Professional Documents

Culture Documents

2013 Infonetics Optical Vendor Leadership Survey Excerpts 101613

Uploaded by

victoriovega0 ratings0% found this document useful (0 votes)

92 views14 pagesInfonetics Research's 2013 optical Equipment vendor leadership survey was independently conducted and written by infonetics research, and was not sponsored by any vendor.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInfonetics Research's 2013 optical Equipment vendor leadership survey was independently conducted and written by infonetics research, and was not sponsored by any vendor.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

92 views14 pages2013 Infonetics Optical Vendor Leadership Survey Excerpts 101613

Uploaded by

victoriovegaInfonetics Research's 2013 optical Equipment vendor leadership survey was independently conducted and written by infonetics research, and was not sponsored by any vendor.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 14

I N F O N E T I C S R E S E A R C H S U R V E Y E X C E R P T S

Optical Equipment Vendor

Leadership Survey Excerpts

Service Providers Name Top Optical Suppliers

Infonetics Research Survey Excerpts

Written by Andrew Schmitt

October 2013

i

Contents

Introduction 1

Top Takeaways 1

The 2013 Survey 2

Service Provider Familiarity With Suppliers 2

Exhibit 1: Operator Familiarity with Optical Transmission and Switching Suppliers 2

Respondents Name Top Optical Suppliers 3

Ciena, ALU, Huawei Identifed as Leaders in Overall Optical Equipment 3

Exhibit 2: Top Optical Transmission and Switching Suppliers 3

Infonetics Packet Optical Taxonomy: Defnitions, Vendors, and Products 4

Exhibit 3: METRO-EDGE P-OTS Defnition, Vendors, and Products 4

Exhibit 4: METRO-REGIONAL P-OTS Defnition, Vendors, and Products 4

Ciena Perceived as Leader in Metro-Edge Packet Optical 5

Exhibit 5: Top Metro Edge Packet Optical Transport Suppliers 5

Ciena and Alcatel-Lucent Leaders in Metro-Regional Packet Optical 6

Exhibit 6: Top Metro Regional Packet Optical Transport Suppliers 6

Ciena Perceived as Runaway Leader in Optical Control Plane Technology 7

Exhibit 7: Top Optical Control Plane Suppliers 7

Important Product Features That Set Vendors Apart 8

Exhibit 8: Evaluating New VendorsImportant Features (Raw Responses) 8

Exhibit 9: Equipment Features 9

Equipment Supplier Leadership by Purchase Criterion 10

Exhibit 10: Optical Transmission and Switching Equipment Supplier Leadership 10

Methodology And Demographics 11

Survey Author 12

About Infonetics Research 12

1

Note

Infonetics Researchs 2013 Optical Equipment Vendor Leadership: Global Service Provider Survey was independently conducted

and written by Infonetics Research, and was not sponsored by any vendor.

Introduction

Opinions at industry conferences, magazines, panel discussions, websites, and message boards all add tremendous noise to

the critical issue: what does the customer think? Our annual optical leadership survey is an attempt to quantify the opinions

of customers in a departure from too much qualitative discussion.

This year we asked service providers to name whom they consider to be the overall leading optical supplier as well as the top

suppliers in packet optical transport systems (P-OTS) and optical control plane technology. We also asked respondents what

criteria they use when making purchasing decisions and how they rate vendors on these factors.

Top Takeaways

Ciena secured all the top leadership positions, distanced itself from perennial challenger Alcatel-Lucent in metro edge

packet optical, and is the runaway leader in optical control plane technology. Respondents also identified Ciena as the

leader in technology innovation.

Alcatel-Lucent is tied with Huawei for 2nd in overall optical supplier leadership and 2nd in packet optical leadership,

and is perceived as the leader in service and support.

Huawei is in 3rd and 4th place for leadership in metro regional and metro edge packet optical equipment, respectively.

Infinera is a consistent 4th in overall leadership categories and edged out Alcatel-Lucent for 3rd in optical control

plane technology. It is a close 2nd to Ciena in technology innovation.

Respondents consider reliability and total cost of ownership to be the most important criteria for selecting new vendors,

and rank solution breadth, R&D investment, and financial stability the lowest.

Mention of 100G as an important feature when evaluating suppliers dropped from 25% to 5%, indicating the battle for

100G, at least as a key decision criterion, is over.

I NFONETI CS RESEARCH, I NC. OCTOBER 2013

Opinions at industry conferences, magazines, panel discussions,

websites, and message boards all add tremendous noise to the

critical issue: what does the customer think?

2

The 2013 Survey

Each year Infonetics Research surveys service providers for their opinions on which optical vendors are seen as the leaders in

a number of categories. This is a summary of some of the results from our September 2013 Optical Equipment Features and

Vendor Leadership: Global Service Provider Survey, in which we interviewed 20 service providers globally that represent 31%

of 2012 worldwide telecom capex and revenue.

Service Provider Familiarity With Suppliers

It is important to understand the level of familiarity a service provider has with various vendors, particularly in a fragmented

market such as optical equipment. This allows equipment vendors to see the relative awareness the market has of their

product versus other companies.

Though familiarity with a manufacturers offering does not necessarily translate into contract wins, vendors need buyer

awareness to be evaluated as potential suppliers. Without a degree of familiarity, suppliers dont even get invited to the table.

Respondents rated their familiarity with each of a list of optical transmission and switching equipment suppliers on a scale

of 1 to 7, where 1 is not familiar and 7 is definitely familiar, a measure called aided awareness.

Exhibit 1: Operator Familiarity with Optical Transmission and Switching Suppliers

Infonetics Research, Optical Equipment Vendor Leadership: Global Service Provider Survey, September 2013

I NFONETI CS RESEARCH, I NC. OCTOBER 2013

Percent of Respondents Rating 6 or 7

0% 20% 40% 60% 80%

BTI

Transmode

ECI

NEC

ZTE

Cyan

Ericsson

Fujitsu

Coriant

ADVA

Cisco

Tellabs

Infinera

Huawei

Alcatel-Lucent

Ciena 75%

70%

70%

55%

45%

40%

35%

35%

25%

20%

15%

15%

10%

10%

10%

5%

3

I NFONETI CS RESEARCH, I NC. OCTOBER 2013

Respondents Name Top Optical Suppliers

In past years, we focused our optical vendor survey on OTN switching and 100G technologies. Ciena and Alcatel-Lucent

consistently dominated in the 100G category, and after several years of these surveys, it was time for a change. This year we

decided to take the discussion in a new direction and investigate leadership in packet optical transport and optical control

plane technology. This is particularly important for OTN switching vendor selection as previous surveys indicate that the future

inclusion of packet capabilities is needed, particularly at the edge of the network.

Ciena, ALU, Huawei Identifed as Leaders in Overall Optical Equipment

First, respondents named their top 3 overall optical transmission and switching vendors.

Ciena returned to #1 this year after Alcatel-Lucent broke several years of Cienas dominance in our 2012 survey. Huawei

remains in 3rd place with about the same percentage of respondents naming the company among the top 3 as last year.

Infinera vaulted forward, staying in 4th place but with 45% of respondents considering them a leader, up from 25% last year.

Exhibit 2: Top Optical Transmission and Switching Suppliers

Infonetics Research, Optical Equipment Vendor Leadership: Global Service Provider Survey, September 2013

Percent of Respondents

0% 20% 40% 60% 80%

Ciena

Alcatel-Lucent

Huawei

Infinera

Fujitsu

ZTE

NEC

Coriant

Tellabs

75%

60%

60%

45%

15%

10%

10%

10%

5%

5%

5% Cisco

Ericsson

4

I NFONETI CS RESEARCH, I NC. OCTOBER 2013

Infonetics Packet Optical Taxonomy: Defnitions, Vendors, and Products

To put into context the next set of service provider responses, Infonetics definitions of metro-edge and metro-regional packet

optical transport systems (P-OTS) follow, along with examples of vendors and products that fall into these categories of equipment.

Exhibit 3: METRO-EDGE P-OTS Defnition, Vendors, and Products

Definition Vendors and Products

Metro-edge packet optical transport systems are platforms

with an architecture that provides all of the following:

Optical networking features including OTN transport

(not switching) and WDM; no ROADM support required

Support for optical and layer 2 restoration

Ethernet switching, including support for connection

oriented Ethernet (COE) protocols (e.g., MPLS-TP,

PBB-TE, T-MPLS, switched VLANs) and carrier grade

per-flow traffic management

Alcatel-Lucent 1850 TSS

BTI Systems 700/7000 Series

Ciena 6500 w/L2 MOTR, eMOTR

Cisco CPT, 15300, 15454

Cyan Z-Series

ECI NPT

Ericsson SPO1410

Fujitsu 4100ES

Transmode TM-Series

Exhibit 4: METRO-REGIONAL P-OTS Defnition, Vendors, and Products

Definition Vendors and Products

Metro-regional packet optical transport systems are platforms

with an architecture that provides all of the following:

Optical transport features including WDM and ROADM

Optical circuit switching (SONET/SDH crossconnect

and/or OTN) across the chassis

Support for optical and layer 2 restoration

Ethernet switching, including support for connection

oriented Ethernet (COE) protocols (e.g., MPLS-TP,

PBB-TE, T-MPLS, switched VLANs) and carrier grade

per-flow traffic management

Alcatel-Lucent 1830 TTS w/MPLS-TP

Ciena 6500 w/L2 Fabric, 5430

Unannounced Cisco products

ECI OPT

Ericsson SPO1460

Fujitsu Flashwave 9500

Hitachi AMN 6400

Huawei OptiX 8800

Infinera DTN-X w/MPLS

Nokia Siemens Networks hiT 7100

Tellabs 7100 Nano, 7100 OTS

5

I NFONETI CS RESEARCH, I NC. OCTOBER 2013

Ciena Perceived as Leader in Metro-Edge Packet Optical

We asked respondents whom they consider to be the top 3 suppliers of edge packet optical transport systems (P-OTS).

60% of respondents identified Ciena as a top 3 leader, which is a rather high percentage considering their presence in this

category is new. The company is porting the technology from products acquired from World Wide Packets and deployed widely

into tier 1 networks into the 6500 product line.

Alcatel-Lucent has the successful 1850 TSS platform, which is used in wireless backhaul deployments around the world.

Not surprisingly, about a third of respondents named Cisco, but the company is not as high on this list as we expected given

the expertise and lengthy presence the company has had in this market.

Exhibit 5: Top Metro Edge Packet Optical Transport Suppliers

Infonetics Research, Optical Equipment Vendor Leadership: Global Service Provider Survey, September 2013

Percent of Respondents

0% 20% 40% 60%

Cyan

Ericsson

Hitachi

NEC

Tellabs

ADVA

BTI

Transmode

ZTE

Fujitsu

Huawei

Cisco

Alcatel-Lucent

Ciena 60%

40%

35%

25%

20%

10%

10%

10%

5%

10%

5%

5%

5%

5%

6

Ciena and Alcatel-Lucent Leaders in Metro-Regional Packet Optical

The results for metro-regional P-OTS closely mirror the overall optical leadership results. Ciena and Alcatel-Lucent are

considered leaders by the most respondents. Infinera is in 4th place, a curiosity given the company has yet to field a production

system capable of any packet intelligence or switchingthough it is widely speculated this is something it plans to do. Long-

time P-OTS suppliers Fujitsu and Tellabs follow.

Exhibit 6: Top Metro Regional Packet Optical Transport Suppliers

Infonetics Research, Optical Equipment Vendor Leadership: Global Service Provider Survey, September 2013

I NFONETI CS RESEARCH, I NC. OCTOBER 2013

Percent of Respondents

0% 10% 20% 30% 40% 50% 60% 70%

Cisco

Coriant

Ericsson

NEC

Transmode

ZTE

ADVA

Tellabs

Fujitsu

Infinera

Huawei

Alcatel-Lucent

Ciena 65%

60%

40%

35%

20%

10%

10%

5%

5%

5%

5%

5%

5%

7

Ciena Perceived as Runaway Leader in Optical Control Plane Technology

Optical control plane technology (G-MPLS, ASON, SDN) is responsible for automating and controlling the configuration of

connections across an optical network, typically through a combination of optical (ROADM) or electrical (SDH and/or OTN)

switches. This includes provisioning of new services as well as failure recovery.

Ciena is the runaway leader here, with 85% of respondents naming them among the top 3. Huawei is 2nd, followed by

Infinera, which edged out Alcatel-Lucent for 3rd place. This result is notable, as Alcatel-Lucent scored well throughout the

survey except in this question.

Exhibit 7: Top Optical Control Plane Suppliers

Infonetics Research, Optical Equipment Vendor Leadership: Global Service Provider Survey, September 2013

I NFONETI CS RESEARCH, I NC. OCTOBER 2013

Percent of Respondents

0% 20% 40% 60% 80% 100%

Ciena

Huawei

Infinera

Alcatel-Lucent

Tellabs

ADVA

Cyan

Coriant

Cisco

85%

45%

35%

30%

10%

10%

10%

10%

5%

5%

5%

ZTE

Fujitsu

8

Important Product Features That Set

Vendors Apart

After asking service providers to identify the leading vendors in several areas, we wanted to understand what features are

most important when they evaluate suppliersthe features that typically set them apart. We switched to an open-ended

response methodology several years ago that allowed respondents to freely name what they think is important, and we feel it

yields interesting and useful data. This is a word cloud of all the responses we received.

Exhibit 8: Evaluating New VendorsImportant Features (Raw Responses)

Infonetics Research, Optical Equipment Vendor Leadership: Global Service Provider Survey, September 2013

I NFONETI CS RESEARCH, I NC. OCTOBER 2013

9

I NFONETI CS RESEARCH, I NC. OCTOBER 2013

We then looked at the responses and made some logical groups to tally the responsesthe logical groups are listed in the next chart.

Price and TCO were cited in 45% of responses and many respondents cited reliability issues as well. Other areas that received

more attention this year are multi-layer support and control plane. Last year, responses were more focused on layer 2 switching

or MPLS, whereas this year, the word multi-layer appeared repeatedly.

100G features dropped from 25% last year to 10% this year, indicating the battle for 100G, at least as a key decision criterion,

is over. Were glad we dropped the top 100G vendor question this yearits clear 100G technology is now more evenly

distributed. Issues such as multi-layer support and control plane are rising in importance.

Exhibit 9: Equipment Features

Infonetics Research, Optical Equipment Vendor Leadership: Global Service Provider Survey, September 2013

Percent of Respondents

0%

10%

20% 30% 40% 50%

Price and TCO

Reliability

Control plane &

network management

Scalability & flexibility

Multi-layer support

ROADM features

Technology innovation

Service & support

Performance

45%

40%

30%

20%

10%

15%

10%

OTN/ODU switching

features

100G features

45%

20%

25%

40%

T

o

p

3

F

e

a

t

u

r

e

s

Issues such as multi-layer support and control plane

are rising in importance.

10

I NFONETI CS RESEARCH, I NC. OCTOBER 2013

Equipment Supplier Leadership by

Purchase Criterion

Each year we ask respondents to rank the relative importance of several criteria for selecting new vendors. We also ask them

to select the vendors they perceive to be the leaders for each criterion. This was a prompted questionrespondents could

choose up to 3 suppliers for each criterion from a provided list of 16 vendors.

The following table lists the top 3 vendors cited for each criterion. Note that the rows are ordered with the criteria ranked

as most important (product reliability) at the top and least important (R&D Investment) at the bottom based on the relative

importance service providers perceive each category.

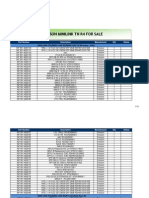

Exhibit 10: Optical Transmission and Switching Equipment Supplier Leadership

Criteria Number 1 Number 2 Number 3

Product reliability Ciena Infinera

Alcatel-Lucent, Fujitsu,

Huawei (3-way tie)

Total cost of ownership Huawei ZTE ADVA

Service and support Alcatel-Lucent Huawei, Infinera (tie) Ciena

Pricing Huawei ZTE

ADVA, Alcatel-Lucent,

Infinera (3-way tie)

Technology innovation Ciena Infinera Alcatel-Lucent

Management tools Ciena Huawei Alcatel-Lucent

Financial stability Cisco Huawei Ciena

Solution breadth Alcatel-Lucent, Ciena, Huawei (3-way tie)

R&D Investment Huawei Ciena Cisco

11

I NFONETI CS RESEARCH, I NC. OCTOBER 2013

Bottom Line

This years survey results give us the first picture of which companies are leaders in packet optical equipment and highlight

the increasing importance of multi-layer features as a decision criterion. We believe 100G has waned as a key differentiator,

and this is supported in the decline of responses mentioning it as such.

Methodology And Demographics

In August and September of 2013, Infonetics surveyed 20 service providers from around the world who have an optical

transport network; they represent almost a third of worldwide telecom capex.

Respondents have detailed knowledge of their companies 10G/40G/100G optical transmission and switching equipment and

are influential in planning and making purchase decisions for this equipment.

Our sample includes a good mix of telcos, ranging from large incumbent service providers to smaller fiber-based competitive carriers:

Incumbent service providers: 75%

Competitive service providers: 20%

Wireless service providers: 5%

Service provider respondents for this survey are based in:

Europe, the Middle East, and Africa (EMEA): 40%

Asia Pacific: 30%

North America: 25%

Central and Latin America (CALA): 5%

I N F O N E T I C S R E S E A R C H S U R V E Y E X C E R P T S

I NFONETI CS RESEARCH, I NC. OCTOBER 2013

Survey Author

Andrew Schmitt

Principal Analyst, Optical

andrew@infonetics.com

+1 408.583.3393

Infonetics Researchs 2013 Optical Equipment Vendor Leadership: Global Service Provider Survey was independently conducted

and written by Infonetics Research, and was not sponsored by any vendor. The excerpts herein are reprinted by Ciena with

permission from Infonetics.

About Infonetics Research

Infonetics Research is an international market research and consulting analyst firm serving the communications industry

since 1990. A leader in defining and tracking emerging and established technologies in all world regions, Infonetics helps

clients plan, strategize, and compete more effectively.

Report Reprints and Custom Research

To learn about distributing excerpts from Infonetics reports or to learn about custom research opportunities, please contact:

North America (West), Asia Pacific

Larry Howard, Vice President, larry@infonetics.com, +1 408.583.3335

North America (East, Midwest, Texas), Latin America

Scott Coyne, Senior Account Director, scott@infonetics.com, +1 408.583.3395

Europe, Middle East, Africa, India, Singapore

George Stojsavljevic, Senior Account Director, george@infonetics.com, +44 755.488.1623

Japan, South Korea, China, Taiwan

http://www.infonetics.com/contact.asp

695 TECHNOLOGY PARKWAY SUITE 200 CAMPBELL, CALIFORNIA 95008 TEL 408.583.0011 FAX 408.583.0031 www.infonetics.com

S I L I C O N V A L L E Y B O S T O N M E T R O L O N D O N A M S T E R D A M S H A N G H A I T O K Y O

You might also like

- 2012.08.06 Osn - 1800 - R3 - CWDM & DWDMDocument45 pages2012.08.06 Osn - 1800 - R3 - CWDM & DWDMvictoriovegaNo ratings yet

- 100G Coherent Technologies Oriented To Next Generation of ULH Transmission SystemsDocument2 pages100G Coherent Technologies Oriented To Next Generation of ULH Transmission SystemsvictoriovegaNo ratings yet

- Huawei 100G/40G Solution: WDM & Next Generation Optical Networking 21 23 June 2011 Monte Carlo, MonacoDocument22 pagesHuawei 100G/40G Solution: WDM & Next Generation Optical Networking 21 23 June 2011 Monte Carlo, MonacovictoriovegaNo ratings yet

- Huawei DWDM 100G Field TrialDocument3 pagesHuawei DWDM 100G Field TrialvictoriovegaNo ratings yet

- enDocument10 pagesenlololiliNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Moving Object Tracking in Video Using MATLABDocument5 pagesMoving Object Tracking in Video Using MATLABSumeet SauravNo ratings yet

- List of Book - Computer ScienceDocument3 pagesList of Book - Computer Sciencelibranhitesh7889100% (1)

- NEC Aspila Key Telephone Quick GuideDocument12 pagesNEC Aspila Key Telephone Quick GuideNormel UyNo ratings yet

- SH20-9161-0 Document Composition Facility Users Guide Jul78Document391 pagesSH20-9161-0 Document Composition Facility Users Guide Jul78ccchanNo ratings yet

- SNCP ProtectionDocument6 pagesSNCP Protectionhekri100% (2)

- Lenze Servo DriverDocument186 pagesLenze Servo DriverElyNo ratings yet

- RT-flex82 Flexview-9520 Rev.00Document64 pagesRT-flex82 Flexview-9520 Rev.00Gaby Cris100% (2)

- DIY Coil WinderDocument7 pagesDIY Coil WinderWilson F SobrinhoNo ratings yet

- Ericsson Minilink TN R4Document15 pagesEricsson Minilink TN R4Ebenezer AnnanNo ratings yet

- RK1000 Rockchip PDFDocument57 pagesRK1000 Rockchip PDFsecretobcnNo ratings yet

- Fpga Class 2Document47 pagesFpga Class 2lowtecNo ratings yet

- Narbik NocDocument23 pagesNarbik Nocobee1234No ratings yet

- Acer Aspire 4252/4552/4552G Service GuideDocument178 pagesAcer Aspire 4252/4552/4552G Service GuideKarolMichaelSaavedraContrerasNo ratings yet

- Computer Architecture NoteDocument10 pagesComputer Architecture Notekazi habibaNo ratings yet

- Franklin Electronic Dictionaries 09fdsfDocument6 pagesFranklin Electronic Dictionaries 09fdsfArsalan Arif0% (1)

- Department of Computer Science & Engineering: - + 'KLE Society's KLE Technological University HUBLI-31Document11 pagesDepartment of Computer Science & Engineering: - + 'KLE Society's KLE Technological University HUBLI-31kishorNo ratings yet

- KEYBOARDComputer Keyboard Key ExplanationsDocument9 pagesKEYBOARDComputer Keyboard Key ExplanationsGarg MayankNo ratings yet

- Androidx Class MappingDocument52 pagesAndroidx Class MappingBrittany ZirkleNo ratings yet

- Computer Consumable and Peripherals Prise List: Oxford InfotechDocument4 pagesComputer Consumable and Peripherals Prise List: Oxford Infotechnarendra_bhradiyaNo ratings yet

- Artikel Dan Contoh Soal (Bahasa Inggris)Document15 pagesArtikel Dan Contoh Soal (Bahasa Inggris)BWfool100% (1)

- Capitulo 10 Metodos NumericosDocument42 pagesCapitulo 10 Metodos NumericosMarioAlbertoSimbronNo ratings yet

- lcd 主要参数速查表Document30 pageslcd 主要参数速查表api-3821017100% (1)

- Case Study - (Q & R) - DFC10033 - 1 2021 - 2022Document6 pagesCase Study - (Q & R) - DFC10033 - 1 2021 - 2022lokeshNo ratings yet

- IB Attrition AnalysisDocument121 pagesIB Attrition AnalysisAmeetNo ratings yet

- Assignment of DOSDocument2 pagesAssignment of DOSPravah Shukla100% (1)

- Valeport MIDAS SurveyorDocument1 pageValeport MIDAS SurveyorAndika Yoga RamadanaNo ratings yet

- Sense Point XCD Technical ManualDocument80 pagesSense Point XCD Technical ManualKarina Jimenez VegaNo ratings yet

- Intelligent Block UpconverterDocument196 pagesIntelligent Block UpconverterGeo ThaliathNo ratings yet

- Hitachi Manual - TS5K500.B OEM Specification R18Document176 pagesHitachi Manual - TS5K500.B OEM Specification R18Adrian ScripcaruNo ratings yet

- 10 1 1 26 3120Document18 pages10 1 1 26 3120gonxorNo ratings yet