Professional Documents

Culture Documents

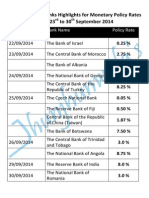

Monetary Policy Highlights For Global Central Banks For Month of August 2014

0 ratings0% found this document useful (0 votes)

57 views47 pagesMonetary Policy Highlights for Global Central Banks for Month of August 2014 .

#CentralBankOfColombia raised its PolicyRate by 25 basis points to 4.25 % as on 1st August 2014.

Data compiled and released by Central Bank of Colombia.

#BancoCentralDeColombia #BancoDeLaRepublica #BanRep #Colombia Rate #PolicyRate

The #ReserveBankOfFiji Board, at its monthly meeting on 31st July, agreed to maintain the

#OvernightPolicyRate (OPR) at 0.5 percent.

Data released by Reserve Bank of Fiji on 1st August 2014. #FIJI #OPR

#NationalBankOfRomania at its meeting on 5th August 2014, lowers the #MPR Rate to 3.25% per annum from 3.50% per annum. . .

Data released by National Bank of Romania. .

#BancaNationalaaRomaniei #Romania #BNR

#ReserveBankOfAustralia at its meeting as on 5th

August 2014 the Board maintains the #CashRate at 2.5% . .

Data released by Reserve Bank Of Australia.

#RBA #Australia #RBI #ReserveBankOfIndia Highlights as on 5th August 2014 :

#SLR cut by 50 basis points to 22.0 %, #CRR remains unchanged at 4.0 % and #RR also remains the same at 8.0 % . . .

Data released by Reserve Bank Of India. .

SLR - Statutory Liquidity Ratio

CRR - Cash Reserve Ratio

RR - Repo Rate

#StatutoryLiquidityRatio #CashReserveRatio #RepoRate

#RBIReserveBankOfIndia #India

#BankOfZambia in its meeting on 5th August 2014 maintains current Rate at 12% per annum

Data released by Bank Of Zambia . .

#Zambia #MPR

#BankOfThailand maintains #PolicyRate at 2.0% per annum as on 6th August 2014. Thailand's #HeadlandInflationRate eased to 2.16% in

July from 2.35% in June per annum and #InflationRate rose to 1.81% in July from 1.71% in June.

Data released by Bank of Thailand . .

#CentralBankOfThailand #Thailand #MPR #Inflation

#BankOfEngland #BOE maintains its #BankRate at 0.5% pa and asset purchase programme at 375 Billion

Pounds at its meeting on 7th August 2014, next due as on 4th Sep 2014.

Key Facts :

#CurrentInflation at 1.9% based on #CPI with next due on 19th Sep 2014.

Data compiled and released by Bank of England

#Inflation #ConsumerPriceInflation #England

#EuropeanCentralBank maintained its #BenchmarkRefinancingRate at 0.15 % as on 7th August 2014, along with its

#MarginalLendingFacilityRate at 0.4 % and its #DepositRate at minus 0.10 %.

Data compiled and released by European Central Bank.

#EuropeanUnion #ECB Rate #PolicyRate #MPR

#NationalBankOfSerbia at its meeting on 7th August 2014 maintains PolicyRate at 8.5% per annum.

Data compiled and released by National Bank of Serbia.

#NBS #Serbia #MPR Rate

#CentralBankOfTheGambia raised its #PolicyRate by 200 #BasisPoints to 22.0% per annum as on 8th August 2014.

Data released by Central Bank Of The Gambia. . . #Gambia

#CentralReserveBankOfPeru maintained its

MonetaryPolicyReferenceRate at 3.75 % as on 8th August 2014.

Data compiled and released by Central Reserve Bank of Peru. #CRBP #Peru Rate #PolicyRate

#TheCentralBankOfArmenia cuts its Benchmark

#RefinancingRate by 25 Basis Points to 6.75% per annum as on 12th August 2014

Data compiled and released by The Central Bank of Armenia.

#Armenia

#BankOfMozambique maintains Benchmark #StandingFacilityRate at 8.25% per annum as on 12th August 2014. .

Data compiled and released by Bank Of Mozambique #Mozambique #RepublicOfMozambique

#BancoDeMocambique

#BankOfKorea cuts its #BaseRate to 2.25% per annum by 25 Basis Points as on 13th August 2014

Data compiled and released by Bank of Korea #SouthKorea #BOK #CentralBankOfKorea

#IndonesiaCentralBank maintains its Benchmark #BIRate at 7.5% per annum as on 14th August 2014.

Data compiled and released by Bank Indonesia

#BI #BankIndonesia #Indonesia

#BankSentralRepublikIndonesia

The #BankOfUganda maintains its #CentralBankRate at 11% per annum as on 14th August 2014.

Data compiled and released by Central Bank Of Uganda .

#CBR #BOU #Uganda

The #CentralBankOfChile cuts its Rate by 25

Original Title

Monetary Policy Highlights for Global Central Banks for Month of August 2014

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMonetary Policy Highlights for Global Central Banks for Month of August 2014 .

#CentralBankOfColombia raised its PolicyRate by 25 basis points to 4.25 % as on 1st August 2014.

Data compiled and released by Central Bank of Colombia.

#BancoCentralDeColombia #BancoDeLaRepublica #BanRep #Colombia Rate #PolicyRate

The #ReserveBankOfFiji Board, at its monthly meeting on 31st July, agreed to maintain the

#OvernightPolicyRate (OPR) at 0.5 percent.

Data released by Reserve Bank of Fiji on 1st August 2014. #FIJI #OPR

#NationalBankOfRomania at its meeting on 5th August 2014, lowers the #MPR Rate to 3.25% per annum from 3.50% per annum. . .

Data released by National Bank of Romania. .

#BancaNationalaaRomaniei #Romania #BNR

#ReserveBankOfAustralia at its meeting as on 5th

August 2014 the Board maintains the #CashRate at 2.5% . .

Data released by Reserve Bank Of Australia.

#RBA #Australia #RBI #ReserveBankOfIndia Highlights as on 5th August 2014 :

#SLR cut by 50 basis points to 22.0 %, #CRR remains unchanged at 4.0 % and #RR also remains the same at 8.0 % . . .

Data released by Reserve Bank Of India. .

SLR - Statutory Liquidity Ratio

CRR - Cash Reserve Ratio

RR - Repo Rate

#StatutoryLiquidityRatio #CashReserveRatio #RepoRate

#RBIReserveBankOfIndia #India

#BankOfZambia in its meeting on 5th August 2014 maintains current Rate at 12% per annum

Data released by Bank Of Zambia . .

#Zambia #MPR

#BankOfThailand maintains #PolicyRate at 2.0% per annum as on 6th August 2014. Thailand's #HeadlandInflationRate eased to 2.16% in

July from 2.35% in June per annum and #InflationRate rose to 1.81% in July from 1.71% in June.

Data released by Bank of Thailand . .

#CentralBankOfThailand #Thailand #MPR #Inflation

#BankOfEngland #BOE maintains its #BankRate at 0.5% pa and asset purchase programme at 375 Billion

Pounds at its meeting on 7th August 2014, next due as on 4th Sep 2014.

Key Facts :

#CurrentInflation at 1.9% based on #CPI with next due on 19th Sep 2014.

Data compiled and released by Bank of England

#Inflation #ConsumerPriceInflation #England

#EuropeanCentralBank maintained its #BenchmarkRefinancingRate at 0.15 % as on 7th August 2014, along with its

#MarginalLendingFacilityRate at 0.4 % and its #DepositRate at minus 0.10 %.

Data compiled and released by European Central Bank.

#EuropeanUnion #ECB Rate #PolicyRate #MPR

#NationalBankOfSerbia at its meeting on 7th August 2014 maintains PolicyRate at 8.5% per annum.

Data compiled and released by National Bank of Serbia.

#NBS #Serbia #MPR Rate

#CentralBankOfTheGambia raised its #PolicyRate by 200 #BasisPoints to 22.0% per annum as on 8th August 2014.

Data released by Central Bank Of The Gambia. . . #Gambia

#CentralReserveBankOfPeru maintained its

MonetaryPolicyReferenceRate at 3.75 % as on 8th August 2014.

Data compiled and released by Central Reserve Bank of Peru. #CRBP #Peru Rate #PolicyRate

#TheCentralBankOfArmenia cuts its Benchmark

#RefinancingRate by 25 Basis Points to 6.75% per annum as on 12th August 2014

Data compiled and released by The Central Bank of Armenia.

#Armenia

#BankOfMozambique maintains Benchmark #StandingFacilityRate at 8.25% per annum as on 12th August 2014. .

Data compiled and released by Bank Of Mozambique #Mozambique #RepublicOfMozambique

#BancoDeMocambique

#BankOfKorea cuts its #BaseRate to 2.25% per annum by 25 Basis Points as on 13th August 2014

Data compiled and released by Bank of Korea #SouthKorea #BOK #CentralBankOfKorea

#IndonesiaCentralBank maintains its Benchmark #BIRate at 7.5% per annum as on 14th August 2014.

Data compiled and released by Bank Indonesia

#BI #BankIndonesia #Indonesia

#BankSentralRepublikIndonesia

The #BankOfUganda maintains its #CentralBankRate at 11% per annum as on 14th August 2014.

Data compiled and released by Central Bank Of Uganda .

#CBR #BOU #Uganda

The #CentralBankOfChile cuts its Rate by 25

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

57 views47 pagesMonetary Policy Highlights For Global Central Banks For Month of August 2014

Monetary Policy Highlights for Global Central Banks for Month of August 2014 .

#CentralBankOfColombia raised its PolicyRate by 25 basis points to 4.25 % as on 1st August 2014.

Data compiled and released by Central Bank of Colombia.

#BancoCentralDeColombia #BancoDeLaRepublica #BanRep #Colombia Rate #PolicyRate

The #ReserveBankOfFiji Board, at its monthly meeting on 31st July, agreed to maintain the

#OvernightPolicyRate (OPR) at 0.5 percent.

Data released by Reserve Bank of Fiji on 1st August 2014. #FIJI #OPR

#NationalBankOfRomania at its meeting on 5th August 2014, lowers the #MPR Rate to 3.25% per annum from 3.50% per annum. . .

Data released by National Bank of Romania. .

#BancaNationalaaRomaniei #Romania #BNR

#ReserveBankOfAustralia at its meeting as on 5th

August 2014 the Board maintains the #CashRate at 2.5% . .

Data released by Reserve Bank Of Australia.

#RBA #Australia #RBI #ReserveBankOfIndia Highlights as on 5th August 2014 :

#SLR cut by 50 basis points to 22.0 %, #CRR remains unchanged at 4.0 % and #RR also remains the same at 8.0 % . . .

Data released by Reserve Bank Of India. .

SLR - Statutory Liquidity Ratio

CRR - Cash Reserve Ratio

RR - Repo Rate

#StatutoryLiquidityRatio #CashReserveRatio #RepoRate

#RBIReserveBankOfIndia #India

#BankOfZambia in its meeting on 5th August 2014 maintains current Rate at 12% per annum

Data released by Bank Of Zambia . .

#Zambia #MPR

#BankOfThailand maintains #PolicyRate at 2.0% per annum as on 6th August 2014. Thailand's #HeadlandInflationRate eased to 2.16% in

July from 2.35% in June per annum and #InflationRate rose to 1.81% in July from 1.71% in June.

Data released by Bank of Thailand . .

#CentralBankOfThailand #Thailand #MPR #Inflation

#BankOfEngland #BOE maintains its #BankRate at 0.5% pa and asset purchase programme at 375 Billion

Pounds at its meeting on 7th August 2014, next due as on 4th Sep 2014.

Key Facts :

#CurrentInflation at 1.9% based on #CPI with next due on 19th Sep 2014.

Data compiled and released by Bank of England

#Inflation #ConsumerPriceInflation #England

#EuropeanCentralBank maintained its #BenchmarkRefinancingRate at 0.15 % as on 7th August 2014, along with its

#MarginalLendingFacilityRate at 0.4 % and its #DepositRate at minus 0.10 %.

Data compiled and released by European Central Bank.

#EuropeanUnion #ECB Rate #PolicyRate #MPR

#NationalBankOfSerbia at its meeting on 7th August 2014 maintains PolicyRate at 8.5% per annum.

Data compiled and released by National Bank of Serbia.

#NBS #Serbia #MPR Rate

#CentralBankOfTheGambia raised its #PolicyRate by 200 #BasisPoints to 22.0% per annum as on 8th August 2014.

Data released by Central Bank Of The Gambia. . . #Gambia

#CentralReserveBankOfPeru maintained its

MonetaryPolicyReferenceRate at 3.75 % as on 8th August 2014.

Data compiled and released by Central Reserve Bank of Peru. #CRBP #Peru Rate #PolicyRate

#TheCentralBankOfArmenia cuts its Benchmark

#RefinancingRate by 25 Basis Points to 6.75% per annum as on 12th August 2014

Data compiled and released by The Central Bank of Armenia.

#Armenia

#BankOfMozambique maintains Benchmark #StandingFacilityRate at 8.25% per annum as on 12th August 2014. .

Data compiled and released by Bank Of Mozambique #Mozambique #RepublicOfMozambique

#BancoDeMocambique

#BankOfKorea cuts its #BaseRate to 2.25% per annum by 25 Basis Points as on 13th August 2014

Data compiled and released by Bank of Korea #SouthKorea #BOK #CentralBankOfKorea

#IndonesiaCentralBank maintains its Benchmark #BIRate at 7.5% per annum as on 14th August 2014.

Data compiled and released by Bank Indonesia

#BI #BankIndonesia #Indonesia

#BankSentralRepublikIndonesia

The #BankOfUganda maintains its #CentralBankRate at 11% per annum as on 14th August 2014.

Data compiled and released by Central Bank Of Uganda .

#CBR #BOU #Uganda

The #CentralBankOfChile cuts its Rate by 25

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 47

Global Central Banks Highlights for Monetary

Policy Rates in month of August 2014

Global Central Banks Highlights

for Monetary Policy Rates in

month of August 2014

Colombia Central Bank :

The Board of Directors of Banco de la Repblica Raises the Benchmark Interest

Rate by 25 Basis Points

At todays meeting, the Board of Directors of Banco de la Repblica decided to raise the benchmark

interest rate by 25 bp, placing it at 4.25%. The following aspects were taken into consideration by the

Board in reaching this decision.

After climbing and moving towards the 3% target faster than expected, annual consumer inflation declined

to 2.79% in June. This movement in inflation is due mainly to changes in the price of food and regulated

items. The average of the various measurements of core inflation behaved similarly, and one-year-ahead

inflation expectations remain near or slightly above 3%.

Average growth for Colombias major trading partners proved to be weaker than was anticipated several

months back, given the sharp drop in GDP in the United States during the first quarter and less growth

reported by several countries in the region. However, based on recent real and financial indicators, the

Bank's technical staff continues to project increased momentum in external demand during the coming

quarters. On the other hand, energy mining revenues are still at high levels, but with a tendency to decline.

In Colombia, recent figures prompted an upward revision of the economic growth forecast for 2014. It is a

well known fact that GDP growth in the first quarter was more than initially predicted, driven partly by

consumption and investment in the construction of civil works and structures. The good performance

shown by these items is likely to continue during the rest of the year. Moreover, consumer confidence has

improved, the slowdown in consumer lending has come to a halt, the momentum in retail sales continues

to be strong, and there is a downward trend in the unemployment rate. All this suggests that real

household spending will remain forceful this year. Consequently, the Banks technical staff set the new

forecast range for growth in 2014 at 4.2% to 5.8%, with 5% being the most likely figure.

Growth in aggregate demand remained strong in the midst of a context marked by almost full use of

productive capacity. At the same time, inflation expectations are near or slightly above 3%. All this is taking

place in an environment where growth in lending has increased and real interest rates on loans are at

levels conducive to spending. Given these circumstances, the Board of Directors felt it was appropriate to

raise the benchmark interest rate by 25 bp.

The Board will continue to carefully monitor performance and forecasts with respect to economic activity

and inflation in Colombia, asset markets and the international situation. Finally, it reiterated that monetary

policy will depend on the information that is available.

Tuesday, 12 August 2014

14:33

Reserve Bank Of Fiji :

MONETARY POLICY STANCE REMAINS UNCHANGED

The Reserve Bank of Fiji Board, at its monthly meeting on 31 July, agreed to maintain the Overnight Policy

Rate (OPR) at 0.5 percent.

The Governor and Chairman of the Board, Mr Barry Whiteside, stated that, while recovery continues in

the global economy, growth prospects remain broadly fragile and uneven. In its latest update, the

International Monetary Fund downgraded its 2014 global growth projection to 3.4 percent from 3.6

percent, largely reflecting weak quarter one activity especially in the United States and the subdued

outlook for several emerging market economies. In addition, increased geopolitical tensions which could

escalate energy prices present prominent downside risks to the current global economic outlook.

The Governor also highlighted that indicators of domestic activity in the first half of 2014 suggest that

outcomes are broadly consistent with the growth projection of 3.8 percent. Consumption and investment

activity remained firm in the review period, supported by the growth in household income and private

sector credit. Furthermore, apart from the fish and gold industries, sectoral performances were largely

positive.

On the external front, relatively higher import demand, underpinned by buoyant domestic activity,

outpaced the growth in exports and resulted in the widening in the trade deficit. Nevertheless, improved

tourism earnings and remittances continue to support the countrys balance of payments position. For long

term sustainability, the Governor emphasised the continuation of policies geared towards boosting the

export and import substitution sectors.

Mr Whiteside stated that given the stable outlook for its twin objectives of inflation and foreign reserves,

the accommodative monetary stance remains appropriate. Inflation was 1.1 percent in June while foreign

reserves were around $1,611.3 million as at 31 July 2014, sufficient to cover 4.4 months of retained

imports of goods and non-factor services.

The Governor concluded that, the Reserve Bank will continue to monitor international and domestic

developments, particularly the impact of growth on the Banks objectives, and align its policy decisions

accordingly.

RESERVE BANK OF FIJI

National Bank of Romania :

Press Release of the Board of the National Bank of Romania

In its meeting of 4 August 2014, the Board of the National Bank of Romania decided the following:

To lower the monetary policy rate to 3.25 percent per annum from 3.50 percent starting with August 5,

2014;

To pursue an adequate liquidity management in the banking system;

To maintain the existing levels of minimum reserve requirement ratios on both leu- and foreign currency-

denominated liabilities of credit institutions.

The NBR examined and approved the quarterly Inflation Report which will be presented to the public in a

news conference scheduled for August 6, 2014.

The analysis of the latest macroeconomic data shows the annual inflation rate remaining on a downward

path and temporarily running below the lower bound of the variation band of the flat target. The new

projected inflation path is significantly lower than that forecasted in May.

Behind this stood one-off factors (the dynamics of volatile food prices, the nominal appreciation of the

local currency, the influence of import prices partly reflecting subdued euro area inflation) overlapping

with the persistent effects of the negative output gap and the downward adjustment in inflation

expectations.

The annual inflation rate fell to a new historic low of 0.66 percent in June 2014 from 0.94 percent in the

previous month and 1.55 percent in December 2013. At the same time, the average annual inflation rate

came in at 1.7 percent in June 2014 compared to 2.1 percent in May. The average annual inflation rate

based on the Harmonised Index of Consumer Prices which is relevant for ensuring comparability at

European level and assessing convergence with the European Union continued to decrease, reaching 1.5

percent in June versus 1.8 percent in May. Romania thus ranks among the countries meeting the

corresponding nominal convergence criterion at EU level.

The improvement in economic activity in Romania has further been fostered by the favourable

performance of industrial output, fuelled mainly by external demand growth and the gradually rebounding

domestic demand, amid a further narrow current account deficit. The international reserves remain in a

comfortable zone while a substantial part of the IMF loan under the 2009-2011 arrangement has been

repaid.

The annual dynamics of total credit to the private sector fell deeper into negative territory, solely on

account of the steeper decline in the rate of change of the foreign currency component, whereas the

annual pace of increase in real terms of leu-denominated credit gained momentum and peaked at a five-

year high in June. Consequently, the share of foreign exchange loans in total credit to the private sector

(stocks) continued to narrow to 58 percent at end-June 2014 against 62 percent in June 2013, thus helping

consolidate the monetary policy transmission mechanism.

In todays meeting, the NBR Board examined and approved the quarterly Inflation Report, which points to

the outlook for the annual inflation rate to run at markedly lower readings than previously forecasted, i.e.

below the midpoint of the flat target until mid-2015 and in the upper half of the variation band in the latter

part of the projection horizon. According to the new projection, the annual inflation rate will be 2.2 percent

at end-2014 and 3 percent at end-2015, while the average annual inflation rate is anticipated to stand at

1.4 percent in 2014 and 2.4 percent in 2015.

Similarly to the previous assessments, the risks associated with this outlook stem chiefly from external

sources, being largely generated by possibly higher volatility of capital flows in Romania following

unfavourable developments in investors risk aversion to the emerging economies.

This could materialise amid the recent geopolitical and regional tensions, the ongoing cross-border

deleveraging and restructuring of some Eurozone banking groups, as well as in the context of uncertainty

surrounding the impact of possible monetary policy stance adjustments by major central banks worldwide.

Domestically, the main risks relate to the persistence of uncertainties about the consistent implementation

of the set of structural reforms and other measures agreed with international institutions in the context of

elections later this year.

Against this background, the Board of the National Bank of Romania has decided to lower the monetary

policy rate to 3.25 percent per annum from 3.50 percent previously. Hence, starting with 5 August 2014,

the interest rate on the NBRs lending facility (Lombard) will fall to an annual 6.25 percent from 6.50

percent and its deposit facility rate will stand at 0.25 percent per annum. The NBR Board has also decided

to continue to pursue adequate liquidity management in the banking system and to maintain the existing

levels of minimum reserve requirement ratios on both leu- and foreign currency-denominated liabilities of

credit institutions, reiterating that their harmonisation with European levels over the medium term will

carry on gradually, at an appropriate pace and time, conditional on the economic and financial

environment domestically and externally.

These decisions help attain the overriding objective of preserving medium-term price stability as well as

financial stability, together with paving the way for balanced and lasting economic growth.

In this context, the consistent implementation of an adequate macroeconomic policy mix, in line with the

provisions of the external financing arrangements, and the resumption, by observing prudential rules, of

financial intermediation in parallel with an appropriate remuneration of bank deposits, conducive to

fostering domestic saving, are pivotal to consolidating favourable prospects for the Romanian economy,

thereby enhancing its resilience to external shocks.

The NBR monitors closely the domestic and global economic developments so as, by calibrating the

monetary policy conduct and making adequate use of its available tools, to maintain medium-term price

stability and preserve financial stability.

The new quarterly Inflation Report will be presented to the public in a news conference on 6 August 2014.

According to the approved calendar, the next NBR Board meeting dedicated to monetary policy issues is

scheduled for 30 September 2014.

Reserve Bank of Australia :

Statement by Glenn Stevens, Governor: Monetary Policy Decision

At its meeting today, the Board decided to leave the cash rate unchanged at 2.5 per cent.

Growth in the global economy is continuing at a moderate pace, helped by firmer conditions in the

advanced countries. China's growth remains generally in line with policymakers' objectives. Commodity

prices in historical terms remain high, but some of those important to Australia have declined this year.

Financial conditions overall remain very accommodative. Long-term interest rates and risk spreads remain

very low. Emerging market economies are receiving capital inflows. Volatility in many financial prices is

currently unusually low. Markets appear to be attaching a very low probability to any rise in global interest

rates, or other adverse event, over the period ahead.

In Australia, growth was firmer around the turn of the year, but this resulted mainly from very strong

increases in resource exports as new capacity came on line; smaller increases in such exports are likely in

coming quarters. Moderate growth has been occurring in consumer demand. A strong expansion in

housing construction is now under way. At the same time, resources sector investment spending is starting

to decline significantly. Signs of improvement in investment intentions in some other sectors are emerging,

but these plans remain tentative as firms wait for more evidence of improved conditions before

committing to significant expansion. Public spending is scheduled to be subdued. Overall, the Bank still

expects growth to be a little below trend over the year ahead.

There has been some improvement in indicators for the labour market this year, but it will probably be

some time yet before unemployment declines consistently. Recent data showed an increase in inflation,

with both headline and underlying measures affected by the decline in the exchange rate last year. But

growth in wages has declined noticeably and is expected to remain relatively modest over the period

ahead, which should keep inflation consistent with the target even with lower levels of the exchange rate.

Monetary policy remains accommodative. Interest rates are very low and for some borrowers have

continued to edge lower over recent months. Savers continue to look for higher returns in response to low

rates on safe instruments. Credit growth has picked up a little, including most recently to businesses. The

increase in dwelling prices has been slower this year than last year, though prices continue to rise. The

exchange rate remains high by historical standards, particularly given the declines in key commodity prices,

and hence is offering less assistance than it might in achieving balanced growth in the economy.

Looking ahead, continued accommodative monetary policy should provide support to demand and help

growth to strengthen over time. Inflation is expected to be consistent with the 23 per cent target over the

next two years.

In the Board's judgement, monetary policy is appropriately configured to foster sustainable growth in

demand and inflation outcomes consistent with the target. On present indications, the most prudent

course is likely to be a period of stability in interest rates.

Reserve Bank Of India :

Monetary and Liquidity Measures

On the basis of an assessment of the current and evolving macroeconomic situation, it has been decided

to:

keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 8.0 per cent;

keep the cash reserve ratio (CRR) of scheduled banks unchanged at 4.0 per cent of net demand and

time liabilities (NDTL);

reduce the statutory liquidity ratio (SLR) of scheduled commercial banks by 50 basis points from

22.5 per cent to 22.0 per cent of their NDTL with effect from the fortnight beginning August 9, 2014;

and

continue to provide liquidity under overnight repos at 0.25 per cent of bank-wise NDTL and

liquidity under 7-day and 14-day term repos of up to 0.75 per cent of NDTL of the banking system.

Consequently, the reverse repo rate under the LAF will remain unchanged at 7.0 per cent, and the marginal

standing facility (MSF) rate and the Bank Rate at 9.0 per cent.

Assessment

2. Since the second bi-monthly monetary policy statement of June 2014, global economic activity has been

picking up at a modest space from a sharp slowdown in Q1. Investor risk appetite has buoyed financial

markets, partly drawing strength from assurances of continuing monetary policy support in industrial

countries. Portfolio flows to emerging market economies (EMEs) have risen strongly. This implies, however,

that EMEs remain vulnerable to changes in investor risk appetite driven by any reassessment of the future

path of US monetary policy or possible escalation of geopolitical tensions.

3. Sentiment on domestic economic activity appears to be reviving, with incoming data suggesting a firming

up of industrial growth and exports. The June round of the Reserve Banks industrial outlook survey also

points to improvement in business expectations in Q2. Leading indicators of the services sector are mixed,

although there are early signs of modest strengthening of corporate sales and business flows. While the

initial slow progress of the monsoon and its uneven spatial distribution raised serious concerns regarding

agricultural production, these have been mitigated, though not entirely dispelled, by the pick-up in the

monsoon through much of the country in July. The implementation of government policy actions that have

been announced should create a congenial setting for a steady improvement in domestic demand and

supply conditions.

4. Retail inflation measured by the consumer price index (CPI) has eased for the second consecutive month

in June, with a broad-based moderation accompanied by deceleration in momentum. Higher prices of

vegetables, fruits and protein-based food items were offset by the muted increase in the prices of non-

food items, particularly those of household requisites and transport and communication. CPI inflation

excluding food and fuel decelerated further, extending the decline that began in September 2013.

However, with some continuing uncertainty about the path of the monsoon, it would be premature to

conclude that future food inflation, and its spill-over to broader inflation, can be discounted.

5. Liquidity conditions have remained broadly stable, barring episodic tightness on account of movements

in the cash balances of the Government maintained with the Reserve Bank. While the systems recourse to

liquidity from the LAF, and regular and additional term repos has been around 1.0 per cent of the NDTL of

banks, access to the MSF has been minimal and temporary. In order to manage transient liquidity pressures

associated with tax outflows and sluggish spending by the Government, the Reserve Bank injected

additional liquidity aggregating over ` 940 billion through nine special term repos of varying maturities

during the months of June and July. Despite the reduction in the export credit refinance effected in early

June, average utilisation of the facility has only been around 70 per cent of the available limit. The Reserve

Bank will review existing liquidity arrangements and continue to monitor and manage liquidity to ensure

adequate flow of credit to the productive sectors.

6. With the buoyancy in export performance sustained through Q1, the trade deficit has narrowed from its

level a year ago. While oil imports rose in June partly on higher international crude prices, gold import

growth picked up in response to some liberalization of import restrictions, and non-oil non-gold import

growth has turned positive since May. Turning to external financing, all categories of capital flows have

been buoyant. Surges in capital inflows in excess of the current account financing requirement and the

repayment of swaps by oil marketing companies have bolstered international reserves.

Policy Stance and Rationale

7. The moderation in CPI headline inflation for two consecutive months, despite the seasonal firming up of

prices of fruits and vegetables since March, is due to both base effects and the steady deceleration in CPI

inflation excluding food and fuel. The recent fall in international crude prices, the benign outlook on global

non-oil commodity prices and still-subdued corporate pricing power should all support continued

disinflation, as should measures undertaken to improve food management. There are, however, upside

risks also, in the form of the pass-through of administered price increases, continuing uncertainty over

monsoon conditions and their impact on food production, possibly higher oil prices stemming from geo-

political concerns and exchange rate movement, and strengthening growth in the face of continuing supply

constraints. Accordingly, the upside risks to the target of ensuring CPI inflation at or below 8 per cent by

January 2015 remain, although overall risks are more balanced than in June (Chart 1). It is, therefore,

appropriate to continue maintaining a vigilant monetary policy stance as in June, while leaving the policy

rate unchanged.

8. Prospects for reinvigoration of growth have improved modestly. The firming up of export growth should

support manufacturing and service sector activity. If the recent pick-up in industrial activity is sustained in

an environment conducive to the revival of investment and unlocking of stalled projects, with ongoing

fiscal consolidation releasing resources for private enterprise, external demand picking up and

international crude prices stabilising, the central estimate of real GDP growth of 5.5 per cent within a likely

range of 5 to 6 per cent that was set out in the April projection for 2014-15 can be sustained. On the other

hand, if risks relating to the global recovery, the monsoon and geo-political tensions intensify, the balance

of risks could tilt to the downside (Chart 2).

9. The Reserve Bank will continue to monitor inflation developments closely, and remains committed to

the disinflationary path of taking CPI inflation to 8 per cent by January 2015 and 6 per cent by January

2016. While inflation at around 8 per cent in early 2015 seems likely, it is critical that the disinflationary

process is sustained over the medium-term. The balance of risks around the medium-term inflation path,

and especially the target of 6 per cent by January 2016, are still to the upside, warranting a heightened

state of policy preparedness to contain these risks if they materialise. In the months ahead, government

actions on food management and to facilitate project completion should improve supply, but as consumer

and business confidence pick up, aggregate demand will also strengthen. The Reserve Bank will act as

necessary to ensure sustained disinflation.

10. In the second bi-monthly monetary policy statement of June 2014, the Reserve Bank reduced the SLR to

22.5 per cent of NDTL in anticipation of recovery in economic activity. With the Union Budget for 2014-15

renewing commitment to the medium-term fiscal consolidation roadmap and budgeting 4.1 per cent of

GDP as the fiscal deficit for the year, space has opened up further for banks to expand credit to the

productive sectors in response to its financing needs as growth picks up. Accordingly, the SLR is reduced by

a further 0.5 per cent of NDTL.

11. In consonance with the calibrated reduction in the SLR, it is necessary to enhance liquidity in the money

and debt markets so that financial intermediation expands apace with a growing economy. Currently,

banks are permitted to exceed the limit of 25 per cent of total investments under the held to maturity

(HTM) category provided the excess comprises only SLR securities, and banks total holdings of SLR

securities in the HTM category is not more than 24.5 per cent of their NDTL as on the last Friday of the

second preceding fortnight. In order to enable banks greater participation in financial markets, this ceiling

is being brought down to 24 per cent of NDTL with effect from the fortnight beginning August 9, 2014.

12. The Reserve Bank has taken a number of steps to enhance efficiency, increase entry, speed up

resolution, and improve access to financial services, such as modified regulations on long term lending and

borrowing, proposals for licensing payment banks and small banks, a framework to deal with stressed

assets, actions to further the use of mobile phones in banking, and efforts to simplify know your customer

(KYC) norms, among others. The Reserve Bank will continue to carry forward its banking sector reforms

agenda.

13. The fourth bi-monthly monetary policy statement is scheduled on Tuesday, September 30, 2014.

Bank Of Zambia :

GOVERNORS MONETARY POLICY STATEMENT 5TH AUGUST 2014

The Monetary Policy Committee (MPC) met today, 5th August 2014, to consider developments in the

domestic economy over the second quarter of the year. The MPC now meets on a quarterly basis and

following the meeting, issues a statement outlining its deliberations and its policy decision in order to

enhance transparency. The Bank of Zambias mandate is to maintain price and financial system stability

that supports balanced economic development. In its deliberations, the MPC considered recent

developments in the global economy and the possible ramifications of these developments on our

economy and the Central Banks ability to achieve its core objective of maintaining price stability.

GLOBAL ECONOMIC DEVELOPMENTS

Global economic growth continues to proceed at a moderate pace. The underlying strength appears to be

emanating from the USA and the UK economies. However, monetary policy easing measures undertaken

by their central banks are likely to be terminated by year end. Growth in Europe remains challenging

outside Germany, and this is compounded by geopolitical events in Europe, specifically in Ukraine and the

middle-east. Growth is likely to remain low and the recovery long. Global commodity prices are likely to be

impacted by the developments in Europe and the Middle-East, although the extent and direction of this

impact remains unclear at the current time. Underlying demand for commodities may remain supported,

however, by the growth in China, which is unlikely to slip below 7% as earlier feared.

MONETARY POLICY

Monetary policy over the second quarter of the year was challenging. Inflationary pressures were

persistent and these were compounded by excessive volatility in the foreign exchange market. Measures

taken to tighten monetary policy in April 2014, by upward adjustments in the policy rate to 12% and raising

of the statutory reserve ratio from 8% to 14%, had to be augmented at the end of May. Specifically, the

Bank of Zambia extended the application of statutory reserve ratios to Government and other deposits not

already subject to the reserve ratio. In addition, the penal rate on the overnight lending facility was raised

and access limited to once a week. Finally, the maintenance of statutory reserves by commercial banks was

tightened from a weekly average to a daily average basis.

In implementing the additional measures at the end of May, the Bank of Zambia was mindful of the fact

that the significant tightening in liquidity would have an impact on the interbank rates, but the primary

objective was to support price stability by arresting the excessive depreciation in the exchange rate. Indeed

in subsequent communications, we indicated that as stability returned to the foreign exchange market, we

would reassess these measures whilst taking into account wider developments in the economy. In this

regard, the measures the Bank of Zambia implemented have been successful in restoring relative stability

in the foreign exchange market and in the financial sector in general. In July, the Bank of Zambia was able

to begin the process of easing the tight liquidity conditions in a gradual manner. In its deliberations, the

MPC therefore, has taken into account this relative stability and assessed developments in the wider

economy in determining the appropriate monetary policy stance going forward.

INFLATION

Inflationary pressures appear to have stabilized between June and July, 2014. During the second quarter,

annual inflation rose to 7.9% in June from 7.7% in March, 2014 with both food and non-food inflation

rising. Food inflation rose to 7.8% from 7.6% having risen to 8% in May. Non-food inflation rose to 8.0% in

June form 7.8% in March. In July, annual inflation marginally rose to 8.0%. However, annual food inflation

fell from 7.8% in June to 6.9% in July, whilst non-food inflation rose from 8.0% in June to 9.2% in July. The

Committee noted, however, that the increase in non-food inflation was to a large extent driven by the

increase in the Housing, Water, Electricity, Gas and Other fuels component of the consumer price index.

This in turn was largely due to the rise in electricity tariffs effected in July as ZESCO looks to migrate to cost

reflective tariffs that support increased investment in power generation and transmission.

Over the third quarter the upside risks to inflation include the second round effects of the upward revision

in electricity tariffs, the lagged effects of the depreciation in the exchange rate, particularly over the second

quarter, and the upward adjustment in the FRA maize floor price from K65 to K70. Downside risks to

inflation largely relate to the seasonal decline in food prices, exemplified by the record maize harvest as

well as the stabilization in the exchange rate which are expected to exert downward pressure on prices.

THE DOMESTIC MONEY MARKET AND GOVERNMENT SECURITIES

For much of the second quarter, money market liquidity was tight with the weighted interbank rate rising

to as high as 25% at the end of May from around 16% at end of March. Reflecting these tight conditions,

the overnight interbank rate remained significantly higher than the BoZ policy rate over the second quarter

of the year. One consequence of the higher interbank rates were that the wholesale funding costs for

banks also rose, putting pressures on lending margins and bank profitability. This was further compounded

by the rise in the Government security yield rates. The weighted average yield rate on Treasury bills and

Government bonds actually rose to 19.4% and 18.1% from 14.8% and 16.0%, respectively over the second

quarter. In July when pressures in the foreign exchange market receded, the Bank of Zambia was able to

ease liquidity in a measured way, by injecting liquidity into the banking system through Open Market

Operations. The result has been that the interbank rate has now fallen back to 14.5% from 25% in June,

easing the pressure on the wholesale funding costs for banks. At the end of June the stock of outstanding

Government securities registered a modest increase of 1.3% to K20.5 billion compared with K20.2 billion at

end March 2014. However, foreign investor holdings of Government securities declined by 5.9% to K1.2

billion from K1.3 billion. The decline was mainly attributed to maturities of securities during the quarter

which were not rolled-over. The modest increase in Government securities also reflects the fact that the

financing of the Government budget during the second quarter was within the budget projections.

DOMESTIC CREDIT AND INTEREST RATES

The growth in domestic credit and money supply, witnessed early in the year, eased at the end of the

second quarter. This reflected the stabilizing of conditions in the financial markets. Domestic credit fell by

22.1% to K24.8 billion from K31.9 billion in March 2014. This largely reflected a drop in credit to

Government following the receipt of the Eurobond proceeds. However, lending to private enterprises grew

by 9.3%. In terms of the provision of credit to the private sector, households (personal loans category)

continued to account for the largest share of outstanding credit of about 34.5% in June 2014 compared

with 34.8% in March 2014. The agricultural sector remained second at 17.6%, followed by Manufacturing

10.5%. The credit shares of these two sectors in March were 17.4% and 8.7%, respectively.

Broad money (M3), declined by 2.2% to K32.7 billion in June 2014 from K33.4 billion in March 2014 and

was 3.4% below the second quarter projected target of K33.8 billion. This largely reflected the 35.9%

contraction in Net Domestic Assets to K11.4 billion following the fall in lending to Government. The Net

Foreign Assets, however, increased by 36.3% to K21.2 billion, largely on account of the rise in the Bank of

Zambia foreign assets by 40.6%. Money supply growth excluding foreign currency deposits (M2), has,

however, fallen consistently throughout the quarter, partly reflecting a shift into foreign currency deposits.

Commercial banks nominal average lending rate rose by 1.7 percentage points to 18.7% in June 2014 from

17.0% in March 2014, partly due to the rise in the Bank of Zambia policy rate. In June, following the sharp

increase in the wholesale funding costs of commercial banks, the fixed margin between the policy rate and

the lending rates was adjusted upwards. Some banks subsequently adjusted upwards their lending rates.

The Bank of Zambia has subsequently eased liquidity conditions and the MPC has therefore also

deliberated on what the appropriate margin between the policy rate and the lending rates should be now

that liquidity conditions had eased. Deposits rates also edged upwards, with the 30-day deposit rate for

amounts exceeding K20,000 rising to 6.7% from 5.6% in March 2014. The average savings rate for amounts

not exceeding K20,000, however, remained unchanged at 3.5% in the quarter under review.

FOREIGN EXCHANGE MARKET AND THE EXTERNAL SECTOR

The foreign exchange market has stabilized with a significant reduction in volatility. Over the second

quarter the Kwacha depreciated by 2% to K6.26 against the US Dollar at the end of June from K6.10 per US

Dollar at the end of March. The Kwacha, however, crossed above K7 per US dollar at the end of May in

intra- day interbank trading, a depreciation of approximately 25% on a year to date basis. Following the

measures taken to tighten monetary policy, the Kwacha has subsequently shown relative stability at the

current level of K6.15 per US Dollar. During the second quarter, the real effective exchange rate

depreciated by 1.9% as reflected in the index, which rose to 106.07 in June 2014 from 104.12 recorded in

March 2014. This was largely driven by the 3.3% depreciation of the nominal effective exchange rate, of

which the South African rand and the Swiss franc accounted for 1.9 and 0.6 percentage points, respectively.

Preliminary data show that Zambia recorded a favourable Balance of Payments position, with an overall

BoP surplus of US $740.1 million compared with a surplus of US $8.4 million recorded during the first

quarter of 2014. This was driven by improvements in the financial account, largely attributed to the

sovereign bond proceeds, which compensated for unfavourable performance in the current account.

Zambia recorded current account deficit for the second consecutive quarter during the period under

review. However, Zambias trade balance remained positive over the second quarter, at US $330.6 million

compared to a trade balance of US $422.4 million during the first quarter of the year.

FISCAL POLICY

Fiscal performance improved in the second quarter of 2014. Preliminary data indicate that a central

Government fiscal deficit of K1.3 billion was recorded against the programmed deficit of K1.8 billion during

the second quarter of 2014, due to lower than programmed expenditure. Total revenue and grants were

K7.4 billion, hence 7.9% lower than the programmed amount of K8.1 billion. Total expenditure at K8.7

billion was 12.7% lower than programmed, mainly attributed to lower than programmed expenditure on

non-financial assets, use of goods and services as well as social benefits.

INDICATORS OF ECONOMIC ACTIVITY

Available indicators of economic activity suggest that the Government is on track in meeting its growth

objective for 2014, estimated at 6.5% using the rebased GDP. Most of the selected real sector development

indicators recorded tracked by the Monetary Policy Committee recorded higher output during the second

quarter of the year, particularly when assessed against developments in the corresponding quarter of

2013.

In the agricultural sector, the country continued to hold adequate maize stocks on the back of a bumper

harvest. However, the stock of maize grain held by the Food Reserve Agency (FRA) decreased by 20.3% to

343,581.3 mt from 431,130.0 mt at the end of March 2014 due to domestic sales. Copper output declined

by 2.5% to 276,075.0 mt from 283,042.3 mt in the first quarter. However, on a year-to-date basis, copper

production was 559,117.3 mt, 16.3% higher than the 480,892.6 mt produced in the first half of 2013.

Electricity generation increased by 3.1% to 3,509,053 Mwh in the second quarter 2014 from 3,403,077

Mwh during the first quarter. On a year-to-date basis, total electricity generation amounted to 6,912,130

Mwh in the first half of 2014, higher than the 6,601,175 Mwh generated in the first half of 2013.

In the manufacturing sector, production of soft drinks rose by 16.9% to 456,326.8 hectolitres in the second

quarter of 2014 from 390,501.0 in the first quarter. This output was 39.1% higher than the 327,996.6

hectolitres in the corresponding quarter in 2013. Similarly, production of mineral water increased by 38.7%

over the second quarter to 1,872,672 litres from 1,349,730 litres in the first quarter. This level of

production was 56.3% higher than the 1,197,984 litres produced in the second quarter of 2013

THE BANK OF ZAMBIA POLICY RATE

The measures taken by the Bank of Zambia during the second quarter in tightening monetary policy are

beginning to bear the intended results. However, inflationary pressures remain and, therefore, the

Monetary Policy Committee decided to maintain the policy rate at the current level of 12%.

The stabilization of the financial sector provides an opportunity for the Bank of Zambia to normalise money

market conditions. The measures taken to supply liquidity to the market through open market operations

have now seen the interbank rate fall to 14.5%. The wholesale funding costs rose sharply during the second

quarter, and the Bank of Zambia adjusted the effective interest rate margin which raised the lending rate

ceiling to 28% from 21%. With the interbank rate having returned to levels consistent with the policy rate,

the maximum annual effective lending rate ceiling has been adjusted down to 24% from 28%.

Statutory reserve ratios remain unchanged at 14%. However, the Bank will continue to monitor the

liquidity conditions in the market and stands ready to provide further support to the market should this be

required, including through the reduction of the statutory reserve ratios.

The Bank is further determined to ensure that it maintains price and financial system stability as the best

way of supporting the investment and growth of the economy. In this regard, the Bank will take

appropriate measures when this stability is challenged or under threat.

The next meeting of the monetary policy committee will be held on Friday 21 November, 2014.

Bank Of Thailand :

Monetary Policy Committees Decision on 6 August 2014

Mr. Paiboon Kittisrikangwan, Secretary of the Monetary Policy Committee (MPC), announced the outcome

of the meeting on 6 August 2014 as follows.

The global economy continued to improve steadily. The US economy grew at a firmer pace from

accelerating domestic demand and stronger labour market. The euro area and Japan recovered slowly,

entailing continued accommodative monetary policy. Growth in China and Asia stabilized on the back of

improving exports to major economies. Some central banks in the region have begun to raise policy

interest rates in light of domestic developments.

The Thai economy showed signs of improvements in the second quarter of 2014, from private spending

following the political resolution. Exports recovered modestly, while public spending fell slightly short of

previous assessment. In the second half of the year, firmer domestic demand and fiscal policy, particularly

public investment, should lend further impetus to growth recovery. Exports of goods and tourism are

expected to expand at a subdued pace. Inflationary pressure remains contained.

The committee judges that current accommodative monetary policy remains appropriate in supporting

economic recovery. The policy stance is deemed consistent with longterm financial stability, which should

complement governments reform efforts to lift the economys potential growth. The committee thus

voted unanimously to maintain the policy rate at 2.00 percent per annum.

Bank Of England :

Minutes of the Monetary Policy Committee Meeting held on 6 and 7 August 2014

The Governor invited the Committee to vote on the propositions that:

Bank Rate should be maintained at 0.5%;

The Bank of England should maintain the stock of purchased assets financed by the

issuance of central bank reserves at 375 billion.

Regarding Bank Rate, seven members of the Committee (the Governor, Ben Broadbent, Jon Cunliffe, Nemat Shafik,

Kristin Forbes, Andrew Haldane and David Miles) voted in favour of the proposition.

Ian McCafferty and Martin Weale voted against the proposition, preferring to increase Bank Rate by 25 basis points.

Regarding the stock of purchased assets, the Committee voted unanimously in favour of the proposition.

European Central Bank :

Monetary policy decisions 7 August 2014 -

At todays meeting the Governing Council of the ECB decided that the interest rate on the main refinancing

operations and the interest rates on the marginal lending facility and the deposit facility will remain

unchanged at 0.15%, 0.40% and -0.10% respectively.

The President of the ECB will comment on the considerations underlying these decisions at a press

conference starting at 2.30 p.m. CET today.

National Bank of Serbia :

Key Policy Rate Stays at 8.5 Percent

At its meeting today, the NBS Executive Board voted to keep the key policy rate at 8.5%.

Y-o-y inflation is moving below the lower bound of the target tolerance band and is expected to return

within the target band by the year-end. Such movements are attributable to low inflationary pressures,

reflecting mainly low aggregate demand and the continuing disinflationary impact of prices of primary

agricultural commodities, relative stability of the dinar exchange rate and inflation expectations.

However, considering the expected depletion of effects of low food prices and the risks that may adversely

affect economic developments at home in the coming period, the NBS Executive Board decided to keep the

key policy rate on hold.

In taking the decision, the NBS Executive Board also took into account the persistent uncertainties

emanating from the international environment, which may negatively impact the countrys risk premium

and foreign capital flows. The risks of further heightening of geopolitical tensions also relate to the

postponement or slowdown of the initiated economic recovery of euro area. The NBS Executive Board

expects that consistent implementation of fiscal consolidation measures and structural reforms in the

period ahead may contribute to the alleviation of external risks.

At its meeting today, the NBS Executive Board adopted the August Inflation Report, to be presented at the

press conference on Wednesday, 13 August.

The next rate-setting meeting is scheduled for 11 September 2014.

Governors Office

07.08.2014

Central Bank of The Gambia

Since the previous meeting of the Monetary Policy Committee (MPC), the International Monetary Fund

(IMF) has revised global growth projections for 2014 from 3.7 percent to 3.0 percent. The earlier optimism

of robust US growth of around 3.0 percent in 2014 has been revised downwards following the 2.1 percent

contraction in economic activity in the first quarter partly due to temporary factors such as the slowdown

in inventory investment, the expiration of some fiscal measures at the beginning of 2014 and severe winter

weather.

Growth in advanced economies is forecast at 1.8 percent in 2014, higher than the 1.3 percent in 2013.

Economic activity in the Euro zone continues to expand, albeit modestly. Growth was uneven with

economic expansion in Germany offset by contraction in many other countries in the region. Growth is

expected to strengthen to 1.1 percent in 2014 and 1.5 percent in 2015. The outlook for emerging market

economies remains relatively subdued. The Chinese economy is expected to grow by 7.4 percent, the

weakest pace since 2009. In other emerging economies, activity is weighed down by political uncertainty

and tightening financial conditions. The outlook is for a modest 4.6 percent growth in 2014.

The GDP growth for Sub-Saharan Africa is projected at 5.4 percent from 4.8 percent in 2013, premised on

improved agricultural production, increased private consumption and expansion in commodity related

projects.

Global inflation remains benign in advanced economies, although the risk of deflation in the Euro zone

persists reflecting the combination of the substantial output gap, the decline in the prices of commodities,

especially fuels and food and low inflation expectations. In emerging markets and developing economies,

inflation is expected to decline from about 6 percent in 2014 to about 5 percent in 2015. To the extent

that the decline in global commodity prices should help reduce price pressures, this reduction is more than

offset by recent exchange rate depreciations in a number of emerging and developing countries, including

The Gambia.

Global crude oil prices have fluctuated in recent months reflecting mainly geopolitical developments. Year-

to-date, oil prices averaged US$105.3 per barrel, slightly higher than the average of US$105.09 per barrel a

year earlier. The FAO Food Price Index averaged 206 points in 2014, 6 points lower than in June 2013. The

decline was the third in succession and was largely the result of marked drop in cereal and vegetable oil

prices.

The Domestic Economy

Growth

The growth outlook for the Gambian economy has moderated since the previous meeting of the MPC.

Owing to uncertainties surrounding agricultural production due to the prospects of inadequate rainfall, real

GDP is projected at 5.3 percent in 2014, slightly lower than the 5.6 percent in 2013 and the earlier forecast

of between 6.06.5 percent. Agriculture value-added is forecast to increase by 12.5 percent, industry (2.9

percent) and services (3.6 percent).

Money and Banking Sector Developments

In the year to end-June 2014, money supply grew by 8.1 percent, lower than the 14.8 percent a year ago

and the target of 15.0 percent. The deceleration in the growth of money supply was mainly the result of

slower pace of expansion of the net domestic assets (NDA) and the contraction in the net foreign assets

(NFA) of the banking system. The NDA rose to D13.6 billion, or 12.6 percent, but lower than the growth

rate of 15 percent a year earlier. The NFA contracted to D4.95 billion, or 2.5 percent.

Reserve money, the Banks operating target increased to D5.78 billion, or 19.7 percent. Although reserve

money growth was above the target of 13.5 percent, it was lower than the strong expansion of 26.4

percent a year earlier. The decrease in the pace of expansion of reserve money was mainly the result of the

contraction in the NFA of the Central Bank by 8.4 percent compared to the robust growth of 21.4 percent a

year ago. The NDA of the Central Bank, on the other hand, increased significantly to D2.5 billion, or 97.2

percent. Central Bank net claims on government rose from D1.3 billion in June 2013 to D2.2 billion in June

2014.

The banking sector remains fundamentally sound. Recent data indicate that capital and reserves increased

to D3.45 billion in June 2014, or 16.2 percent from June 2013. The risk-weighted capital adequacy ratio

averaged 35.1 percent, higher than the minimum requirement of 10.0 percent. All the banks met the

capital adequacy requirement.

Total assets increased to D25.57 billion, or 14.2 percent from a year earlier. Gross loans and advances,

which accounted for 23.4 percent of total assets, decreased to D5.97 billion, or 2.3 percent from June 2013.

Private sector credit, net of provisions declined from D4.42 billion in June 2013 to D4.09 billion in June

2014. The non-performing loans (NPL) ratio increased from 11.3 percent in June 2013 to 16.0 percent in

June 2014. Deposit liabilities totaled D15.15 billion in June 2014, higher than the D14.28 billion in June

2013.

The industry recorded a net income of D197.0 million in the first six months of 2014 compared to D80.6

million in the corresponding period in 2013. The return on assets was 3.3 percent and return on equity

(21.3 percent) compared to 1.7 percent and 10.8 percent respectively in the first half of 2013.

In the year to end-June 2014, the domestic debt rose to D14.7 billion, or 29.3 percent from a year earlier.

Treasury bills and Sukuk-Al Salaam bills, accounting for 82.4 percent and 4.0 percent of the domestic debt

stock, increased by 36.1 percent and 50.1 percent respectively.

Yields in all the maturities rose reflecting in the main the tight monetary policy stance. The yield on the

91-day, 182-day and 364-day bills increased from 12.40 percent, 13.44 percent and 14.54 percent in June

2013 to 14.31 percent, 15.95 percent and 18.12 percent respectively in June 2014. The weighted average

interbank rate also increased from 10.45 percent in June 2013 to 14.54 percent in June 2014.

Government Fiscal Operations

Provisional data on Government fiscal operations for the first half of 2014 indicate that total revenue and

grants increased to D4.12 billion (22 percent of GDP), or 26.0 percent from the corresponding period in

2013. The outturn was also higher than the target of D4.10 billion (21.0 percent of GDP). Domestic

revenue, comprising tax and non-tax revenue, amounted to D3.16 billion, higher than the D2.82 billion in

the first half of 2013 and the target of D3.14 billion attributed mainly to the 14.0 percent increase in tax

revenue. Non-tax revenue, on the other hand, rose by only 2.0 percent.

Expenditure and net lending totaled D4.9 billion (26 percent of GDP), higher than the outturn of D4.2

billion (25 percent of GDP) and the projection of D4.83 billion. Current and capital expenditure rose to D3.3

billion and D1.5 billion compared to D3.0 billion and D1.2 billion respectively in the corresponding period in

2013.

The overall budget balance (including grants) recorded a deficit of D778.5 million (4.0 percent of GDP)

which was financed by both domestic and foreign sources.

External Sector Developments

Provisional balance of payments estimates indicate an overall surplus of US$10.12 million in the first

quarter of 2014, higher than the deficit of US$4.70 million in the corresponding quarter in 2013. The

current account deficit widened from US$16.70 million in the first quarter of 2013 to US$19.41 million in

the quarter under review. Of the components of the current account, the goods account deficit narrowed

to US$37.30 million compared to a deficit of US$44.5 million in the same period in 2013. Merchandise

exports rose to US$41.1 million, or 101.4 percent. Total imports also rose to US$87.9 million, but at a

slower pace of 25.0 percent.

The surplus in the services account and the transfers account narrowed to US$12.8 million and US$13.5

million compared to US$17.7 million and US$16.0 million respectively in the corresponding quarter in 2013.

Furthermore, the deficit in the income account widened from US$5.9 million to US$8.4 million during the

same period. The capital and financial account, on the other hand, recorded increased surplus from

US$11.97 million to US$29.54 million in the first quarter of 2014.

At end-June 2014, gross international reserves totaled US$163.5 million, equivalent to 4.0 months of

import cover compared to US$176.06 million, or 4.8 months of import cover a year ago.

Volume of transactions in the foreign exchange market decreased to US$1.33 billion in the year to end-July

2014, or 10.7 percent from a year earlier. In the year to end-June 2014, the Dalasi depreciated against the

US Dollar by 19.4 percent, Euro (20.8 percent) and Pound Sterling (30.5 percent).

Inflation Outlook

Consumer price inflation, measured by the National Consumer Price Index (NCPI), declined to 5.4 percent

in June 2014, from 5.8 percent in June 2013. Both food and non-food inflation decelerated to 6.2 percent

and 4.4 percent respectively from 6.8 percent and 4.6 percent in June 2013 respectively. However, core

inflation, which excludes the prices of volatile food items and energy, accelerated to 5.5 percent in June

2014 from 3.8 percent a year earlier.

At the last MPC meeting in May 2014, the MPC decided to leave the policy rate unchanged having

assessed the policy stance to be appropriate.

Monetary policy is forward looking because policy actions take time to work their way through the

economy and have their full effect on inflation.

Although headline inflation trajectory has not deteriorated, the MPC sees the risks to the inflation outlook

to be skewed to the upside. Apart from weather-related risks, the sharp depreciation of the Dalasi is

expected to put upward pressure on inflation as higher import prices would pass-through to domestic

consumer prices. In addition, readings of the latest private sector business sentiment survey indicate

heightened inflationary expectations which could affect the price behaviour of agents in the economy.

Decision

Against this backdrop, the MPC has decided to increase the policy rate by 2.0 percentage points to 22.0

percent. The MPC would continue to monitor price developments and take appropriate action.

Central Reserve Bank Of Peru :

MONETARY PROGRAM FOR AUGUST 2014

BCRP MAINTAINED THE REFERENCE INTEREST RATE AT 3.75%

1. The Board of the Central Reserve Bank of Peru approved to maintain the monetary policy reference rate

at 3.75 percent. This level of the reference rate is compatible with an inflation forecast according to which

inflation will converge to the target range in 2014 and to 2.0 percent in 2015. This forecast takes into

account that: i) inflation expectations remain anchored within the inflation target range; ii) GDP continues

to show lower growth rates than the countrys potential level of growth, which is expected to be a

temporary situation; iii) recent indicators show signals of recovery in the U.S. economy, and iv) the supply

factors that led inflation to increase are moderating at a slower pace than expected.

2. Inflation in July showed a rate of 0.43 percent, as a result of which inflation in the last 12 months fell

from 3.45 percent in June to 3.33 percent in July. The rate of inflation excluding food and energy was 0.24

percent, as a result of which the rate of inflation in the last 12 months fell from 2.77 percent in June to 2.73

percent in July. Inflation is forecast to remain initially close to the upper band of the target range due to

the persistent effect of the supply shocks and to converge thereafter to the 2 percent target.

3. Current and advanced indicators of activity continue to show a weaker economic cycle than the one

expected, with lower GDP growth rates than the potential output due mainly to the lower dynamism

observed in investment and exports.

4. The Board oversees the inflation forecasts and inflation determinants, and will implement additional

monetary easing measures if it is necessary.

5. The Board of the Central Bank also approved to maintain the annual interest rates on lending and

deposit operations in domestic currency (not included in auctions) between the BCRP and the financial

system, as described below:

a. Overnight deposits: 2.55 percent.

b. Direct repos and rediscount operations: 4.55 percent.

c. Swaps: a commission equivalent to a minimum annual effective cost of 4.55 percent.

6. The Monetary Program for September will be approved on the Boards meeting of

September 11, 2014.

The Central Bank of Armenia :

Lowered the refinancing rate by 0.25 percentage points, 6.75% 2014 On August 12, the Central Bank has

decided to reduce refinancing rate by 0.25 percentage point to 6.75%. 2014 July recorded a 0.9% drop from

the previous year. 0.4% increase for the month, while the 12-month inflation rate has decreased to 0.4%

The Board believes that the 12-month inflation in the coming months. Gradually increase in 2015. The first

quarter is expected to stabilize its target indicator surroundings.

The Board notes that geopolitical developments the external sector increased uncertainties

associated with partner economic prospects, but external significant inflationary pressures are expected.

The Council estimates that in 2014.

The second quarter was maintained weak domestic and foreign demand, which contributed to the

low level of inflation formation: August Energy Prices and fourth Quarter of a number of products on the

introduction of compulsory labelling expand somewhat inflationary environment, however, short-term part

of the 12-month inflation still remain below the end of the year the target index, the lower the allowable

variation border monetary policy easing, combined with 2014.

The second half of the expected expansionary fiscal policy, will lead to the expansion of aggregate

demand and inflation rates during the restoration of 2015. However, the Board noted that the external and

internal further adjustments are possible depending on economic developments Monetary policy

directions, providing inflation purpose forecast horizon. Interest rate decisions are based on detailed

information can be published on 22 August Inflation report (2014 monetary policy in the third quarter of

the program).

Reported, the source is required. CBA press service tel / fax. 56 37 61 e-mail. mcba@cba.am

PRESS RELEASE 12.08.2014

The Bank of Korea :

The Monetary Policy Committee of the Bank of Korea decided today to lower the Base Rate by 25 basis

points, from 2.50% to 2.25%.

Based on currently available information the Committee considers that, although the trend of economic

recovery in the US has been sustained, the euro area economic recovery still appears weak, while trends of

economic growth in emerging market countries have differed from country to country. The Committee

forecasts that the global economy will sustain its modest recovery going forward, centering around

advanced economies, but judges that the possibility exists of its being affected by the changes in global

financial market conditions stemming from the shift in the US Federal Reserves monetary policy stance, by

the weakening of economic growth in some emerging market countries and by geopolitical risks.

In Korea, exports have maintained their buoyancy but the Committee judges that improvements in

domestic demand, which had contracted due mainly to the impacts of the Sewol ferry accident, have been

insufficient, and that the consumption and investment sentiments of economic agents also continue to

show sluggishness. On the employment front, the scale of increase in the number of persons employed has

expanded in line with increases in the 50-and-above age group and in the service sector. The Committee

expects that the negative output gap in the domestic economy will gradually narrow going forward,

although its pace of narrowing will be moderate.

Consumer price inflation fell from 1.7% the month before to 1.6% in July, due mainly to increases in the

extents of decline in the prices of agricultural and petroleum products. Core inflation excluding agricultural

and petroleum product prices rose slightly to 2.2%, from 2.1% in June. The Committee forecasts that

inflation will gradually rise, but judges that for the time being inflationary pressures will not be high.

Housing prices in the country excluding Seoul and its surrounding areas showed a slight upward

movement, while leasehold deposit prices both in Seoul and its surrounding areas and in the rest of the

country continued their modest uptrends. In the domestic financial markets, after having risen

substantially owing chiefly to the governments announcement of economic policies, stock prices have

fallen back somewhat due for example to geopolitical risks. The Korean won has depreciated under the

influence of the US dollars strength globally, and long-term market interest rates have fallen. Looking

ahead, the Committee will conduct monetary policy so as to keep consumer price inflation within the

inflation target range over a medium-term horizon while supporting the recovery of economic growth. In

this process it will closely monitor external risk factors such as shifts in major countries monetary policies,

changes in economic agents sentiment and movements of future economic indicators including the

household debt trend, while observing the effects of this months Base Rate cut and the governments

economic policies.

Indonesias Central Bank :

It was decided at the Board of Governors Meeting, convened on 14th August 2014, to hold the BI rate at a

level of 7.50%, with the lending facility and deposit facility rates maintained at 7.50% and 5.75%

respectively. Such policy is consistent with efforts to guide inflation towards its target corridor of 4.51% in

2014 and 4.01% in 2015, as well as reduce the current account deficit to a more sustainable level. Bank

Indonesia acknowledges the ongoing economic rebalancing process, underpinned by tenacious

macroeconomic stability, as corroborated by moderating domestic demand and falling inflation despite a

burgeoning current account deficit in line with seasonal trends during the second quarter of 2014. Looking

ahead, there remain a number of external and domestic risk factors that demand vigilance due to their

potential to undermine achievement of the inflation target and delay improvements in the current

account. To this end, Bank Indonesia will continue to strengthen its monetary and macroprudential policy

mix along with policies to bolster the structure of the domestic economy and manage external debt, in

particular corporate external debt. Furthermore, Bank Indonesia will also tighten policy coordination with

the Government with respect to controlling inflation and reducing the current account deficit in order to