Professional Documents

Culture Documents

8.18.14 City's Response To Syncora's Objection

Uploaded by

WDET 101.9 FM0 ratings0% found this document useful (0 votes)

44 views55 pagesHere is the city of Detroit's response to Syncora's challenge to the "grand bargain" in the bankruptcy case.

Original Title

8.18.14 City's Response to Syncora's Objection

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentHere is the city of Detroit's response to Syncora's challenge to the "grand bargain" in the bankruptcy case.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

44 views55 pages8.18.14 City's Response To Syncora's Objection

Uploaded by

WDET 101.9 FMHere is the city of Detroit's response to Syncora's challenge to the "grand bargain" in the bankruptcy case.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 55

UNITED STATES BANKRUPTCY COURT

EASTERN DISTRICT OF MICHIGAN

SOUTHERN DIVISION

------------------------------------------------x

In re

CITY OF DETROIT MICHIGAN,

Debtor.

:

:

:

:

:

:

:

:

:

Chapter 9

Case No.: 13-53846

Hon. Steven W. Rhodes

------------------------------------------------x

THE CITY OF DETROITS MOTION TO STRIKE

IN PART SYNCORA GUARANTEE INC. AND SYNCORA

CAPITAL ASSURANCE INC.S SECOND SUPPLEMENTAL

OBJECTION TO THE DEBTORS PLAN OF ADJUSTMENT

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 1 of 31

1CFN.(2aJ

1353846140818000000000065

Docket #6845 Date Filed: 8/18/2014

TABLE OF CONTENTS

Page

-i-

PRELIMINARY STATEMENT .............................................................................. 1

I. Syncoras Accusations of Bias and Undisclosed Conflicts in the

Mediation Process Are False and Misleading ................................................ 4

A. Syncoras Accusation of an Undisclosed Conflict On the Part of

Eugene Driker Is Entirely False ........................................................... 5

B. Syncoras Characterization of The Grand Bargain Is Grossly

Misleading .......................................................................................... 10

II. Syncoras Attack on the Mediation Process Is Untimely and Improper ...... 16

III. The Grand Bargain Is an Exemplary Achievement of Municipal

Restructuring, Not a Fraudulent Transfer ................................................. 18

CONCLUSION ....................................................................................................... 24

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 2 of 31

ii

TABLE OF AUTHORITIES

Page

CASES

Apperson v. Fleet Carrier Corp.,

879 F.2d 1344 (6th Cir. 1989) .............................................................................. 9

Estes v. Titus,

481 Mich. 573, 751 N.W.2d 493 (2008)............................................................. 20

In re Fieger

191 F.3d 451 (6th Cir. 1999) (unpublished) ......................................................... 7

In re Greater Middle Missionary Baptist Church,

463 B.R. 24 (Bankr. E.D. Mich. 2011) ................................................................. 8

In re Gregory Boat Co.,

144 B.R. 361 (Bankr. E.D. Mich. 1992) ............................................................. 17

In re Ruben,

825 F.2d 977 (6th Cir. 1987) ................................................................................ 8

In re Smothers,

322 F.3d 438 (6th Cir. 2003) ................................................................................ 7

Jones v. Continental Corp.,

789 F.2d 1225 (6th Cir. 1986) .............................................................................. 8

Nationwide Mut. Ins. Co. v. Home Ins. Co.,

429 F.3d 640 (6th Cir. 2005) ................................................................................ 9

Nationwide Mut. Ins. Co. v. Home Ins. Co.,

90 F. Supp. 2d 893 (S.D. Ohio 2000) ................................................................... 9

Questar Capital Corp. v. Gorter,

909 F. Supp. 2d 789 (W.D. Ky. 2012) .................................................................. 8

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 3 of 31

iii

Steinberg v. Young,

2010 U.S. Dist. LEXIS 31996 (E.D. Mich. Mar. 31, 2010) ............................... 22

Univ. Commons-Urbana, Ltd. v. Universal Constructors Inc.,

304 F.3d 1331 (11th Cir. 2002) ............................................................................ 9

STATUTES

11 U.S.C. 904 ........................................................................................................ 19

11 U.S.C. 943(b)(7) and 1129(b)(1) ................................................................... 17

28 U.S.C. 1927 .................................................................................................. 7, 24

OTHER AUTHORITIES

Federal Rule of Civil Procedure Rule 11 ............................................................. 7, 24

Federal Rule of Civil Procedure Rule Rule 12 .................................................... 8, 24

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 4 of 31

1

PRELIMINARY STATEMENT

In its Second Supplemental Objection, Syncora asserts for the first time that

the Citys bankruptcy plan is not proposed in good faith because it is the product of

a conspiracy among the City and the bankruptcy mediatorsincluding federal

judges and leading members of the Michigan barwho supposedly have

colluded to defraud the Citys creditors and subvert the purposes of the

Bankruptcy Code. Desperation is seldom pretty, and here it is particularly ugly as

it has led Syncora into a strategy of distortions, half-truths, and outright falsehoods.

Syncora falsely claims that one bankruptcy mediator committed an ethical

breach by failing to disclose an alleged conflict. In fact, that exact disclosure was

made to Syncora more than eleven months ago in an e-mail sent directly to five of

the six attorneys who are signatories to Syncoras latest pleading. By making this

false and defamatory accusation, it is Syncora that has crossed the line. As a

result, the Court may wish to consider imposing sanctions and ordering Syncora to

issue a formal apology. At the very least, this Court should strike the false and

defamatory allegations from Syncoras pleading.

1

1

In this filing, the City addresses only those aspects of Syncoras Second

Supplemental Objection [Dkt. No. 6651] that are so manifestly improper, false, and

misleading as to warrant a motion to strike. The other aspects of Syncoras Second

Supplemental Objection will be addressed in the ordinary course in the Citys

consolidated pretrial brief.

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 5 of 31

2

Syncoras attack on the mediation process should also be struck because it

does not arise from any new revelations, developments in the bankruptcy case, or

changes in the Citys plan. Instead, it is a transparent repackaging of Syncoras old

objections in a sensationalized new form designed to generate maximum press

coverage. It is nothing less than a desperate, last-ditch effort to use under-handed

tactics to derail the Plan, a plan which numerous classes of creditors have already

acceptedincluding classes of financial creditors.

As evidence of the allegedly secretive conspiracy between the City and the

bankruptcy mediators, Syncora points without any hint of irony to a number of

public statements and features of the publicly filed and broadly disseminated

bankruptcy plan that the City has been openly defending in legal briefing. For

example, Syncora distorts the public remarks of the chief bankruptcy mediator to

accuse him of bias in favor of the Citys retirees at the expense of other creditors.

In fact, the alleged bias is illusory, and the remarks in question were nothing more

than an endorsement of public features of the Grand Bargain and the Citys

bankruptcy plan that Syncora has known about for months. It is only now, after

participating in the bankruptcy case for over a year, that Syncora seeks to

confabulate a conspiracy.

Contrary to Syncoras name-calling, the Grand Bargain contains a perfectly

legitimate settlement that is the product of arms-length negotiation among well-

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 6 of 31

3

represented adversaries. It brings in outside funding to produce remarkable

benefits for the City and its retirees without causing harm to Syncora or anyone

else. The test of the Grand Bargains validity is whether it contains a legitimate

settlement that meets the requirements of law. Likewise, the test of the Plans

validity is whether it meets the requirements of plan confirmation, including that it

does not unfairly discriminate among creditors, and that it does not provide

creditors with less recovery than they would reasonably expect, as measured by

what they could otherwise achieve if the chapter 9 case were dismissed. The City

has already explained why the Plan satisfies all of those factors, it will prove so in

the confirmation hearing, and this Court will have an opportunity to pass judgment

in due course.

Finally, Syncora goes far astray in its untimely assertion that the Grand

Bargain is a fraudulent transfer because it establishes a public trust for the assets

of the Detroit Institute of Arts (the DIA) instead of selling them off to the highest

bidder. Syncoras basic premise is false: According to Syncora, financial creditors

have a rightful claim to the Citys tangible assets, including even a priceless civic

treasure like the DIA. In fact, however, chapter 9 protects the Citys right to

preserve its assets for the public benefit, and to avoid selling them off to satisfy

creditor demands. Syncora simply ignores the fact that the Grand Bargain

preserves virtually all of the civic value of the DIA by keeping it in the City and

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 7 of 31

4

safeguarding it for generations to come. Also ignored is the significant value

created for the City by putting to rest several claims, including one by the State

Attorney General, asserting that the City does not have any right to transfer or

monetize the DIA collection, because the City is already a constructive trustee and

must maintain the collection for the public benefit. In short, the Grand Bargain

produces more than fair value for the City and leaves Syncora no worse off than if

the City had simply decided to retain direct ownership of the DIA, as it is fully

entitled to do.

I. Syncoras Accusations of Bias and Undisclosed Conflicts in the

Mediation Process Are False and Misleading

Syncora claims that the Citys plan is proposed in bad faith because it is the

product of [a] secret combination, conspiracy, [and] concert of action formed for

a deceitful purpose to defraud creditors of their rights by the forms of law.

Syncora Second Supp. Obj. at 12 (citation and internal quotation marks omitted).

On its face, this claim is not only wrong, but is built on a foundation of falsehoods

and distortions that appear calculated to generate publicity and to inflict damage on

those working to settle the bankruptcy case rather than to serve any real litigation

purpose.

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 8 of 31

5

A. Syncoras Accusation of an Undisclosed Conflict On the Part of

Eugene Driker Is Entirely False

Syncora asserts that one of the bankruptcy mediators, Eugene Driker,

committed an ethical breach by failing to disclose that his wife serves as an

emeritus board member of the DIA. Id. at 15. In reality, this fact was expressly

disclosed to Syncora on September 9, 2013, in a letter sent to all parties, including

the individual e-mail addresses of five of the six attorneys who signed Syncoras

latest pleading. These attorneys are Ryan Bennett, James Sprayregen, and Stephen

Hackney of the law firm of Kirkland & Ellis, as well as Stephen M. Gross and

Joshua Gadharf of the law firm of McDonald Hopkins. See Exhibits 6-A, 6-B. In

the disclosure letter sent to each of these attorneys on September 9, 2013, Chief

Judge Gerald E. Rosen listed each of the bankruptcy mediators and specifically

disclosed facts about them that might give rise to any perceived conflict. See

generally Exhibit 6-C. In particular, the letter stated:

Mr. Drikers wife, Elaine, served for a number of years

as a member of the Board of Directors of the Detroit

Institute of Arts. Her term ended in 2011, but she was

elected a Director Emerita in 2012, entitling her to

attending Board meetings, without a vote. Both Mr. and

Mrs. Driker have been contributors to the DIA for many

years.

Id. at 7. The letter further stated that [a]ny concerns about these disclosures

should be addressed to the particular mediator who is the subject of the concern,

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 9 of 31

6

with a copy to Chief Judge Rosen. Id. at 1. To the best of the Citys knowledge,

Syncora never objecteduntil now.

Syncora now asserts that Neither Judge Rosen nor Mr. Driker ever

disclosed any biases or conflicts of interest that might affect their ability to serve as

impartial mediators in this case, and points specifically to Mr. Drikers wife as an

alleged source of an undisclosed conflict. Syncora Second Supp. Obj. at 15.

Mssrs. Bennett, Sprayregen, Hackney, Gross, and Gadharf have full knowledge

that this accusation is unequivocally false. The assertion thus shows abject

disregard for the professional reputation of Mr. Driker and Chief Judge Rosen, and

for the integrity of the bankruptcy proceedings. It is both puzzling and

disappointing. Could they have expected this misrepresentation to go undetected?

It is flatly contradicted by the official disclosure letter, after all. Was it purely

reckless, or was it intended to garner sensational press coverage, regardless of the

cost to those who are honestly working to resolve the Citys bankruptcy case? If

that was the purpose, it arguably succeeded: within hours of Syncoras filing, its

false and defamatory accusation was splashed across the pages of not only the local

Detroit media, but also major national publications such as the New York Times

and the Wall Street Journal.

2

2

See, e.g., Nathan Bomey, Detroit bankruptcy mediators accused of naked

favoritism for pensioners, DIA, Detroit Free Press (Aug. 12, 2014), available at

http://www.freep.com/article/20140812/NEWS01/308120096/Detroit-bankruptcy-

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 10 of 31

7

At the very least, the City asks this Court to act under Rule 12(f) to strike the

scandalous allegations contained in Syncoras pleading for being reckless at best,

if not willfully malicious. In addition, this Court may wish to consider ordering

Syncora and its attorneys to issue a formal public apology to Mr. Driker and Chief

Judge Rosen, whose conduct and reputations have been falsely impugned. See In

re Smothers, 322 F.3d 438, 442 (6th Cir. 2003) (holding that federal courts

inherent power to maintain respect and decorum grants courts the flexibility to

equitably tailor punishments, including the power to order [a]n apology on the

record); In re Fieger, 191 F.3d 451, 1999 WL 717991, at *1, *4 (6th Cir. 1999)

(unpublished) (holding that it was well within the courts discretion to order an

attorney to apologize formally to opposing counsel and the court for a Rule 11

violation). The Court may also wish to consider ordering Syncoras attorneys to

show cause why their behavior does not merit other sanctions under Rule 11 of the

Federal Rules of Civil Procedure, which requires counsel to make truthful

Syncora-mediation; Associated Press, Detroit's Bankruptcy Plan Opposed by

Creditor Syncora Guarantee, Wall Street Journal (Aug. 12, 2014), available at

http://online.wsj.com/articles/detroits-bankruptcy-plan-opposed-by-creditor-

syncora-guarantee-1407870333; Marry Williams Walsh, Bond Insurer Syncora

Claims Mediator Favors Detroits Retirees, New York Times (Aug. 12, 2014),

available at http://dealbook.nytimes.com/2014/08/12/big-bond-insurer-syncora-

files-objection-to-detroits-bankruptcy-plan. One of Syncoras attorneys also

repeated the allegations in a televised interview. See Detroit vs. Wall Street:

What Does Syncora Want?, Bloomberg Business Week (Aug. 13, 2014), available

at http://www.businessweek.com/videos/2014-08-13/detroit-vs-dot-wall-street-

what-does-syncora-want.

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 11 of 31

8

statements based on an inquiry [that is] reasonable under the circumstances, and

to avoid pleadings for any improper purpose.

3

Sanctions also may be appropriate under 28 U.S.C. 1927, which provides

that any attorney who so multiplies the proceedings in any case unreasonably or

vexatiously may be required by the court to satisfy personally the excess costs,

expenses, and attorneys fees reasonably incurred because of such conduct. A

court may impose such sanctions when an attorney knows or reasonably should

know that a claim pursued is frivolous, or that his or her litigation tactics will

needlessly obstruct the litigation of nonfrivolous claims. Jones v. Continental

Corp., 789 F.2d 1225, 1230 (6th Cir. 1986). Sanctions would be appropriate here

because Syncoras filing falls short of the obligations owed by a member of the

bar to the court and [], as a result, causes additional expense to the opposing

party. In re Ruben, 825 F.2d 977, 984 (6th Cir. 1987). The filing so far

exceed[s] zealous advocacy that it constitutes the kind of punishable aggressive

tactics that . . . require or permit sanctions. In re Greater Middle Missionary

Baptist Church, 463 B.R. 24, 27 (Bankr. E.D. Mich. 2011).

In any event, the explicit disclosure regarding Mr. Drikers wife completely

defeats Syncoras claim of an undisclosed conflict. Even in the context of binding

3

This pleading serves as notice to Syncora that there may be grounds for Rule 11

sanctions unless Syncora withdraws its false and malicious statements. The City

reserves the right to file a separate motion for sanctions.

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 12 of 31

9

arbitration, it is well established that once a disclosure is made, a party cannot

remain silent as to perceived or actual partiality or bias and then later object to

avoid an unfavorable result. Questar Capital Corp. v. Gorter, 909 F. Supp. 2d 789,

814 (W.D. Ky. 2012). Where a potential conflict is clearly known to the parties

at the outset, they cannot complain after the fact, but instead must exercise due

diligence in asserting any right [they might have] with respect to claims of bias or

evident partiality. Nationwide Mut. Ins. Co. v. Home Ins. Co., 90 F. Supp. 2d 893,

903 (S.D. Ohio 2000). See also Apperson v. Fleet Carrier Corp., 879 F.2d 1344,

1358-59 (6th Cir. 1989) (noting that, as a general rule, a grievant must object to

an arbitrators partiality at the arbitration hearing before such an objection will be

considered by the federal courts); Univ. Commons-Urbana, Ltd. v. Universal

Constructors Inc., 304 F.3d 1331, 1340 (11th Cir. 2002) (Of course, this, or any

other instance of alleged partiality would be moot if [the arbitrator] had disclosed it

to the parties. Had [the parties] failed to contest [the arbitrators] status as an

arbitrator at that time, they would have waived the right to object in the future.).

Here, as the Sixth Circuit has explained elsewhere, there can be no ethical

violation on the part of the mediators because this is not even a case of

nondisclosure, as they made full and timely disclosures of the relevant

information. Nationwide Mut. Ins. Co. v. Home Ins. Co., 429 F.3d 640, 648 (6th

Cir. 2005). Syncora has long been aware of the supposed conflict it now asserts,

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 13 of 31

10

and never before raised the slightest objection. Now, after participating in the

bankruptcy case for over a year and having failed to convince any court to grant it

substantive relief, Syncora is attempting to scuttle the entire bankruptcy by making

false charges to impugn the integrity of the process. This type of destructive

gamesmanship should be discouraged, not rewarded.

B. Syncoras Characterization of The Grand Bargain Is Grossly

Misleading.

Continuing its pattern of accusations, Syncora claims that Chief Judge Rosen

and Mr. Driker acted with improper bias by hatching a plot and developing a

master planthe Grand Bargain, which, according to Syncora, favors the Citys

retirees and the DIA at the expense of financial creditors. Syncora Supp. Obj. at

16-17. Not a single other creditor has made this allegation, and in fact several

financial creditors have used the mediation process to reach agreements with the

City that are now reflected in the Plan, thus underscoring the outlandish nature of

Syncoras charge. The reality is that the Grand Bargain is an agreement reached

by adversaries negotiating at arms length in the mediation process, based on all

the facts and circumstances. The Grand Bargain makes use of outside funds and

charitable contributions that were available solely for the purposes of providing

relief to pensioners or preserving the DIA in a public trust, or both. Because these

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 14 of 31

11

outside donations never would have been available for any other purpose,

4

especially to bail out the Citys financial creditors, the Grand Bargain does not

inflict any cognizable harm on Syncora or anyone else. On the contrary, by

facilitating the infusion of hundreds of millions of dollars into the City and settling

numerous hotly disputed issues related to the bankruptcy, the Grand Bargain

preserves the Citys assets from the costs and risks of litigation, and if anything

enhances the overall recovery available to Syncora and other creditors.

Syncoras accusations are built on a litany of implausible claims and

mischaracterizations. Syncora alleges that Chief Judge Rosen issued a misleading

press release that made it seem as if the non-profit foundations were driving the

Grand Bargain, when in fact Rosen and Mr. Driker are the ones who secretly

hatched the idea. Id. at 17. Syncora then attempts to spin this supposed

revelation as evidence of misconduct on the part of the mediators. This is silly.

First, the smoking gun evidence of the purportedly secret conspiracy is a set of

innocent public statements made by Chief Judge Rosen himself, and by the officers

of the foundations that were supposedly in on the plot. What this truly reveals, of

course, is that there was no secret plot, no hidden bias, and no unethical behavior.

Contrary to Syncoras insinuation, there is no ethical guideline that prohibits

a mediator from proposing any settlement, which the parties may then take or leave

4

See, e.g., Deposition of Rip Rapson (Rapson Dep.) at 43:6-13, 46:6-11.

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 15 of 31

12

based on their independent interests. That is exactly what happened here. Chief

Judge Rosen and the other mediators had no reason to cover up this fact, and their

press release did not remotely deny it. Syncora points to the language of the press

release stating that the foundations agreement to participate is specifically

conditioned upon all of their funds being committed to pension relief and the

preservation of the DIA in a public trust. Id. at 17. But that statement does not say

or imply anything about who hatched the idea for the Grand Bargain. More

importantly, it is entirely irrelevant who came up with the ideas included in the

Grand Bargain. What matters is that the adversaries themselves agreed to the

Grand Bargain through qualified representatives in arms-length negotiations, and

that the agreement is fair and reasonable. None of the applicable standards even

refers to the origins of the blueprint for a settlement.

The mediators proposed the Grand Bargain as a possible solution that would

bring in significant outside funding to help the City achieve a successful

reorganization. In the absence of the Grand Bargain, Syncora would not see a

single cent more in recovery because it would have no hope of accessing the

outside funds that were donated on the express condition of providing pension

relief and establishing the DIA as a public trust. The mediators thus deserve

praise, not condemnation, for facilitating this win-win arrangement.

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 16 of 31

13

Syncora distorts the public remarks of Chief Judge Rosen to create the false

impression that he expressed bias in favor of pensioners at the expense of other

creditors. On June 9, 2014, Rosen spoke at a press conference to discuss the Grand

Bargain, where he lauded outside donors for making charitable contributions to

ease the blow to the Citys pensioners. As Syncora points out, Rosen stated at that

time that none of this would be possible without all of us keeping a clear vision

firmly in mind about who this is really about. Its about Detroits retirees who

have given decades and decades of their lives devoted to Detroit . . . . And thats

what this is really all about.

5

He also stated that the Grand Bargain was the very

best deal that we could do for Detroits retirees, to whom all of us here owe so

much. Id. at 21. According to Syncora, these remarks discarded any pretense of

impartiality among the creditors and instead reflected an illicit design to pick

winners and losers in the bankruptcy at the expense of financial creditors. Id. at

18, 20.

Syncoras characterization is highly misleading. In context, Rosen was

simply acknowledging that there were outside donors who were willing to make

charitable contributions to the City, but only if the donations were specifically

5

Syncora Second Supp. Obj. at 17 (quoting audio recording of Judge Rosens

public remarks, available at http://www.nextchapterdetroit.com/detroits-chief-

mediator-judge-gerald-rosen-speaks-about-the-bankruptcy-process (the Rosen

Remarks))

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 17 of 31

14

earmarked to provide relief to the Citys pensioners. It is obvious on the face of

Rosens remarks that when he lauded the goal of helping pensioners and stated

thats what this is really all about, he was referring to the Grand Bargain and the

outside charitable donations. He obviously was not suggesting that the entire

bankruptcy or the mediation process was all about helping pensioners. Once

again, the outside charitable donations never would have been available to enhance

Syncoras recovery.

6

For that reason, any suggestion that Judge Rosens remarks

demonstrated bias in favor of pensioners at the expense of other creditors is

entirely specious.

Finally, Syncora asserts that the DIA Settlement is a settlement in search of

a dispute because there was [n]ever a dispute about the . . . Museum Assets or

the Citys ownership of them. Id. at 18. That is both false and irrelevant. It is

irrelevant because the City wanted to maximize the value of the DIA while

preserving the Museum Assets as a public trust, and the only way it could do so

was through the Grand Bargain, with outside donors insisting on the terms of the

DIA Settlement as a condition of their donations. Moreover, as the City has

explained and will further demonstrate at trial, even if the City did want to sell the

DIA, there was an intense dispute with both the non-profit corporation that

operates the DIA (the DIA Corp.) and the Michigan Attorney General over

6

Rapson Dep. at 43:6-13, 46:6-11.

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 18 of 31

15

whether the City had full and unrestricted ownership of over the DIA assets, or

whether the DIA was already protected as a public or charitable trust. In light of

that dispute, the Attorney General and the DIA Corp. were prepared to oppose any

sale and engage in protracted litigation that would have entailed substantial risk for

the City and millions of dollars in legal fees.

7

Moreover, in order to sell the DIA

into private hands, the City also would have been required to undertake the

logistically arduous task of giving notice to a slew of benefactors who had placed

restrictions on their gifts to the DIA, many of whom would assert that they were

entitled to the return of their gifts or were entitled to receive the proceeds of any

sales. The DIA Settlement eliminates all of those costs and risks while also

serving the Citys legitimate purpose of preserving its cultural heritage by keeping

the art collection in Detroit as a public benefit for its residents.

To the extent Syncora alleges that any of the Grand Bargains long-

publicized settlement terms are improper, that claim has already been fully briefed

and will be evaluated as part of the confirmation process. The test for a legitimate

7

See, e.g., Michigan Attorney General Opinion No. 7272 (June 13, 2013) at 1

(asserting that [t]he art collection of the Detroit Institute of Arts is held by the

City of Detroit in charitable trust for the people of Michigan, and no piece of the

collection may thus be sold, conveyed, or transferred to satisfy the City's debts or

obligations); DIA Statements Regarding the City of Detroit Bankruptcy, available

at http://www.dia.org/news/1511/DIA-Statements-Regarding-the-City-of-Detroit-

Bankruptcy.aspx (last visited August 13, 2014) ([T]he DIAs art collection is not

subject to sale because it is protected by a public trust and, as recognized by the

attorney general, a charitable trust that dates back to 1885.).

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 19 of 31

16

settlement is whether it has been settled fairly and equitably, and whether it is truly

the product of arms-length negotiation. See Citys Consolidated Reply, at 7-15.

Both the City and its objectors, including Syncora, have already had a chance to

address those issues at length. Syncoras latest volley does not add anything

beyond a sensationalized distraction from the merits.

II. Syncoras Attack on the Mediation Process Is Untimely and Improper

Syncoras attack on the bankruptcy mediation process should also be struck

because it violates this Courts order that supplemental objections should be

submitted only to the extent that [they] result from discovery, the results of plan

voting, or changes incorporated in the Citys latest plan of adjustment.

8

None of

those conditions is met here. Instead, Syncoras attack is a redundant assault on

basic features of the Citys bankruptcy plan that long have been public.

Although Syncora purports to be objecting to the supposed bad faith of the

City and the bankruptcy mediators, Syncora Second Supp. Obj. at 12-30, its

arguments are in fact addressed almost entirely to two other confirmation issues

that were already asserted by Syncora (and others) and are now awaiting

disposition at trial. First, Syncora repeatedly asserts that the Citys plan is

proposed in bad faith because it includes unfair discrimination against financial

8

See Seventh Amended Order Establishing Procedures, Deadlines and Hearing

Dates Relating to the Debtors Plan of Adjustment, Dkt. No. 6560 (Aug. 6, 2004),

at 1.

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 20 of 31

17

creditors in favor of retirees. But in reality, the City openly and forthrightly

disclosed the Plans treatment of retiree claims and of Syncoras claims months

ago and has explained in briefing why the Plans differential treatment of retirees is

legitimate and necessary to the Citys reorganization. Good faith simply requires

that the terms of the Plan be reasonably necessary to the success of the debtors

reorganization, and as long there is a sound business justification for the

treatment, then the plan is proposed in good faith. In re Gregory Boat Co., 144

B.R. 361, 367 (Bankr. E.D. Mich. 1992). As the City has explained at length, it

easily satisfies that test in the present case.

9

The mere fact that the City has

proposed differences in the treatment of its creditors does not evince any bad faith

on the Citys part. If it did, then the Codes express allowance for fair

discrimination among creditors would be a dead letter. At the end of the day, the

proper test of Syncoras allegations of unfairness is simply whether the Citys

treatment of creditors truly amounts to unfair discrimination under the

circumstances, which will be adjudicated soon enough. Discrimination that is not

unfair will not defeat confirmation of the Plan.

10

9

See Citys Consolidated Reply to Certain Objections to Confirmation of Fourth

Amended Plan, Dkt. No 5034 (May 26, 2014) (Citys Consolidated Reply), at

278-89.

10

See Citys Consolidated Reply at 39-102.

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 21 of 31

18

Second, Syncora repeatedly chastises the City for failing to liquidate the

DIAs art collection, which Syncora asserts should be used to collateralize a loan

the City has no ability to repay or sold off to maximize the recovery of Syncora

and other financial creditors. Once again, however, this argument is properly

addressed under the separate confirmation factors of the best interest of creditors

and the fair and equitable tests of 11 U.S.C. 943(b)(7) and 1129(b)(1).

Together, those tests ensure that any plan of adjustment will provide creditors with

all they can reasonably expect based upon alternatives actually available in the

absence of the chapter 9 case.

11

The city and Objectors have already briefed that

question. It is under that rubric that this Court should determine whether Syncora

has any reasonable expectation that the City must liquidate the DIA to maximize

Syncoras recovery instead of preserving the art collection in a charitable trust for

the public benefit.

III. The Grand Bargain Is an Exemplary Achievement of Municipal

Restructuring, Not a Fraudulent Transfer

Syncora asserts that the Grand Bargain is contrary to state law and indeed

tantamount to a fraudulent transfer because it is a sinister attempt to move the

DIA art collection beyond the reach of creditors while squandering a major

municipal asset at a rock-bottom price. Syncora Supp. Obj. at 24. Once again,

this claim is untimely and improper because it is not based on any new

11

See Citys Consolidated Reply at 103-182.

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 22 of 31

19

information, but instead derives from features of the Grand Bargain that Syncora

has known about for months without ever raising any such allegation. In any

event, Syncoras fraudulent transfer argument is confused at its core. The

Michigan state legislature explicitly authorized the Grand Bargain in a sweeping

bipartisan vote. The claim that the Grand Bargain somehow violates state law is

thus extremely dubious as a matter of law and logic.

12

At bottom, Syncoras objection to the Grand Bargain as a fraudulent

transfer stems from its refusal to acknowledge that Detroit is not a commercial

debtor, and that this is not a commercial bankruptcy. As the City has explained

elsewhere, the purpose of chapter 9 is not to maximize creditor recovery, but

instead to restore distressed municipalities to their rightful place as sound, healthy,

and vibrant centers of American culture and society.

13

To achieve that purpose,

chapter 9 expressly provides that cities are not required to sell off civic assets to

the highest bidder to satisfy creditor demands, which would effectively mandate

the privatization of some of the most precious items of Americas public heritage.

See 11 U.S.C. 904. Under chapter 9, a bankrupt New York City would not be

forced to sell off Central Park to cover its bond debt; Boston would not be

12

The City will address the particular elements of Syncoras fraudulent-transfer

arguments in its consolidated pre-trial brief.

13

See Citys Consolidated Reply at 103-182.

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 23 of 31

20

compelled to barter away the Common; Philadelphia would not have to auction off

Independence Hall. On the contrary, in the unique context of municipal

bankruptcy, creditors cannot reasonably expect cities to divest themselves of any

civic assets, much less those that are part of the very fabric of municipal identity.

Chapter 9 and Michigan law protect the Citys sovereign right to preserve

the status of the DIA as a civic treasure for the public benefit instead of selling it

off to satisfy creditors.

14

As the Michigan Supreme Court has made clear,

fraudulent-transfer actions are inapplicable to transfers of property that are

otherwise exempt from creditor claims. Simply put, it is difficult to comprehend

how disposing of property that a creditor cannot reach could defraud that

creditor. Estes v. Titus, 481 Mich. 573, 751 N.W.2d 493, 498 (2008).

If there is a benchmark for reasonable value of the DIA in the circumstances

of this case, it is not what it would fetch at a series of private auctions, but instead

the amount of proceeds it can generate, if any, consistent with its preservation for

the public benefit. Under that metric, the City has acted responsibly to establish

the DIA as an independent public trust, in exchange for outside donations that are

specifically conditioned on that purpose. As a result, Syncora has no basis to

complain: It never had any claim to the value of the DIA collection, which is

14

Michigan law specifically prevents the Citys creditors from executing a

judgment against any of the Citys tangible assets. See MCL 600.621.

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 24 of 31

21

shielded from private creditors not by any nefarious fraudulent transfer, but by

the express terms of chapter 9 and Michigan law.

Syncora asserts that the City has no standing to shield the DIA from

liquidation because it chose to monetize the Museum Assets, and because the

entire DIA Settlement is predicated on the notion that unsecured creditors (the

pensioners) have at least a colorable claim against those assets. Syncora Second

Supp. Obj. at 29. Once again, this is simply a misrepresentation of what the Grand

Bargain does. It does not monetize the DIA at all. Instead, it preserves the DIA

collection consistent with the Citys legitimate municipal purpose of safeguarding

the DIA for the public benefit of the City and its residents. In keeping with the

express authorization of chapter 9, the City has pointedly chosen not to resort to an

outright monetization of the DIA by selling it off to the highest bidder.

Syncora claims that the Grand Bargain actually harms the City by wasting

significant assets that could be used in the future to satisfy the Citys obligations.

Id. at 30. What Syncora really means, apparently, is that it would better serve the

Citys interests to liquidate a unique aspect of its cultural heritage to satisfy the

demands of its holdout financial creditors. The City disagrees. In the Citys view,

it is not squandering a financial asset but preserving the DIA as part of Detroits

public heritage, which will make a vital contribution to its recovery as a vibrant

American metropolis, benefiting its residents for generations to come. In

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 25 of 31

22

preserving that vital municipal interest, the City flatly rejects the notion that it is

receiving less than reasonably equivalent value of the DIA by preserving it in a

charitable trust. Cf. Steinberg v. Young, No. 09-11836, 2010 U.S. Dist. LEXIS

31996 (E.D. Mich. Mar. 31, 2010) (emphasizing that the test for reasonably

equivalent value takes into account what the debtor gave up, and incorporates the

residual value that the debtor has preserve[d]).

In technical terms, the transfer of the DIA into a public trust as part of the

Grand Bargain produces reasonably equivalent value for the City for three reasons.

First, it brings in hundreds of millions of dollars in outside contributions for the

City. Second, it preserves the DIAs incalculable public benefit for the residents of

Detroit by keeping the art collection in the City as a public trust instead of selling it

off into private hands.

15

And third, it settles claims from persons and entities such

as the State Attorney General and the DIA Corp., who have asserted that the City

was already obligated to keep the DIA in trust for the public benefit.

Contrary to Syncoras claims, Syncora Second Supp. Obj. at 29, the City

has not remotely conceded that pensioners or other creditors have any rightful

claim against the DIAs assets. Instead, the City has simply acknowledged that

defending its legal position would carry some risks and costs, and has accepted

outside donations to benefit pensioners without disadvantaging any other creditor.

15

See, e.g., Deposition of Mayor Mike Duggan at 174:2-18.

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 26 of 31

23

To be sure, as Syncora points out, ibid., the City has agreed to insert provisions in

the DIA Settlement Agreement making clear that no creditor can have any claim

against the DIAs assets now or in the future. But that disclaimer is not a

concession of any existing valid claim against the DIA assets. It is simply a

reassurance to the charitable donors, who expressly required the disclaimer as a

condition of their financial contributions.

Syncora complains that the Grand Bargains outside charitable donations

flow to pensioners instead of to financial creditors like Syncora, id. at 27, but

that complaint is groundless for two reasons. First, the outside donations received

by the City were specifically earmarked for pension relief, and they never would

have been forthcoming but for the satisfaction of that condition.

16

Accordingly,

these outside donations simply help to provide relief for retirees without making

Syncora any worse off than if the Grand Bargain had never been made. In fact,

even if the City wanted to, it has no ability to redirect these donor-specified gifts.

And second, even on the flawed assumption that the City must somehow treat the

outside donations as if they were available for distribution to all creditors in

general, the City has separately explained why the differential recovery for retirees

does not amount to unfair discrimination.

16

See, e.g., Rapson Dep. at 43:6-13, 46:6-11.

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 27 of 31

24

For all of these reasons, there is no basis to attack the Grand Bargain as a

fraudulent transfer that contravenes the purposes of the Bankruptcy Code. In

fact, the Grand Bargain represents a remarkable achievement that is the product of

an exemplary mediation process. It provides significant benefits to the City and its

creditors by preserving the Citys cultural heritage, settling acrimonious disputes,

and creating a significant infusion of outside funding without inflicting the

slightest harm on Syncora or any other creditor. This path-marking achievement

deserves to be studied and emulated, not disparaged.

CONCLUSION

For the reasons set forth herein, the City submits that the aforementioned

false and malicious allegations as well as the untimely and redundant submissions

contained in Section I of Syncora Guarantee Inc. and Syncora Capital Assurance

Inc.s Second Supplemental Objection to the Debtors Plan of Adjustment [Dkt.

No. 6651] should be struck under Federal Rule of Civil Procedure 12(f).

17

17

In accordance with Local Rule 9014-1(b), the City sought but did not obtain

Syncoras concurrence in the requested relief.

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 28 of 31

Dated: August 18, 2014

Respectfully submitted

David G. Heiman (OH 0038271)

Heather Lennox (OH 0059649)

Thomas A. Wilson (OH 0077047)

JONES DAY

North Point

901 Lakeside Avenue

Cleveland, Ohio 44114

Telephone: (216) 586-3939

Facsimile: (216) 579-0212

dgheiman@jonesday.com

hlennox@jonesday.com

tawilson@jonesday.com

Bruce Bennett (CA 105430)

JONES DAY

555 South Flower Street

Fiftieth Floor

Los Angeles, California 90071

Telephone: (213) 243 2382

Facsimile: (213) 243 2539

bbennett@jonesday.com

Thomas F. Cullen, Jr. (DC 224733)

Gregory M. Shumaker (DC 416537)

Geoffrey S. Stewart (DC 287979)

JONES DAY

51 Louisiana Ave., N.W.

Washington, D.C. 20001

Telephone: (202) 879-3939

Facsimile: (202) 626-1700

tfcullen@jonesday.com

gshumaker@jonesday.com

gstewart@jonesday.com

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 29 of 31

/s/ Deborah Kovsky-Apap

Robert S. Hertzberg (P30261)

Deborah Kovsky-Apap (P68258)

PEPPER HAMILTON LLP

4000 Town Center, Suite 1800

Southfield, MI 48075

Telephone: (248) 359-7300

Facsimile: (248) 359-7700

hertzbergr@pepperlaw.com

kovskyd@pepperlaw.com

ATTORNEYS FOR THE CITY

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 30 of 31

SUMMARY OF ATTACHMENTS

The following documents are attached to this Motion, labeled in accordance with

Local Rule 9014-1(b).

Exhibit 1 Proposed Form of Order

Exhibit 2 Notice of Motion

Exhibit 3 None [Brief Not Required]

Exhibit 4 Certificate of Service

Exhibit 5 None [No Affidavits Filed Specific to This Motion]

Exhibit 6-A Disclosure E-mail

Exhibit 6-B

Exhibit 6-C

Disclosure Followup E-mail

Disclosure Letter

13-53846-swr Doc 6845 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 31 of 31

EXHIBIT 1

Proposed Order

13-53846-swr Doc 6845-1 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 1 of 3

UNITED STATES BANKRUPTCY COURT

EASTERN DISTRICT OF MICHIGAN

SOUTHERN DIVISION

-----------------------------------------------------

In re

CITY OF DETROIT, MICHIGAN,

Debtor.

-----------------------------------------------------

x

:

:

:

:

:

:

:

:

x

Chapter 9

Case No. 13-53846

Hon. Steven W. Rhodes

ORDER, PURSUANT TO FEDERAL RULE OF CIVIL PROCEDURE 12(f),

STRIKING IN PART SYNCORA GUARANTEE INC. AND SYNCORA

CAPITAL ASSURANCE INC.S SECOND SUPPLEMENTAL

OBJECTION TO THE DEBTORS PLAN OF ADJUSTMENT

This matter coming before the Court on the Motion of the City of

Detroit, Pursuant to Federal Rule of Civil Procedure 12(f) seeking to strike in part

Syncora Guarantee Inc. and Syncora Capital Assurance Inc.s Second

Supplemental Objection to the Debtors Plan of Adjustment (the Motion), filed

by the City of Detroit, Michigan (the City); the Court having reviewed the

Motion and having determined that the legal and factual bases set forth in the

Motion establish just cause for the relief granted herein;

IT IS HEREBY ORDERED THAT:

1. The Motion is GRANTED.

13-53846-swr Doc 6845-1 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 2 of 3

-2-

2. Section I of Syncora Guarantee Inc. and Syncora Capital

Assurance Inc.s Second Supplemental Objection to the Debtors Plan of

Adjustment is struck from the record.

This Order shall be effective immediately upon its entry.

13-53846-swr Doc 6845-1 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 3 of 3

EXHIBIT 2

Notice

13-53846-swr Doc 6845-2 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 1 of 5

UNITED STATES BANKRUPTCY COURT

EASTERN DISTRICT OF MICHIGAN

SOUTHERN DIVISION

In re

CITY OF DETROIT, MICHIGAN,

Debtor.

Chapter 9

Case No. 13-53846

Hon. Steven W. Rhodes

NOTICE OF MOTION AND OPPORTUNITY TO RESPOND

PLEASE TAKE NOTICE that on August 18, 2014, the Debtor, City of

Detroit, filed its Motion to Strike in Part Syncora Guarantee Inc. and Syncora

Capital Assurance Inc.s Second Supplemental Objection to the Debtors Plan of

Adjustment (the Motion) in the United States Bankruptcy Court for the Eastern

District of Michigan (the Bankruptcy Court).

PLEASE TAKE FURTHER NOTICE that your rights may be affected

by the relief sought in the Motion. You should read these papers carefully

and discuss them with your attorney, if you have one. If you do not have an

attorney, you may wish to consult one.

PLEASE TAKE FURTHER NOTICE that if you do not want the

Bankruptcy Court to grant the Debtors Motion, or you want the Bankruptcy Court

to consider your views on the Motion, within 17 days

1

you or your attorney must:

1

Concurrently herewith, the Debtor has filed a motion seeking to shorten the

notice period and expedite the hearing, if any, on the Motion. If that motion is

granted, the Court will enter an order on the docket setting the deadline to respond

to the Motion.

13-53846-swr Doc 6845-2 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 2 of 5

-2-

1. File a written objection or response to the Motion explaining your

position with the Bankruptcy Court electronically through the Bankruptcy Courts

electronic case filing system in accordance with the Local Rules of the Bankruptcy

Court or by mailing any objection or response to:

2

United States Bankruptcy Court

Theodore Levin Courthouse

231 West Lafayette Street

Detroit, MI 48226

You must also serve a copy of any objection or response upon:

David G. Heiman (OH 0038271)

Heather Lennox (OH 0059649)

JONES DAY

North Point

901 Lakeside Avenue

Cleveland, Ohio 44114

Telephone: (216) 586-3939

Facsimile: (216) 579-0212

-and-

Bruce Bennett (CA 105430)

JONES DAY

555 South Flower Street

Fiftieth Floor

Los Angeles, California 90071

Telephone: (213) 243-2382

Facsimile: (213) 243-2539

-and-

Robert Hertzberg

Deborah Kovsky-Apap

Pepper Hamilton LLP

2

A response must comply with F. R. Civ. P. 8(b), (c) and (e).

13-53846-swr Doc 6845-2 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 3 of 5

-3-

Suite 1800, 4000 Town Center

Southfield, Michigan 48075

2. If an objection or response is timely filed and served, the clerk will

schedule a hearing on the Motion and you will be served with a notice of the date,

time and location of the hearing.

PLEASE TAKE FURTHER NOTICE that if you or your attorney do

not take these steps, the court may decide that you do not oppose the relief

sought in the Motion and may enter an order granting such relief.

[signature page follows]

13-53846-swr Doc 6845-2 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 4 of 5

-4-

Dated: August 18, 2014 Respectfully submitted,

David G. Heiman (OH 0038271)

Heather Lennox (OH 0059649)

JONES DAY

North Point

901 Lakeside Avenue

Cleveland, Ohio 44114

Telephone: (216) 586-3939

Facsimile: (216) 579-0212

dgheiman@jonesday.com

hlennox@jonesday.com

Bruce Bennett (CA 105430)

JONES DAY

555 South Flower Street

Fiftieth Floor

Los Angeles, California 90071

Telephone: (213) 243-2382

Facsimile: (213) 243-2539

bbennett@jonesday.com

/s/ Deborah Kovsky-Apap

Robert S. Hertzberg (P30261)

Deborah Kovsky-Apap (P68258)

PEPPER HAMILTON LLP

4000 Town Center, Suite 1800

Southfield, MI 48075

Telephone: (248) 359-7300

Facsimile: (248) 359-7700

hertzbergr@pepperlaw.com

kovskyd@pepperlaw.com

ATTORNEYS FOR THE CITY

13-53846-swr Doc 6845-2 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 5 of 5

EXHIBIT 3

[Not Applicable]

13-53846-swr Doc 6845-3 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 1 of 1

EXHIBIT 4

Certificate of Service

13-53846-swr Doc 6845-4 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 1 of 2

UNITED STATES BANKRUPTCY COURT

EASTERN DISTRICT OF MICHIGAN

SOUTHERN DIVISION

In re

CITY OF DETROIT, MICHIGAN,

Debtor.

Chapter 9

Case No. 13-53846

Hon. Steven W. Rhodes

CERTIFICATE OF SERVICE

I, Deborah Kovsky-Apap, hereby certify that the Motion of the City of

Detroit to Strike in Part Syncora Guarantee Inc. and Syncora Capital Assurance

Inc.s Second Supplemental Objection to the Debtors Plan of Adjustment was filed

and served via the Court's electronic case filing and noticing system on this 18th

day of August, 2014.

/s/ Deborah Kovsky-Apap

Deborah Kovsky-Apap (P68258)

13-53846-swr Doc 6845-4 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 2 of 2

EXHIBIT 5

[Not Applicable]

13-53846-swr Doc 6845-5 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 1 of 1

EXHIBIT 6-A

13-53846-swr Doc 6845-6 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 1 of 2

13-53846-swr Doc 6845-6 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 2 of 2

EXHIBIT 6-B

13-53846-swr Doc 6845-7 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 1 of 2

13-53846-swr Doc 6845-7 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 2 of 2

EXHIBIT 6-C

13-53846-swr Doc 6845-8 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 1 of 8

13-53846-swr Doc 6845-8 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 2 of 8

13-53846-swr Doc 6845-8 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 3 of 8

13-53846-swr Doc 6845-8 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 4 of 8

13-53846-swr Doc 6845-8 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 5 of 8

13-53846-swr Doc 6845-8 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 6 of 8

13-53846-swr Doc 6845-8 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 7 of 8

13-53846-swr Doc 6845-8 Filed 08/18/14 Entered 08/18/14 21:35:23 Page 8 of 8

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Georgia Senate ResolutionDocument5 pagesGeorgia Senate ResolutionBreitbart NewsNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Canon 8 Case CompilationDocument32 pagesCanon 8 Case Compilationchan.aNo ratings yet

- Affidavit in Support of Default JudgmentDocument6 pagesAffidavit in Support of Default JudgmentMarc MkKoy100% (1)

- Philex Mining Corp. Vs CIRDocument20 pagesPhilex Mining Corp. Vs CIRJerome ArañezNo ratings yet

- DRAFTING NOTICE ON LEGAL NOTICEDocument18 pagesDRAFTING NOTICE ON LEGAL NOTICEAkanksha SinghNo ratings yet

- Court Rules School Not Obligated to Operate Until Students Finish CoursesDocument2 pagesCourt Rules School Not Obligated to Operate Until Students Finish CoursesAntonio Salvador100% (2)

- Canton V. City of Cebu (2007)Document2 pagesCanton V. City of Cebu (2007)Genesis Leal100% (1)

- 2007 Tax Case DigestsDocument44 pages2007 Tax Case DigestsJeff Hebron50% (4)

- GSIS v. Hon. Vicente A. Pacquing A.M. No. RTJ-04-1831Document2 pagesGSIS v. Hon. Vicente A. Pacquing A.M. No. RTJ-04-1831Ceresjudicata67% (3)

- Mental Health Across The Criminal Legal ContinuumDocument24 pagesMental Health Across The Criminal Legal ContinuumWDET 101.9 FMNo ratings yet

- Infographic - Michigan School Finance at The Crossroads: A Quarter Century of State ControlDocument1 pageInfographic - Michigan School Finance at The Crossroads: A Quarter Century of State ControlWDET 101.9 FMNo ratings yet

- Did The Past Economic Recovery Result in Shared Prosperity?Document33 pagesDid The Past Economic Recovery Result in Shared Prosperity?WDET 101.9 FMNo ratings yet

- Greens RecipeDocument2 pagesGreens RecipeWDET 101.9 FMNo ratings yet

- NTSB Preliminary Report On Arizona FatalityDocument4 pagesNTSB Preliminary Report On Arizona FatalityWDET 101.9 FMNo ratings yet

- Marathon Application and Variance RequestDocument43 pagesMarathon Application and Variance RequestWDET 101.9 FMNo ratings yet

- Lake Erie Harmful Algal Bloom Early ProjectionDocument1 pageLake Erie Harmful Algal Bloom Early ProjectionWDET 101.9 FMNo ratings yet

- Asian Carp Control MeasuresDocument2 pagesAsian Carp Control MeasuresWDET 101.9 FMNo ratings yet

- Algae Bloom Forecast 5/23/19Document1 pageAlgae Bloom Forecast 5/23/19WDET 101.9 FMNo ratings yet

- 2019 Combined BracketsDocument2 pages2019 Combined BracketsWDET 101.9 FMNo ratings yet

- Bell Pepeprs RecipeDocument2 pagesBell Pepeprs RecipeWDET 101.9 FMNo ratings yet

- 2014 Regional System MapDocument1 page2014 Regional System MapWDET 101.9 FMNo ratings yet

- 2019 Wayne County Road ScheduleDocument7 pages2019 Wayne County Road ScheduleWDET 101.9 FMNo ratings yet

- Residential Road Program Introduction 2019Document6 pagesResidential Road Program Introduction 2019WDET 101.9 FMNo ratings yet

- PFAS in Drinking WaterDocument2 pagesPFAS in Drinking WaterWDET 101.9 FMNo ratings yet

- Lake Erie Bill of RightsDocument3 pagesLake Erie Bill of RightsWDET 101.9 FMNo ratings yet

- Black GarlicDocument2 pagesBlack GarlicWDET 101.9 FMNo ratings yet

- Detroit Census MapDocument1 pageDetroit Census MapWDET 101.9 FMNo ratings yet

- What's Fresh: Sweet Corn SoupDocument2 pagesWhat's Fresh: Sweet Corn SoupWDET 101.9 FMNo ratings yet

- Pickled Summer SquashDocument2 pagesPickled Summer SquashWDET 101.9 FMNo ratings yet

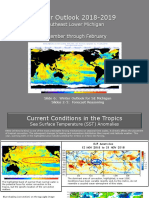

- Winter 2018-19 OutlookDocument6 pagesWinter 2018-19 OutlookWDET 101.9 FMNo ratings yet

- IRS Tax Reform Basics For Individuals 2018Document14 pagesIRS Tax Reform Basics For Individuals 2018WDET 101.9 FMNo ratings yet

- WDET's Preschool BallotDocument1 pageWDET's Preschool BallotWDET 101.9 FMNo ratings yet

- Jim Hines DJC Interview TranscriptDocument15 pagesJim Hines DJC Interview TranscriptWDET 101.9 FMNo ratings yet

- Shri Thanedar DJC Interview TranscriptDocument12 pagesShri Thanedar DJC Interview TranscriptWDET 101.9 FMNo ratings yet

- Gretchen Whitmer DJC Interview TranscriptDocument15 pagesGretchen Whitmer DJC Interview TranscriptWDET 101.9 FMNo ratings yet

- Patrick Colbeck DJC Interview TranscriptDocument14 pagesPatrick Colbeck DJC Interview TranscriptWDET 101.9 FMNo ratings yet

- Brian Calley DJC Interview TranscriptDocument14 pagesBrian Calley DJC Interview TranscriptWDET 101.9 FMNo ratings yet

- Abdul El-Sayed DJC Interview TranscriptDocument18 pagesAbdul El-Sayed DJC Interview TranscriptWDET 101.9 FMNo ratings yet

- Voters Not Politicians ProposalDocument8 pagesVoters Not Politicians ProposalWDET 101.9 FMNo ratings yet

- Gercio vs. Sun Life Assurance Co of CanadaDocument4 pagesGercio vs. Sun Life Assurance Co of CanadaGlendalyn PalacpacNo ratings yet

- Writ of Possession JurisDocument17 pagesWrit of Possession JurisEdmond LorenzoNo ratings yet

- MurderDocument27 pagesMurderPando Daily50% (2)

- Rizona Ourt of Ppeals: Plaintiff/Appellant, VDocument12 pagesRizona Ourt of Ppeals: Plaintiff/Appellant, VScribd Government DocsNo ratings yet

- Not PrecedentialDocument7 pagesNot PrecedentialScribd Government DocsNo ratings yet

- 01.02 - Cariño vs. Insular Government (7 Phil 132)Document5 pages01.02 - Cariño vs. Insular Government (7 Phil 132)JMarcNo ratings yet

- Kaviraj Pandit Durga Dutt Sharma Vs Navaratna Pharmaceutical ... On 20 October, 1964Document16 pagesKaviraj Pandit Durga Dutt Sharma Vs Navaratna Pharmaceutical ... On 20 October, 1964shubhangNo ratings yet

- Corporation Law NotesDocument3 pagesCorporation Law NotesErrol John RamosNo ratings yet

- Labor Relations GuideDocument7 pagesLabor Relations GuideCedric VanguardiaNo ratings yet

- Sullivan v. O'Connor: Supreme Court Rules on Damages in Breach of Medical Contract CaseDocument5 pagesSullivan v. O'Connor: Supreme Court Rules on Damages in Breach of Medical Contract CaseLuis Enrique Polanco AriasNo ratings yet

- Ancheta Vs AnchetaDocument20 pagesAncheta Vs AnchetaShiva100% (1)

- Tayob & Wandera 2011Document67 pagesTayob & Wandera 2011Abdulkader TayobNo ratings yet

- G. Jane Shipp v. Sheila E. Widnall, Secretary of The Air Force, 166 F.3d 348, 10th Cir. (1998)Document4 pagesG. Jane Shipp v. Sheila E. Widnall, Secretary of The Air Force, 166 F.3d 348, 10th Cir. (1998)Scribd Government DocsNo ratings yet

- 14 Chapter 5Document47 pages14 Chapter 5David Honey DiviyaNo ratings yet

- ToC Repsonse ADA CadeDocument25 pagesToC Repsonse ADA CadeAnkur SinghNo ratings yet

- Week 1 Handout 3 Contempt of CourtDocument5 pagesWeek 1 Handout 3 Contempt of CourtMatNo ratings yet

- The Third Gender and Gender Self-Identification in India: A ReviewDocument10 pagesThe Third Gender and Gender Self-Identification in India: A ReviewAakanksha KumarNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument13 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- People v. Mcmahon-Counter AffidavitDocument6 pagesPeople v. Mcmahon-Counter AffidavitAmado Vallejo IIINo ratings yet

- People vs. DyDocument14 pagesPeople vs. DyGeenea VidalNo ratings yet

- Domestic Violence Act 2005: Issues in Defining "Shared HouseholdDocument10 pagesDomestic Violence Act 2005: Issues in Defining "Shared HouseholdNishant KhatriNo ratings yet