Professional Documents

Culture Documents

HDFC Bank

Uploaded by

Aastha Jindal0 ratings0% found this document useful (0 votes)

51 views38 pagesThis document provides an overview of Housing Development Finance Corporation (HDFC) Bank, one of India's largest private sector banks. It discusses HDFC Bank's promoter (HDFC), business focus on housing finance, capital structure, acquisition of Times Bank, distribution network of over 3,100 branches across India, management, technology capabilities, business lines, and high credit ratings. HDFC Bank was among the first private sector banks to receive approval after India liberalized its banking industry in 1994.

Original Description:

customer satisfaction

Original Title

hdfc bank

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides an overview of Housing Development Finance Corporation (HDFC) Bank, one of India's largest private sector banks. It discusses HDFC Bank's promoter (HDFC), business focus on housing finance, capital structure, acquisition of Times Bank, distribution network of over 3,100 branches across India, management, technology capabilities, business lines, and high credit ratings. HDFC Bank was among the first private sector banks to receive approval after India liberalized its banking industry in 1994.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

51 views38 pagesHDFC Bank

Uploaded by

Aastha JindalThis document provides an overview of Housing Development Finance Corporation (HDFC) Bank, one of India's largest private sector banks. It discusses HDFC Bank's promoter (HDFC), business focus on housing finance, capital structure, acquisition of Times Bank, distribution network of over 3,100 branches across India, management, technology capabilities, business lines, and high credit ratings. HDFC Bank was among the first private sector banks to receive approval after India liberalized its banking industry in 1994.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 38

PROBLEM STATEMENT

The first step in research is formulating a research problem. A poorly defined

problem will not yield any useful result. It is rightly said that a problem well defined if

half solved.

In order to identify the research problem three categories of symptomatic situation

namely overt difficulties, latent difficulties and unnoticed opportunities should be

studied.

1. Overt difficulties are those, which are quite apparent, and which manifest

themselves for example if a firm has been witnessing a decline in sale for same

time this could be called on overt difficulty.

2. Latent difficulties on the other hand are those, which are not so apparent and I

which if not checed, would soon become evident for ex. !ecline sales may in

due course demorali"e the sale staff.

#. $nnoticed %pportunities indicate the potential for growth in a certain area of

mareting. &uch opportunities are not clearly seen and some effort is required to

explore them.

As such no problem was given to me while doing my summer training pro'ect but

I found the following problems in the organi"ation.

1

Complicated terms and Conditions

The terms and conditions of every product was so much complicated that it is not

easily understandable by the customers.

Strict Rules and Hig Targets

(ules and regulation for the employee of the organi"ation were so much tight some time

they feel very hectic. )oreover the targets given to them are also very high

!NTRO"#CT!ON TO BAN$!N%

MEAN!N% AN" "E&!N!T!ON'

*y +indla &heras

*an is an institution that deals in money and its substitutes and provides crucial

financial services. The principal type of baing in the modern industrial world is

commercial baning , central baning.

*aning means -Accepting !eposits for the purpose of lending or investment of

deposits of money from the public, repayable on demand or otherwise and withdraw by

cheque, draft or otherwise..

*aning /ompanies 0(egulation1 Act, 1232

The concise oxford dictionary has defined a ban as -4stablishment for custody

of money which it pays out on customers order.. Infact this is the function which the

ban performed when baning originated.

-*aning in the most general sense, is meant the business of receiving,

conserving , utili"ing the funds of community or of an special section of it..

*y 5. 6ills , 7. *ogan

-A baner of ban is a person, a firm, or a company having a place of business

where credits are opened by deposits or collection of money or currency or where money

is advanced and waned..

A Ban('

Accept deposits of money from public,

8ays interest on money deposited with it.

9ends or invests money.

2

(epays the amount on demand

Allow the money deposited to be with drawn by cheque or draft.

OR!%!N O& )OR" BAN$'

The origin of the word ban is shrouded in mystery. According to one view point

the Italian business house carrying on crude from of baning were called banchi

bancheri.. According to another viewpoint baning is derived from :erman word

-*ranc. which mean heap or mound. In 4ngland, the issue of paper money by the

government was referred to as a raising a ban.

OR!%!N O& BAN$!N%'

Its origin in the simplest form can be traced to the origin of authentic history.

After recogni"ing the benefit of money as a medium of exchange, the importance of

baning was developed as it provides the safer place to store the money. This safe place

ultimately evolved in to financial institutions that accepts deposits and mae loans i.e.,

modern commercial bans.

BAN$!N% S*STEM !N !N"!A

H!STOR!CAL PERSPECT!+E'

6e can identify there distinct phases in the history of Indian baning;

1. 4arly phase from 1<=>?12>2.

2. @ationali"ation of bans and up to 1221 prior to baning sector reforms.

#. @ew phase of Indian baning with the advent of financial baning. *aning in

India has its origin as early as Aedic period. It is believed that the transitions

from man lending to baning must have occurred even before )anu, the great

5indu furriest, who has devoted a section of his wor to deposit and advances

and laid down rules relating to the rate of interest. !uring the mogul period,

the indigenious baner played a very important role in lending money and

financing foreign trade and commerce.

!uring the days of the 4ast India company it was the turn of agency house to

carry on the baning business. The :eneral *an of India was the first 'oint stoc ban to

be established in the year 1<=>. The other which followed was the *an of 5industan and

*engal *an.

The *an of 5industan is reported to have continued till 12B>. 6hile other two

failed in the meantime. In the first half of the 12

th

century the 4ast India /ompany

established there bans. The band of *ombay in 1=B2, and the *an *ombay in 1=3#.

These three bans were amalgamated in 122B and new ban, the imperial *an of India

was established on 2<

th

7anuary, 1221.

#

6ith the passing of the &tate *an of India Act in 12CC the undertaing of the

Imperial *an of India was taen over by the newly constituted &*I. The (eserve *an

of India 0(*I1which is the /entral ban was established in April, 12#C by passing

(eserve *an of India Act 12#C. The /entral office of (*I is in )umbai and it controls

all the other bans in the country.

In the wae of &wadeshi )ovement, number of bans with the Indian

management were establishment in the country, namely, 8un'ab @ational *an 9td., *an

of India 9td., *an of *aroda 9td., /anara *an 9td. %n 12

th

7ul 12>2, 13 ma'or bans of

the country were nationali"ed and on 1C

th

April 12=B, > more commercial private sector

bans were taen over by the government.

CLASS!&!CAT!ON ON BAS!S O& O)NERSH!P'

%n the basis of ownership bans are of the following types'

,- P#BL!C SECTOR BAN$'

8ublic sector bans are those bans that are owned by the :overnment. The :ovt.

runs these *ans. In India 13 bans were nationali"ed in 12>2 , in 12=B another

> bans were also nationali"ed. Therefore in 12=B the number of nationali"ed

ban 2B. *ut at present there are 2 bans are nationali"ed. All these bans are

belonging to public sector category. 6elfare is their principle ob'ective.

.- PR!+ATE SECTOR BAN$S'

These bans are owned and run by the private sector. Aarious bans in the country

such as I/I/I *an, 5!+/ *an etc. An individual has control over there bans

in preparation to the share of the bans held by him.

/- CO0OPERAT!+E BAN$S'

/o?operative bans are those financial institutions. They provide short term ,

medium termD loans to there members. /o?operative bans are in every state in

India ?Its branches at district level are nown as the central co?operative ban.

The central co?operative ban in turn has its branches both in the urban , rural

areas. .4very state cooperative ban is an apex ban, which provides credit

facilities to the central co?operative ban. It mobili"ed financial resources from

richer section of urb#n population by accepting deposit and creating the credit lie

commercial ban and borrowing from the money mt. It also gets funds from

(*I.

&#NCT!ONS O& BAN$S'

,- Primar1 &unctions

2a3 Acceptance of deposits

243 Ma(ing Loans and Advances

3

9oans

%verdrafts

/ash /redit

!iscounting of *ills of 4xchange

.- Secondar1 &unctions

0a3 Agenc1 &unctions

/ollection of cheques and bills etc

/ollection of interest and dividend

)aing payment on behalf of customers .

8urchase and sale of securities.

To act as trustee and executor

043 #tilit1 &unctions

&afe custody of customers valuable articles and securities.

$nderwriting facility

Issuing of TravellerDs cheque and letter of credit

+acility of foreign exchange

8roviding trade information

8roviding information regarding credit worthiness of their customers.

C

H"&C Ban(

The 5ousing !evelopment +inance /orporation 9imited 05!+/1 was amongst the first

to receive an Ein principleF approval from the (eserve *an of India 0(*I1 to set up a

ban in the private sector, as part of the (*IFs liberali"ation of the Indian *aning

Industry in 1223. The ban was incorporated in August 1223 in the name of E5!+/ *an

9imitedF, with its registered office in )umbai, India. 5!+/ *an commenced operations

as a &cheduled /ommercial *an in 7anuary 122C.

5!+/ *an is headquarted in )umbai. The *an at present has networ of over

3C#1 branches spread over 22= cities across India. All branches are lined on an online

real time basis. /ustomers in over 12B locations are also serviced through Telephone

*aning.

8romoter

*usiness +ocus

/apital &tructure

Time *an Amalgamation

!istribution @etwor

)anagement

Technology

*usinesses

(atings

PROMOTER

5!+/ is IndiaDs premier housing finance company and en'oys an impeccable

trac record in India as well as in international marets. &ince its inception in 12<<, the

/orporation has maintained a consistent and healthy growth in its operations to remain a

maret leader in mortgages. 5!+/ currently has a client base of over C,BB,BBB

borrowers, 1#,BB,BBB depositors, 1,BB,BBB shareholders and C2,BBB deposit agents.

5!+/ raises funds from international agencies such as the 6orld *an, I+/

06ashington1, $&AI!, /!/, A!* and Gf6, domestic term loans from bans and

insurance companies, bonds and deposits. 5!+/ has received the highest rating for its

bonds and deposits program for the eighth year in succession.

Its outstanding loan portfolio covers well over a million dwelling units. 5!+/

has developed significant expertise in retail mortgage loans to different maret segments

and also has a large corporate client base for its housing related credit facilities. 6ith its

>

experience in the financial marets, a strong maret reputation, large shareholder base

and unique consumer franchise, 5!+/ was ideally positioned to promote a ban in the

Indian environment.

%ver the years, 5!+/ has helped to promote institutions in the field of housing

finance, and in the financial sector in general.

@otable amongst these has been 5!+/ *an. This was initially promoted in a

strategic alliance with @at west )arets?$G. 5!+/

*an commenced its operations in +ebruary 122C. 5!+/ *an currently has

strategic business collaboration with The /hase )anhattan *an. 5!+/ *an is

presently one of the largest private sector bans following the merger with Times *an

9imited. The merger has provided 5!+/ *an a strong presence in the retail?baning

segment.

5!+/ currently holds 23.3 H of equity in 5!+/ *an.

&toc also listed on @I&4 in the form of American !epository &hares

@etwor of over 131> branches and ##=2 AT)s in CCB cities

8hone baning, mobile and internet baning

/ustomer base of over #.1 million accounts

Gey business areas

6holesale baning

(etail baning

Treasury operations

+inancials 0as per Indian :)81 for year ended )ar #1,2BB#

Total income; (s 23.2> bn, increase of2#H over previous year

8AT; (s #.2 billion, increase of#BH over previous year.

(eturn on 4quity ?1=.1 H ?)aret capitali"ation J (s. >> billion 0$&K

1.#2 billion1.

B#S!NESS &OC#S

5!+/ *anDs mission is to be a 6orld?/lass Indian *an. The *anDs aim is to

build sound customer franchises across distinct businesses so as to be the preferred

provider of baning services in the segments that the ban operates in and to achieve

healthy growth in profitability, consistent with the banDs ris appetite. The ban is

committed to maintain the highest level of ethical standards, professional integrity and

regulatory compliance. 5!+/ *anDs business philosophy is based on four core values;

%perational 4xcellence, /ustomer +ocus, 8roduct 9eadership and 8eople.

<

T!MES BAN$ AMAL%AMAT!ON

In a milestone transaction in the In Indian baning industry, Times *an 9imited

0another new private sector ban promoted by *ennett, /oleman , /o. LTimes :roup1

was merged with 5!+/ *an 9td, effective +ebruary 2>, 2BBB. As per the scheme of

amalgamation approved by the shareholders of both bans and the (eserve *an of India,

shareholders of Times *an received share of 5!+/ *an for every C.<C shares of Times

*an. The amalgamation added significant value to 5!+/ *an in terms of increased

branch networ, expanded geographic reach, enhanced customer base, silled manpower

and the opportunity to crosssell and leverage alternative delivery channels.

"!STR!B#T!ON NET)OR$

5!+/ *an is headquartered in )umbai. The *an at present has an enviable

networ of over >=3 branches spread over #1C cities across the country. All branches are

lined on an online real?time basis. /ustomers in =B locations are also serviced through

8hone *aning. The *anDs expansion plans tae into account the need to have a

presence in all ma'or industrial and commercial centres where its corporate customers are

located as well as the need to build a strong retail customer base for both deposits and

loan products. *eing a clearingLsettlement ban to various leading stoc exchanges, the

*an has branches in the centers where the @&4L*&4 have a strong and active member

base.

The ban also has a networ of over 1>BC networed AT)Ds across these cities.

)oreover, all domestic and international AisaL)aster/ard, Aisa 4lectronL)aestro,

8lusL/irrus and American 4xpress /reditL/harge cardholders can access 5!+/ *anDs

AT) networ.

MANA%EMENT

)r. 7agdish /apoor too over as the banDs /hairman in 7uly 2BB1. 8rior to this,

)r. /apoor was a !eputy :overnor of the (eserve *an of India. The )anaging

!irector, )r. Aditya 8uri, has been a professional baner for over 2C years, and before

'oining 5%+/ *an in 1223 was heading /itibanDs operations in )alaysia.

The *anDs *oard of !irectors is composed of eminent individuals with a wealth

of experience in public policy, administration, industry and commercial baning.

&enior executives representing 5%+/ are also on the *oard.

&enior baning professionals with substantial experience in India and abroad head

various businesses and functions and report to the )anaging !irector. :iven the

professional expertise of the management team and the overall focus on recruiting and

=

retaining the best talent in the industry, the ban believes that its people are a significant

competitive strength.

H"&C PRO&!LE

Board of "irectors'

)r. 7agdish /apoor /hairmanL/hair 8erson

)r. Aditya 8uri )anaging !irector

)r. Gei ). )istry !irector

)r. Arvind 8ande !irector

)r.Ashim &amanta !irector

)r gautam divan !irector

)s (enu Garnad !irector

)r. /.). Aasudev !irector

!r. 8andit 8alande !irector

)r. 5arish 4ngineer 4xec. !irector

)r. 8aresh &uhtanar 4x. !ivn.

E5e!cutive +ice0President 2Legal3 6 Co- Secretar1

)r. &an'ay *.!ongre

Auditors

)Ls 5aribhati , /o.

/hartered Accountant

Registered Office

5!+/ *an 5ouse

&enapati *apat )arg

9ower 8arel

)umbai J 3BB B1#

Tel.;C>C21BBB, >>C21BBB

+ax; 232>B<#<

6ebsite;www.hdfcban.com

4mail;investor.heupdesMhdfcban.com

2

H"&C Product Profile

5!+/ *an India provides the following range of products;

&avings Account

5!+/ *an 8referred

&weep?In Account

&uper &aver Account

5!+/ *an 8lus

!emat Account

5!+/ )utual +und

5!+/ &tandard 9ife Insurance

H"&C !ndia innovative services

5!+/ 8hone *aning

5!+/ AT)

5!+/ Inter?cityLInter?branch *aning

5!+/ @et *aning

5!+/ International !ebit /ard

5!+/ )obile *aning

5!+/ *ill 8ay

H"&C Ban( Loans

5!+/ 8ersonal 9oan

5!+/ @ew /ar 9oan and $sed /ar 9oan

5!+/ 9oan Against &hares

5!+/ Two 6heeler , /onsumer 9oan

5!+/ 5ome 9oan

1B

TECHNOLO%*

5!+/ *an operates in a highly automated environment in terms of information

technology and communication systems. All the banDs branches have connectivity, which

enables the ban to offer speedy funds transfer facilities to its customers. )ultibranch

access is also provided to retail customers through the branch networ and Automated

Teller )achines 0AT)s1.

The *an has made substantial efforts and investments in acquiring the best

technology available internationally to build the infrastructure for a world?class ban. In

terms of software, the /orporate *aning business is supported by +lexcube, while the

(etail *aning business by +inware, both from i?flex &olutions 9td. The systems are

open, scaleable and web?enabled.

The *an has prioriti"ed its engagement in technology and the Internet as one of

its ey goals and has already made significant progress in web?enabling its core

businesses. In Deach of its businesses, the *an has succeeded in leveraging? its maret

position, expertise and technology to create a competitive advantage and build maret

share.

B#S!NESS PRO&!LE

5!+/ *an caters to a wide range of baning services covering both commercial and

investment baning on the wholesale side and transactionalLbranch baning on the retail

side. The ban has three ey business areas;

2a3 )olesale Ban(ing Services

The *anDs target maret is primarily large, blue chip manufacturing companies in

the Indian corporate sector and to a lesser extent, emerging midsi"ed corporates.

+or these corporate, the *an provides a wide range of commercial and

transactional baning services, including woring capital finance, trade services,

transactional services, cash management, etc. The ban is also a leading provider

of structured solutions that combine cashD management services with vendor and

distributor finance for facilitating superior supply chain management for its

corporate customer

243 Retail Ban(ing Services

The ob'ective of the (etail *an is to provide its target maret customers a full

range of financial products and baning services, giving the customer a one stop

window for all hisLher baning requirements. The products are baced by world?

class service and delivered to the customers through the growing branch networ,

as well as through alternative delivery channels lie AT)s, 8hone *aning, @et

*aning and )obile *aning.

11

The 5!+/ *an 8referred program for high net worth individuals, the 5!+/

*an 8lus and the Investment Advisory &ervices programs have been designed

eeping in mind needs of customers who see distinct financial solutions,

information and advice on various investment avenues. The *an also has a wide

array of retail loan products including Auto 9oans, 9oans against maretable

securities, 8ersonal 9oans and 9oans for Two?wheelers. Its also a leading provider

of !epository &ervices to retail customers, offering customers the facility to hold

their investments in electronic form.

5!+/ *an was the first ban in India to launch an International !ebit /ard in

association with AI&A 0AI&A 4lectron1 and issues the )aster/ard )aestro debit

card as well. The debit card allows the user to directly debit his account at the

point of purchase at a merchant establishment, in India and overseas. The *an

launched its credit card in association with AI&A in @ovember 2BB1. The *an is

also one of the leading players in the Nmerchant acquiringN business with over

2C,BBB 8oint?of?sale 08%&1 terminals for debit L credit cards acceptance at

merchant establishments. The *an is well positioned as a leader in various net?

based *2/ opportunities including a wide range of Internet baning services for

+ixed !eposits, 9oans, *ill 8ayments., etc.

2c3 Treasur1 Operations

6ithin this business, the ban has three main product areas?+oreign 4xchange

and !erivatives, 9ocal /urrency )oney )aret , !ebt &ecurities, and 4quities

6ith the liberali"ation of the financial marets in India, corporate need more

sophisticated ris management information, advice and product structures, These

and fine pricing on various treasury products are provided through the banDs

Treasury team. To comply with statutory reserve requirements, the ban is

required to hold 2CH of its deposits in government securities. The Treasury

business is responsible for managing the returns and maret ris on this

investment portfolio.

12

RESERCH METHO"OLO%* '

The procedure adopted for conducting the research requires a lot of attention as it has

direct bearing on accuracy, reliability and adequacy of results obtained. It is due to this

reason that research methodology, which we used at the time of conducting the research,

needs to be elaborated upon. (esearch )ethodology is a way to systematically study ,

solve the research problems. If a researcher wants to claim his study as a good study, he

must clearly state the methodology adopted in conducting the research so that it ma be

'udged by the reader whether the methodology of wor done is sound or not.

(esearch is any organi"ed inquiry carried out to provide information for solving

problems. *usiness research is a systematic inquiry that provides information to tae

business decisions.

"efinition

-(esearch comprises of defining and redefining hypothesis or suggesting solution,

collecting, organi"ing and evaluating data maing deductions and reaching conclusions..

B1 Clifford )ood1

The term (esearch )ethodology here comprises of all research activities carried

on in connection with the -Anal1sis is various scemes under Saving7 Current and

&i5ed "eposit Accounts Provided 41 H"&C Ban(8-

Meaning of Researc;

(esearch is defined as -a scientific , systematic search for pertinent information

on a specific topic. (esearch is an art of scientific investigation. (esearch is a

systemati"ed effort to gain new nowledge. It is a careful investigation or inquiry

especially through search for new facts in any branch of nowledge. (esearch is an

academic activity and this term should be used in a technical sense. (esearch com prices

defining and redefining problems, formulating hypothesis or suggested solutionsO maing

deductions and reaching conclusions to determine whether they fit the formulating hypo

thesis. (esearch is thus, an original contribution to the existing stoc of nowledge

maing for its advancement. The search for nowledge through ob'ective and systematic

method of findqing solution to a problem is research.

Sampling 6 Sampling "esign

1#

All items in any field of inquiry constitute a E$niverseF or E8opulationF. A

complete enumeration of all items in the population is nown as census inquiry. *ut

where census inquiry is not feasible due to time, money and efforts constraint sample

survey is conducted.

The respondents selected should be as representative of the total population as possible in

order to produce a miniature cross?section. The selected respondents constitute what is

technically called a EsampleF and the selection process is called 9sampling tecni:ue;

and the survey so conducted is nown as 9sample surve1;-

A 9sample design; is a definite plan for obtaining a sample from a given

population. It refers to the technique or the procedure the researcher would adopt in

selecting items for the sample.

The corporate sea being very fast, it becomes impossible to contact each and

every individual of the universe due to the time and money constraints. Therefore, the

study has been narrowed down to a representative sample to mae the study more

manageable.

Geeping in view the ob'ectives and resource limitations of the study, sample of

1BB orgnaisations was taen. This sample of three organi"ations was selected on the basis

of random sampling.

Researc "esign

A research design is the arrangement of conditions for collection and analysis of

data in a manner that aims to combine relevance to the research purpose with economy in

procedure. (esearch design is the conceptual structure within which research is

conducted. It constitutes the blueprint for the collection measurement and analysis of

data. (esearch design operational implication to the final analysis of data.

It also includes the time and cost budget since most studies are done under these

two constraints. (esearch design can be categori"ed as;

The present study is descriptive in nature, as it sees to describe ideas and insight

and to bring out new relationships. (esearch design is flexible enough to provide

opportunity for considering different aspects of problems under study. It helps in bringing

into focus some inherent weaness in enterprise regarding which in depth study can be

conducted by management

In the study I will apply descriptive researc design- As descriptive researc design is

the description of state of affairs, as it exists at present. In this type of research the

researcher has no control over the variables, he can only report what has happened or

what is happening.

13

"ata Collection '

The data for the study is comprised both primary as well as secondary.

Primar1 data has been collected from executives of 5!+/ *an, other bans and

customers, through the questionnaire comprising the various questions related to the

study, by discussions, meeting with the executives at different levels, copy of

questionnaire is enclosed in the annexure. &econdary data has been collected through the

annual reports, data from maga"ines, 'ournals, newspapers and online information.

The primary data are those which are collected a fresh and for the first time and

thus happen to be original in character.

The secondar1 data are those which have already been collected by someone else

and which have already been passed through the statistical process.

Primar1 "ata' Puestionnaire, data from ban staff members and

9oan department.

Secondar1 "ata' !ata from maga"ines, 'ournals, newspapers,

%nline information etc.

OB<ECT!+ES O& THE ST#"*

To now the concept of *aning sector.

To explore various schemes lie saving account, current account, fixed deposits,

demat account offered by 5!+/ *an.

To now which is the most popular scheme of the ban.

To now promotional efforts made by the ban to attract customers.

To now problems faced by the customers in the ban.

To find out awareness level , reaction of customers towards direct baning

channels providing by ban.

To find causes of dissatisfaction, if any, about !irect *aing /hannels.

To provide suggestions for improvement in different schemes provided by 5!+/

ban.

1C

L!M!TAT!ONS O& THE ST#"*

!ue to constraints of time , resources the present study is liely to suffer from

certain limitations some of these are mentioned below, so that study can be

understood in a proper way ;

Area covered under the report as sample si"e was very small.

The research was carried out in a short period of >?< wees as a part of summer

training. The pro'ect was completed within the given time frame.

&ome of the respondents of the survey were unwilling to give information.

&ometimes wrong respondents provided information, which needed to be,

crosscheced , verified.

/hances of biasness are there because of the use of convenient sampling.

&ome respondents were not available and thus needed data could not be found.

Availability of data was a constraint due to only on those schemes are considered,

which is available.

Though every J -8recaution has taen due to large data , complex calculation

there may be chance of errors..

1>

S)OT ANAL*S!S

Strengths

HDFC bank is the second largest private banking sector in India having

2,201 branches and 7,110 ATMs

HDFC bank is located in 1,17! cities in India and has "ore than #00

locations to serve c$sto"ers thro$gh Telephone banking

The banks ATM card is co"patible %ith all do"estic and international

&isa'Master card, &isa (lectron' Maestro, )l$s'cir$s and A"erican (*press+

This is one reason ,or HDFC cards to be the "ost pre,erred card ,or shopping and

online transactions

HDFC bank has the high degree o, c$sto"er satis,action %hen co"pared

to other private banks

The attrition rate in HDFC is lo% and it is one o, the best places to %ork in

private banking sector

HDFC has lots o, a%ards and recognition, it has received -.est .ank

a%ard ,ro" vario$s ,inancial rating instit$tions like D$n and .radstreet,

Financial e*press, ($ro"one/ a%ards ,or e*cellence, Finance Asia co$ntr/

a%ards etc

HDFC has good ,inancial advisors in ter"s o, g$iding c$sto"ers to%ards

right invest"ents

Weakness

HDFC bank doesnt have strong presence in 0$ral areas, %here as ICICI

bank its direct co"petitor is e*panding in r$ral "arket

HDFC cannot en1o/ ,irst "over advantage in r$ral areas+ 0$ral people are

hard core lo/als in ter"s o, banking services+

HDFC lacks in aggressive "arketing strategies like ICICI

The bank ,oc$ses "ostl/ on high end clients

2o"e o, the banks prod$ct categories lack in per,or"ance and doesnt

have reach in the "arket

1<

The share prices o, HDFC are o,ten ,l$ct$ating ca$sing $ncertaint/ ,or the

investors

Opportunities

HDFC bank has better asset 3$alit/ para"eters over govern"ent banks,

hence the pro,it gro%th is likel/ to increase

The co"panies in large and 2M( are gro%ing at ver/ ,ast pace+ HDFC has

good rep$tation in ter"s o, "aintaining corporate salar/ acco$nts

HDFC bank has i"proved its bad debts port,olio and the recover/ o, bad

debts are high %hen co"pared to govern"ent banks

HDFC has ver/ good opport$nities in abroad

4reater scope ,or ac3$isitions and strategic alliances d$e to strong

,inancial position

Threats

HDFCs nonper,or"ing assets 56)A7 increased ,ro" 0+1# 8 to 0+208+

Tho$gh it is a slight variation its not a good sign ,or the ,inancial health o, the

bank

The non banking ,inancial co"panies and ne% age banks are increasing in

India

The HDFC is not able to e*pand its "arket share as ICICI i"poses "a1or

threat

The govern"ent banks are tr/ing to "oderni9e to co"pete %ith private

banks

0.I has opened $p to 7!8 ,or ,oreign banks to invest in Indian "arket

1=

PESTLE ANAL*S!S

1. Indian baning sector is least affected as compared to other developed countries?

thans to robust policy framewor of (*I.Q :overnment affects the performance of

baning sector most by legislature and framing policy government through its budget

affects the baning activities securiti"ation act has given more power to baning sector

against defaulting borrowers.Q &tricter prudential regulations with respect to capital and

liquidity gives India an advantage in terms of credibility over other countries.Q To support

capitalisation, the government has infused (s 2#,2BB crore 0$&K C.2 billion1 into state?

owned bans during the last three fiscals

2. The move to increase +oreign !irect Investment +!I limits to 32 percent from 2B

percent during the first quarter of this fiscal came as a welcome announcement to foreign

players wanting to get a foot hold in the Indian )arets by investing in willing Indian

partners who are starved of net worth to meet /A( norms.Q /eiling for +II investment in

companies was also increased from 23.B percent to 32.B percent and have been included

within the ambit of +!I investment Q Increase +arm /redit Q &ubvention of 1H to be paid

as incentive to farmers Q !ebt 6aiver for +armers Q &etting up of separate tas force for

those not covered under the debt waiver scheme

#. Agriculture has been the mainstay of our economy with >BH of our

populationderiving their sustenance from it.QIn the recent past, the sector has recorded a

growth of about 3H per annum withsubstantial increase in plan allocations and capital

formation in the sector with help ofbaning assistance.QThe one?time ban loan waiver of

nearly (s <1,BBB crore to cover an estimated 3B million farmers was one of the ma'or

highlights

3. 4very year (*I declares its > monthly policies and accordingly the

variousmeasures and rates are implemented which has an impact on the

baningsector.QThe 4conomic measures affects the baning sector to boost the economy

by giving certain concessions or facilities. If in the savings are encouraged, thenmore

deposits will be attracted towards the bans and inturn they can lendmore money to the

agricultural sector and industrialsector, therefore, booming the economy.QIf the +!I limits

are relaxed, then more +!I are brought in India through baning channels

C. Gey 7uly &ept %ct4very year (*I declares its > monthly (ate 2>th 1>th

2Cthpolicies and accordingly the various smeasures and rates are implemented whichhas

an impact on the baning /(( >.oo >.BB >.BBsector.In past 23 months (*I has changed

its (epo =.BB =.2C =.CBey monetary rates 1# times to curb rateinflation and other

economic riss. (ever <.BB <.2C <.CB se repo rate &9( 23 23 23

12

>. Indian economy has registered robust growth in past years and *aning sector

isdirectly related to the growth of the economy.:%I is trying to push the economy by

framing favorable +!I policies , @(IInvestment plans which directly affect the

:!8.These plans directly affect baning industry as money comes through bans

andban earns interest on that.

<. Interest (ates;(*I controls interest rates, which (*I monitors regularly(ecently

(*I reduced ban rate to stimulate growth of baning industryInflation (ate;India is

facing huge troubles due to inflation as it is 1BH now.To curb the inflation and slowdown

of economy (*I has taen varioussteps lie lowering interest rates to increase the

demand in baning sector&avings and Investments; :ross domestic saving is 2=H of total

income in India9atest step taen by (*I to deregulate savings rates is a step to

increase*an savings

=. It includes cultural aspects and health consciousness, population growth rate,

agedistribution, career attitudes and emphasis on safety. This could be

classifiedinto;*efore the birth of the bans, people of India were used to borrow money

localmoneylenders, shahuars, shroffs. They were used to charge higher interest andalso

mortgage land and house. *ut after emergence of bans attitude of people waschanged

and they have started lending from the bans 9ife style of India is changing rapidly. They

are demanding high class products. They have become more advanced. 8eople needs and

wants are increasing day by day. And this has this has opened opportunities for baning

sector to tap this change. This has made things available easily to everyone.

2. Increase in population is one of he important factor, which affect theprivate sector

bans. *ans would open their branches after looing into thepopulation demographics

of the area.@ewer branches are coming to serve the increasing population. This incentive

to banscomes on the bac of the continuing need to open more branches in these &tates

inorder to ensure more uniform spatial distribution9iteracy rate in India is very low

compared to developed countries.Illiterate people hesitate to transact with bans. &o, this

impacts negatively onbans. *ut there is positive side of this as well i.e. illiterate people

trust more onbans to deposit their money, they do not have maret

information.%pportunities in stocs or mutual funds

1B. Technology plays a very important role in banFs internal control mechanisms as

wellas services offered by them. Through the use of technology new products and

serviceare introduced. It include technological aspects suchas (,! activity, automation,

technology incentives and the rate of technologicalchange. &ome of the technological

changes which brought radical changes in baningindustry are described below ; The

latest developments in terms of technology in computer and telecommunication have

encouraged the baners to change the concept of branch baning to anywhere baning.

The use of AT) and Internet baning has allowed Eanytime, anywhere baningF facilities

Automatic voice recorders now answer simple queries, currency accounting machines

maes the 'ob easier and self?service counters are now encouraged.

11. /redit card facility has encouraged an era of cashless society. The bans have

now started issuing smartcards or debit cards to be used for maing payments. These are

2B

also called as electronic purse.Q &ome of the bans have also started home baning

through telecommunicationfacilities and computer technology by using terminals

installed at customers homeand they can mae the balance inquiry, get the statement of

accounts, giveinstructions for fund transfers, etc.Q Today bans are also using &)& and

Internet as ma'or tool of promotions and giving great utility to its customers. +or example

&)& functions through simple text messages sent from your mobileQ Technology

advancement has changed the face of traditional baning systems. Technology

advancement has offer 23R< baning even giving faster and securedservice

12. Indian economy has registered a high growth for last three years and is expected

tomaintain robust growth rate as compare to other developed and developingcountries.

*aning Industry is directly related to the growth of the economy.The growth rate of

different industries were;Agriculture ; 1=.CHIndustry ; 2>.#H&ervices ; CC.2HQ It is great

news that today the service sector is contributing more than half of the Indian :!8. It

taes India one step closer to the developed economies of the world. 4arlier it was

agriculture which mainly contributed to the Indian :!8.Q This increases the avenues of

investment by the industrial sector . This wouldfurther increase the borrowings by the

industries leading to the baning IndustryQ In regards with the service sector , as the

income of the people will increase, lending and savings will increase leading to increased

business for the bans .

1#. There are two ma'or factors determining the legal aspects of the *aning Industry

;In 1232, the *aning (egulation Act was enacted which empowered the (eserve *an

ofIndia 0(*I1 Nto regulate, control, and inspect the bans in India.The *aning

(egulation Act also provided that no new ban or branch of an existingban could be

opened without a license from the (*I, and no two bans could havecommon directors

The (eserve *an of India 0(*I1 will intervene to smooth sharp movements in the rupee

and prevent a downward spiral in its value, but will balance this with the need to retain

reserves in the event of prolonged turbulence

13. The impressive performance of Indian bans as compared to other large

economies onalmost all parameters ? profitability, cost to income ratio, non?performing

asset 0@8A1levels, valuations, net interest margins, fee income ? the industry is on the

right side ofaverage among comparable economies.Q Transition from class baning to

mass baning and increased customer focus isdrastically changing the landscape of

Indian baning. 4xpansion of retail baning has alot of potential as retail assetsQ @ew

channels 0lie AT) and mobile phones1 allow transactions at a fractional cost.The study

exposes a possibility for the next decade. Investment in technology in theIndian baning

industry is about half of international averageQ /onsolidation in the baning industry has

remained crucial to ensuring technologicalprogress, excess retention capacity, emerging

opportunities and deregulation of variousfunctional and product

21

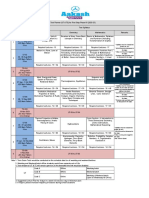

=,- )at factor pla1s an important role >ile opening an account?

TA*94 ?3.1

&ACTORS @A%E O& RESPON"ENTS

Advertisement 2B

&pecial %ffer #B

%perational &taff 1C

/onvincing 8ower of 4xecutive 2B

/redibility of *an 1C

@ of Respondents

08(I)A(I &%$(/4?&$(A4I1

!NTERPRETAT!ON '0 #BH, after conducting the survey advertisement plays 2BH,

&pecial %ffer plays %perational &taff plays 1CH, /onvincing 8ower of 4xecutives plays

22

2BH and /redibility of *an 8lays 1CH role while opening an account in 5!+/ *an.

Thus study shows that special offer plays the most important role while opening an

account according to the respondents.

=.- )ic product does 1ou use te most?

TA*94?3.2

PRO"#CT NAME @A%E O& RESPON"ENTS

&aving ALc 33

/urrent ALc 22

+ixed !eposit 2>

!emat ALc =

@ of Respondents

08(I)A(I &%$(/4?&$(A4I1

!NTERPRETAT!ON '

I this table shows that the people who are using &aving ALc are 33H, /urrent ALc are

22H, +ixed !eposit are 2>H and %ther are =H.

Thus the study shows that &aving ALc is the most preferred product of 5!+/

*an by respondents.

2#

=/- )ic t1pe of &"R is most popular?

TA*94?3.#

&" Sceme @A%E O& RESPON"ENTS

&imple +! #B

&uper &aver 3C

&weep in ALc 2C

@ of Respondents

08(I)A(I &%$(/4?&$(A4I1

!NTERPRETAT!ON '0 This Table shows that people are using simple +! are #BH,

&uper &aver are 3CH are &weep in ALc are 2CH.Thus the study shows that &uper &aver is

the most popular +! &cheme by the respondents )ost 8opular +! &cheme.

23

=A- Are 1ou a4le to maintain A=B of Rs- ,BBBB in saving account?

TABLE0A-A

84(/4@TA:4 %+ T54 (4&8%@!4@T&

Ies @o

CD ,D

Tis can 4e so>n 41 tis grap

H of (espondents

2PR!MAR* SO#RCE0 S#R+E*3

!NTERPRETAT!ON '

)ost of the customers were able to maintain average Puarterly *alance.

2C

=D. )ic of te follo>ing "irect Ban(ing Cannels 2"BC3 1ou avail

te most?

TA*94?3.C

!*/ +A/I9ITI4& HA:4 %+ T54 (4&8%@!4@T&

AT) AD

8hone *aning ,B

@et *aning .D

)obile *aning .B

84(/4@TA:4 %+ (4&8%@!4@T&

08(I)A(I &%$(/4? &$(A4I1

!NTERPRETAT!ON '

Thus study shows that AT) is the most preferred !irect *aning /hannel by the

respondents.

2>

=E -)at are te causes for not using an1 of te "irect Ban(ing

Cannels?

TA*94?3.>

/A$&4& HA:4 %+ T54 (4&8%@!4@T&

$nawareness #2

9ac of Gnowledge 32

+eel more secure while baning personally 1C

$nsatisfied C

84(/4@TA:4 %+ (4&8%@!4@T&

08(I)A(I &%$(/4?&$(A4I1

!NTERPRETAT!ON '

This graph shows that the main cause for not using !*/ by respondents is lac of

nowledge.

2<

=F- Ho> >ill 1ou rate performance of director 4an(ing cannels 1ou

are using?

TA*94?3.<

84(+%()A@/4 %+ %*/ HA:4 %+ T54 (4&8%@!4@T&

*est 3B

:ood #B

+air 2B

8oor <

Aery 8oor #

08(I)A(I &%$(/4?&$(A4I1

!NTERPRETAT!ON '

The graph shows that 3BH people says !*/ *est, #BH says !*/ is good, 2BH

says !*/ +air, <H says !*/ is poor and #H says !*/ is very poor in its performance.

2=

=C- Ho> >ould 1ou rate performance of H"&C Ban(?

TA*94?3.=

/A$&4& HA:4 %+ T54 (4&8%@!4@T&

Best AB

%ood /D

&air .B

Poor /

+er1 Poor .

84(/4@TA:4 %+ (4&8%@!4@T&

08(I)A(I &%$(/4?&$(A4I1

!NTERPRETAT!ON '

This graph shows that 3BH people says 5!+/ is *est in its performance, #CH people

says 5!+/ is :ood, 2BH says it is +air, #H says it is poor and 2H people says it is

very poor in its performance.

22

=G- "id 1ou face an1 pro4lems >ile maintaining 1our account in

4an(?

Table no.? 3.2

Option @

*es .E

No FA

@ O& RESPON"ENTS

08(I)A(I &%$(/4?&$(A4I1

!NTERPRETAT!ON '

This :raph shows that 2>H people says they are facing the problem while maintaining

the Account and <3H people says they are not facing any of the problem while

maintaining the Account in 5!+/ *an.

#B

=,B- )1 do 1ou prefer H"&C Ban(?

TA*94?3.1B

+A/T%(& 84(/4@TA:4

*etter +acilities 2B

8lan #B

&elusen #B

Agents 1C

%thers C

08(I)A(I &%$(/4? &$(A4I1

!NTERPRETAT!ON '

The graph shows that 2BH respondents preferred 5!+/ *an because of *etter

+acilities, #BH because of *etter plan, #BH because of &elusen, 1CH because of agents

and CH because of other facilities.

&!N!"!N%

#1

&aving account is the most important product, next come +!, then current and

lastly !emat.

&uper saver scheme is the most popular scheme in +!.

Around =CH of respondents are able to maintain their AP* of (s. CBBB in saving

account.

AT) facility is mostly used among all direct baning channels as 3CH

respondents agreed to this.

9ac of nowledge about !*/ is the most important reason for not using !*/.

Also awareness about them is the reason !*/ performance is rated as

satisfactory.

5!+/ *anFs performance is rated as satisfactory.

4xecutives have satisfactory nowledge about products.

<3H of respondents faced no problem while maintaining their account.

5!+/ *an is preferred the most because of facilities , better plans , selusen.

#2

S#%%EST!ONS

8romotional efforts lie advertisement canopies increase in number of )areting

4xecutive, distribution of brochures, sponsoring various shows , functions

should be increased to increase awareness about 5!+/ *an and its products and

attract customers.

%n line trading of shares should be started for !emat ALc holders.

&ervice charges for non maintenance of AP* in saving account should be

decreased.

!emonstrate the use of !irect *aning /hannels 0!*/1 lie AT), phone

baning, net baning, +or account opening and delivery of welcome it, time

should be reduced.

The ban should provide regular and frequent calls to their profitable customers to

retain clientele , to mae them feel more comfortable and attached to the ban

0/()1.

5!+/ *an should also bring a new feature of // 0/ash /redit1 limit.

##

B!BL!O%RAPH*

)e4 sites ;

www.hdfcban.com

www.pnb.com

www.statebanofindia.com

finance.indiamart.com

rupya.com

tribuneindia.com

ingvs'aban.com

otamahindra.com

Annual reports or annual statement of 5!+/ ban

*rouchers of 5!+/ Ban(

<ournal '

International 'ournal of mareting research

International 'ournal of research in mareting

7ournal of business research

7ournal of business /onsumer research

7ournal of finance

7ournal of financial economics

7ournal of financial management , analysis

7ournal of general management

*usiness India

*usiness wee

*usiness today

*usiness world

Treasury )gt. challenges for India *aning Industry, I/+AI university C#>?#=.

#3

=#EST!ONNA!RE

@ame ; SSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSS

Age ; SSSSSSSSSSSSSSSSSSSS &ex SSSSSSSSSSSSSSSSSS

%ccupation ; SSSSSSSSSSSSSSSSSSSSS 8hone @o. ; SSSSSSSSSSSSS

,- )ic factor pla1s an important role >ile opening an account?

Advertisement &pecial %ffers

/onvincing power of 4xecutives

%perational &taff ! /redibility of ban

.- )ic product do 1ou use te most?

&aving Account %thers

/urrent Account +!

/- )ic &" sceme is mot popular?

+! &uper saver ALc

&weep in account

A- Are 1ou a4le to maintain A=B of Rs- ,BBBB in savings account?

Ies @o

D- )ic of te follo>ing facilities "irect 4an(ing Cannels 2"BC3 1ou avail

te most?

AT) @et *aning

)obile *aning 8hone *aning

#C

E- )at are te causes for non using an1 of te "irect Ban(ing Cannels?

$nawareness $nsatisfied

9ac of nowledge about use %ther

F- Ho> >ill 1ou rate performance of direct 4an(ing cannels 1ou are using?

*est :ood +air

8oor Aery 8oor

C- Ho> >ould 1ou rate performance of H"&C Ban(?

*est :ood +air

8oor Aery 8oor

G- "id 1ou face an1 pro4lems >ile maintaining 1our account at 4an(? !f 91es;

please mention >at pro4lems 1ou faced-

Ies SSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSS

@o SSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSS

,B- )1 do 1ou prefer H"&C Ban(?

*etter &ervices Attractive 8lans

%ther *etter (eturns Agent Gnown

,,- Suggestions '

SSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSS

SSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSSS

Place ' HHHHHHHHHHHHHHHHH

"ate ' HHHHHHHHHHHHHHHHHH

#>

CONCL#S!ON

#CH of respondents carne to now about ban through friends while 3BH

through mareting executive 1BH through ads and exhibition each.

&pecial offer with the products played an important role while opening an

account as suggested by #BH respondents are credibility of ban plays important

role as suggested by another 1CH of respondents agreed while 1CH of

respondents agreed operational staff and convincing power of executives play

important role as 2BH.

&aving account is the most important product, next come +!, then current and

lastly !emat.

&uper saver scheme is the most popular scheme in +!.

Around =CH of respondents are able to maintain their AP* of (s. CBBB in saving

account.

AT) facility is mostly used among all direct baning channels as 3CH

respondents agreed to this.

9ac of nowledge about !*/ is the most important reason for not using !*/.

Also awareness about them is the reason !*/ performance is rated as

satisfactory.

5!+/ *anFs performance is rated as satisfactory.

4xecutives have satisfactory nowledge about products.

<3H of respondents faced no problem while maintaining their account.

5!+/ *an is preferred the most because of facilities , better plans , selusen.

#<

#=

You might also like

- Banking Laws: Regulatory Framework For Business TransactionsDocument100 pagesBanking Laws: Regulatory Framework For Business TransactionsMarian Roa100% (1)

- The Mutual Funds Book: How to Invest in Mutual Funds & Earn High Rates of Returns SafelyFrom EverandThe Mutual Funds Book: How to Invest in Mutual Funds & Earn High Rates of Returns SafelyRating: 5 out of 5 stars5/5 (1)

- Clearing Negative SpiritsDocument6 pagesClearing Negative SpiritsmehorseblessedNo ratings yet

- Motion To Strike BasedDocument16 pagesMotion To Strike BasedForeclosure Fraud100% (1)

- OglalaDocument6 pagesOglalaNandu RaviNo ratings yet

- Equine PregnancyDocument36 pagesEquine Pregnancydrdhirenvet100% (1)

- Grammar Reference With Practice Exercises: Unit 1Document25 pagesGrammar Reference With Practice Exercises: Unit 1violet15367% (3)

- Evolution of BankingDocument73 pagesEvolution of BankingKavita KohliNo ratings yet

- Comparative Analysis of HDFC Bank and SBIDocument37 pagesComparative Analysis of HDFC Bank and SBIsiddhantkamdarNo ratings yet

- (Dan Stone) The Historiography of The HolocaustDocument586 pages(Dan Stone) The Historiography of The HolocaustPop Catalin100% (1)

- FINANCIAL INTELLIGENCE: FUNDAMENTALS OF PRIVATE PLACEMENT PROGRAMS (PPP)From EverandFINANCIAL INTELLIGENCE: FUNDAMENTALS OF PRIVATE PLACEMENT PROGRAMS (PPP)Rating: 5 out of 5 stars5/5 (1)

- Accounts of IndividualsDocument67 pagesAccounts of IndividualsgauriNo ratings yet

- Law of Banking and Insurance in Nigeria by IsochukwuDocument17 pagesLaw of Banking and Insurance in Nigeria by IsochukwuVite Researchers100% (1)

- 2018080, CRPC Research PaperDocument23 pages2018080, CRPC Research Paperguru charanNo ratings yet

- BANCASSURANCE - Blackbook Project 2k17Document56 pagesBANCASSURANCE - Blackbook Project 2k17Harshil Doshi75% (8)

- A Project Report On HDFC BankDocument47 pagesA Project Report On HDFC BankMukesh Lal100% (1)

- Theater 10 Syllabus Printed PDFDocument7 pagesTheater 10 Syllabus Printed PDFJim QuentinNo ratings yet

- "What Is A Concept Map?" by (Novak & Cañas, 2008)Document4 pages"What Is A Concept Map?" by (Novak & Cañas, 2008)WanieNo ratings yet

- Tamil and BrahminsDocument95 pagesTamil and BrahminsRavi Vararo100% (1)

- Hercules Industries Inc. v. Secretary of Labor (1992)Document1 pageHercules Industries Inc. v. Secretary of Labor (1992)Vianca MiguelNo ratings yet

- Service and Maintenance Manual AFPX 513 PDFDocument146 pagesService and Maintenance Manual AFPX 513 PDFManuel Amado Montoya AgudeloNo ratings yet

- Workings of Debt Recovery TribunalsDocument25 pagesWorkings of Debt Recovery TribunalsSujal ShahNo ratings yet

- BANKING AND INSURANCE (1) .Docx NewDocument59 pagesBANKING AND INSURANCE (1) .Docx Newsuganya100% (1)

- Chapter 1 BankingDocument23 pagesChapter 1 BankingKalpana GundumoluNo ratings yet

- Advertising Strategies of Banking Sectors in IndiaDocument77 pagesAdvertising Strategies of Banking Sectors in Indiakevalcool250No ratings yet

- History of Banking & Principles of InsuranceDocument11 pagesHistory of Banking & Principles of InsuranceRudresh SrivastavaNo ratings yet

- Banking TheoryDocument56 pagesBanking TheoryChella KuttyNo ratings yet

- Review of LiteratureDocument64 pagesReview of LiteratureRUTUJA PATILNo ratings yet

- Review of LiteratureDocument65 pagesReview of LiteratureRUTUJA PATILNo ratings yet

- Corporate Insolvency NotesDocument15 pagesCorporate Insolvency NotesAnirudh SoodNo ratings yet

- Evolution & Growth of Investment Banking in India - grp6 - SecannnnDocument13 pagesEvolution & Growth of Investment Banking in India - grp6 - SecannnnNaveen KeswaniNo ratings yet

- Slide 1 - Definition and Functions of BankingDocument38 pagesSlide 1 - Definition and Functions of BankingVaibhav Suchdeva0% (1)

- Winter ProjectDocument25 pagesWinter ProjectKishan gotiNo ratings yet

- Project On Bank of IndiaDocument56 pagesProject On Bank of IndiaJoanna HernandezNo ratings yet

- Chapter 3 Book AnswersDocument14 pagesChapter 3 Book AnswersKaia LorenzoNo ratings yet

- MBFS Questions 1 TO 5Document16 pagesMBFS Questions 1 TO 5ravipriya19No ratings yet

- PGDM Chirag PresentationDocument57 pagesPGDM Chirag PresentationEkta Chaturvedi [LUC]No ratings yet

- Final Proj 03Document150 pagesFinal Proj 03disha_kackerNo ratings yet

- Basis For Comparison Common Law Statutory LawDocument10 pagesBasis For Comparison Common Law Statutory Lawbhanu pratap singh rathoreNo ratings yet

- The Financial Sector Part 2.Document5 pagesThe Financial Sector Part 2.Steven JamesNo ratings yet

- HDFC G - 1Document83 pagesHDFC G - 1Gurinder SinghNo ratings yet

- A Seminar Report ON A Contemporary Management Issue Titled: Quickly Changing View of Banking Sector in India'Document38 pagesA Seminar Report ON A Contemporary Management Issue Titled: Quickly Changing View of Banking Sector in India'Vlkjogfijnb LjunvodiNo ratings yet

- Swot Analysis in Bancassurance.Document50 pagesSwot Analysis in Bancassurance.Parag More100% (2)

- CRT - BankingDocument8 pagesCRT - BankingPola DeepuNo ratings yet

- Loans and Advances BBM ProjectDocument102 pagesLoans and Advances BBM ProjectRamesh Ravi82% (33)

- Banking Paper1Document38 pagesBanking Paper1Prashant KumarNo ratings yet

- Unit IDocument11 pagesUnit IShahid AfreedNo ratings yet

- Banking Paper1Document38 pagesBanking Paper1ronaksingh6496313No ratings yet

- PPT of NBFC SDocument31 pagesPPT of NBFC SsagarkharpatilNo ratings yet

- History of Banking in India. History of Insurance in India.: PrefaceDocument42 pagesHistory of Banking in India. History of Insurance in India.: PrefaceKarishmaNo ratings yet

- Central University of South Bihar: Aishwarya Sudhir CUB1413125006 B.A.LLB. 8 SemDocument12 pagesCentral University of South Bihar: Aishwarya Sudhir CUB1413125006 B.A.LLB. 8 SemSidhant SinhaNo ratings yet

- 403 PPT-1Document14 pages403 PPT-1NikitaNo ratings yet

- Bala Handout On The Subject Merchant Banking & Venture CapitalDocument75 pagesBala Handout On The Subject Merchant Banking & Venture CapitalBalachandran RamachandranNo ratings yet

- Evolution of Financial Services in India: 1. The Stage of InfancyDocument15 pagesEvolution of Financial Services in India: 1. The Stage of InfancyImdad HazarikaNo ratings yet

- Banking SystemDocument12 pagesBanking SystemDilip RCNo ratings yet

- Npa's ContentDocument46 pagesNpa's ContentPiyushVarmaNo ratings yet

- Chapter1: Introduction of Indian BankDocument46 pagesChapter1: Introduction of Indian BankRupal Rohan DalalNo ratings yet

- Indranil Paul - 092 - Internatioanl Trade FinanceDocument61 pagesIndranil Paul - 092 - Internatioanl Trade FinanceIndranil PaulNo ratings yet

- Chapter Vi: Classification of Credit and Their ResourcesDocument5 pagesChapter Vi: Classification of Credit and Their Resourcesfsfsfsfs asdfsfsNo ratings yet

- Unit 1-The Organisation of The Financial Industry PDFDocument25 pagesUnit 1-The Organisation of The Financial Industry PDFNguyễn Văn NguyênNo ratings yet

- Reliance MoneyDocument121 pagesReliance MoneykushalsaxenaNo ratings yet

- Internship ReportDocument63 pagesInternship Reportimislamian0% (1)

- Banking Structure in India: A Project OnDocument22 pagesBanking Structure in India: A Project OnnehaNo ratings yet

- IFS BOOK MEPL Sem 3 CUDocument67 pagesIFS BOOK MEPL Sem 3 CUkohinoor5225No ratings yet

- Measures To Solve Problems of NPADocument29 pagesMeasures To Solve Problems of NPAYogesh ShankarNo ratings yet

- Chapter 1Document98 pagesChapter 1Om Prakash SinghNo ratings yet

- Business Finance and The SMEsDocument6 pagesBusiness Finance and The SMEstcandelarioNo ratings yet

- Romanian Oil IndustryDocument7 pagesRomanian Oil IndustryEnot SoulaviereNo ratings yet

- Windows SCADA Disturbance Capture: User's GuideDocument23 pagesWindows SCADA Disturbance Capture: User's GuideANDREA LILIANA BAUTISTA ACEVEDONo ratings yet

- Lite Touch. Completo PDFDocument206 pagesLite Touch. Completo PDFkerlystefaniaNo ratings yet

- Quarter 3 Week 6Document4 pagesQuarter 3 Week 6Ivy Joy San PedroNo ratings yet

- Reported Speech StatementsDocument1 pageReported Speech StatementsEmilijus Bartasevic100% (1)

- Star QuizDocument3 pagesStar Quizapi-254428474No ratings yet

- Finding Nemo 2Document103 pagesFinding Nemo 2julianaNo ratings yet

- Springfield College Lesson Plan Template PHED 237: The Learning and Performance of Physical ActivitiesDocument5 pagesSpringfield College Lesson Plan Template PHED 237: The Learning and Performance of Physical Activitiesapi-285421100No ratings yet

- A Quality Improvement Initiative To Engage Older Adults in The DiDocument128 pagesA Quality Improvement Initiative To Engage Older Adults in The Disara mohamedNo ratings yet

- Aspects of The Language - Wintergirls Attached File 3Document17 pagesAspects of The Language - Wintergirls Attached File 3api-207233303No ratings yet

- Chapter 12 Social Structural Theories of CrimeDocument5 pagesChapter 12 Social Structural Theories of CrimeKaroline Thomas100% (1)

- UT & TE Planner - AY 2023-24 - Phase-01Document1 pageUT & TE Planner - AY 2023-24 - Phase-01Atharv KumarNo ratings yet

- Types of Numbers: SeriesDocument13 pagesTypes of Numbers: SeriesAnonymous NhQAPh5toNo ratings yet

- Daud Kamal and Taufiq Rafaqat PoemsDocument9 pagesDaud Kamal and Taufiq Rafaqat PoemsFatima Ismaeel33% (3)

- GN No. 444 24 June 2022 The Public Service Regulations, 2022Document87 pagesGN No. 444 24 June 2022 The Public Service Regulations, 2022Miriam B BennieNo ratings yet

- RubricsDocument1 pageRubricsBeaMaeAntoniNo ratings yet

- K9G8G08B0B SamsungDocument43 pagesK9G8G08B0B SamsungThienNo ratings yet