Professional Documents

Culture Documents

Industry Overview - Automobile Sector in India 2012-13

Uploaded by

Kinshuk AcharyaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Industry Overview - Automobile Sector in India 2012-13

Uploaded by

Kinshuk AcharyaCopyright:

Available Formats

Draft for discussion purposes only

Industry

Overview -

Automobile

Financial Year 2012-13

Draft for Discussion Purposes

Table of Contents Draft for discussion purposes only

Table of Contents

1. Indian Industry 1

1.1. Objective 1

1.2. Introduction 1

1.3. Background 1

1.4. Current Scenario 2

1.5. Major Players 2

1.6. Industry Trends 3

1.7. Financial Performance 3

1.7.1. Domestic Sales 3

1.7.2. Export 3

1.8. Government initiatives 3

1.9. Automotive Mission Plan (2006-2016) 4

1.10. Growth Drivers 4

1.11. Way Ahead 5

1.12. Sectoral Outlook 2013 5

1.12.1. Domestic automobile sales likely to witness moderate growth 5

1.12.2. Export performance to remain moderate 5

1.13. Segmental Commentary 6

1.13.1. Commercial Vehicles 6

1.13.2. Passenger Vehicles 6

1.13.3. Two Wheelers 6

1.14. Strategic Insight 6

1.14.1. Commercial vehicles 6

1.14.2. Passenger vehicles 7

1.14.3. Two wheelers 7

1.15. Summary 7

Draft for discussion purposes only

Industry Overview - Automobile - Transfer pricing analysis and report

Price Waterhouse & Co. 1

1. Indian Industry

1.1. Objective

The Indian Regulations

1

prescribe that the comparability of an international transaction with an

uncontrolled transaction shall be judged with reference to the conditions prevailing in the markets in

which the respective parties to the transactions operate. Hence, for the purposes of transfer pricing

analysis an overview of the industry is essential.

1.2. Introduction

2

The Indian automotive industry has emerged as a 'sunrise sector' in the Indian economy. India is

emerging as one of the world's fastest growing passenger car markets and second largest two wheeler

manufacturer. It is also home for the largest motor cycle manufacturer and fifth largest commercial

vehicle manufacturer. India is emerging as an export hub for sports utility vehicles (SUVs). The global

automobile majors are looking to leverage India's cost-competitive manufacturing practices and are

assessing opportunities to export SUVs to Europe, South Africa and Southeast Asia. India can emerge

as a supply hub to feed the world demand for SUVs. India also has the largest base to export compact

cars to Europe. Moreover, hybrid and electronic vehicles are new developments on the automobile

canvas and India is one of the key markets for them. Global and Indian manufacturers are focussing

their efforts to develop innovative products, technologies and supply chains. The automotive plants of

global automakers in India rank among the top across the world in terms of their productivity and

quality. Top auto multinational companies (MNCs) like Hyundai, Toyota and Suzuki rank their Indian

production facilities right on top of their global pecking order.

1.3. Background

The Indian automobile industry, the seventh largest in the world, has demonstrated a growth over the

last ten years, during which industry volumes have increased by 3.2 times, from a level of 4.7 million

numbers to 14.9 million numbers, according to Vishnu Mathur, Director General, Society of Indian

Automobile Manufacturers (SIAM). The Indian Automobile Industry embarked on a new journey

since 1991 with delicensing of the sector and subsequent opening up for 100 per cent FDI through

automatic route. Almost all the global majors have set up their facilities in India taking the next level

of production of vehicles from 2 million in 1991 to 110+ million in 2011.

3

The industry, by virtue of its deep connects with several key segments of the economy, occupies a

prominent place in the countrys growth canvas. It exhibits a strong multiplier effect and has the

ability to be the key driver of economic growth. A robust transportation system plays a key role in a

country's rapid economic and industrial development, and the well-developed Indian automotive

industry justifies this catalytic role by producing a wide variety of vehicles, which include passenger

cars, light, medium and heavy commercial vehicles, multi-utility vehicles such as jeeps, scooters,

motorcycles, mopeds, three wheelers, tractors etc. Some defining characteristics are:

4

Largest three wheeler market in the world

2nd largest two wheeler market in the world

7th largest passenger car market in Asia & 10th Largest in the world

4th largest tractor market in the world

5th largest commercial vehicle market in the world

1

Section 92D read with Rule 10B(2)(d)

2

http://www.ibef.org/industry/india-automobiles.aspx

3

http://ciiautoserve.in/autoserve/indus.php

4

http://www.studymode.com/essays/Automobiles-Industry-In-India-842312.html

Draft for discussion purposes only

Industry Overview - Automobile - Transfer pricing analysis and report

Price Waterhouse & Co. 2

5th largest bus & truck market in the world

5

1.4. Current Scenario

6

As the year 2012 comes to an end, the Indian automobiles industry witnessed a moderation in

demand in 2012, after the double-digit growth in sales recorded in the preceding three years. Weak

macroeconomic sentiment coupled with subdued consumer confidence pulled down sales, particularly

in the latter half of the year. Domestic automobile sales grew by 6.6% in 2012 (Jan-Nov), as compared

to growth of 14-31% during 2009-2011.

In view of the current macro environment, both domestically and globally, we are cautiously

optimistic about the Indian automobile industrys prospects in the near term. As a result, achieving

high growth rates is likely to be a major concern for the industry in 2013.

1.5. Major Players

7

5

http://ciiautoserve.in/autoserve/indus.php

6

http://www.indiainfoline.com/Markets/News/Automobile-Sector-Outlook-2013-Dun-and-Bradstreet/5572570465

7

A Brief Report on Auto And Auto Ancilaries, CCI, March 2013.

Draft for discussion purposes only

Industry Overview - Automobile - Transfer pricing analysis and report

Price Waterhouse & Co. 3

1.6. Industry Trends

8

Passenger Car volumes were down 6.7% YoY but Utility Vehicles were up 52% in 2012-13

Weakness continues in Commercial Vehicle segment; down 2.0% YoY in 2012-13

Domestic Two-Wheeler volumes up 2.9% in 2012-13

Three-Wheeler (passenger) segment benefits from fresh permits, registered 8.5% YoY growth

1.7. Financial Performance

9

Automobile companies across segments continue to face tremendous pressure on profit margins due

to elevated inflation levels. Added to this are the heightened marketing costs incurred and heavy

discounts offered by vehicle manufacturers to attract consumers to the showrooms. This partially

explains the price hikes initiated by the vehicle OEMs to protect margins, despite the weak demand

environment. Going ahead, amidst rising market competition, new product launches, as also product

refreshes planned, OEMs are expected to increase spend on marketing & promotional activities.

Although commodity prices are not expected to witness steep hikes, overall cost and competitive

pressures would keep the profit margins under pressure.

1.7.1. Domestic Sales

1.7.2. Export

1.8. Government initiatives

10

Government has taken several policy initiatives and pro-active measures to enhance the effectiveness

and drive growth in Automotive Sector. Major steps have been taken to make India a global

8

Indian Automobile Industry, ICRA, April 16, 2013

9

A Brief Report on Auto And Auto Ancilaries, CCI, March 2013.

10

A Brief Report on Auto And Auto Ancilaries, CCI, March 2013.

Draft for discussion purposes only

Industry Overview - Automobile - Transfer pricing analysis and report

Price Waterhouse & Co. 4

automotive hub under the 'Automotive Mission Plan'for the period of 2006-2016. The Mission Plan

aims to make India emerge as the destination of choice in the world for design and manufacture of

automobiles and auto components, with output reaching a level of US$145 billion. Some of the other

key initiatives include:

Formation of National Automotive Board (NAB) to look into the issue of recall of vehicles;

hence improving manufacturing standards

Reduction of excise duty on small cars

Launch of the National Mission for Hybrid & Electric Vehicles under Budget FY12, to make

hybrid vehicle kits cheaper by reducing the excise duty rebate to 5% from 10%

State Government promoting industrial space especially in the automobile sector Open to

Public Private Partnerships (PPP)

Establishing special auto parks and virtual SEZ's for auto components industry by providing

an interest subsidy on loans and investment in new plants and equipments

Export benefits to intermediate suppliers of auto components against the Duty Free

Replenishment Certificate (DFRC)

Automatic approval for 100% Foreign Equity Investment in auto components manufacturing

Manufacturing and importing in this sector exempt from licensing and approvals

1.9. Automotive Mission Plan (2006-2016)

11

The Automotive Mission Plan is a major step taken to make India a global automotive hub. The

Mission Plan aims to make India emerge as the destination of choice in the world for design and

manufacture of automobiles and auto components, with output reaching a level of US$ 145 billion

(accounting for more than 10% of the GDP) and providing additional employment to 25 million people

by 2016. It envisages increase in production of automotive industry from the current level of Rs.

169000 crore to reach Rs. 600000 crore by 2016. The Mission seeks to oversee the development of the

automotive industry, that is, the present scenario of the sector, its broad role in the growth of national

economy, its linkages with other key facets of the economy as well as its future growth prospects. This

is involved in improving the automobiles in the Indian domestic market, providing world class

facilities of automotive testing and certification as well as ensuring a healthy competition among the

manufacturers at a level playing field.

1.10. Growth Drivers

Rising industrial and agricultural output

Rising per capita income

Favourable demographic distribution with rising working population and middle class

Urbanisation

Increasing disposable incomes in rural agri-sector

Availability of a variety of vehicle models meeting diverse needs and preferences

Greater affordability of vehicles

Easy finance schemes

Favourable government policies

Robust production

12

Huge Demand for Vehicle Servicing, Repairs and Maintenance

Non Vehicle Manufacturers are getting into Automotive Service Business

Branded service networks being set up both by vehicle manufacturers and other players

Expansion of Service Networks by Vehicle Manufacturer

Increased Customer Awareness on Vehicle Maintenance.

Emergence of One-stop-shop for vehicle owners to meet their needs like servicing, spares,

accessories, insurance, warranty, etc, under one roof

13

11

http://business.gov.in/Industry_services/automobile_industry.php

12

http://www.indiainbusiness.nic.in/industry-infrastructure/industrial-sectors/automobile.htm

Draft for discussion purposes only

Industry Overview - Automobile - Transfer pricing analysis and report

Price Waterhouse & Co. 5

1.11. Way Ahead

14

The rapid improvement in infrastructure, huge domestic market, increasing purchasing power,

established financial market and stable corporate governance framework have made the country a

favorable destination for investment by global majors in the auto industry, as per Automotive Mission

Plan (AMP) (2006-16). Additionally, the introduction of alternative fuels like hydrogen and bio fuels

needs to be promoted to ensure sustainability of the industry over the long term. The vision of AMP

2006- 2016 aims India to emerge as the destination of choice in the world for design and manufacture

of automobiles and auto components with output reaching a level of US$145 billion accounting for

more than 10 per cent of the GDP and providing additional employment to 25 million people by 2016.

In addition, the US-based car major, Ford aims to make India its export hub and plans to sell its

products in more than 50 countries over a period of time. The company has committed a total

investment of US$2 billion in India so far (November 2012). The luxury car market of India is set for

growth over the medium and long term. The market is about 30,000 cars a year and is rising steadily.

1.12. Sectoral Outlook 2013

15

1.12.1. Domestic automobile sales likely to witness moderate

growth

The Indian automobiles industry witnessed a moderation in demand in 2012, after the double-digit

growth in sales recorded in the preceding three years. Weak macroeconomic sentiment coupled with

subdued consumer confidence pulled down sales, particularly in the latter half of the year. Domestic

automobile sales grew by 6.6% in 2012 (Jan-Nov), as compared to growth of 14-31% during 2009-

2011. In view of the current macro environment, both domestically and globally, we are cautiously

optimistic about the Indian automobile industrys prospects in the near term. As a result, achieving

high growth rates is likely to be a major concern for the industry in 2013. While the long term

fundamentals of the Indian economy remain robust, the sluggish global environment has impacted

sentiments in the domestic market in the short term. But we expect this to be only a temporary

phenomenon, and prospects for 2013 look better than this year. Growth in sales would be driven by

the expected improvement in macro conditions on the domestic front, moderation in interest rates

and revival in consumer confidence, mainly after the initial two quarters. Consequently, the deferred

purchases witnessed in H2 2012 are expected to get converted into sales next year. The auto industry

is likely to gain considerably from the various initiatives on infrastructure development, rural focus

and the improved road infrastructure.

1.12.2. Export performance to remain moderate

In 2012 (up to Nov), all the segments, barring three-wheelers recorded higher exports. Growth in

exports of two-wheelers, which account for over 65% of automobile exports, slumped to 1% in 2012

(up to Nov), from 31% in 2011. Vehicle exports have been on a downhill drive since mid-2012. The

situation is not likely to witness a sudden turnaround, particularly with the uncertainty looming in the

global economy. Moreover, with Sri Lanka recently announcing steep increase in import tariffs and

excise duties, it is likely to have an adverse impact on Indias automobile exports, as Sri Lanka is one

of the important export destinations for the industry. Nevertheless, vehicle manufacturers continued

thrust on exploring newer export markets will open growth opportunities for the industry.

13

http://ciiautoserve.in/autoserve/indus.php

14

http://www.ibef.org/industry/india-automobiles.aspx

15

http://www.indiainfoline.com/Markets/News/Automobile-Sector-Outlook-2013-Dun-and-Bradstreet/5572570465

Draft for discussion purposes only

Industry Overview - Automobile - Transfer pricing analysis and report

Price Waterhouse & Co. 6

1.13. Segmental Commentary

16

1.13.1. Commercial Vehicles

The year 2012 saw a moderation in growth in domestic sales of commercial vehicles (6.5% up to Nov),

after strong performance in the preceding years. This growth was driven by the light vehicle segment

(19.4%), even as sales of medium and heavy vehicles (M&HCV) declined (-10%). Subdued macro-

economic environment, sluggish industrial demand and increase in diesel price led to fall in sales of

M&HCVs. Growth in overall domestic sales of commercial vehicles is expected to be driven by the light

vehicle segment in the year ahead as well. The export environment for commercial vehicles is expected

to remain challenging, with demand expected to remain subdued in the key overseas destinations.

Nevertheless, CV manufacturers would increase thrust on exploring opportunities in non-traditional

markets (Africa, Middle East, Thailand, Afghanistan, Latin America, Russia, etc).

1.13.2. Passenger Vehicles

2012 was a challenging year for the passenger vehicle industry, as rising fuel prices and high interest

rates led to significant increase in ownership costs, deterring customers from making vehicle

purchases. In the year ahead, increased marketing efforts by companies and launch of new

models/variants would be directed at pulling customers into the showroom. However, the demand

momentum is expected to gain momentum after the initial couple of quarters. Meanwhile, with the

differential between petrol and diesel prices continuing to remain large, the coming year would

continue to witness strong demand for diesel fuelled vehicles.

1.13.3. Two Wheelers

Rising petrol prices kept growth momentum in the motorcycle segment under pressure in 2012, with

domestic sales growing by a meager 2% (up to Nov) compared to growth of 27.1% in 2010 and 14.7%

in 2011. There have been early signs of an improvement in demand as the festive period towards the

end of the year saw pick up in sales. We expect demand for two wheelers to improve next year,

supported by moderation in inflation levels and revival in consumer sentiment. However, the industry

is unlikely to record the high growth rates as seen prior to 2012.

1.14. Strategic Insight

17

Some of the key strategies that vehicle manufacturers are likely to adopt in 2013 are listed below:

1.14.1. Commercial vehicles

Launch new models

Increased customer focus by expanding sales and service network

Focus on product innovation to create new market segments

Develop new products for the international markets

Expand footprint to newer export markets

Continue thrust on cost control & productivity improvement measures

Greater thrust on and expansion of less cyclical businesses.

16

http://www.indiainfoline.com/Markets/News/Automobile-Sector-Outlook-2013-Dun-and-Bradstreet/5572570465

17

A Brief Report on Auto And Auto Ancilaries, CCI, March 2013.

Draft for discussion purposes only

Industry Overview - Automobile - Transfer pricing analysis and report

Price Waterhouse & Co. 7

1.14.2. Passenger vehicles

Launch new vehicle models, especially more diesel models

Increase focus on tier II and tier III markets, even for high-end models

Expand sales and service network for enhanced customer satisfaction

Increase focus on expanding pre-owned vehicle business

Continue thrust on cost control & productivity improvement measures

Leverage social media to establish closer bonds with customers.

1.14.3. Two wheelers

Increase focus on small towns and rural markets (e.g. expansion of distribution/service

network)

Increase focus on emerging markets such as Brazil, Africa, Argentina, Indonesia, etc to

push exports.

1.15. Summary

Given the large population and growing middle class, India has the potential to develop into a

significant market for automobile manufacturers. With a large, English speaking, relatively low- cost

labour pool, India could eventually serve as a major regional export hub throughout Asia, Africa, and

Europe. However, there are a number of factors that must be overcome in order for India, along with

automobile manufacturers, to fully realize the potential in the Indian market. In particular, logistical

transportation infrastructure capabilities will need to be improved to meet domestic and export needs.

Based simply on the amount of investments by GM and Ford alone, it is clear that foreign vehicle

manufacturers view India as a crucial player in the future of the automotive industry as a regional

export hub, and as a supplier of automobiles and automotive parts globally.

Draft for discussion purposes only

Industry Overview - Automobile - Transfer pricing analysis and report

Price Waterhouse & Co. 8

2. Industry Overview

18

2.1. Objective

The Indian Regulations

19

prescribe that the comparability of an international transaction with an

uncontrolled transaction shall be judged with reference to the conditions prevailing in the markets in

which the respective parties to the transactions operate. Hence, for the purposes of transfer pricing

analysis an overview of the industry is essential.

The following section contains an analysis designed to provide an overview of the auto component

industry under which OMR Bagla operates.

2.2. Background

India has emerged as one of the world's most competitive tyre markets due to vast availability of raw

material (natural rubber) and ultramodern production facilities. The radial tyre market is expected to

reach Rs 393 billion (US$ 7.33 billion) by FY 2015 growing at a CAGR of more than 21 per cent during

FY 2011-FY 2015.

The automotive plants of global automakers in India rank among the top across the world in terms of

their productivity and quality. Top auto multinational companies (MNCs) like Hyundai, Toyota and

Suzuki rank their Indian production facilities right on top of their global pecking order.

The Indian automobile and auto components industry can be expected to surpass China's growth path

by 2021, according to a research report by Espirito Santo Securities.

20

The Indian auto component industry is ancillary to the automobile industry. Major automobile

markets such as North America, Europe and Japan have been witnessing significant slowdown in

automobile sales growth since last one decade. While on the other hand India and China has grown

rapidly, consequently leading the surge in the auto component industry in these regions. Gauging the

growth prospects in these two regions almost all the major automobile OEMs as well as auto

component manufacturers has ventured in these markets.

21

The Indian auto component sector is transforming itself from a low-volume, highly fragmented one

into a competitive industry, and backed by competitive strengths, technology and transition up the

value chain. Broadly the Indian automotive component industry can be divided into the organized and

the unorganized segments. While the forte of the organized sector is the high valued added precision

engineering products, the presence of a large unorganized sector is characteristic especially of the

lower value-added segments of the industry.

The Indian auto component industry is expected to reach a turnover worth US$ 113 billion by 2020-21

from US$ 43.4 billion in 2011-12, according to an Automotive Component Manufactures Association

18

The contents of this chapter are based entirely on information obtained from various internet based resources. PW & Co.

has not carried out any independent research about accuracy and validity of such statements, facts and figures which are

provided in this chapter.

19

Section 92D read with Rule 10B(2)(d)

20

http://www.ibef.org/industry/autocomponents-india.aspx

21

http://www.bharatbook.com/market-research-reports/tyre-tire-market-research-report/indian-auto-component-

industry-for-indian-customers.html

Draft for discussion purposes only

Industry Overview - Automobile - Transfer pricing analysis and report

Price Waterhouse & Co. 9

(ACMA) report. The exports from the industry are expected to grow at a compound annual growth

rate (CAGR) of 17 per cent during 2012-21, the ACMA report highlighted.

22

Indian auto component industry is about Rs 1,600 billion (US$ 30.77 billion) and derives its growth

impetus from the growth in automobile industry. Industry body Society of Indian Automobile

Manufacturers (SIAM) expects overall automobile sales to grow by 10-12 per cent in 2012-13 on the

back of supportive Government policies, launch of new models and intensifying enthusiasm for cars

among Indian consumers. Therefore, it could be expected that increase in demand for automobiles

would eventually drive growth for auto parts sector.

As per industry estimates, Indian auto component industry derives 60 per cent of its turnover from

sales to domestic original equipment manufacturers (OEMs), 25 per cent from sales to the domestic

replacement market and around 15 per cent from exports.

23

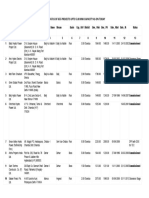

Figure 1: Product segments of the Auto Components Industry

24

2.3. Characteristics of the industry

2.3.1. Industry size

The Indian auto component industry is one of Indias sunrise industries with tremendous growth

prospects. From a low- key supplier providing components to the domestic market alone, the industry

has emerged as one of the key auto components centres in Asia and today seen as a significant player

in the automotive supply chain. India is now a supplier of a range of high-value and critical

automobile components to global auto makers.

India is also emerging as a sourcing hub for engine components, with original equipment

manufacturers (OEMs) increasingly setting up engine manufacturing units in the country.

22

http://www.ibef.org/industry/autocomponents-india.aspx

23

http://www.ibef.org/PrintThisArticle.aspx?artid=31497&pgno=1&totalpage=1

24

http://www.ibef.org/download/Auto_Components50112.pdf

Draft for discussion purposes only

Industry Overview - Automobile - Transfer pricing analysis and report

Price Waterhouse & Co. 10

According to industry statistics derived by Automotive Component Manufacturers Association of

India (ACMA), Engine parts form the largest segment (31 per cent) of auto part industry followed by

drive transmission and steering parts (19 per cent). Suspension & braking parts and Body & Chassis

account for 12 per cent each in the entire product range, followed by equipment accounting for 10 per

cent of the same.

Further, estimates made by ACMA reveal that auto component exports would robustly grow at a

compounded annual growth rate (CAGR) of 18.8 per cent over 2011-21, garnering about US$ 29

billion. European and North American markets account for 36 and 23 per cent of the entire industry

exports, respectively, while 28 per cent of the exports are made to Asian countries.

25

The amount of cumulative foreign direct investment (FDI) inflow into the automobile industry during

April 2000 to January 2013 was worth US$ 8,061 million, accounting to 4 per cent of the total FDI

inflows (in terms of US$), as per data published by Department of Industrial Policy and Promotion

(DIPP), Ministry of Commerce.

The tyre production in India is anticipated to reach 191 million units by the end of FY 2016, according

to a RNCOS research report titled, 'Indian Tyre Industry Forecast to 2015'. The manufacturers are

expected to invest huge amount into the industry over the next few years, with a major proportion of

this investment directed towards the radial tyre capacity expansion.

In addition, with a significant increase in the number of CNG vehicles, the CNG vehicle market is

witnessing a strong growth pattern. According to a RNCOS report titled, "India CNG Vehicle Market

Analysis", the CNG kit market is expected to reach around INR 30 Billion in FY 2014, growing at a

CAGR of around 22 per cent during FY 2011-2014.

26

2.3.2. Industry Growth Drivers

27

Figure 2: Growth Drivers

25

http://www.ibef.org/PrintThisArticle.aspx?artid=31497&pgno=1&totalpage=1

26

http://www.ibef.org/industry/autocomponents-india.aspx

27

www.ibef.org/download/Auto-Components-261112.pdf

Draft for discussion purposes only

Industry Overview - Automobile - Transfer pricing analysis and report

Price Waterhouse & Co. 11

2.3.3. Competitive Landscape

28

The Indian auto components industry is facing formidable pricing challenge from China and

South East Asian countries as they compete not only in the international markets but also on the

domestic turf. At present, the cost competitiveness of Indian players is constrained on account of

infrastructure inefficiencies; higher cost of power; upward pressure on wages and inflexible labour

laws.

Free Trade Agreements (FTAs) entered into by India with many countries have catalysed the import of

auto components into India as many components have become more cost effective to import following

reduction of import duty.

The Indian auto component industry faces competition from the Chinese market. Chinas automobile

component industry presents higher growth rate, superior infrastructure and more stable profit

margin.

2.3.4. Regulatory Environment

The government has taken many initiatives to promote foreign direct investment (FDI) in the

industry.

The Ministry of Heavy Industries and Public Enterprises has envisaged the Automotive Mission Plan

(AMP) 2006-2016 to promote growth in the sector. It targets to:

Increase turnover to US$ 122 billionUS$ 159 billion by 2016 from US$ 34 billion in 2006

Increase export revenue to US$ 35 billion by 2016

Provide employment to additional 25 million people by 2016

The Indian Government is in the process of forming a National Automotive Board (NAB) which would

become a formal set-up to look into the issue of recall of vehicles and hence improve manufacturing

standards. The prospective body, to oversee technical and safety aspects of vehicles, will have

representatives from all the nodal ministries and automotive bodies such as the Automotive Research

Association of India (ARAI).

The Government of Tamil Nadu has also announced that it will sign several memoranda of

understanding (MoU) with various automobile and auto part makers and will soon release industry-

specific policies. The reforms would give a boost to the state's position as a strategic auto

destination.

29

Favourable policy measures aiding growth:

30

Automotive Mission Plan 200616

Setting up of a technology modernisation fund focusing on small and medium enterprises

Establishment of automotive training institutes and auto design centres, special auto parks and

auto component virtual SEZs

NATRiPs

28

http://www.icra.in/Files/ticker/Auto_Ancillary_Ind_Note-Dec10.pdf

29

http://www.ibef.org/industry/autocomponents.aspx

30

www.ibef.org/download/Auto-Components-261112.pdf

Draft for discussion purposes only

Industry Overview - Automobile - Transfer pricing analysis and report

Price Waterhouse & Co. 12

Set up at a total cost of USD 388.5 million to enable the industry to adopt and implement global

performance standards

Focus on providing low-cost manufacturing and product development solutions

Dept. of Heavy Industries & Public Enterprises

Created a USD 200 million fund to modernise the auto components industry by providing an

interest subsidy on loans and investment in new plants and equipment

Provided export benefits to intermediate suppliers of auto components against the Duty Free

Replenishment Certificate (DFRC)

Union Budget 201213

Prescribed a concessional excise duty of 6 per cent for manufacturers of batteries supplying to

makers of electrically operated vehicles

Five year extension of 200 per cent weighted deduction of R&D expenditure under the Income

Tax Act

Introduced weighted deduction of 150 per cent for expenditure on skills development

2.4. Key Trends

31

The auto component industry is expected to be influenced by following trends:

a) India is poised to become a global components sourcing hub-

Major global OEMs are planning to make India a component sourcing hub for their global

operations.

Several global tier-I suppliers have also announced their plans to increase procurement

from their Indian subsidiaries.

India is also emerging as a sourcing hub for engine components, with OEMs increasingly

setting up engine manufacturing units in the country.

b) Product-development capabilities have improved-

Increased investments in research and development operations and laboratories, which are

being set up to conduct activities such as analysis and simulation and engineering

animations.

The growth of global OEM sourcing from India and the increased indigenisation of global

OEMs is making the country a preferred manufacturing base.

c) Inorganic route to expand-

Domestic players are acquiring global companies to gain access to the latest technology,

expand client base and diversify revenue streams.

31

www.ibef.org/download/Auto-Components-261112.pdf

Draft for discussion purposes only

Industry Overview - Automobile - Transfer pricing analysis and report

Price Waterhouse & Co. 13

Players such as Amtek Auto and Bharat Forge have adopted a dual-shore manufacturing

model.

2.5. Key Challenges

32

The Indian auto industry is changing rapidly. During the last decade, many international auto

manufacturers, either by themselves or in partnership with Indian companies, have started

manufacturing in India. The ancillary industries have also grown in tandem. The quality of production

in small and medium-scale industries has improved to such an extent that they started exporting

products to international manufacturers. The development in the auto industry has given confidence

to everyone related to the industry and specifically to the government which resulted in

announcement of Auto Policy 2006-2016 by the Ministry of Heavy industries. To realise future

growth, it is important to overcome various challenges the industry is facing currently.

Some of the challenges faced by the industry are listed below:

Rising oil prices: International price of crude oil has crossed US$120 per barrel and is rising at

an alarming rate. The rise in oil prices will impact the growth of the automotive industry.

Human Resources: The industry is facing severe shortage of skilled technical as well as

managerial manpower.

Import of components: import of ancillary from other countries has put pressure on domestic

manufacturers.

Technological issues: The industry does not have access to the latest technology.

Depleting Margins: Rise in price of commodity items like steel, non-ferrous, precious metals,

rubber and petroleum products has put pressure on the profit margins. Commodity prices that

make up to 60 per cent of the cost of the product have moved up by 45-60 per cent in the last year.

2.6. Opportunities

33

The Indian auto component industry has huge opportunities ahead in terms of domestic and export

markets which hold huge potential -

The domestic market is expected to account for 80 per cent of total sales by 2020 with a total

market size of USD 80 billion

Exports will account for as much as 20 per cent of the market by 2020.

Market potential balanced across product types

The domestic and export markets are at par in terms of product type. For instance, Engine &

Exhaust components, along with Body & Structural parts, account for about 50 per cent of the

potential in both domestic and export markets

Other major product types include Transmission & Steering components and Electronics &

Electrical parts

Opportunities in engineering products:

32

http://www.autofocusasia.com/management/indian_automotive_industry.htm

33

www.ibef.org/download/Auto-Components-261112.pdf

Draft for discussion purposes only

Industry Overview - Automobile - Transfer pricing analysis and report

Price Waterhouse & Co. 14

Engine & Engine Parts

New technological changes in this segment include introduction of turbochargers and common

rail systems

The trend of outsourcing may gain traction in this segment in the short to medium term

Transmission & Steering Parts

Share of the replacement market in sub-segments such as clutches is likely to grow due to rising

traffic density

The entry of global players is expected to intensify competition in sub-segments such as gears

and clutches

Suspension & Braking Parts

The segment is estimated to witness high replacement demand, with players maintaining a

diversified customer base in the replacement and OEM segments besides the export market

The entry of global players is likely to intensify competition in sub-segments such as shock

absorbers

Equipment

Companies operating in the replacement market are likely to focus on establishing a

distribution network, brand image, product portfolio and pricing policy

Electrical

Manufacturers are expected to benefit from the growing demand for electric start mechanisms

in the two-wheeler segment

Others

Leading players in the sheet metal parts sub-segment are in the process of expanding their

customer base. This sub-segment is expected to grow 1011 per cent during 201015

2.7. Way Forward

The global automotive industry is witnessing tremendous and unprecedented changes. This industry

is slowly and gradually shifting towards Asian countries, mainly because of saturation of automobile

industry in the western world. The principal driving markets for Asian automotive industry are China,

India and ASEAN nations. Entrance of new manufacturers into the small car market and new

launches of low cost vehicles namely scooters, motorcycles, mopeds and bicycles have led to the

massive growth of domestic automotive industry, which provides an opportunity for the auto

component players to grow revenues with multiple OEM customers.

Technological shifts in the Indian automobile industry have been the key drivers of growth and

innovation in the countrys auto components industry. The number of global players moving to India

has been increasing as a result of government of India permitting 100 per cent foreign equity

investments. The country is also witnessing increased investment in R&D operations and the

establishment of laboratories to conduct activities such as analysis and simulation as well as

engineering animations. Robust demand for automobiles is a catalyst for auto component market.

Draft for discussion purposes only

Industry Overview - Automobile - Transfer pricing analysis and report

Price Waterhouse & Co. 15

Revival of global demand will keep the outsourcing story intact. Recent fall in metal prices, which

constitute major part of their raw material cost, will lead to expansion in margins and thus better

earnings. Thus the auto component industry is expected to grow at healthy rate in the future.

An analysis released by TechNavio predicts that auto component market in India would grow at a

CAGR of 11.7 per cent over 2011-15. Apart from surge in demand for automobiles, rise in auto

financing activities would spur the growth of the sector.

Also, on the back of improving markets in the US and Europe, industry experts forecast a very positive

outlook for automotive exports in 2012.

34

The vision of Automotive Mission Plan (AMP - 2006-16) aims India to emerge as the destination of

choice in the world for design and manufacture of automobiles and auto components with output

reaching a level of US$ 145 billion accounting for more than 10 per cent of the gross domestic product

(GDP) and to provide additional employment to 25 million people by 2016.

The rapid improvement in infrastructure, huge domestic market, increasing purchasing power,

established financial market and stable corporate governance framework have made the country a

favourable destination for investment by global majors in the auto industry, as per AMP 2006-16. The

Plan aims at doubling the contribution of automotive sector to the GDP with special emphasis on

export of small cars, MUVs, two & three wheelers and auto components.

35

2.8. Summary

The objective of undertaking a review of the industry is to describe and gauge the economic/ business

conditions and trends affecting companies in India in the specified industry. This review provides a

deeper understanding of the industry in which the company operates. An understanding of the same

allows us to evaluate the companys functions performed, assets employed and risks assumed in

relation to similar entities within the industry.

The Indian automobile ancillary sector is transforming itself from a low-volume, highly fragmented

one into a competitive industry, and backed by competitive strengths, technology and transition up

the value chain. Broadly the Indian automotive component industry can be divided into the organized

and the unorganized segments. While the forte of the organized sector is the high valued added

precision engineering products, the presence of a large unorganized sector is characteristic especially

of the lower value-added segments of the industry. Investments and exports in this segment are

witnessing continuous growth.

The global auto industry's search for lower cost and more international outsourcing will also lead to a

sharp growth in component output and exports in the coming years. Factors such as superior

engineering skills, modest domestic market growth, the sophistication of its IT industry and

increasing free trade agreements in addition to low cost, are expected to boost India's auto component

sector growth over other countries in the environment of off-shoring to low-cost countries.

34

http://www.ibef.org/industry/autocomponents.aspx

35

http://www.ibef.org/industry/autocomponents-india.aspx

Draft for discussion purposes only

Industry Overview - Automobile - Transfer pricing analysis and report

Price Waterhouse & Co. 16

You might also like

- Case Study Report - 22MBAB35Document50 pagesCase Study Report - 22MBAB35varshini vishakanNo ratings yet

- Birla Institute of Technology and Science Pilani: Automobile Sector in IndiaDocument16 pagesBirla Institute of Technology and Science Pilani: Automobile Sector in Indiaਸਚਿਨ ਸੋਨੀNo ratings yet

- Automobile Industry AnalysisDocument11 pagesAutomobile Industry Analysissehgal110No ratings yet

- Auto Industry: India in The Changing World OrderDocument16 pagesAuto Industry: India in The Changing World Orderbindya2211No ratings yet

- Project Report On Commercial Vehicles IndustryDocument26 pagesProject Report On Commercial Vehicles IndustryVivekNo ratings yet

- Auto MobileDocument44 pagesAuto MobileSanjay PatelNo ratings yet

- India's Growing Automobile IndustryDocument79 pagesIndia's Growing Automobile Industry2014rajpoint0% (1)

- Automobile Industies IndiaDocument4 pagesAutomobile Industies IndiaSharath RaoNo ratings yet

- AUTOMOBILE INDUSTRY GROWTHDocument16 pagesAUTOMOBILE INDUSTRY GROWTHHarish ShashidharNo ratings yet

- Automobile & Components PDFDocument13 pagesAutomobile & Components PDFTejas SonigraNo ratings yet

- Report On Indian Automobile IndustryDocument34 pagesReport On Indian Automobile IndustryArvind Sanu MisraNo ratings yet

- Automobile Industry in WorldDocument20 pagesAutomobile Industry in WorldHari Haran100% (1)

- Demand Analysis & Forecasting - The Car Industry: Presented byDocument31 pagesDemand Analysis & Forecasting - The Car Industry: Presented byprerna_bafnaNo ratings yet

- Ashok Leyland FinalDocument45 pagesAshok Leyland FinalsmitaNo ratings yet

- Analysis of Indian Automobile IndustryDocument15 pagesAnalysis of Indian Automobile Industrymithai1985No ratings yet

- A Study On Costomer Perception Towards Selected Marketing Mix of Shivnath Hyundai Raipur C.GDocument59 pagesA Study On Costomer Perception Towards Selected Marketing Mix of Shivnath Hyundai Raipur C.Gjassi7nishadNo ratings yet

- Bharat BenzDocument31 pagesBharat BenzMUHAMMED ASLAMNo ratings yet

- Fundamental Analysis On Automobile IndustryDocument18 pagesFundamental Analysis On Automobile Industryaroralekant18No ratings yet

- Final Report On JBMDocument40 pagesFinal Report On JBMdivyansh khanduja67% (3)

- Abhi AimsDocument89 pagesAbhi AimsAnkita PrasadNo ratings yet

- Porter's Five Forces Analysis of India's Automobile IndustryDocument33 pagesPorter's Five Forces Analysis of India's Automobile Industryneha4301No ratings yet

- 1.1: Overview of Automobile Industry in India: Chapter 1: Industrial ProfileDocument93 pages1.1: Overview of Automobile Industry in India: Chapter 1: Industrial Profiletamal mukherjeeNo ratings yet

- HSCI CEO worried about sales in India/TITLEDocument14 pagesHSCI CEO worried about sales in India/TITLESagar HandralNo ratings yet

- 34 Tvs Apache in ShimogaDocument102 pages34 Tvs Apache in Shimogaavinash_s1302No ratings yet

- Project Report On Commercial Vehicles IndustryDocument26 pagesProject Report On Commercial Vehicles IndustryMansi Prashar0% (2)

- Customer Perceptions of Honda CarsDocument66 pagesCustomer Perceptions of Honda CarsPankajPetwalNo ratings yet

- Industrial Data: Group: 2Document17 pagesIndustrial Data: Group: 2Elle7loboNo ratings yet

- Marketing Case StudyDocument10 pagesMarketing Case StudyShakshi TradersNo ratings yet

- Murugaselvi M Main Project ReportDocument84 pagesMurugaselvi M Main Project Report20PAU016 Karthikeyan RNo ratings yet

- Analysis of Automobile IndustryDocument9 pagesAnalysis of Automobile IndustryNikhil Kakkar100% (1)

- Final ProjectDocument64 pagesFinal ProjectAneesh Chorode0% (2)

- India's Automotive Industry - Growth of Two-Wheelers Despite Rising Middle ClassDocument4 pagesIndia's Automotive Industry - Growth of Two-Wheelers Despite Rising Middle ClassvvkvckyNo ratings yet

- India's Auto Industry: A Major Domestic Sector & Global PlayerDocument5 pagesIndia's Auto Industry: A Major Domestic Sector & Global Playerbipin3737No ratings yet

- Indian Automobile Industry OutlookDocument12 pagesIndian Automobile Industry OutlookPranayagarwalNo ratings yet

- JBMDocument53 pagesJBMVaibhav Ahlawat100% (1)

- Industry Profile: Automobile Industry at Global LevelDocument21 pagesIndustry Profile: Automobile Industry at Global LevelTanzim VankaniNo ratings yet

- Mini ProjectDocument22 pagesMini ProjectAshutosh PandeyNo ratings yet

- Prestige Institute of Management and Research: Assignment Topic: - Fundamental and Technical Analysis of Tata MotorsDocument42 pagesPrestige Institute of Management and Research: Assignment Topic: - Fundamental and Technical Analysis of Tata MotorsSamyak JainNo ratings yet

- Sandaesh BFR 22Document44 pagesSandaesh BFR 22Nikhil hu Nikhil huNo ratings yet

- Automobile - Beacon Sector SpecialDocument36 pagesAutomobile - Beacon Sector SpecialMammen Vergis PunchamannilNo ratings yet

- Project On Tvs Vs BajajDocument63 pagesProject On Tvs Vs BajajSk Rabiul Islam100% (1)

- Indian Automobile Industry OverviewDocument16 pagesIndian Automobile Industry OverviewKanoj AcharyNo ratings yet

- Hyundai CompanyDocument67 pagesHyundai CompanySandeep SinghNo ratings yet

- Industry AnalysisDocument38 pagesIndustry AnalysisIbrahim RaghibNo ratings yet

- A Report On Indian Automobile IndustryDocument33 pagesA Report On Indian Automobile IndustryUniq Manju100% (1)

- FEDERAL MOGUL GOETZE INDIA LIMITED - ReportDocument56 pagesFEDERAL MOGUL GOETZE INDIA LIMITED - Reportchaitra rNo ratings yet

- Maruti Suzuki Training Report Full ReportDocument62 pagesMaruti Suzuki Training Report Full ReportAnkit Dua76% (21)

- Automobile Industry in India GrowthDocument7 pagesAutomobile Industry in India GrowthMohammad HasanNo ratings yet

- A Study On Consumer Satisfaction Towards Royal Enfield at Bhavani Motors 2019-20Document43 pagesA Study On Consumer Satisfaction Towards Royal Enfield at Bhavani Motors 2019-20Mithun GopalNo ratings yet

- Automotive Perspective - 2012 and Beyond: The India OpportunityDocument2 pagesAutomotive Perspective - 2012 and Beyond: The India OpportunitySameer SamNo ratings yet

- Automobile MGM WhitepaperDocument16 pagesAutomobile MGM WhitepaperSudip KarNo ratings yet

- projet editing-2Document50 pagesprojet editing-2Manoj KumarNo ratings yet

- Automobile Industry in India - Marketing ChallengesDocument21 pagesAutomobile Industry in India - Marketing ChallengesAnkit VermaNo ratings yet

- EICDocument10 pagesEICDeepak VishwakarmaNo ratings yet

- Report On Automobile IndustryDocument16 pagesReport On Automobile IndustryDivyansh KaushikNo ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- Designated Drivers: How China Plans to Dominate the Global Auto IndustryFrom EverandDesignated Drivers: How China Plans to Dominate the Global Auto IndustryNo ratings yet

- Review and Assessment of the Indonesia–Malaysia–Thailand Growth Triangle Economic Corridors: Malaysia Country ReportFrom EverandReview and Assessment of the Indonesia–Malaysia–Thailand Growth Triangle Economic Corridors: Malaysia Country ReportNo ratings yet

- DebtCrisisCD Workbook7Document31 pagesDebtCrisisCD Workbook7Kinshuk AcharyaNo ratings yet

- The Riemann Sum and The Definite IntegralDocument7 pagesThe Riemann Sum and The Definite IntegralDiego PardoNo ratings yet

- Maria DelhiDocument55 pagesMaria DelhiRohit KumarNo ratings yet

- On Accounting Flows and Systematic RiskDocument10 pagesOn Accounting Flows and Systematic RiskKinshuk AcharyaNo ratings yet

- ATP Oil & Gas-Initiating CoverageDocument14 pagesATP Oil & Gas-Initiating CoverageKinshuk AcharyaNo ratings yet

- ATP Oil & Gas-Initiating CoverageDocument14 pagesATP Oil & Gas-Initiating CoverageKinshuk AcharyaNo ratings yet

- Identification Guide To The Deep-Sea Cartilaginous Fishes of The Indian OceanDocument80 pagesIdentification Guide To The Deep-Sea Cartilaginous Fishes of The Indian OceancavrisNo ratings yet

- Oilwell Fishing Operations Tools and TechniquesDocument126 pagesOilwell Fishing Operations Tools and Techniqueskevin100% (2)

- What is your greatest strengthDocument14 pagesWhat is your greatest strengthDolce NcubeNo ratings yet

- Introduction to Networks Visual GuideDocument1 pageIntroduction to Networks Visual GuideWorldNo ratings yet

- Relay Models Per Types Mdp38 EnuDocument618 pagesRelay Models Per Types Mdp38 Enuazer NadingaNo ratings yet

- Thesis Proposal On Human Resource ManagementDocument8 pagesThesis Proposal On Human Resource Managementsdeaqoikd100% (2)

- Pot PPTDocument35 pagesPot PPTRandom PersonNo ratings yet

- Piramal Annual ReportDocument390 pagesPiramal Annual ReportTotmolNo ratings yet

- Kina Finalan CHAPTER 1-5 LIVED EXPERIENCES OF STUDENT-ATHLETESDocument124 pagesKina Finalan CHAPTER 1-5 LIVED EXPERIENCES OF STUDENT-ATHLETESDazel Dizon GumaNo ratings yet

- KaphDocument7 pagesKaphFrater MagusNo ratings yet

- DPS Chief Michael Magliano DIRECTIVE. Arrests Inside NYS Courthouses April 17, 2019 .Document1 pageDPS Chief Michael Magliano DIRECTIVE. Arrests Inside NYS Courthouses April 17, 2019 .Desiree YaganNo ratings yet

- Supreme Court Rules on Retirement Benefits ComputationDocument5 pagesSupreme Court Rules on Retirement Benefits Computationemman2g.2baccay100% (1)

- Is The Question Too Broad or Too Narrow?Document3 pagesIs The Question Too Broad or Too Narrow?teo100% (1)

- Installation, Operation and Maintenance Instructions Stainless Steel, Liquid Ring Vacuum PumpsDocument28 pagesInstallation, Operation and Maintenance Instructions Stainless Steel, Liquid Ring Vacuum PumpspinplataNo ratings yet

- FOREIGN DOLL CORP May 2023 TD StatementDocument4 pagesFOREIGN DOLL CORP May 2023 TD Statementlesly malebrancheNo ratings yet

- Torts and DamagesDocument63 pagesTorts and DamagesStevensonYuNo ratings yet

- Hbo Chapter 6 Theories of MotivationDocument29 pagesHbo Chapter 6 Theories of MotivationJannelle SalacNo ratings yet

- List/Status of 655 Projects Upto 5.00 MW Capacity As On TodayDocument45 pagesList/Status of 655 Projects Upto 5.00 MW Capacity As On Todayganvaqqqzz21No ratings yet

- Activity Codes - Jun 2011 - v4Document2 pagesActivity Codes - Jun 2011 - v4Venugopal HariharanNo ratings yet

- Bell I Do Final PrintoutDocument38 pagesBell I Do Final PrintoutAthel BellidoNo ratings yet

- Maurice Strong by Henry LambDocument9 pagesMaurice Strong by Henry LambHal ShurtleffNo ratings yet

- Block 2 MVA 026Document48 pagesBlock 2 MVA 026abhilash govind mishraNo ratings yet

- Visual and Performing Arts Standards For California K-12Document172 pagesVisual and Performing Arts Standards For California K-12Vhigherlearning100% (2)

- Who Are The Prosperity Gospel Adherents by Bradley A KochDocument46 pagesWho Are The Prosperity Gospel Adherents by Bradley A KochSimon DevramNo ratings yet

- Fundamentals of Financial ManagementDocument550 pagesFundamentals of Financial ManagementShivaang Maheshwari67% (3)

- 22 Reasons To Go Mgtow Troofova ReethinDocument291 pages22 Reasons To Go Mgtow Troofova Reethinalbert86% (7)

- AmulDocument4 pagesAmulR BNo ratings yet

- Web Design Course PPTX Diana OpreaDocument17 pagesWeb Design Course PPTX Diana Opreaapi-275378856No ratings yet

- HM5 - ScriptDocument4 pagesHM5 - ScriptCamilleTizonNo ratings yet

- Financial Management Module - 3Document2 pagesFinancial Management Module - 3Roel AsduloNo ratings yet