Professional Documents

Culture Documents

Drift in Global Microfinance Industry - An Empirical Study

Uploaded by

thesijCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Drift in Global Microfinance Industry - An Empirical Study

Uploaded by

thesijCopyright:

Available Formats

The SIJ Transactions on Industrial, Financial & Business Management (IFBM), Vol. 1, No.

2, May-June 2013

ISSN: 2321 242X 2013 | Published by The Standard International Journals (The SIJ) 40

AbstractThe growth and performance of microfinance sector in global perspective during the recent years

has shown distinctive differences among regions. With a view to capture the direction of movement of the

sector among the regions, a comparative analysis of the performance of the sector in regions like Africa, East

Asia & Pacific, Eastern Europe, Central Asia, Latin America, Caribbean, Middle East & North Africa and

South Asia is attempted in this paper. It focuses on loan loss rate, Portfolio at risk, cost factor, yield on gross

portfolio, return on assets and equity among varied countries. Mix Market Data for the period 2003-2010 has

been the source for this analysis.

KeywordsLoan Loss, Microfinance, Operating Expenses, Portfolio at Risk; JEL: B26; G21; G23; G32; N20;

N25; N26; N27

AbbreviationsEast Asia & Pacific (EAP), Eastern Europe & Central Asia (EECA), Latin America & the

Caribbean (LAC), Micro Finance Institutions (MFI), Middle East & North Africa (MENA), Portfolio at Risk

(PaR), Return on Assets (RoA), Return of Equity (RoE), South Asia (SA)

I. INTRODUCTION

HE economist Intelligence Unit had brought an edition

of Global Microscope on the MFI sector for the year

2011. The study covered 55 countries. The countries

had been ranked on the basis of various revised parameters

which were like overall microfinance business environment,

Regulatory framework and practices, Supporting institutional

framework and stability. The study findings concluded that in

the aftermath of the global financial crisis, microfinance has

begun to enter a more mature and sustainable growth phase

[James Clark, 2011]. After years of rapid expansion, the

focus has turned to accelerating the improvements already

underway in corporate governance, regulatory capacity and

risk management. Further, risk management, which has

become a post-crisis priority for all financial institutions, has

improved considerably in the microfinance sector, which is

essential, given that it is offering an increasingly diversified

range of innovative financial services to the poor. Efforts to

strengthen the sector have been stabilized, beside new

opportunities; microfinance is well positioned to take further

advantage of technological and market innovations and to

build on improvements already underway. This progress

stands in contrast to the financial crisis period and its

aftermath, which had a dampening impact on the sector by

exposing structural weaknesses, leading to a deterioration in

the quality of some loan portfolios.

Troubling events over the past year highlight the

industrys need to respond to new challenges and changing

local conditions. While microfinance continues to shift from

a niche product to a globally recognized form of finance,

regulatory and market gaps continue to impede the industrys

ability to realize its potential. Data collection and

transparency have improved markedly from the early days of

microfinance, spurred by the notable efforts of microfinance

ratings agencies and organizations, such as the MIX Market

and Microfinance Transparency. But the varied product

offerings and market conditions globally imply a continuing

need for policymakers to adopt a more systematic and robust

way of evaluating the sectors development, while remaining

attuned to the nuances of local markets [Venugopalan

Puhazhendhi, 2012]. Similar to earlier performance, Peru was

ranked first as the country with highest score followed by

Bolivia and Pakistan. India and Ghana which were in top 10

lists had an exit (Table 1). On the other end Uganda, Mexico

& Panama have made an entry to the top list. Under the

overall business category, Bangladesh the land of

microfinance origin had been in 43

rd

rank and Vietnam finds

the last place.

This paper focuses on understanding the relative global

performance of Indian MFIs and intends to learn the varied

cost incurred by the MFIs, the Loan loss rate incurred by

them and also traces out the reasons for such losses.

T

*Director, Department of Management Studies, Sri Ramakrishna Engineering College, Coimbatore, Tamilnadu, INDIA.

E-Mail: profkchitra@gmail.com

**Corresponding Author, Assistant Professor, KCT Business School, Saravanampatti, Coimbatore, Tamilnadu, INDIA.

E-Mail: sangisubramanian@gmail.com

Dr. K. Chitra* & S. Sangeetha**

Drift in Global Microfinance Industry -

An Empirical Study

The SIJ Transactions on Industrial, Financial & Business Management (IFBM), Vol. 1, No. 2, May-June 2013

ISSN: 2321 242X 2013 | Published by The Standard International Journals (The SIJ) 41

II. REVIEWS OF LITERATURE

Ayi Gavriel Ayayi (2012) in his paper credit risk assessment

in the microfinance industry with reference to Vietnamese

microfinance institutions has discussed about the assessing

risk through conventional and specialised evaluation metrics.

The study identified that microfinance institutions could

sustain financial sound and good corporate governance

through the execution of risk management tools. It also stated

that the microfinance institutions invariably adopt the same

risk management techniques [Ayi Gavriel Ayayi, 2011;

Padma et al., 2012]. The researcher has used econometric

analysis to assess the credit risk. This study helps to

understand the importance of assessing credit risk and

enhances on the tools to adopt for assessing the credit risk.

Milford Bateman & Dean Sinkovic (2009): This paper

focuses on the negative impact of the neo liberal policy on

Croatia. It also speaks about the Grameen bank model in

promoting the standard of living in poor countries. But this

model has proved good; today it is facing a threat, which

demands for revision in development policy. In Croatia, the

micro finance institutions have seen an extraordinary growth

from 1999 upto 2006 [Maitreyee Gaikwad, 2006]. The firm

and household loans had excessive demand during the study

period. But it also describes the repayment tactics followed

by the companies are very aggressive during the last few

years of the study period, which made the poor to be even

poor. The neoliberal capitalism was dead and the one of the

consequence was microfinance. Hence this paper helped in

understanding the change in policies and in its negative ill

effects on micro funding.

K.O. Osotimehin, et al., (2011) in their study focused on

identifying the determinants of the outreach capabilities and

trends of microfinance institutions in Microfinance in south

western Nigeria. The econometric analysis has been

performed to understand the trend of outreach of

microfinance institutions. The model specifies that the

depository microfinance institutions exhibit 2 stage

production process, first FOP for mobilising savings and

secondly for institutions production process. The results of

the has shown that there had been increase in the outreach of

microfinance institutions in South western Nigeria which has

been driven by factors like effective lending rates, cost of

loans disbursed, average loan size and staff salary. The

researcher has found there is an existence of negative

correlation between real effective lending rates and outreach,

because higher lending rates will discourage borrowings and

have led to lower outreach.

III. OBJECTIVES AND METHODOLOGY

The study aimed to explore on the following aspects:

To analyze the relative performance of Indian MFIs

in Global perspective.

To analyse the loan loss rate among varied

countries.

To analyze the yield on gross portfolio, the return on

assets and equity among varied countries.

To analyze the operating, administrative cost

incurred in managing the loan portfolio and average

borrower among varied countries.

The study will enlighten on the trends in the global MFI

industry. The study assumes to be descriptive which explores

the trends of Global MFI industry. Secondary data has been

collected and comparative and trend analysis has been carried

out for analyzing the performance among varied regions.

Data of microfinance belonging to varied countries for a span

of 9 years (ie. 2003-2011) had been used for analysis.

IV. DISCUSSIONS

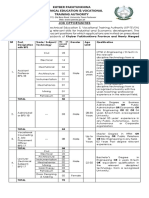

Table 1 Ranking of Top 10 Countries in Microfinance in 2011

Rank Country Score

1. Peru 67.8

2. Bolivia 64.7

3. Pakistan 62.8

4. Kenya 60.3

5. El Salvador 58.8

6. Philippines 58.5

7. Colombia 56.0

8. Ecuador 55.1

9. Uganda 53.7

10. Mexico & Panama 53.6

The relative performance of Indian MFIs in the global

context has shown greater downfall during the last three years

which needs to be taken serious note while discussing the

issues on future perspectives.

Table 2 Relative Performance of Indian MFIs in Global

Perspective

Particulars

2009 2010 2011

Score Rank Score Rank Score Rank

Overall MF

business

Environment

62.1 4 59.1 8 43.1 27

Regulatory

frame work

and Practices

62.5 13 62.5 14 50.0 22

Institutional

Development /

Supporting

framework

66.7 3 58.3 7 40.0 20

Investment

Climate

51.9 14 53.9 14 - -

Stability - - - - 62.5 40

Source: Global microspore on the microfinance business

environment 2009-2011, Economic Intelligence unit Ltd

(www.eiu.com)

Pakistan, Philippines and Uganda shares first place in the

regulatory framework and practices. Trinidad and Tobago

had occupied the bottom of the list. Bolivia and Peru shares

first rank in Supporting Institutional framework followed by

Columbia and Armenia. Costa Rica has topped in the stability

The SIJ Transactions on Industrial, Financial & Business Management (IFBM), Vol. 1, No. 2, May-June 2013

ISSN: 2321 242X 2013 | Published by The Standard International Journals (The SIJ) 42

factor followed by Uruguay and Chile countries. As like in

the overall business category, in supporting Institutional

Framework, Vietnam has occupied the back seat.

Peru has been rated number one for the consecutive three

years. It had an excellent record of legal framework,

sophisticated regulators and government commitment which

purely focused on making unbanked bankable. Bolivia in

second place had better price transparency and disclosure

rules. Pakistan in the third place had separate legal

framework for microfinance banks and good networking. The

Kyrgyz Republic has stepped down from 12

th

position to 21

st

rank globally. This is due to change in political regime which

halted regulatory overhaul. Latin America and the Caribbean

have the largest number of top performing countries in the

Global Microscope. The regions have eight of the countries in

the top global 12 countries. In addition the first two places are

occupied by its countries Peru and Bolivia respectively. This

had been possible as they very strong supporting institutional

framework category. But Latin American countries are not

very strong in regulatory framework and practices inspite of

eight countries are in the top list.

Arab countries had faced political unrest earlier this year

which seriously handicapped the functioning of the

Microfinance industry. Yemen is one of the most affected

countries which moved from best to worst category. It

stepped down from 27

th

rank to 44

th

place. This instability has

caused many MFIs to reduce their scale of operations. This

landed up in closure of banks too. Kenya is one of the

strongest and most stable countries in this region. Kenya is

placed in the fourth place and Uganda in the ninth place in

the global list. But Uganda places itself in the first place

globally in the regulatory framework and practices category.

Clients are benefitted with the active microfinance markets.

India has been pushed to 27

th

rank with a score of 43.1 in

the overall microfinance business environment. It possesses

22

nd

rank in regulatory framework and practices, 20

th

place in

supporting institutional framework and 40

th

rank in terms of

stability. The Government of India had strongly promoted the

Self-Help Group model through the National Rural

Livelihood Mission by offering cheap funding and also to

restrict market-based lending. A perception prevails that the

rapid growth had slow down by the local politicians ability

to use rural credit more.

In a study carried out by Microrate MIV survey 2011

[Luis A. Viada, 2011], Latin America and the Caribbean

(LAC) and Europe and Central Asia continue to account for

the majority of microfinance investments receiving a

combined total of 73% of all microfinance investment in

2010. JP Morgans CGAP Global Equity Valuation Survey

2012 has reported that LAC has more than half the

investment followed by Asia [Global Microfinance Equity

Valuation Survey, 2012]. India is the major contributor with

more than 92% of Asians investment levels.

The Gross Loan Portfolio

The gross loan portfolio is very high in Latin America &

Caribbean (28,66,309). MENA ranks second with loan

portfolio of 23,02,788. Africa had less gross loan Portfolio

comparatively with other 5 regions, during 2003. But this

trend had found to be changing in the next year, where it

(Africa-9,01,087) could perform better than South Asia

(8,16,720).

Table 3 Gross Loan Portfolio

Year

Gross Loan Portfolio

LAC MENA Market Leadership Position

2003 2866309 2302788 LAC

2004 3290834 3319529

MENA

2005 3325504 4257163

2006 4076073 3958660

LAC

2007 4730981 4201610

2008 4717270 3523469

2009 6109115 4234538

2010 8094382 5489360

2011 128007902 16294574

The growth of Gross loan portfolio of LAC had

increased by 12,51,41,593 between the years 2003-11. The

gross loan portfolio to total assets had been 84.58% than the

previous year (2010).

Table 4 Gross Loan Portfolio / Total Assets (%)

Year

Gross Loan Portfolio / Total Assets (%)

Africa

East Asia &

Pacific (EAP)

Eastern Europe &

Central Asia (EECA)

Latin America & the

Caribbean (LAC)

Middle East & North

Africa (MENA)

South Asia

(SA)

2003 64.65 71.97 82.61 78.28 71.69 74.41

2004 67.17 72.25 85.00 79.90 67.06 77.32

2005 64.07 72.19 84.01 79.77 74.98 76.22

2006 63.78 74.58 86.82 80.15 79.05 78.62

2007 62.05 73.53 87.30 80.97 76.85 78.03

2008 65.73 75.93 87.56 80.45 75.21 77.23

2009 63.97 72.88 81.70 79.39 76.75 77.34

2010 65.22 74.60 84.24 81.13 79.29 82.01

2011 72.08 102.76 76.14 84.58 80.57 -

Though the industry seems to have growth in Gross Loan

Portfolio/ Total Assets invariably for all the countries during

2011, the trend from 2003-11 is fluctuating. Except Eastern

Europe & Central Asia, Latin America and the Caribbean all

other countries had a dip during 2007. But Latin America and

the Caribbean had experienced a light fall in the subsequent

The SIJ Transactions on Industrial, Financial & Business Management (IFBM), Vol. 1, No. 2, May-June 2013

ISSN: 2321 242X 2013 | Published by The Standard International Journals (The SIJ) 43

year 2008 while regions like Africa, East Asia & pacific and

Eastern Europe & Central Asia were incrementally growing.

During the year 2011 a significant data of Eastern Asia &

Pacific makes the world to observe them, as it had 102.76%

from 74.6% comparatively with other regions.

The borrowings have reduced by 5.48% from

3,35,59,161 to 3,17,21,406 in Bhutan during 2009 & 2010.

The number of MFIs count decreased from 100 to 94 in India

and found to be common scenario in all other countries

except Pakistan.

Portfolio at Risk (90 days)

For the country like India PaR has reduced considerably

to 0.13% during 2007. Thereafter it seems to be inconsistent;

it is hiking year after year. During 2010 the PaR had been

0.64% from 0.16% the previous year. This sort of hike in PaR

has not been experienced by this industry earlier. It is also

evident that Bhutan being the leader the depositors, the loans

outstanding will be naturally high and the PaR seems to be

very high comparatively with other nations ie 11.7%. But the

land of microfinance origin is under promising side where

their PaR has come down to 4.47 % (2010) from 5.34%

previous year. It is also noticeable that Nepal has the lowest

PaR with 0.63% (2010). The PaR weighted average 30 days

of India had been very alarming with 24.86% amounting to

Rs.3, 42, 76,696 loans outstanding out of gross loan portfolio

of Rs. 5,25,11,14,052.

The active borrowers in India (2010) is 3,17,09,335,

while in Bhutan it is just 24, 476. The deposit sum during the

year 2010 for India had been Rs. 30,07,60,871, whereas in

Bangladesh it is Rs. 2,17,12,20,435 which tops among all the

7 nations. The deposit sum is just Rs. 3,26,45,020 for Bhutan

whereas Srilanka has considerable deposits of Rs.

49,41,30,770 which is higher than India, inspite Srilanka

comparatively having less active borrowers (13,34,744).

The gross loan portfolio of India is considerably

increasing from the year 2006-10. ie. (46,15,10,391 to

5,25,11,14,052). Though Bhutans entry was from 2008, it

also has tasted the growth in its gross loan portfolio

((5,14,66,128 to 7,93,89,045 (2010)). The number of

depositors in India has increased in a large way. But it has

experienced an exponential increase during the 2010

(65,01,658) while considering the previous year (20,36,591).

Table 5 Loan Loss Rate

Year

Loan Loss Rate

Africa

East Asia &

Pacific

Eastern Europe

& Central Asia

Latin America & the

Caribbean

Middle East &

North Africa

South Asia

2003 0.34 0.45 0.27 0.85 0.04 0.0

2004 0.54 0.13 0.07 0.65 0.06 0.0

2005 1.11 0.07 0.00 0.62 0.06 0.0

2006 0.50 0.00 0.04 0.56 0.07 0.0

2007 0.40 0.04 0.00 0.58 0.21 0.0

2008 0.31 0.07 0.00 0.95 0.02 0.0

2009 0.23 0.06 0.06 1.05 0.03 0.0

2010 0.26 0.33 0.19 1.19 0.02 0.0

2011 0.31 0.41 - 1.83 6.38 0.0

The loan loss rate is found to be very high in MENA than other regions which accounts to 6.38% of the loan portfolio during

the year 2011. Inspite of having large loan portfolio LAC has only 1.83 % extent of loan loss rate which promotes additional

portfolio growth.

Table 6 Operating Expenses / Loan Portfolio

Year

Operating Expenses / Loan Portfolio (%)

Africa

East Asia &

Pacific

Eastern Europe

& Central Asia

Latin America & the

Caribbean

Middle East &

North Africa

South Asia

2003 26.85 29.44 20.67 22.85 21.41 15.60

2004 27.73 21.76 18.11 22.88 23.80 15.44

2005 30.39 23.90 16.73 22.14 22.26 13.99

2006 30.81 23.28 17.19 20.48 20.93 13.30

2007 31.32 19.96 14.89 19.02 19.42 13.88

2008 31.45 20.35 14.30 22.23 20.40 13.84

2009 29.99 20.04 14.89 19.76 20.33 14.19

2010 31.42 18.97 16.10 21.42 20.27 14.06

2011 59.40 22.71 01.34 14.09 19.67 -

The SIJ Transactions on Industrial, Financial & Business Management (IFBM), Vol. 1, No. 2, May-June 2013

ISSN: 2321 242X 2013 | Published by The Standard International Journals (The SIJ) 44

Table 7 Operating Expenses / Total Assets (%)

Year

Operating Expenses / Total Assets (%)

Africa East Asia & Pacific

Portfolio

Operating Expenses

/ Loan Portfolio (%)

Gross Loan Portfolio /

Total Assets

Portfolio

Operating Expenses /

Loan Portfolio (%)

Gross Loan Portfolio

/ Total Assets

2003 646614 26.85 15.31 965457 29.44 20.69

2004 901087 27.73 16.12 1124755 21.76 15.63

2005 869392 30.39 17.79 1325123 23.90 16.74

2006 937462 30.81 16.60 1520924 23.28 16.16

2007 1578846 31.32 17.23 1767032 19.96 13.99

2008 1955964 31.45 18.77 1948487 20.35 14.51

2009 2463203 29.99 18.33 3673460 20.04 14.40

2010 2929689 31.42 18.68 4418928 18.97 14.63

2011 1754993 59.40 28.03 36128828 22.71 23.99

The operational expenses / portfolio had been comparatively very high for EAP (19.64%), though it has slightly decreased

from the previous year. East Asia & pacific had very high gross loan portfolio/ total assets during the year 2010. But the

operational expense/ portfolio was surprisingly low during 2010 for that region. But the very next year the operational expenses /

portfolio & operational expenses had been very high, as the portfolio size had a larger hike by 8.18 times.

The African region is facing upside down situations where the portfolio size has declined (2011), but the operating expenses

have nearly the double the times with reference to the previous years. The EECA had an effective control over its operating

expenses. It could manage its portfolio with just 1.34%, though the portfolio has expanded by 13.8 times.

Table 8 Yield on Gross Portfolio (Real)

Year

Yield on Gross Portfolio (Real) (%)

Africa

East Asia &

Pacific

Eastern Europe

& Central Asia

Latin America & the

Caribbean

Middle East &

North Africa

South Asia

2003 20.96 36.71 30.90 26.07 31.55 20.60

2004 25.18 28.12 26.48 27.42 31.54 15.49

2005 19.76 28.50 22.09 25.75 25.98 13.83

2006 19.61 23.35 21.22 25.11 23.54 15.04

2007 21.73 24.57 17.92 25.30 21.62 13.89

2008 16.41 19.13 15.20 21.80 15.29 10.46

2009 22.10 26.19 21.23 25.21 27.40 14.73

2010 22.56 24.05 22.67 24.83 22.28 13.34

2011 - - 18.55 - - -

It is notable that all the regions have experienced a downfall during the year 2009, largely due to the impact of economic

slowdown. Thereafter the scenario has improved the very next year (2010) to a large extent. LAC tops in the yield on gross loan

portfolio comparatively with 24.83% (2010). It is closely followed by regions like EECA, Africa & MENA. But EECA had

experienced a dip in yield during the year 2011.

Table 9 Return on Assets (Median) (%)

Year

Return on Assets (Median) (%)

Africa

East Asia &

Pacific

Eastern Europe &

Central Asia

Latin America & the

Caribbean

Middle East &

North Africa

South Asia

2003 -0.53 3.31 3.60 3.70 2.06 0.68

2004 0.76 3.03 3.50 3.61 3.49 0.83

2005 0.44 2.59 3.19 3.20 2.96 1.25

2006 0.55 3.12 3.29 3.22 3.65 0.87

2007 0.74 2.76 3.20 2.92 4.22 0.77

2008 1.06 2.85 2.83 2.24 3.13 1.00

2009 0.35 2.19 1.34 1.46 4.09 1.11

2010 0.81 2.83 2.34 1.60 4.69 1.47

2011 7.08 8.93 4.60 1.87 6.44 -

The Return on Assets (RoA) of African region have shown as tremendous improvement from -0.53% (2003) to 7.08%

(2011), inspite of large fluctuation during the course of time. Similarly East Asia and Pacific have improved and tops in RoA

with 8.93% during the year 2011. Though LAC has higher gross loan portfolio, it has picked a very low RoA comparatively to

an extent of 1.87% (2011) though it has improved from the previous year. The RoA of LAC had not been attractive with respect

to the portfolio size it holds.

The SIJ Transactions on Industrial, Financial & Business Management (IFBM), Vol. 1, No. 2, May-June 2013

ISSN: 2321 242X 2013 | Published by The Standard International Journals (The SIJ) 45

Table 10 Return on Equity (Median)

Year

Return on Equity (Median) (%)

Africa

East Asia &

Pacific

Eastern Europe

& Central Asia

Latin America & the

Caribbean

Middle East &

North Africa

South Asia

2003 0.23 10.06 9.82 12.62 2.38 4.90

2004 2.95 15.64 10.43 12.62 4.87 6.63

2005 2.12 12.82 18.65 11.61 10.00 7.45

2006 1.76 16.07 20.77 12.36 18.01 6.25

2007 3.50 14.27 16.51 11.66 19.56 7.32

2008 6.68 13.42 14.64 8.82 6.27 8.84

2009 3.86 11.22 3.80 6.26 10.62 10.36

2010 4.55 11.98 7.85 6.94 8.23 9.61

2011 -10.6 42.55 22.97 12.14 9.40 -

Profit Margin

2010 4.46 15.48 13.54 8.59 23.61 -

2011 26.85 27.66 25.26 12.83 17.83 -

Though the return on assets (RoA) was very promising for African region RoE had found to be negative. But EAP, EECA

regions had good ROE of 42.55% & 22.97% which has exponentially grown from 11.98% & 7.85% respectively for the years

2010 & 11. LAC has also enjoyed increase in RoE from 6.94% to 12.14% for the years 2010 & 11.

Profit Margin

The profit margin had improved in a larger way to all regions except MENA which had steeply declined from 23.61% to 17.83%

during the years 2010 & 11.

Table 11 Number of Loans Outstanding

Year

Number of Loans Outstanding

Africa

East Asia &

Pacific

Eastern Europe

& Central Asia

Latin America &

the Caribbean

Middle East &

North Africa

South Asia

2003 924394 752436 275513 1825806 410301 6727748

2004 1751191 1056165 367794 4306171 593236 9614728

2005 2575013 1544024 1160416 6539412 885741 20834249

2006 4080546 7026395 1748260 10088166 1586393 27011352

2007 5548788 8757888 2487778 13121763 2292119 35561112

2008 7114175 11174803 3170175 14362030 2521780 44002404

2009 6291261 14123042 2815314 15886925 2504037 54604003

2010 5035715 16257342 2868191 16989423 2245047 61040324

2011 33867 632317 290892 30525592 28450 -

The loans outstanding had been found to be very high for South Asia which had been consistently growing over the years.

Africa & MENA regions have tactically reduced their loans outstanding. The noticeable fact is that MENA have reduced

outstanding loans with less operating expenses.

Table 12 Number of MFIs

Year

Number of MFIs

Africa

East Asia &

Pacific

Eastern Europe

& Central Asia

Latin America & the

Caribbean

Middle East &

North Africa

South Asia

2003 183 95 157 166 31 132

2004 183 119 189 218 38 197

2005 241 131 237 280 42 214

2006 255 159 256 304 49 207

2007 284 183 323 370 59 196

2008 280 182 314 392 68 222

2009 266 149 255 386 70 219

2010 196 123 213 369 64 208

2011 6 3 4 40 2 -

The number of MFIs has gone up for LAC, MENA & SA regions, while in other regions, it is observed to have larger

winding up of MFIs from 2007 onwards. This is crucial to understand, as the globe was experiencing recession during the same

session. But even the LAC, MENA & SA regions had tasted the bitter of closing down MFIs 2009 onwards.

The SIJ Transactions on Industrial, Financial & Business Management (IFBM), Vol. 1, No. 2, May-June 2013

ISSN: 2321 242X 2013 | Published by The Standard International Journals (The SIJ) 46

Table 13 Average Loan / Borrower

Year

Average Loan / Borrower

Africa

East Asia &

Pacific

Eastern Europe

& Central Asia

Latin America & the

Caribbean

Middle East &

North Africa

South Asia

2003 205 200 1091 514 270 72

2004 170 156 1315 609 267 76

2005 174 204 1083 641 248 92

2006 216 245 1693 659 259 107

2007 249 288 2222 746 321 138

2008 302 317 2002 838 388 124

2009 378 312 1788 917 463 141

2010 363 305 1691 1050 611 142

2011 269 123 1571 2629 1151 -

The average loan/ borrower had been reduced from 2009 onwards in Africa, EAP and EECA regions. Inversely LAC,

MENA & SA have increased the average loan / borrower in their regions during the same period. LAC has doubled the average

loan/ borrower between 2010 & 11; whereas the EAP has reduced by half during the same period.

Table 14 Administrative Expenses / Total Assets

Year

Administrative Expenses / Total Assets

Africa

East Asia &

Pacific

Eastern Europe &

Central Asia

Latin America & the

Caribbean

Middle East &

North Africa

South Asia

2003 6.29 8.82 8.23 7.14 5.55 5.12

2004 7.73 7.37 7.10 7.59 5.97 5.32

2005 8.10 8.72 6.01 7.00 6.42 3.79

2006 8.42 8.34 5.84 7.48 5.30 4.23

2007 9.67 6.39 5.21 7.14 4.98 4.12

2008 10.67 6.74 4.99 7.42 4.88 3.99

2009 10.60 6.30 4.91 6.79 5.01 3.97

2010 9.53 6.20 4.94 7.20 5.30 3.85

2011 13.40 8.51 0.88 4.71 5.91 -

It is understood that EECA and LAC has taken measures to curtail the administrative expenses significantly inspite of

increase in portfolio size. The administrative expenses have drastically increased in African, EAP regions and have incrementally

increased in MENA during 2011.

Table 15 Number of Depositors (Sum)

Year

Number of Depositors (Sum)

Africa

East Asia &

Pacific

Eastern Europe

& Central Asia

Latin America &

the Caribbean

Middle East &

North Africa

South Asia

2003 44,48,059 13,04,673 8,90,716 9,43,675 6,886 1,34,03,380

2004 57,05,409 15,42,817 11,86,099 32,10,057 5,539 1,59,41,327

2005 75,54,102 20,97,382 15,87,235 63,50,983 13,589 1,91,36,200

2006 91,91,585 65,93,152 27,14,996 76,40,896 87,664 2,64,38,711

2007 1,16,96,536 32,55,613 39,11,986 97,10,388 81,397 3,01,71,105

2008 1,71,37,730 46,14,980 52,44,592 1,35,64,741 97,489 3,20,18,765

2009 2,05,72,668 48,99,512 27,99,959 1,71,68,351 63,748 3,23,06,744

2010 1,70,60,833 58,30,700 28,32,014 1,54,49,440 89,552 2,67,69,982

2011 57,975 6,34,999 10,114 41,19,481 0 0

The number of depositors (sum) statistics shows an alarming picture throughout the world invariably. There had been huge

decline in the number of Depositors (sum).

Table 16 Deposit (Sum)

Year

Deposit (Sum)

Africa

East Asia and

the Pacific

Eastern Europe

and Central Asia

Latin America and

The Caribbean

Middle East and

North Africa

South Asia

2003 26,06,07,065 3,30,75,49,344 13,10,88,591 75,74,81,525 69,147 17,35,93,793

2004 52,05,64,877 10,57,19,602 3,53,98,226 2,21,84,87,228 1,72,475 22,38,44,342

2005 85,97,01,224 3,96,67,65,831 1,24,80,03,627 5,04,44,25,869 2,48,514 65,95,07,361

2006 1,34,28,72,904 5,34,71,92,014 2,24,06,02,281 6,79,95,66,116 12,51,398 89,78,61,876

2007 3,25,76,11,106 6,01,01,40,130 5,04,03,90,748 8,71,83,52,564 6,29,38,252 1,18,93,12,415

2008 4,00,24,07,301 6,15,99,25,668 6,16,45,05,179 10,00,99,71,646 7,50,47,789 1,99,85,11,287

2009 5,28,21,32,767 8,44,20,68,436 5,23,56,99,452 13,35,25,83,689 11,88,54,318 2,54,50,11,110

2010 4,88,27,93,790 11,77,51,31,989 6,42,28,31,882 15,26,39,26,637 12,19,64,001 3,29,98,39,062

2011 94,20,885 3,64,35,971 2,80,64,933 7,25,14,12,544 0 0

As like the number of depositors, the Deposit sum also has declined unusually during 2011 than ever from 2003 onwards.

The SIJ Transactions on Industrial, Financial & Business Management (IFBM), Vol. 1, No. 2, May-June 2013

ISSN: 2321 242X 2013 | Published by The Standard International Journals (The SIJ) 47

Table 17 Number of Deposit Accounts (Sum)

Year

Number of Deposit Accounts (Sum)

Africa

East Asia and

the Pacific

Eastern Europe and

Central Asia

Latin America & The

Caribbean

Middle East and

North Africa

South Asia

2003 17,26,637 6,95,896 91,284 7,11,282 6,886 73,41,485

2004 23,22,956 10,60,147 68,487 32,17,151 754 85,63,272

2005 51,06,264 16,77,336 16,71,455 66,61,154 12,752 1,86,66,384

2006 72,73,651 63,56,632 26,64,091 83,05,769 59,940 2,55,56,618

2007 1,13,26,263 33,14,652 39,25,301 1,02,16,212 81,973 2,24,92,769

2008 1,73,55,114 47,10,330 53,61,769 1,53,18,807 1,03,735 3,37,75,156

2009 1,94,56,799 52,68,279 54,65,615 1,92,76,038 75,749 3,47,82,370

2010 1,84,71,894 67,48,727 59,62,453 1,89,50,966 89,552 3,11,31,807

2011 62,017 7,55,281 11,307 45,04,558 0 0

Large number of deposit accounts has been closed during the year 2011 in all the economies. But it has started earlier during

the year 2010 itself for economies like Africa, LAC and SA.

Table 18 Number of Active Borrowers

Year

Number of Active Borrowers

Africa

East Asia and the

Pacific

Eastern Europe

and Central Asia

Latin America and

The Caribbean

Middle East and

North Africa

South Asia

2003 24,96,988 44,93,322 6,90,076 34,64,294 5,07,120 1,35,12,280

2004 33,24,066 54,08,477 9,72,016 47,42,094 8,03,425 1,78,82,185

2005 42,81,183 94,68,511 12,89,100 78,05,509 12,41,019 2,43,83,439

2006 52,79,867 1,07,25,120 18,45,936 94,43,992 17,36,626 2,99,60,927

2007 61,87,181 87,83,244 24,47,050 1,20,53,183 22,55,182 3,63,93,712

2008 70,99,295 1,54,56,165 30,62,732 1,30,58,610 24,84,605 4,24,61,106

2009 82,08,512 1,39,11,940 27,87,687 1,43,05,288 25,00,362 4,99,96,298

2010 51,22,529 1,57,94,001 27,73,436 1,57,24,890 22,15,603 5,85,94,977

2011 33,867 6,29,458 2,87,611 40,29,773 28,450 0

The decline in active borrowers has reflected in reduction in deposit too. Though LAC (2011) is comparatively good than

other regions, when compared with the yester years it had experienced a steep fall in its accounts.

Table 19 Cost per Borrower

Year

Cost per Borrower

Africa

East Asia and

the Pacific

Eastern Europe

and Central Asia

Latin America and

The Caribbean

Middle East and

North Africa

South Asia

2003 65 43 204 124 58 11

2004 71 36 214 120 68 12

2005 68 42 209 144 63 11

2006 77 51 229 146 68 12

2007 96 58 286 146 62 16

2008 129 66 320 177 69 17

2009 145 63 259 175 86 18

2010 148 61 268 199 128 19

2011 87 26 - 357 141 0

Table 20 Cost per Loan

Year

Cost per Loan (Median)

Africa

East Asia and

the Pacific

Eastern Europe

and Central Asia

Latin America and

The Caribbean

Middle East and

North Africa

South Asia

2004 71 32 177 137 67 20

2005 77 37 177 126 62 18

2006 87 57 226 132 60 12

2007 100 65 285 140 63 15

2008 127 68 288 164 69 16

2009 132 61 240 169 84 18

2010 132 61 257 189 99 18

2011 0 26 0 339 144 0

The SIJ Transactions on Industrial, Financial & Business Management (IFBM), Vol. 1, No. 2, May-June 2013

ISSN: 2321 242X 2013 | Published by The Standard International Journals (The SIJ ) 48

The cost per borrower and cost per loan has inflated

twice for LAC during 2011, thrice while comparing it from

2003. MENA also has experienced the inflation in

maintaining a borrower. But African and AEP regions have

felt a dip due to large decline in their active borrowers. The

cost per loan has multiplied 1.5 times for MENA regions. The

EAP has declined during 2011 more than half the cost.

V. CONCLUSION

The global scenario is not promising for the MFI industry as

such. Though some economies had booked portfolio, it is

found that they are struggling hard to manage their expenses.

State of the Microcredit Summit Campaign Report 2012 had

said that number of initiatives like values of responsibility,

corporate ethics and social performance management have

emerged to address the field challenges. MFIs have to adopt

new strategies to bring back their customers and as well

reduce their operating and administrative expenses.

REFERENCES

[1] Maitreyee Gaikwad (2006), Micro Finance Emerging

Concerns and Policy Implications, All India Women's

Democratic Association (2006-07).

[2] Milford Bateman & Dean Sinkovic (2009), Global Financial

Crisis and Related Country-Level Financial Sector Disasters:

The Case of Microfinance in Croatia, 8th International

Conference on Challenges of Europe: Financial Crisis and

Climate Change, Pp. 0329.

[3] K.O. Osotimehin, Charles.A J egede & Babatunde Hamed

Akinlabi (2011), Determinants of Microfinance Outreach in

South-Western Nigeria: An Empirical Analysis,

Interdisciplinary Journal of Contemporary Research in

Business, Vol. 3, No 8, Pp. 780797.

[4] Xavier Reille & Daniel Rozas (2011), Discovering Limits -

Global Microfinance Valuation Survey 2011, Global Equity

Research, Pp. 3-29.

[5] James Clark (2011), The Microfinance Movement Benefits

Canada, Vol. 35, No. 7, Pp. 55.

[6] Ayi Gavriel Ayayi (2011), Credit Risk Assessment in the

Microfinance Industry, Economics of Transition, The

European Bank for Reconstruction and Development.

Blackwell Publishing Ltd, USA, Pp. 37-71.

[7] Global Microscope on the Microfinance Business Environment

(2011), URL:

http://www.eiu.com/Handlers/WhitepaperHandler.ashx?fi=EIU

_Microfinance_Eng_2011_WEB.pdf&mode=wp&campaignid=

microscope2011. Pp. 6-73.

[8] Luis A. Viada (2011), MicroRates 6th Annual Survey &

Analysis of MIVs, The-State-of-Microfinance-Investment-

2011-MicroRate, Pp. 4-13.

[9] Venugopalan Puhazhendhi (2012), Microfinance India: State

of the Sector Report 2012, SAGE Publications, India, Pp. 149-

158.

[10] Ayi Gavriel Ayayi (2012), Associate Professor of Financial

Economics, Economics of Transition, Vol. 20, No. 1, Pp. 37

72, DOI: 10.1111/j.1468-0351.2011.00429.x.

[11] Global Microfinance Equity Valuation Survey 2012, URL:

https://groups.google.com/forum/?fromgroups#!msg/casei3stud

ents/OPE3eFsbAos/m-_28RlToIIJ , Pp. 3-22.

[12] K.M.S. Padma, A.M. Suresh & L Vijayashree (2012), Micro

Finance and its Risk Management Practices in India: A

Conceptual Study, Synergy (January, 2012), Vol. X, No. I, Pp.

13-24.

Dr. K. Chitra is the Director of Department

of Management Studies, Sri Ramakrishna

Engineering College, Coimbatore. Her

research domain is marketing. She has

published 25 articles and 3 books. She is a

Reviewer for 4 International J ournal,

Member in Board of studies, Chairperson for

Conferences conducted in India and abroad,

Interacted with academicians in Singapore,

Malaysia and Newyork. She is a Member in All India Management

Association; Member in education & Industry Institution

Interaction, Panel of (CIII); Executive Committee member

Coimbatore Management Association (CMA); National Institution

of Personnel Management (NIPM); Management Teachers

Consortium(MTC).

S. Sangeetha has 10 years of experience to

her credit and specializes in Finance.

Currently she is pursuing her doctoral degree

in Management at Anna University, Chennai.

Her research domain is microfinance. She

received Excellent grade in the field study

viva voce. She is an alumnus of Indian

institute of Management, Kozhikode. She has

presented more than 19 empirical papers in

International and National Level Conferences in reputed institutes

like IIMA, IIMB and also has published papers in journals.

You might also like

- ROI of Training and Development Programmes: Challenges and DevelopmentsDocument6 pagesROI of Training and Development Programmes: Challenges and DevelopmentsthesijNo ratings yet

- The Role of Total Productive Maintenance (TPM) in Safety Improvement and Decreasing Incidents in Steel IndustryDocument6 pagesThe Role of Total Productive Maintenance (TPM) in Safety Improvement and Decreasing Incidents in Steel IndustrythesijNo ratings yet

- Effect of Environmental Temperature and PH Water On Compressive Strength of Clay Brick Mixed Wood Chips Mahogany Based Building MaterialsDocument4 pagesEffect of Environmental Temperature and PH Water On Compressive Strength of Clay Brick Mixed Wood Chips Mahogany Based Building MaterialsthesijNo ratings yet

- Effectiveness Evaluation of Behavioural Training and Development ProgrammesDocument9 pagesEffectiveness Evaluation of Behavioural Training and Development ProgrammesthesijNo ratings yet

- An Entrepreneurial Mindset and Factors' Effect On Entrepreneur's Spirit in IndonesianDocument6 pagesAn Entrepreneurial Mindset and Factors' Effect On Entrepreneur's Spirit in IndonesianthesijNo ratings yet

- The Behavioural Finance: A Challenge or Replacement To Efficient Market ConceptDocument5 pagesThe Behavioural Finance: A Challenge or Replacement To Efficient Market ConceptthesijNo ratings yet

- Edge Ratio of Nifty For Last 15 Years On Donchian ChannelDocument8 pagesEdge Ratio of Nifty For Last 15 Years On Donchian ChannelthesijNo ratings yet

- Attributable E-Commerce Toward Purchase Intention: Online Search of Food ProductDocument7 pagesAttributable E-Commerce Toward Purchase Intention: Online Search of Food ProductthesijNo ratings yet

- Vaclav Havel: The Politician Practicizing CriticismDocument9 pagesVaclav Havel: The Politician Practicizing CriticismthesijNo ratings yet

- The Effects of Earnings Management On Dividend Policy in Nigeria: An Empirical NoteDocument8 pagesThe Effects of Earnings Management On Dividend Policy in Nigeria: An Empirical NotethesijNo ratings yet

- An Impact of Self-Leadership On Innovative Behaviour in Sports Educators and Understanding of Advanced ResearchDocument6 pagesAn Impact of Self-Leadership On Innovative Behaviour in Sports Educators and Understanding of Advanced Researchthesij100% (1)

- Spending & Saving Habits of Youth in The City of AurangabadDocument8 pagesSpending & Saving Habits of Youth in The City of Aurangabadthesij100% (2)

- Gender and Violence in School: Current Phenomena and Copping StrategiesDocument8 pagesGender and Violence in School: Current Phenomena and Copping StrategiesthesijNo ratings yet

- The Research On The Female Stereotype of The Online Games Advertisements in TaiwanDocument8 pagesThe Research On The Female Stereotype of The Online Games Advertisements in TaiwanthesijNo ratings yet

- Prevalence of Dysmenorrhoea in AdolescenceDocument5 pagesPrevalence of Dysmenorrhoea in AdolescencethesijNo ratings yet

- Coping Strategies On Academic Performance Among Undergraduate Students in MalaysiaDocument5 pagesCoping Strategies On Academic Performance Among Undergraduate Students in MalaysiathesijNo ratings yet

- Coping Strategies On Academic Performance Among Undergraduate Students in ThailandDocument4 pagesCoping Strategies On Academic Performance Among Undergraduate Students in Thailandthesij100% (1)

- Teachers' Pedagogy and Conceptions of History: Decolonizing and Transforming History in ElementaryDocument8 pagesTeachers' Pedagogy and Conceptions of History: Decolonizing and Transforming History in ElementarythesijNo ratings yet

- Analytical Modeling of The Guidance Systems ParametersDocument6 pagesAnalytical Modeling of The Guidance Systems ParametersthesijNo ratings yet

- Effect of Enzyme Treated Copra Meal On Nutritive Value, Reducing Sugars and Oligosaccharides As PrebioticsDocument4 pagesEffect of Enzyme Treated Copra Meal On Nutritive Value, Reducing Sugars and Oligosaccharides As PrebioticsthesijNo ratings yet

- Coagulation-Flocculation of Anaerobic Landfill Leachate Using Ferric Chloride (FeCl3), Aloe Vera (AV) and Chitosan (CS)Document5 pagesCoagulation-Flocculation of Anaerobic Landfill Leachate Using Ferric Chloride (FeCl3), Aloe Vera (AV) and Chitosan (CS)thesijNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 2SB817 - 2SD1047 PDFDocument4 pages2SB817 - 2SD1047 PDFisaiasvaNo ratings yet

- Comparitive Study ICICI & HDFCDocument22 pagesComparitive Study ICICI & HDFCshah faisal100% (1)

- 70 Valves SolenoidDocument105 pages70 Valves SolenoidrizalNo ratings yet

- Chapter3 Elasticity and ForecastingDocument25 pagesChapter3 Elasticity and ForecastingGee JoeNo ratings yet

- Ricoh IM C2000 IM C2500: Full Colour Multi Function PrinterDocument4 pagesRicoh IM C2000 IM C2500: Full Colour Multi Function PrinterKothapalli ChiranjeeviNo ratings yet

- Appendix - Pcmc2Document8 pagesAppendix - Pcmc2Siva PNo ratings yet

- CX Programmer Operation ManualDocument536 pagesCX Programmer Operation ManualVefik KaraegeNo ratings yet

- Companyprofil E: Erfanconstructionsolut IonDocument14 pagesCompanyprofil E: Erfanconstructionsolut IonNurin AleesyaNo ratings yet

- DN Cross Cutting IssuesDocument22 pagesDN Cross Cutting Issuesfatmama7031No ratings yet

- Report Card Grade 1 2Document3 pagesReport Card Grade 1 2Mely DelacruzNo ratings yet

- Oracle - Prep4sure.1z0 068.v2016!07!12.by - Lana.60qDocument49 pagesOracle - Prep4sure.1z0 068.v2016!07!12.by - Lana.60qLuis AlfredoNo ratings yet

- Human EpigenomicsDocument234 pagesHuman EpigenomicsHeron HilárioNo ratings yet

- FM 2030Document18 pagesFM 2030renaissancesamNo ratings yet

- Washing Machine: Service ManualDocument66 pagesWashing Machine: Service ManualFernando AlmeidaNo ratings yet

- Chapter 13 Exercises With AnswerDocument5 pagesChapter 13 Exercises With AnswerTabitha HowardNo ratings yet

- Residual Power Series Method For Obstacle Boundary Value ProblemsDocument5 pagesResidual Power Series Method For Obstacle Boundary Value ProblemsSayiqa JabeenNo ratings yet

- BNF Pos - StockmockDocument14 pagesBNF Pos - StockmockSatish KumarNo ratings yet

- Role of Personal Finance Towards Managing of Money - DraftaDocument35 pagesRole of Personal Finance Towards Managing of Money - DraftaAndrea Denise Lion100% (1)

- DPSD ProjectDocument30 pagesDPSD ProjectSri NidhiNo ratings yet

- Post Appraisal InterviewDocument3 pagesPost Appraisal InterviewNidhi D100% (1)

- The Construction of Optimal Portfolio Using Sharpe's Single Index Model - An Empirical Study On Nifty Metal IndexDocument9 pagesThe Construction of Optimal Portfolio Using Sharpe's Single Index Model - An Empirical Study On Nifty Metal IndexRevanKumarBattuNo ratings yet

- Role of Losses in Design of DC Cable For Solar PV ApplicationsDocument5 pagesRole of Losses in Design of DC Cable For Solar PV ApplicationsMaulidia HidayahNo ratings yet

- WEB DESIGN WITH AUSTINE-converted-1Document9 pagesWEB DESIGN WITH AUSTINE-converted-1JayjayNo ratings yet

- Duavent Drug Study - CunadoDocument3 pagesDuavent Drug Study - CunadoLexa Moreene Cu�adoNo ratings yet

- UC 20 - Produce Cement Concrete CastingDocument69 pagesUC 20 - Produce Cement Concrete Castingtariku kiros100% (2)

- Recommendations For Students With High Functioning AutismDocument7 pagesRecommendations For Students With High Functioning AutismLucia SaizNo ratings yet

- Activity # 1 (DRRR)Document2 pagesActivity # 1 (DRRR)Juliana Xyrelle FutalanNo ratings yet

- KP Tevta Advertisement 16-09-2019Document4 pagesKP Tevta Advertisement 16-09-2019Ishaq AminNo ratings yet

- ReadmeDocument3 pagesReadmedhgdhdjhsNo ratings yet

- FDA Approves First Gene Therapy, Betibeglogene Autotemcel (Zynteglo), For Beta-ThalassemiaDocument3 pagesFDA Approves First Gene Therapy, Betibeglogene Autotemcel (Zynteglo), For Beta-ThalassemiaGiorgi PopiashviliNo ratings yet