Professional Documents

Culture Documents

Japan Based Investment Banks

Uploaded by

Siddharth Joshi0 ratings0% found this document useful (0 votes)

498 views36 pagesList of Japanese i Banks

Original Title

Japan based Investment Banks

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentList of Japanese i Banks

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

498 views36 pagesJapan Based Investment Banks

Uploaded by

Siddharth JoshiList of Japanese i Banks

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 36

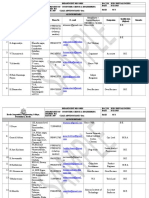

Present in Japan I-banks research done earlier, so they may have been contacted

Sno Name Overview

1 AGS Consulting Co Ltd It is a part of AGS Group. Its alliance partner SCS

Global Holdings Pte Ltd is present in India. Its

M&A services include DD, Valuation, M&A

aftercare, etc

2 Daiwa Institute of Research `- Daiwa Institute of Research Ltd. is a research

firm

- It focuses its research on domestic and foreign

economies, capital markets, and industry

structure

3 Frontier Management Inc `- FMI offers corporate finance and

management advisory services

- It was founded in 2007 and is based in Tokyo,

Japan

4 GCA Savvian Group Corp `- GCA Savvian Corporation is engaged in the

provision of investment banking services

primarily in Japan

5 Mizuho Securities Co Ltd `- Mizuho Securities Co., Ltd. is a Japanese

investment banking and securities firm. It is a

subsidiary of Mizuho Corporate Bank, Ltd.,

which is a wholly owned subsidiary of Mizuho

Financial Group, the second-biggest Japanese

financial services conglomerate

- Mizuho Securities USA has concluded an

agreement with Evercore Partners Inc., a leading

U.S. M&A boutique investment bank, to provide

Japan-U.S. cross-border M&A deals

6 SMBC Nikko Securities Inc `- SMBC Nikko is one of the leading full-line

securities company in Japan covering all client

segments with a broad range of financial

products and services through its international

network

- As on 30 June 2014 it employees 8,270 people

- It has strategic alliance agreements with

Sumitomo Mitsui Banking Corporation; Kotak

Mahindra Capital Company Limited; and Moelis

& Company LLC

7 Crosspoint Advisors Inc `- Crosspoint Advisors is Japans leading

independent advisory firm

- The firms clientele include Kenko.com Inc.

and UCC Holdings Co., Ltd

8 Growin Partners Inc `- Growin Partners is engaged in M & A and

support business and public support services

9 Miyake CPA Office `- The firm was started in 1973

10 Pinnacle Inc `- Pinnacle Inc. provides advisory and business

consulting services

- The company was founded in 2004 and is

based in Tokyo

- As of February 1, 2010, Pinnacle Inc. operates

as a subsidiary of The International Network of

M&A Partners

- In 2009, Pinnacle, as exclusive partner for the

Japanese market, joined IMAP, a global M&A

partnership located in more than 30 countries,

in order to strengthen our cross-border M&A

practice

11 RECOF Corporation `- RECOF Corporation operates as a boutique

investment bank that offers financial advisory

services

- It offers a comprehensive services relating to

M&A from M&A strategic planning, origination

and execution of M&A transactions to realizing

synergies

12 Tokyo Kyodo Accounting Office `- TKAO, founded in August 1993, is engaged in

Accounting and Tax Consulting Services,

Valuations, Due Diligence and Other Assurance

Services, Financial Advisory Services,

Management of Special Purpose Companies

Offerings Sectors

`- Management Services

- Succession of Business

- IPO Services

- M&A Services

- Turn around Support

- International Services

Based on deal database:

Natural Gas transmission, F&B,

Automotive stampings

`- Offers macro economic reports including monthly

economy review and Japan's economic quarterly

outlook

- Provides consulting services in corporate and

advisory pertaining to reorganizations, mergers and

acquisitions, strategies, and business opportunities to

private companies and public institutions

Based on deal database:

Retail, Refrigeration and heating

equipments

`- Provides merger and acquisition, business

structuring and restructuring, due diligence,

valuation, strategic, financial, voluntary and

involuntary liquidation, and turnaround advisory

services

- It also offers initial public offering and capital

transfer advisory; and business survey and market

analysis services

Based on deal database:

IT, Pharma retail, F&B,

Manufacturing, Chemicals,

`- Offers M&A advisory services for public and private

companies, including buyside, sellside, and going-

private transactions, as well as hostile defense,

reorganization proceedings, recapitalizations, and

restructuring services

- Also provides restructuring advisory services for

debtors and creditors comprising restructurings and

recapitalizations, capital raising and rescue financing,

distressed mergers and acquisitions, and assessment

of strategic alternatives; and capital markets services,

such as placement of common and preferred stock,

mezzanine debt, convertible debt, equity lines, and

acquisition and roll-up financings, as well as initial

public offering advisory services

Technology, Media,

Communications, Healthcare,

Consumer and Retail, and

Industrials Sectors

Europe: Underwriting, sales, and other operations of

marketable securities

Switzerland: Private Banking

United States: Bonds, equities, futures, and M&A

advisory services

Hong Kong: Investment Banking

Greater China: Investment Consulting

Based on deal database:

Chemicals, Entertainment, IT,

Retail, Amusement and

recreation, Engineering Services,

Financial Services, Automotive

stampings, F&B, Manufacturing,

Healthcare

M&A and Financing Solutions, Trading of financial

products, Equity Research, Underwriting activities

Based on deal database:

Retail including Pharma Retail,

Energy, Surveying services,

Manufacturing, F&B, Consumer,

Automobile parking, IT,

Chemicals, HR services

`- It focuses on providing value-added financial advice

on mergers, acquisitions, restructurings and capital

raisings to global corporations and institutions doing

business in or with Japan

Technology, Web and mobile

integration, Online drugstore,

Finance and many other

industries

`- Under M&A services it offers M&A advisory, Due

Diligence, Valuation, Purchase Price Allocation,

Business Recovery / Business Succession

- Under Accounting & Tax Services it offers IFRS

consulting, IPO support, Financial Accounting

Advisory and Tax Advisory

Based on deal database:

Education, Advertisement

`- Services include Tax, Audit, Accounting,

Management Advisory, Merger and Acquisition

(including Takeover, Divestment, Consolidation,

MBO, Spin-off), Listing Advisory, Asset Management,

HR/Admin and Accounting Outsourcing, and Software

Development

Its businesses include:

- M&A Advisory

- Cross-border Advisory

- Restructuring Advisory

- Consulting

Based on deal database:

Consumer, Automobile parking

`- It provides mergers and acquisitions advisory,

project financing, fund raising, and strategic business

consulting services

- Additionally, it offers disinvestments, succession

planning, cross border, and business planning

advisory services

Manufacturing, Retail, IT,

Financial services

`- Broadly, businesses include International taxation,

Corporate finance, Structured finance and Wealth

management

- Under corporate finance, it provides Accounting &

Taxation services, valuation services, Due Diligence

and other support services in case of business

expansions, corporate restructuring, IPOs, MBOs, etc

Based on deal database:

Energy

Geographies

Presence throug Alliance Partners in

Singapore, China, Vietnam, Malaysia,

Phillippines, India, Indonesia, Thailand, USA,

UK, Germany, France, Netherland, Spain,

Taiwan, Myanmar, Australia, Sri Lanka

Japan, Shanghai, USA, UK

Japan, Singapore, China

Japan, USA, UK, China, India

Japan, UK, Switzerland, USA, Hong Kong,

Greater China, Singapore, India

Japan, UK, USA, Hong Kong, Singapore,

Shanghai

Japan, Singapore

Japan

Japan

Through IMAP:

Argentina, Austria, Belgium, Brazil, Canada,

Chile, China, Costa Rica, Croatia, Czech

Republic, Denmark, Egypt, Finland, France,

Germany, Hungary, Ireland, India, Italy,

Japan, Mexico, Norway, Poland, Portugal,

Russia, Spain, Sweden, Switzerland, Turkey,

UK, The Netherlands, USA

Own Presence:

Japan

Has a major presence in North America,

South America and Europe through

membership of "Global M&A"

Japan

Select Recent Deals / Clientele

`- Advised Shinnihon Gas Corp in its acquisition by Nippon Gas in a $37 mn Enterprise Value

- Advised Fujisan Sensui Co Ltd in its acquisition by Asahi Soft Drinks Co Ltd in a $10 mn Enterprise value

- Co-advised Jidosha Buhin Kogyo Co Ltd in acquisition of TDF Corp in a $40 mn Enterprise Value

`- Advised Yamazawa Co Ltd in acquisition of Supermarket Yoneya in a $12 mn Enterprise Value

- Advised Sanden Corp in acquisition of Sanwa in a $18 mn Enterprise Value

- Advised Sun Corp in its acquisition by Fujishoji Co Ltd in a $43 mn Enterprise Value

`- Advised Beacon Information Technology in its acquisition by BSP Inc in a $25 mn Enterprise Value

- Co-advised Sakai Co Ltd in its acquisition by G Taste Co Ltd in $45 mn Enterprise Value

- Co-advised G Networks Co Ltd in its acquisition by G Taste Co Ltd in $43 mn Enterprise Value

`- Advised NM Holdings in acquisition of Wiseman Co Ltd in $19 mn Enterprise Value

- Advised Arden in its acquisition by HOKUTO Corp in a $21 mn Enterprise Value

- Advised Foodsnet Corp in its acquisition by Sato Restaurant Systems Co Ltd in a $29 mn Enterprise Value

- Co-advised Magaseek Corp in its acquisition by NTT DOCOMO Inc in a $14 mn Enterprise Value

`- Advised Nippon Signal Co Ltd in acquisition of Nisshin Electronics Service in a $36 mn Enterprise Value

- Advised Yugen Kaisha Kouno Shoji in acquisition of Musashino Kogyo Co Ltd in a $13 mn Enterprise Value

- Advised NISHITETSU in acquisition of Maryuko Corp in a $38 mn Enterprise Value

- Advised AXAS Corp in acquisition of Zakkaya Bulldog Co Ltd in a $13 mn Enterprise Value

- Co-advised both companies in Jidosha Buhin Kogyo Co Ltd's acquisition of TDF Corp in a $40 mn Enterprise

Value

- Advised GEO Holdings Corp in acquisition of Warehouse Co Ltd in a $43 mn Enterprise Value

- Advised target Co Stylife Corp in its acquisition by Rakuten Inc in a $24 mn Enterprise Value

- Advised TY Holdings in acquisition of Unipulse Corp in a $33 mn Enterprise Value

- Advised Tokyo Fudosan Kanri in acquisition of Tokyo Building Service in a $28 mn Enterprise Value

- Co-advised Magaseek Corp in its acquisistion by NTT DOCOMO Inc in a $14 mn Enterprise Value

`- Advised NTT DOCOMO Inc in acquisition of Magaseek Corp in a $13 mn Enterprise Value

- Advised Nippon Gas Co Ltd in acquisitions of Higashinihon Gas Corp, Kitanihon Gas Co Ltd and Shinnihon Gas

Corp in a $37 mn, $11 mn and $37 mn Enterprise Value respectively

- Advised West Japan Railway Co in acquisition of Asia Air Survey Co Ltd in a $25 mn Enterprise Value

- Advised Nisshin Electronics Service in its acquisition by Nippon Signal Co Ltd in a $36 mn Enterprise Value

- Advised Nippon Oil Pump Co Ltd in acquisition of Wendel Japan in a $32 mn Enterprise Value

- Advised Happinet Corp in acquisition of Toys Union in a $19 mn Enterprise Value

- Advised Xing Inc in acquisition of Media Create Co Ltd in a $12 mn Enterprise Value

- Advised SAM holdings Co Ltd in acquisition of Hybrid Service Co Ltd in a $19 mn Enterprise Value

`- Co-advised GRO-BELS Co Ltd in acquisition of Prospect Co Ltd in a $23 mn Enterprise Value

- Advised J-Star in acquisition of Kugami Precision Plastic

`- Advised COOKPAD Inc in acquisition of Coach United In in a $10 mn Enterprise Value

- Advised Hakuhodo Inc in acquisition of Cosmo Communication Inc in a $14 mn Enterprise Value

`- Advised Natoco Co Ltd in acquisition of Tomoe Corp in a $10 mn Enterprise Value

`- Advised Forest Co Ltd in its acquisition by J Front Retailing Co Ltd in a $29 mn Enterprise Value

Deals not disclosed on website

`- Advised Higashinihon Gas Corp in its acquisition by Nippon Gas Co Ltd in a $37 mn Enterprise Value

Contact person Designation Email-id

Chikara Kanzawa

Yoshihide Hirowatari

Yasuaki Obara

Chairman

President

Executive Director

[c.kanzawa@agsc.co.jp]

[y.hirowatari@agsc.co.jp]

Takashi Fukai

Koichi Suzuki

President

Debuty President koichi.suzuki@rc.dir.co.jp

Shoichiro Onishi Co-President s.onishi@frontier-mgmt.com

Nao Fukutani

Sameer Jindal

MD

MD - India sjindal@gcasavvian.com

Mitsuhiro Nagahama

Hiroshi Motoyama

Yasuhiko Imaizumi

Chairman

President & CEO

Deputy President

Shigenobu Aikyo

Tetsuya Kubo President & CEO

Akio Katsuragi

Shun Maeda

Tetsu Serizawa

CEO

Partner - Japan

Partner - Singapore

katsuragi@xpoint.jp

Tetsuya Sano

Satoshi Taki Date

Ishihara HiroshiTakashi

Sato ShinYu

Representative Director

Director

Director

Director

Junichi Miyake Founder & President

Ikuo Yasuda

Kishio Shindo

Masaaki Takano

President & CEO

MD

MD

ikuo.yasuda@imap.com

kishio.shindo@imap.com

Yoshimitsu Onji

Shigeo Fukushima

Tamotsu Majima

President & CEO

MD

Director

fukushima@recof.co.jp

majima@recof.co.jp

Ryutaro Uchiyama

Kazuhiko Suda

Shuji Fujita

Junri Imaizumi

Representative Partner

Partner - Consulting Div

Partner - Consulting Div

Partner - Consulting Div

ryutaro-uchiyama@tkao.com

Tel No

81-3-6803-6750

81-3-5620-5501 /

81-3-5620-5515

+81-3-3514-1300

Tokyo: +81 (3)

6212-7100

India: +91-22-6106-

9002

81-3-5208-3210

81 45-311-1431

81-3-6721-5190

03-5157-1616

81-3-3350-5981

81-3-5408-7850

81-3-3221-4948

81-3-5219-8777

Japanese I-banks

Source: Capital IQ

Sno Name Overview

2 ADCC-FAS

3 AGS Consulting Co Ltd It is a part of AGS Group. Its alliance partner SCS

Global Holdings Pte Ltd is present in India. Its

M&A services include DD, Valuation, M&A

aftercare, etc

8 Aoi Corporate Advisory

11 Asahi Osaka Tax Inc

12 Astar Consulting

16 Brain Partner

19 Chuo Sogo Business Consulting

22 Corporate Advisors Accounting

23 Crosspoint Advisors Inc `- Crosspoint Advisors is Japans leading

independent advisory firm

- The firms clientele include Kenko.com Inc.

and UCC Holdings Co., Ltd

24 Daiwa Institute of Research `- Daiwa Institute of Research Ltd. is a research

firm

- It focuses its research on domestic and foreign

economies, capital markets, and industry

structure

33 es Networks Co Ltd

34 First Make Ltd

35 Frontier Management Inc `- FMI offers corporate finance and

management advisory services

- It was founded in 2007 and is based in Tokyo,

Japan

36 GCA Savvian Group Corp `- GCA Savvian Corporation is engaged in the

provision of investment banking services

primarily in Japan

38 Growin Partners Inc `- Growin Partners is engaged in M & A and

support business and public support services

48 Matsuyama Konin Kaikei No website

50 Mita Securities

52 Miyake CPA Office `- The firm was started in 1973

60 Okada Konin Kaikeishi Jimusyo

61 Pinnacle Inc `- Pinnacle Inc. provides advisory and business

consulting services

- The company was founded in 2004 and is

based in Tokyo

- As of February 1, 2010, Pinnacle Inc. operates

as a subsidiary of The International Network of

M&A Partners

- In 2009, Pinnacle, as exclusive partner for the

Japanese market, joined IMAP, a global M&A

partnership located in more than 30 countries,

in order to strengthen our cross-border M&A

practice

64 Quam Capital Ltd `- China based

- Quam Capital provides middle-market clients

with a full range of corporate finance services

71 Tokyo Financial Advisers No website

72 Tokyo Kyodo Accounting Office `- TKAO, founded in August 1993, is engaged in

Accounting and Tax Consulting Services,

Valuations, Due Diligence and Other Assurance

Services, Financial Advisory Services,

Management of Special Purpose Companies

73 Toranomon Audit LLC Audit Firm

74 Trustees Advisory No website

75 TSUJI&PARTNERS Inc Website in Japanese; Not translating in English

77 Yuasa Konin Kaikeishi Zerishi

Offerings Sectors

`- Management Services

- Succession of Business

- IPO Services

- M&A Services

- Turn around Support

- International Services

`- It focuses on providing value-added financial advice

on mergers, acquisitions, restructurings and capital

raisings to global corporations and institutions doing

business in or with Japan

Technology, Web and

mobile integration,

Online drugstore, Finance

and many other

industries

`- Offers macro economic reports including monthly

economy review and Japan's economic quarterly

outlook

- Provides consulting services in corporate and

advisory pertaining to reorganizations, mergers and

acquisitions, strategies, and business opportunities to

private companies and public institutions

`- Provides merger and acquisition, business

structuring and restructuring, due diligence,

valuation, strategic, financial, voluntary and

involuntary liquidation, and turnaround advisory

services

- It also offers initial public offering and capital

transfer advisory; and business survey and market

analysis services

`- Offers M&A advisory services for public and private

companies, including buyside, sellside, and going-

private transactions, as well as hostile defense,

reorganization proceedings, recapitalizations, and

restructuring services

- Also provides restructuring advisory services for

debtors and creditors comprising restructurings and

recapitalizations, capital raising and rescue financing,

distressed mergers and acquisitions, and assessment

of strategic alternatives; and capital markets services,

such as placement of common and preferred stock,

mezzanine debt, convertible debt, equity lines, and

acquisition and roll-up financings, as well as initial

public offering advisory services

Technology, Media,

Communications,

Healthcare, Consumer

and Retail, and Industrials

Sectors

`- Under M&A services it offers M&A advisory, Due

Diligence, Valuation, Purchase Price Allocation,

Business Recovery / Business Succession

- Under Accounting & Tax Services it offers IFRS

consulting, IPO support, Financial Accounting

Advisory and Tax Advisory

`- Services include Tax, Audit, Accounting,

Management Advisory, Merger and Acquisition

(including Takeover, Divestment, Consolidation,

MBO, Spin-off), Listing Advisory, Asset Management,

HR/Admin and Accounting Outsourcing, and Software

Development

Its businesses include:

- M&A Advisory

- Cross-border Advisory

- Restructuring Advisory

- Consulting

Offerings include:

- Corporate Advisory

- Mergers and Acquisitions

- Sponsorship

-Fund Raising

`- Broadly, businesses include International taxation,

Corporate finance, Structured finance and Wealth

management

- Under corporate finance, it provides Accounting &

Taxation services, valuation services, Due Diligence

and other support services in case of business

expansions, corporate restructuring, IPOs, MBOs, etc

Geographies

Presence throug Alliance Partners in

Singapore, China, Vietnam, Malaysia,

Phillippines, India, Indonesia, Thailand, USA,

UK, Germany, France, Netherland, Spain,

Taiwan, Myanmar, Australia, Sri Lanka

Japan, Singapore

Japan, Shanghai, USA, UK

Japan, Singapore, China

Japan, USA, UK, China, India

Japan

Japan

Through IMAP:

Argentina, Austria, Belgium, Brazil, Canada,

Chile, China, Costa Rica, Croatia, Czech

Republic, Denmark, Egypt, Finland, France,

Germany, Hungary, Ireland, India, Italy,

Japan, Mexico, Norway, Poland, Portugal,

Russia, Spain, Sweden, Switzerland, Turkey,

UK, The Netherlands, USA

Own Presence:

Japan

Japan

Select Recent Deals done / Clientele

`- Co-advised RealVision in its acquisition by Investor Group in a $13 mn Enterprise Value

`- Advised Shinnihon Gas Corp in its acquisition by Nippon Gas in a $37 mn Enterprise Value

- Advised Fujisan Sensui Co Ltd in its acquisition by Asahi Soft Drinks Co Ltd in a $10 mn Enterprise value

- Co-advised Jidosha Buhin Kogyo Co Ltd in acquisition of TDF Corp in a $40 mn Enterprise Value

`- Advised Hitachi Construction Machinery in acquisition of Hitachi Kenki Logistics Tech in a $49 mn Enterprise

Value

`- Advised Kintetsu Corp in acquisition of Hokko Daiwa Taxi Co Ltd in a $22 mn Enterprise Value

`- Co-advised RealVision in its acquisition by Investor Group in a $13 mn Enterprise Value

`- Advised Mie Kotsu Group Holdings Inc in acquisition of Sanco Creative Life in a $11 mn Enterprise Value

`- Acquired Kitanihon Gas Co Ltd in its acquisition by Nippon Gas Co Ltd in a $11 mn Enterprise Value

`- Advised Hakone Kogen Hotel in its acquisition by Kintetsu Corp in a $16 mn Enterprise Value

- Advised Nippon Manufacturing Service in acquisition of TKR Corp in a $ 24 mn Enterprise Value

`- Co-advised GRO-BELS Co Ltd in acquisition of Prospect Co Ltd in a $23 mn Enterprise Value

- Advised J-Star in acquisition of Kugami Precision Plastic

`- Advised Yamazawa Co Ltd in acquisition of Supermarket Yoneya in a $12 mn Enterprise Value

- Advised Sanden Corp in acquisition of Sanwa in a $18 mn Enterprise Value

- Advised Sun Corp in its acquisition by Fujishoji Co Ltd in a $43 mn Enterprise Value

`- Advised Konyusha in its acquisition by Asrapport Dining Co Ltd in a $26 mn Enterprise Value

- Co-advised Hybrid Service Co Ltd in its acquisition by SAM Holdings Co Ltd in a $19 mn Enterprise value

- Advised Samantha Thavasa Japan Ltd in acquisition of L'Est Co Ltd in a $16 mn Enterprise Value

`- Advised Minato Electronics Inc in its acquisition by Investor Group in a $17 mn Enterprise Value

`- Advised Beacon Information Technology in its acquisition by BSP Inc in a $25 mn Enterprise Value

- Co-advised Sakai Co Ltd in its acquisition by G Taste Co Ltd in $45 mn Enterprise Value

- Co-advised G Networks Co Ltd in its acquisition by G Taste Co Ltd in $43 mn Enterprise Value

`- Advised NM Holdings in acquisition of Wiseman Co Ltd in $19 mn Enterprise Value

- Advised Arden in its acquisition by HOKUTO Corp in a $21 mn Enterprise Value

- Advised Foodsnet Corp in its acquisition by Sato Restaurant Systems Co Ltd in a $29 mn Enterprise Value

- Co-advised Magaseek Corp in its acquisition by NTT DOCOMO Inc in a $14 mn Enterprise Value

`- Advised COOKPAD Inc in acquisition of Coach United In in a $10 mn Enterprise Value

- Advised Hakuhodo Inc in acquisition of Cosmo Communication Inc in a $14 mn Enterprise Value

`- Advised Sakai Co Ltd in its acquisition by G taste Co Ltd in a $45 mn Enterprise Value

- Advised G Networks Co Ltd in its acquisition by G taste Co Ltd in a $43 mn Enterprise Value

`- Co-advised Ace Investments Inc in acquisition of Ace Koeki Co Ltd in a $20 mn Enterprise Value

- Co-advised Fujiyakuhin Co Ltd in acquisition of OST Japan Group Inc in a $16 mn Enterprise Value

`- Advised Natoco Co Ltd in acquisition of Tomoe Corp in a $10 mn Enterprise Value

`- Advised Prospect Co Ltd in its acquisition by GRO-BELS Co Ltd in a $23 mn Enterprise Value

`- Advised Forest Co Ltd in its acquisition by J Front Retailing Co Ltd in a $29 mn Enterprise Value

`- Advised Dynam Japan Holdings Co Ltd in acquisition of HUMAP Japan Co Ltd in a $39 mn Enterprise Value

`- Acquired ARDEPRO Co Ltd in its acquisition by Tatsuya Akimoto in a $30 mn Enterprise Value

`- Advised Higashinihon Gas Corp in its acquisition by Nippon Gas Co Ltd in a $37 mn Enterprise Value

`- Advised Warehouse Co Ltd in its acquisition by GEO Holdings Corp in a $43 mn Enterprise Value

`- Co-advised TDF Corp in its acquisition by Jidosha Buhin Kogyo Co Ltd in a $40 mn Enterprise Value

- Advised Ace Koeki Co Ltd in its acquisition by Ace Investment Inc in a $20 mn Enterprise Value

`- Advised Taihei Co Ltd in acquisition of Digital Soken Co Ltd in a $18 mn Enterprise Value

`- Advised Media Create Co Ltd in its acquisition by Xing Inc in a $12 mn Enterprise Value

Contact person Designation Email-id

Chikara Kanzawa

Yoshihide Hirowatari

Yasuaki Obara

Chairman

President

Executive Director

[c.kanzawa@agsc.co.jp]

[y.hirowatari@agsc.co.jp]

Akio Katsuragi

Shun Maeda

Tetsu Serizawa

CEO

Partner - Japan

Partner - Singapore

katsuragi@xpoint.jp

Takashi Fukai

Koichi Suzuki

President

Debuty President koichi.suzuki@rc.dir.co.jp

Shoichiro Onishi Co-President s.onishi@frontier-mgmt.com

Nao Fukutani

Sameer Jindal

MD

MD - India sjindal@gcasavvian.com

Tetsuya Sano

Satoshi Taki Date

Ishihara HiroshiTakashi

Sato ShinYu

Representative Director

Director

Director

Director

Junichi Miyake Founder & President

Ikuo Yasuda

Kishio Shindo

Masaaki Takano

President & CEO

MD

MD

ikuo.yasuda@imap.com

kishio.shindo@imap.com

Ryutaro Uchiyama

Kazuhiko Suda

Shuji Fujita

Junri Imaizumi

Representative Partner

Partner - Consulting Div

Partner - Consulting Div

Partner - Consulting Div

ryutaro-uchiyama@tkao.com

Tel No

81-3-6803-6750

81-3-6721-5190

81-3-5620-5501 /

81-3-5620-5515

+81-3-3514-1300

Tokyo: +81 (3)

6212-7100

India: +91-22-6106-

9002

03-5157-1616

81-3-3350-5981

81-3-5408-7850

81-3-5219-8777

You might also like

- Accident Insurance CoverDocument24 pagesAccident Insurance Coversantanu40No ratings yet

- Quiz ListDocument1,892 pagesQuiz ListVishal Vinay RamNo ratings yet

- Reat Cause List Cr-1 Cause List 17-09-2021Document2 pagesReat Cause List Cr-1 Cause List 17-09-2021Shyam APA JurisNo ratings yet

- Client List for Mr. K ThirugnanamDocument68 pagesClient List for Mr. K ThirugnanamDhananjayan GopinathanNo ratings yet

- Investadd PDFDocument5 pagesInvestadd PDFhooligunzNo ratings yet

- (붙임1) 2019년 WFK-과학기술지원단 수요조사 결과Document2 pages(붙임1) 2019년 WFK-과학기술지원단 수요조사 결과Bood ReyNo ratings yet

- 6-May-09 Sirimalla Yamuna Hamsasri Textiles: Date Applicantname Companyname ApplicantemailDocument22 pages6-May-09 Sirimalla Yamuna Hamsasri Textiles: Date Applicantname Companyname ApplicantemailVivek PatilNo ratings yet

- GenEd - GE2 - Mathematics in The Modern World - B (As of 8-24-22)Document3 pagesGenEd - GE2 - Mathematics in The Modern World - B (As of 8-24-22)Jonathan AysonNo ratings yet

- Agencies in MumbaiDocument5 pagesAgencies in MumbaiPriyanku BhatnagarNo ratings yet

- Timestamp log from 03/05/2012 to 05/05/2012Document10 pagesTimestamp log from 03/05/2012 to 05/05/2012sghane5674No ratings yet

- STAFFINGDocument2 pagesSTAFFINGPeekay KNo ratings yet

- Final List of Participants - Good ContactDocument7 pagesFinal List of Participants - Good ContactKaew Vera SenapanNo ratings yet

- Yashwantrao Chavan Law College Internal Assignment Email IDsDocument10 pagesYashwantrao Chavan Law College Internal Assignment Email IDsAmit BakleNo ratings yet

- Hardware 1Document50 pagesHardware 1JobyThomasIssacNo ratings yet

- EPSMM-01 - Attendance UpdatedDocument6 pagesEPSMM-01 - Attendance UpdatedShrutika MathurNo ratings yet

- 2nd Round Cho Merit ListDocument1 page2nd Round Cho Merit ListSanjay BhagwatNo ratings yet

- HR Media ListDocument4 pagesHR Media Listakush24No ratings yet

- UntitledDocument11 pagesUntitledSusan KunkleNo ratings yet

- Restaurant DataDocument14 pagesRestaurant Datasshagun1506No ratings yet

- Norway tech professionals contact listDocument5 pagesNorway tech professionals contact listSocial ListNo ratings yet

- Alumni Details 2007 BatchDocument5 pagesAlumni Details 2007 Batchrevathyjayabaskar0% (3)

- Aditya Birla Group ProfileDocument4 pagesAditya Birla Group ProfileSarvesh JanotiNo ratings yet

- AIESEC India Contact ListDocument2 pagesAIESEC India Contact ListHimanshu PatelNo ratings yet

- CBA Batch 5 Profile Book 25JAN18 PDFDocument62 pagesCBA Batch 5 Profile Book 25JAN18 PDFhappiness ElemNo ratings yet

- cc6 MeatDocument8 pagescc6 MeatElenora13No ratings yet

- Project 2 Seoul South KoreaDocument36 pagesProject 2 Seoul South Koreaben kunNo ratings yet

- SIP Status 28.6.18mentorDocument2 pagesSIP Status 28.6.18mentorgoyalpramodNo ratings yet

- International Dailaing Our Hotlines Inin Ext: KuwaitDocument46 pagesInternational Dailaing Our Hotlines Inin Ext: KuwaitFawziNo ratings yet

- Name of Companies in India - UpdatedDocument18 pagesName of Companies in India - UpdatedShobhit PalNo ratings yet

- 15k GmailDocument370 pages15k GmailJayzNo ratings yet

- Emp. Code Employee Name Sutradhar CodeDocument7 pagesEmp. Code Employee Name Sutradhar CodearunNo ratings yet

- ProfessorsDocument48 pagesProfessorsAnonymous htFZkgrNbNo ratings yet

- Loan Taken People in KeralaDocument9 pagesLoan Taken People in KeralaganeshkumarNo ratings yet

- Leads List with Contact DetailsDocument3 pagesLeads List with Contact DetailsTarun VBRSITNo ratings yet

- Food Machiunery ManufacturerDocument4 pagesFood Machiunery Manufacturernikhil indoreinfolineNo ratings yet

- Registered NGO List VODocument15 pagesRegistered NGO List VOHarsh AroraNo ratings yet

- Register of Members As On 14 09 2020 Evoting-Cut-Off-WebsiteDocument16 pagesRegister of Members As On 14 09 2020 Evoting-Cut-Off-WebsitenancyNo ratings yet

- Sr. No 1 2: Employee Code Mobile No. Name of The Employee Nomination For Inter JPL Badminton Tournament 2013-14Document14 pagesSr. No 1 2: Employee Code Mobile No. Name of The Employee Nomination For Inter JPL Badminton Tournament 2013-14Abhishek KandeyNo ratings yet

- Email / Proprietor Name: Aprecruiters@yahoo - Co.inDocument8 pagesEmail / Proprietor Name: Aprecruiters@yahoo - Co.inompal21No ratings yet

- USA Companies Part 2Document30 pagesUSA Companies Part 2Vikram GuptaNo ratings yet

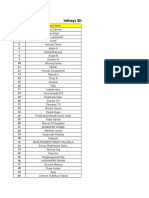

- Infosys ShortlistDocument22 pagesInfosys Shortlistmanisha abhichandaniNo ratings yet

- POSH Committee Members at PVR CinemasDocument1 pagePOSH Committee Members at PVR CinemasIMPEL Learning SolutionsNo ratings yet

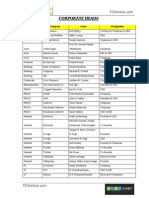

- Corporate Heads: Industry Company Name DesignationDocument2 pagesCorporate Heads: Industry Company Name DesignationAbhinav WaliaNo ratings yet

- List of Major Software Companies in IndiaDocument112 pagesList of Major Software Companies in IndiaVaibhav MahobiyaNo ratings yet

- Employee Name ListDocument72 pagesEmployee Name ListAmit Dwivedi0% (1)

- 1511002267gls Private University - Ugc Initial Information Report 2015Document143 pages1511002267gls Private University - Ugc Initial Information Report 2015Rahul PambharNo ratings yet

- Active Agents data as of Nov 2017Document1,954 pagesActive Agents data as of Nov 2017Sujay ItiNo ratings yet

- CSE DEPT Student Record NBADocument11 pagesCSE DEPT Student Record NBAsdureja03No ratings yet

- LBS National Award jury membersDocument5 pagesLBS National Award jury membersAnonymous RjIueYSlNo ratings yet

- Top 10 Indian SME and Mid-Corporate CompaniesDocument5 pagesTop 10 Indian SME and Mid-Corporate CompaniesRahil Saeed 07889582701No ratings yet

- Lucknow Media ListDocument3 pagesLucknow Media Liststuti.tocNo ratings yet

- B2BDocument5 pagesB2BFahim MeerNo ratings yet

- Living and Working in NicaraguaDocument2,870 pagesLiving and Working in NicaraguaWaf Etano100% (1)

- T NG UID GROUP Full Thong TinDocument2,850 pagesT NG UID GROUP Full Thong TinSiêu Trí Nhớ Rèn Luyện0% (1)

- Gnitc - B.tech Dept - of EceDocument18 pagesGnitc - B.tech Dept - of EceAjay YadavNo ratings yet

- Automation COMPANIES FOR PLACEMENTSDocument3 pagesAutomation COMPANIES FOR PLACEMENTSvikramsimhareddy0% (1)

- Leads 4.26Document287 pagesLeads 4.26Leeladhar KushwahaNo ratings yet

- ContactsDocument2 pagesContactsYakitNo ratings yet

- Anand Rathi Securities LTDDocument30 pagesAnand Rathi Securities LTDLuvesh AdvaniNo ratings yet

- JP Morgan Chase: Global Banking and Financial Services GiantDocument1 pageJP Morgan Chase: Global Banking and Financial Services GiantAyan PandaNo ratings yet

- Cover LetterDocument1 pageCover LetterSiddharth JoshiNo ratings yet

- Assetclasses HistoricallyDocument0 pagesAssetclasses HistoricallyHector T Villalona-tDsNo ratings yet

- JLL Report Aug13Document10 pagesJLL Report Aug13Siddharth JoshiNo ratings yet

- Mathematics Assignment Report on Power Index Analysis 16/08/2011 to 26/09/2011Document3 pagesMathematics Assignment Report on Power Index Analysis 16/08/2011 to 26/09/2011Siddharth JoshiNo ratings yet

- Mad VentureDocument6 pagesMad VentureSiddharth JoshiNo ratings yet

- Assignment GuidelineDocument1 pageAssignment GuidelineSiddharth JoshiNo ratings yet

- ADVT LECT 3 PositioningDocument6 pagesADVT LECT 3 PositioningSiddharth JoshiNo ratings yet

- An Introduction To IMFDocument3 pagesAn Introduction To IMFSiddharth JoshiNo ratings yet

- Credit Controller - Mustapha MellaliDocument3 pagesCredit Controller - Mustapha MellaliMustapha MellaliNo ratings yet

- Moore Medical CorporationDocument6 pagesMoore Medical Corporationbanerjeetania1989100% (1)

- Test Bank For M Finance 3rd Edition by CornettDocument36 pagesTest Bank For M Finance 3rd Edition by Cornettcorinneheroismf19wfo100% (42)

- Maxicare v. CIRDocument11 pagesMaxicare v. CIRHazel SegoviaNo ratings yet

- Statement 34Document6 pagesStatement 34Doris AgeeNo ratings yet

- Decoding Digital Transformation in Construction VF PDFDocument7 pagesDecoding Digital Transformation in Construction VF PDFArgon UsmanNo ratings yet

- Joseph Carlson - Netflix ValuationDocument4 pagesJoseph Carlson - Netflix ValuationNicoletta MarianiNo ratings yet

- OHS Monthly Report - C.O.T MARCHDocument6 pagesOHS Monthly Report - C.O.T MARCHvicNo ratings yet

- 22 Top 10 Auditand Program Review Findings V1Document65 pages22 Top 10 Auditand Program Review Findings V1Abdu MohammedNo ratings yet

- BMK308 SM Jan 2024 Assignment 2Document14 pagesBMK308 SM Jan 2024 Assignment 2shichiaNo ratings yet

- PT VOKSEL ELECTRIC TBKDocument14 pagesPT VOKSEL ELECTRIC TBKIra MakingNo ratings yet

- BM W5 - W6Document65 pagesBM W5 - W6Clareen June DagoyNo ratings yet

- Topic 6 (PMS 1)Document40 pagesTopic 6 (PMS 1)Thiba 2772No ratings yet

- Evaluating Cloud Risk For The Enterprise:: A Shared Assessments GuideDocument53 pagesEvaluating Cloud Risk For The Enterprise:: A Shared Assessments Guidejchan_9117068No ratings yet

- Sizzle DocumentDocument5 pagesSizzle DocumentBethanNo ratings yet

- Section 400 418Document7 pagesSection 400 418Macy Andrade100% (1)

- ENTREP - Chap4Document5 pagesENTREP - Chap4Myla MoriNo ratings yet

- Tenable+Master+Partner+Agreement+v4+3 16 21+CLICKDocument7 pagesTenable+Master+Partner+Agreement+v4+3 16 21+CLICKAristides ParruqueNo ratings yet

- Labor PWLMTDocument82 pagesLabor PWLMTAngelina Villaver ReojaNo ratings yet

- ch12 - Problems and SolutionsDocument44 pagesch12 - Problems and SolutionsErica Borres0% (1)

- The External Factor Evaluation (EFE) Matrix: Key External Factors Weig HT Rati NG Weighted Score OpportunitiesDocument6 pagesThe External Factor Evaluation (EFE) Matrix: Key External Factors Weig HT Rati NG Weighted Score OpportunitiesEnum MeerzaNo ratings yet

- Capital Assets Taxation RulesDocument5 pagesCapital Assets Taxation Rulesaki_0915296457No ratings yet

- Management of TANESCODocument3 pagesManagement of TANESCOVincsNo ratings yet

- Purchase Order Terms and Conditions: 219976 (Canada) Rev.11/07Document4 pagesPurchase Order Terms and Conditions: 219976 (Canada) Rev.11/07AKHIL JOSEPHNo ratings yet

- Elementary Progress Test 3Document4 pagesElementary Progress Test 3Pao NogalesNo ratings yet

- FRM Presentation 2Document20 pagesFRM Presentation 2Paul BanerjeeNo ratings yet

- Chapter 07 Slides - L5Document23 pagesChapter 07 Slides - L5alikamaliNo ratings yet

- Termination of Contract, Corporate Recovery and Insolvency: RICS Professional Guidance, UKDocument33 pagesTermination of Contract, Corporate Recovery and Insolvency: RICS Professional Guidance, UKHicham FaresNo ratings yet

- Management Project "Nirala Sweets"Document6 pagesManagement Project "Nirala Sweets"tamur_ahan100% (1)

- Vegetable Stall 2Document22 pagesVegetable Stall 2api-302625023No ratings yet