Professional Documents

Culture Documents

Micro MAX

Uploaded by

Sameer ShahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Micro MAX

Uploaded by

Sameer ShahCopyright:

Available Formats

Introduction

Micromax has entered into handset market in 2008 and within 3 years it has become the third

largest handset manufacturer in India. In this period, it has focused mainly on rural market

and has become a leader in the same. Now it wants to expand its presence within India and

then on international level. This plan incorporates innovative strategies that will utilize

opportunities and address weaknesses as outlined in the Situation Analysis.

The plan addresses following marketing challenges:

To position in the mind of customers as their preferred brand

To concentrate more on potential urban and youth market

To make a global presence in the market

Situation Analysis

Analyzing current situation through 4C framework:

Customers

Currently Micromax is dominating the rural market. Initially the marketing strategy of

Micromax was to target rural market. They are basically catering to the need of the customers

of the rural area.

For example the first mobile Micromax introduced in rural area was having the battery

backup of 30 days which was catering to the need of the rural market of inconsistent power

availability.

Competitors

Micromax knows that there are many established brands in Mobile Phones industry like

Nokia, Samsung, LG and several other local as well as Chinese manufacturers . Some major

competitors and their strategy and strengths are identified as below:

NOKIA Nokia is the leader in the mobile phone industry in India (38% market share).

It is dominating the Indian market from years. Recently it is facing problems to retain its

growth and sales. But the pioneer is working hard to get out of this. For the same reason

Nokia is going to use operating system of software biggie Microsoft. So it is expected that

Nokia will try to regain its lost market share.

SAMSUNG Samsung has emerged as a very healthy and prominent competitor in the

market. Samsung is backed with the high quality and professional team in the R&D area.

Innovative products specially smart phones and Galaxy series from Samsung are ruling in

the market. So it is expected that with the increasing demand of mobile phones Samsung

will try to retain and increase its market share.

APPLE Apple is one of the most major competitors in this industry. Slick, stylish and

innovative phones of Apple are driving crazy to its users. Apple is aggressively entering

Indian market with its amazing iPhone series.

Other domestic players Other players like Karbon, Spice, Lava etc have more or less

the same market strategy.

Chinese manufacturers Some of the Chinese manufacturers have already entered the

Indian market. These manufacturers have priced their mobiles very low. So these

manufacturers are expected to grow as with the demand.

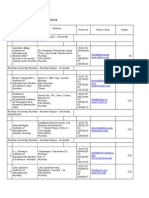

Various comparative analyses show that the market shares of Nokia fell drastically while

that of Samsung rose impressively. Besides Samsungs growth, market also witnessed the

growth of the local manufacturers (36% of the market share). The most prominent local

manufacturer with a market share of 7% is Micromax.

Lava

8%

Others

11%

Spice

16%

Karbon

20%

Micro

max

45%

Others

22%

LG

4%

Domestic

20%

Nokia

38%

Samsung

17%

Courtesy: IDC report on growth of mobile sales in India, 2011

Figure 1: Market share of various handset manufacturers in India in 2011

Company

It was in 2008 that four friends, Rajesh Agarwal, Sumeet Arora, Rahul Sharma and Vikas

Jain, came together and decided to diversify their IT hardware distribution business and start

making mobile phones. The move towards selling handsets was a natural progression. With a

Cost Leadership Business strategy Micromax entered into Indian rural market. And within 3

years of operation they have become the 3

rd

largest selling company in India. Micromax is

planning to launch an IPO of 2.15 crore shares to raise around Rs 2260 million. The major

part of the money raised will be used in setting a new manufacturing plant in Tamil Nadu and

the rest in acquiring additional market share.

Context

India is the second largest and the fastest growing telecom market in the world in terms of

number of wireless connections, according to the Telecom Regulatory Authority of India (the

"TRAI"). Currently around 250 million handsets are sold annually. By 2014, it is expected to

grow to around 400 million handsets.

While wireless penetration in urban areas has increased significantly over the last few years,

rural and semi-urban areas continue to be under-penetrated. The medium ASP segment is

likely to be the fastest growing with 240 million handsets in 2014 (Source: Analysys Mason)

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Employee Participation in CSR ActivityDocument6 pagesEmployee Participation in CSR ActivitySameer ShahNo ratings yet

- Lecture-1 What Is Organisation Development?Document2 pagesLecture-1 What Is Organisation Development?Sameer ShahNo ratings yet

- Research Methodology: Books and Websites Which Have Been Mentioned in The Bibliography at The End of The ProjectDocument1 pageResearch Methodology: Books and Websites Which Have Been Mentioned in The Bibliography at The End of The ProjectSameer ShahNo ratings yet

- Lecture-1 What Is Organisation Development?Document2 pagesLecture-1 What Is Organisation Development?Sameer ShahNo ratings yet

- Curriculum Vitae: Nitesh Raj SatyalDocument4 pagesCurriculum Vitae: Nitesh Raj SatyalSameer ShahNo ratings yet

- Od Interventions: What Is An OD Intervention?Document9 pagesOd Interventions: What Is An OD Intervention?Sameer ShahNo ratings yet

- Human ResourceDocument26 pagesHuman ResourceSameer ShahNo ratings yet

- 17.list of MBA Institutes in MaharashtraDocument18 pages17.list of MBA Institutes in MaharashtraSameer Shah100% (3)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Altius Golf and The Fighter Brand: Marketing Management Ii Case StudyDocument5 pagesAltius Golf and The Fighter Brand: Marketing Management Ii Case StudyVedashree RelkarNo ratings yet

- SWOT ANALYSIS of Telecom CompaniesDocument8 pagesSWOT ANALYSIS of Telecom CompaniessurajitbijoyNo ratings yet

- Delighting Customer Importance & MethodDocument81 pagesDelighting Customer Importance & Methodjitendra77798580% (1)

- Marketing & Digital Strategy - #40047588 - April 2022Document24 pagesMarketing & Digital Strategy - #40047588 - April 2022SIA Innovita marketingsNo ratings yet

- Welcome To Our PresentationDocument28 pagesWelcome To Our PresentationSifath Adnan Khan SifathNo ratings yet

- What Is Market ResearchDocument13 pagesWhat Is Market ResearchBenjie MariNo ratings yet

- 08 Handout 1Document6 pages08 Handout 1Marriel SasilNo ratings yet

- Millward Brown TV AdsDocument5 pagesMillward Brown TV AdsAkhilesh MenonNo ratings yet

- New Criteria For Market Segmentation by YankelovichDocument12 pagesNew Criteria For Market Segmentation by YankelovichShahidul SumonNo ratings yet

- Newell Case AnalysisDocument10 pagesNewell Case AnalysisSandip KumarNo ratings yet

- OPEMANA - Wegman's CaseDocument8 pagesOPEMANA - Wegman's CaseDennyseOrlidoNo ratings yet

- Jagu PPT SMDocument45 pagesJagu PPT SMjagrutisolanki01No ratings yet

- Revlon Case AnalyisDocument44 pagesRevlon Case AnalyisHeLena Prisca Nobo83% (6)

- BAT ReportDocument34 pagesBAT ReportBijonms10% (1)

- Marketing Management - MCQ'sDocument11 pagesMarketing Management - MCQ'sMr. Saravana KumarNo ratings yet

- Coca-Cola Strategic PlanDocument17 pagesCoca-Cola Strategic Planapi-326272121100% (1)

- Concept Note 9Document12 pagesConcept Note 9Nirup ChaudhuryNo ratings yet

- BR4 Progress Test 1 (Units 1 - 4)Document3 pagesBR4 Progress Test 1 (Units 1 - 4)Valeria Yakovova60% (5)

- Del Monte Corp. v. Ca, G.R. No. L-78325, January 25, 1990 1Document5 pagesDel Monte Corp. v. Ca, G.R. No. L-78325, January 25, 1990 1VINCENTREY BERNARDONo ratings yet

- P&GDocument25 pagesP&GSanjeev Prasad100% (12)

- Evaluating IMC EffectivenessDocument36 pagesEvaluating IMC EffectivenessNicole BradNo ratings yet

- Raj School of Management & Sciences: Advertising Stratergy of Indian Corporate World L.G. ElectronicsDocument78 pagesRaj School of Management & Sciences: Advertising Stratergy of Indian Corporate World L.G. Electronicsindia cybercafeNo ratings yet

- Aaker - Beyond Functional BenefitsDocument1 pageAaker - Beyond Functional BenefitsSamuel Obiri-Yeboah100% (4)

- Balzli Kelsey Resume LatestDocument1 pageBalzli Kelsey Resume Latestapi-195146903No ratings yet

- Case Study Analysis Cola Wars Continue CDocument12 pagesCase Study Analysis Cola Wars Continue CHarsh Vora100% (1)

- 5 Tips To Integrate Strategic Storytelling Into Your PresentationsDocument10 pages5 Tips To Integrate Strategic Storytelling Into Your PresentationsErika BiocarlesNo ratings yet

- 1 MIT Project - B2B Marketing Strategies For Digital MediaDocument44 pages1 MIT Project - B2B Marketing Strategies For Digital MediaStudent ProjectsNo ratings yet

- Understanding FDA Regulations On PackagingDocument6 pagesUnderstanding FDA Regulations On PackagingSameer NaikNo ratings yet

- Kotler Krasher 2018 PDFDocument98 pagesKotler Krasher 2018 PDFRitvik YadavNo ratings yet

- Scope of The StudyDocument36 pagesScope of The StudyMSMNo ratings yet