Professional Documents

Culture Documents

Molnar Plea Agreement

Uploaded by

MNCOOhioOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Molnar Plea Agreement

Uploaded by

MNCOOhioCopyright:

Available Formats

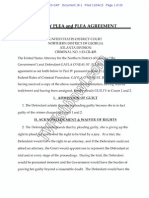

r'L}:D,

JOHN P.

IN THE UNITED STATES DISTRICT COURT CLERK

FOR THE SOUTHERN DISTRICT OF OHIO

EASTERN DIVISION -5 PM 3: 46'

UNITED STATES OF AMERICA

v.

JOSEPH P. MOLNAR

PLEA AGREEMENT

CASE NO.

JUDGE

The United States Attorney for the Southern District of Ohio and the defendant,

JOSEPH P. MOLNAR hereby enter into the following Plea Agreement pursuant to Rule ll(c) of

the Federal Rules of Criminal Procedure:

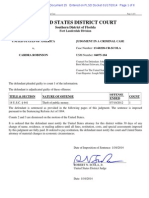

1. Defendant JOSEPH P. MOLNAR will enter pleas of guilty to Count 1 and Count

2 of the Information previously filed with the Court, charging him with embezzlement from a

financial institution in violation of Title 18, United States Code, Section 656, and making false

statements on a tax return in violation of Title 26, United States Code, Section 7206(1),

respectively.

2. Defendant JOSEPH P. MOLNAR understands that the maximum penalty that

may be imposed pursuant to his plea of guilty to Count I of the Information is a term of

imprisonment of not more than 30 years, a fine of not more than I ,000,000, restitution to the

victims ofhis crimes, and up to 5 years of supervised release. Defendant MOLNAR

understands that the maximum penalty that may be imposed pursuant to his plea of guilty to

Count 2 of the Information is a term of imprisonment of not more than five years; a fine of not

more than $250,000; restitution to the victims of his crimes, specifically the Department of the

Treasury, in the amount of approximately $987,0 11.66; and up to 3 years of supervised release.

3. Defendant JOSEPH P. MOLNAR will pay a special assessment of$200 as

Case: 2:14-cr-00194-ALM Doc #: 2 Filed: 09/05/14 Page: 1 of 6 PAGEID #: 3

required in 18 U.S.C. 3013. This assessment shall be paid by defendant before sentence is

imposed and defendant will furnish a receipt at sentencing. The payment shall be made to the

United States District Court, at the Clerk's Office, 85 Marconi Boulevard, Columbus, Ohio

43215.

4. Defendant JOSEPH P. MOLNAR further understands that he has the following

rights, among others:

a. To be represented by an attorney at every stage of the proceeding,

and that, if necessary, one will be appointed to represent him;

b. To plead not guilty and to be tried by a jury;

c. To be assisted by counsel during such trial;

d. To confront and cross-examine adverse witnesses;

e. To use compulsory process to summon witnesses for the defense;

f. Not to be compelled to testify; and

g. To be presumed innocent throughout trial until and unless found

guilty by a jury beyond a reasonable doubt.

5. Defendant JOSEPH P. MOLNAR understands that if his pleas of guilty to Counts

I and 2 of the Information are accepted by the Court there will not be a further trial of any kind,

so that by pleading guilty he waives, or gives up, his right to a trial.

6. Defendant JOSEPH P. MOLNAR understands that the Court intends to question

him on the record about the offense to which he is pleading guilty, which questioning may be

under oath and which could provide a basis for a later prosecution of this defendant for perjury

or false statements if he does not tell the truth.

7. Defendant JOSEPH P. MOLNAR agrees to testify truthfully and completely

concerning all matters pertaining to the Information returned herein and to any and all other tax

Case: 2:14-cr-00194-ALM Doc #: 2 Filed: 09/05/14 Page: 2 of 6 PAGEID #: 4

violations and bank embezzlement occurring in the Southern District of Ohio in which he may

have been involved or as to which he may have knowledge. Defendant further agrees to

provide a complete statement to authorities of the United States concerning such matters prior to

sentencing or at any other time that may be requested by the United States Attorney or a federal,

state or local investigative agency. Defendant agrees to submit to supplemental debriefings on

such matters whenever requested by federal, state or local authorities.

Pursuant to 181.8 of the United States Sentencing Guidelines ("Guidelines"), the

government agrees that any self-incriminating information so provided will not be used against

the defendant in determining the applicable Guidelines range for sentencing, or as a basis for

upward departure from the advisory Guidelines range.

8. Defendant JOSEPH P. MOLNAR is aware that the United States Sentencing

Guidelines and Policy Statements are no longer mandatory in determining his sentence.

However, the defendant also understands that said guidelines and policy statements will be given

consideration by the District Court, in conjunction with all other sentencing factors set forth in

18 U.S.C. 3553(a), to determine an appropriate sentence. The defendant is further aware that

the District Court has jurisdiction and authority to impose any sentence within the statutory

maximum set forth for the offense to which the defendant pleads guilty. Defendant is aware

that the Court has not yet determined a sentence. Defendant is also aware that any estimate of

the probable sentencing range under the United States Sentencing Guidelines that the defendant

may have received from the defendant's counsel, the United States, or the probation office is a

prediction, not a promise, and is not binding on the United States, the probation office, or the

Court. The United States makes no promise or representation concerning the sentence that the

defendant will receive, and the defendant cannot withdraw a guilty plea based upon the actual

3

Case: 2:14-cr-00194-ALM Doc #: 2 Filed: 09/05/14 Page: 3 of 6 PAGEID #: 5

sentence.

9. Understanding that the following agreements under the advisory Guidelines

cannot bind the Probation Department or the Court, the United States Attorney for the Southern

District of Ohio and Defendant JOSEPH P. MOLNAR, the parties to this Plea Agreement,

hereby make the following agreements under the advisory Guidelines:

a. The parties agree that with respect to Count I of the Information, the

amount of loss described is attributed to JOSEPH P. MOLNAR's embezzlement from

his employer, the Huntington National Bank and its affiliates, and that the amount of

loss is approximately $4,076,189.44, and between $2.5 million and $7 million, which

constitutes the defendant, JOSEPH P. MOLNAR's relevant conduct for Count I as

the term is applied under the Guidelines; and the resulting base offense level is 25.

b. The parties agree that for Count 2 the amount of tax loss described is

attributed to JOSEPH P. MOLNAR's false statements on his personal tax returns

representing his income for the years 2008, 2009, 20 I 0, 20 II, and 2012, and that the

amount of such loss is approximately $987,011.66, and between $400,000 and

$1,000,000, which amount constitutes the defendant, JOSEPH P. MOLNAR's

relevant conduct for Count I as the term is applied under the Guidelines, and that the

resulting base offense level is 20.

c. The parties agree that pursuant to 3El.l(a) of the Guidelines, at the time

of his plea, the defendant, JOSEPH P. MOLNAR, has accepted responsibility for the

offense and therefore is entitled to a two-level reduction in the applicable base

offense level under this section of the Sentencing Guidelines. The parties further

agree that this defendant has timely notified the United States as to his intention to

plead guilty and therefore may be entitled to an additional one-point reduction of his

offense level under Guideline 3E 1.1 (b).

d. The parties agree that the application and final sentencing guideline

calculations for defendant JOSEPH P. MOLNAR will be completed by the probation

office, and that the Guidelines for the offenses may be "grouped," pursuant to the

rules of the United States Sentencing Guidelines.

10. The United States Attorney for the Southern District of Ohio agrees that if

Defendant JOSEPH P. MOLNAR provides substantial assistance in the investigation or

prosecution of others who have committed criminal offenses, the United States Attorney may

move the Court pursuant to 18 U.S.C. 3553(e) and/or SKI. I of the Guidelines for an

4

Case: 2:14-cr-00194-ALM Doc #: 2 Filed: 09/05/14 Page: 4 of 6 PAGEID #: 6

appropriate departure from the otherwise applicable Guidelines range for Defendant's sentence

and will in connection therewith make known to the Court the nature and extent of Defendant's

assistance. Defendant understands that whether such motion should be made lies within the

discretion of the United States Attorney and that whether and to what extent such motion should

be granted are solely matters for determination by the Court.

II. If such a plea of guilty is entered, and not withdrawn, and the Defendant JOSEPH

P. MOLNAR acts in accordance with all other terms of this agreement, the United States

Attorney for the Southern District of Ohio agrees not to file additional criminal charges against

Defendant JOSEPH P. MOLNAR based on his activities charged in the Information or based on

other embezzlement and tax violations occurring in the Southern District of Ohio prior to the

date of the Information and as to which Defendant gives testimony or makes statements pursuant

to this agreement.

12. By virtue of his plea of guilty to Counts I and 2 of the Information, this defendant

understands that he is not a prevailing party as defined by 18 U.S.C. 3006A and hereby

expressly waives his right to sue the United States.

13. Defendant further understands and accepts that in addition to any criminal

sanctions, defendant may be subject to other civil and/or administrative consequences, including,

but not limited to civil liability and loss of any professionallicense(s).

5

Case: 2:14-cr-00194-ALM Doc #: 2 Filed: 09/05/14 Page: 5 of 6 PAGEID #: 7

14. No additional promises, agreements, or conditions have been made relative to this

matter other than those expressly set forth herein, and none will be made unless in writing and

signed by all parties.

'(;--). 7 ._ ( f

(Date)

6

R. WILLIAM MEEKS (0014

Meeks & Thomas Co.

511 S. High Street

Columbus, OH 432 I 5-5602

Phone: (614) 228-4141

Fax: (614) 228-0899

CARTER M. STEWART

. FULTON (VA 72885)

Assistant United States Attorney

303 Marconi Blvd., Suite 200

Columbus, Ohio 43215

(614) 469-5715

Case: 2:14-cr-00194-ALM Doc #: 2 Filed: 09/05/14 Page: 6 of 6 PAGEID #: 8

You might also like

- Motions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsFrom EverandMotions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsRating: 4.5 out of 5 stars4.5/5 (14)

- Sample Motion to Vacate, Motion to Dismiss, Affidavits, Notice of Objection, and Notice of Intent to File ClaimFrom EverandSample Motion to Vacate, Motion to Dismiss, Affidavits, Notice of Objection, and Notice of Intent to File ClaimRating: 5 out of 5 stars5/5 (21)

- Rule 11 Plea Agreement: Rev. September2019Document18 pagesRule 11 Plea Agreement: Rev. September2019Str8UpNo ratings yet

- Small Claims and Summary ProcedureDocument9 pagesSmall Claims and Summary ProcedureAra LimNo ratings yet

- Bar and Restaurant Assistance FundDocument126 pagesBar and Restaurant Assistance FundMNCOOhio100% (1)

- Article Vi Philippine Constitution (Legistative Department)Document92 pagesArticle Vi Philippine Constitution (Legistative Department)Dayledaniel SorvetoNo ratings yet

- 49 Gamilla v. Burgundy Realty CorporationDocument1 page49 Gamilla v. Burgundy Realty CorporationLloyd Edgar G. ReyesNo ratings yet

- PaulDocument9 pagesPaulCLDC_GSNo ratings yet

- Reckless ImprudenceDocument7 pagesReckless ImprudenceAJ SantosNo ratings yet

- Criminal Law 2 Mid Term Exam 2014Document16 pagesCriminal Law 2 Mid Term Exam 2014sarah ganiasNo ratings yet

- Runnels PLEA AgreementDocument10 pagesRunnels PLEA AgreementPINAC NewsNo ratings yet

- David Mack Jr. Plea DealDocument8 pagesDavid Mack Jr. Plea DealIsland Packet and Beaufort GazetteNo ratings yet

- Federal Criminal Plea Agreement For Rachel DuncanDocument10 pagesFederal Criminal Plea Agreement For Rachel DuncanThe State NewspaperNo ratings yet

- Agreement To Reduce Jeffrey Skilling's SentenceDocument10 pagesAgreement To Reduce Jeffrey Skilling's SentenceDealBookNo ratings yet

- Zacher Plea AgreementDocument7 pagesZacher Plea AgreementCLDC_GSNo ratings yet

- Apollo Nida Plea AgreementDocument21 pagesApollo Nida Plea AgreementAll About The TeaNo ratings yet

- Raylon Jones PleaDocument11 pagesRaylon Jones Pleasteve_gravelleNo ratings yet

- Kadeiera White PleaDocument19 pagesKadeiera White PleaZachary HansenNo ratings yet

- USA v. Berkowitz Doc 11 Filed 29 Jul 14Document12 pagesUSA v. Berkowitz Doc 11 Filed 29 Jul 14scion.scionNo ratings yet

- Sorenson Information and Plea AgreementDocument21 pagesSorenson Information and Plea AgreementPando DailyNo ratings yet

- William Madonna PleaDocument9 pagesWilliam Madonna PleacitypaperNo ratings yet

- US (Szymoniak) V Ace Doc 243-1 U.S. V Lorraine Brown Plea Agreement 12CR00198 M.D.F.L. Nov. 20, 2012Document22 pagesUS (Szymoniak) V Ace Doc 243-1 U.S. V Lorraine Brown Plea Agreement 12CR00198 M.D.F.L. Nov. 20, 2012larry-612445No ratings yet

- Rodgers Carlos PleaDocument9 pagesRodgers Carlos PleaFOX45No ratings yet

- Micky Hammon Plea AgreementDocument13 pagesMicky Hammon Plea AgreementMike CasonNo ratings yet

- Mr. E. PC SE: Greffenson I 4 1 5Document8 pagesMr. E. PC SE: Greffenson I 4 1 5jamiljonnaNo ratings yet

- Stephen J. Ingle Plea AgreementDocument17 pagesStephen J. Ingle Plea AgreementWashington ExaminerNo ratings yet

- Katelyn Curtis PleaDocument11 pagesKatelyn Curtis Pleasteve_gravelleNo ratings yet

- USA V Regis - Plea AgreementDocument11 pagesUSA V Regis - Plea AgreementMax GreenwoodNo ratings yet

- U.S. v. Todd A. BoulangerDocument28 pagesU.S. v. Todd A. BoulangerWashington Post Investigations100% (2)

- Petraeus Plea AgreementDocument5 pagesPetraeus Plea AgreementSyndicated NewsNo ratings yet

- United States District Court For The District of ColumbiaDocument21 pagesUnited States District Court For The District of Columbiainatter1No ratings yet

- William Hillar Plea AgreementDocument10 pagesWilliam Hillar Plea AgreementEmily BabayNo ratings yet

- Case 1:11-cr-00052-WDQ Document 35 Filed 03/30/11 Page 1 of 10Document10 pagesCase 1:11-cr-00052-WDQ Document 35 Filed 03/30/11 Page 1 of 10gabejmartinezNo ratings yet

- Joshua Myers Charges and Plea AgreementDocument17 pagesJoshua Myers Charges and Plea AgreementAlexandra Nicolas, joplinglobe.comNo ratings yet

- Felicity Huffman Plea AgreementDocument6 pagesFelicity Huffman Plea AgreementLaw&CrimeNo ratings yet

- Nicolaos Kantartzis Plea AgreementDocument9 pagesNicolaos Kantartzis Plea AgreementEmily BabayNo ratings yet

- Elias Casiano Plea AgreementDocument13 pagesElias Casiano Plea AgreementEmily BabayNo ratings yet

- 06-29-2016 ECF 799 USA V BRIAN CAVALIER - Plea Agreement As To Brian CavalierDocument5 pages06-29-2016 ECF 799 USA V BRIAN CAVALIER - Plea Agreement As To Brian CavalierJack RyanNo ratings yet

- Jack (Jay) Hu JudgementDocument6 pagesJack (Jay) Hu JudgementEdNo ratings yet

- Oberlton Plea AgreementDocument23 pagesOberlton Plea Agreementwfaachannel8No ratings yet

- Solberg PleaDocument13 pagesSolberg PleaScott HurleyNo ratings yet

- Eastern District of Virginia: in The United States District Court For TheDocument16 pagesEastern District of Virginia: in The United States District Court For TheEmily BabayNo ratings yet

- Yomade Aborishade - Plea AgreementDocument18 pagesYomade Aborishade - Plea AgreementEmily BabayNo ratings yet

- Marco Gaudino PleaDocument32 pagesMarco Gaudino PleaABC Action NewsNo ratings yet

- Dye Guilty PleaDocument20 pagesDye Guilty PleaArs TechnicaNo ratings yet

- United States v. Ramos-Palomino, 10th Cir. (2003)Document6 pagesUnited States v. Ramos-Palomino, 10th Cir. (2003)Scribd Government DocsNo ratings yet

- Whitehead La Rayne PleaDocument13 pagesWhitehead La Rayne PleaSouthern Maryland OnlineNo ratings yet

- Signed Stacie Getsinger Plea Letter and Statement of OffenseDocument14 pagesSigned Stacie Getsinger Plea Letter and Statement of OffenseABC News 4No ratings yet

- Judgment/probation OrderDocument5 pagesJudgment/probation Orderblak_dawgNo ratings yet

- USA V Basim Sabri Sentencing Stipulations 2Document9 pagesUSA V Basim Sabri Sentencing Stipulations 2ghostgripNo ratings yet

- Stal Jerome PleaDocument9 pagesStal Jerome PleaPeter HermannNo ratings yet

- Michael Papantonakis PleaDocument9 pagesMichael Papantonakis PleacitypaperNo ratings yet

- Acuerdo Empresario José Patín Con Gobierno EEUUDocument9 pagesAcuerdo Empresario José Patín Con Gobierno EEUUDiario LibreNo ratings yet

- YamanohaDocument18 pagesYamanohaNicoleNo ratings yet

- Bunch Best 3 06 CR 00038 WdvaDocument9 pagesBunch Best 3 06 CR 00038 WdvaTF JADENo ratings yet

- Ondrik and Yamatani Brady Notification With Statements of Fact and Plea AgreementsDocument26 pagesOndrik and Yamatani Brady Notification With Statements of Fact and Plea AgreementsD B Karron, PhDNo ratings yet

- Green SH Awn PleaDocument10 pagesGreen SH Awn PleacitypaperNo ratings yet

- Paul Dunham Plea DealDocument12 pagesPaul Dunham Plea DealRaf Sanchez100% (1)

- Ryan Hadeed's Muder-For-Hire Plea Agreement - July 27, 2022 - Miami, FLDocument6 pagesRyan Hadeed's Muder-For-Hire Plea Agreement - July 27, 2022 - Miami, FLOmar Rodriguez OrtizNo ratings yet

- File0 471110444554267Document6 pagesFile0 471110444554267Chaz StevensNo ratings yet

- USA v. Allen Dwight Gailliot Plea AgreementDocument11 pagesUSA v. Allen Dwight Gailliot Plea AgreementCaleb100% (1)

- John Hubert Getsinger Jr. Signed Plea Letter and Statement of OffenseDocument14 pagesJohn Hubert Getsinger Jr. Signed Plea Letter and Statement of OffenseABC News 4No ratings yet

- HW Group Plea AgreementDocument11 pagesHW Group Plea AgreementWACHNo ratings yet

- Gayla St. Julien Plea AgreementDocument20 pagesGayla St. Julien Plea AgreementTVFishbowlNo ratings yet

- U.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)From EverandU.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)No ratings yet

- Hospital Regions and ZonesDocument4 pagesHospital Regions and ZonesMNCOOhioNo ratings yet

- Bar and Restaurant Assistance FundDocument286 pagesBar and Restaurant Assistance FundMNCOOhioNo ratings yet

- Main Street Improvement PlanDocument27 pagesMain Street Improvement PlanMNCOOhioNo ratings yet

- The West End Neighborhood PlanDocument25 pagesThe West End Neighborhood PlanMNCOOhioNo ratings yet

- St. Peter's Reopening PlanDocument9 pagesSt. Peter's Reopening PlanMNCOOhioNo ratings yet

- Covid-19 Reopening GuidanceDocument8 pagesCovid-19 Reopening GuidanceMNCOOhioNo ratings yet

- Park System Master PlanDocument57 pagesPark System Master PlanMNCOOhio100% (1)

- Summary Alert IndicatorsDocument3 pagesSummary Alert IndicatorsMNCOOhioNo ratings yet

- IAFF Local 266Document2 pagesIAFF Local 266MNCOOhioNo ratings yet

- South Main ST MailingDocument6 pagesSouth Main ST MailingMNCOOhioNo ratings yet

- GENERAL Election Candidate/Issues ListDocument33 pagesGENERAL Election Candidate/Issues ListMNCOOhio100% (1)

- Westgate Shopping CenterDocument2 pagesWestgate Shopping CenterMNCOOhioNo ratings yet

- Criminal LawDocument23 pagesCriminal LawAvinash MishraNo ratings yet

- Site Pro-1, Inc. v. Better Metal, LLC - Document No. 17Document13 pagesSite Pro-1, Inc. v. Better Metal, LLC - Document No. 17Justia.comNo ratings yet

- Article 16 of Constitution of India: Equality of Opportunity in Matters of Public EmploymentDocument14 pagesArticle 16 of Constitution of India: Equality of Opportunity in Matters of Public EmploymentAnjali MakkarNo ratings yet

- Saint Michael College of Caraga: CLJ 4-Criminal Law 2 SyllabusDocument2 pagesSaint Michael College of Caraga: CLJ 4-Criminal Law 2 SyllabusYec YecNo ratings yet

- David Salcedo Government ClaimDocument3 pagesDavid Salcedo Government ClaimSan Gabriel ValleyNo ratings yet

- Corporate LawDocument27 pagesCorporate LawSamreenNo ratings yet

- 060 Peralta v. CSCDocument3 pages060 Peralta v. CSCDarrell MagsambolNo ratings yet

- Mufti Taqi Usmani - The Reality of Women Protection BillDocument9 pagesMufti Taqi Usmani - The Reality of Women Protection BillSobiaHasanNo ratings yet

- Lim vs. Court of AppealsDocument2 pagesLim vs. Court of AppealsElaine HonradeNo ratings yet

- Case 31Document3 pagesCase 31Jasmin BayaniNo ratings yet

- 10-Ynot v. IAC G.R. No. 74457 March 20, 1987Document6 pages10-Ynot v. IAC G.R. No. 74457 March 20, 1987Jopan SJNo ratings yet

- Alston v. NIckleson Et Al - Document No. 3Document5 pagesAlston v. NIckleson Et Al - Document No. 3Justia.comNo ratings yet

- Pfda Vs CbaaDocument6 pagesPfda Vs CbaayanieggNo ratings yet

- Worcester vs. Ocampo 22 Phil 42Document3 pagesWorcester vs. Ocampo 22 Phil 42Anonymous BWruIy0FE3No ratings yet

- Tadic Doctrine SynopsisDocument1 pageTadic Doctrine SynopsisJen DioknoNo ratings yet

- Manila: University of The EastDocument34 pagesManila: University of The EastPhilBoardResultsNo ratings yet

- Michael Kapoustin Defeated Justice - Society and Law, SeptemDocument4 pagesMichael Kapoustin Defeated Justice - Society and Law, SeptemMichaelNo ratings yet

- Bongolan vs. Bongolan Ejectment CaseDocument5 pagesBongolan vs. Bongolan Ejectment CaseJM EnguitoNo ratings yet

- People vs. Gacott Jr. 246 SCRA 52 July 13 1995Document12 pagesPeople vs. Gacott Jr. 246 SCRA 52 July 13 1995Amala Fay ChavezNo ratings yet

- PreliminaryDocument59 pagesPreliminaryAkanksha BohraNo ratings yet

- G.R. No. L-30805Document1 pageG.R. No. L-30805Dec JucoNo ratings yet

- Michael J Grace V The Examiner News Et AlDocument9 pagesMichael J Grace V The Examiner News Et AlBrian AlexanderNo ratings yet

- 01 Rizal Cement Co. Inc. v. VillarealDocument12 pages01 Rizal Cement Co. Inc. v. VillarealJaypoll DiazNo ratings yet

- Dacasin V DacasinDocument9 pagesDacasin V DacasinAbi GieNo ratings yet

- Nevada Reports 1989 (105 Nev.) PDFDocument838 pagesNevada Reports 1989 (105 Nev.) PDFthadzigsNo ratings yet