Professional Documents

Culture Documents

Tata Steel Ratio Analysis

Uploaded by

cb3089Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tata Steel Ratio Analysis

Uploaded by

cb3089Copyright:

Available Formats

Company >> Finance >> Balance Sheet

Tata Steel Ltd

Industry :Steel - Large

(Rs in Crs)

Year

SOURCES OF FUNDS :

Share Capital

Reserves Total

Total Shareholders Funds

Hybrid Perpetual securities

Mar 13

Mar 12

971.41

971.41

54,238.27 51,245.05

55,209.68 52,216.46

2,275.00

2,275.00

Long Tem Borrowings

Deferred tax Liabilities

Other Long term liabilities

Long Term Provisions

Non Current Liabilities

23,565.57 21,353.20

1,843.74

970.51

380.87

298.03

2,113.42 1,851.30

27,903.60 24,473.04

Short term borrowings

Trade Payables

Othe current liabilities

Short term provisions

Current Liabilities

70.94

65.62

6,369.91 5,883.92

8,503.54 8,716.57

1,544.26 2,172.38

16,488.65 16,838.49

Total Liabilities

101,876.93 95,802.99

APPLICATION OF FUNDS :

Tangible assets

Intangible Assets

Capital Work in Progress

Fixed Assets

24,650.54 11,142.36

224.51

223.9

8,722.29 16,046.75

33,597.34 27,413.01

Investments

Long term loans and advances

Other Non Current Assets

49,984.80 49,078.35

6,574.15 6,301.08

190.04

190.98

Inventories

Trade Receivables

Cash and Bank

5,257.94

796.92

2,218.11

4,858.99

904.08

3,946.99

Loans and Advances

Current Investments

Other Current Assets

Current Assets, Loans & Advances

Total Assets

2,207.83 1,829.25

434.00 1,204.17

615.8

76.09

11,530.60 12,819.57

101,876.93 95,802.99

61010.35

Company >> Finance >> Profit & Loss

Tata Steel Ltd

Industry :Steel - Large

(Rs in Crs)

Year

INCOME :

Sales Turnover

Excise Duty

Net Sales

Other Income

Mar 13(12) Mar 12(12)

42,317.24

4,117.81

38,199.43

902.04

37,005.71

3,072.25

33,933.46

886.45

39,101.47

34,819.91

EXPENDITURE :

Raw Materials Consumed

Other Purchases

Changes in Inventorie

Employee Cost

Other Expenses

Interest

Depreciation

Less: Pre-operative Expenses Capitalised

9,877.40

453.34

-404.60

3,608.52

14,414.66

1,876.77

1,640.38

876.13

8,014.37

209.52

-220.72

3,047.26

11,824.49

1,925.42

1,151.44

478.23

Total Expenses

30,590.34

25,473.55

Profit Before Tax

Tax

7,836.60

2,773.63

9,857.35

3,160.93

Reported Net Profit

5,062.97

6,696.42

776.97

0

80

50.79

1,165.46

0

120

67.07

Total Income

Dividend

Preference Dividend

Equity Dividend %

Earnings Per Share-Unit Curr

Name of the Ratio

2013

2012

Short Term Solvency Ratio

Current Ratio

Quick Ratio

Cash Ratio

0.699305 0.761325

0.380423 0.472761

0.134523 0.234403

Long Term Solvency Ratio

Debt/Equity Ratio

Debt Ratio

Interest Coverage Ratio

Interest Coverage Ratio with dep

Debt Service Coverage Ratio

Equity Multiplier

0.426838

0.299149

5.175578

6.049622

0.408936

0.290245

6.119584

6.717604

1.845273 1.834728

Activity /Efficiency Ratios

Inventory Turnover Ratio

Inventory Holding Period (days)

Recievables Turnover Ratio

Debtors Collection Period (days)

Fixed Assets Turnover ratio

Total Assets turnover ratio

Profitability Ratios

Net Profit Ratio

ROE

ROA

EPS

Market Related Ratios

Price Earnings

Dividend Payout Ratio

Dupont Analysis (3 step)

ROE

Net Profit Ratio

Total Asset Turnover Ratio

Equity Multiplier

Dupont Analysis (5 step)

ROE

7.265094

49.55201

47.93383

7.510353

1.136978

0.374957

6.983645

51.54901

37.53369

9.591383

1.23786

0.3542

13.25%

9.17%

4.97%

50.28

19.73%

12.82%

6.99%

50.28

10.84626

9.17%

12.82%

13.25%

19.73%

0.374957

0.3542

1.845273 1.834728

9.17%

12.82%

Tax Retention rate

Interest Expense Rate

Operating Profit Rate

Total Asset Turnover Ratio

Equity Multiplier

0.646067 0.679333

0.806785 0.83659

0.25428 0.347232

0.374957

0.3542

1.845273 1.834728

You might also like

- CV Midterm Exam 1 - Solution GuideDocument11 pagesCV Midterm Exam 1 - Solution GuideKala Paul100% (1)

- Corporate Governance: A practical guide for accountantsFrom EverandCorporate Governance: A practical guide for accountantsRating: 5 out of 5 stars5/5 (1)

- 61 - 2004 Winter-Spring PDFDocument25 pages61 - 2004 Winter-Spring PDFGaro Ohanoglu100% (1)

- Credit ManualDocument100 pagesCredit Manualeimg200413330% (1)

- Toa Q3Document13 pagesToa Q3Rachel Leachon100% (1)

- Corporate Overview - Oxane PartnersDocument11 pagesCorporate Overview - Oxane PartnersSaubhagya SuriNo ratings yet

- @icmaifamily CA CMA Final SFM Theory NotesDocument156 pages@icmaifamily CA CMA Final SFM Theory NotesOmkar Pednekar100% (1)

- SALN Form 2019 ExampleDocument3 pagesSALN Form 2019 ExampleShaNe Besares100% (1)

- Escorts Kubota Limited FinalDocument23 pagesEscorts Kubota Limited FinalRidhi BagariNo ratings yet

- Nirc 1997Document160 pagesNirc 1997Charlie Magne G. SantiaguelNo ratings yet

- Wiley GAAP 2017: Interpretation and Application of Generally Accepted Accounting PrinciplesFrom EverandWiley GAAP 2017: Interpretation and Application of Generally Accepted Accounting PrinciplesNo ratings yet

- Sears Case AnalysisDocument2 pagesSears Case AnalysisAakash ShawNo ratings yet

- Balance Sheet 1.infosysDocument10 pagesBalance Sheet 1.infosysmoonlight3t31No ratings yet

- Afm AssignmentDocument11 pagesAfm Assignmentakansha mehtaNo ratings yet

- Ballance Sheet of Lucky Cement FactoryDocument9 pagesBallance Sheet of Lucky Cement FactoryTanvir Khan MarwatNo ratings yet

- Cma Format WcaDocument8 pagesCma Format Wcaabhishekbehal5012No ratings yet

- Financial AnalysisDocument39 pagesFinancial AnalysisniranjanaNo ratings yet

- Kfa Standalone Balance SheetDocument4 pagesKfa Standalone Balance Sheetkpatil.kp3750No ratings yet

- AccountsDocument6 pagesAccountshoney SoniNo ratings yet

- Balance SheetDocument6 pagesBalance Sheetranjitghosh684No ratings yet

- Comparative & Common Size Income & Balance SheetDocument20 pagesComparative & Common Size Income & Balance SheetAnil KumarNo ratings yet

- BHELDocument22 pagesBHELRam Krishna KrishNo ratings yet

- Balance Sheet As At: 38 Annual Report 2013-2014 108Document1 pageBalance Sheet As At: 38 Annual Report 2013-2014 108ankit singhNo ratings yet

- BS TataDocument18 pagesBS Tataitubanerjee28No ratings yet

- Balance Sheet of Tata Motors (In Rs. CR.) : Equity S Are Capita Reserves and Surp UsDocument7 pagesBalance Sheet of Tata Motors (In Rs. CR.) : Equity S Are Capita Reserves and Surp UsGaurav VarshneyNo ratings yet

- Balance Sheet of Future Group (Big Bazar)Document2 pagesBalance Sheet of Future Group (Big Bazar)NeilDuttaNo ratings yet

- Bv-Cia 1.2 526 - 646 - 674Document20 pagesBv-Cia 1.2 526 - 646 - 674Pevin KumarNo ratings yet

- Tamilnadu Petroproducts ltd-1Document10 pagesTamilnadu Petroproducts ltd-1celestial.shanksNo ratings yet

- Final JSWDocument20 pagesFinal JSWgomathi21100% (1)

- Tatasteel Inclass DiscusionDocument6 pagesTatasteel Inclass DiscusionADAMYA VARSHNEYNo ratings yet

- Tata MotorsDocument10 pagesTata MotorsGourav BainsNo ratings yet

- Balance Sheet of Arvind - in Rs. Cr.Document14 pagesBalance Sheet of Arvind - in Rs. Cr.Shashank PatelNo ratings yet

- L&T LTDDocument38 pagesL&T LTDRam Krishna KrishNo ratings yet

- Tata SteelDocument10 pagesTata SteelSakshi ShahNo ratings yet

- ICICI Bank - Consolidated Balance Sheet Banks - Private Sector Consolidated Balance Sheet of ICICI Bank - BSE: 532174, NSE: ICICIBANKDocument1 pageICICI Bank - Consolidated Balance Sheet Banks - Private Sector Consolidated Balance Sheet of ICICI Bank - BSE: 532174, NSE: ICICIBANKr79qwkxcfjNo ratings yet

- Balance SheetDocument1 pageBalance SheetBharat AroraNo ratings yet

- Particulars 31-3-2011 31-3-2012 Increase Decrease Current AssetsDocument25 pagesParticulars 31-3-2011 31-3-2012 Increase Decrease Current AssetsJithendar ReddyNo ratings yet

- Ashok LeylandDocument124 pagesAshok LeylandananndNo ratings yet

- 01 SKDM Draft - Recasted Balance - Sheet - 21.11.2012Document25 pages01 SKDM Draft - Recasted Balance - Sheet - 21.11.2012saifulcrislNo ratings yet

- 6189 Management Account ProjectDocument7 pages6189 Management Account ProjectGauri SalviNo ratings yet

- CompanyDocument19 pagesCompanyMark GrayNo ratings yet

- M&M Balance SheetDocument4 pagesM&M Balance SheetAkash SNo ratings yet

- Sushrut Yadav PGFB2156 IMDocument15 pagesSushrut Yadav PGFB2156 IMAgneesh DuttaNo ratings yet

- DLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)Document18 pagesDLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)AkshithKapoorNo ratings yet

- Square Textile S Limite D: Balance SheetDocument5 pagesSquare Textile S Limite D: Balance Sheetjeeji126No ratings yet

- 1 EcDocument1 page1 Ecmohammedaashik.f2022No ratings yet

- Accounts Term PaperDocument508 pagesAccounts Term Paperrohit_indiaNo ratings yet

- BSDocument2 pagesBSVRNo ratings yet

- In Crores: Consolidated Balance Sheet of Indian Oil CorporationDocument2 pagesIn Crores: Consolidated Balance Sheet of Indian Oil CorporationNikhil GangoliNo ratings yet

- Consolidated Balance SheetDocument2 pagesConsolidated Balance SheetSEHWAG MATHAVANNo ratings yet

- ..Balance Sheet and Profit & Loss Account Top 5 Cement Comapanies in India .Document14 pages..Balance Sheet and Profit & Loss Account Top 5 Cement Comapanies in India .Pranav JoshiNo ratings yet

- Aditya Aggarwal Metal, Metal Products & Mining Naveen Tanvi Nitin Ganapule 11020841151 Shruti Mehta 11020841110Document15 pagesAditya Aggarwal Metal, Metal Products & Mining Naveen Tanvi Nitin Ganapule 11020841151 Shruti Mehta 11020841110Nitin R GanapuleNo ratings yet

- Financial Accounting 2022Document5 pagesFinancial Accounting 2022Siddhant GNo ratings yet

- Balance Sheet M&MDocument2 pagesBalance Sheet M&MRitik AggarwalNo ratings yet

- Ratio Analysis Ibrahim Fibres LTDDocument4 pagesRatio Analysis Ibrahim Fibres LTDanon_607941No ratings yet

- RC 2Document4 pagesRC 2Golden Mandhir Retail Private LimitedNo ratings yet

- AbhimanyuDocument46 pagesAbhimanyuMaurya KNo ratings yet

- Join Stock Company Ratio AnalysisDocument16 pagesJoin Stock Company Ratio AnalysisRahul BabbarNo ratings yet

- Financial Analysis Amtek AutoDocument99 pagesFinancial Analysis Amtek AutoanuragNo ratings yet

- Project Report On Working Capital Management at Tata Steel Ltd.Document8 pagesProject Report On Working Capital Management at Tata Steel Ltd.Ankit Agrawal50% (4)

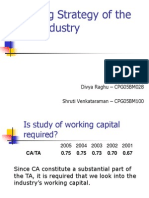

- Hedging Strategy of The Tyre Industry: Divya Raghu - CPG05BM028 Shruti Venkataraman - CPG05BM100Document8 pagesHedging Strategy of The Tyre Industry: Divya Raghu - CPG05BM028 Shruti Venkataraman - CPG05BM100Deepa RaghuNo ratings yet

- Balance Sheet of Maruti Suzuki IndiaDocument415 pagesBalance Sheet of Maruti Suzuki IndiaMahesh VaiShnavNo ratings yet

- Associated Cement Company LTD: Profit & Loss Account Balance SheetDocument3 pagesAssociated Cement Company LTD: Profit & Loss Account Balance SheetZulfiqar HaiderNo ratings yet

- ASHIKDocument21 pagesASHIKmohammedaashik.f2022No ratings yet

- Research Methodology AssignmentDocument11 pagesResearch Methodology AssignmentShakshi YadavNo ratings yet

- TITANBSDocument1 pageTITANBSMithin TkNo ratings yet

- Balance Sheet of Indian Oil CorporationDocument4 pagesBalance Sheet of Indian Oil CorporationPradipna LodhNo ratings yet

- Wiley GAAP 2016: Interpretation and Application of Generally Accepted Accounting PrinciplesFrom EverandWiley GAAP 2016: Interpretation and Application of Generally Accepted Accounting PrinciplesNo ratings yet

- Supply Chain Management and Business Performance: The VASC ModelFrom EverandSupply Chain Management and Business Performance: The VASC ModelNo ratings yet

- 7ba2fe3619 6199dd8ec2Document73 pages7ba2fe3619 6199dd8ec2Faris Rusydi AliyverdanaNo ratings yet

- AnnualReport2016 17Document244 pagesAnnualReport2016 17RiteshRajputNo ratings yet

- Somendra Kumar MeenaDocument98 pagesSomendra Kumar MeenaSomendra Kumar MeenaNo ratings yet

- What Is Financial Management?Document4 pagesWhat Is Financial Management?Ellaine Pearl AlmillaNo ratings yet

- TDTLDocument4 pagesTDTLGeorgeNo ratings yet

- D-Mba-Fm-304 Management of Financial ServicesDocument216 pagesD-Mba-Fm-304 Management of Financial ServicesImran KhanNo ratings yet

- Financial MarketDocument14 pagesFinancial MarketDavid DavidNo ratings yet

- Astro Electronics Corp. vs. Philippine Export and Foreign Loan Guarantee Corporation, G.R. No. 136729, September 23, 2003Document3 pagesAstro Electronics Corp. vs. Philippine Export and Foreign Loan Guarantee Corporation, G.R. No. 136729, September 23, 2003Fides DamascoNo ratings yet

- Primary Markets: Issue of Capital and Disclosure Requirements RegulationsDocument47 pagesPrimary Markets: Issue of Capital and Disclosure Requirements RegulationsMaunil OzaNo ratings yet

- ASC Research Case-Defensive Intangible AssetDocument2 pagesASC Research Case-Defensive Intangible AssetJoey LessardNo ratings yet

- Islamic Vs Modern BONDDocument18 pagesIslamic Vs Modern BONDPakassignmentNo ratings yet

- Sec-F Grp-3 CF-II Project - Tata SteelDocument20 pagesSec-F Grp-3 CF-II Project - Tata SteelPranav BajajNo ratings yet

- Unioniank: Unionbank Plal.A Meralco An!Nue Onyx Sapphire Roads, Onigas CenlerDocument7 pagesUnioniank: Unionbank Plal.A Meralco An!Nue Onyx Sapphire Roads, Onigas CenlerEdgar LayNo ratings yet

- FIN 5001 - Course OutlineDocument9 pagesFIN 5001 - Course OutlineMahendra BediNo ratings yet

- Guidelines For Listing: ChecklistDocument6 pagesGuidelines For Listing: ChecklistParag MogarkarNo ratings yet

- Audit of Ultratech Cement LimitedDocument43 pagesAudit of Ultratech Cement Limitedpallavi21_1992No ratings yet

- Stock Market Participants: Claudine Jane L. HibanDocument4 pagesStock Market Participants: Claudine Jane L. HibanJerbert JesalvaNo ratings yet

- Assignment of IFSDocument3 pagesAssignment of IFSvishnu sharmaNo ratings yet

- Transparency & Disclosure On Corporate Governance As A Key Factor of Companies' Success A Simultaneous Equations Analysis For GermanyDocument13 pagesTransparency & Disclosure On Corporate Governance As A Key Factor of Companies' Success A Simultaneous Equations Analysis For GermanyDimas IndrajayaNo ratings yet

- Garcia V BOIDocument7 pagesGarcia V BOITheodore BallesterosNo ratings yet

- 1-2 Introduction To Accounting, Branches of Accounting (10 Pages)Document10 pages1-2 Introduction To Accounting, Branches of Accounting (10 Pages)Vivienne LayronNo ratings yet