Professional Documents

Culture Documents

HB-SB76 Presentation To Senate Finance 10-15-2013

Uploaded by

shadowchb0 ratings0% found this document useful (0 votes)

11 views29 pagesPosition paper on SB-76

Original Title

HB-SB76 Presentation to Senate Finance 10-15-2013

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPosition paper on SB-76

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views29 pagesHB-SB76 Presentation To Senate Finance 10-15-2013

Uploaded by

shadowchbPosition paper on SB-76

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 29

Analysis of House Bill 76

and Senate Bill 76

Presented to the Senate Finance Committee

October 15, 2013

Independent Fiscal Office

Todays Presentation

Discuss the objectives of the analysis.

Provide a brief overview of the

proposal.

Summarize the results. Detail the fiscal

impact by fund or local entity.

2 10/15/2013 Presentation - Senate Finance Committee

Analysis Objectives

Compare revenues under the proposal

to revenues under current law.

Examine the volatility of sales,

personal income and property taxes.

Review the impact of the proposal

using a historical simulation.

3 10/15/2013 Presentation - Senate Finance Committee

Overview of Proposal

Generally seeks to replace school

property taxes with personal income and

sales taxes.

Prohibits the issuance of new debt.

Retains property taxes to service

debt incurred on or before

12/31/2012.

4 10/15/2013 Presentation - Senate Finance Committee

School Property Tax Replacement

Calculation of amount to be replaced:

1. Revenues received under current law.

2. Reduced by delinquent taxes collected.

3. Reduced by property tax retained to

service debt incurred on or before

12/31/2012.

5 10/15/2013 Presentation - Senate Finance Committee

School Property Tax Replacement

(fiscal year, $ millions)

2014-15 2018-19

School Property Tax Forecast $13,683 $15,864

Less: Delinquent Taxes (Prior Years) -459 0

Less: Property Tax for Debt Service -2,039 -1,483

School Property Tax Replacement 11,185 14,381

6 10/15/2013 Presentation - Senate Finance Committee

Replacement Revenue

Revenue sources to replace school

district property taxes:

1. Sales tax: expanded base and

higher rate.

2. Personal income tax: higher rate.

3. Transfers from other funds.

7 10/15/2013 Presentation - Senate Finance Committee

Sales and Use Tax

Proposal increases rate from 6% to 7%.

Expands the tax base to include many

untaxed goods and services, including:

o Most food, certain clothing, recreation, non-

prescription drugs, health care, nursing and

other services. (Detail in Appendix A of the full

report.)

8 10/15/2013 Presentation - Senate Finance Committee

Sales and Use Tax

Two major assumptions deal with

conflicting or ambiguous language in the

proposal:

1. Treatment of new revenues from the

rate increase and base expansion.

2. Transfers supporting public

transportation.

9 10/15/2013 Presentation - Senate Finance Committee

Sales and Use Tax

(fiscal year, $ millions)year, $ millions) 2014-15 2018-19

Rate Increase (from 6% to 7%) $1,583 $1,828

Base Expansion 4,312 5,242

Secondary Effects 53 78

Transfers (public transportation) -262 -315

Net Sales Tax 5,686 6,833

10 10/15/2013 Presentation - Senate Finance Committee

Personal Income Tax

Proposal increases the rate from 3.07%

to 4.34%.

The tax base remains unchanged.

Assumes tax refunds are paid from

General Fund.

11 10/15/2013 Presentation - Senate Finance Committee

Personal Income Tax

(fiscal year, $ millions)

2014-15 2018-19

Rate Increase (3.07% to 4.34%) $4,908 $5,834

Secondary Effects 9 13

Total Personal Income Tax 4,917 5,847

Tax Refunds (General Fund) -180 -261

12 10/15/2013 Presentation - Senate Finance Committee

PTRF Transfers

Redirect monies from the Property Tax

Relief Fund (PTRF).

Property Tax / Rent Rebate (Lottery

Fund).

Philadelphia resident and nonresident

wage tax.

General school district property tax relief.

13 10/15/2013 Presentation - Senate Finance Committee

PTRF Transfers

(fiscal year, $ millions)

2014-15 2018-19

Property Tax / Rent Rebate $168 $172

Philadelphia Wage Tax 86 86

School District Property Tax Relief 529 529

Unallocated Property Tax Relief Fund 41 37

Total Transfer from Property Tax Relief

Fund (PTRF)

824 824

14 10/15/2013 Presentation - Senate Finance Committee

Distributions to School Districts

FY 2013-14 property tax collections

serve as the base for distributions.

Reduced by FY 2013-14 debt service.

Grows by lesser of CPI or sales tax in

prior calendar year.

15 10/15/2013 Presentation - Senate Finance Committee

Distributions to School Districts

(fiscal year, $ millions)

2014-15 2018-19

Base Year / Prior Year $10,963 $11,602

Cost of Living Factor 1.0% 1.6%

Distributions 11,073 11,788

16 10/15/2013 Presentation - Senate Finance Committee

Education Stabilization Fund

(fiscal year, $ millions)

2014-15 2018-19

Sales and Use Tax (net) $5,686 $6,833

Personal Income Tax 4,917 5,847

Transfers (Property Tax Relief Fund) 824 824

Distributions to School Districts -11,073 -11,788

Net Impact on ESF 354 1,716

17 10/15/2013 Presentation - Senate Finance Committee

School Districts

(fiscal year, $ millions)

2014-15 2018-19

Distributions from the ESF $11,073 $11,788

Property Tax to be Replaced 11,185 14,381

Net Impact on School Districts -112 -2,593

18 10/15/2013 Presentation - Senate Finance Committee

Lottery Fund

(fiscal year, $ millions)

2014-15 2018-19

Property Tax / Rent Rebate Funding -$138 -$142

Supplemental Rebate Funding -30 -30

Reduction in Rebates 0 47

Net Impact on Lottery Fund -168 -125

19 10/15/2013 Presentation - Senate Finance Committee

Other Fiscal Impacts

(fiscal year, $ millions)

2014-15 2018-19

Philadelphia (wage and non-property) -$278 -$306

Property Tax Relief Fund -41 -37

General Fund 76 110

Public Transportation Transfers (net) 166 204

Total Other Impacts -77 -29

20 10/15/2013 Presentation - Senate Finance Committee

Fiscal Impact Summary

(fiscal year, $ millions)

2014-15 2018-19

Education Stabilization Fund $354 $1,716

School District Property Tax Replacement -112 -2,593

Lottery Fund -168 -125

Other -77 -29

Fiscal Impact -3 -1,031

21 10/15/2013 Presentation - Senate Finance Committee

Alternative Summary

FY 2018-19

($ millions)

Current School Funding -$14,381 New School Distributions $11,788

Philadelphia -306 ESF Accumulation 1,716

Lottery Fund -125 Transportation Funding 204

Property Tax Relief Fund -37 General Fund 110

Total -14,849 Total 13,818

22

Net Fiscal Change -$1,031

10/15/2013 Presentation - Senate Finance Committee

Other Effects (FY 2014-15)

Higher federal income taxes.

o $300 million individuals; $290 million pass-through

entities.

Expansion of local sales tax base.

o Allegheny County ($57 m) and Philadelphia ($86 m).

Local realty transfer taxes.

o Tax cut capitalized into real estate prices ($10 m).

23 10/15/2013 Presentation - Senate Finance Committee

Volatility Analysis

Compares the annual growth rates of

personal income, sales and property

taxes.

Displays the cumulative growth in

these taxes compared to CPI.

24 10/15/2013 Presentation - Senate Finance Committee

Annual Growth Rates

-8.0%

-4.0%

0.0%

4.0%

8.0%

A

n

n

u

a

l

G

r

o

w

t

h

R

a

t

e

Personal Income Sales Property

25 10/15/2013 Presentation - Senate Finance Committee

Cumulative Growth Rates

1.0

1.2

1.4

1.6

1.8

2.0

2.2

2.4

2.6

I

n

d

e

x

b

a

s

e

y

e

a

r

(

F

Y

1

9

9

3

-

9

4

)

=

1

Personal Income Sales Property CPI

26

146%

113%

83%

61%

10/15/2013 Presentation - Senate Finance Committee

Historical Simulation

Reviews impact of proposal as if it were

fully implemented for FY 2002-03.

Confirms trends revealed in the forecast.

Structure of the proposal contributes to a

negative fiscal impact that grows over

time.

27 10/15/2013 Presentation - Senate Finance Committee

Historical Simulation

-5,000

-4,000

-3,000

-2,000

-1,000

0

1,000

$

m

i

l

l

i

o

n

s

ESF less Property Tax Replacement

Property Tax Replacement less Distributions

ESF Accumulation

28 10/15/2013 Presentation - Senate Finance Committee

Cost of Living Factor

-4.0%

-2.0%

0.0%

2.0%

4.0%

6.0%

CPI Sales Tax

29 10/15/2013

prior calendar year

Presentation - Senate Finance Committee

You might also like

- 2015-16 Final Proposed General Fund Budget PresentationDocument21 pages2015-16 Final Proposed General Fund Budget PresentationPennLiveNo ratings yet

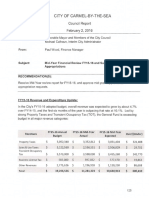

- City of Carmel-By-The-Sea: Council Report February 2, 2016Document6 pagesCity of Carmel-By-The-Sea: Council Report February 2, 2016L. A. PatersonNo ratings yet

- Summary of 2014-15 Taylor Budget ChangesDocument2 pagesSummary of 2014-15 Taylor Budget ChangesDavid KomerNo ratings yet

- Quickstart 2013-14Document29 pagesQuickstart 2013-14Rick KarlinNo ratings yet

- Tribal Oil Revenue ForecastDocument5 pagesTribal Oil Revenue ForecastRob PortNo ratings yet

- 2013-14 Proposed FInal BudgetDocument23 pages2013-14 Proposed FInal BudgetPress And JournalNo ratings yet

- 2013 14 d156 Budget State Form 091013Document29 pages2013 14 d156 Budget State Form 091013api-233183949No ratings yet

- Sioux City 2013 Operating BudgetDocument378 pagesSioux City 2013 Operating BudgetSioux City JournalNo ratings yet

- Fourth Quarter FY 2012-13 Performance Reportt 09-10-13Document10 pagesFourth Quarter FY 2012-13 Performance Reportt 09-10-13L. A. PatersonNo ratings yet

- Smyth Order Lower MerionDocument17 pagesSmyth Order Lower MerionPhiladelphiaMagazineNo ratings yet

- Shakopee Quarterly Financial Update Q1-2016Document6 pagesShakopee Quarterly Financial Update Q1-2016Brad TabkeNo ratings yet

- Special City Council Meeting Agenda Packet 03-19-13Document115 pagesSpecial City Council Meeting Agenda Packet 03-19-13L. A. PatersonNo ratings yet

- FY 2012-13 Adopted Budget SummaryDocument31 pagesFY 2012-13 Adopted Budget SummaryBesir AsaniNo ratings yet

- Town of Galway: Financial OperationsDocument17 pagesTown of Galway: Financial OperationsdayuskoNo ratings yet

- City of Troy Financial PresentationDocument62 pagesCity of Troy Financial PresentationThe Saratogian and Troy RecordNo ratings yet

- Web Pearland 2016 Annualreport CalendarDocument32 pagesWeb Pearland 2016 Annualreport Calendarapi-306549584No ratings yet

- 2012 Budget BookDocument27 pages2012 Budget BookGerrie SchipskeNo ratings yet

- Office of The State ComptrollerDocument4 pagesOffice of The State ComptrollerflippinamsterdamNo ratings yet

- Mobile Mayor Sam Jones Proposed Budget For 2012Document25 pagesMobile Mayor Sam Jones Proposed Budget For 2012jamieburch75No ratings yet

- FY 13-14 Fiscal HighlightsDocument144 pagesFY 13-14 Fiscal HighlightsRepNLandryNo ratings yet

- City of Los Angeles Budget Overview Presentation 2012Document35 pagesCity of Los Angeles Budget Overview Presentation 2012Bill RosendahlNo ratings yet

- Tax Rate PropDocument23 pagesTax Rate PropDC StrongNo ratings yet

- LMSD Tax InjunctionDocument17 pagesLMSD Tax InjunctionRichard IlgenfritzNo ratings yet

- Public Accounts 2012-2013 Saskatchewan Government Details of Revenue & ExpensesDocument290 pagesPublic Accounts 2012-2013 Saskatchewan Government Details of Revenue & ExpensesAnishinabe100% (1)

- Revised ForecastDocument4 pagesRevised Forecastjennifer_brooks3458No ratings yet

- Ithaca Budget NarrativeDocument42 pagesIthaca Budget NarrativeTime Warner Cable NewsNo ratings yet

- 06 General FundDocument64 pages06 General FundSamirahSwalehNo ratings yet

- Saratoga Springs City School District: Fund BalanceDocument13 pagesSaratoga Springs City School District: Fund BalanceBethany BumpNo ratings yet

- Annual Audit Fy07-08 RiversideDocument65 pagesAnnual Audit Fy07-08 Riversideapi-126378091No ratings yet

- FY 2014 Budget Status Final CorrectedDocument74 pagesFY 2014 Budget Status Final Correctedted_nesiNo ratings yet

- Syracuse Financial OverviewDocument24 pagesSyracuse Financial OverviewJimmy VielkindNo ratings yet

- January 14Document51 pagesJanuary 14Nick ReismanNo ratings yet

- House of Commons Library Note On Cuts To Children's BenefitsDocument1 pageHouse of Commons Library Note On Cuts To Children's BenefitsFedericaCoccoNo ratings yet

- FY2017 Prelim Budget PresentationDocument27 pagesFY2017 Prelim Budget PresentationKevinOhlandtNo ratings yet

- 2013-14 Mid-Year BriefingDocument20 pages2013-14 Mid-Year BriefingKarenShueyNo ratings yet

- Assabet Budgets-How Much Does It Cost To Run? Marlborough Council, 1-23-12 AgendaDocument67 pagesAssabet Budgets-How Much Does It Cost To Run? Marlborough Council, 1-23-12 AgendaourmarlboroughNo ratings yet

- Projected Year-End Financial Results - Third QuarterDocument7 pagesProjected Year-End Financial Results - Third QuarterpkGlobalNo ratings yet

- City MGM'T Memo On Restoring Certain Long Beach Fire Services (Nov. 5, 2013)Document5 pagesCity MGM'T Memo On Restoring Certain Long Beach Fire Services (Nov. 5, 2013)Anonymous 3qqTNAAOQNo ratings yet

- St. Tammany Parish School Board AuditDocument219 pagesSt. Tammany Parish School Board AuditKatherine SayreNo ratings yet

- Quickstart 2013-14Document29 pagesQuickstart 2013-14Nick ReismanNo ratings yet

- Public Accounts 2013-14 SaskatchewanDocument270 pagesPublic Accounts 2013-14 SaskatchewanAnishinabeNo ratings yet

- AISD Power Point Presentation On Recommended Budget For 2011-12 (August 8, 2011)Document16 pagesAISD Power Point Presentation On Recommended Budget For 2011-12 (August 8, 2011)KUTNewsNo ratings yet

- 2014-2015 City of Sacramento Budget OverviewDocument34 pages2014-2015 City of Sacramento Budget OverviewCapital Public RadioNo ratings yet

- Money Report House HHS Subcommittee Report - 05!14!2015Document20 pagesMoney Report House HHS Subcommittee Report - 05!14!2015CarolinaMercuryNo ratings yet

- 2015 South Euclid, Ohio Budget (Final Council Draft)Document128 pages2015 South Euclid, Ohio Budget (Final Council Draft)seoversightNo ratings yet

- 2918 - Quarterly Financial Update Q2-2016Document6 pages2918 - Quarterly Financial Update Q2-2016Brad TabkeNo ratings yet

- FY 2011-2012 ADOPTED Budget 20110614Document829 pagesFY 2011-2012 ADOPTED Budget 20110614City of GriffinNo ratings yet

- Welcome IrsDocument22 pagesWelcome IrsJohn Bates BlanksonNo ratings yet

- FY 16 Analysis of Introduced Budget 102115Document65 pagesFY 16 Analysis of Introduced Budget 102115The Daily LineNo ratings yet

- Wrrbfy14 BudgetDocument18 pagesWrrbfy14 BudgetMass LiveNo ratings yet

- FY 2015-2016 Budget Message - FranklinDocument4 pagesFY 2015-2016 Budget Message - FranklinThunder PigNo ratings yet

- Union Budget 2013-14Document17 pagesUnion Budget 2013-14Ashima AggarwalNo ratings yet

- Montgomery TWP 2013 Budget PresentationDocument20 pagesMontgomery TWP 2013 Budget Presentationsokil_danNo ratings yet

- IBA Review of The Fiscal Year 2013 Proposed BudgetDocument30 pagesIBA Review of The Fiscal Year 2013 Proposed Budgetapi-63385278No ratings yet

- Annual Financial Report Sequatchie County, TennesseeDocument158 pagesAnnual Financial Report Sequatchie County, TennesseeNewsDunlapNo ratings yet

- LGU Budgeting ProcessDocument35 pagesLGU Budgeting ProcessGina Lee Mingrajal Santos90% (21)

- Amending The Adopted Budget 09-01-15Document3 pagesAmending The Adopted Budget 09-01-15L. A. PatersonNo ratings yet

- Budgetory Policy: Presented By: Khushboo Menka Keshri. Mba 2 YearDocument21 pagesBudgetory Policy: Presented By: Khushboo Menka Keshri. Mba 2 YearvadgaonkarysNo ratings yet

- HFPackerAmp InstructionsDocument37 pagesHFPackerAmp InstructionsshadowchbNo ratings yet

- CH341DS1Document14 pagesCH341DS1tranquangluong86No ratings yet

- Seatools For Windows UdseDocument23 pagesSeatools For Windows UdseClaudia CharlesNo ratings yet

- TS 570GDocument89 pagesTS 570Ggeekster123No ratings yet

- Are and Accounting Systems Compatible With: ABC RCADocument16 pagesAre and Accounting Systems Compatible With: ABC RCAGanesh BalajiNo ratings yet

- IRR of R. A. 7924Document13 pagesIRR of R. A. 7924Orville CipresNo ratings yet

- Chapter 14 Financial StatementsDocument12 pagesChapter 14 Financial StatementsAngelica Joy ManaoisNo ratings yet

- A Civil Conversation: The Our Budget, Our Economy Final ReportDocument48 pagesA Civil Conversation: The Our Budget, Our Economy Final ReportAmerica SpeaksNo ratings yet

- Audit Proforma 2019Document12 pagesAudit Proforma 2019Spandana pdicdsNo ratings yet

- New COA FormsDocument62 pagesNew COA FormsYuri VillanuevaNo ratings yet

- Local Budget Circular No 121Document19 pagesLocal Budget Circular No 121Jefford Vinson ValdehuezaNo ratings yet

- Let's Hear It For The BoyDocument48 pagesLet's Hear It For The Boyapi-26032005No ratings yet

- Office of The Municipal Mayor: Continued On Next PageDocument5 pagesOffice of The Municipal Mayor: Continued On Next PageErnest AtonNo ratings yet

- A National Survey of American Economic Literacy PDFDocument6 pagesA National Survey of American Economic Literacy PDFIsmon IntanNo ratings yet

- 02 Procurement Planning and Budget LinkagegppbDocument52 pages02 Procurement Planning and Budget LinkagegppbMina Abbilani100% (1)

- Chap008 Budgets ProfitPLanningDocument89 pagesChap008 Budgets ProfitPLanningStack1nPaperNo ratings yet

- Martech Adoption Benchmark ReportDocument37 pagesMartech Adoption Benchmark ReportDemand Metric100% (1)

- SOAS - Welcome To Mars Colony PDFDocument10 pagesSOAS - Welcome To Mars Colony PDFFabrício CarvalhoNo ratings yet

- p3 Guide For MunicipalitiesDocument74 pagesp3 Guide For MunicipalitiesaliomairNo ratings yet

- Flexible Budgeting for Cost ControlDocument16 pagesFlexible Budgeting for Cost Controlnotes.mcpuNo ratings yet

- New Government Accounting SystemDocument2 pagesNew Government Accounting SystemOwdray CiaNo ratings yet

- Monetary Policy: Fiscal Policy, Measures Employed by Governments To Stabilize TheDocument3 pagesMonetary Policy: Fiscal Policy, Measures Employed by Governments To Stabilize TheYan Lean DollisonNo ratings yet

- Capital Budgeting DecisionsDocument88 pagesCapital Budgeting Decisionsthenikkitr100% (1)

- Module - 1Document37 pagesModule - 1rajdrklNo ratings yet

- General Financial Rules 2017 - Chapter 6: Procurement of Goods and ServicesDocument18 pagesGeneral Financial Rules 2017 - Chapter 6: Procurement of Goods and ServicesProf. Manpreet Singh GillNo ratings yet

- Two Branches of Economics: Micro vs MacroDocument12 pagesTwo Branches of Economics: Micro vs MacroRex Michael100% (1)

- Taking Mental Health Seriously with NZ's First Wellbeing BudgetDocument157 pagesTaking Mental Health Seriously with NZ's First Wellbeing BudgetPramuji HandrajadiNo ratings yet

- Which of The Activity Variances Should Be of Concern ToDocument2 pagesWhich of The Activity Variances Should Be of Concern ToDoreenNo ratings yet

- Single Point Data EntryDocument2 pagesSingle Point Data EntryRidzuan MamatNo ratings yet

- Organization Study of Carris Pipes & Tubes Pvt. LtdDocument65 pagesOrganization Study of Carris Pipes & Tubes Pvt. LtdBonson DevasykuttyNo ratings yet

- Management and Cost Accounting: Colin DruryDocument14 pagesManagement and Cost Accounting: Colin DruryUmar SulemanNo ratings yet

- Cash Budgets 2Document9 pagesCash Budgets 2Kopanang LeokanaNo ratings yet

- Article Vi: The Legislative DepartmentDocument4 pagesArticle Vi: The Legislative DepartmentJun MarNo ratings yet

- Union Budget 2023 AnalysisDocument6 pagesUnion Budget 2023 AnalysisModifierNo ratings yet