tuf z270 Mark 2Jonah HexNo ratings yet

- RESISTANCEDocument9 pagesRESISTANCERohit SahuNo ratings yet

- 2tak Vs 4takDocument3 pages2tak Vs 4takTaufiq AlhakimNo ratings yet

- User ManualDocument14 pagesUser ManualKhaled BellegdyNo ratings yet

- Brosur Sy135cDocument9 pagesBrosur Sy135cDenny KurniawanNo ratings yet

- Tenofovir Disoproxil Fumarate: Riefing - Nfrared BsorptionDocument4 pagesTenofovir Disoproxil Fumarate: Riefing - Nfrared BsorptionMostofa RubalNo ratings yet

- Contemporary Philippine Arts From The Regions: Quarter 3Document15 pagesContemporary Philippine Arts From The Regions: Quarter 3Ackie Inacay RosarioNo ratings yet

- Starter Unit Basic Vocabulary: Smart Planet 3Document21 pagesStarter Unit Basic Vocabulary: Smart Planet 3Rober SanzNo ratings yet

- The Focus Shooting Method CourseDocument48 pagesThe Focus Shooting Method CourseKobiXDNo ratings yet

- Unit 5 Project ManagementDocument19 pagesUnit 5 Project ManagementYashu RajNo ratings yet

- DigiMasterIII Car Model ListDocument72 pagesDigiMasterIII Car Model ListRAGB1989No ratings yet

- Pancreatic NekrosisDocument8 pagesPancreatic Nekrosisrisyda_mkhNo ratings yet

- THEORY of METAL CUTTING-Cutting Tool, Cutting Fluid & Machining EconomicsDocument17 pagesTHEORY of METAL CUTTING-Cutting Tool, Cutting Fluid & Machining EconomicsIzi75% (4)

- Outliers by Malcolm Gladwell - Book Summary: The Story of SuccessFrom EverandOutliers by Malcolm Gladwell - Book Summary: The Story of SuccessRating: 4.5 out of 5 stars4.5/5 (17)

- Auto Parts Storekeeper: Passbooks Study GuideFrom EverandAuto Parts Storekeeper: Passbooks Study GuideNo ratings yet

- Programmer Aptitude Test (PAT): Passbooks Study GuideFrom EverandProgrammer Aptitude Test (PAT): Passbooks Study GuideNo ratings yet

- The PMP Project Management Professional Certification Exam Study Guide PMBOK Seventh 7th Edition: The Complete Exam Prep With Practice Tests and Insider Tips & Tricks | Achieve a 98% Pass Rate on Your First AttemptFrom EverandThe PMP Project Management Professional Certification Exam Study Guide PMBOK Seventh 7th Edition: The Complete Exam Prep With Practice Tests and Insider Tips & Tricks | Achieve a 98% Pass Rate on Your First AttemptNo ratings yet

- Check Your English Vocabulary for TOEFL: Essential words and phrases to help you maximise your TOEFL scoreFrom EverandCheck Your English Vocabulary for TOEFL: Essential words and phrases to help you maximise your TOEFL scoreRating: 5 out of 5 stars5/5 (1)

- EMT (Emergency Medical Technician) Crash Course Book + OnlineFrom EverandEMT (Emergency Medical Technician) Crash Course Book + OnlineRating: 4.5 out of 5 stars4.5/5 (4)

- Radiographic Testing: Theory, Formulas, Terminology, and Interviews Q&AFrom EverandRadiographic Testing: Theory, Formulas, Terminology, and Interviews Q&ANo ratings yet

- The NCLEX-RN Exam Study Guide: Premium Edition: Proven Methods to Pass the NCLEX-RN Examination with Confidence – Extensive Next Generation NCLEX (NGN) Practice Test Questions with AnswersFrom EverandThe NCLEX-RN Exam Study Guide: Premium Edition: Proven Methods to Pass the NCLEX-RN Examination with Confidence – Extensive Next Generation NCLEX (NGN) Practice Test Questions with AnswersNo ratings yet

- 2023/2024 ASVAB For Dummies (+ 7 Practice Tests, Flashcards, & Videos Online)From Everand2023/2024 ASVAB For Dummies (+ 7 Practice Tests, Flashcards, & Videos Online)No ratings yet

- Improve Your Global Business English: The Essential Toolkit for Writing and Communicating Across BordersFrom EverandImprove Your Global Business English: The Essential Toolkit for Writing and Communicating Across BordersRating: 4 out of 5 stars4/5 (14)

- Clinical Internal Medicine Review 2023: For USMLE Step 2 CK and COMLEX-USA Level 2From EverandClinical Internal Medicine Review 2023: For USMLE Step 2 CK and COMLEX-USA Level 2No ratings yet

- ASE A1 Engine Repair Study Guide: Complete Review & Test Prep For The ASE A1 Engine Repair Exam: With Three Full-Length Practice Tests & AnswersFrom EverandASE A1 Engine Repair Study Guide: Complete Review & Test Prep For The ASE A1 Engine Repair Exam: With Three Full-Length Practice Tests & AnswersNo ratings yet

- Real Property, Law Essentials: Governing Law for Law School and Bar Exam PrepFrom EverandReal Property, Law Essentials: Governing Law for Law School and Bar Exam PrepNo ratings yet

- The Science of Self-Discipline: The Willpower, Mental Toughness, and Self-Control to Resist Temptation and Achieve Your GoalsFrom EverandThe Science of Self-Discipline: The Willpower, Mental Toughness, and Self-Control to Resist Temptation and Achieve Your GoalsRating: 4.5 out of 5 stars4.5/5 (76)

- Nursing School Entrance Exams: HESI A2 / NLN PAX-RN / PSB-RN / RNEE / TEASFrom EverandNursing School Entrance Exams: HESI A2 / NLN PAX-RN / PSB-RN / RNEE / TEASNo ratings yet

- EMT (Emergency Medical Technician) Crash Course with Online Practice Test, 2nd Edition: Get a Passing Score in Less TimeFrom EverandEMT (Emergency Medical Technician) Crash Course with Online Practice Test, 2nd Edition: Get a Passing Score in Less TimeRating: 3.5 out of 5 stars3.5/5 (3)

- Summary of Sapiens: A Brief History of Humankind By Yuval Noah HarariFrom EverandSummary of Sapiens: A Brief History of Humankind By Yuval Noah HarariRating: 1 out of 5 stars1/5 (3)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- NCLEX-RN Exam Prep 2024-2025: 500 NCLEX-RN Test Prep Questions and Answers with ExplanationsFrom EverandNCLEX-RN Exam Prep 2024-2025: 500 NCLEX-RN Test Prep Questions and Answers with ExplanationsNo ratings yet

- 1,001 Questions & Answers for the CWI Exam: Welding Metallurgy and Visual Inspection Study GuideFrom Everand1,001 Questions & Answers for the CWI Exam: Welding Metallurgy and Visual Inspection Study GuideRating: 3.5 out of 5 stars3.5/5 (7)

- PTCE - Pharmacy Technician Certification Exam Flashcard Book + OnlineFrom EverandPTCE - Pharmacy Technician Certification Exam Flashcard Book + OnlineNo ratings yet

- 2024 – 2025 FAA Drone License Exam Guide: A Simplified Approach to Passing the FAA Part 107 Drone License Exam at a sitting With Test Questions and AnswersFrom Everand2024 – 2025 FAA Drone License Exam Guide: A Simplified Approach to Passing the FAA Part 107 Drone License Exam at a sitting With Test Questions and AnswersNo ratings yet