Professional Documents

Culture Documents

Qarm

Uploaded by

kanaks1992Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Qarm

Uploaded by

kanaks1992Copyright:

Available Formats

QARM ASSIGNMENT NO -2

Submitted by:

Kanak

Roll No. (35139)

Section B

IRMA

2

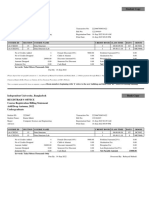

1. GIEVN DATA ACCORDING TO THE ROLL NUMBER

Being an Investor one need to get into market trends. After researching the markets over last

few years five possible scenarios for national economy are:

1. Rapid Expansion,

2. Moderate Expansion,

3. No Growth,

4. Moderate Contraction, And

5. Serious Contraction.

Below is the given data with probability distribution and market return for each of these 5

scenarios.

We are going to use simulation model to know what is the most likely scenario to occur with

the help of given probability and market return with each scenario.

A simulation model is same as random spreadsheet model except that some cells include

random quantities. It is an useful tool to incorporate uncertainty explicitly into spreadsheet

model. Excel recalculates many times and helps in discovering which is the most likely to

occur, best case and the worst case results.

Or Goal here is to simulate many returns for random variables( distributed between 0 to 1) in

short run( 50 data entries) and Long run (5000 and 50,000 entries) from the given probability

distribution and analyze the resulting returns.

2. CALCULATION OF MEAN, VARIANCE AND STANDARD

DEVIATION FROM RETURN

Mean of return 13.88%

Variance from return 0.005396213

standard deviation from

return 0.372598578

Mean, variance and standard deviation from return/gain are important indicators for deciding

if our expected outcome by simluation (in short run or long run) is profitable or not.

Economic outcome Probability Market return

Rapid Expansion 0.13 29.80%

Moderate Expansion 0.26 16.04%

No Growth 0.26 13.83%

Moderate Contraction 0.25 6.99%

Serious Contraction 0.10 4.97%

3

3. CUMULATIVE PROBABILITY SCALE

For comparison of outputs from short run to long run random probabilities (50, 5000, 50,000

samples) with the initial reference table, another table with cumulative probability range & its

outputs is compiled:

Cumulative range Market return Economic Outcome

0 29.80% Rapid Expansion

0.13 16.04% Moderate Expansion

0.39 13.83% No Growth

0.65 6.99% Moderate Contraction

0.9 4.97% Serious Contraction

4. MEAN OF RETURN

Mean from Return 13.88%

Short Range Mean (50

Entries) 13.69%

Long Range Mean(5000

Entries) 13.88%

Long Range Mean(50000

Entries) 13.88%

Fig 1: Graph Representing Mean of return for Short term and long Term

1.Short Run(50 entries): From the graph of mean of return we can observe that for short range simulation (

50 entries) the difference between actual mean and expected mean is significant, that is 13.69% is our

mean from short run and our actual mean is 13.88%

2. Long Run ( 5000 entries): From the graph of mean of return we can observe that for long range

simulation ( 5000 entries) there is no difference between actual mean and expected mean . Both are at the

same value that is 13.88%.

2. Long Run ( 50,000 entries): From the graph of mean of return we can observe that for long range

simulation ( 50000 entries) there is no difference between actual mean and expected mean . Both are at the

same value that is 13.88%.

Conclusion:

As we go from short-term simulation to long-term simulation we tend to reach our actual or desired data

value. Probability to achieve desired result is increases in long-run.

5. STANDARD DEVIATION FROM RETURN

Standard Deviation from

Return 0.073459

Standard Deviation from

Return in Short Run (50

Entries) 0.071058

Standard Deviation from

Return in Long Run(5000

Entries) 0.073402

Standard Deviation from

Return in Long Run(50000

Entries) 0.073304

Fig 2: Graph Representing Standard deviation from return for Short term and long Term

5

1.Short Run(50 entries): From the graph of Standard deviation from return we can observe that for short

range simulation ( 50 entries) the difference between actual stand deviation and expected is significant,

that is 0.071058 is our mean from short run and our actual standard deviation is .073458.

2. Long Run ( 5000 entries): From the graph of Standard deviation from return we can observe that for

long range simulation ( 5000 entries) there is a very small difference between actual standard deviation

and expected standard deviation .

2. Long Run ( 50,000 entries): From the graph of Standard deviation from return we can observe that for

long range simulation ( 50000 entries) again there is a small difference between actualactual standard

deviation and expected standard deviation .

Conclusion:

As we go from short-term simulation to long-term simulation we tend to reach our actual or desired data

value. Probability to achieve desired result is increases in long-run.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Gandhian ModelDocument14 pagesGandhian Modelkanaks1992No ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Agrarian Distress and Farmers Suicide in IndiaDocument37 pagesAgrarian Distress and Farmers Suicide in Indiakanaks1992No ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Communalism - An Indian PerspectiveDocument20 pagesCommunalism - An Indian Perspectivekanaks1992No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- QARM Lec 10 - Decision - TheoryDocument65 pagesQARM Lec 10 - Decision - Theorykanaks1992No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- CommunalismDocument571 pagesCommunalismkanaks1992No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Dis 35063 35109 35139 35171Document66 pagesDis 35063 35109 35139 35171kanaks1992No ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Policy Brief - ADB and Food SecurityDocument4 pagesPolicy Brief - ADB and Food Securitykanaks1992No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Policy Brief Education OxfamDocument4 pagesPolicy Brief Education Oxfamkanaks1992No ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- NFHS-4 Woman's Questionnaire for State NameDocument93 pagesNFHS-4 Woman's Questionnaire for State Namekanaks1992No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- An Overview of The Sample Registration System in India - India PDFDocument13 pagesAn Overview of The Sample Registration System in India - India PDFkanaks1992No ratings yet

- Reflection Homophone 2Document3 pagesReflection Homophone 2api-356065858No ratings yet

- Impact of IT On LIS & Changing Role of LibrarianDocument15 pagesImpact of IT On LIS & Changing Role of LibrarianshantashriNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- AATCC 100-2004 Assesment of Antibacterial Dinishes On Textile MaterialsDocument3 pagesAATCC 100-2004 Assesment of Antibacterial Dinishes On Textile MaterialsAdrian CNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- New Education Policy 2019Document55 pagesNew Education Policy 2019Aakarshanam VenturesNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Why Genentech Is 1Document7 pagesWhy Genentech Is 1panmongolsNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Rohit Patil Black BookDocument19 pagesRohit Patil Black BookNaresh KhutikarNo ratings yet

- Marshal HMA Mixture Design ExampleDocument2 pagesMarshal HMA Mixture Design ExampleTewodros TadesseNo ratings yet

- Energy AnalysisDocument30 pagesEnergy Analysisca275000No ratings yet

- Reg FeeDocument1 pageReg FeeSikder MizanNo ratings yet

- ESA Knowlage Sharing - Update (Autosaved)Document20 pagesESA Knowlage Sharing - Update (Autosaved)yared BerhanuNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Evaluating Sources IB Style: Social 20ib Opvl NotesDocument7 pagesEvaluating Sources IB Style: Social 20ib Opvl NotesRobert ZhangNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Mazda Fn4A-El 4 Speed Ford 4F27E 4 Speed Fnr5 5 SpeedDocument5 pagesMazda Fn4A-El 4 Speed Ford 4F27E 4 Speed Fnr5 5 SpeedAnderson LodiNo ratings yet

- Important Instructions To Examiners:: Calculate The Number of Address Lines Required To Access 16 KB ROMDocument17 pagesImportant Instructions To Examiners:: Calculate The Number of Address Lines Required To Access 16 KB ROMC052 Diksha PawarNo ratings yet

- Yellowstone Food WebDocument4 pagesYellowstone Food WebAmsyidi AsmidaNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Complete Guide To Sports Training PDFDocument105 pagesComplete Guide To Sports Training PDFShahana ShahNo ratings yet

- AgentScope: A Flexible Yet Robust Multi-Agent PlatformDocument24 pagesAgentScope: A Flexible Yet Robust Multi-Agent PlatformRijalNo ratings yet

- (23005319 - Acta Mechanica Et Automatica) A Study of The Preload Force in Metal-Elastomer Torsion SpringsDocument6 pages(23005319 - Acta Mechanica Et Automatica) A Study of The Preload Force in Metal-Elastomer Torsion Springsstefan.vince536No ratings yet

- Biology Mapping GuideDocument28 pagesBiology Mapping GuideGazar100% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Ultimate Advanced Family PDFDocument39 pagesThe Ultimate Advanced Family PDFWandersonNo ratings yet

- Customer Perceptions of Service: Mcgraw-Hill/IrwinDocument27 pagesCustomer Perceptions of Service: Mcgraw-Hill/IrwinKoshiha LalNo ratings yet

- Electronics Project Automatic Bike Controller Using Infrared RaysDocument16 pagesElectronics Project Automatic Bike Controller Using Infrared RaysragajeevaNo ratings yet

- TDS Sibelite M3000 M4000 M6000 PDFDocument2 pagesTDS Sibelite M3000 M4000 M6000 PDFLe PhongNo ratings yet

- Social Media Exposure and Its Perceived Impact On Students' Home-Based Tasks ProductivityDocument9 pagesSocial Media Exposure and Its Perceived Impact On Students' Home-Based Tasks ProductivityJewel PascuaNo ratings yet

- Assignment 2 - Weather DerivativeDocument8 pagesAssignment 2 - Weather DerivativeBrow SimonNo ratings yet

- Good Ethics Is Good BusinessDocument9 pagesGood Ethics Is Good BusinesssumeetpatnaikNo ratings yet

- ERP Complete Cycle of ERP From Order To DispatchDocument316 pagesERP Complete Cycle of ERP From Order To DispatchgynxNo ratings yet

- Coffee Table Book Design With Community ParticipationDocument12 pagesCoffee Table Book Design With Community ParticipationAJHSSR JournalNo ratings yet

- Tigo Pesa Account StatementDocument7 pagesTigo Pesa Account StatementPeter Ngicur Carthemi100% (1)

- всё необходимое для изучения английского языкаDocument9 pagesвсё необходимое для изучения английского языкаNikita Chernyak100% (1)

- HenyaDocument6 pagesHenyaKunnithi Sameunjai100% (1)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)