Professional Documents

Culture Documents

Case 6-1 Browning

Uploaded by

Patrick HariramaniCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case 6-1 Browning

Uploaded by

Patrick HariramaniCopyright:

Available Formats

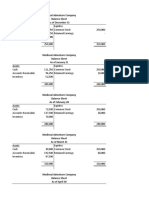

Direct Materials Used:

Beginning ------------------------------------

Purchases ------------------------------------

Total ------------------------------------ 811,000.00

Ending ------------------------------------

Direct Labor ------------------------------------ 492,000.00

Factory Overhead (Indirect Labor and Materials)

Indirect Labor --------------------- 198,000.00

SSS ------------------------------------49,200.00

Power, heat and Light ----------------------- 135,600.00

Depreciation ------------------------------------ 140,400.00

Prepaid Tax ------------------------------------52,800.00

Supplies ------------------------------------61,200.00 637,200.00

Work in Process, Total -------------------------------- 1,940,200.00

Work in Process, Beginning -------------------------- 172,000.00

Less: Work in Process end--------------------------- -38,248.00

TotallGoods Manufactured -------------------------- 2,073,952.00

Finished Goods, Beginning -------------------------- 257,040.00

Total goods Available purchase --------------------- 2,330,992.00

Finished Goods, end ---------------------------------- -352,368.00

Total Cost of Goods Sold ----------------------------- 1,978,624.00

Browning Manufacturing Company

Projected Statement Cost of Goods Sold

Year 2010

Beginning : 110,520 Beginning : 172,200 Beginning : 257,040

Purchases : 825,000 Marerials Used : 811,000 Materials Used: : 811,000 Cost of Goods Manufactured: : 1,901,952

Cost of Goods

Manufactured:

: 1,901,952

Cost of

Goods Sold

:

Direct Labor : 492,000

Manufacturing Overhead : 637,200

Materials

End

: 124,520 2,112,400 2,158,992

Total Cost of Goods

Placed in Process end:

: 210,448

Goods Available for

Sale end

: 352,368

Beginning : 118,440 144,000 Beginning : 311,760 Collections : 2,604,000

6) 264,000 78,000 Credit Sales : 2,562,000 Sales returs and Allowances : 19,200

7) 2,604,000 874,800 Sales Discounts : 49,200

522,000

38,400 2,873,760 2,672,400

788,400

9,000

52,200

36,000

2,986,440 2,542,800 End : 201,360

End : 443,640

2,562,000 Beginning : 66,720

Add Pre-payment : 78,000 Used pre-paid tax and insurance : 52,800

End : 91,920

Beginning : 2,678,400 Beginning : 907,200

Purchases : 144,000 Current Dep Expense : 140,400

End : 2,822,400 End : 1,047,600

Beginning : 185,760 Beginning : 288, 840

Payment : 788,400 Purchases : 891,000 Borrowings : 264,000

End : 288,360 End : 552, 840

Beginning : 9,000 Beginning : 829,560

Payment : 52,200 Income Tax Expense:: 5,800 Dividends : 36,000 Net Income : 68,576

End : 5, 800 End : 862,136

Income Tax Payable Retained Earnings

Sales Pre-Paid Tax Insurance

Manufacturing Plant and Equipment Accumulated Depreciation

Accounts Payable Note Payable

Cash and Marketable Securities Accounts Receivable

T acounts

Browning Manufacturing Company

Materials Work In Process Finished Goods

1,806,624

T acounts

Browning Manufacturing Company

Finished Goods

Assets

Current Assets:

Cash and Marketable Securities $495,840

Accounts Receivable (net of allowance for doubtful accounts) $239,760

Less allowance for bad debt 19,200 220,560

Inventories:

Materials 124,520

Work in process 172,200

Finished goods 352,368

Supplies 22,080 671,168

Prepaid taxes and insurance 91,920

Total current assets 1,479,488

Other assets:

Manufacturing plant at cost 2,822,400

Less: Accumulated depreciation 1,047,600 1,774,800

Total Assets $3,254,288

Liabilities and Shareholders' Equity

Current Liabilities:

Accounts Payable $288,360

Notes payable 552,840

Income taxes payable 52,200

Total current liabilities $893,400

Shareholders' equity:

Capital Stock 2,360,888

Total Liabilities and Shareholders' Equity 3,254,288

Browning Manufacturing Company

Projected Balance Sheet

December 31, 2010

SALES 2,562,000

Less: Sales Returns and Allowances P 19,200

Sales Discount 49,200 68,400

NET SALES 2,493,600

Less: Cost of Sales (per schedule) 1,806,624

Gross Margin 686, 976

Less: Selling and Admin Expense 522, 000

Operating Income 164, 976

Less: Interest Expense 38,400

Income Before Tax Expense 126, 576

Less: Estimated Income Tax Expense 58,000

NET INCOME 68,576

Browning Manufacturing Company

Income Statement

For the Period Ending December 31, 2010

Question # 2

2009 2010

Accounts Receivable Turn Over 50.9357 29.47401 This ration means its improving because in 2010 its ratio was 29 days. It means that the cycle for its receivables is improving

Cash Its ok but the cash can be used to reinvest to the business

Finished Goods Inventory Its ok still manegable but it will be better if it will use its inventory well because if there is a lot of inventory cash

is sleeping and money is wasted, interest is being accumulated. If it can be sold early much better because you can harvest or pay the interest

Liquidity Ratio 2.179404 1.707599 This ratio means that its capability of meating its obligation is falling. But still it can be enhance because it is still close to 2.0

Acis Test Ratio 1.06 0.90 This means it needs to plan so that it can improved its financial position

Day's Cash 20.30521 66.77402 Cash can be reinvested because there is a concept of cost of money and infalation

Inventory Turnover 6.101307 5.127094 The company needs to plan better because many company fall because of miss management of its inventory

Gross Profit Ratio 30% 28% This ratio can still be improved its not yet that bad but with careful planning and better positioning they can turn it around

Profitability Ratio 5% 3% 3% percent is not bad but if it continue to decline it will be terible

Question # 3

The goal of the company can't be achieved. The company should optimise its inventory, costing and sales. It should improve its sales plan and study their price versus its cost of producing

Question #4

The goal can be achieved. To improve its turnover they should plan their production carefuly so that its inventory will not go up.

More so it should improve it sales so that their profit can go up and maximize the time

Question #5

As we have seen its standing has gone down but it is still tolerable, it has enough assets to pay off its liabilities but in the long run they should improve it

The company should improve its ratios because it is the way that banks or other finnacial institution can annalyze the progress of the business

You might also like

- Case Study - Rayco Inc. Group 1Document4 pagesCase Study - Rayco Inc. Group 1bryan albertNo ratings yet

- CASE 6-1 - Browning Manufacturing Company - 2Document7 pagesCASE 6-1 - Browning Manufacturing Company - 2Weng Torres AllonNo ratings yet

- CASE 4-1 PC DepotDocument7 pagesCASE 4-1 PC Depotkimhyunna75% (4)

- 11-1 Medieval Adventures CompanyDocument8 pages11-1 Medieval Adventures CompanyWei DaiNo ratings yet

- Mid Term Business Economy - Ayustina GiustiDocument9 pagesMid Term Business Economy - Ayustina GiustiAyustina Giusti100% (1)

- 6 - Browning MFTG Company Case SolutionDocument12 pages6 - Browning MFTG Company Case Solutionjenice joy100% (2)

- CASE 6-1 - Browning Manufacturing CompanyDocument4 pagesCASE 6-1 - Browning Manufacturing CompanyWeng Torres AllonNo ratings yet

- Mid Exam BSEM - BLEMBA 25 - 29318428 - Aditya Tri SudewoDocument3 pagesMid Exam BSEM - BLEMBA 25 - 29318428 - Aditya Tri SudewoAditya Tri Sudewo100% (1)

- Case 7 - An Introduction To Debt Policy and ValueDocument5 pagesCase 7 - An Introduction To Debt Policy and ValueAnthony Kwo100% (2)

- Case 9-2 Innovative Engineering CoDocument4 pagesCase 9-2 Innovative Engineering CoFaizal PradhanaNo ratings yet

- Genmo CorporationDocument12 pagesGenmo CorporationAarushi Pawar100% (1)

- Fonderia TorinoDocument3 pagesFonderia TorinoMatilda Sodji100% (1)

- WACC Nice Ventures Group7 SectionADocument9 pagesWACC Nice Ventures Group7 SectionAmayur2510.20088662No ratings yet

- Dell Working Capital SolutionDocument10 pagesDell Working Capital SolutionIIMnotes100% (1)

- Case-Study-2 - Browning Manufacturing Company - Delaraga-Yocson - FranciscoDocument10 pagesCase-Study-2 - Browning Manufacturing Company - Delaraga-Yocson - Franciscoabigail franciscoNo ratings yet

- Browning Manufacturing CaseDocument6 pagesBrowning Manufacturing CaseChleo EsperaNo ratings yet

- Nice Ventures: Group 2 Yulianti Suryaningsih - Sylvia Darwin - Wahyono Hidayat - Meidhy P SaputraDocument11 pagesNice Ventures: Group 2 Yulianti Suryaningsih - Sylvia Darwin - Wahyono Hidayat - Meidhy P SaputraSylvia DarwinNo ratings yet

- Analisis Krakatau Steel (A)Document6 pagesAnalisis Krakatau Steel (A)JonathanSomba100% (1)

- Sunbeam 20Document15 pagesSunbeam 20Muhammad Nabil EzraNo ratings yet

- Al' DunlapDocument8 pagesAl' DunlapMani Kanth0% (1)

- Nike CaseDocument7 pagesNike CaseNindy Darista100% (1)

- London Pop Concert TreePlanDocument2 pagesLondon Pop Concert TreePlanTri Septia Rahmawati KaharNo ratings yet

- Executive Decision Making at General MotorsDocument14 pagesExecutive Decision Making at General MotorsGourav Guha100% (2)

- Maynard CompanyDocument2 pagesMaynard CompanyArchin Padia100% (1)

- Individual Assignment - Financial ManagementDocument2 pagesIndividual Assignment - Financial ManagementrenaldooNo ratings yet

- Final Exam - Manfin - EMBA61 - 2020Document12 pagesFinal Exam - Manfin - EMBA61 - 2020NurIndah100% (1)

- Krakatau Steel (A)Document12 pagesKrakatau Steel (A)Fez Research Laboratory100% (4)

- The Financial DetectiveDocument7 pagesThe Financial DetectivearifhafiziNo ratings yet

- Nike Inc Cost of Capital - Syndicate 1 (Financial Management)Document26 pagesNike Inc Cost of Capital - Syndicate 1 (Financial Management)natya lakshitaNo ratings yet

- Multiple Choice: Shade The Box Corresponding To Your Answer On The Answer SheetDocument10 pagesMultiple Choice: Shade The Box Corresponding To Your Answer On The Answer SheetRhad Estoque0% (1)

- Electrosurgery: The Compact Electrosurgical Unit With High CapacityDocument6 pagesElectrosurgery: The Compact Electrosurgical Unit With High CapacityPepoNo ratings yet

- Browning Manufacturing CompanyDocument7 pagesBrowning Manufacturing CompanyajsibalNo ratings yet

- Case 6 1Document10 pagesCase 6 1cashmerehitNo ratings yet

- Medieval Case SolutionDocument7 pagesMedieval Case SolutionTarry BerryNo ratings yet

- Case 4-1 PC DepotDocument5 pagesCase 4-1 PC Depotamitsemt67% (3)

- PC DepotDocument2 pagesPC DepotJohn Carlos WeeNo ratings yet

- Accounting Case Study: PC DepotDocument7 pagesAccounting Case Study: PC DepotPutri Saffira YusufNo ratings yet

- Accounting: Stern CorporationDocument12 pagesAccounting: Stern CorporationCamelia Indah Murniwati100% (3)

- Browning Manufactur Company C6-1Document18 pagesBrowning Manufactur Company C6-1Faizal Pradhana100% (1)

- Syndicate 1 An Introduction To Debt Policy and ValueDocument9 pagesSyndicate 1 An Introduction To Debt Policy and ValueBernadeta PramudyaWardhaniNo ratings yet

- PC Depot (Accounting)Document4 pagesPC Depot (Accounting)Ange Buenaventura Salazar100% (2)

- Fonderia Di Torino (Final)Document4 pagesFonderia Di Torino (Final)Tracye Taylor100% (2)

- 11-1 Medieval Adventures CompanyDocument5 pages11-1 Medieval Adventures Companydhosmanyos100% (1)

- Leadership - Peter BrowningDocument2 pagesLeadership - Peter BrowningMohammad Fidi Abganis HermawanNo ratings yet

- AppShop CaseDocument14 pagesAppShop CaseJuliana Kalaany100% (1)

- Fonderia Di Torina SpADocument10 pagesFonderia Di Torina SpARoberta AyalingoNo ratings yet

- UTS / Mid Semester Test Finance Management (M5007) - MBA ITB CCE 58 2018Document28 pagesUTS / Mid Semester Test Finance Management (M5007) - MBA ITB CCE 58 2018DenssNo ratings yet

- Kota Fibres LTD: ASE NalysisDocument7 pagesKota Fibres LTD: ASE NalysisSuman MandalNo ratings yet

- Maynard CompanyDocument5 pagesMaynard CompanySantosh GovindarajanNo ratings yet

- (DMN GM 10) Mid-Term Exam - Bianda Puspita SariDocument6 pages(DMN GM 10) Mid-Term Exam - Bianda Puspita SariBianda Puspita SariNo ratings yet

- Fonderia Di Torino's Case - Syndicate 5Document20 pagesFonderia Di Torino's Case - Syndicate 5Yunia Apriliani Kartika0% (1)

- Fonderia DI TorinoDocument19 pagesFonderia DI TorinoA100% (3)

- Case Analysis 3 1 Maynard BusinessDocument6 pagesCase Analysis 3 1 Maynard BusinessDAVE RYAN DELA CRUZNo ratings yet

- Casa de DisenoDocument8 pagesCasa de DisenoMarilou Broñosa-PepañoNo ratings yet

- Syndicate 4 - Carly Fiorina Case - OB 21 Apr 2019Document4 pagesSyndicate 4 - Carly Fiorina Case - OB 21 Apr 2019Zafar Nur HakimNo ratings yet

- Finance Detective - Rizqi Ghani Faturrahman - 29120382 - YP-64BDocument4 pagesFinance Detective - Rizqi Ghani Faturrahman - 29120382 - YP-64BrizqighaniNo ratings yet

- Case 25 Gainesboro-Exh8Document1 pageCase 25 Gainesboro-Exh8odie99No ratings yet

- 6e Brewer CH09 B EOCDocument10 pages6e Brewer CH09 B EOCJonathan Altamirano BurgosNo ratings yet

- Accounting 16Document20 pagesAccounting 16Michiko Kyung-soonNo ratings yet

- Working Capital ManagementDocument66 pagesWorking Capital ManagementvaishalikatkadeNo ratings yet

- Quiz - iCPA PDFDocument14 pagesQuiz - iCPA PDFCharlotte Canabang AmmadangNo ratings yet

- Are We Heading To A Cashless Society?: Andal, Catherine Atienza, Erika Hariramani, PatrickDocument72 pagesAre We Heading To A Cashless Society?: Andal, Catherine Atienza, Erika Hariramani, PatrickPatrick HariramaniNo ratings yet

- The Spa V BioessenceDocument18 pagesThe Spa V BioessencePatrick HariramaniNo ratings yet

- Case 4 1Document23 pagesCase 4 1Patrick HariramaniNo ratings yet

- Case 8-1 Norman Corp, Patrick AnalysisDocument2 pagesCase 8-1 Norman Corp, Patrick AnalysisPatrick HariramaniNo ratings yet

- Chapter 7-1 SternDocument7 pagesChapter 7-1 SternPatrick HariramaniNo ratings yet

- Barriers To Effective Human CommunicationDocument4 pagesBarriers To Effective Human CommunicationPatrick HariramaniNo ratings yet

- Case 2 1Document8 pagesCase 2 1Patrick HariramaniNo ratings yet

- Two-Post Lift Model:210C 210CXDocument36 pagesTwo-Post Lift Model:210C 210CXventitapostNo ratings yet

- Start Repairing Laptop and Cell PhoneDocument23 pagesStart Repairing Laptop and Cell PhoneAnonymous S6UCpG1ZuP100% (1)

- BFBANFIX - Activity Learning - 01Document2 pagesBFBANFIX - Activity Learning - 01Spheal GTNo ratings yet

- How To Conduct A Situation AnalysisDocument10 pagesHow To Conduct A Situation AnalysisÂmany AymanNo ratings yet

- 1.indentify The Functions of Various Keys On The Key BoardDocument83 pages1.indentify The Functions of Various Keys On The Key BoardMuhammad AbbasNo ratings yet

- 1198-Article Text-5716-1-10-20221219Document9 pages1198-Article Text-5716-1-10-20221219Hendarko AriNo ratings yet

- Boiler Installation - AfbcDocument2 pagesBoiler Installation - AfbcSarah FrazierNo ratings yet

- Wifpl Qap 2019-20-058 Rev 00 Konecranes 18crnimo7 6 SignedDocument2 pagesWifpl Qap 2019-20-058 Rev 00 Konecranes 18crnimo7 6 SignedDeepak HoleNo ratings yet

- Tutorial 2 Organizing DataDocument2 pagesTutorial 2 Organizing Datazurila zakariaNo ratings yet

- Drugstudy - Delivery RoomDocument12 pagesDrugstudy - Delivery RoomAUBREY MARIE . GUERRERONo ratings yet

- Cde-Class II Amalgam Restorations-31!12!14Document36 pagesCde-Class II Amalgam Restorations-31!12!14Archita KureelNo ratings yet

- Kim Lighting Landscape Lighting Catalog 1988Document28 pagesKim Lighting Landscape Lighting Catalog 1988Alan MastersNo ratings yet

- Fortnightly Test For 11th NEET - 2024 - Test-03 - QP - 01!07!2023Document19 pagesFortnightly Test For 11th NEET - 2024 - Test-03 - QP - 01!07!2023dhruvi.v91No ratings yet

- 2021 H2 Chemistry Prelim Paper 1Document15 pages2021 H2 Chemistry Prelim Paper 1clarissa yeoNo ratings yet

- Vision Medilink Product DetailsDocument4 pagesVision Medilink Product DetailsRaj SekarNo ratings yet

- Pizza Hut and Dominos - A Comparative AnalysisDocument19 pagesPizza Hut and Dominos - A Comparative AnalysisSarvesh Kumar GautamNo ratings yet

- Sex Education in The PhilippinesDocument3 pagesSex Education in The PhilippinesChinchin CañeteNo ratings yet

- E4 - Review Unit 11 To Unit 20Document16 pagesE4 - Review Unit 11 To Unit 20Tuyen NgoNo ratings yet

- Comparitive Study of Pile Foundations With Foundations On Stone Column Treated Ground 170704090313Document23 pagesComparitive Study of Pile Foundations With Foundations On Stone Column Treated Ground 170704090313anurag hazarikaNo ratings yet

- Daftar Pustaka ProposalDocument4 pagesDaftar Pustaka ProposalraniNo ratings yet

- Enzyme Review Mcqs (From The Official Biochemistry Study Guide)Document5 pagesEnzyme Review Mcqs (From The Official Biochemistry Study Guide)Mrs Rehan100% (1)

- 327 - Mil-C-15074Document2 pages327 - Mil-C-15074Bianca MoraisNo ratings yet

- EO MNC 10 June 2022Document4 pagesEO MNC 10 June 2022LeulaDianneCantosNo ratings yet

- Aigen Zhao, PHD, Pe, Gse Environmental, LLC, Usa Mark Harris, Gse Environmental, LLC, UsaDocument41 pagesAigen Zhao, PHD, Pe, Gse Environmental, LLC, Usa Mark Harris, Gse Environmental, LLC, UsaCarlos Ttito TorresNo ratings yet

- Industrialisation by InvitationDocument10 pagesIndustrialisation by InvitationkimberlyNo ratings yet

- Index: General Notices (1) Apply To All Monographs and Other TextsDocument36 pagesIndex: General Notices (1) Apply To All Monographs and Other TextsGhenaNo ratings yet

- Curriculum Guide: Exploratory Course On Household ServicesDocument5 pagesCurriculum Guide: Exploratory Course On Household ServicesJovanni Mancao PodadorNo ratings yet

- Module-1-ISO 13485-DocumentDocument7 pagesModule-1-ISO 13485-Documentsri manthNo ratings yet