Professional Documents

Culture Documents

Movie Funding Essentials: A Film Financing Company Can Finance Your Tax Incentive and Other Capital Needs For Media Projects

Uploaded by

Stan Prokop0 ratings0% found this document useful (0 votes)

42 views4 pagesInformation on movie funding and the tax incentive finance strategy that is offered by a film financing company. Tax credits and other forms of film / tv / animation finance provide valuable capital for your projects.

Original Title

Movie Funding Essentials : A Film Financing Company Can Finance Your Tax Incentive And Other Capital Needs For Media Projects

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInformation on movie funding and the tax incentive finance strategy that is offered by a film financing company. Tax credits and other forms of film / tv / animation finance provide valuable capital for your projects.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

42 views4 pagesMovie Funding Essentials: A Film Financing Company Can Finance Your Tax Incentive and Other Capital Needs For Media Projects

Uploaded by

Stan ProkopInformation on movie funding and the tax incentive finance strategy that is offered by a film financing company. Tax credits and other forms of film / tv / animation finance provide valuable capital for your projects.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 4

Movie Funding Essentials : A Film Financing Company Can Finance Your

Tax Incentive And Other Capital Needs For Media ro!ects

" The Film Finance #usiness is a cruel and shallo$ money trench% a long plastic

hall$ay $here thieves and pimps run &ree% and good men die li'e dogs( There)s also

a negative side(*

O+E,+IE- . In&ormation on movie &unding and the tax incentive &inance strategy

that is o&&ered #y a &ilm &inancing company( Tax credits and other &orms o& &ilm / tv /

animation &inance provide valua#le capital &or your pro!ects

Movie &unding in Canada (and that includes film, television and digital productions) may

not be exciting as in the U.S., so with apologies to famous journalist unter !hompson "

!he #ilm #inance business is a cruel and shallow money trench, a long plastic hallway

where thieves and pimps run free...............$ who was actually referring to the music

business its still important to understand what a film financing company can deliver on

for your projects if you%re a producer&owner. !hat might mean &ilm tax incentive credits

that are widely used, or other forms of finance uni'ue to the entertainment industry. (et%s

dig in.

)hile almost everyone thin*s of % +((,)++- % when it comes to productions the

reality is that it has lost a lot of its business to other states in the U.S., Canada, and even

.urope. owever, our focus here is on Canadian productions(

!he &ilm tax credit system in Canada is largely responsible for the success of film

financing here. )hile an ongoing debate rages on around the benefit of govt film tax

credits (both the federal govt and provinces offer credits) hundreds of millions of dollars

continue to be available to project owners.

)hen you loo* at the total financing pac*age of a project the film tax credit portion is

often called ) so&t money 0( /n Canada it%s 'uite often very achievable to finance 012314

of a project via the tax credit system. 5ost people recogni6e that there%s really what top

exerts have called a % global battle % for countries vying for your production via their tax

credits.

#rom the owner&producers point of view film tax credits eliminate a large amt of the ris*

and at the same time maximi6e the return on investment for any e'uity holders in the

project. +ne of the most popular aspects these programs specifically is the )

,O12CTION 3E,+ICE3 TA4 C,E1IT ) 53TC6% which finances a large

component of your labor costs. 7nd again, remember that that includes film, !8, and

interactive digital productions.

#inancing for your 3TC is available because the program is structured as a refundable

credit 2 allowing you to cash flow the claim. Similar to financing S9:.- research tax

credits the financing is typically structured as a bridge loan, with no payments being

made until the govt issues the refund che'. !hat of course allows you to recover monies

spent, satisfy other obligations within the project, or start on your next project;

!he 01igital ) aspect of special effects and animation has become so popular in the

industry that it has its own lucrative tax incentive 2 its the ) 1I7ITA8 INTE,ACTI+E )

credit and is specifically formulated to cover off the spending around aspects of special

effects productions

/n the case of the <S!C or digital credits it%s important to have a good film tax credit

accountant prepare and maximi6e your claim.

#inancing from traditional institutions such as our Canadian chartered ban*s is generally

not available for independent producers. !he si6e of these projects (generally smaller)

and the % ris* =more often than not preclude traditional financing.

/f you%re loo*ing for film tax incentive financing from a film financing company for tax

credits or the other forms of film finance (presales, distribution, gap, etc) see* out and

spea* to a trusted% credi#le and experienced Canadian #usiness Financing Advisor

$ith a trac' record o& success who can assist you with your capital needs.

Stan <ro*op 2 9 ar' Avenue Financial :

http://$$$(9par'avenue&inancial(com

:usiness &inancing &or Canadian Firms % speciali;ing in $or'ing capital% cash &lo$%

asset #ased &inancing % E<uipment 8easing % &ranchise &inance and Cdn( Tax Credit

Finance ( Founded =>>? @ Completed in excess o& A> Million B o& &inancing &or

Canadian corporations ( In&o /Contact :

9 A,C A+EN2E FINANCIA8 D CANA1IAN FI8M TA4 C,E1IT FINANCIN7

E4E,TI3E

Eave A Fuestion /Comment On Our :log Or Canadian :usiness Financing

Alternatives G

CONTACT:

9 ar' Avenue Financial

3outh 3heridan Executive Centre

=AH> 3outh 3heridan -ay

3uite I>H

Oa'ville% Ontario

8JK 9KL

1irect 8ine D ?HJ IHA M9JA

O&&ice D A>M L=A =JMI

Email D spro'opN9par'avenue&inancial(com

) Canadian :usiness Financing -ith The Intelligent 2se O& Experience )

3tan ro'op

You might also like

- Turnaround Finance Canada: Don't Just Imagine Company Restructuring FinancingDocument5 pagesTurnaround Finance Canada: Don't Just Imagine Company Restructuring FinancingStan ProkopNo ratings yet

- The Equipment Finance Lease in Canada: Eliminating Rough Waters in Asset FinancingDocument4 pagesThe Equipment Finance Lease in Canada: Eliminating Rough Waters in Asset FinancingStan ProkopNo ratings yet

- Receivable Credit in Canada: How To Properly Finance Trade Receivables in CanadaDocument6 pagesReceivable Credit in Canada: How To Properly Finance Trade Receivables in CanadaStan ProkopNo ratings yet

- Business Loans: Healing Power of Financing Sources in CanadaDocument5 pagesBusiness Loans: Healing Power of Financing Sources in CanadaStan ProkopNo ratings yet

- We're Cutting All The Red Tape in The Gov't Guaranteed Business LoanDocument4 pagesWe're Cutting All The Red Tape in The Gov't Guaranteed Business LoanStan ProkopNo ratings yet

- Explained: Commercial Loans in Canada: Basic Business Loan KnowledgeDocument5 pagesExplained: Commercial Loans in Canada: Basic Business Loan KnowledgeStan ProkopNo ratings yet

- Business Funding in Canada: Climb Aboard The Traditional and Alternative Financing TrainDocument4 pagesBusiness Funding in Canada: Climb Aboard The Traditional and Alternative Financing TrainStan ProkopNo ratings yet

- Start Up Sources of Finance in Canada: Early Stage Financing Is Your New BFFDocument4 pagesStart Up Sources of Finance in Canada: Early Stage Financing Is Your New BFFStan ProkopNo ratings yet

- Canadian Business Financing: Game Plan Required For SME Commercial Finance NeedsDocument4 pagesCanadian Business Financing: Game Plan Required For SME Commercial Finance NeedsStan ProkopNo ratings yet

- Technology Financing Canada: The Psychology and Facts Around Computer and Tech LeasingDocument4 pagesTechnology Financing Canada: The Psychology and Facts Around Computer and Tech LeasingStan ProkopNo ratings yet

- Business Financing Options in Canada: Most Effective and WhyDocument5 pagesBusiness Financing Options in Canada: Most Effective and WhyStan ProkopNo ratings yet

- Business Financial Solutions in Canada: Untapping CapitalDocument4 pagesBusiness Financial Solutions in Canada: Untapping CapitalStan ProkopNo ratings yet

- Franchising Loans in Canada: Top Franchise Financing Tips ExplainedDocument4 pagesFranchising Loans in Canada: Top Franchise Financing Tips ExplainedStan ProkopNo ratings yet

- Business Acquisitions Finance: SME Commercial Acquisitions Financing in CanadaDocument5 pagesBusiness Acquisitions Finance: SME Commercial Acquisitions Financing in CanadaStan ProkopNo ratings yet

- Bank Lending Plus Lesser Known Business Finance Alternatives Deliver Financing SolutionsDocument5 pagesBank Lending Plus Lesser Known Business Finance Alternatives Deliver Financing SolutionsStan ProkopNo ratings yet

- Business Cash Solutions: Break Free With Sources of Growth Financing in CanadaDocument5 pagesBusiness Cash Solutions: Break Free With Sources of Growth Financing in CanadaStan ProkopNo ratings yet

- A Tax Credit Financing Loan in Canada: SRED Finance Allows You To Do More With Less With Your SR ED ClaimDocument4 pagesA Tax Credit Financing Loan in Canada: SRED Finance Allows You To Do More With Less With Your SR ED ClaimStan ProkopNo ratings yet

- Confidential AR Finance : The Inside Secret To Financing Receivables Via FactoringDocument5 pagesConfidential AR Finance : The Inside Secret To Financing Receivables Via FactoringStan ProkopNo ratings yet

- Buying A Company in Canada: Business Purchase Finance Problems Are Solved Like ThisDocument5 pagesBuying A Company in Canada: Business Purchase Finance Problems Are Solved Like ThisStan ProkopNo ratings yet

- How To Make A Success Story of Your Business Cash FlowDocument5 pagesHow To Make A Success Story of Your Business Cash FlowStan ProkopNo ratings yet

- Why The Equipment Lease Bravely Steps Up: Leasing Company Solutions Help Acquire AssetsDocument4 pagesWhy The Equipment Lease Bravely Steps Up: Leasing Company Solutions Help Acquire AssetsStan ProkopNo ratings yet

- Financing Research and Development Tax Credits: SRED Finance Is The Easy Part of Your R & DDocument5 pagesFinancing Research and Development Tax Credits: SRED Finance Is The Easy Part of Your R & DStan ProkopNo ratings yet

- Gov't Guaranteed Loans in Canada: Winds of Change in The Government Small Business LoanDocument5 pagesGov't Guaranteed Loans in Canada: Winds of Change in The Government Small Business LoanStan ProkopNo ratings yet

- A Government Backed Business Loan: How Not To Fail at SBL Bank LoansDocument5 pagesA Government Backed Business Loan: How Not To Fail at SBL Bank LoansStan ProkopNo ratings yet

- Which of These Business Credit Lines Would Your Company ChooseDocument4 pagesWhich of These Business Credit Lines Would Your Company ChooseStan ProkopNo ratings yet

- Need A Special Ops Team To Provide You With A Business Asset Based Credit Line?Document4 pagesNeed A Special Ops Team To Provide You With A Business Asset Based Credit Line?Stan ProkopNo ratings yet

- SRED Loans: Don't Be Out of The Loop On SR ED Refundable Tax Credit FinancingDocument4 pagesSRED Loans: Don't Be Out of The Loop On SR ED Refundable Tax Credit FinancingStan ProkopNo ratings yet

- Working Capital Factoring: Connecting The Dots in Solutions Via Receivable Factor CompaniesDocument4 pagesWorking Capital Factoring: Connecting The Dots in Solutions Via Receivable Factor CompaniesStan ProkopNo ratings yet

- Looking For Solutions To A Creativity Defecit in Your Cash Flow Crunches?Document5 pagesLooking For Solutions To A Creativity Defecit in Your Cash Flow Crunches?Stan ProkopNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Financial AccountingDocument3 pagesFinancial AccountingJaimee CruzNo ratings yet

- Air Cargo Management: JSP Krishna TejaDocument10 pagesAir Cargo Management: JSP Krishna TejaAnonymous x7YkEubrw0No ratings yet

- ABA-GURO Party List vs. Ermita VAT RulingDocument2 pagesABA-GURO Party List vs. Ermita VAT Rulingyannie11No ratings yet

- Persistent Systems: Equity Research - ModelDocument9 pagesPersistent Systems: Equity Research - ModelNaman MalhotraNo ratings yet

- Andrews' PitchforkDocument23 pagesAndrews' PitchforkDoug Arth100% (8)

- Foreign Exchange Market: Introduction ToDocument20 pagesForeign Exchange Market: Introduction ToTraders AdvisoryNo ratings yet

- Financial Analysis of Coca Cola in PakistanDocument40 pagesFinancial Analysis of Coca Cola in PakistanŘabbîâ KhanNo ratings yet

- Accounting Cycle (I) : Journalizing Posting and Preparing Trial BalanceDocument17 pagesAccounting Cycle (I) : Journalizing Posting and Preparing Trial BalancemansiNo ratings yet

- Roadmap FASB 123R Share-Based Pymt - DeloitteDocument280 pagesRoadmap FASB 123R Share-Based Pymt - DeloitteAlycia SkousenNo ratings yet

- SNV Supporting Shea Sector in Northern GhanaDocument32 pagesSNV Supporting Shea Sector in Northern GhanaDean Reeves100% (1)

- Executive Summary: Comparative Study of Effects of Sub-Prime Crisis On BSE and Dow JonesDocument72 pagesExecutive Summary: Comparative Study of Effects of Sub-Prime Crisis On BSE and Dow JonesNeel_hi2uNo ratings yet

- Receivables Management: Unit 5Document28 pagesReceivables Management: Unit 5ANUSHANo ratings yet

- 'Ol50C PH: Dist ICDocument9 pages'Ol50C PH: Dist ICscion.scionNo ratings yet

- Management of Financial Services PDFDocument76 pagesManagement of Financial Services PDFManisha Nagpal100% (1)

- The Process of Portfolio Management: Mohammad Ali SaeedDocument35 pagesThe Process of Portfolio Management: Mohammad Ali SaeedShahrukh Abdur RehmanNo ratings yet

- English Solar Farm Proposal by TSF Oct 123Document38 pagesEnglish Solar Farm Proposal by TSF Oct 123Atiqah HamzahNo ratings yet

- 6 - Virag-TEN-t PDFDocument19 pages6 - Virag-TEN-t PDFAlex NadNo ratings yet

- Risk and Return PDFDocument14 pagesRisk and Return PDFluv silenceNo ratings yet

- Keynesian TheoryDocument98 pagesKeynesian TheorysamrulezzzNo ratings yet

- EduTap Finance NotesDocument22 pagesEduTap Finance NotesHormaya Zimik100% (3)

- Project Feasibility Study AnalysisDocument3 pagesProject Feasibility Study AnalysisJanus Aries SimbilloNo ratings yet

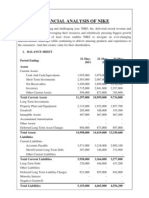

- Financial Analysis of NikeDocument5 pagesFinancial Analysis of NikenimmymathewpkkthlNo ratings yet

- Q4fy12 Earningsslides Final PDFDocument38 pagesQ4fy12 Earningsslides Final PDFmahony0No ratings yet

- Tests of Controls in Revenue and Receipts CyclesDocument13 pagesTests of Controls in Revenue and Receipts CyclesダニエルNo ratings yet

- Chronocrator XL ManualDocument30 pagesChronocrator XL ManualDiego Ratti100% (2)

- BrandDocument31 pagesBrandyadavraj23No ratings yet

- AICPA Released Questions FAR 2015 DifficultDocument33 pagesAICPA Released Questions FAR 2015 DifficultAZNGUY100% (2)

- 0020 Letter and Business ProposalDocument3 pages0020 Letter and Business ProposalPhilip Wen Argañosa BombitaNo ratings yet

- Petron Corporation: Profile of the Leading Oil Refiner and Fuel Provider in the PhilippinesDocument26 pagesPetron Corporation: Profile of the Leading Oil Refiner and Fuel Provider in the PhilippinesAl CayosaNo ratings yet

- Analysis of Ambuja Cements LimitedDocument1 pageAnalysis of Ambuja Cements LimitedJayant Lakhotia0% (1)