Professional Documents

Culture Documents

Account Based Payment

Uploaded by

Deepika Agrawal0 ratings0% found this document useful (0 votes)

28 views33 pagesff

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentff

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

28 views33 pagesAccount Based Payment

Uploaded by

Deepika Agrawalff

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 33

Account-Based Electronic Payment Systems

Speaker: J erry Gao Ph.D.

San J ose State University

email: jerrygao@email.sjsu.edu

URL: http://www.engr.sjsu.edu/gaojerry

Sept., 2000

Topic: Account-Based Electronic Payment Systems

- I ntroduction to Credit Card-Based Payment Systems

- Credit-Card based electronic payment systems

- First Virtual

- CyberCash

- Set

- Electronic check payment systems

- FSTC

- NetBill

- Comparisons and summary

J erry Gao Ph.D. 5/20000

Presentation Outline

All Rights Reserved

Credit Card payment schemes have been in use as a payment methodsince 1960s.

There are two major international brands: VI SA and MasterCard

About VI SA:

- The VI SA brand grew from a scheme launched by the Bank of America, which

was subsequently licensed by Barclaycard in the United Kingdom in 1966.

- By the middle of 1995, VI SA owned by its 180,000 member financial institutions,

had issued more than 420 million cards and is accepted by more than 12 million

merchants in 247 countries.

About MasterCard:

- MasterCard is of comparable size with 13 million merchants in 220 countries

and 22,000 member organizations.

- More than 800 million cards issued and nearly $1,300 billion of sales each year.

J erry Gao Ph.D. 5/2000

I ntroduction To Credit Card-Based Payment Systems

Topic: Account-Based Electronic Payment Systems

Different types of payment card schemes:

(A) Credit cards, where payments are set against a special-purpose account

associated with some form of installment-based repayment scheme or a revolving

line of credit.

- pay later with limit and interest rate.

(B) Debit cards (paperless checks) are linked to a checking/saving account.

- pay now with balance checking.

(C)Charge cards: work in a similar way to credit cards in that payments are set

against a special-purpose account.

- payment must be made at the end of billing period without limit.

(D) Travel and entertainment cards are charge cards whose usage is linked to

airlines, hotels, restaurants, car rental companies, or particular retail outlets.

J erry Gao Ph.D. 5/2000

I ntroduction To Credit Card-Based Payment Systems

Topic: Account-Based Electronic Payment Systems

J erry Gao Ph.D. 5/2000

I ntroduction To Credit Card-Based Payment Systems

Topic: Account-Based Electronic Payment Systems

Card Association

Card I ssuers Bank

Card Acquirers Bank

Merchant CardHolder

Payment Model:

J erry Gao Ph.D. 5/2000

I ntroduction To Credit Card-Based Payment Systems

Topic: Account-Based Electronic Payment Systems

Region

--------------------------------------------------------------------------------------------------------

U.S. 358.4 228.1 202.4 174

Europe 262.4 81.2 not available 53.5

Asia-Pacific 91.6 73 116.2 72.5

Canada 36.8 18.6 not available not available

Middle East 5.6 2.3 5.5 2

Africa

Latin America 23.6 21.4 19.1 21.2

Totals 778.4 424.7 470 338.7

VI SA (total $1248.4B sales)

-----------------------------------------------

Sales Volume No. of

billions of $(U.S.) Cards (millions)

MasterCard (763.4 million cards)

--------------------------------------------

Sales Volume No. of

billions of $(U.S.) Cards (millions)

J erry Gao Ph.D. 5/2000

Topic: Electronic Cash Payment Protocols and Systems

Special Features of Credit Card-Based Electronic Payment Systems

- Online Transaction.

- Anonymity: This ensure that no detailed cash transactions for customer

are traceable. Even sellers do not know the identity of

customers involved in the purchases

- Security: High security and low risk due to the use of traditional

banking system and user accounts.

- Standardization: Use of the existing standardized payment model

- Flexibility: consumers can have multiple cards used in different

countries and concurrency

- All transactions can be easily traced by banking system and merchants.

J erry Gao Ph.D. 5/2000

Topic: Electronic Check Payment Protocols and Systems

Limitations:

- Dependency: dependent on existing banking systems.

- Transaction cost: high transaction cost compared with other approaches

- Performance: slower performance due to the authentication and

account validation using the existing banking systems

- Privacy: consumer loss of the privacy of their transactions

Special Features of Credit Card-Based Electronic Payment Systems

J erry Gao Ph.D. 5/2000

Topic: Account-based Electronic Payment Systems

About First Virtual:

- First Virtual was the first Credit Card Processing System started in Oct. 1994 by a

company called First Virtual Holding.

-The product is called Virtual PI N.

- The major goal is to allow the selling of low value informationitems across the

network without the need of a client software or hardware to be in place.

- Both the merchant and the buyers are required to register with First Virtual before

any transactions can take place.

- First Virtual depends on the conventional bank automated clearing house (ACH)

service.

- First Virtual use WWW web server to support online purchasing and selling.

- Security method: VirtualPI N are used to verify accounts of merchants and buyers.

Credit Card-Based Electronic Payment System: First Virtual

J erry Gao Ph.D. 5/2000

Topic: Account-based Electronic Payment Systems

Credit Card-Based Electronic Payment System: First Virtual

Web Server

First Virtual I nternet

Payment System Server

Buyer

1. Account I D

4. I nformation

Goods

2. Account I D Valid?

3. Account OK!

5. Transaction Details

7. Accept/Reject or

Fraud I ndication

6. Satisfied

Buying with First Virtual:

J erry Gao Ph.D. 5/2000

Topic: Account-based Electronic Payment Systems

Major advantages of First Virtual:

- Simple due to:

- no use of encryption

- no export problems

- simple exchanges without special software and hardware at the client

side

- server software is not complex

The disadvantages and limitations of First Virtual:

- Both merchants and buyers must pre-register.

- No encryption mechanisms are used.

Credit Card-Based Electronic Payment System: First Virtual

J erry Gao Ph.D. 5/2000

Topic: Account-based Electronic Payment Systems

History of SET:

- I n October 1995, the Secure Electronic Payment Protocol (SEPP) was proposed by

the alliance of MasterCard, Netscape Corp, I BM, and others.

- After a few days, a different network payment specification, called Secure

Transaction Technology (STT) was launched by a VI SA and Microsoft consortium.

- Both efforts were made in parallel to develop secure payment protocols and

technologies for a number of months.

- I n J anuary 1996, both companies announced that they would come together to

develop a unified system -- a secure I nternet payment system based on Secure

Electronic Transitions (SET) protocol.

- I t is developed by Visa and MasterCard jointly later.

- Later, most significant organizations in the I nternet payment industry have stated

that they will support SET.

Credit Card-Based Electronic Payment System: Set

J erry Gao Ph.D. 5/2000

Topic: Account-based Electronic Payment Systems

Phases of a credit card payment addressed by SET standards:

Credit Card-Based Electronic Payment System: Set

Financial Network

Card I ssuer

Card Holder Merchant

Payment

Gateway

Non-Set

Non-Set

Set

Set

J erry Gao Ph.D. 5/2000

Topic: Account-based Electronic Payment Systems

Credit Card-Based Electronic Payment System: Set

Set Transaction Processing Layer

(E-Wallet,Digital Certificate)

Application Layer

I nternet Protocol Layer

HTTP, SMTP SSL, X.509

Set Transport and Secure Sockets Layer

Set Message Structure Layer

SET Protocol Layered Architecture:

J erry Gao Ph.D. 5/2000

Topic: Account-based Electronic Payment Systems

Credit Card-Based Electronic Payment System: Set

Certificate

Authority

Certificate

Authority

Payment

Gateway

Payment

Gateway

Cardholder Merchant

Purchasing

Transaction

s

Certify with CA

for Digital

Certificate

Validates SET Digital

Certificates, preprocesses,

authorization, capture,

and settlement work

SET Process Architecture:

E-Wallet SET POS

Certify with CA for

Digital Certificate

Certify with

CA for Digital

Certificate

Wakeup

Wakeup

Store Front

Certificate

Authority

E-Wallet SET

POS

Payment

Gateway

Browser

Merchant

Server

Acquirer

Legacy

System

Bank

Interchange

CertReq

CertReq

CertRes CertRes

PInitReq

PInitRes

PReq

PRes

AuthReq

AuthRes

CapReq

CapRes

Wakeup

CertReq

CertRes

Post

HTTP

Page

Message

Details

Wakeup

AuthRes AuthReq

Shop

wakeup

Interactions among all SET entities:

J erry Gao Ph.D. 5/2000

Topic: Account-based Electronic Payment Systems

Topic: Account-based Electronic Payment Systems

Cardholder

Cardholder

Merchant

Merchant Acquirer Payment

Gateway

Acquirer Payment

Gateway

PWakeup

PI nitReq

PI nitRes

PReq

PRes AuthReq

AuthRes

I nqReq

I nqRes

CapReq

CapRes

Sequence of SET message pairs:

J erry Gao Ph.D. 5/2000

Topic: Account-based Electronic Payment Systems

The messages needed to perform a complete purchase transaction include:

Initialization (PInitReq/PInitRes)

Purchase order (PReq/Pres)

Authorization (AuthReq/AuthRes)

Capture of payment (CapReq/CapRes)

Cardholder inquiry (InqReq/InqRes)

Security mechanism in SET:

Certification for all parties, including

Cardholder CA, Merchant CA, and Payment CA.

Authentication for parties based on a public-key pair with RSA.

Encryption is performed on parts of certain messages.

Dual signatures are used in the SET protocol.

J erry Gao Ph.D. 5/2000

Credit Card-Based Electronic Payment System: Set

Topic: Account-based Electronic Payment Systems

J erry Gao Ph.D. 5/2000

Credit Card-Based Electronic Payment System: Set

Brand Certification Authority

Geo-Political Authority (optional)

Root

Certification Authority

Cardholder

CA

Cardholder

Merchant

CA

Merchant

Payment

CA

Payment

Gateway

J erry Gao Ph.D. 5/2000

Topic: Account-based Electronic Payment Systems

About CyberCash:

- CyberCash is a secure I nternet payment system developed byCyberCash, I nc., which

is located at Reston, VA, USA, and it was found in August 1994 to provide software

and service solutions for secure financial transactions over theI nternet.

- CyberCash uses special wallet software, enable consumers to make secure purchases

using major credit cards from CyberCash-affiliated merchants.

- theCyberCashpayment system was launched in April 1995. I t had over half a

million copies in circulation.

- CyberCash has other payment systems, such as CyberCoin (electronic cash system)

and PayNow (electronic check system).

Credit Card-Based Electronic Payment System: CyberCash

J erry Gao Ph.D. 5/2000

Topic: Account-based Electronic Payment Systems

Features of CyberCash:

- Use the existing credit card infrastructure for settlement payments.

- Use cryptographic techniques to protect the transaction data during a purchase.

- Authenticate the identifies of both parties to the transaction.

- Provide online transaction and online authentication.

- Broker the transaction between merchants bank and cardholdersbank.

Credit Card-Based Electronic Payment System: CyberCash

J erry Gao Ph.D. 5/2000

Topic: Account-Based Payment Protocols and Systems

Credit Card-Based Electronic Payment System: CyberCash

Web Browser

Customer

Wallet

Web Server

Merchant

Software

CyberCash

Server

Shopping

Purchase

Purchase messages Registration

Card binding

Banking

Network

I nternet

CyberCash Payment Model

J erry Gao Ph.D. 5/2000

Topic: Account-Based Payment Protocols and Systems

Credit Card-Based Electronic Payment System: CyberCash

Payment Steps in aCyberCashPurchase

Consumer

Cybercash

Server (CS)

Merchant

Click PAY

order

form

forward

details

issue

receipt

authorize

+clear

with bank

Credit-card pay

Payment-req

Charge-card-res

auth-capture

charge-action-res

Finish

shopping

Choose

CC, addr

log

transaction

Topic: Account-Based Payment Protocols and Systems

Credit Card-Based Electronic Payment System: CyberCash

Header Transport Trailer Opaque

CyberCashMessages:

Header: I t indicates the start of a CyberCashmessage.

Transport: I t contains the order information in a purchase, transaction I D, date,

and the key I D to the encrypt the opaque part.

Opaque: The encrypted part of a message.

Trailer: the end of aCyberCashmessage.

J erry Gao Ph.D. 5/2000

Topic:Elect ronicCheck Payment Protocols and Systems

Overview of NetBill:

- NetBill is a dependable, secure and economical payment method for purchasing

digital goods and services through the I nternet.

- NetBill protocol is developed by Carnegie Mellon University.

- I n partnership with Visa I nternational and MellonBank, the first trial of the system

was installed in early 1996.

Major goals of NetBill:

- Support high transaction volumes at low cost

- Provide authentication, privacy, and security for transactions

- Provide account management and administration for consumers andmerchants

Electronic Check Payment System: NetBill

J erry Gao Ph.D. 5/2000

Topic: Electronic Check Payment Protocols and Systems

Electronic Check Payment Process: NetBill

NetBill

Server

Customer Merchant

Bank

Network

J erry Gao Ph.D. 5/2000

Topic: Electronic Check Payment Protocols and Systems

Electronic Check Payment System: NetBill

1. Consumers application send a price quote request to the merchants application

through a checkbook library.

2. Merchants application sends back the price quote the consumers application.

3. Consumer accepts the price quote, and then sends a purchase request through the

Checkbook library.

4. Merchants application sends to the consumers Checkbook encrypted in a one-

time key.

5.Consumer sends a electronic payment order (EPO) to merchants application.

6. The merchants application sends the endorsed EPO to the NetBill server.

7. NetBill server verifies that the consumer and merchant signatures are valid. Then,

return the merchant a digitally signed receipt with a decryptionkey.

8. The merchants application forward the NetBill servers receipt to the Check book.

NetBill

Server

Customer Merchant

1

2

3

4

8

6

7 5

J erry Gao Ph.D. 5/2000

Topic: Electronic Check Payment Protocols and Systems

Electronic Check Payment System: NetBill

NetBill Archecture: (Source: NetBill 1994 Prototype)

Consumer

Application

Checkbook

Merchant

Application

Till

User Admin.

Server

Transaction

Server

Security

Server

System Admin.

Server

Payment &

Collection Server

DB

J erry Gao Ph.D. 5/2000

Topic: Electronic Check Payment Protocols and Systems

Electronic Check Payment System: NetBill

Major features of NetBill:

- Certified delivery: delivering encrypted information goods and then charging

against the consumers NetBill account. Then, decryption key registration are used at

both the merchants application and the NetBill server.

- Scalability: the bottleneck in the NetBill model is the NetBill Server which supports

many different merchants.

- Support for flexible pricing: by including the steps of offer and acceptance. The

merchant can calculate a customized quote for individual consumer.

- Protection of consumer accounts against unscrupulous merchants in a conventional

credit card transaction.

J erry Gao Ph.D. 5/2000

Topic: Electronic Check Payment Protocols and Systems

Electronic Check Payment System: NetBill

Security Mechanisms of NetBill:

- Create a NetBill account for each consumer by using a unique user I D and the RSA

public key.

- the key pair is certified by NetBill and is used for signatures and authentication in

the system.

-These signatures are used to check the elements of NetBill transactions (the price

quote, the acceptance, etc) really came from the right parties.

- NetBill uses symmetric cryptogrphy method for message authentication and

encryption and decryption.

J erry Gao Ph.D. 5/2000

Topic:Elect ronicCheck Payment Protocols and Systems

Overview of FSTC:

- The Financial Service Technology Consortium (FSTC) is a group of American

Banks, research agencies, and government organizations, formed in 1995.

- The basic concepts is use electronic checks to conduct payment transactions.

- I n Sept. 1995, a demonstration of the FSTC electronic check concept was given that

involved a purchase of an item from a merchant site on the I nternet.

- the FSTC payment system uses:

- electronic checks to transfer and moves funds from the buyers bank

account to the merchants bank account based on a conventional ACH

network.

- a secure hardware device, called a Smart Token, is used to play as

a checkbook. I t takes the form of a PC card with an in-built

cryptographic support processor..

Electronic Check Payment System: FSTC

J erry Gao Ph.D. 5/2000

Topic:Electronic Check Payment Protocols and Systems

Electronic Check Payment System: FSTC

payer Payee

Secure H/W

Debit Account

Credit Account

ACH Check Clearing

Checkbook

(secure H/W)

Secure envelope

invoice

Statement

Secure envelope

Certs Sig Check

Electronic check

Certs

endorsement

certs

sig

check

J erry Gao Ph.D. 5/2000

Topic:Electronic Check Payment Protocols and Systems

Electronic Check Payment System: FSTCsFunctional Flows

payer Payee

write endorse

Payers

Bank

Payees

Bank

debit credit

1. pay

5. statement 2. deposit 4. report

3.clear

payer Payee

write

Payers

Bank

Payees

Bank

debit Endorse & credit

1. pay

4. statement

3.accounts

receivable

update

2.clear

payer Payee

write endorse

Payers

Bank

Payees

Bank

debit credit

1. pay

6. statement

2.cash

5. report

4.EFT

payer Payee

write

Payers

Bank

Payees

Bank

debit credit

1. pay

5. statement

3. Accounts

Receivable

update

2.EFT

3.notify

Deposit-and-clear scenario Cash-and-transfer scenario

Lockbox scenario Fund transfer scenario

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- FABM2 Q2 Module WS 1Document14 pagesFABM2 Q2 Module WS 1Mitch Dumlao73% (11)

- Your Business Fundamentals Checking: Account SummaryDocument14 pagesYour Business Fundamentals Checking: Account Summaryabal67% (3)

- An Energy Aware Fuzzy Unequal Clustering Algorithm For Wireless Sensor NetworksDocument8 pagesAn Energy Aware Fuzzy Unequal Clustering Algorithm For Wireless Sensor NetworksDeepika AgrawalNo ratings yet

- IP Lab ManualDocument81 pagesIP Lab ManualDeepika AgrawalNo ratings yet

- Mobile Internet: K R School of Information Technology IIT BombayDocument280 pagesMobile Internet: K R School of Information Technology IIT BombayDeepika AgrawalNo ratings yet

- Explain Bernstein Condition With ExampleDocument1 pageExplain Bernstein Condition With ExampleDeepika AgrawalNo ratings yet

- AweshiDocument2 pagesAweshiDeepika AgrawalNo ratings yet

- 1 UnixDocument40 pages1 UnixDeepika AgrawalNo ratings yet

- Unix Basics: Presented By: Benjamin LynchDocument42 pagesUnix Basics: Presented By: Benjamin LynchNakul MaheshwariNo ratings yet

- Book 1Document2 pagesBook 1Deepika AgrawalNo ratings yet

- Ice Tea RecipeDocument1 pageIce Tea RecipeDeepika AgrawalNo ratings yet

- Mutual FundDocument9 pagesMutual Fund05550No ratings yet

- Course Outline For Financial Instituions and MarketsDocument2 pagesCourse Outline For Financial Instituions and MarketsAbdiNo ratings yet

- Bruno - Gomes Statement 2021 07Document4 pagesBruno - Gomes Statement 2021 07B gNo ratings yet

- Obamacare Ushers in New Era For The Healthcare IndustryDocument20 pagesObamacare Ushers in New Era For The Healthcare Industryvedran1980No ratings yet

- Financial ManagementDocument18 pagesFinancial ManagementCyril EstandarteNo ratings yet

- Electronic Ticket Receipt, June 22 For Carlosandres QuintanadeavilaDocument3 pagesElectronic Ticket Receipt, June 22 For Carlosandres QuintanadeavilaCal QuintanaNo ratings yet

- Kartik Vivek Johar Bank StatementDocument13 pagesKartik Vivek Johar Bank Statementjaxefa7669No ratings yet

- Mobile Broadcasting: Communication PrinciplesDocument23 pagesMobile Broadcasting: Communication PrinciplesSemi SmdNo ratings yet

- IGCSE-OL - Bus - CH - 20 - Answers To CB ActivitiesDocument3 pagesIGCSE-OL - Bus - CH - 20 - Answers To CB ActivitiesOscar WilliamsNo ratings yet

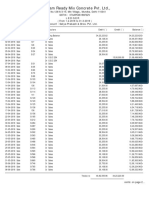

- Shri Ram Ready Mix Concrete Pvt. LTD.Document7 pagesShri Ram Ready Mix Concrete Pvt. LTD.Inderjeet Kaur KNo ratings yet

- CGTMSE PresentationDocument20 pagesCGTMSE Presentationsandippatil03No ratings yet

- Restaurant Management System - (RMS) FeaturesDocument4 pagesRestaurant Management System - (RMS) FeaturesTejendra PachhaiNo ratings yet

- Inter State Bus Terminal (I.S.B.T) : Submited By:-Gurpreet Singh 13BAC003Document6 pagesInter State Bus Terminal (I.S.B.T) : Submited By:-Gurpreet Singh 13BAC003Gurpreet SinghNo ratings yet

- Literature Review On Airtel and VodafoneDocument5 pagesLiterature Review On Airtel and Vodafonesrxzjavkg100% (1)

- FHKHKHDocument1 pageFHKHKHKara BrownNo ratings yet

- Eventos Autos Clasicos TunjaDocument10 pagesEventos Autos Clasicos TunjaDenis Tatiana Salazar MartínezNo ratings yet

- Programa RSSDocument4 pagesPrograma RSSHELP REMOÇÕESNo ratings yet

- Wired and Wireless NetworkDocument5 pagesWired and Wireless Networkjimoh emmanuelNo ratings yet

- Tera Romm 1Document7 pagesTera Romm 1Temp TNo ratings yet

- Assertion Category Transaction or Balance Specific Audit ObjectiveDocument1 pageAssertion Category Transaction or Balance Specific Audit ObjectiveYidersal DagnawNo ratings yet

- Proforma Invoice AUTOTECHDocument1 pageProforma Invoice AUTOTECHWilhelm FischerNo ratings yet

- MSRTC TicketDocument1 pageMSRTC TicketJaydeep PatilNo ratings yet

- 533 - Lucky Brimblecombe Fitzpatrick Referrals Invoice 1-88682Document1 page533 - Lucky Brimblecombe Fitzpatrick Referrals Invoice 1-88682himanshu kNo ratings yet

- Test Bank For Core Concepts of Accounting Information Systems 14th by SimkinDocument11 pagesTest Bank For Core Concepts of Accounting Information Systems 14th by SimkinMamie Bilbao100% (30)

- 2018 Interim Disclosure ChecklistDocument24 pages2018 Interim Disclosure ChecklistWedi TassewNo ratings yet

- Cabatan SC109Document5 pagesCabatan SC109xylynn myka cabanatanNo ratings yet

- Pumps (Kemai Pumps 2022-07-27)Document6 pagesPumps (Kemai Pumps 2022-07-27)Brion Bara IndonesiaNo ratings yet

- FRA Air-Traffic-Statistics-2018Document52 pagesFRA Air-Traffic-Statistics-2018Evgeny KirovNo ratings yet