Professional Documents

Culture Documents

2014.07 - Oil & Gas Study - Criteria For The Non Investment Grade World

Uploaded by

jj88jeff0 ratings0% found this document useful (0 votes)

87 views236 pagesDBRS Criteria for Rating non investment grade oil & gas companies

Original Title

2014.07_Oil & Gas Study - Criteria for the Non Investment Grade World

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDBRS Criteria for Rating non investment grade oil & gas companies

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

87 views236 pages2014.07 - Oil & Gas Study - Criteria For The Non Investment Grade World

Uploaded by

jj88jeffDBRS Criteria for Rating non investment grade oil & gas companies

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 236

Industry Study

Oil & Gas Study

Criteria For the Non-Investment Grade

World

July 2014

CONTACT INFORMATION

James Jung, CFA, FRM, CMA

Senior Vice President

Corporate Research & Analysis

+1 416 597 7577

jjung@dbrs.com

Eric Eng, MBA

Vice President

Corporate Research & Analysis

+1 416 597 7578

eeng@dbrs.com

Peter Schroeder

Managing Director

Corporate Research & Analysis

+1 416 597 7579

ps@dbrs.com

Andy Thi

Senior Financial Analyst

Corporate Research & Analysis

+1 416 597 7337

athi@dbrs.com

Eric Chun

Financial Analyst

Corporate Research & Analysis

+1 416 597 7341

echun@dbrs.com

Angie Wong

Junior Financial Analyst

Corporate Research & Analysis

Saadat Hussain

Junior Financial Analyst

Corporate Research & Analysis

Salina Miao

Junior Financial Analyst

Corporate Research & Analysis

Lin Dong

Junior Financial Analyst

Corporate Research & Analysis

Linda Zhang

Junior Financial Analyst

Corporate Research & Analysis

Vincent Chui

Junior Financial Analyst

Corporate Research & Analysis

DBRS is a full-service credit rating agency

established in 1976. Privately owned and operated

without affliation to any fnancial institution,

DBRS is respected for its independent, third-party

evaluations of corporate and government issues,

spanning North America, Europe and Asia.

DBRSs extensive coverage of securitizations

and structured fnance transactions solidifes our

standing as a leading provider of comprehensive,

in-depth credit analysis.

All DBRS ratings and research are available in

hard-copy format and electronically on Bloomberg

and at DBRS.com, our lead delivery tool for

organized, Web-based, up-to-the-minute

information. We remain committed to

continuously refning our expertise in the analysis

of credit quality and are dedicated to maintaining

objective and credible opinions within the global

fnancial marketplace.

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

3

Oil and Gas Study

Criteria For the Non-Investment Grade World

TABLE OF CONTENTS

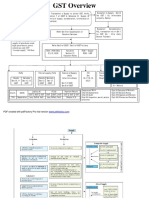

Executive Summary 4

The Five Business Factors 4

Financial Risk Factors 5

Topic Two: The Natural Gas Focus 6

Natural Gas: The Global Perspective 6

Natural Gas: North American Focus 7

The Past: The Great Pricing Divergence 7

The Future: Natural Gas Environment Supports Higher Prices 9

Topic Three: Sensitivity Analysis for Oil Producers 10

Oil Could Pressure Weaker Credits 10

Characteristics of Players 11

2014 Ratings Outlook 12

Top Ten Credit Drivers 12

Overall Rankings 14

Overall Standing 15

Key Players 20

Key Credit Metrics 34

Income Statement Data in Q1 2014 39

Balance Sheet and Capital Structure in Q1 2014 44

Q1 2014 Cash Flows 49

Fiscal Year Ends 55

Aggregate Totals and Averages 59

Key Metrics 59

Key Ratios 59

Company List 60

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

4

Executive Summary

Criteria for the Non-Investment Grade World is a statistical study of 163 companies in the oil and

gas industry between 2008 and Q1 2014. In its review, DBRS has targeted the industry participants with

characteristics indicative of a non-investment grade rating, which are ratings below BBB (low). This is the

fnal study of a four part series that identifes the key characteristics used to defne the individual rating

categories. DBRS recently published three studies, which focused on the AAA/AA (Best of the Best,

September 2013), A (Straight As, December 2013) and BBB (Making the Grade, April 2014)

rating categories. In addition, this study updates discussion on the natural gas market, the oil pricing

sensitivity analysis, and the 2014 ratings outlook.

In determining any rating in the oil and gas sector, DBRS places emphasis on fve key criteria.

THE FIVE BUSINESS FACTORS

DBRS uses fve key business factors in determining credit quality for oil and gas exploration and production

(E&P) companies. These factors include: (1) Size and Business Mix; (2) Reserves of Core Operations; (3)

Cost Competitiveness; (4) Sensitivity to Price/Market Volatility; and (5) Capital Flexibility.

(1) Size and Business Mix Analysis:

Size is one of the most critical factors in determining credit quality in the oil and gas sector, especially

for non-investment grade companies. Larger entities are typically able to take a longer-term approach

to resource development, with lower borrowing costs and greater diversifcation. Smaller entities on the

other hand have considerably less fexibility to withstand market volatility, which increases their credit

risk. Daily production is key measurement to determine size for an exploration & production (E&P)

company.

Common characteristics for a Non-Investment Grade rating

Very small to small size (typically less than 100,000 barrels of oil equivalent per day (boe/d))

Minimal integration

Minimal product mix (liquids versus dry gas)

Limited geographical diversifcation

(2) Reserves of Core Operations Analysis:

The companys reserves quality is another important factor to determine credit quality. Non-investment

grade companies generally have a relatively limited inventory of reserves that can be developed in the

future. These reserves also typically have a lower quality relative to investment grade companies.

Common characteristics for a Non-Investment Grade rating

Weak reserve quality

Short reserve life

Weak ability to grow reserves and production

(3) Cost Competitiveness Analysis:

Non-investment grade companies generally have a relatively high cost base, with below-average operating

effciency. These companies are generally not vertically integrated, with only upstream operations.

Common characteristics for a Non-Investment Grade rating

High cost base

Low operating effciency

Weak infrastructure

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

5

(4) Sensitivity to Price/Market Volatility Analysis:

Non-investment grade companies have a limited ability to withstand signifcant pricing volatility and are

highly susceptible to prolonged periods in low pricing environments.

Common characteristics for a Non-Investment Grade rating

Weak ability to withstand market volatility

(5) Capital Flexibility Analysis:

Non-investment grade players generally have a greater diffculty in responding to changing dynamics in

the industry. The players typically have weak capital fexibility, which will negatively affect the effciency

and effectiveness of capital deployment.

Common characteristics for a Non-Investment Grade rating

Weak capital fexibility.

FINANCIAL RISK FACTORS

DBRS ratings are also determined by the level of fnancial risk based on the following criteria. Key metrics

for the non-investment grade rating categories are shown below.

Key Credit Metrics:

Key Metric BB B

Debt-to-cash fow 2.0x to 3.0x > 3.0x

Debt-to-capital 45% to 55% > 55%

EBIT interest coverage 3.0x to 5.0x < 3.0x

Analysis:

Key metrics for a non-investment grade rated entity are typically much weaker versus investment grade

entities. Specifcally, non-investment grade entities generally have poor balance sheets, weaker cash fow

streams to service debt obligations, and much more limited access to capital to fund future capex needs.

Ranking:

DBRS notes that the vast majority of the companies reviewed were non-investment grade. Of the 163

companies reviewed, 110 companies had characteristics indicative of a non-investment grade rating.

In determining the ranking of the companies within this study, DBRS focused primarily on fnancial

statistics, sovereign infuence and to a lesser extent, business risk characteristics. The ranking within the

study is presented for illustrative purposes only and in most cases, do not represent DBRSs actual ratings.

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

6

Topic Two: The Natural Gas Focus

NATURAL GAS: THE GLOBAL PERSPECTIVE

What should the price of natural gas be?

The price of natural gas is traditionally based on a six to one energy equivalent to oil. The ratio is based

on the substitution between oil for natural gas. For example, a barrel of oil will generate approximately

six million British thermal units (Btus) of energy, while one thousand cubic feet (Mcf) of gas would

produce approximately one million Btus of energy. On a direct substitution basis, this would indicate

that the price of natural gas should theoretically be over $16 based on an oil price of $100. However, in

reality, oil and gas are not direct substitutions and are subject to supply and demand imbalances that may

make this ratio invalid.

Todays pricing environment in Asia, Europe and North America

Natural gas pricing varies quite dramatically between Asia, Europe and North America.

Asia: Natural gas prices are linked to the price of Brent oil on an energy-equivalent basis with various

pricing adjustments to limit volatility. The Q1 2014 price in Japan averaged over $16/million British

thermal units (MMBtu). Key suppliers to the region are Australia, Qatar, Malaysia and Indonesia.

Europe: Similar to Asia, natural gas prices are closely linked to Brent oil. For example, the price for

natural gas from Russia is often linked to Brent oil and sold under long-term contracts. Currently, the

Russian Natural Gas border price in Germany trades just under $11/MMBtu. Key suppliers to the

region are the U.K. (North Sea), Norway, the Netherlands and Russia.

North America: Pricing is based on market supply and demand characteristics, which may vary quite

dramatically from an energy-equivalent basis. In Q1 2014, the Henry Hub (the largest natural gas hub

in North America) price averaged approximately $4.60/MMBtu. This low price, relative to Europe

and Asia, is attributable to oversupply conditions that have existed since 2008. This region is self-

suffcient and does not require foreign imports.

Price Comparison - Henry Hub vs. Japan vs. Russia

NYMEX Japan Import LNG Price

U

S

D

/

M

M

B

t

u

Natural Gas - Russian Natural Gas Border Price in Germany

Source: Bloomberg

$0

$2

$4

$6

$8

$10

$12

$14

$16

$18

$20

2006 2007 2008 2009 2010 2011 2012 2013 2014

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

7

NATURAL GAS: NORTH AMERICAN FOCUS

The North American natural gas pricing imbalance - good or bad?

The defnition of an imbalance is an ineffciency within the capital markets, thus, the net impact is negative.

The current pricing imbalance between North America and other regions has created many winners and

losers. The main benefciaries of low natural gas prices in North America are consumers and energy-

intensive industries such as oil sands players. Consumers beneft from lower utility rates and heating

costs, while the industrial sector is better positioned today to handle foreign competition. The key losers

during a weak natural gas pricing environment are the natural gas producers, which face tremendous

margin pressures and weak proftability. To correct the overall negative impact of the imbalance, North

America needs to have the ability to export an excess supply of natural gas to global markets.

Shifting natural gas trends has lead to greater volatility

Prior to 2008, the price of natural gas was closely linked to oil prices and natural gas production consisted

primarily of conventional drilling methods used to extract a depleting resource base. Using conventional

technology, natural gas supply was not keeping pace with rising consumption. The growth of consumption

was primarily attributable to changes in the electricity generation mix from dirty coal to cleaner

natural gas. Ultimately, this consumption shift led to concerns that North America would eventually

run out of natural gas, causing a spike in pricing. Furthermore, these concerns led to the development of

fracking technology, contributing to a massive oversupply of natural gas into the North America market.

As a result, considerable pricing volatility followed.

NYMEX AECO Differential

$

Source: Bloomberg

(1.5)

(1.0)

(0.5)

0.0

0.5

1.0

1.5

2.0

2.5

3.0

2008 2009 2010 2011 2012 2013 2014

THE PAST: THE GREAT PRICING DIVERGENCE

Prior to 2008, North American natural gas prices were closely linked to the price of crude oil (6:1

to 10:1), as both commodities benefted from tight supply-demand conditions. Post-2008, the great

divergence occurred, as natural gas supply dramatically increased with the unexpected development of

fracking technologies. This resulted in a signifcant drop in prices in North America that continues today.

However, despite the cold winter that recently passed (which helped eliminate some of the excess supply

conditions that existed) pricing has yet to fully recover. The section that follows outlines some of the

reasons contributing to this odd pricing dynamic.

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

8

WTI-NYMEX Price Comparison

NYMEX WTI

U

S

D

/

b

b

l

U

S

D

/

m

m

c

f

Source: Bloomberg

0

20

40

60

80

100

120

140

160

0

2

4

6

8

10

12

14

16

18

1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014

WTI-NYMEX Ratio

Price Ratio Mean - 12.4 Median - 9.6

Source: Bloomberg

0

10

20

30

40

50

60

1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014

U.S. Natural Gas Storage (Bcf) Canadian Natural Gas Storage (Bcf)

Source: Canadian Gas Association Source: Canadian Gas Association

B

c

f

Record High

Oct. 2012

3,908 Bcf

B

c

f

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

Jan. Feb. Mar. Apr. May Jun. Jul. Aug. Sept. Oct. Nov. Dec.

2014

To Date

Mar. 2008

1,248 Bcf

6 Year High/Low Range

6 Year Average

2011

2012

2013

2014

0

100

200

300

400

500

600

700

800

900

Jan. Feb. Mar. Apr. May Jun. Jul. Aug. Sept. Oct. Nov. Dec.

Record High

Oct. 2013

821 Bcf

Mar. 2012

256 Bcf

2014

To Date

6 Year High/Low Range

6 Year Average

2011

2012

2013

2014

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

9

THE FUTURE: PRICING UNCERTAINTY

Should 2015 see a winter similar to this past year, natural gas prices could be driven considerably higher

than currently forecasted. This is somewhat positive news for most E&Ps, especially for operators that

have greater exposure to North American natural gas. However, it is unlikely to result in prices greater

than $5/MMcf. Below are some supply-side and demand-side dynamics that will likely continue to affect

the natural gas pricing environment going forward.

Future supply-side dynamics

Rig count heavily infuenced by the pricing environment: DBRS believes that E&P producers will

begin to allocate more capital expenditures (capex) to natural gas production when prices surpass

approximately $5/MMcf. This could limit any upside in pricing beyond $5/MMcf.

Growing associated natural gas production from liquids-focused drilling: Signifcant production

from unconventional plays will continue to have an impact on the level of liquids and gas volumes

produced.

Continued improvement in drilling and completion effciency: Exploration and production (E&P)

producers have continued to increase operating effciencies for producing wells. As a result, production

has continued to rise despite a drop in rig count.

Future development of LNG: In May 2013, the frst natural gas project that will allow for the export

of natural gas from North America to global markets was approved. Additional approvals could

improve future supply-demand balances; however, lead times for these developments can exceed ten

years.

Future demand-side dynamics

The use of natural gas from the power sector: Coal-fred generation typically becomes more cost

effective when natural gas prices are over $4/MMcf. This could limit any signifcant growth in demand

from the power sector.

Weather conditions: As evidenced, warmer- or colder-than-average temperatures greatly infuence

the demand-supply balance, and will continue to have an impact on price volatility. For example

in 2014, the frigid temperatures in North America saw inventories decline substantially resulting

in a signifcant increase in prices. Should North America experience another cold winter, potential

shortages could exist, which would result in signifcant price volatility.

Recovery of the North American economy: The pace of economic improvement could have a positive

impact on demand for natural gas.

Future transportation fuel: Natural gas as a substitute to fuel for the transportation industry remains in

its infancy. However, new technologies and any pricing differentials could increasingly lead consumers

to switch over in the long term.

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

10

Topic Three: Sensitivity Analysis for Oil Producers

OIL COULD PRESSURE WEAKER CREDITS

DBRS has found that, should oil prices drop below the $60 per barrel level, smaller E&P issuers and mid-

sized issuers with limited fnancial fexibility will likely face signifcant negative pressure on credit ratings.

DBRS has stress-tested the impact of various crude oil pricing points on issuers within its ratings universe,

analyzing the effects of oil prices on capex, dividends, ability to access capital market funding and asset

sales/purchases. Large E&P issuers could possibly see some minor pressure on metrics; however, they

would generally have suffcient fnancial fexibility and liquidity to withstand extended periods of lower

pricing, with little to no rating action expected.

Small E&P (<100 mboe/d)

Crude Pricing Capex Dividends Capital Market Access Asset Sales

100+ signifcant expansion increasing dividends strong access limited transactions

90 expansion plans modest dividend

increases

good access modest increase in

transactions

80 no additional expansion

plans

no change limited access assets sold at slight

premium

70 capex below budget dividend cuts very limited access assets sold at discount

<60 capex curtailment signifcant dividend cuts no access assets sold at signifcant

discount

Mid-sized E&P (100 to 500 mboe/d)

Crude Pricing Capex Dividends Capital Market Access Asset Sales/Purchases

100+ signifcant expansion modest dividend

increases

strong access limited transactions

90 expansion plans modest dividend

increases

strong access modest increase in

transactions

80 no additional expansion

plans

no change good access assets sold at slight

premium

70 no additional expansion

plans

no change good access assets sold/bought at

discount

<60 capex below budget dividend cuts limited access assets sold/bought at

signifcant discount

Large E&P (> 500 mboe/d)

Crude Pricing Capex Dividends Capital Market Access Asset Purchases

100+ signifcant expansion modest dividend

increases

strong access limited transactions

90 expansion plans no change strong access modest increase in

transactions

80 no additional expansion

plans

no change strong access assets sold at slight

premium

70 no additional expansion

plans

no change good access assets bought at

discount

<60 no additional expansion

plans

no change good access assets bought at

signifcant discount

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

11

For smaller to mid-sized E&P issuers, sub-$60 oil prices would likely cause a signifcant shift in capex and

dividend planning. Issuers slow to react to this lower pricing level could face considerable free cash fow

defcits that would need to be funded with existing liquidity. Typically, liquidity for these issuers consists

of: (1) existing on-balance sheet cash and credit facilities, (2) cuts to dividends and capex and, as a last

resort, (3) asset sales. For those mid-sized E&P issuers, liquidity support should be sustainable for at

least two years, with only a minimal impact on current ratings. However, for the smaller E&Ps, liquidity

support is typically shorter-term in nature and less able to withstand price shocks. As a result, smaller

E&P issuers face downside risks to current ratings, should oil prices drop below $60 for an extended

period of time.

Larger E&P issuers take a multiple-cycle approach to strategic planning. During sub-$60 pricing periods,

they are unlikely to change plans and may see this pricing as an opportunity to acquire assets at a

discount. Given their size and the strength of their fnancial profles, larger E&P issuers are unlikely to

experience pressure on ratings. Larger companies have adequate access to capital markets under most

conditions and maintain considerable balance sheet strength.

$70 to $80 pricing results in few changes to strategic plans

Large- and mid-sized E&P issuers are not likely to be affected at pricing between $70 and $80 per barrel,

given their size and fnancial/liquidity profles and general long-term outlook in relation to dividends

and capital spending. In contrast, at this price point, smaller E&P issuers would likely begin planning

decreases to capex levels and/or dividends.

Prices above $90 lead to expansionary spending

At prices above $90, all E&P issuers are expected to generate considerable growth in operating cash fow.

This cash fow will be used primarily to increase capex and dividends. Activity surrounding asset pur-

chases and sales is likely to decrease as sellers will demand premium pricing for their assets and mid-sized

players are unlikely to participate.

CHARACTERISTICS OF PLAYERS

Small-sized E&P

DBRS defnes small-sized E&P issuers as those with production levels of 100,000 barrels of oil equivalent

per day (boe/d) or less. These issuers are generally concentrated in one or few geographic regions and,

due to their small size, have limited economies of scale. Small E&P issuers generally have shorter-term

focus and limited balance sheet strength and fnancial fexibility, making them highly susceptible to price

volatility and economic fuctuations. These characteristics limit their access to the capital markets, thus

constraining their overall liquidity. As a result, many smaller E&P issuers credit quality is considered to

be below investment grade, with a greater probability of rating action during economic downturn.

Mid-sized E&P

Mid-sized E&P issuers are those with production levels between 100,000 boe/d and 500,000 boe/d,

as defned by DBRS. Issuers of this size generally beneft from greater geographic diversifcation and

economies of scale; however, operations are less diversifed than those of larger E&P issuers. Issuers of

this scale are more likely to withstand a short-term (i.e., one cycle) economic downturn, as they have

modest liquidity and greater fnancial fexibility, as compared to smaller E&P issuers.

Large-sized E&P

Large-sized E&P issuers are generally more resilient to pricing shocks, due to stronger fnancial profles

and access to liquidity. Operational and fnancial planning consider a longer time horizon (i.e., multiple

cycles), resulting in minimal cuts to capex or dividends during cycle downturns. These issuers also beneft

from greater global diversifcation, as well as economies of scale due to their high production levels

(greater than 500,000 boe/d). As a result of their size and fnancial strength, larger E&P issuers are better

positioned to withstand market shocks and are less likely to be subject to rating volatility during market

swings. Larger E&P issuers generally have a higher ceiling for credit ratings.

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

12

2014 Ratings Outlook

DBRS expects generally stable credit profles in 2014, particularly for companies with production profles

heavily weighted toward crude oil and/or liquids-rich natural gas (including natural gas at an oil-linked

index price). Most large E&P companies are expected to live within their means by ensuring capital

expenditures (capex) spending and dividends are fundable by operating cash fow, whereas smaller E&P

companies are expected to generate cash fow defcits due to a high level of capex in order to ramp up

production. Rating volatility is not anticipated in the near term.

2014 global oil pricing

Oil prices are expected to remain well above $80 per barrel as the global economy begins to stabilize. It

is expected that many companies will continue to focus growth spending on oil and oil-based natural gas

in order to generate higher margins.

2014 North American natural gas pricing

Pricing for natural gas in North America is expected to remain relatively fat. Some previous excess supply

conditions have been alleviated; however three key challenges may limit upside potential for natural gas

prices: (1) signifcant shut-in capacity, (2) coal to natural gas switching, which is uneconomic above $4

per MMcf, and (3) potential for increased drilling activity should prices go above $5 per MMcf.

TOP TEN CREDIT DRIVERS

In this study, DBRS collected historical data from 163 oil and gas companies between 2008 and Q1 2014.

Following a review of the data and industry trends, DBRS drew the following ten key conclusions:

(1) Asia drives demand for the industry.

Demand from Asia is the main driving force behind strong commodity prices and production growth.

Over the past decade, oil consumption growth in Asia has signifcantly outpaced production growth in

the region, creating a supply-demand imbalance and placing upward pressure on global prices.

(2) Key credit ratios remain strong.

Following the sector turmoil of 2008, many issuers maintained conservative fnancial profles. All key

credit metrics remained at or near cycle highs in Q1 2014, benefting from high oil prices.

(3) Capital expenditure is focused on oil and liquids development.

Capital expenditure has grown signifcantly since hitting a low point in 2009, when many companies

scaled back spending to provide fexibility during the fnancial crisis. In North America, the majority

of capital spending is allocated to higher-margin oil and liquids developments, shifting away from low

margin natural gas drilling.

(4) Revolutionary technology advances fuel growth.

Recent technology advances specifcally, the development of horizontal drilling and fractionation

technologies have proven incredibly successful, resulting in signifcant growth in shale oil and gas

production. This new technology, coupled with lean, factory-like practices used in feld development, has

shortened drilling and completion times and raised production levels.

(5) Rising oil sands investment in Canada and Bakken Shale/Eagleford development in the United

States

Excluding reserves owned by governments, Canadas oil sands account for approximately 52% of global

accessible oil reserves. In the United States, the Bakken Shale/Eagleford will likely see considerable

investment for the foreseeable future. Investment in emerging markets, such as Venezuela and Iran,

remains minimal, due to limitations on foreign ownership and the risk of political instability. Similar

limitations can also be found in well-established growth countries such as Saudi Arabia and Russia.

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

13

(6) A growing shortage of highly skilled labour is an ongoing challenge.

The skilled labour pool remains limited when compared with the numerous future projects under

development. As a result, the tight labour market could lead to a repeat of the substantial cost overruns

experienced in 20062008.

(7) Pipeline and infrastructure constraints contribute to signifcant pricing differential.

The North American oil price differential has remained volatile, with prices of Canadian light and heavy

oil and North Dakota Bakken crude oil trading at discounts. Currently, there is a glut of oil supply at

one of the key hubs at land-locked Cushing, Oklahoma, which has negatively affected proftability of

non-integrated E&Ps. This glut is directly attributable to unanticipated oil and gas production from the

Bakken Shale and Canadian oil sands, which the existing pipeline infrastructure has not been able to

support.

(8) Integrated operations provide natural hedge.

Companies with integrated operations have been able to achieve superior returns in downstream businesses

by capturing the price differential. In contrast, the price differential did not perform well in the previous

commodity cycle. In general, companies with integrated operations have stronger business risk profles.

(9) Regulatory issues continue to have signifcant implications for future production growth.

The oil and gas sector, particularly oil sands, continues to come under increased scrutiny, as environmental

issues pertaining to air, water and land have gained worldwide attention. In addition, obtaining regulatory

approval for new pipelines has remained challenging, as evidenced by the Keystone XL pipelines regulatory

approval permitting delays. A lack of takeaway capacity in the medium term could signifcantly affect

future production growth.

(10) North America makes a big bet on liquefed natural gas (LNG).

LNG projects require signifcant capital investments over the next decade in North America. Many large

E&P companies will contribute signifcant capital to grow LNG. Lead times are considerable and the

ability to bring projects online remains highly challenging.

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

14

Overall Rankings

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

15

Overall Standing

Rank Company Name Rating EBIT

EBIT Gross

Interest

Coverage

Adjusted

Gross Debt

in Capital

Structure

Adjusted Total

Debt-to-Cash

Flow

1 Exxon Mobil Corporation -

2 Imperial Oil Limited

AA

(high)

3 Chevron Corporation AA

4 Royal Dutch Shell plc -

5 Total S.A. and Subsidiaries -

6 Statoil ASA -

7 CNOOC Limited

1

-

8 PetroChina Company Ltd. -

9 Sinopec Corp. -

10 BP p.l.c. A

11 Eni S.p.A. -

12 Occidental Petroleum Corporation A

13 ConocoPhillips A

14 Inpex Corporation -

15 Suncor Energy Inc. A (low)

16 Apache Corporation -

17 Husky Energy Inc. A (low)

18 Marathon Oil Corporation -

19 OMV Aktiengesellschaft -

20 Cenovus Energy Inc. A (low)

21 EOG Resources, Inc. -

22 Canadian Natural Resources Limited

BBB

(high)

23 BG Group plc -

24 Devon Energy Corporation

BBB

(high)

25 Hess Corporation -

26 Talisman Energy Inc.

BBB

(high)

27 OAO Gazprom

1

-

28 OAO Lukoil -

29 Rosneft -

30 Petrobras -

31 Murphy Oil Corporation BBB

32 Canadian Oil Sands Limited BBB

33 Anadarko Petroleum Corporation BBB

34 Noble Energy Inc. -

35 Encana Corporation BBB

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

16

Overall Standing

Rank Company Name Rating EBIT

EBIT Gross

Interest

Coverage

Adjusted

Gross Debt

in Capital

Structure

Adjusted Total

Debt-to-Cash

Flow

36 PGNiG S.A. -

37 Energen Corporation -

38 Repsol, S.A. -

39 Ecopetrol S.A. -

40 Southwestern Energy Co. -

41 Continental Resources, Inc. -

42 Pioneer Natural Resources Company -

43 Newfeld Exploration Co. -

44 Crescent Point Energy Corporation -

45 MOL Group -

46 Concho Resources Inc. -

47 Pacifc Rubiales Energy Corp. -

48 Cimarex Energy Co. -

49 Denbury Resources Inc. -

50 The Delek Group Ltd. -

51 Chesapeake Energy Corporation -

52 JSOC Bashneft -

53 Whiting Petroleum Corporation -

54 ARC Resources Ltd. -

55 Vermilion Energy Inc. BB (low)

56 Cabot Oil & Gas Corp. -

57 Unit Corporation -

58 QEP Resources Inc. -

59 Baytex Energy Corp. -

60 Penn West Petroleum Ltd. -

61 SM Energy Company -

62 Range Resources Corporation -

63 Bonavista Energy Corporation -

64 Galp Energia SGPS, SA

1

-

65 MEG Energy Corporation -

66 Tourmaline Oil Corp. -

67 Enerplus Corporation -

68 Energy XXI (Bermuda) Limited -

69 Oasis Petroleum Inc. -

70 Pengrowth Energy Corporation -

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

17

Overall Standing

Rank Company Name Rating EBIT

EBIT Gross

Interest

Coverage

Adjusted

Gross Debt

in Capital

Structure

Adjusted Total

Debt-to-Cash

Flow

71 SandRidge Energy, Inc. -

72 LightStream Resources Ltd. -

73 Stone Energy Corp. -

74 Rosetta Resources Inc. -

75

PEYTO Exploration & Development

Corp.

-

76 Legacy Oil & Gas Inc. -

77 Northern Oil & Gas Inc. -

78 Gran Tierra Energy Inc. -

79 Bankers Petroleum Ltd. -

80 Whitecap Resources Inc. -

81 TransGlobe Energy Corporation -

82 Parex Resources Inc. -

83 Trilogy Energy Corp. B

84 Gulfport Energy Corporation -

85 Advantage Oil & Gas Ltd. -

86 Crew Energy Inc. B

87 Grupa LOTOS S.A. -

88 Birchcliff Energy Ltd. -

89 Bonanza Creek Energy, Inc. -

90 Long Run Exploration Ltd. -

91 EPL Oil & Gas, Inc. -

92 Kosmos Energy Ltd. -

93 PDC Energy, Inc. -

94 Ultra Petroleum Corp. -

95 Kodiak Oil & Gas Corp. -

96 PT Medco Energi Internasional Tbk -

97 Laredo Petroleum Holdings, Inc. -

98 Carrizo Oil & Gas, Inc. -

99 Athabasca Oil Corporation B

100 Resolute Energy Corporation -

- W&T Offshore -

- YPF S.A. -

- Pakistan Petroleum Limited -

- Raging River Exploration Inc. -

- Freehold Royalties Ltd. -

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

18

Overall Standing

Rank Company Name Rating EBIT

EBIT Gross

Interest

Coverage

Adjusted

Gross Debt

in Capital

Structure

Adjusted Total

Debt-to-Cash

Flow

- Mari Petroleum Company Limited -

- BlackPearl Resources Inc. -

- Bonterra Energy Corp. -

-

Oil & Gas Development Company

Limited

-

- Surge Energy Inc. -

- Bellatrix Exploration Ltd. -

- Longview Oil Corp. -

- Twin Butte Energy LTD. -

- Vaalco Energy, Inc. -

- Approach Resources Inc. -

- Painted Pony Petroleum Ltd. -

- Cequence Energy Ltd. -

- Chinook Energy Inc. -

- Renegade Petroleum Ltd. -

- LINN Energy, LLC -

- Exco Resources, Inc. -

- Bill Barrett Corporation -

- Halcn Resources Corporation -

- Penn Virginia Corporation -

- NuVista Energy Ltd. -

- Comstock Resources Inc. -

- WPX Energy, Inc. -

- RMP Energy Inc. -

- Warren Resources, Inc. -

- Eagle Energy Trust -

- Zargon Oil & Gas Ltd. -

- Rock Energy Inc. -

- Gastar Exploration Ltd. -

- Parallel Energy Trust -

- Delphi Energy Corp. -

- Arcan Resources Ltd. -

- Forest Oil Corporation -

- Atlantic Petroleum P/F -

- Connacher Oil and Gas Limited -

- TORC Oil & Gas Ltd. -

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

19

Overall Standing

Rank Company Name Rating EBIT

EBIT Gross

Interest

Coverage

Adjusted

Gross Debt

in Capital

Structure

Adjusted Total

Debt-to-Cash

Flow

- Hellenic Petroleum S.A. -

- Pinecrest Energy Inc. -

- Goodrich Petroleum Corporation -

- Questerre Energy Corporation -

- Pan Orient Energy Corp. -

- Paramount Resources Ltd. -

- ShaMaran Petroleum Corp. -

- Africa Oil Corp. -

- Strategic Oil & Gas Ltd. -

- Perpetual Energy Inc. -

- Noreco SA -

-

Magnum Hunter Resources

Corporation

-

- Canacol Energy Ltd. -

- Isramco, Inc. -

- Argent Energy Trust -

- Quicksilver Resources Inc. -

- Pine Cliff Energy Ltd. -

- Sunshine OilSands Ltd. -

- Antrim Energy Inc. -

- Southern Pacifc Resources Corp. CCC

- HKN, Inc. -

- Anderson Energy Ltd. -

- Niko Resources Ltd. -

1. 2014 fgures refect YE December 31, 2013

Ranking

($ millions where applicable) EBIT

EBIT Gross

Interest

Coverage

Adjusted Gross

Debt in Capital

Structure

Adjusted

Total Debt-to-

Cash Flow

Strong >600 >9 <25% <1.5

Average >100 to <600 >3 to <9 >25% to <40% >1.5 to <3

Below

Average

<100 <3 >40% >3

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

20

KEY PLAYERS

Rank Rating Description

1 -

Exxon Mobil Corporation (the Company) is a multinational company

engaged in crude oil and natural gas production. Headquartered in Irving,

Texas, the company is involved in exploration, manufacture of petroleum

products, transportation, as well as the manufacture and sales of commodity

petrochemicals.

2 AA (high)

Imperial Oil Limited, 69.6% owned by ExxonMobil, is a refner and marketer

of petroleum products and a major producer of petrochemical products in

Canada.

3 AA

Chevron Corporation has a portfolio of upstream assets and global

downstream operations, consisting of refning and marketing operations

alongside an international petrochemicals business.

4 -

Royal Dutch Shell plc (The Company) is a diversifed and integrated oil and

gas company, based in The Hague, Netherlands. The Company engages in the

exploration and production of crude oil and natural gas, conversion of crude

oil to a wide range of refned products, as well as the production and sale of

petrochemicals for industrial use.

5 -

Total S.A. and Subsidiaries is an integrated non-government-owned

petroleum company. It has global upstream activities, downstream operations

and a chemicals business.

6 -

Statoil ASA (the Company) engages in the exploration and production of

crude oil and natural gas, as well as transportation, refning, and marketing of

petroleum and petroleum-derived products in Norway and internationally. The

Company is also involved in the retail sale of stationary energy, and building

and operating offshore wind farms in the U.K.

7 -

CNOOC Limited (CNOOC) is a Chinese producer of offshore crude oil and

natural gas and an independent oil and gas exploration and production

company. CNOOC mainly engages in exploration, development, production and

sales of oil and natural gas.

8 -

PetroChina Company Ltd. (the Company) is a Chinese oil and gas company

and is the listed arm of state-owned China National Petroleum Corporation

(CNPC), headquartered in Beijing. The Company is mainly engaged in the

production and sale of oil and gas related products.

9 -

Sinopec Corp. is an integrated energy and chemical company with upstream,

midstream and downstream operations. Its principal business includes:

exploring, developing, producing and trading of crude oil and natural gas;

producing, storing, transporting and distributing and marketing of petroleum

products, petrochemical products, synthetic fber, fertilizer and other chemical

products.

10 A

BP p.l.c. (BP) is a multinational company with headquarters in London,

England. BP is vertically integrated and engages in all areas of the oil and gas

industry, including exploration and production, refning, distribution, power

generation, etc.

11 -

Eni S.p.A., based in Italy, is an integrated energy company involved in the

exploration, production, transportation, refning and sale of oil and natural gas

with operations worldwide. It also produces and sells electricity, petrochemical

and petroleum products, hydrocarbons and engages in offshore and onshore

hydrocarbon felds.

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

21

Rank Rating Description

12 A

Occidental Petroleum Corporation is a U.S.-concentrated oil and gas

producer. It is also involved in manufacturing operations, midstream marketing

and commodities trading.

13 A

ConocoPhillips, headquartered in Houston, Texas, is an independent

exploration and production company. Its principal operating regions include the

U.S., Europe and Canada.

14 -

Inpex Corporation (Inpex) is a Japanese company headquartered in

Akasaka district, Tokyo. Inpexs main business includes: research, exploration,

development, production and sales of oil, natural gas and other mineral

resources, other related businesses and investment and lending to the

companies engaged in these activities.

15 A (low)

Suncor Energy Inc. is an integrated oil and gas company. Its upstream

operations are mainly oil sands based in North America, with the balance in

the North Sea and North Africa. Its downstream operations include refneries, a

lubricants plant and a national network of retail stations.

16 -

Apache Corporation is a Texas-based independent oil and gas company with

exploration and production interests in the Gulf of Mexico, Gulf Coast Onshore

in the United States, Western Canada and the United Kingdom.

17 A (low)

Husky Energy Inc.s upstream and midstream operations, primarily located

in Canada, include infrastructure and commodity marketing. Its downstream

operations include upgrading, refning and marketing.

18 -

Marathon Oil Corporation (the Company) is an energy company with

worldwide operations in exploration and production of liquid hydrocarbons and

natural gas, oil sands mining and the production of integrated gas products.

Headquartered in Houston, Texas, the Company was formerly known as USX

Corp. prior to July 2001.

19 -

OMV Aktiengesellschaft is active in two core countries, Romania and Austria,

in terms of exploration and production and holds a balanced international

portfolio.

20 A (low)

Cenovus Energy Inc. is an integrated oil company with enhanced oil recovery

and oil sands properties in Western Canada, along with interests in two

refneries in the United States through a joint venture.

21 -

EOG Resources, Inc. and its subsidiaries engage in crude oil and natural gas

exploration, development, production and marketing with operations located

primarily in the United States, Canada, U.K., China, Trinidad and Tobago and

Argentina. It is headquartered in Houston, Texas.

22 BBB (high)

Canadian Natural Resources Limited (CNRL) is an oil and gas exploration,

development and production company located in Calgary, Alberta, with

operations focused in Canada and smaller interests internationally.

23 -

BG Group plc (the Company) is an international company engaged in the

exploration and production of natural gas products.

24 BBB (high)

Devon Energy Corporation has a portfolio of reserves in North America. It is

a producer in the Canadian oil sands and the Texas Barnett Shale formation.

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

22

Rank Rating Description

25 -

Hess Corporation is a global energy company engaged in the exploration and

production of crude oil and natural gas, as well as in refning and marketing

refned petroleum products, natural gas and electricity.

26 BBB (high)

Talisman Energy Inc. is an internationally diversifed oil and gas exploration

and production company, with production located in North America, the North

Sea, Southeast Asia and other international areas.

27 -

OAO Gazprom is a global energy company headquartered in Russia

Federation. Its major business lines are geological exploration, production,

transportation, storage, processing and sales of gas, gas condensate and oil,

sales of gas as a vehicle fuel as well as generation and marketing of heat and

electric power.

28 -

OAO Lukoil is an international vertically-integrated oil & gas company,

accounting for 2.1% of global output of crude oil.

29 -

Rosneft (the Company) is a publicly traded oil and gas company based in

Russia. The Company is primarily engaged in exploration and production of

hydrocarbons, production of petroleum products and petrochemicals, and

marketing of outputs.

30 -

Petrobras (the Company) is a semi-public Brazilian multinational energy

corporation headquartered in Rio de Janeiro, Brazil and was founded in 1953.

The Company owns oil refneries and oil tankers and is engaged in development

of advanced technology from deep-water and ultra-deep water oil production.

31 BBB

Murphy Oil Corporation is engaged mainly in worldwide offshore oil and

gas exploration and production. It also owns a U.K. refnery and marketing

operations in both the U.K. and the United States.

32 BBB

Canadian Oil Sands Limited has a working interest in Syncrude Canada

Limited, which operates an oil sands mine, as well as bitumen extraction and

upgrading facilities in Alberta.

33 BBB

Anadarko Petroleum Corporation (Anadarko) is a large, diversifed oil

and gas producer. The majority of Anadarkos assets are located in the U.S.,

representing about 90% of total proved reserves.

34 -

Noble Energy Inc. is an energy company with core operations onshore in

the United States, in the deepwater Gulf of Mexico, offshore in the eastern

Mediterranean, and offshore in West Africa.

35 BBB

Encana Corporation is a North American energy producer focused on its

portfolio of natural gas, oil and natural gas liquids.

36 -

PGNiG S.A. is a Polish oil and gas exploration and production company

engaged in the trade, distribution, oil and gas exploration and production as

well as gas storage and processing in Poland.

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

23

Rank Rating Description

37 -

Energen Corporation (the Company) is an independent producer of domestic

oil, natural gas and natural gas liquids, and is headquartered in Birmingham,

Alabama. More than 90% of the Companys proved reserves are located in

the Permian basin in West Texas and in the San Juan basin in New Mexico and

Colorado.

38 -

Repsol S.A. is a Spanish multinational oil and gas company based in Madrid,

Spain. It operates in all areas of the oil and gas industry, including exploration

and production, refning, distribution and marketing, petrochemicals, power

generation and trading.

39 -

Ecopetrol S.A. is a Colombian energy company that focuses on oil and gas

exploration, production, transportation and marketing.

40 -

Southwestern Energy Company is an independent energy company

primarily engaged in natural gas and crude oil exploration, development and

production within North America. Currently, its operations are principally

focused on the development of unconventional oil and natural gas.

41 -

Continental Resources, Inc. is a petroleum liquids producer based in

Oklahoma City. It is a leaseholder in the Bakken Play of North Dakota and

Montana, and also has a presence in the Anadarko Woodford Play of Oklahoma

and the Red River Units Play of North Dakota, South Dakota and Montana.

42 -

Pioneer Natural Resources Company (the Company) is an independent

company involved in the exploration and production of oil and gas, and

natural gas liquids in the United States and South Africa. The Company is

headquartered in Irving, Texas.

43 -

Newfeld Exploration Company is an independent crude oil and natural gas

exploration and production company headquartered in The Woodlands, Texas.

Its operations include the Mid-Continent, the Rocky Mountains, onshore Texas

and the Gulf of Mexico.

44 -

Crescent Point Energy Corporation engages in acquiring, exploiting,

developing and holding interests in light and medium oil and gas properties

mainly in Saskatchewan and Alberta.

45 -

MOL Group (the Company) is an international, integrated oil and gas company

from Hungary. In addition to the Companys refnery and commercial position

in the CEE region, increasing focus is now being given to its exploration and

production assets.

46 -

Concho Resources Inc. (the Company) is an independent oil and natural gas

company based in Midland, Texas. The Company is engaged in the acquisition,

development and exploration of oil and natural gas properties, and has

operations primarily in the Permian Basin of Southeast New Mexico and West

Texas.

47 -

Pacifc Rubiales Energy Corp. (the Company) is a conventional oil and gas

company that engages in the exploration, development and production of oil

and natural gas in Colombia, Peru and Guatemala. It also operates oil pipelines

in Colombia. The Company is headquartered in Toronto.

48 -

Cimarex Energy Co. is a Denver-based independent oil and gas exploration

and production company with principal operations in the Mid-Continent and

Permian Basin areas of the U.S.

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

24

Rank Rating Description

49 -

Denbury Resources Inc. (the Company) is an independent oil and gas

company headquartered in Dallas, Texas. The Company is a large oil and

natural gas producer in both Mississippi and Montana and holds an operating

acreage in the Rocky Mountain and Gulf Coast regions.

50 -

The Delek Group Ltd., an integrated energy company in Israel, is engaged in

natural gas exploration and production activities.

51 -

Chesapeake Energy Corporation, based in Oklahoma, engages in the

acquisition, exploration, development and production of natural gas and oil

properties in the United States.

52 -

JSOC Bashneft (Bashneft) is a vertically integrated oil company based on the

largest fuel and energy producers of the Republic of Bashkortostan. Bashneft

sells its products in Russia and exports them to Eastern and Western Europe

and Kazakhstan.

53 -

Whiting Petroleum Corporation (the Company) is an independent

exploration and production company that acquires, explores, develops, and

produces crude oil, natural gas liquids, and natural gas in the United States.

The Company is headquartered in Denver, Colorado.

54 -

ARC Resources Limited is a Canadian conventional oil and gas company.

It currently operates in Western Canada, holding interests in petroleum and

natural gas properties and assets.

55 BB (low)

Vermilion Energy Inc. is engaged in oil and gas exploration and production.

Its operations are internationally diversifed, with production located in Canada,

France, Australia and the Netherlands.

56 -

Cabot Oil & Gas Corporation (the Company) is an independent oil and gas

company headquartered in Houston, Texas. The Company is engaged in the

development, exploitation and exploration of oil and gas properties exclusively

in the continental United States.

57 -

Unit Corporation is a diversifed energy company engaged through its

subsidiaries in the exploration for and production of oil and natural gas, the

acquisition of producing oil and natural gas properties, the contract drilling of

onshore oil and natural gas wells, and the gathering and processing of natural

gas.

58 -

QEP Resources, Inc. engages in the domestic oil and natural gas exploration

and production industry, with operations focused in the Rocky Mountain and

Midcontinent regions of the U.S. Its activities include drilling, completing and

equipping oil and natural gas wells for itself and its partners.

59 -

Baytex Energy Corporation (the Company) is a conventional Canadian oil

and gas company operating mainly in the Western Canadian Sedimentary

Basin. The Company has a presence in the United States, offering heavy oil,

light oil and natural gas liquids.

60 -

Penn West Petroleum Ltd. (the Company) is a petroleum and natural gas

exploration and production company with reserves located in Western Canada

and the United States. The Company was formerly known as Penn West Energy

Trust.

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

25

Rank Rating Description

61 -

SM Energy Company is an independent energy company engaged in the

acquisition, exploration, development and production of crude oil, natural gas

and natural gas liquids in onshore North America.

62 -

Range Resources Corporation (Range) is an independent oil and gas

exploration and production company based in Fort Worth, Texas. Range

produces shale gas from the Devonian-aged Marcellus Shale in Pennsylvania.

63 -

Bonavista Energy Corporation is a conventional oil and gas company with

properties located in Alberta, British Columbia and Saskatchewan.

64 -

Galp Energia SGPS, SA (the Company) is Portugals oil and natural gas

integrated operator. The Company focuses on exploration and production of oil

and natural gas to refning and marketing oil products, natural gas marketing

and sales and power generation.

65 -

MEG Energy Corporation (the Company) is a Canadian oil sands company

focused on sustainable development and production in Albertas Athabasca

region. The Company owns a 50% interest in a dual pipeline system with

Devon Energy Corporation.

66 -

Tourmaline Oil Corporation (the Company) is engaged in the acquisition,

exploration, development, and production of crude oil and natural gas

properties in the Western Canadian Sedimentary Basin. The Company is based

in Calgary, Canada.

67 -

Enerplus Corporation (the Company) is engaged in the development and

exploration of crude oil and natural gas in Canada and the United States. The

Company is headquartered in Calgary, Alberta.

68 -

Energy XXI (Bermuda) Limited is an oil-focused company with assets in

South Louisiana and on the Gulf of Mexico Shelf. It operates fve oilfelds on the

Gulf of Mexico Shelf.

69 -

Oasis Petroleum Inc. (the Company) is an independent exploration

and production company focused on the acquisition and development of

unconventional oil and natural gas resources. The Company has its operations

in the Bakken Shale, located in Montana and North Dakota.

70 -

Pengrowth Energy Corporation (the Company) is an oil and gas producer

headquartered in Calgary, Alberta. The Company explores for crude oil, natural

gas and liquids in Alberta, British Columbia, Saskatchewan and Nova Scotia.

71 -

SandRidge Energy Inc. (SandRidge) focuses on drilling conventional oil

wells in shallow carbonate reservoirs. Based in Oklahoma City, SandRidge is a

developer of the Mississippian Oil Play, with assets in the Permian Basin and the

Gulf of Mexico.

72 -

LightStream Resources Ltd. is a light oil-focused exploration and production

company. Principal operating areas include southeastern Saskatchewan,

targeting the Bakken formation and conventional Mississippian reservoirs,

central Alberta, focusing on the Cardium formation, and north-central Alberta,

engaging in exploring for light oil resource plays.

73 -

Stone Energy Corporation is an independent oil and natural gas exploration

and production company headquartered in Lafayette, Louisiana, with additional

offces in New Orleans, Louisiana, Houston, Texas and Morgantown, West

Virginia.

74 -

Rosetta Resources Inc. is an independent oil and gas company based in

Houston, and is engaged in the exploration, development and exploitation of

onshore energy resources in the U.S.

75 -

Peyto Exploration & Development Corp. (the Company) is engaged in the

exploration and development of gas properties. The Company has operations

located halfway between the Northwest Territories and the U.S.

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

26

Rank Rating Description

76 -

Legacy Oil & Gas Inc. (the Company) is an intermediate oil and natural

gas company based in Calgary, Alberta. The Companys assets are focused in

southeast Saskatchewan and southwest Alberta.

77 -

Northern Oil and Gas Inc. is an oil and gas exploration and production

company, and it is a Williston Basin Bakken and Three Forks pure play in

western North Dakota and eastern Montana.

78 -

Gran Tierra Energy Inc. (Gran Tierra or the Company) is an international

oil and gas exploration and production company headquartered in Calgary,

Alberta. The Company currently holds interests in producing and has

prospective properties in Colombia, Argentina, Peru and Brazil.

79 -

Bankers Petroleum Ltd. (the Company) is a Canadian-based oil and gas

exploration and production company focused on developing oil and gas

reserves in Albania. The Company operates and has the rights to develop the

Patos-Marinza heavy oilfeld and has a 100% interest in the Kuova oilfeld.

80 -

Whitecap Resources Inc. (the Company) is engaged in the acquisition,

development, and production of crude oil and natural gas in western Canada.

The Company is based in Calgary, Canada.

81 -

TransGlobe Energy Corporation (TransGlobe or the Company) is an

international exploration and production company based in Calgary, with oil

interests in Egypt and Yemen.

82 -

Parex Resources Inc. (Parex) is an oil and gas exploration company with

a portfolio of high impact prospects in the prolifc Llanos Basin and Middle

Magdalena Basin of Colombia and onshore Trinidad and Tobago. Headquartered

in Calgary, Alberta, Parex holds interests in 17 onshore exploration blocks.

83 B

Trilogy Energy Corporation is a Canadian energy corporation that owns and

operates many properties to exploit gas reservoirs.

84 -

Gulfport Energy Corporation (the Company) is an oil and gas exploration

and production company headquartered in Oklahoma City. The Companys

principal producing properties are located along the Louisiana Gulf Coast and in

the Permian Basin in West Texas.

85 -

Advantage Oil & Gas Ltd. (the Company) is a Canadian oil and gas company

based in Calgary, Alberta. The Company owns and operates properties located

in Alberta, British Columbia and Saskatchewan.

86 B

Crew Energy Inc. (the Company) is an oil and natural gas producer based

in Calgary, Alberta. Its activities are concentrated in Alberta, northeast British

Columbia and Saskatchewan. The Companys focus is on the development and

expansion of its core natural gas and light oil producing areas and exploration

of its large, undeveloped land base.

87 -

Grupa LOTOS S.A. (the Company) is an oil company engaged in the business

of production and processing of crude oil, as well as wholesale and retail sale

of high quality petroleum products. The Company is a producer and supplier

of a number of products, including unleaded gasoline, diesel oil, diesel oil

for heating purposes (light fuel oil), aviation fuel and heavy fuel oil. It also

specialises in the production and sale of lubricating oils and bitumens.

88 -

Birchcliff Energy Ltd. (the Company) is a Calgary-based intermediate oil and

gas company that explores, develops and produces natural gas, light oil and

natural gas liquids. The Companys operations are concentrated in the Peace

River Arch area of Alberta.

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

27

Rank Rating Description

89 -

Bonanza Creek Energy, Inc. (the Company) is an exploration and production

company focused on the extraction of oil and associated liquids-rich natural gas

in the United States. The Companys operations are focused in the Wattenberg

Field in the DJ Basin of Colorado and the Cotton Valley sands of southern

Arkansas.

90 -

Long Run Exploration, Ltd. (the Company) is an intermediate oil company

focused on light-oil development and exploration in western Canada. The

Company is focused in three areas in Alberta, namely Triassic oil, Duvernay,

and Carbonate oil.

91 -

EPL Oil & Gas, Inc. (the Company) is an independent oil and natural gas

exploration and production company. The Companys current operations are

concentrated in the U.S. GOM shelf & Gulf Coast, focusing on the state and

federal waters offshore LA.

92 -

Kosmos Energy Ltd. is a pathfnding oil and gas exploration and production

company headquartered in Bermuda. Its primary areas of operation are

underexplored regions of Africa and South America.

93 -

PDC Energy (the Company) is a 40-year old independent natural gas and oil

company. The company operates in Colorado, Ohio, and West Virginia.

94 -

Ultra Petroleum Corporation (Ultra or the Company) is an independent

energy company engaged in the exploration and production of oil and natural

gas. Its primary asset is the sand river play in the Green River basin of

Wyoming.

95 -

Kodiak Oil & Gas Corp. is an independent exploration and production

company. It is focused on exploring, developing and producing oil and natural

gas in the U.S. Rocky Mountain region, and has core operations in the Williston

Basin in Montana and North Dakota, and the Vermillion Basin of the Great

Green River basin.

96 -

PT Medco Energi Internasional Tbk (Medco Energi) is an Indonesian

company operating in the oil & gas exploration and production business listed

on the Jakarta Stock Exchange since 1994. Currently, Medco Energi is focused

on oil & gas exploration, development and production, and power generation.

97 -

Laredo Petroleum, Inc. (the Company) is an independent energy company

with headquarters in Tulsa, Oklahoma. The Company is focused on the

exploration, development and acquisition of oil and natural gas properties in

the Permian and Mid-Continent regions of the United States.

98 -

Carrizo Oil & Gas, Inc. (the Company) is a Houston-based energy company

actively engaged in the exploration, development, and production of oil and

gas. The Companys current operations are principally focused in producing oil

and gas shales primarily in the Eagle Ford Shale in South Texas, the Niobrara

Formation in Colorado, the Marcellus Shale in Pennsylvania, and the Utica Shale

in Ohio.

99 B

Athabasca Oil Corporation is an Alberta-based company focused on the

development of oil sands in the Athabasca region in northeastern Alberta and

light oil resources in northwestern Alberta.

100 -

Resolute Energy Corporation (Resolute) is a private company engaged in

the acquisition, development and production of domestic oil and gas. Resolutes

primary producing assets are its properties in Aneth Field, located in the

Paradox Basin in southeast Utah and Hilight Field, a conventional gas feld in

the Powder River Basin of northeastern Wyoming.

- -

W&T Offshore, Inc. is an independent oil and natural gas acquisition,

exploitation and exploration company, with a focus primarily in the Gulf of

Mexico.

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

28

Rank Rating Description

- -

YPF S.A. (the Company), acronym for Yacimientos Petrolferos Fiscales

(Treasury Petroleum Fields), is a vertically integrated Argentine energy

company. The Company engages in the exploration and production of oil and

gas, as well as in transportation, refning, and marketing of gas and petroleum

products.

- -

Pakistan Petroleum Limited is a major supplier of natural gas in addition to

producing crude oil, natural gas liquids and liquefed petroleum gas.

- -

Raging River Exploration Inc. engages in the exploration, development, and

production of oil and gas properties in western Canada. It primarily focuses

its operations on the Dodsland light oil play in southwestern Saskatchewan.

Raging River Exploration Inc. is headquartered in Calgary, Canada.

- -

Freehold Royalties Ltd. is an oil and gas company based in Calgary, Alberta.

The companys royalty interests are a major contributor to operating and

fnancial performance and are not subject to expenses such as operating and

capital costs. The companys assets generate income from crude oil, natural

gas, natural gas liquids, and potash.

- -

Mari Petroleum Company Limited (the Company) is an exploration and

production company located in Pakistan. It operates the countrys second

largest gas reservoir at Mari Field, District Ghotki, Sindh. The Company is

primarily engaged in exploration, development and production of hydrocarbon

potentials in the country.

- -

BlackPearl Resources Inc. (the Company) is a publicly held Canadian oil and

gas company. The Companys focus is heavy oil and oil sands assets located in

western Canada.

- -

Bonterra Energy Corp. is an oil and gas company headquartered in Calgary,

Alberta, with an asset base of properties across Western Canada.

- -

Oil & Gas Development Company Limited (the Company), headquartered

in Islamabad Pakistan, explores, develops, produces, and sells oil and gas

resources. The Company primarily produces crude oil, gas, liquefed petroleum

gas, and sulphur.

- -

Surge Energy Inc. (Surge Energy or the Company) is an oil-focused oil and

gas company with operations in Alberta, Manitoba and North Dakota.

- -

Bellatrix Exploration Ltd. (Bellatrix) is a Canada-based oil and gas

company. Bellatrix is engaged in the exploration, acquisition, development and

production, of oil and natural gas reserves in the provinces of Alberta, British

Columbia and Saskatchewan.

- -

Longview Oil Corp. (Longview or the Company) is a Canada-based oil and

natural gas production, exploitation and acquisition company in the Western

Canadian sedimentary basin. It aims to acquire and operate primarily producing

crude oil properties. The Company was a wholly owned subsidiary of Advantage

Oil & Gas Ltd (Advantage).

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

29

Rank Rating Description

- -

Twin Butte Energy Limited (the Company) is an oil and gas company based

in Calgary. The Company focuses on heavy oil in the greater Lloydminster area

along the Alberta and Saskatchewan border.

- -

Vaalco Energy, Inc. (the Company) is a Houston, Texas based independent

energy company engaged in the acquisition, exploration, development and

production of crude oil and natural gas. The Companys properties and

exploration activities are located in Gabon and Angola.

- -

Approach Resources Inc. (the Company) is an independent energy company

headquartered in Fort Worth, Texas. The Company focuses on exploring for and

developing oil and gas reserves in the West Texas Permian Basin.

- -

Painted Pony Petroleum Ltd. is a Canadian public resource company based

in Calgary, Alberta, with operations in Saskatchewan, Alberta and British

Columbia.

- -

Cequence Energy Ltd. is a natural gas and oil resource company based in

Calgary, Alberta. Its properties are located in the Deep Basin, with Simonette

as its primary focus area.

- -

Chinook Energy Inc. is a balanced mid-sized producer based in Calgary,

Alberta. Its international oil and gas exploration and production operations are

focused in Tunisia and Western Canada.

- -

Renegade Petroleum Ltd. (Renegade) is an exploitation and exploration

focused light oil producer. Renegades primary focus areas are located in

southeast Saskatchewan in various pools, such as Bakken, Souris Valley,

Frobisher, Midale and Kisby, as well as the Dodsland area of the Viking play in

west-central Saskatchewan.

- -

LINN Energy, LLC (the Company) is an independent oil and natural gas

company headquartered in Houston, Texas. The Companys core focus areas

are the Mid-Continent, Permian basin, Hugoton basin, Rockies, Michigan and

California.

- -

EXCO Resources, Inc. (the Company) is a natural gas and oil company

headquartered in Dallas, Texas. The Company is engaged in the exploration,

exploitation, development and production of onshore natural gas and oil

properties. Its operations are focused in the Permian Basin, the Appalachian

basin and the East Texas/North Louisiana area.

- -

Bill Barrett Corporation (the Company) is an oil and natural gas exploration

and development company headquartered in Denver, Colorado. The Companys

assets are located in the Rocky Mountain region with active exploration and

development properties located throughout the area.

- -

Halcn Resources Corporation is an independent energy company focused

on the acquisition, production, exploration and development of onshore liquids-

rich assets in the United States.

- -

Penn Virginia Corporation (the Company) is an independent oil and gas

company engaged primarily in the exploration, development and production

of oil, natural gas liquids and natural gas in various domestic onshore regions

of the United States, with a primary focus in Texas, and to a lesser extent, the

Mid-Continent, Mississippi and the Marcellus Shale in Appalachia. The company

is headquartered in Radnor, PA.

Oil & Gas Study

Criteria For the Non-Investment Grade World

July 2014

30

Rank Rating Description

- -

NuVista Energy Ltd. is a company engaged in exploration, development and

production activities on properties located in three operating regions of the

Western Canadian Sedimentary Basin.

- -

Comstock Resources, Inc. (the Company) is a growing independent energy

company engaged in the acquisition, development, production and exploration

of oil and natural gas properties. The Companys operations are primarily

focused in Texas and Louisiana.

- -

WPX Energy, Inc. is an independent natural gas and oil exploration and

production company engaged in the development of unconventional properties.

It is based in Tulsa, Oklahoma, with operations and interests in Colorado, New

Mexico, North Dakota, Pennsylvania, Wyoming, Argentina and Colombia.

- -

RMP Energy Inc. is an oil and gas company with assets concentrated in West

Central Alberta and southeastern Saskatchewan.

- -

Warren Resources, Inc. (the Company) is an independent energy company

engaged in the acquisition, exploration, development and production of

domestic onshore crude oil and gas reserves. The Company focuses primarily

on the exploration and development of waterfood oil recovery properties in the

Wilmington Field within the Los Angeles Basin of California.

- -

Eagle Energy Trust (the Trust) is an unincorporated open-ended limited

purpose trust. The Trust is engaged in the acquisition, development, and

production of petroleum reserves in the United States. The Trust is based in

Calgary, Canada.

- -

Zargon Oil & Gas Ltd. (the Company) is engaged in exploring, developing,

and producing oil and natural gas in Canada and the United States. The

Company is based in Calgary, Canada.

- -

Rock Energy Inc. is an exploration and production company. Its current

assets are primarily heavy oil properties in the Plains area and Southwest

Saskatchewan.

- -

Gastar Exploration Ltd. is engaged in the exploration, development and

production of natural gas, natural gas liquids, oil and condensate in the United

States.

- -

Parallel Energy Trust (the Trust) is an unincorporated open-ended limited

purpose trust. The Trusts objective is to create returns for investors through

the acquisition and development of conventional oil and natural gas reserves

and production with unexploited potential, located in certain regions of the

United States.

- -

Delphi Energy Corp. (the Company) is an oil and gas company operating

in Alberta, Canada. It is engaged in the exploration for, development and

production of crude oil and natural gas from properties and assets located in

Western Canada. The Companys operations are primarily concentrated in the