Professional Documents

Culture Documents

Ejercicios Equivalencias Canada-Sullivan-Kulonda

Uploaded by

Moises David Herrera PalominoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ejercicios Equivalencias Canada-Sullivan-Kulonda

Uploaded by

Moises David Herrera PalominoCopyright:

Available Formats

John R. Canada, William; G. Sullivan, Dennis; J. Kulonda.

Capital investment analysis for engineering and management, 3rd ed. 2005,

Pearson Prentice Hall

Chapter 4

Computations InvoIving Interest

What equal monthly investment is required over a period of 360 months to achieve a balance of

$2,000.000 in an investment account that pays monthly interest of 1/2%?

How many monthly payments are necessary to repay a loan of $15,000 with an interest rate of 1%

per month and end-of-month payments of $250?

Using an 8% annual compound interest rate, what investment today is needed in order to

withdraw $2,000 annually for 10 years? Assume the first withdrawal occurs in one year. What

if the first withdrawal does not occur for 5 years?

When Juan was 25, he decided to begin planning for retirement in 40 years. Beginning

with his 26th birthday, he invested $5,000 annually in an account that paid annual compound

interest of 6%. How much was in the account immediately after his 40th deposit?

Maria purchased a refrigerator for $1,000. The store financed the refrigerator by charging 0.5%

monthly interest on the unpaid balance. If the refrigerator is paid for with 30 equal end-of-

month payments, what will be the size of the monthly payments? If the first payment is not

made until I year after the purchase, what will be the size of the monthly pavments?

A $100,000 investment is made over a 10-year period. A return of $23.000 occurs at the end of the

first year. Each successive year yields a return that is $2,000 less than the previous year's

return. If money is worth 8%, what is the equivalent present worth for the investment? What

is the equivalent annual worth for the investment? What is the equivalent future worth for

the investment?

Marcida invests $50,000 in a fund that provides incentives for long-range investments. During the

first year, the fund pays interest at an annual compound rate of 4%. Thereafter, the interest

rate earned on the cumulative investment balance increases by 1/4% per year. Hence, the

account will pay annual compound interest of 10% during the 25th year of the deposit. How

much will the investment be worth after 25 years?

What single sum of money today is equivalent to five future cash flows, with the first cash flow of

$5,000 occurring 5 years from today? Subsequent cash flows are $500 smaller than the

previous cash flow. Money is worth 8% compounded annually.

You might also like

- Simple, Compound Interest and Annuity Problems For Special ClassDocument2 pagesSimple, Compound Interest and Annuity Problems For Special ClassPaolo PerezNo ratings yet

- Time Value of Money ProblemsDocument2 pagesTime Value of Money ProblemssabyasachibosuNo ratings yet

- Tutorial 5 TVM Application - SVDocument5 pagesTutorial 5 TVM Application - SVHiền NguyễnNo ratings yet

- Chapter 2 QDocument4 pagesChapter 2 QKiều LinhNo ratings yet

- TVM Exercise - FullDocument2 pagesTVM Exercise - FullYudita Dwi Nur'AininNo ratings yet

- Tutorial 4 TVM ApplicationDocument4 pagesTutorial 4 TVM ApplicationTrần ThảoNo ratings yet

- Bonds N Stock All Ques TogetherDocument5 pagesBonds N Stock All Ques TogetherSufyan AshrafNo ratings yet

- Exam Financial Mathematics 15122023Document2 pagesExam Financial Mathematics 15122023nguyen16023No ratings yet

- Problem Set #2 Financial Management Professor KuhleDocument2 pagesProblem Set #2 Financial Management Professor KuhleYuRi LuvNo ratings yet

- Tutorial TVM - S1 - 2020.21Document4 pagesTutorial TVM - S1 - 2020.21Bảo NhiNo ratings yet

- Tutorial 2Document3 pagesTutorial 2jhagantiniNo ratings yet

- 2023 - Tute 4 - Time Value of MoneyDocument3 pages2023 - Tute 4 - Time Value of MoneyThe flying peguine CụtNo ratings yet

- 2023 - Tute 4 - Time Value of MoneyDocument3 pages2023 - Tute 4 - Time Value of MoneyThe flying peguine CụtNo ratings yet

- EECODocument6 pagesEECOJohnNo ratings yet

- Tutorial TVM - S1 - 2020.21Document4 pagesTutorial TVM - S1 - 2020.21anon_355962815No ratings yet

- Sec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffDocument4 pagesSec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffNaveen KumarNo ratings yet

- Sums Time ValueDocument2 pagesSums Time ValueMavani snehaNo ratings yet

- Tutorial TVMDocument5 pagesTutorial TVMMi ThưNo ratings yet

- Corp Finance Hw1Document5 pagesCorp Finance Hw1Tran Tuan LinhNo ratings yet

- Exercises 1Document4 pagesExercises 1Dilina De SilvaNo ratings yet

- Tutorial 2Document4 pagesTutorial 2Funny CatNo ratings yet

- Week1 in Class ExerciseDocument12 pagesWeek1 in Class Exercisemuhammad AdeelNo ratings yet

- Tutorial 2Document5 pagesTutorial 2K60 Trần Công KhảiNo ratings yet

- BONDS and STOCKDocument3 pagesBONDS and STOCKSufyan AshrafNo ratings yet

- AnnuityDocument10 pagesAnnuityJiru Kun0% (1)

- Compound Int WsDocument2 pagesCompound Int WsClydeLisboaNo ratings yet

- Es FOR TIME VALUE OF MONEYDocument6 pagesEs FOR TIME VALUE OF MONEYphuongnhitran26No ratings yet

- TVM CWDocument4 pagesTVM CWDua hussainNo ratings yet

- Tutorial QuestionsDocument15 pagesTutorial QuestionsWowKid50% (2)

- ImranOmer - 37 - 15663 - 4 - Time Value Money Practice Questions (Revised)Document3 pagesImranOmer - 37 - 15663 - 4 - Time Value Money Practice Questions (Revised)EmaanNo ratings yet

- Mathematics of Finance BMT-101, Business Mathematics-I Course Instructor - Mozumdar Arifa AhmedDocument1 pageMathematics of Finance BMT-101, Business Mathematics-I Course Instructor - Mozumdar Arifa AhmedNahiyan Islam ApuNo ratings yet

- TUTORIAL TVM Feb17Document5 pagesTUTORIAL TVM Feb17Thu Uyên Trần ThiNo ratings yet

- Plates Annuity, Gradient, PerpetuityDocument7 pagesPlates Annuity, Gradient, PerpetuityMarianne Nicole DespiNo ratings yet

- DraftDocument2 pagesDraftYUDITA NUR'AININNo ratings yet

- Es 21-Quiz No. 1 Guimbarda, KientDocument5 pagesEs 21-Quiz No. 1 Guimbarda, KientKIENT GUIMBARDANo ratings yet

- Solved ProblemsDocument44 pagesSolved ProblemsGlyzel Dizon0% (1)

- Time Value of Money 1Document5 pagesTime Value of Money 1k61.2211155018No ratings yet

- FINMA1 - Time Value of Money Practice ProblemsDocument1 pageFINMA1 - Time Value of Money Practice Problemseath__No ratings yet

- ES 301 SeatWork 1Document2 pagesES 301 SeatWork 1trixie marie jamoraNo ratings yet

- FINC1302 - Exer&Asgnt - Revised 5 Feb 2020Document24 pagesFINC1302 - Exer&Asgnt - Revised 5 Feb 2020faqehaNo ratings yet

- Chapter 4 - Time Value of MoneyDocument4 pagesChapter 4 - Time Value of MoneyTruc Khanh Pham NgocNo ratings yet

- Discount, Denoted by D Which Is A Measure of Interest Where The Interest IsDocument3 pagesDiscount, Denoted by D Which Is A Measure of Interest Where The Interest IsNguyễn Quang TrườngNo ratings yet

- Exam in StatDocument11 pagesExam in StatA-nn Castro NiquitNo ratings yet

- Tutorial Simple Interest & Rate of ReturnDocument1 pageTutorial Simple Interest & Rate of ReturnNe PaNo ratings yet

- Exercises - Corporate Finance 1Document12 pagesExercises - Corporate Finance 1Hông HoaNo ratings yet

- Faculty of Economics and Business Universiti Malaysia Sarawak Business Mathematics EBQ1043 Tutorial 8Document2 pagesFaculty of Economics and Business Universiti Malaysia Sarawak Business Mathematics EBQ1043 Tutorial 8Li YuNo ratings yet

- Time Value of Money QuestionDocument1 pageTime Value of Money Questionਨਿਖਿਲ ਬਹਿਲ100% (1)

- Time Value of Money Problems:: 8. You Invest $10,000. During The First Year The Investment Earned 20%Document3 pagesTime Value of Money Problems:: 8. You Invest $10,000. During The First Year The Investment Earned 20%UmerMajeedNo ratings yet

- Engecon ReviewerDocument2 pagesEngecon Reviewerdaday el machoNo ratings yet

- Time Value of MoneyDocument1 pageTime Value of MoneyJustine Mae AgapitoNo ratings yet

- Time Value of MoneyDocument9 pagesTime Value of Moneyelarabel abellareNo ratings yet

- Tutorial 1Document4 pagesTutorial 1Thuận Nguyễn Thị KimNo ratings yet

- Plates EconDocument2 pagesPlates EconAizhia Marielle De La CruzNo ratings yet

- ProblemsDocument3 pagesProblemsÐhammaþriyaKamßleNo ratings yet

- TVM WorksheetsDocument4 pagesTVM WorksheetsRia PiusNo ratings yet

- TVM WorksheetsDocument4 pagesTVM WorksheetsRia Pius100% (1)

- EconomicsDocument11 pagesEconomicsJorosh Laurente DelosoNo ratings yet

- Investing for Interest 6: My Favorite High-Yield Savings Account: MFI Series1, #82From EverandInvesting for Interest 6: My Favorite High-Yield Savings Account: MFI Series1, #82No ratings yet

- What if Your House Paid Dividends?: Do You Understand Leverage and Investing?: MFI Series1, #41From EverandWhat if Your House Paid Dividends?: Do You Understand Leverage and Investing?: MFI Series1, #41Rating: 1 out of 5 stars1/5 (1)

- Foreign Exchange MathDocument6 pagesForeign Exchange MathJoyanta Sarkar100% (1)

- FIRS's Circular On The Tax Implications of The Adoption of The IFRSDocument19 pagesFIRS's Circular On The Tax Implications of The Adoption of The IFRSOnaderu Oluwagbenga EnochNo ratings yet

- Card Holder Dispute FormDocument1 pageCard Holder Dispute Formcool3420No ratings yet

- Gic 115Document6 pagesGic 115Vilas DesaiNo ratings yet

- Merchant Banking and Financial ServicesDocument42 pagesMerchant Banking and Financial Servicesanita singhalNo ratings yet

- BCOM V Sem - Principles of Insurance Business - Unit II NotesDocument3 pagesBCOM V Sem - Principles of Insurance Business - Unit II NotesMona Sharma DudhaleNo ratings yet

- Gulf Resorts Inc. v. Philippine Charter Insurance Corp. G.R. No. 156167 May 16 2005Document3 pagesGulf Resorts Inc. v. Philippine Charter Insurance Corp. G.R. No. 156167 May 16 2005Abilene Joy Dela Cruz100% (1)

- 34 Analysis of Demat Account and Online Trading HimanshuDocument74 pages34 Analysis of Demat Account and Online Trading HimanshuVasant Kumar VarmaNo ratings yet

- Canara Bank ChargesDocument8 pagesCanara Bank Chargesaca_trader100% (1)

- Acctstmt HDocument2 pagesAcctstmt Hmaakabhawan26No ratings yet

- MritunjayDocument6 pagesMritunjaykaydev1No ratings yet

- Analysis of Mutual Fund & Portfolio Management in Mutual Fund For Motilal Oswal Securities by Kalpa KabraDocument59 pagesAnalysis of Mutual Fund & Portfolio Management in Mutual Fund For Motilal Oswal Securities by Kalpa KabravishalbehereNo ratings yet

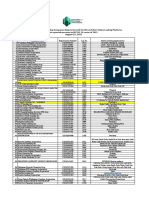

- List of Financing and Lending Companies Registered With The SEC and Their Online Lending Platforms As Reported Pursuant To SEC MC 19, Series of 2019Document2 pagesList of Financing and Lending Companies Registered With The SEC and Their Online Lending Platforms As Reported Pursuant To SEC MC 19, Series of 2019Clark Adrian De Asis. Distor0% (1)

- Conversion Active LandlinesDocument8 pagesConversion Active LandlinesRitsheNo ratings yet

- 213 Keppel Cebu Vs Pioneer InsuranceDocument3 pages213 Keppel Cebu Vs Pioneer InsuranceHarry Dave Ocampo PagaoaNo ratings yet

- BUSANA1 Chapter 4: Sinking FundDocument17 pagesBUSANA1 Chapter 4: Sinking Fund7 bitNo ratings yet

- Premium Paid Acknowledgement PDFDocument1 pagePremium Paid Acknowledgement PDFPragna NachikethaNo ratings yet

- Cbse Affiliation 2020-21 PDFDocument2 pagesCbse Affiliation 2020-21 PDFAkhilesh Jain50% (2)

- 2090-1600-Const-T-03 R1Document497 pages2090-1600-Const-T-03 R1sefpl_delhi100% (1)

- 12 Favourite Sales Pitches of A Life Insurance 1215321666163853 9Document6 pages12 Favourite Sales Pitches of A Life Insurance 1215321666163853 9D.V.SUBBAREDDYNo ratings yet

- Annuity CommissionsDocument18 pagesAnnuity CommissionsScott Dauenhauer, CFP, MSFP, AIFNo ratings yet

- 138 JCB MachineDocument11 pages138 JCB Machineashutosh dimriNo ratings yet

- Enter Amount To Be Added in Wallet: Search For A Product, Brand or CategoryDocument1 pageEnter Amount To Be Added in Wallet: Search For A Product, Brand or CategoryHowaxNo ratings yet

- M&M First Draft CommentsDocument43 pagesM&M First Draft CommentsGedionNo ratings yet

- GWHT PDFDocument22 pagesGWHT PDFAndinetNo ratings yet

- Dec 2021. VattamDocument11 pagesDec 2021. VattamsadaSivaNo ratings yet

- Islamic Law of ContractsDocument81 pagesIslamic Law of ContractsJahanzeb Hussain Qureshi67% (3)

- Cash and CequizDocument5 pagesCash and CequizMaria Emarla Grace CanozaNo ratings yet

- Robert Kiyosaki 60 Menit Jadi KayaDocument11 pagesRobert Kiyosaki 60 Menit Jadi KayaAnas ApriyadiNo ratings yet

- Govacctg New PDFDocument190 pagesGovacctg New PDFJasmine Lim100% (1)