Professional Documents

Culture Documents

TopPicks 020820141

Uploaded by

Anonymous W7lVR9qs25Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TopPicks 020820141

Uploaded by

Anonymous W7lVR9qs25Copyright:

Available Formats

Sharekhan Top Picks

The stock market took a breather in July after the sharp run-

up in the previous two months. Though the benchmark indices,

Nifty and Sensex, are only marginally down by 0.1-0.4% each

since our revision in the Top Picks basket last month, but there

has been a substantial correction in the broader market

especially in the high-beta mid-cap space. The CNX Mid-cap

Index has declined by 3.6% and the CNX Small-cap Index is

down by close to 8.2% in the same period.

After healthy gains of the previous two months, the Top Picks

basket (down 4.8%) has lagged the benchmark indices due to

a double-digit decline in Larsen and Toubro (which announced

unexpectedly weak results for Q1FY2015; a loss of Rs942 crore

in the hydrocarbon business due to cost over-runs and

execution delays) and LIC Housing Finance (regulatory changes

that put banks at an advantage to the housing finance

Augsut 02, 2014 Visit us at www.sharekhan.com

For Private Circulation only

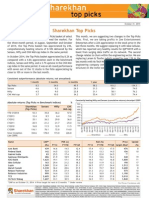

Absolute outperformance

Constantly beating Nifty and Sensex (cumulative returns) since April 2009

Name CMP* PER (x) RoE (%) Price Upside

(Rs) FY14 FY15E FY16E FY14 FY15E FY16E target (Rs)# (%)

Apollo Tyres 169 8.7 8.2 7.2 25.2 21.4 19.9 210 25

Federal Bank 118 12.0 10.4 8.6 12.6 13.3 14.5 142 20

Gateway Distriparks 234 17.8 16.5 14.0 17.5 18.0 20.3 ** -

ICICI Bank 1,476 17.4 15.5 13.1 14.0 14.5 15.7 1,728 17

Larsen & Toubro 1,472 27.8 24.5 20.3 15.6 15.6 17.1 1,840 25

Lupin 1,165 28.4 20.5 17.9 26.5 27.7 24.4 1,300 12

Persistent Systems 1,255 20.1 16.2 13.8 22.3 23.1 22.7 1,400 12

PTC India Financial Services 33 6.6 6.1 4.5 16.1 15.4 18.5 44 32

TVS Motors 152 27.8 21.6 16.7 19.7 21.8 23.6 175 15

UltraTech Cement 2,471 33.0 25.3 22.0 12.0 13.7 13.8 2,868 16

Zee Entertainment 289 31.1 29.2 22.2 20.6 19.1 22.3 367 27

*CMP as on August 01, 2014 # Price target for next 6-12 months ** Under review

Consistent outperformance (absolute returns; not annualised) (%)

1 month 3 months 6 months 1 year 3 years 5 years

Top Picks -4.8 13.3 23.6 43.4 57.0 105.1

Sensex -0.1 13.8 24.4 33.1 42.6 63.3

Nifty -0.4 13.6 25.0 33.7 41.9 66.3

CNX Mid-cap -3.6 22.0 42.7 60.6 31.4 86.7

Regd Add: Sharekhan Limited, 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg Railway Station, Kanjurmarg (East),

Mumbai 400042, Maharashtra. Tel: 022 - 61150000. Fax: 67481899; E-mail: publishing@sharekhan.com; Website: www.sharekhan.com; CIN:

U99999MH1995PLC087498. Sharekhan Ltd.: SEBI Regn. Nos. BSE- INB/INF011073351 ; CD-INE011073351; NSE INB/INF231073330 ; CD-INE231073330; MCX

Stock Exchange- INB/INF261073333 ; CD-INE261073330; DP-NSDL-IN-DP-NSDL-233-2003 ; CDSL-IN-DP-CDSL-271-2004 ; PMS-INP000000662 ; Mutual Fund-ARN

20669 ; Commodity trading through Sharekhan Commodities Pvt. Ltd.: MCX-10080 ; (MCX/TCM/CORP/0425) ; NCDEX-00132 ; (NCDEX/TCM/CORP/0142) ;

NCDEX SPOT-NCDEXSPOT/116/CO/11/20626; For any complaints email at igc@sharekhan.com ; Disclaimer: Client should read the Risk Disclosure Document

issued by SEBI & relevant exchanges and Dos & Donts by MCX & NCDEX and the T & C on www.sharekhan.com before investing.

25%

12%

35%

17%

116%

268%

-20%

-50%

0%

50%

100%

150%

200%

250%

300%

CY2014 CY2013 CY2012 CY2011 CY2010 CY2009 Since

Inception

(Jan

2009)

Sharekhan (Top Picks) Sensex Nifty

companies further dented sentiment towards the stock after

not so encouraging Q1FY2015 results of the company).

We are making three changes this month. First, within the

non-banking finance companies space, we are replacing LIC

Housing Finance with PTC India Financial Services on which

we have recently initiated coverage with a very positive view.

Second, we are booking profit in Gabriel India after gains of

close to 18% in the last two months and re-introducing TVS

Motor Company (which has corrected by over 6% and offers a

decent upside to our price target now). Lastly, as a tactical

call, we are replacing Crompton Greaves with Persistent

Systems (one of our best performing mid-cap IT picks which is

witnessing substantial interest from foreign investors due to

its niche positioning in the cloud, mobility and analytics areas).

100

150

200

250

300

350

400

A

p

r

-

0

9

J

u

l

-

0

9

O

c

t

-

0

9

J

a

n

-

1

0

A

p

r

-

1

0

J

u

l

-

1

0

O

c

t

-

1

0

J

a

n

-

1

1

A

p

r

-

1

1

J

u

l

-

1

1

O

c

t

-

1

1

J

a

n

-

1

2

A

p

r

-

1

2

J

u

l

-

1

2

O

c

t

-

1

2

J

a

n

-

1

3

A

p

r

-

1

3

J

u

l

-

1

3

O

c

t

-

1

3

J

a

n

-

1

4

A

p

r

-

1

4

J

u

l

-

1

4

Sharekhan Sensex Nif ty

sharekhan top picks

2

Name CMP PER (x) RoE (%) Price Upside

(Rs) FY14 FY15E FY16E FY14 FY15E FY16E target (Rs) (%)

Apollo Tyress 169 8.7 8.2 7.2 25.2 21.4 19.9 210 25

Remarks: Apollo Tyres is a leading player in the domestic passenger car and truck tyre segments. The tyre industrys volume

has been subdued given the weak macro environment. We expect the demand to improve in H2FY2015 with a

pick-up in the economy.

The profitability of the tyre companies has improved given the soft natural rubber prices and this benefit is

expected to continue in FY2015-16 as global supply of natural rubber is expected to outstrip demand.

Apollos European operations too have reported a strong performance with a strong volume growth and high

profitability. The company will be investing EUR200mn for setting up a greenfield facility in Eastern Europe which

will start production in Q4FY2017 and cater to the long-term growth in Europe. Additionally, Apollo will invest

Rs2,000 crore in its Indian operations for capacity expansion.

We like the stock for its consistent performance and long-term growth prospects (expansion in Europe and Chennai).

We have a Buy recommendation on the stock with a price target of Rs210.

Federal Bank 118 12.0 10.4 8.6 12.6 13.3 14.5 142 20

Remarks: Federal Bank undertook structural changes in the balance sheet, viz increasing the proportion of the better rated

assets and improving the retail deposit base, and is thus better prepared to ride the recovery cycle. As the

economy is gradually showing signs of a revival, the bank is much better capitalised (tier-1 capital adequacy ratio

of ~15%) compared with its peer banks to expand the balance sheet.

Asset quality has improved substantially over the past three to four quarters and is likely to improve further in

the coming period. Higher provision coverage ratio of over 80% and a possibility of recovery from one large-ticket

account (likely in the next two to three quarters) would further increase the comfort on asset quality.

The valuation of 1.2x FY2016E BV is attractive when compared with the regional banks and other old private

banks. The expansion in the return on equity (RoE) led by a better than industry growth (FY2014-16) will lead to

an expansion in the valuation multiple. We have a Buy rating on the stock with a price target of Rs142.

Sharekhan

August 2014

3 August 2014

Sharekhan

sharekhan top picks

Name CMP PER (x) RoE (%) Price Upside

(Rs) FY14 FY15E FY16E FY14 FY15E FY16E target (Rs) (%)

Gateway Distriparks 234 17.8 16.5 14.0 17.5 18.0 20.3 ** -

Remarks: An improvement in exim trade along with a rise in port traffic at the major ports are signalling an improving

business environment for the logistic companies. Gateway Distriparks being a major player in the CFS and rail

logistic segments is expected to witness an improvement in the volumes of its CFS and rail divisions going ahead.

The improving trend in the rail freight and cold chain subsidiaries would sustain on account of the recent efforts

to control costs and improve utilisation.

We continue to have faith in GDLs long-term growth story based on the expansion of each of its three business

segments, ie CFS, rail transportation and cold storage infrastructure segments. First, we believe the listing of SLL

will unlock the inherent value and the potential of the cold chain operations. Second, the coming on stream of

the Faridabad facility and the strong operational performance will further enhance the performance of the rail

operations. Third, the expected turnaround in the global trade should have a positive impact on the CFS operations.

We maintain our Buy rating on the stock.

ICICI Bank 1,476 17.4 15.5 13.1 14.0 14.5 15.7 1,728 17

Remarks: With an improvement in the liability profile, ICICI Bank is better positioned to expand its market share especially

in the retail segment. We expect its advances to grow at ~19% compound annual growth rate (CAGR) over FY2014-

16 leading to a CAGR of 17.0% in the net interest income.

ICICI Banks asset quality has stabilised and fresh NPA additions are within manageable limits. We believe the

strong operating profits should help the bank to absorb the stress which anyway is expected to recede due to an

uptick in economy.

Led by a pick-up in the advance growth and a significant improvement in the margin, the RoE is likely to expand

to ~16% by FY2016 while the return on assets (RoA) is likely to improve to 1.8%. This would be driven by a 15.3%

growth (CAGR) in the profit over FY2014-16.

The stock trades at 1.9x FY2016E BV. Moreover, given the improvement in the profitability led by lower NPA

provisions, a healthy growth in the core income and improved operating metrics, we recommend a Buy with a

price target of Rs1,728.

4

August 2014

Sharekhan

sharekhan top picks

Name CMP PER (x) RoE (%) Price Upside

(Rs) FY14 FY15E FY16E FY14 FY15E FY16E target (Rs) (%)

Larsen & Toubro 1,472 27.8 24.5 20.3 15.6 15.6 17.1 1,840 25

Remarks: Larsen & Toubro (L&T), the largest engineering and construction company in India, is a direct beneficiary of the

strong domestic infrastructure development and industrial capital expenditure (capex) revival now.

L&T continues to impress us with its order inflow growth achievement and good execution skills even in a slowdown.

Now it is looking at better days ahead with the domestic environment improving. We believe in such a situation,

L&T would be a major beneficiary as it is placed much ahead of its peers with a strong balance sheet. Moreover,

monetisation of various assets (including listing of subsidiary) would help the company to improve the RoE.

Owing to poor results in its hydrocarbon subsidiary, L&T reported weak performance for Q1FY2015 and the stock

corrected significantly. We recommend investors to consider this as an opportunity to enter at a lower price as

L&T is one of the best bets to play the cyclical (revival benefit yet to reflect in numbers) and its management

expects the performance of the hydrocarbon business to improve in future.

Lupin 1,165 28.4 20.5 17.9 26.5 27.7 24.4 1,300 12

Remarks: A vast geographical presence, focus on niche segments like oral contraceptives, ophthalmic products, para-IV

filings and branded business in the USA are the key elements of growth for Lupin. The company has remarkably

improved its brand equity in the domestic and international generic markets to occupy a significant position in

the branded formulation business. Its inorganic growth strategy has seen a stupendous success in the past. The

company is now debt free and that enhances the scope for inorganic initiatives.

The company has shown a sharp improvement in the base business margin in Q1FY2015 on the back of cost

rationalization measures and better products mix. The management has given a guidance to sustain the OPM at

27% to 28% in FY2015 (vs 25% in FY2014), which especially impress us.

The company is expected to see stronger traction in the US business on the back of the key generic launches in

recent months and a strong pipeline in the US generic business (over 97 abbreviated new drug approvals pending

approval including 86 first-to-files) to ensure the future growth. The key products that are going to provide a

lucrative generic opportunity for the company include Nexium (market size of $2.2 billion), Lunesta (market size

of $800 million) and Namenda (market size of $1.75 billion) that will be going out of patent protection in FY2015.

We expect revenue and profit CAGR of 21% and 26% over FY2014-16.

5 August 2014

Sharekhan

sharekhan top picks

Name CMP PER (x) RoE (%) Price Upside

(Rs) FY14 FY15E FY16E FY14 FY15E FY16E target (Rs) (%)

Persistent Systems 1,255 20.1 16.2 13.8 22.3 23.1 22.7 1,400 12

Remarks: Persistent Systems has proven expertise and an early movers advantage in the digital technologies (Social, Mobile

Analytics and Cloud; SMAC). Additionally, strength to improve its IP base and the best-in-the-class margin profile

which sets it apart from the other mid-cap IT companies.

The distinctive advantage of PSLs lies in SMAC oriented business model (a big growth area), strong balance sheet

(Rs663 crore, at 41% of the balance sheet size) and good corporate governance.

Despite trading at a valuation (trading at 14.5x FY2016E earnings) that is closer to that of the large-cap IT

companies after a steep re-rating in the last six months, PSL continues to attract investors interest (FIIs have

increased the stake in company from 20.6 in March 2014 to 27.4% in June 2014). Given the huge potential in the

SMAC space, we see PSL as a long-term value creator for investors.

PTC India Financial 33 6.6 6.1 4.5 16.1 15.4 18.5 44 32

Services

Remarks: Given its strong parentage (PTC India) and domain knowledge of the power sector, PTC India Financial Services

(PFS) is among the specialised lenders in the energy value chain. Going ahead, an improving scenario for the

power sector and an outstanding sanction of over Rs5,500 crore will drive the growth in the advances (45% CAGR

over FY2014-16).

PFS has a fairly diversified loan book with the renewable energy segment constituting about 35% followed by the

thermal segment. The renewable sector projects have a lower gestation period, do not face risk of fuel and

environmental clearances, and receive regulatory and fiscal support. The asset quality remains robust (GNPA of

0.09% and nil net NPA) and we expect the quality to sustain going ahead.

PFS has delivered strong results for Q1FY2015 led by healthy margins which, in turn, have helped it to maintain

superior return ratios. Going ahead, the cost of borrowing may moderate led by higher borrowings from bonds/

ECBs. The company also plans to exit one of its equity investments in FY2015 which will boost the profit (it exited

three to four investments in the past with an average return of 25%). With close to doubling of its advances book

over the next two years, we expect PFS earnings to grow at 44% CAGR over FY2014-16. We have a Buy rating and

price target of Rs44 on the stock.

6

August 2014

Sharekhan

sharekhan top picks

Name CMP PER (x) RoE (%) Price Upside

(Rs) FY14 FY15E FY16E FY14 FY15E FY16E target (Rs) (%)

TVS Motors 152 27.8 21.6 16.7 19.7 21.8 23.6 175 15

Remarks: TVS Motor Company (TVS), the fourth largest two-wheeler manufacturer in India, continues to impress with its

robust volume growth on the back of new launches, ie Jupiter in the scooter segment and Star City + in the

motorcycle segment. A wide product range in motorcycles, scooters and mopeds, a healthy market share in the

fast growing scooter segment (a 12.5% market share) along with new launches (new Scooty Zest in Q2FY2015 and

two motorcycles in H2FY2015) are expected to drive the volume and revenue growth.

Its two-wheeler exports after a dismal performance in FY2013 rebounded with a 16% growth in FY2014. Its three-

wheeler exports maintain the momentum with a 103% growth in FY2014. Further, it has entered into a partnership

with BMW Motorrad for development of a new range of motorcycles in the sub-500cc category. The partnership

will leverage the technical strength of BMW Motorrad and the benefits of TVS low-cost manufacturing. The first

product from the tie-up is expected in H2FY2015.

During FY2010-13, TVS invested in its Indonesian subsidiary and other group companies. However, going forward

no major investment is expected outside the core business which would help the company to generate better

cash flow to de-leverage the balance sheet. With an improvement in the profitability coupled with debt reduction,

we expect the company to report both RoCE and RoE in excess of 20% in FY2015-16. We recommend a Buy with a

price target of Rs175.

UltraTech Cement 2,471 33.0 25.3 22.0 12.0 13.7 13.8 2,868 16

Remarks: We expect the demand environment to improve with a cyclical upturn in the economy aided by policy push

driving investments in the infrastructure sector. The cement prices across India have risen recently which can

boost the OPM of pan-India players like UltraTech.

UltraTech being an industry leader with a strong balance sheet is placed comfortably to grow inorganically by

acquiring assets at reasonable valuations and maintaining its dominant position. The company is slated to increase

its current capacity to 70MMT by 2016 from 55MMT currently.

We like UltraTech on account of its pan-India presence and a strong balance sheet. We maintain our Buy

recommendation on the stock with a price target of Rs2,868.

7 August 2014

Sharekhan

Disclaimer

This document has been prepared by Sharekhan Ltd.(SHAREKHAN) This Document is subject to changes without prior notice and is intended only for the person or entity to which it is addressed to and may contain

confidential and/or privileged material and is not for any type of circulation. Any review, retransmission, or any other use is prohibited. Kindly note that this document does not constitute an offer or solicitation for

the purchase or sale of any financial instrument or as an official confirmation of any transaction.

Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is from publicly available data or other sources believed to be reliable. While we would endeavour to update the information herein on reasonable basis, SHAREKHAN, its

subsidiaries and associated companies, their directors and employees (SHAREKHAN and affiliates) are under no obligation to update or keep the information current. Also, there may be regulatory, compliance, or

other reasons that may prevent SHAREKHAN and affiliates from doing so. We do not represent that information contained herein is accurate or complete and it should not be relied upon as such. This document is

prepared for assistance only and is not intended to be and must not alone betaken as the basis for an investment decision. The user assumes the entire risk of any use made of this information. Each recipient of this

document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks

involved), and should consult its own advisors to determine the merits and risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to

advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution,

publication, availability or use would be contrary to law, regulation or which would subject SHAREKHAN and affiliates to any registration or licensing requirement within such jurisdiction. The securities described

herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such

restriction.

SHAREKHAN & affiliates may have used the information set forth herein before publication and may have positions in, may from time to time purchase or sell or may be materially interested in any of the securities

mentioned or related securities. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company mentioned herein. Without limiting any of the foregoing, in no

event shall SHAREKHAN, any of its affiliates or any third party involved in, or related to, computing or compiling the information have any liability for any damages of any kind. Any comments or statements made

herein are those of the analyst and do not necessarily reflect those of SHAREKHAN.

Sharekhan Limited, its analyst or dependant(s) of the analyst might be holding or having a position in the companies mentioned in the article.

sharekhan top picks

Name CMP PER (x) RoE (%) Price Upside

(Rs) FY14 FY15E FY16E FY14 FY15E FY16E target (Rs) (%)

Zee Entertainment 289 31.1 29.2 22.2 20.6 19.1 22.3 367 27

Remarks: Among the key stakeholders of the domestic TV industry, we expect the broadcasters to be the prime beneficiary

of the mandatory digitisation process initiated by the government. The broadcasters would benefit from higher

subscription revenues at the least incremental capex as the subscriber declaration improves in the cable industry.

The management maintains that the advertisement spending will continue to grow in double digits going ahead

and ZEEL will be able to outperform the same. The growth in the advertisement spending will be driven by an

improvement in the macro-economic factors and the fact the ZEEL is well placed to capture the emerging

opportunities being a leader in terms of market share.

ZEEL is well placed to benefit from the ongoing digitalisation theme and the overall recovery in the macro

economy. Also, the phase-wise rate hikes in the channel rates would augur well for the subscription revenues. We

maintain our Buy rating on the stock with a price target of Rs367.

You might also like

- Sharekhan Top Picks: CMP As On September 01, 2014 Under ReviewDocument7 pagesSharekhan Top Picks: CMP As On September 01, 2014 Under Reviewrohitkhanna1180No ratings yet

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocument7 pagesSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapJignesh RampariyaNo ratings yet

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocument7 pagesSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapRajesh KarriNo ratings yet

- Stock Market Today Tips - Book Profit On The Stock CMCDocument21 pagesStock Market Today Tips - Book Profit On The Stock CMCNarnolia Securities LimitedNo ratings yet

- Sharekhan Top PicksDocument7 pagesSharekhan Top PicksLaharii MerugumallaNo ratings yet

- SharekhanTopPicks 31082016Document7 pagesSharekhanTopPicks 31082016Jigar ShahNo ratings yet

- Sharekhan Top Picks: October 26, 2012Document7 pagesSharekhan Top Picks: October 26, 2012Soumik DasNo ratings yet

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocument7 pagesSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapchetanjecNo ratings yet

- Sharekhan Top Picks: October 01, 2011Document7 pagesSharekhan Top Picks: October 01, 2011harsha_iitmNo ratings yet

- SBI Securities Morning Update - 13-01-2023Document7 pagesSBI Securities Morning Update - 13-01-2023deepaksinghbishtNo ratings yet

- 4QFY14E Results Preview: Institutional ResearchDocument22 pages4QFY14E Results Preview: Institutional ResearchGunjan ShethNo ratings yet

- Top PicksDocument7 pagesTop PicksKarthik KoutharapuNo ratings yet

- JK Lakshmi Cement: Capacity Expansion With Favourable Macro Environment To Drive Earnings CMP: Rs97Document4 pagesJK Lakshmi Cement: Capacity Expansion With Favourable Macro Environment To Drive Earnings CMP: Rs97ajd.nanthakumarNo ratings yet

- Finolex Cables-Initiating Coverage 22 Apr 2014Document9 pagesFinolex Cables-Initiating Coverage 22 Apr 2014sanjeevpandaNo ratings yet

- Zee Entertainment Enterprises: Reco: Buy Good Show, Ads Growth and Margins Surprise Positively CMP: Rs418Document3 pagesZee Entertainment Enterprises: Reco: Buy Good Show, Ads Growth and Margins Surprise Positively CMP: Rs418Marutisinh RajNo ratings yet

- India Equity Analytics For Today - Buy Stocks of CMC With Target Price From Rs 1490 To Rs 1690.Document23 pagesIndia Equity Analytics For Today - Buy Stocks of CMC With Target Price From Rs 1490 To Rs 1690.Narnolia Securities LimitedNo ratings yet

- La Opala RG - Initiating Coverage - Centrum 30062014Document21 pagesLa Opala RG - Initiating Coverage - Centrum 30062014Jeevan PatwaNo ratings yet

- Sharekhan Top Picks: April 03, 2010Document6 pagesSharekhan Top Picks: April 03, 2010Kripansh GroverNo ratings yet

- Two-Wheelers Update 27aug2014Document12 pagesTwo-Wheelers Update 27aug2014Chandreyee MannaNo ratings yet

- Deccan Cements (DECCEM: Value PlayDocument5 pagesDeccan Cements (DECCEM: Value PlayDinesh ChoudharyNo ratings yet

- NCL Industries (NCLIND: Poised For GrowthDocument5 pagesNCL Industries (NCLIND: Poised For GrowthDinesh ChoudharyNo ratings yet

- Investment Funds Advisory Today - Buy Stock of UltraTech Cement LTD, DB Corp and InfosysDocument25 pagesInvestment Funds Advisory Today - Buy Stock of UltraTech Cement LTD, DB Corp and InfosysNarnolia Securities LimitedNo ratings yet

- IDirect MuhuratPicks 2014Document8 pagesIDirect MuhuratPicks 2014Rahul SakareyNo ratings yet

- EPC Industrie (EPCIND) : Micro-Irrigation: Niche SegmentDocument4 pagesEPC Industrie (EPCIND) : Micro-Irrigation: Niche SegmentpriyaranjanNo ratings yet

- Opening Bell: Market Outlook Today's HighlightsDocument7 pagesOpening Bell: Market Outlook Today's HighlightsBharatNo ratings yet

- Ultratech Cement ReportDocument19 pagesUltratech Cement Reportkishor waghmareNo ratings yet

- India Equity Analytics-Persistent System: Focusing On The Increase IP-led RevenuesDocument20 pagesIndia Equity Analytics-Persistent System: Focusing On The Increase IP-led RevenuesNarnolia Securities LimitedNo ratings yet

- Sharekhan Top Picks: February 02, 2013Document7 pagesSharekhan Top Picks: February 02, 2013nit111No ratings yet

- Wealth Creator StocksDocument18 pagesWealth Creator Stocksshishir_ghatgeNo ratings yet

- Sharekhan Top Picks: January 01, 2013Document7 pagesSharekhan Top Picks: January 01, 2013Rajiv MahajanNo ratings yet

- India Equity Analytics Today: Buy Stock of KPIT TechDocument24 pagesIndia Equity Analytics Today: Buy Stock of KPIT TechNarnolia Securities LimitedNo ratings yet

- 1 - 0 - 08072011fullerton Escorts 7th July 2011Document5 pages1 - 0 - 08072011fullerton Escorts 7th July 2011nit111No ratings yet

- Top Picks: Research TeamDocument30 pagesTop Picks: Research TeamPooja AgarwalNo ratings yet

- Smart Gains 42 PDFDocument4 pagesSmart Gains 42 PDF476No ratings yet

- SharekhanTopPicks 070511Document7 pagesSharekhanTopPicks 070511Avinash KowkuntlaNo ratings yet

- Research Scorecard: December 2015Document46 pagesResearch Scorecard: December 2015senkum812002No ratings yet

- Simplex Infra ICDocument7 pagesSimplex Infra ICAyush KillaNo ratings yet

- Mid-Cap Marvels: RCM ResearchDocument20 pagesMid-Cap Marvels: RCM ResearchmannimanojNo ratings yet

- IEA Report 13th DecemberDocument23 pagesIEA Report 13th DecembernarnoliaNo ratings yet

- Top Picks For 2015Document14 pagesTop Picks For 2015Dhawan SandeepNo ratings yet

- Sharekhan Top Picks: November 30, 2012Document7 pagesSharekhan Top Picks: November 30, 2012didwaniasNo ratings yet

- India Equity Analytics: HCLTECH: "Retain Confidence"Document27 pagesIndia Equity Analytics: HCLTECH: "Retain Confidence"Narnolia Securities LimitedNo ratings yet

- Integrated Business at A Discount: Key PointsDocument11 pagesIntegrated Business at A Discount: Key PointssanjeevpandaNo ratings yet

- Investor Update (Company Update)Document34 pagesInvestor Update (Company Update)Shyam SunderNo ratings yet

- 10 MidcapsDocument1 page10 MidcapspuneetdubeyNo ratings yet

- Stock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedDocument24 pagesStock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedNarnolia Securities LimitedNo ratings yet

- Jamna AutoDocument5 pagesJamna AutoSumit SinghNo ratings yet

- Stock Update Wonderla Holidays Viewpoint Zee Learn: IndexDocument4 pagesStock Update Wonderla Holidays Viewpoint Zee Learn: IndexRajasekhar Reddy AnekalluNo ratings yet

- Stock Investment Tips Recommendation - Buy Stocks of Shree Cement With Target Price Rs.4791Document20 pagesStock Investment Tips Recommendation - Buy Stocks of Shree Cement With Target Price Rs.4791Narnolia Securities LimitedNo ratings yet

- Sinindus 20110913Document9 pagesSinindus 20110913red cornerNo ratings yet

- Nivesh Stock PicksDocument13 pagesNivesh Stock PicksAnonymous W7lVR9qs25No ratings yet

- 4QFY16 Top Picks Equity ResearchDocument3 pages4QFY16 Top Picks Equity ResearchJason Soans100% (1)

- Bartronics LTD (BARLTD) : Domestic Revenues Take A HitDocument4 pagesBartronics LTD (BARLTD) : Domestic Revenues Take A HitvaluelettersNo ratings yet

- Top Picks Sep 2012Document15 pagesTop Picks Sep 2012kulvir singNo ratings yet

- IEA Report 17th JanuaryDocument28 pagesIEA Report 17th JanuarynarnoliaNo ratings yet

- ICICIdirect HDFCBank ReportDocument21 pagesICICIdirect HDFCBank Reportishan_mNo ratings yet

- Stocksview Report On JiyaDocument3 pagesStocksview Report On JiyaMuralidhar RayapeddiNo ratings yet

- Top Recommendation - 140911Document51 pagesTop Recommendation - 140911chaltrikNo ratings yet

- Earning Conference Call Transcript - For Q1 FY 17 (Company Update)Document14 pagesEarning Conference Call Transcript - For Q1 FY 17 (Company Update)Shyam SunderNo ratings yet

- Axis Bank Up and AboutDocument1 pageAxis Bank Up and AboutAnonymous W7lVR9qs25No ratings yet

- Varahamihira - UpagrahaDocument5 pagesVarahamihira - UpagrahaAnonymous W7lVR9qs25No ratings yet

- How To Know Inner Nature of A PersonDocument1 pageHow To Know Inner Nature of A PersonAnonymous W7lVR9qs25No ratings yet

- Lotus TheoryDocument1 pageLotus TheoryAnonymous W7lVR9qs25No ratings yet

- Convekta Training MethodsDocument9 pagesConvekta Training MethodsTech PadawanNo ratings yet

- ASTM E466 Uji Fatik LogamDocument5 pagesASTM E466 Uji Fatik LogamMad Is100% (1)

- ST Unit2Document75 pagesST Unit2Abhinav AbzNo ratings yet

- May 29Document2 pagesMay 29gerrymattinglyNo ratings yet

- Best Trusts and Estates OutlineDocument84 pagesBest Trusts and Estates OutlineJavi Luis100% (4)

- Synthesis of Bicyclo (2.2.l) Heptene Diels-Alder AdductDocument2 pagesSynthesis of Bicyclo (2.2.l) Heptene Diels-Alder AdductJacqueline FSNo ratings yet

- 1940 - English Missal - Order of MassDocument15 pages1940 - English Missal - Order of MassDavid ConleyNo ratings yet

- Is 456 - 2016 4th Amendment Plain and Reinforced Concrete - Code of Practice - Civil4MDocument3 pagesIs 456 - 2016 4th Amendment Plain and Reinforced Concrete - Code of Practice - Civil4Mvasudeo_ee0% (1)

- UEFA Stadium Design Guidelines PDFDocument160 pagesUEFA Stadium Design Guidelines PDFAbdullah Hasan100% (1)

- Polytechnic University of The Philippines Basketball Athletes' Superstitious Rituals and Its Effects in Their Game PerformanceDocument25 pagesPolytechnic University of The Philippines Basketball Athletes' Superstitious Rituals and Its Effects in Their Game PerformanceJewo CanterasNo ratings yet

- Trading Floors WSDocument86 pagesTrading Floors WSAlok Singh100% (3)

- Schema and Reading Comprehension Relative To Academic Performance of Grade 10 Students at Binulasan Integrated SchoolDocument12 pagesSchema and Reading Comprehension Relative To Academic Performance of Grade 10 Students at Binulasan Integrated SchoolShenly EchemaneNo ratings yet

- Reaction Paper PoliticsDocument1 pageReaction Paper PoliticsDenise Jim GalantaNo ratings yet

- Warm Pretend Lead Line Cater Resist Provide Reflect Anticipate Advertise Range Sentence AccessDocument24 pagesWarm Pretend Lead Line Cater Resist Provide Reflect Anticipate Advertise Range Sentence AccessJacinto Leite Aquino RêgoNo ratings yet

- Life and Work of Architect Ejaz AhedDocument25 pagesLife and Work of Architect Ejaz Ahedwajihazahid100% (2)

- RB September 2014 The One Thing Kekuatan Fokus Untuk Mendorong ProduktivitasDocument2 pagesRB September 2014 The One Thing Kekuatan Fokus Untuk Mendorong ProduktivitasRifat TaopikNo ratings yet

- The Traditional of The Great Precept Transmission Ordination Ceremony in Vietnam BuddhistDocument20 pagesThe Traditional of The Great Precept Transmission Ordination Ceremony in Vietnam BuddhistAn NhiênNo ratings yet

- VocabularyDocument7 pagesVocabularyReynald Satria Dwiky IrawanNo ratings yet

- Notes Ilw1501 Introduction To LawDocument11 pagesNotes Ilw1501 Introduction To Lawunderstand ingNo ratings yet

- Emma Becomes CluelessDocument8 pagesEmma Becomes CluelessNathorlNo ratings yet

- TRAFFIC JUNCTION SIMULATION-projectDocument45 pagesTRAFFIC JUNCTION SIMULATION-projectmacklyn tyan100% (2)

- Podcasts in IndiaDocument4 pagesPodcasts in IndiaShruti MahajanNo ratings yet

- Commerce and Peace 11Document28 pagesCommerce and Peace 11FEDERICO ORSININo ratings yet

- Ultimate Power Errata: Ultimate Power Mutants & Masterminds Mutants & Masterminds FAQ Mutants & MastermindsDocument2 pagesUltimate Power Errata: Ultimate Power Mutants & Masterminds Mutants & Masterminds FAQ Mutants & MastermindsYunus Emre AtalayNo ratings yet

- Handbook PDFDocument91 pagesHandbook PDFMohammad Suriyaidulman RianseNo ratings yet

- 2a Group 12 Suggested AnswersDocument2 pages2a Group 12 Suggested AnswersRalph John Alipio ValdezNo ratings yet

- Objectives: A. Identify The Reasons For Keeping Business Records and B. Perform Key Bookkeeping TaskDocument11 pagesObjectives: A. Identify The Reasons For Keeping Business Records and B. Perform Key Bookkeeping TaskMarife CulabaNo ratings yet

- Gambit-Creating Geometry and MeshDocument3 pagesGambit-Creating Geometry and MeshMuralidharan ShanmugamNo ratings yet

- Reconceptualising Smart CitiesDocument80 pagesReconceptualising Smart CitiesDevang Parekh100% (1)

- English 3 Reading Nat 1Document23 pagesEnglish 3 Reading Nat 1robelynemendoza17No ratings yet