Professional Documents

Culture Documents

Basics of Indian Economy

Uploaded by

laxmaiahv212Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basics of Indian Economy

Uploaded by

laxmaiahv212Copyright:

Available Formats

www. h i t b u l l s e y e .

c o m

1 Bulls Eye

Basic of Indian

Economy

Basics of Indian Economy

Economics is the science which studies human behaviour as a relationship between ends and scarce means

which have alternative uses.

Measuring health of economy:

Gross Domestic Product (GDP): Aggregate of goods and services produced by a country within its boundary

in a financial year.

Net Domestic Product (NDP): GDP Depreciation

Gross National Product (GNP): GDP + Incomes from abroad Foreign repatriable earning

Net National Product (NNP): GNP Depreciation

What Does The Term PPP In Relation To GDP Refer To?

If we measure the GDP per capita of all countries in the same currency, say the US Dollar, we might present a

misleading picture of how well-off people in different countries are. This is because exchange rates do not

correctly reflect the purchasing power of currencies within their own economies. For example, although one

US dollar is worth almost Rs 50, a dollar in the US would not be able to buy as much as Rs 50 does in India.

To correct for this and make international comparisons more meaningful, we use the notion of purchasing

power parity (PPP). In effect, what we are doing here is to make the conversion based on a notional exchange

rate (one that tells you how many rupees you would need to buy the same things as you could with a dollar in

the US).

India An overview

Indicator Amount Rank

GDP (Official Exchange Rate) $ 1.798 trillion 10

GDP (PPP) $ 4.421 trillion 5

GDP per capita (PPP) $ 3700 165

Growth rate 6.8% 35

Unemployment Rate 9.8% 109

Population below poverty line 29.8% -

Exports $ 307.2 billion 20

Imports $ 475.3 billion 12

India vis--vis USA/China

Indicator India USA China

GDP (Official Exchange Rate) $ 1.798 t $ 14.83 t $ 7.181 t

GDP (PPP) $ 4.421 t $ 15.08 t $ 11.3 t

GDP per capita (PPP) $ 3700 $ 48300 $ 8400

Growth rate 6.8% 1.8% 9.2%

Unemployment Rate 9.8% 9% 6.5%

Population below poverty line 29.8% 15.1% 13.4%

Exports $ 307.2 b $ 1.497 t $ 1.904 t

Imports $ 475.3 b $ 2.236 t $ 1.66 t

Poverty line in India is defined by national norms of a minimum of 2400 cal/day and 2100 cal/day

consumption for rural and urban areas respectively.

2

Bulls Eye

www. h i t b u l l s e y e . c o m

Basic of Indian

Economy

Central problems of economics

1. Problem of allocation of resources: what to produce and in what quantity; how to produce; for whom to

produce.

2. Problem of fuller utilization of resources: ensure that resources do not remain under-utilized.

3. Problem of growth of resources: to combat their scarcity, the resources must grow gradually.

To address these problems planning is needed.

Imperative planning: Government sets targets and uses its agencies and resources to achieve them.

Indicative Planning: Government acts as facilitator. Unlike a centrally planned economy, indicative planning

works through the market rather than replacing it. To this end, the planning process specifically brings

together both sides of industry (the trade unions and management) and the government.

Planning in India

Planning Commission estd. in 1950 formulates five-year plans for social and economic development of India.

The Eighth Five Year Plan introduced indicative planning in India. Following it government agencies act as

facilitators.

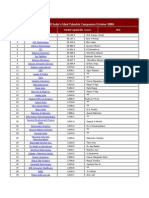

Growth through FYPs

Plan Period Target Actual

First (1951-56) 2.1% 3.6%

Second (1956-61) 4.5% 4.0%

Third (1961-66) 5.6% 2.4%

Fourth (1969-74) 5.7% 3.3%

Fifth (1974-79) 4.4% 5.0%

Sixth (1980-85) 5.2% 5.4%

Seventh (1985-90) 5.0% 5.7%

Eighth (1992-97) 5.6% 6.78%

Ninth (1997-2002) 6.5% 5.35%

Tenth (2002-2007) 8.1% 7.7%

Eleventh (2007-12) 9% (later revised to 8.1%) 7.9%

Twelfth (2012-17) 8.2% -

Some Targets of 12

th

FYP

Agricultural growth of 4%

Industrial growth of 10%

$1 trillion investment in infrastructure

More investment in health and education

Better targeting of subsidy

Bring down poverty ratio by 10%

Direct cash transfer of subsidy

The government has announced that direct cash transfer of subsidies to the bank accounts of the recipients

would start in 51 out of Indias 659 districts from January 2013 and would be gradually extended to the rest of

the country by April 2014.

It is proposed that the cash equivalent of all subsidies, such as kerosene, LPG cooking gas, food, fertiliser,

scholarships, old-age pensions, NREGS (there are some 42 government schemes), would be eventually

transferred directly to the Aadhaar-based bank accounts of all the recipients.

According to some estimates, the loss in subsidy distribution is as high as 40 percent, which will potentially

be eliminated through the implementation of the scheme.

www. h i t b u l l s e y e . c o m

3 Bulls Eye

Basic of Indian

Economy

Sectoral Composition of Labour Force and sectoral contribution to GDP (in %)

Country Agriculture Industry Services

India Labour Force 17.2 26.4 56.4

Contribution to GDP 52 14 34

USA Labour Force 1.2 19.2 79.6

Contribution to GDP 0.7 20.3 79

China Labour Force 10 46.6 43.3

Contribution to GDP 36.7 28.7 34.6

Government Initiatives:

Agriculture:

Co-operatives

Contract farming

Micro finance

Diffusion of technological know-how

Industry

1991 Reforms

Facilitation of technology

International collaborations (FDI and acquisitions)

Promoting Small and Medium Enterprises (SMEs)

Services

FDI inflows

Better management through regulatory bodies

Rural penetration

Benchmarking by government companies

Some terminology

Contract farming

Agricultural production carried out according to an agreement between a buyer and farmers. Benefits such as

the assured market and access to support services for the farmers. It is also a system of interest to buyers who

are looking for assured supplies of produce for sale or for processing.

Microfinancing

Providing banking facility to people belonging to lower and middle economic strata in rural and semi-urban

areas who are otherwise outside the coverage of formal banking system.

Foreign Direct Investment (FDI)

Investment made by a foreign individual or company in the productive capacity of another country. It grants

the investor control over the acquired asset.

Foreign Institutional Investment (FII)

The term is used most commonly in India to refer to outside companies investing in the financial markets of

India. These include investments in hedge funds, insurance companies, pension funds and mutual funds.

Benchmarking

Benchmarking is the process of comparing one's business processes and performance metrics to industry bests

or best practices from other industries. Dimensions typically measured are quality, time and cost.

4

Bulls Eye

www. h i t b u l l s e y e . c o m

Basic of Indian

Economy

Growth vs Development

Economic growth is a narrower concept than economic development.

The definition of economic development given by Michael Todaro is an increase in living standards,

improvement in self-esteem needs and freedom from oppression as well as a greater choice.

Human Development Index (HDI) was devised and launched by Pakistani economist Mahbub ul Haq,

followed by Indian economist Amartya Sen in 1990.

Starting with the 2011 Human Development Report the HDI combines three dimensions:

1. A long and healthy life: Life expectancy at birth

2. Education index: Mean years of schooling and Expected years of schooling

3. A decent standard of living: GNI per capita (PPP US$)

India has an HDI Rank of 134

Deficit Financing

Promoted by JM Keynes

Practice in which government spends more money than it receives as revenue

Helps in stimulating growth

Extra money to fund more expenditure comes from printing extra money or external borrowing. Extra

money in pockets will create demand. It will facilitate production. Jobs will be created. Economy will

be back on track.

More money in market, however, also leads to inflation.

Inflation

In a broad sense, inflation is that state in which the prices of goods and services rise on one hand and value of

money falls on the other.

Inflation is of two types

1. Cost Push Inflation: Due to an increase in production cost that gets translated into higher price for that item.

2. Demand Pull Inflation: When the item being purchased is in short supply

Monetary policy

Monetary and credit policy is the policy statement, through which the RBI targets a key set of indicators to

ensure price stability in the economy.

It is declared twice a year and helps in taming inflation.

Fiscal policy

It is the use of government revenue collection (taxation) and expenditure (spending) to influence the economy.

Union budget that is prepared every year is used to shape the fiscal policy of the country.

Budgeting is done at two levels:

1. Revenue budget - done for short time, recurring in nature eg: maintenance of roads

2. Capital budget - done for longer time, non-recurring in nature eg: construction of roads

Deficits

Budget deficit = Total expenditure Total receipts

Fiscal deficit = Total expenditure Total receipts excluding borrowings

Fiscal deficit gives the signal to government about total borrowing needs

Primary deficit = Fiscal deficit Interest payment on the borrowing

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Kannada KaliDocument18 pagesKannada Kaliapi-379970091% (11)

- View Duplicate Invoice Apple IphoneDocument1 pageView Duplicate Invoice Apple IphoneAnoop JangraNo ratings yet

- Tic Tac Plans BookDocument20 pagesTic Tac Plans BookNick Michael100% (1)

- Virgin Mobile USA Case Study On Pricing Strategy: 1. Clone The Industry PricesDocument3 pagesVirgin Mobile USA Case Study On Pricing Strategy: 1. Clone The Industry PricesDipesh JainNo ratings yet

- QlikView Best Practices - Development v0.5Document68 pagesQlikView Best Practices - Development v0.5Eleazar BrionesNo ratings yet

- QlikView12 What'SNewOverviewDocument13 pagesQlikView12 What'SNewOverviewlaxmaiahv212No ratings yet

- QlikView Question and Answer For Fresher-ExperiencedDocument14 pagesQlikView Question and Answer For Fresher-Experiencedfalguni jadhavNo ratings yet

- HBaseDocument13 pagesHBaselaxmaiahv212No ratings yet

- HDFS Architecture Guide: by Dhruba BorthakurDocument13 pagesHDFS Architecture Guide: by Dhruba BorthakurBabjee ReddyNo ratings yet

- QlikView Optimization Best Practices PDFDocument13 pagesQlikView Optimization Best Practices PDFAni ketNo ratings yet

- Hadoop Interview Questions ManishDocument19 pagesHadoop Interview Questions Manishlaxmaiahv212No ratings yet

- 200 Important AnalogiesDocument21 pages200 Important Analogiesshailesh_shekharNo ratings yet

- 501 Sentence Completion QuestionsDocument194 pages501 Sentence Completion QuestionsSapna Ludhani100% (4)

- Commands ManualDocument12 pagesCommands ManualPiyaliNo ratings yet

- QlikView Oracle Procedure IntegrationDocument5 pagesQlikView Oracle Procedure Integrationlaxmaiahv212No ratings yet

- 61st National Film AwardsDocument10 pages61st National Film Awardslaxmaiahv212No ratings yet

- Global Counsel Impact of Brexit June 2015Document43 pagesGlobal Counsel Impact of Brexit June 2015mrbarrpianoNo ratings yet

- QlikView Section Access ExamplesDocument3 pagesQlikView Section Access ExamplesjeevasakthiNo ratings yet

- List of Top Indian Service CompaniesDocument4 pagesList of Top Indian Service Companieslaxmaiahv212No ratings yet

- EVS Indian Economy OpportunitiesDocument16 pagesEVS Indian Economy Opportunitieslaxmaiahv212No ratings yet

- Types of Verb InversonDocument6 pagesTypes of Verb Inversonveer_sNo ratings yet

- Padma Awards 2013 Complete List PDFDocument5 pagesPadma Awards 2013 Complete List PDFShiva RamNo ratings yet

- Brain Busters FinalDocument15 pagesBrain Busters FinalAizat ZakariaNo ratings yet

- XAT2014 PaperDocument40 pagesXAT2014 Paperlaxmaiahv212No ratings yet

- Interm Budget 2014 Highlights EngDocument3 pagesInterm Budget 2014 Highlights Englaxmaiahv212No ratings yet

- 111 Spiritual Quotes For Inspirational MomentsDocument9 pages111 Spiritual Quotes For Inspirational Momentsn-chickNo ratings yet

- Fuzzy AR HelmDocument92 pagesFuzzy AR HelmTuấn Anh NguyễnNo ratings yet

- BLUETOOTH ArchitectureDocument38 pagesBLUETOOTH ArchitecturenaushadvickyNo ratings yet

- Sapna Hooda Thesis A Study of FDI and Indian EconomyDocument153 pagesSapna Hooda Thesis A Study of FDI and Indian EconomyPranik123No ratings yet

- Postmort AnalysisDocument8 pagesPostmort Analysislaxmaiahv212No ratings yet

- Association Rules and Fuzzy Association Rules To Find New Query TermsDocument5 pagesAssociation Rules and Fuzzy Association Rules To Find New Query Termslaxmaiahv212No ratings yet

- Fuzzy AR HelmDocument92 pagesFuzzy AR HelmTuấn Anh NguyễnNo ratings yet

- ECO372 Week 5 International Trade and FiananceDocument6 pagesECO372 Week 5 International Trade and FiananceWellThisIsDifferentNo ratings yet

- CPG Annual Report 2015Document56 pagesCPG Annual Report 2015Anonymous 2vtxh4No ratings yet

- Income Taxes, Unusual Income Items, and Investments in StocksDocument44 pagesIncome Taxes, Unusual Income Items, and Investments in StocksEdeltrudis JujuNo ratings yet

- Chap4 SolutionDocument3 pagesChap4 SolutionTrudy YayraNo ratings yet

- Chapter 8 Capital Asset Pricing & Artge PRNG ThryDocument64 pagesChapter 8 Capital Asset Pricing & Artge PRNG ThryAanchalNo ratings yet

- Ind As 2 PDFDocument26 pagesInd As 2 PDFmanan3466No ratings yet

- Basic Vessel Valuation - Issue No 3Document4 pagesBasic Vessel Valuation - Issue No 3SafoienTuihriNo ratings yet

- CFC Afghanistan Review, 07 April 2013Document6 pagesCFC Afghanistan Review, 07 April 2013Robin Kirkpatrick BarnettNo ratings yet

- Elements of Marketing Management ProjectDocument84 pagesElements of Marketing Management ProjectJayantKartikay0% (1)

- Business Math DictionaryDocument25 pagesBusiness Math DictionaryReinan Ezekiel Sotto Llagas100% (1)

- Chapter 5 ExercisesDocument3 pagesChapter 5 ExercisesHình VậnNo ratings yet

- Lecture Notes - Life Cycle CostingDocument5 pagesLecture Notes - Life Cycle CostingsympathhiaNo ratings yet

- Taxation of Repurchase AgreementsDocument5 pagesTaxation of Repurchase AgreementsAnonymous Q0KzFR2iNo ratings yet

- SAPMDocument10 pagesSAPMadisontakke_31792263No ratings yet

- Tender No: 52205683B Closing Date/Time: 26/03/2022 11:00: 2. Item DetailsDocument4 pagesTender No: 52205683B Closing Date/Time: 26/03/2022 11:00: 2. Item DetailsMahesh SakpalNo ratings yet

- Singapore Institute of Surveyors and Valuers: Valuation Guidelines For Collective SalesDocument2 pagesSingapore Institute of Surveyors and Valuers: Valuation Guidelines For Collective SalesThe PariahNo ratings yet

- EVOE Spring Spa: Shubhankar Gautam (17343) Section - CDocument1 pageEVOE Spring Spa: Shubhankar Gautam (17343) Section - Cshubhan001No ratings yet

- Standard Costing Modified PDFDocument87 pagesStandard Costing Modified PDFadhishsirNo ratings yet

- Cost Analysis and Pricing DecisionsDocument34 pagesCost Analysis and Pricing DecisionsSumy Thomas73% (11)

- Role of The Government in Organized Society IIDocument2 pagesRole of The Government in Organized Society IISheldon JosephNo ratings yet

- Exercises For Stock Valuation: InvestmentsDocument2 pagesExercises For Stock Valuation: InvestmentsMiguelNo ratings yet

- Case Study 1 - Network Design - W18Document3 pagesCase Study 1 - Network Design - W18Fayshal MiazyNo ratings yet

- Topic 4 Investment AnalysisDocument22 pagesTopic 4 Investment Analysistinie@surieqNo ratings yet

- Describe The Causes of and Responses To The Great DepressionDocument5 pagesDescribe The Causes of and Responses To The Great DepressionPaul ProvenceNo ratings yet

- Session 2 ButanGas Serbia Goran Djurdjevic Serban PopaDocument13 pagesSession 2 ButanGas Serbia Goran Djurdjevic Serban Popatrinhvonga7289No ratings yet

- Capital BudgetingDocument24 pagesCapital BudgetingInocencio Tiburcio100% (2)

- Percentage - Aptitude MCQ Questions and Solutions With ExplanationsDocument7 pagesPercentage - Aptitude MCQ Questions and Solutions With ExplanationsVip Mbp37No ratings yet