Professional Documents

Culture Documents

As - 7 and As - 9 As 10 As 6 As 28 - Ideal

Uploaded by

Lalit JhaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

As - 7 and As - 9 As 10 As 6 As 28 - Ideal

Uploaded by

Lalit JhaCopyright:

Available Formats

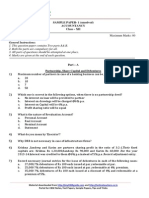

Practical Problems on Accounting Standards for Service Sectors

AS- 9

1. Arjun Ltd. sold farm equipment through its dealer. One of the conditions at the time of

sale is payment of consideration in 14 days and, in the event of delay, interest is

chargeable @ 15% p.a. The company has not realized interest from the dealers in the

past. However, for the year ended 31.03.2013, it wants to recognized interest due on the

balances due from dealers. The account is ascertained at Rs. 9 lakhs.

Decide whether the income by way of interest from dealers is eligible for recognition as

per AS 9

2. Advise B Ltd. about the treatment of the following in the final statement of accounts for

the year ended 31st March, 2013.

As a result of a recently announced price revision granted by the Govt. of India w.e.f

01.07.2012 the company stands to receive Rs. 5,20,000 form its customers in respect of

sales made in 2012-13.

3. TVSM Ltd. has taken a transit insurance policy. Suddenly, in the year 2012-13, the

percentage of accident has gone up to 7% and the company wants to recognize

insurance claim as revenue in 2012-13. In accordance with relevant accounting

standard.

Do you agree?

4. Bottom Ltd. entered into a sale deed for its immovable property before the end of the

year. But registration was done with Registrar subsequent to Balance Sheet date.

But before finalization, is it possible to recognize the sale and the gain at the Balance

Sheet date? Give your views with reasons.

5. SCL Ltd. sells agricultural products to dealers, One of the conditions of sale is that

interest is payable at the rate of 2% p.m. for delayed payments. Percentage of interest

recovery is only 10% on such overdue outstanding due to various reasons. During the

year 2012-13, the company wants to recognize the interest receivable. Do you agree?

6. When can revenue be recognized in the case of transaction of sale of goods?

7. X Ltd. has recognized Rs. 10 lakhs on accrual basis from dividends on units of mutual

fund of the face value of Rs. 50 lakhs held by it as at the end of the financial year 31st

March, 2013. The dividends on mutual funds were declared @ 20% on 15th July 2013.

The dividends were proposed on 10th April, 2013 by the declaring company. Whether

the treatment is as per the relevant Accounting Standard?

8. Y co. Ltd. used certain resources of X Ltd. In return X Ltd. received Rs. 10 lakhs and Rs.

15 lakhs as interest and royalties, respectively from Y Ltd. during the year 2012-13.

9. Advise P Ltd. about the treatment of the following in final statement of accounts for the

year ended 31.03.13:

A claim lodged with the Railways in March 2010, for loss of goods of Rs. 2,00,000 had

been passed for payment in March 2013 for Rs. 1,50,000. No entry was passed in the

books of the company when claim was lodged.

AS-7

1. Calculate the contract revenue from the following details

2. On 31.12.2012, Viswakarma Construction Company Ltd. undertook a contract to

construct a building for Rs. 85 lakhs. On 31.03.2013, the company found that it had

already spent Rs. 64,99,000 on the construction. Prudent estimate of the additional cost

for completion was Rs. 32,01,000

What is the additional provision for foreseeable loss which must be made in the final

accounts for the year ended 31.03.12 As per provisions AS 7 on Accounting for

construction contract?

3. A firm of contractors obtained a contract for completion of bridges across river Revathi.

The following details are available in the records kept the year ended 31st March, 2012.

The firm seeks your advice and assistance in presentation of accounts keeping in view

the requirements of AS-7 Accounting for Construction Contract

4. Assume a Rs. 10,00,000 contract that requires 3 years to complete and incurs a total cost

of Rs. 8,10,000. The following data pertain to the construction period

The firm seeks your advice and assistance in the presentation of accounts keeping in view the

requirements of AS-7.

Accounting Standards related to Fixed assets

AS-10

1. During the current year 2012-13, X Ltd. made the following expenditure relating to its

plant building.

How much amount should be capitalized?

2. A company obtained term loan during the year ended 31.3.2012, to an extent of Rs. 650

lakhs for modernisation and development of its factory. Building worth Rs. 120 lakhs

were completed and Plant and Machinery worth Rs. 350 lakhs were installed by

31.3.2012. A sum of Rs. 70 lakhs has been advanced for assets, the installation of which

is expected in the following year. Rs. 110 lakhs has been utilised for Working Capital

requirements. Interest paid on the loans of Rs. 650 lakhs during the year 2011-12

amounted to Rs. 58.50 lakhs.

Flow should the interest amount be treated in the accounts of the company.

3. From the following particulars determine the amount of profit to be transferred to Profit

and Loss Account in each of the companies for the period 2013:

In 1993, identical building space purchased for official purposes by X Ltd. and Y Ltd. for

Rs. 10,00,000 for each space. X Ltd. revalued the same building for Rs. 15,00,000 in 1998

and recorded the revaluation in the books of accounts accordingly. Y Ltd. did not make

any revaluation like X Ltd. Both X Ltd. and Y Ltd. however, sold their respective office

space for Rs. 20,00,000 in 2013. (Ignore depreciation and tax).

4. A company has purchased plant and machinery in the year 2009-10 for Rs. 90. A balance

of Rs. 10 lakhs is still payable to the suppliers for the same. The supplier waived off the

balance amount during the financial year 2012-13. The company treated it as income

and credited to profit and loss account during 2012-13

5. On December 1, 2013, Mitra Ltd. purchased Rs.6,00,000 worth of land for a factory site.

Mitra Ltd. razed an old building on the property and sold the materials it salvaged from

the demolition. Mitra Ltd. incurred additional costs and realized salvage proceeds

during December 2013 as follows:

Demolition of old building Rs. 50,000

Legal fees for purchase contract and recording ownership Rs. 10,000

Title guarantee insurance Rs. 12,000

Proceeds from sale of salvaged materials Rs. 8,000

In its December 31, 2013 Balance Sheet, Mitra Ltd. should report a balance in the land

account.

6. On March 31, 2013, Winn Company traded in an old machine having a carrying amount

of Rs. 1,68,000, and paid cash difference of Rs. 60,000 for a new machine having a total

cash price of Rs. 2,05,000. On March 31, 2013, what amount of loss should Winn

Company recognize on this exchange?

7. One customer from whom Rs. 10 lakhs are recoverable for credit sales given a motor car

in full settlement of dues. The directors estimate that the market value of the motor car

transferred is Rs. 10.50 lakhs. As on the date of the balance sheet the car has not been

registered in the name of the auditee. As an auditor, what would you do in this

situations?

8. A publishing company undertook repair and overhauling of its machinery at a cost of Rs.

5.00 lakhs to maintain them in good condition and capitalized the amount, as it is more

than 25% of the original cost of the machinery. As an auditor, what would you do in this

situation?

9. Is Project under sale fixed or current asset?

10. Amrit Ltd. expects that a plant has become useless which is appearing in the books at Rs.

20 lakhs gross value. The company charges SLM depreciation on a period of 10 years

estimated life and estimated scrap value of 3%. At the end of 7th year the plant has been

assessed as useless. Its estimated net realisable value is Rs. 6,20,000. Determine the

loss/gain on retirement of the fixed assets?

AS 6

Methods of Charging Depreciation

Capital/Source of Fund

(i) Sinking Fund Method

(ii) Annuity Method

(iii) Insurance Policy Method

Time Base

(i) Fixed Installment Method

(ii) Reducing Balance Method

(iii) Sum of Years Digit Method

(iv) Double Declining Method

Use Base

(i) Working Hours Method

(ii) Mileage Method

(iii) Depletion Service Hours Method

(iv) Unit method

1. On 1.7.2009 W Ltd. purchased a machinery for Rs. 1,10,000 and spent Rs. 6,000 on its

installation. The expected life of the machine is 4 years, at the end of which the

estimated scrap value will be Rs. 16,000. Desiring to replace the machine on the expiry

of its life, the company establishes a Sinking Fund. Investments are expected to realize

5% interest.

On 30.06.2013, the machine was sold off as scrap for Rs. 18,000 and the investments

were retained at 5% less than the book value. On 1.7.2013, a new machine is installed at

a cost of Rs. 1,25,000. Sinking Fund table shows that Rs. 0.2320 invested each year will

produce Rs. 1 at the end of 4 years at 5%.

Show the necessary ledger accounts in the books of W Ltd.

2. Sri Tirthankar takes a lease for 5 years for Rs. 10,000. He decides to write off the lease

by annuity method charging 5% interest p.a. Show the lease account for 5 years.

The annuity table shows that annual amount necessary to write off Rs.1 in 5 years at 5%

p.a. is Rs. 0.230975.

3. In 2011, a company acquired a mine at a cast of Rs. 5,00,000. The estimated reserve of

minerals is 50,00,000 tonnes, of which 80% is expected to be realised. The first three

years raisings are 1,50,000; 2,00,000 and 2,50,000 tonnes, respectively. Show the Mines

Account, charging depreciation under Depletion Method.

4. S & Co. purchased a machine for Rs. 1,00,000 on 1.1.2011. Another machine costing Rs.

1,50,000 was purchased on 1.7.2012. On 31.12.2013, the machine purchased on

1.1.2011 was sold for Rs. 50,000. The company provides depreciation at 15% on

Straight Line Method. The company closes its accounts on 31st December every year.

Prepare (i) Machinery A/c, (ii) Machinery Disposal A/c and (iii) Provision for

Depreciation A/c.

5. Ram Ltd. which depreciates its machinery at 10% p.a. on Diminishing Balance Method,

had on 1st January, 2013 Rs. 9,72,000 on the debit side of Machinery Account. During

the year 2013 machinery purchased on 1st January, 2011 for Rs. 80,000 was sold for Rs.

45,000 on 1st July, 2013 and a new machinery at a cost of Rs. 1,50,000 was purchased

and installed on the same date, installation charges being Rs. 8,000.

The company wanted to change the method of depreciation from Diminishing Balance

Method to Straight Line Method with effect from 1st January, 2010. Difference of

depreciation up to 31st December, 2013 to be adjusted. The rate of depreciation

remains the same as before. Show Machinery Account.

AS-28

1. Z Ltd. acquired a machine for Rs. 31,00,000 on 01.04.2010. The machine has ten years

life with Rs. 1,00,000 salvage value and was depreciated using straight-line method. On

31.03.2012 a test for impairment reveals the following :-

Present value of future cash flow Rs. 14,50,000

Net Selling Price Rs. 16,00,000

Estimated salvage value Nil

Assuming loss for impairment is recognized for the year 31.03.2012. What should be the

depreciation expenses for the year ended 31.03.2013?

2. N Ltd. gives the following estimates of cash flows relating to fixed asset on 31.03.2012.

The discount rate is 10%.

The Asset was purchased on 01.04.2010 for Rs. 25,00,000. The useful life of the asset is

7 years. The salvage value of the asset is Rs. 50,000. Net Selling Price is Rs. 10,00,000

after incurring an cost of Rs. 50,000.

Calculate impairment loss and the amount of depreciation to be charged for the year

2012-13.

3. AB Ltd. acquired C Ltd. as on 31.03.2010 for Rs. 6,000 Lakhs [Goodwill (to be amortised

in 5 years) Rs. 1,000 Lakhs and other Fixed Assets Rs. 5,000 Lakhs]. The anticipated

useful life of the acquired assets is 8 years. The company uses straight-line method of

depreciation with no residual values. On 31.03.2012, due to change in Government

policies, the company estimates the significant decline in production. The Net Selling

Price is Rs. 3,000 Lakhs. The cash flow forecast based on recent financial budget for the

next 6 years after considering changed Government policies are as follows, incremental

financing cost is 10% which represent current market assessment of the time value of

money.

You are required to calculate the amount of impairment loss and revised carrying

amount?

4. Shiva Ltd recognises Goodwill at Rs. 25 lakhs in the Balance Sheet. An amount of Rs. 9

lakhs is allocable on a reasonable and consistent basis to a CGU. The carrying amount of

the CGU is Rs. 27 lakhs before allocation of goodwill. What will be the treatment of

Impairment Loss if the recoverable amount of the CGU is (1) Rs. 32 lakhs, (2) Rs. 22

lakhs and (3) (Rs. 2 lakhs).

5.

Ayushman Ltd is engaged in a business of genetically creating high breed food products

and manufacturing. A major portion of its output is exported.

During April 2008, to support its activities, the company had acquired a R&D cum

Manufacturing Plant for a total consideration of Rs. 7.50 crores. Identifiable Assets were

worth Rs. 5 crores and the balance was treated as Goodwill, to be amortised over a

period of 5 years. The useful life of the plant was estimated at 20 years. The company

adopts a Straight Line Method of depreciation for its assets with a NIL residual value.

In March 2011, new Government had sworn in and put a restriction on export of all

agricultural produces. This had let to impairment of Ayushmans assets. Ayushman had

recognised the Impairment Loss by determining the recoverable amount of assets at Rs.

3.40 crores.

In March 2013, due to change in policy, the restriction was removed and the recoverable

amount of the plant is estimated at Rs. 4.27 crores.

If the companys financial year ends on 31st March

(a) Compute the Impairment Loss recognised for the year ending 31st March,2011 and

determine its allocation

(b) Compute the reversal of Impairment Loss for the year ending 31st March 2013 and

determine its allocation

(c) If the recoverable amount on 31st March 2013 is determined at 3.40 crores, what is

the amount of reversal to be recognised?

You might also like

- FR QuestionsDocument12 pagesFR Questionsram_eiNo ratings yet

- Isc Accounts 5 MB: (Three HoursDocument7 pagesIsc Accounts 5 MB: (Three HoursShivam SinghNo ratings yet

- Sample Paper 4Document6 pagesSample Paper 4Ashish BatraNo ratings yet

- TH TH STDocument3 pagesTH TH STsharathk916No ratings yet

- AS 9 - ProblemsDocument4 pagesAS 9 - Problemsvishalsingh9669No ratings yet

- CBSE 12th Accountancy 2014 Unsolved Paper Outside DelhiDocument7 pagesCBSE 12th Accountancy 2014 Unsolved Paper Outside DelhiAmlan ChakravortyNo ratings yet

- SAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80Document6 pagesSAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80AcHu TanNo ratings yet

- ABC Limited - Case StudyDocument2 pagesABC Limited - Case StudyRahul BhagatNo ratings yet

- Test Series: October, 2014 Mock Test Paper - 2 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced AccountingDocument8 pagesTest Series: October, 2014 Mock Test Paper - 2 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced Accountingmanish1318No ratings yet

- Their Position On That Date Was As FollowsDocument36 pagesTheir Position On That Date Was As FollowsKenneth NevalgaNo ratings yet

- Disclaimer: © The Institute of Chartered Accountants of IndiaDocument35 pagesDisclaimer: © The Institute of Chartered Accountants of IndiajaimaakalikaNo ratings yet

- Case Study 1Document3 pagesCase Study 1Vivek Pange0% (1)

- Top 25 Problems On Dissolution of A Partnership Firm PDFDocument1 pageTop 25 Problems On Dissolution of A Partnership Firm PDFDaniza Rose AltoNo ratings yet

- Accounting For RevenuesDocument7 pagesAccounting For Revenuesvijayranjan1983No ratings yet

- Test 3Document8 pagesTest 3govarthan1976No ratings yet

- Gujarat Board Accountancy Sample PapersDocument3 pagesGujarat Board Accountancy Sample Papersapi-150539480No ratings yet

- Their Position On That Date Was As FollowsDocument36 pagesTheir Position On That Date Was As FollowsKenneth NevalgaNo ratings yet

- Accounting Concepts CaseletsDocument2 pagesAccounting Concepts CaseletsStorm ShadowNo ratings yet

- Session # 3 - Accounting CaseletsDocument2 pagesSession # 3 - Accounting CaseletsMandapalli SatishNo ratings yet

- Test 3Document8 pagesTest 3govarthan1976No ratings yet

- IPCC MTP2 AccountingDocument7 pagesIPCC MTP2 AccountingBalaji SiddhuNo ratings yet

- Test 1 - InD As 16, 38, 40 - QuestionsDocument5 pagesTest 1 - InD As 16, 38, 40 - Questionskapsemansi1No ratings yet

- Paper 1: AccountingDocument30 pagesPaper 1: Accountingsuperdole83No ratings yet

- CARO Question and AnswerDocument3 pagesCARO Question and AnswerraviNo ratings yet

- Paper 1: AccountingDocument30 pagesPaper 1: AccountingSatyajit PandaNo ratings yet

- IFRS 16 13102022 100655am 1Document3 pagesIFRS 16 13102022 100655am 1Adnan MaqboolNo ratings yet

- WBHSCMock 2Document4 pagesWBHSCMock 2Smita AdhikaryNo ratings yet

- Assignment2 FMDocument2 pagesAssignment2 FMSiva Kumar0% (1)

- E-14 AfrDocument5 pagesE-14 AfrInternational Iqbal ForumNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Spring (Summer) 2010 ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Spring (Summer) 2010 ExaminationsIrfanNo ratings yet

- AccountDocument67 pagesAccountchamalix100% (1)

- Accounts Preliminary Paper No 8Document6 pagesAccounts Preliminary Paper No 8AMIN BUHARI ABDUL KHADERNo ratings yet

- Soal Asistensi Special EditionDocument6 pagesSoal Asistensi Special EditionEden ZaristaNo ratings yet

- Property, Plant and Equipment (IAS-16)Document2 pagesProperty, Plant and Equipment (IAS-16)Raneem BilalNo ratings yet

- Financial Accounting: The Institute of Chartered Accountants of PakistanDocument4 pagesFinancial Accounting: The Institute of Chartered Accountants of PakistanShakeel IshaqNo ratings yet

- AS 29 Q A NotesDocument8 pagesAS 29 Q A NotesDipen AdhikariNo ratings yet

- DepreciationDocument15 pagesDepreciationYash AggarwalNo ratings yet

- Corporate AccountingDocument7 pagesCorporate AccountingSuraksha SaharanNo ratings yet

- 5 Accounts InvestmentsDocument2 pages5 Accounts InvestmentsMurali Krishnan RNo ratings yet

- Accounts Question Paper Omtex ClassesDocument8 pagesAccounts Question Paper Omtex ClassesAmin Buhari Abdul KhaderNo ratings yet

- AccountsDocument59 pagesAccountsrajat0% (1)

- Solved PaperDocument9 pagesSolved PaperHariram RamlalNo ratings yet

- Test Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - I Paper - 3: Advanced Auditing and Professional EthicsDocument5 pagesTest Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - I Paper - 3: Advanced Auditing and Professional EthicsRobinxyNo ratings yet

- DepreciationDocument4 pagesDepreciationMadhura KhapekarNo ratings yet

- Class Exercise - 3 Lease FinancingDocument4 pagesClass Exercise - 3 Lease Financinggaurav shettyNo ratings yet

- Cases Karkraft & Valley TransportersDocument2 pagesCases Karkraft & Valley TransportersAvirup ChatterjeeNo ratings yet

- FE QuestionsDocument2 pagesFE Questionsviedereen12No ratings yet

- Shyam Lal and Associates: New Investment ProposalDocument2 pagesShyam Lal and Associates: New Investment ProposalswagatikaNo ratings yet

- Financial Reporting Exam BAFEDocument3 pagesFinancial Reporting Exam BAFEUsman BalochNo ratings yet

- Problems - PPE & DepnDocument5 pagesProblems - PPE & DepnSaurabh SinghNo ratings yet

- CA IPCC Accounts Mock Test Series 1 - Sept 2015Document8 pagesCA IPCC Accounts Mock Test Series 1 - Sept 2015Ramesh Gupta100% (1)

- Unit-I: DepreciationDocument4 pagesUnit-I: DepreciationEswari GkNo ratings yet

- Appendix Scanner Gr. I GreenDocument25 pagesAppendix Scanner Gr. I GreenMayank GoyalNo ratings yet

- Financial Accounting & AnalysisDocument7 pagesFinancial Accounting & AnalysisSHWETA PATEL88% (8)

- CA INTER Paper 5 Expected Questions May 2022Document138 pagesCA INTER Paper 5 Expected Questions May 2022gimNo ratings yet

- Sample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General InstructionsDocument8 pagesSample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General Instructions9chand3No ratings yet

- ADL 03 Ver2+Document6 pagesADL 03 Ver2+DistPub eLearning SolutionNo ratings yet

- CBSE 12th Accountancy 2012 Unsolved Paper Delhi BoardDocument7 pagesCBSE 12th Accountancy 2012 Unsolved Paper Delhi Boardbrainhub50No ratings yet

- Application LevelDocument45 pagesApplication LevelMinhajul Haque SajalNo ratings yet

- Working Capital - Inventory & CASH MANAGEMENTDocument24 pagesWorking Capital - Inventory & CASH MANAGEMENTenicanNo ratings yet

- CONSTRUCTION EconomicsDocument27 pagesCONSTRUCTION Economicshema16100% (1)

- Adissalem Asefa FinalDocument55 pagesAdissalem Asefa FinalSteven Kisamo AmbroseNo ratings yet

- Plywood Cluster Per Um Bavo orDocument14 pagesPlywood Cluster Per Um Bavo orMelak tarkoNo ratings yet

- Accounting Cycle PDFDocument5 pagesAccounting Cycle PDFSim PackNo ratings yet

- Week 3 Adjusting EntriesDocument17 pagesWeek 3 Adjusting EntriesShiellai Mae PolintangNo ratings yet

- Exercise For Building Plant MachineryDocument29 pagesExercise For Building Plant MachineryGere TassewNo ratings yet

- SiomaiDocument27 pagesSiomaiChristine Margoux SiriosNo ratings yet

- AccountingDocument45 pagesAccountingAfia ZaheenNo ratings yet

- StalasaDocument23 pagesStalasajessa mae zerdaNo ratings yet

- Mat Adjustments Table (Ay 2021-22)Document4 pagesMat Adjustments Table (Ay 2021-22)priyal shahNo ratings yet

- FA Work BookDocument59 pagesFA Work BookUnais AhmedNo ratings yet

- Ppe Cpale Reviewer Ppe Ap 11234Document3 pagesPpe Cpale Reviewer Ppe Ap 11234Sharon CarilloNo ratings yet

- CAF-6 Mock Solution by SkansDocument6 pagesCAF-6 Mock Solution by SkansMuhammad YahyaNo ratings yet

- Chapter 6 The Expenditure Cycle Part II: Payroll Processing Objectives For Chapter 6Document10 pagesChapter 6 The Expenditure Cycle Part II: Payroll Processing Objectives For Chapter 6Mitzi EstelleroNo ratings yet

- AFAB Depreciation Run ExecutionDocument18 pagesAFAB Depreciation Run ExecutionraghuNo ratings yet

- Water Resources Systems Planning and Management - LectureDocument30 pagesWater Resources Systems Planning and Management - LectureTejaswiniNo ratings yet

- NFJPIA - Mockboard 2011 - APDocument12 pagesNFJPIA - Mockboard 2011 - APHazel Iris CaguinginNo ratings yet

- INTACC Chap 4Document5 pagesINTACC Chap 4Lacey DavidNo ratings yet

- F & M AccountingDocument6 pagesF & M AccountingCherry PieNo ratings yet

- Financial Accounting Chap 16Document35 pagesFinancial Accounting Chap 16Zexi WUNo ratings yet

- Accounting 18Document7 pagesAccounting 18Kenshin HayashiNo ratings yet

- Financial Reporting and Analysis 13th Edition Gibson Solutions Manual 1Document20 pagesFinancial Reporting and Analysis 13th Edition Gibson Solutions Manual 1james100% (41)

- First Benchmark PublishingDocument17 pagesFirst Benchmark PublishingChan Mark AyapanaNo ratings yet

- Project Report Granite MineDocument11 pagesProject Report Granite MineSmriti GargNo ratings yet

- Theory of Accounts Quiz 1Document3 pagesTheory of Accounts Quiz 1Cris Tarrazona Casiple100% (1)

- Section B: Property, Plant and Equipment Assets.: MHC Plantation SDN BHDDocument3 pagesSection B: Property, Plant and Equipment Assets.: MHC Plantation SDN BHDYong JinNo ratings yet

- IFRS 16 2022 ExamplesDocument15 pagesIFRS 16 2022 ExamplesSergiu BoldurescuNo ratings yet

- Tax Accounting: Tax On Profit of Juridical PersonsDocument42 pagesTax Accounting: Tax On Profit of Juridical PersonsBasma MohamedNo ratings yet