Professional Documents

Culture Documents

Reporting Standards Document Sap

Uploaded by

kprakashmm0 ratings0% found this document useful (0 votes)

37 views11 pagesReporting Standards Document sap

Original Title

Reporting Standards Document sap

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentReporting Standards Document sap

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

37 views11 pagesReporting Standards Document Sap

Uploaded by

kprakashmmReporting Standards Document sap

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 11

IAAPA

Finance and Information Technology Committee

Accounting Standards for

the Amusement Industry

Reporting Standards Document

Revised August 2007

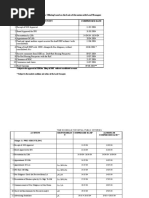

Contents

1. Standardized Reporting ............................................................ 1

2. Balance Sheet ....................................................................... 2

A. Assets .............................................................................. 2

A.1 Current Assets ................................................................ 2

A.2 Fixed Assets................................................................... 2

B. Liabilities and Owners' Equity.................................................. 3

B.1 Current Liabilities............................................................ 3

B.2 Long-Term Liabilities........................................................ 3

B.3 Owners' Equity................................................................ 3

3. Profit & Loss Account .............................................................. 4

4. Cash flow Statement ............................................................... 5

5. Periodic Reporting .................................................................. 7

6. Per Cap Reporting .................................................................. 8

Index ..................................................................................... 9

- 1 -

1. Standardized Reporting

Last year a standardized Chart of Accounts was developed for amusement facilities. The

Chart of Accounts is the foundation for all the financial information of your organization. It

is the primary source of the historical data used to analysis, compare, report and forecast

the operations.

Based upon this Chart of Accounts a standardized form of reporting was developed. The

accompanying spreadsheet shows different reports. Five different reports have been

developed:

Balance Sheet

Profit & Loss Statement

Cash flow Statement

Periodic Reporting

Per Cap Reporting

Each report is shown with full details, i.e. with a breakdown and comparison per account

and sub-account. For interim reporting purposes it might be sufficient to go into less

detail. Each facility can make these adjustments based upon its own requirements.

For the definitions of each item on the reports we refer to the Chart of Accounts document

which was issued in 2005.

- 2 -

2. Balance Sheet

A balance sheet is a statement of the total assets and liabilities of an organization at a

particular date - usually the last date of an accounting period.

The balance sheet is split into two parts:

(1) A statement of fixed assets and current assets.;

(2) A statement showing how the assets have been financed, for example through share

capital, retained profits and liabilities (debt, etc)

The balance of fixed and current assets minus the liabilities is sometimes referred to as Net

Assets

A balance sheet is usually required to be included in the published financial accounts. In

reality, all organizations that need to prepare accounting information for external users

(e.g. banks, charities, clubs, partnerships) will also product a balance sheet since it is an

important statement of the financial affairs of the organization.

A balance sheet does not necessary "value" a company, since assets and liabilities are shown

at "historical cost" and some intangible assets (e.g. brands, quality of management, market

leadership) are not included.

The examples used follow the U.S accounting standards for the presentation of financial

statements. Users of this information outside the Untied States should be aware that the

accounting requirements of their own jurisdictions will not necessarily follow those of the

United States. The laws of other jurisdictions and the application of accounting standards

may significantly affect the format and presentation of financial statements.

For example, countries that are Member States of the European Union must follow the

layout prescribed for company accounts in the European Fourth Directive on company

Accounts-a layout that is quite different from the U.S. standard. Other jurisdictions have no

legal requirements and so whatever layout is considered most appropriate in those

circumstances may be used.

A. Assets

An asset is any right or thing that is owned by a business. Assets include land, buildings,

equipment and anything else a business owns that can be given a value in money terms for

the purpose of financial reporting.

A.1 Current Assets

This section of the Balance Sheet includes accounts that are to be converted to cash or

used in operations within 12 months of the Balance Sheet date. Non-current assets (such as

Non-current Receivables, Property and Equipment, and Other Assets) refer to accounts that

are not expected to be converted to cash or used in operations within 12 months of the

Balance Sheet date.

A.2 Fixed Assets

A "fixed asset" is an asset which is intended to be of a permanent nature and which is used

by the business to provide the capability to conduct its trade. Examples of "tangible fixed

assets" include plant & machinery, land & buildings and motor vehicles. "Intangible fixed

assets" may include goodwill, patents, trademarks and brands - although they may only be

- 3 -

included if they have been "acquired". Investments in other companies which are intended

to be held for the long-term can also be shown under the fixed asset heading.

B. Liabilities and Owners' Equity

To acquire its assets, a business may have to obtain money from various sources in addition

to its owners (shareholders) or from retained profits. The various amounts of money owed

by a business are called its liabilities.

B.1 Current Liabilities

This section of the Balance Sheet includes debt that has to be repaid within 12 months of

the Balance Sheet date.

B.2 Long-Term Liabilities

This section of the Balance Sheet includes debt that will only need to be repaid after at

least 12 months of the Balance Sheet date.

B.3 Owners' Equity

As well as borrowing from banks and other sources, all companies receive finance from

their owners. This money is generally available for the life of the business and is normally

only repaid when the company is "wound up". To distinguish between the liabilities owed to

third parties and to the business owners, the latter is referred to as the "capital" or "equity

capital" of the company.

In addition, undistributed profits are re-invested in company assets (such as stocks,

equipment and the bank balance). Although these "retained profits" may be available for

distribution to shareholders - and may be paid out as dividends as a future date - they are

added to the equity capital of the business in arriving at the total "equity shareholders'

funds"

At any time, therefore, the capital of a business is equal to the assets (usually cash)

received from the shareholders plus any profits made by the company through trading that

remain undistributed.

- 4 -

3. Profit & Loss Account

The Profit & Loss Account represents the portion of a company's financial statements that

summarizes revenues and expenses during a specific period of time. This statement

provides investors with information on the ability of a company to generate revenue and

manage costs and is a measure of financial performance. It is also known as income

statement, or "income and expense statement."

The Profit & Loss account can be broken down is the following section

- Revenues: a summary of all revenues accounts from the Chart of Accounts

- Cost of Sales: a summary of all cost of sales accounts from the Chart of Accounts

- Gross Income: revenues minus cost of sales. Also called gross profit.

- Expenses: this summarizes all other costs except for depreciation/amortization,

the financial expenses/income, extraordinary income and taxes;

- Earnings Before Interest, Taxes, Depreciation and Amortizations (EBITDA): this is

the result of subtracting the Expenses from the Gross Income. Its is an approximate

measure of a company's operating cash flow based on data from the company's

income statement. This earnings measure is of particular interest in cases where

companies have large amounts of fixed assets which are subject to heavy

depreciation charges (such as amusement parks). Since the distortionary accounting

and financing effects on company earnings do not factor into EBITDA, it is a good

way of comparing companies within and across industries. This measure is also of

interest to a company's creditors, since EBITDA is essentially the income that a

company has free for interest payments. In general, EBITDA is a useful measure

only for large companies with significant assets, and/or for companies with a

significant amount of debt financing. It is rarely a useful measure for evaluating a

small company with no significant loans. It is sometimes also called operational

cash flow..

- Interest Expenses and Depreciation/amortization charges

- Earnings Before Taxes and Extraordinary Items: the result of subtracting interest

expenses from EBITDA;

- Extraordinary items: gains or losses included in a company's financial statements,

which are infrequent and unusual in nature. They are the result of unforeseen and

atypical events. They are usually accounted for separately so they don't skew the

company's regular earnings.

- Earnings before Taxes: result of subtracting Extraordinary items from Earnings

Before Taxes and Extraordinary Items

- Taxes: taxes to be paid;

- Net Income or Earnings after Taxes

- 5 -

4. Cash flow Statement

The Cash flow Statement is a financial report detailing the exchange of cash between a

business and the outside world. The flow is categorized as:

flow "in" from Operations

(cash the company made by selling goods and services)

flow "in" from Financing

(cash the company raised by selling stocks and bonds)

flow "out" to Investing

(cash the company spent investing in its future growth)

Each of these flows can actually flow both ways. Banks and investors like to see that the

company can cover its spending with cash from operations, without having to turn to

financing.

The cash flow statement also has to reconcile the net effect of these flows with the

difference in its cash holdings at the beginning and end dates of the reporting period

A typical cash flow statement will consist of 3 categories:

A. Cash flow from operating activities

The cash generated from the operations of a company, generally defined as Net

Income plus all non-cash expenses (such as depreciation/amortization, provisions,

etc). This is then adjusted for Extraordinary items and changes in the working

capital of the company.

The working capital is the balance of current assets minus current liabilities. It

measures how much in liquid assets a company has available to build its business.

The number can be positive or negative, depending on how much debt the company

is carrying. In general, companies that have a lot of working capital will be more

successful since they can expand and improve their operations. Companies with

negative working capital may lack the funds necessary for growth.

Cash flow from operating activities is also known as "operating cash flow. The

operating cash flow is the cash generated in the course of a company running its

business.

It can be a better measure of a business's profits than earnings because a company

can show positive net earnings (on the income statement) and still not be able to

pay its debts. It's cash flow that pays the bills!

B. Cash flow from investing activities

This is an item on the cash flow statement that reports the aggregate change in a

company's cash position resulting from any gains (or losses) from investments and

changes resulting from amounts spent on investments in capital assets such as

amusement rides.

When analyzing a company's cash flow statement, it is important to consider each

of the various sections which contribute to the overall change in cash position. In

many cases, a firm may have negative overall cash flow for a given quarter, but if

the company can generate positive cash flow from its business operations, the

negative overall cash flow may be a result of heavy investment expenditures, which

is not necessarily a bad thing.

- 6 -

C. Cash flow from financing activities

A category in the cash flow statement that accounts for external activities such as

issuing cash dividends, adding or changing loans, or issuing and selling more stock.

The formula for cash flow from financing activities is as follows:

Cash Received from Issuing Stock or Debt - Cash Paid as Dividends and for Re-

Acquisition of Debt/Stock

This section of the statement of cash flows measures the flow of cash between a

firm and its owners and creditors. Negative numbers can mean the company is

servicing debt, but it can also mean the company is making dividend payments and

stock repurchases, which investors might be glad to see.

The results of the first three calculations are used to determine the total change in cash

and marketable securities caused by fluctuations in operating, investing and financing cash

flow. This number is then checked against the change in cash reflected on the balance

sheet from period to period to verify that the calculation has been done correctly.

- 7 -

5. Periodic Reporting

The previous 3 reports are usually generated on a regulate basis (monthly, quarterly, or

annually). In between periods it will be useful to compare a companys results to a budget

or to a previous periods result.

This comparison is usually done for the profit & loss account only, although the same can be

done for the balance or cash flow statement as well.

This type of reporting compares the revenues and expenses of a certain period (e.g. second

quarter of the year) to the budget for the same period (i.e. second quarter in the above

example).

It will also show the total year to date (YTD) numbers. In the example above this would

mean the first plus the second quarter of the year. This can then be compared to the YTD

budget and to the full years budget.

For each column in the report the percentage of that category (e.g. Food & Beverage

revenue, or Personnel expenses) in relation to total revenue is shown. For each comparison

to another period or budget the percentage change is also calculated.

The example in the spreadsheet shows a comparison in full detail. Each revenue or

expense category is broken down in sub accounts. It might be sufficient for interim

reporting purposes to only compare totals of categories.

This type of comparison can be down on a company level, e.g. total food and beverage

revenue compared to budget, but it also possible to compare these numbers on a site by

site basis. The revenue and/or expense numbers of an individual Food & Beverage stand in

a park can be compared to its own numbers of last year

- 8 -

6. Per Cap Reporting

The previous reports all are about aggregate numbers, either for the total company or for a

certain site/ride within the company.

In our industry and additional type of reporting is often used. This type of reporting

calculates the average revenues or expenses per visitor to your amusement facility. The

resulting numbers are called per caps.

For example: if your total revenue from admissions is USD 10,000,000 and your facility has

500,000 visitors, the per cap from admission revenue would be USD 20 (10,000,000 divided

by 500,000).

This exercise can be down both for revenues and expenses although most facilities only

make these calculations for their revenue numbers.

Per Cap reporting can produce interesting information. By calculating your per cap from

admission for example you can calculate your admission yield. If in the example above,

your ticket price is USD 30, this means that your admission yield is 67% (USD 20 divided by

USD 30). This is almost never 100% because you will have complementary admissions and

season pass holders visiting your park.

The per cap reporting can also be compared to previous periods and/or budgeted numbers.

- 9 -

Index

A

admission yield.....................................8

Assets ...............................................2

B

Balance Sheet ......................................2

C

Cash flow from financing activities.............6

Cash flow from investing activities .............5

Cash flow from operating activities ............5

Cash flow Statement ..............................5

Current Assets......................................2

Current Liabilities .................................3

E

EBITDA...............................................4

F

Fixed Assets ........................................2

I

income and expense statement................. 4

income statement................................. 4

L

Liabilities .......................................... 3

Long-Term Liabilities............................ 3

O

operating cash flow............................... 5

Owners' Equity..................................... 3

P

per cap.............................................. 8

Profit & Loss Account............................. 4

W

working capital .................................... 5

You might also like

- Listeners SyllabusDocument1 pageListeners SyllabuskprakashmmNo ratings yet

- Book 2Document2 pagesBook 2kprakashmmNo ratings yet

- Session Mangement NotesDocument5 pagesSession Mangement NoteskprakashmmNo ratings yet

- ChatDocument2 pagesChatkprakashmmNo ratings yet

- ChatLog Account-Determination-in-SAPDocument1 pageChatLog Account-Determination-in-SAPkprakashmmNo ratings yet

- Obiee InstallDocument18 pagesObiee InstallkprakashmmNo ratings yet

- ChatDocument2 pagesChatkprakashmmNo ratings yet

- Prakash Sap (To Everyone) :: Chat Log C:/Users/Windows - 7/Documents/Chatlog Sap MM 2016 - 03 - 09 23 - 32Document1 pagePrakash Sap (To Everyone) :: Chat Log C:/Users/Windows - 7/Documents/Chatlog Sap MM 2016 - 03 - 09 23 - 32kprakashmmNo ratings yet

- New General Ledger AccountingDocument12 pagesNew General Ledger AccountingkprakashmmNo ratings yet

- Oracle® General Ledger Implimentation GuideDocument278 pagesOracle® General Ledger Implimentation GuidekprakashmmNo ratings yet

- GL R12 Demanding GuideDocument1,032 pagesGL R12 Demanding GuideSivakumar HvkNo ratings yet

- Obiee InstallDocument18 pagesObiee InstallkprakashmmNo ratings yet

- Ap SapDocument3 pagesAp SapkprakashmmNo ratings yet

- 11232015Document1 page11232015kprakashmmNo ratings yet

- Real Time Project SessionDocument1 pageReal Time Project SessionkprakashmmNo ratings yet

- Foreign Currency Revaluation Configuration - SCNDocument13 pagesForeign Currency Revaluation Configuration - SCNkprakashmmNo ratings yet

- Asset Accounting (FI-AA) (New) : Organizational Elements and StructuresDocument12 pagesAsset Accounting (FI-AA) (New) : Organizational Elements and StructureskprakashmmNo ratings yet

- SAP CO Cost ElementAccountingDocument3 pagesSAP CO Cost ElementAccountingkprakashmmNo ratings yet

- SAP CO Cost ElementAccountingDocument3 pagesSAP CO Cost ElementAccountingkprakashmmNo ratings yet

- Jamrn Q115Document36 pagesJamrn Q115kprakashmmNo ratings yet

- Automatic Account Assignment OKB9 Does Not Work1Document17 pagesAutomatic Account Assignment OKB9 Does Not Work1kprakashmm0% (1)

- FCDocument19 pagesFCkprakashmmNo ratings yet

- Senarios and Examples For BOE VendorDocument7 pagesSenarios and Examples For BOE VendorkprakashmmNo ratings yet

- Automatic Account Assignment OKB9 Does Not Work1Document17 pagesAutomatic Account Assignment OKB9 Does Not Work1kprakashmm0% (1)

- ChatLog SAP FICO 2015 - 04 - 06 22 - 37Document1 pageChatLog SAP FICO 2015 - 04 - 06 22 - 37kprakashmmNo ratings yet

- Automatic Account Assignment OKB9 Does Not Work2Document2 pagesAutomatic Account Assignment OKB9 Does Not Work2kprakashmmNo ratings yet

- ChatLog SAP FICO 2015 - 04 - 06 22 - 07Document1 pageChatLog SAP FICO 2015 - 04 - 06 22 - 07kprakashmmNo ratings yet

- ChatLog SAP FI Session 2015-03-25 15 - 37Document1 pageChatLog SAP FI Session 2015-03-25 15 - 37kprakashmmNo ratings yet

- ChatLog Meet Now 2015 - 03 - 12 23 - 03 - 1 - 1Document1 pageChatLog Meet Now 2015 - 03 - 12 23 - 03 - 1 - 1kprakashmmNo ratings yet

- Chatlog Sap Co Session by Prakash 2015-03-20 23 - 16Document1 pageChatlog Sap Co Session by Prakash 2015-03-20 23 - 16kprakashmmNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Individual Dividend Growth Portfolios OutperformDocument1 pageIndividual Dividend Growth Portfolios OutperformrickescherNo ratings yet

- Weekly Account Statement KNT357Document1 pageWeekly Account Statement KNT357lexyacc1No ratings yet

- Accounting Monday AssDocument4 pagesAccounting Monday AssCresenciano Malabuyoc0% (1)

- Stock ValuationDocument18 pagesStock Valuationdurgesh choudharyNo ratings yet

- 1-Equity Research - IntroductionDocument3 pages1-Equity Research - IntroductionanuNo ratings yet

- Accounting EquationDocument16 pagesAccounting EquationAbhishek SinhaNo ratings yet

- IPO ChecklistDocument8 pagesIPO Checklistpbush998873No ratings yet

- Mock Final Examination AccountingDocument10 pagesMock Final Examination AccountingPlu AldiniNo ratings yet

- Measures of Leverage: Test Code: R37 MSOL Q-BankDocument8 pagesMeasures of Leverage: Test Code: R37 MSOL Q-BankMarwa Abd-ElmeguidNo ratings yet

- Conceptual Framework and Accounting Standards Quiz Reviewer PDFDocument26 pagesConceptual Framework and Accounting Standards Quiz Reviewer PDFZeo AlcantaraNo ratings yet

- Module BookDocument160 pagesModule BookKarthik RNo ratings yet

- Letter From TCI To ABN AmroDocument2 pagesLetter From TCI To ABN AmroF.N. HeinsiusNo ratings yet

- Week Six Top Schools RatiosDocument7 pagesWeek Six Top Schools Ratiossurfbum2006No ratings yet

- Batch 21-23 - ACT 5001 - Financial Accounting - CODocument7 pagesBatch 21-23 - ACT 5001 - Financial Accounting - COShubham JhaNo ratings yet

- Important Definitions Igcse BusinessDocument19 pagesImportant Definitions Igcse BusinessBigBoiNo ratings yet

- Ifsa 3Document36 pagesIfsa 3Avinash DasNo ratings yet

- BBPW3103 Sample QuesDocument4 pagesBBPW3103 Sample QuesVignashNo ratings yet

- CHP 4 McqsDocument8 pagesCHP 4 McqsNasar IqbalNo ratings yet

- WEYGANDT Planning For Capital InvestmentsDocument43 pagesWEYGANDT Planning For Capital InvestmentsPaula Merriles100% (1)

- Annual Report PT Sepatu Bata TBK 2015-2019Document15 pagesAnnual Report PT Sepatu Bata TBK 2015-2019Kevin LetsoinNo ratings yet

- 3 Integrated Logistics and Customer ValueDocument39 pages3 Integrated Logistics and Customer ValueRose Ann ParaoNo ratings yet

- Week 3 - ACCY111 NotesDocument4 pagesWeek 3 - ACCY111 NotesDarcieNo ratings yet

- New Rekening Koran Online 040501028509507 2023-04-01 2023-04-30 00309296Document3 pagesNew Rekening Koran Online 040501028509507 2023-04-01 2023-04-30 00309296Dimitri Kovan LenkaNo ratings yet

- 1st Quiz - Business ComDocument2 pages1st Quiz - Business ComPeter GonzagaNo ratings yet

- Fidelity Bank - Statement Template 15Document30 pagesFidelity Bank - Statement Template 15colton gallaharNo ratings yet

- Stockholders' Equity Accounts With Normal BalancesDocument3 pagesStockholders' Equity Accounts With Normal BalancesMary67% (3)

- Chapter 5 Advanced Valuation Issues ModuleDocument12 pagesChapter 5 Advanced Valuation Issues ModuleJoannah maeNo ratings yet

- Final Accounts Proj-2Document34 pagesFinal Accounts Proj-2Anil Barolia33% (6)

- The Basics of Capital Budgeting Evaluating Cash FlowsDocument59 pagesThe Basics of Capital Budgeting Evaluating Cash FlowsBabasab Patil (Karrisatte)No ratings yet

- Accounting-Basics-Flashcards-Bawal Sa DdsDocument10 pagesAccounting-Basics-Flashcards-Bawal Sa DdsTaliNo ratings yet