Professional Documents

Culture Documents

Customer Profitability Analysis With Time-Driven Activity-Based Costing: A Case Study in A Hotel

Uploaded by

Siva Krishna Reddy NallamilliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Customer Profitability Analysis With Time-Driven Activity-Based Costing: A Case Study in A Hotel

Uploaded by

Siva Krishna Reddy NallamilliCopyright:

Available Formats

Customer protability analysis

with time-driven activity-based

costing: a case study in a hotel

Ilhan Dalci

Eastern Mediterranean University, Famagusta, Turkey

Veyis Tanis

Business Administration, C ukurova University, Adana, Turkey, and

Levent Kosan

Silifke Vocational Business School, Mersin University, Mersin, Turkey

Abstract

Purpose The purpose of this paper is to show the implementation of customer protability

analysis (CPA) using time-driven activity-based costing (TDABC), in a Turkish hotel.

Design/methodology/approach A case study was conducted in a four-star hotel with 100-room

capacity in the C ukurova region of Turkey. Interviews, direct observations, and documentation

collection were used to collect the data.

Findings The results showed that some of the customer segments which were found unprotable

under the conventional ABC method were determined protable using TDABC. The case study also

revealed the cost of idle resources devoted for front ofce, housekeeping, food preparation, and

marketing activities.

Research limitations/implications Only a single hotel operating in Turkey is examined in this

paper. Further research should focus on implementing CPA using TDABC in other hotels in Turkey

and abroad.

Practical implications Based on the results of the study, the hotel management is better able to

understand protability of different customer segments and implement appropriate strategies.

Moreover, the time equations of TDABC are considered to provide hotel management with an

opportunity to better balance the capacities supplied in departments.

Originality/value There is limited research relating to protability analysis in service companies

in general and in the hotel industry in particular. Therefore, this paper is unique in the sense that it

analyzes the use of TDABC systems for CPA within a real case hotel.

Keywords Activity based costs, Prot, Customers, Hotels, Turkey

Paper type Case study

1. Introduction

Customer cost information is essential for managerial decision making. Therefore,

understanding true costs of serving specic customers is important in any organization.

Companies that understand which customers are more protable and which ones are

not, are armed with valuable information needed to make successful managerial

decisions to improve overall organizational protability (Raaij et al., 2003). Cotton (2005)

and Cooper and Kaplan (1991), also suggest that understanding how current customer

relationships differ in protability enables managers to make better managerial

The current issue and full text archive of this journal is available at

www.emeraldinsight.com/0959-6119.htm

Customer

protability

analysis

609

Received 15 April 2009

Revised 1 September 2009,

22 October 2009,

1 December 2009

Accepted 13 December 2009

International Journal of

Contemporary Hospitality

Management

Vol. 22 No. 5, 2010

pp. 609-637

qEmerald Group Publishing Limited

0959-6119

DOI 10.1108/09596111011053774

decisions. However, obtaining accurate information about customer protability

necessitates the use of an appropriate costing system.

Customer protability analysis (CPA) entails allocation of revenues and costs to

specic customers in a way that the protability of individual customers can be

calculated. Owing to the increased size and organizational complexity of service rms,

Kaplan and Narayanan (2001) state that understanding CPA is especially important for

service companies. Indeed, for service companies, CPA is more important than

production companies because the cost of providing a service is generally determined

by customer behavior. According to Zeithaml and Bitner (1996), the cost of nding and

gaining a new customer in service companies is ve times greater than the cost of

retaining current customers. Therefore, successful implementation of CPA in order to

retain protable relationships with current customers is essential for service

companies. Moreover, Cotton (2005) asserts that the effective use of CPA enables

service companies to increase customer satisfaction and boost protability.

According to Cooper (1988), the use of activity-based costing (ABC) enhances the

traditional contribution margin approach and the quality of CPA. The ABC system

was promoted by Cooper and Kaplan in the mid-1980s, as an alternative costing

system to the traditional one, based on their experiences with some production

companies in the USA (Gunasekaran and Sarhadi, 1998). Subsequent studies dealt with

the deciencies of traditional costing systems in automated production environments

(Innes, 1999; Baird et al., 2004). The activity-based approach to overhead costs is an

extension of the traditional volume-based costing that treats manufacturing overhead

as a complex set of costs with multiple cost-drivers (Drake et al., 2001). Rotch (1990)

points out that the conditions necessary for manufacturing rms to successfully

implement ABC are necessary for service companies as well.

The ABC approach assumes that products or customers generate activities, and the

activities consume resources (Cooper, 1988). ABC is based on a two-stage allocation

process. First of all, the costs of resources are allocated to the activities using rst-stage

cost drivers, and then the costs of activities are apportioned to cost objects by means of

volume and non-volume related drivers (Cooper, 1990). That is, the activity costs are

allocated to the cost objects based on the relevant cost drivers (i.e. number of machine

hours, number of setups, number of design specications, and number of customer

visits). The cost drivers are linkage between activities and cost objects (Cooper, 1988,

1990; Cooper and Kaplan, 1992). The rise of ABC has led to the understanding that not

every customer consumes the same level of activities and resources. Moreover,

resources that particular activities consume are measured in terms of cost driver units.

This is due to the fact that, while traditional cost systems rely on arbitrary cost

allocations of overhead costs, ABC classies cost pools according to the activities (unit,

batch, product, and facility levels) performed within the organization (Kaplan and

Cooper, 1988). Understanding the hierarchical levels of the costs of ABC enables

managers to better understand cost causation, and hence make better decisions. Thus,

with ABC, managers are better equipped to understand which customers are protable

and which ones are not (Kaplan and Cooper, 1998). Additionally, according to Cooper

and Kaplan (1992), the use of ABC by organizations has led to increased protability.

Despite the fact that the ABC system can be a sufcient costing method, it has some

drawbacks. First, due to complexity of the activities performed within organizations,

ABC may take too much time to be implemented (Kaplan and Anderson, 2004). Second,

IJCHM

22,5

610

when activities, that contain more than one subtask with different cost drivers, are

intensied, ignoring that complexity may result in the misallocation of the costs. Third,

since the ABC system needs to be updated regularly, it becomes too costly to

re-interview and re-survey people engaged in the activities (Kaplan and Anderson,

2004). The downsides of traditional ABC system alerted Kaplan and Anderson to

introduce a new costing method called time-driven ABC (TDABC) system to address

the above-mentioned limitations. However, using TDABC in order to bring solutions to

the problems of conventional costing systems does not mean that ABC should be

completely abandoned. Proponents of TDABC argue that it removes time-consuming

and costly interviews and surveys which have been a major barrier to the

implementation of a traditional ABC system, as well as it allows cost driver rates to be

calculated based on the practical capacity of the resources supplied (Kaplan and

Anderson, 2007b).

Under a traditional ABC system, the costs of activity-cost pools, are apportioned

amongst cost objects using activity drivers (Kaplan and Cooper, 1998). On the other

hand, under a TDABC system, these costs are allocated to the cost objects on the basis of

time units consumed by the activities (Kaplan and Anderson, 2004). The TDABC

approach requires identifying resources needed to perform the activities, as it is done

under a traditional approach. It also requires time needed to perform the activities and

the practical rather than the theoretical capacity of the resources supplied. Theoretical

capacity equals the theoretically available working minutes, whereas practical capacity

is expressed as the amount of time that employees can work without idle time (Kaplan

and Anderson, 2007a). The practical capacity of the resources excludes the time that

employees spend on activities (such as having a rest and taking a break) which are

unrelated to actual work performance. Two important aspects of a TDABC system are:

estimating the practical capacity of the resources supplied and the cost of these

resources. Dividing the total cost of resources supplied by the practical capacity yields

the cost per time unit. Then, the time neededfor performing the activities is multiplied by

the cost per time unit in order to assign the costs to products or customers. With the help

of the time equations of TDABC, the time needed to performan activity can be estimated

without any need to continually re-interview people. These time equations can include

multiple time drivers if an activity is driven by more than one driver. Obviously, the

TDABCapproach, withits time equations, makes it possible to knowhowmany minutes

that staff members spend on activities in a particular time period. Therefore, the time

equations of TDABC can provide larger transparency than a traditional ABC system.

With TDABC, it is also possible to pinpoint which customers consume the largest

amount of time and resources (Kaplan and Anderson, 2004).

Research conducted on the analysis of costing systems, in the service industry in

general and the tourism industry in particular, is very limited. There has also been

little innovation regarding cost accounting practices in the hospitality industry (Potter

and Schmidgall, 1999). Fay et al. (1976) demonstrated the use of conventional costing

systems in the hospitality industry. Nordling and Wheeler (1992) implemented CPA in

the Hilton Hotel in Las Vegas. However, analysis of the activities in allocating the

overhead costs was not completed in that study. Although the use of ABC in the

application of CPA in the hospitality industry has attracted little interest, there has

been detailed research about costing practices in tourism enterprises after 1999. In a

case study conducted in a hotel by Noone and Grifn (1999), activities were determined

Customer

protability

analysis

611

at macro and micro level and the cost of these activities were assigned to specic

customers using ABC. Raab and Mayer (2003), surveyed restaurant controllers in the

USA and they found that the use of ABC was almost non-existent in the restaurants.

They also discovered that the use of ABC could be appropriate for the restaurants due

to the characteristics inherent in the restaurant industry. Raab et al. (2005) tested a

model for ABC in a buffet style restaurant in Hong Kong. Raab and Mayer (2007)

analyzed how menu engineering (ME) can be integrated with ABC to determine

whether or not the integration of ME with ABC can boost the protability of a dinner

buffet in a restaurant in Hong Kong. Ultimately, Raab et al. (2009) applied

activity-based pricing in a restaurant setting. The ndings of that study show that

ABC could be used by restaurant managers to better analyze the cost structure of their

restaurants.

Nevertheless, there are many issues, relating to cost and management accounting

practices in the hospitality industry, that deserve research attention (Pellinen, 2003;

Dittman et al., 2008). Several researchers as mentioned above have advocated the use of

ABC in the hospitality industry. However, the costs of activities have not been

analyzed using TDABC in the hospitality industry even though this method has been

applied in other industries. Pernot et al. (2007) used a case study in a university to show

how to use a TDABC system for inter-library services. They argue that TDABC can

improve the cost management of all library services because it enables library

managers to take appropriate actions to reduce the time needed for specic requests of

library customers. Everaert et al. (2008) described a case in a distribution company and

showed that ignoring the complexity of activities containing more than one subtask

with different time drivers, resulted in a misallocation of 54 percent of the costs when

the traditional ABC system rather than a TDABC approach was used. In a recent

study, Demeere et al. (2009) showed how to implement a TDABC model for ve

outpatient clinic departments through a case study. They uncovered that the use of a

TDABC system provided the healthcare managers and physicians with valuable

information which assisted them in operational improvements, making protability

analysis for departments, and deciding on future investments.

The general aim of this paper is to show the implementation of CPA with TDABC in

a hotel operating in the C ukurova region in Turkey. The case hotel is located in the city

of Mersin. The city of Mersin is important for the regions economy because trade

among Turkey, the Middle East, and Europe takes place through the Mersin Port.

Therefore, most of the businesspeople conducting business through the Mersin Port

prefer to stay in the hotels which are located in the city. Thus, hotels have signicant

impact on the economic development of the C ukurova region. In that respect,

implementing CPA successfully for accurate and effective managerial decision making

is important for the managers of the hotels located in this region.

2. The case study and research design

This study adopted both convenience and purposive sampling techniques to select the

research sample (Altinay and Paraskevas, 2008). One of the co-authors of this study

previously worked for the hotel to have experience during his summer holidays. Thus,

he knew the managers and asked for permission to conduct a research of this kind.

He met the hotels managers for a preliminary discussion and he realized that the

case hotel was measuring customer protability by using a traditional ABC system.

IJCHM

22,5

612

Then, he explained to the managers the benets of conducting this case study in their

hotel. The managers of the hotel accepted to give permission for the research with a

condition that, due to condentiality reasons, the hotels name should not be disclosed

in the paper. This request was taken into account and the researchers commenced the

study in the hotel and concluded it within one year.

The physical and environmental information about the hotel is as follows: it is a

four-star hotel operating with 100 rooms in the C ukurova region in Turkey. The hotel

operates at an annual occupancy rate of 60 percent. In addition to a banqueting hall,

steam bath, meeting room, bar, and business centre facilities, various other services

which are suitable for four-star hotel standards are also offered in the hotel. The case

hotel employs 53 personnel (one general manager, one assistant general manager, four

front ofce clerks, seven housekeepers, 30 restaurant staff, two marketing personnel,

three bartenders, two accounting personnel, and two human resource managers).

Our study in the case hotel started in September 2006 and ended in September 2007.

The data presented in this case study represent real gures gathered throughout the

one-year period. All the data presented in this study are expressed in US$. The cost

data were compiled during a three-month (September, October, and November) period

in 2006. In order to compile consistent data regarding the time spent on the activities,

needed for deriving the time equations used in the TDABC model, we observed the

actions of the personnel while they were performing the tasks several times during

the year of 2007. Additionally, we conducted follow-up interviews during the last three

months of the study in 2007 in order to verify and validate the accuracy of the data. By

comparing the results we obtained at different times, we computed the average times

for each of the activities. Moreover, documentation was collected from nancial reports

in order to gain a rich description of the hotels costing system and to understand how

managers implement CPA. All of the above-mentioned case study applications were

conducted with the following theoretical background and literature.

A qualitative research strategy was used as the most appropriate method for a case

study of this kind because case studies are often associated with qualitative research

design even though they can be conducted with both qualitative and quantitative

research methods (Yin, 1994). According to Ryan et al. (2007), Lee (1999) and Yin (1994),

case studies provide the researchers with an opportunity to understand the nature of

accounting systems which are currently used in practice. Moreover, case studies could

be used to explore the application of new procedures. As suggested by Yin (1994), case

studies investigate a contemporary phenomenon in its real-life context and more than

one case can be conducted at a time. Since the main purpose of our study was to

understand the costing system currently applied and to evaluate the applicability of

TDABC in a hotel setting, the case study method was deemed to be the most appropriate

methodto gainin-depthunderstandingof the hotel. In the study, a descriptive case study

was rst used in order to explicate the accounting system currently used in the case

hotel. Then, we used an experimental case study method in order to evaluate the

applicability of the new costing system (TDABC) in the hotel.

We used qualitative research methods for gathering data regarding the costing

method currently used by the hotels accountants, activities performed in the hotel, unit

times needed for performing the activities, and detailed costs of these activities.

Semi-structured interviews that lasted between 45 minutes and one hour with the

personnel of the hotel (i.e. general manager, general assistant manager, cost accountant,

Customer

protability

analysis

613

receptionists, housekeepers, marketing personnel, and waiters), direct observations, and

documentation collection were used as data-collection methods. Semi-structured

interviews were chosen because they enable the researchers to understand the issues in

depth (Bryman and Bell, 2007). The interviews were conducted based on a detailed

interview schedule that was agreed upon with assistant general manager of the hotel.

The interviewees were asked closed-ended as well as open-ended questions on issues

relating to main activities performed in the hotel, the tasks performed by each staff

member, type of costs incurred, and the customers of the hotel. The purpose of those

interviews was to clarify how staff members performed their tasks and how much

time (in terms of minutes) they spend on performing these tasks. Direct observations

were also used to examine the activities while the staff members physically perform the

tasks. As suggested by Tharenou et al. (2007), observations are important tools for

understanding the procedures. In that respect, we conducted observations in order to

ensure that the data gathered through interviews accurately reected the real time

experiences of the employees. After each visit to the relevant department, we wrote up

notes in order to analyze the nature of the activities. We also documented the tasks

performed by the staff members. All the interviews were recorded on tape, and the data

obtained through these interviews were led. We transcribed all tapes and notes and

read the transcripts several times in order to make thorough activity analysis. The cost

data were obtained fromthe cost reports documented by the accounting department. We

used the cost reports to get an insight into the costing systemcurrently employed by the

hotels cost accountants (Tables I and II).

We also utilized job descriptions in reviewing the tasks. In addition, we analyzed the

annual reports of the hotel in order to analyze revenues generated from accommodation

and other revenue generating areas, especially food and beverage spending. We

developed time equations using the data concerning the tasks and unit times needed to

perform these tasks. Based on the time equations that we formulated and the cost data

provided by the accounting department, we allocated the costs to customer segments

using TDABC. Ultimately, we computed protability gures for the customer

segments using TDABC and compared TDABC results to the ones found under the

conventional ABC, as presented in Tables V and VI.

Customer segments of the case hotel

The implementation process for CPA started with scrutinizing the current customer

segments (groups) of the case hotel. The customers of the hotel were determined as

follows:

.

Group 1. This group includes managers of local and foreign companies. The

greatest share (48 percent) in the sales mix belonged to this group of customers.

These customers generally utilized accommodation and food and beverage

services.

.

Group 2. This customer group constitutes customers brought to the hotel by the

travel agents operating both in internal and external markets. That group had

the second highest sales mix percentage (19 percent). The customers clustered in

this group utilized accommodation and food and beverage services.

.

Group 3. These customers represent people holding managerial positions in

government-owned institutions. This customer group used accommodation and

food and beverage services and had a 10 percent share in the total sales mix.

IJCHM

22,5

614

C

o

s

t

c

e

n

t

e

r

s

T

o

t

a

l

c

o

s

t

s

(

$

)

C

o

s

t

d

r

i

v

e

r

C

o

s

t

p

o

o

l

r

a

t

e

F

r

o

n

t

o

f

c

e

H

o

u

s

e

k

e

e

p

i

n

g

M

a

r

k

e

t

i

n

g

F

o

o

d

p

r

e

p

a

r

a

t

i

o

n

B

e

v

e

r

a

g

e

p

r

e

p

a

r

a

t

i

o

n

B

a

n

q

u

e

t

i

n

g

D

e

p

r

e

c

i

a

t

i

o

n

1

5

6

,

6

6

0

D

i

r

e

c

t

$

9

,

2

6

0

$

2

8

,

5

0

0

$

1

6

,

4

0

0

$

3

8

,

4

0

0

$

2

6

,

7

0

0

$

3

7

,

4

0

0

P

e

r

s

o

n

n

e

l

2

6

5

,

2

8

1

D

i

r

e

c

t

$

3

4

,

4

0

4

$

6

8

,

9

4

5

$

2

6

,

2

8

8

$

9

0

,

2

9

1

$

2

2

,

8

4

8

$

2

2

,

5

0

5

E

n

t

e

r

t

a

i

n

m

e

n

t

1

7

7

,

1

0

6

D

i

r

e

c

t

$

1

7

7

,

1

0

6

F

o

o

d

a

n

d

b

e

v

e

r

a

g

e

4

0

3

,

2

1

3

A

c

t

u

a

l

u

s

a

g

e

$

1

1

4

,

7

4

7

$

1

7

8

,

4

6

6

$

1

1

0

,

0

0

0

C

l

e

a

n

i

n

g

a

n

d

l

a

u

n

d

r

y

2

8

2

,

0

7

6

L

a

u

n

d

r

y

a

n

d

c

l

e

a

n

i

n

g

h

o

u

r

s

$

1

2

.

2

4

2

8

/

h

o

u

r

$

1

6

8

,

6

5

6

$

3

3

,

5

1

1

$

4

4

,

5

0

4

$

3

5

,

4

0

5

2

3

,

0

4

0

h

o

u

r

s

1

3

,

7

7

6

h

o

u

r

s

2

,

7

3

7

h

o

u

r

s

3

,

6

3

5

h

o

u

r

s

2

,

8

9

2

h

o

u

r

s

S

t

a

t

i

o

n

a

r

y

3

,

8

4

0

A

c

t

u

a

l

u

s

a

g

e

$

2

,

0

3

1

$

4

4

6

$

8

8

6

$

4

7

7

T

e

l

e

p

h

o

n

e

9

,

4

1

5

D

i

r

e

c

t

$

6

,

5

9

0

$

2

,

8

2

5

M

a

r

k

e

t

i

n

g

5

4

,

9

7

7

D

i

r

e

c

t

$

5

4

,

9

7

7

E

n

e

r

g

y

,

b

u

i

l

d

i

n

g

d

e

p

r

e

c

i

a

t

i

o

n

a

n

d

i

n

s

u

r

a

n

c

e

2

2

1

,

2

3

5

A

r

e

a

$

5

0

.

7

4

2

/

s

q

u

a

r

e

m

e

t

e

r

$

1

1

,

8

5

0

$

8

4

,

2

3

1

$

3

4

,

0

9

6

$

4

9

,

0

2

7

$

4

2

,

0

3

1

4

,

3

6

0

s

q

u

a

r

e

m

e

t

e

r

s

2

3

3

.

5

s

q

u

a

r

e

m

e

t

e

r

s

1

,

6

6

0

s

q

u

a

r

e

m

e

t

e

r

s

6

7

2

s

q

u

a

r

e

m

e

t

e

r

s

9

6

6

.

2

s

q

u

a

r

e

m

e

t

e

r

s

8

2

8

.

3

s

q

u

a

r

e

m

e

t

e

r

s

H

u

m

a

n

r

e

s

o

u

r

c

e

s

8

3

,

0

0

0

E

s

t

i

m

a

t

e

d

$

1

1

,

6

2

0

$

4

2

,

3

3

0

$

9

,

9

6

0

$

1

0

,

7

9

0

$

4

,

9

8

0

$

3

,

3

2

0

p

e

r

c

e

n

t

a

g

e

o

f

t

i

m

e

1

4

%

5

1

%

1

2

%

1

3

%

6

%

4

%

(

c

o

n

t

i

n

u

e

d

)

Table I.

Costs allocated to

customer groups under

traditional ABC

(allocation of costs to

activity-cost pools)

Customer

protability

analysis

615

C

o

s

t

c

e

n

t

e

r

s

T

o

t

a

l

c

o

s

t

s

(

$

)

C

o

s

t

d

r

i

v

e

r

C

o

s

t

p

o

o

l

r

a

t

e

F

r

o

n

t

o

f

c

e

H

o

u

s

e

k

e

e

p

i

n

g

M

a

r

k

e

t

i

n

g

F

o

o

d

p

r

e

p

a

r

a

t

i

o

n

B

e

v

e

r

a

g

e

p

r

e

p

a

r

a

t

i

o

n

B

a

n

q

u

e

t

i

n

g

S

t

o

r

i

n

g

7

9

,

6

0

9

S

p

a

c

e

o

c

c

u

p

i

e

d

6

6

3

.

4

1

/

s

q

u

a

r

e

m

e

t

e

r

$

5

2

,

4

1

0

$

1

3

,

2

6

8

$

6

,

6

3

4

$

7

,

2

9

7

1

2

0

s

q

u

a

r

e

m

e

t

e

r

s

7

9

s

q

u

a

r

e

m

e

t

e

r

s

2

0

s

q

u

a

r

e

m

e

t

e

r

s

1

0

s

q

u

a

r

e

m

e

t

e

r

s

1

1

s

q

u

a

r

e

m

e

t

e

r

s

P

u

r

c

h

a

s

i

n

g

1

6

5

,

6

0

3

O

r

d

e

r

s

$

2

5

0

/

o

r

d

e

r

$

1

0

,

0

0

0

$

8

8

,

1

0

3

$

1

8

,

0

0

0

$

3

7

,

0

0

0

$

1

2

,

5

0

0

6

6

2

o

r

d

e

r

s

4

0

o

r

d

e

r

s

3

5

2

o

r

d

e

r

s

7

2

o

r

d

e

r

s

1

4

8

o

r

d

e

r

s

5

0

o

r

d

e

r

s

G

e

n

e

r

a

l

(

a

d

m

i

n

i

s

t

r

a

t

i

n

g

a

n

d

8

0

,

0

0

0

E

s

t

i

m

a

t

e

d

$

1

1

,

2

0

0

$

1

2

,

0

0

0

$

1

2

,

0

0

0

$

1

6

,

0

0

0

$

1

3

,

6

0

0

$

1

5

,

2

0

0

a

c

c

o

u

n

t

i

n

g

a

n

d

n

a

n

c

e

)

p

e

r

c

e

n

t

a

g

e

o

f

t

i

m

e

1

4

%

1

5

%

1

5

%

2

0

%

1

7

%

1

9

%

R

e

p

a

i

r

a

n

d

m

a

i

n

t

e

n

a

n

c

e

1

1

0

,

1

2

0

M

a

i

n

t

e

n

a

n

c

e

t

i

m

e

$

1

.

4

3

3

9

/

m

i

n

u

t

e

$

2

8

,

1

5

0

3

4

,

0

3

3

2

,

0

0

0

1

1

,

8

0

0

2

9

,

1

3

7

5

,

0

0

0

7

6

,

8

0

0

m

i

n

u

t

e

s

1

9

,

6

3

2

m

i

n

u

t

e

s

2

3

,

7

3

5

m

i

n

u

t

e

s

1

,

3

9

5

m

i

n

u

t

e

s

8

,

2

3

0

m

i

n

u

t

e

s

2

0

,

3

2

1

m

i

n

u

t

e

s

3

,

4

8

7

m

i

n

u

t

e

s

T

o

t

a

l

(

$

)

2

,

0

9

2

,

1

3

5

1

2

5

,

1

0

5

5

7

9

,

2

0

8

1

2

4

,

4

5

0

3

8

1

,

3

4

9

4

1

3

,

7

8

2

4

6

8

,

2

4

1

Table I.

IJCHM

22,5

616

A

c

t

i

v

i

t

i

e

s

T

o

t

a

l

G

r

o

u

p

1

G

r

o

u

p

2

G

r

o

u

p

3

G

r

o

u

p

4

G

r

o

u

p

5

G

r

o

u

p

6

G

r

o

u

p

7

G

r

o

u

p

8

F

r

o

n

t

o

f

c

e

T

o

t

a

l

c

o

s

t

(

$

)

1

2

5

,

1

0

5

3

5

,

6

1

9

4

1

,

4

6

8

8

,

7

3

0

2

6

,

1

9

2

1

0

,

9

1

3

2

,

1

8

3

N

o

.

o

f

a

r

r

i

v

a

l

s

1

7

,

9

9

3

5

,

1

2

3

5

,

9

6

4

1

,

2

5

6

3

,

7

6

7

1

,

5

7

0

3

1

4

C

o

s

t

d

r

i

v

e

r

r

a

t

e

(

$

)

6

.

9

5

2

9

H

o

u

s

e

k

e

e

p

i

n

g

T

o

t

a

l

c

o

s

t

(

$

)

5

7

9

,

2

0

8

2

7

8

,

0

2

0

8

4

,

9

3

4

9

0

,

4

1

4

4

8

,

0

5

8

6

8

,

9

9

0

5

,

7

9

2

N

o

.

o

f

n

i

g

h

t

s

3

1

,

3

9

0

1

5

,

0

6

7

4

,

6

0

3

4

,

9

0

0

2

,

7

6

7

3

,

7

3

9

3

1

4

C

o

s

t

d

r

i

v

e

r

r

a

t

e

(

$

)

1

8

.

4

5

2

2

5

M

a

r

k

e

t

i

n

g

T

o

t

a

l

c

o

s

t

(

$

)

1

2

4

,

4

5

0

9

3

,

8

6

3

5

,

2

1

4

1

5

,

0

4

2

8

0

2

1

,

2

0

3

5

0

1

7

,

8

2

5

N

o

.

o

f

c

u

s

t

o

m

e

r

v

i

s

i

t

s

2

,

4

8

2

1

,

8

7

2

1

0

4

3

0

0

1

6

2

4

1

0

1

5

0

C

o

s

t

d

r

i

v

e

r

r

a

t

e

(

$

)

5

0

.

1

4

0

F

o

o

d

p

r

e

p

a

r

a

t

i

o

n

T

o

t

a

l

c

o

s

t

(

$

)

3

8

1

,

3

4

9

1

5

6

,

2

7

8

5

8

,

3

6

4

3

2

,

4

1

2

4

0

,

9

6

9

9

0

,

2

3

6

3

,

0

9

0

N

o

.

o

f

c

o

v

e

r

s

6

7

,

6

5

2

2

7

,

7

2

4

1

0

,

3

5

4

5

,

7

5

0

7

,

2

6

8

1

6

,

0

0

8

5

4

8

C

o

s

t

d

r

i

v

e

r

r

a

t

e

(

$

)

5

.

6

3

6

9

2

B

e

v

e

r

a

g

e

p

r

e

p

a

r

a

t

i

o

n

T

o

t

a

l

c

o

s

t

(

$

)

4

1

3

,

7

8

2

4

1

3

,

7

8

2

B

a

n

q

u

e

t

i

n

g

T

o

t

a

l

c

o

s

t

(

$

)

4

6

8

,

2

4

1

4

6

8

,

2

4

1

T

o

t

a

l

(

$

)

5

6

3

,

7

8

0

1

8

9

,

9

8

0

1

4

9

,

5

6

8

1

1

5

,

2

1

9

1

7

0

,

9

4

1

4

6

9

,

4

4

4

1

1

,

5

6

6

4

2

1

,

6

0

7

Table II.

Costs allocated to

customer groups under

traditional ABC

(allocation of costs of

activity-cost pools to

customer groups)

Customer

protability

analysis

617

.

Group 4. These customers are walk-in customers coming to the hotel without

making reservations. This customer group used accommodation and food and

beverage services and had a 12 percent share in the total sales mix.

.

Group 5. Professional sport clubs coming to the city of Mersin to play football

matches constitute this group. Customers in this group stayed in the hotel for one

or two days and had a 10 percent share in the total sales mix.

.

Group 6. This customer group comprises people who organize parties and

wedding ceremonies in the hotel. Customers in group 6 received catering and

entertainment services and did not stay overnight in the hotel.

.

Group 7. These customers come to the hotel to participate in wedding ceremonies

and parties and stay in the hotel for just one night. This group had a 1 percent

share in the total sales mix.

.

Group 8. Customers who come to the hotel only for bar and entertainment

services are clustered in this group. These customers do not stay overnight in the

hotel.

Activities performed in the case hotel

In the case hotel, we identied six general activities. Each of these activities comprises

several subtasks (sub-activities). These activities and the related subtasks are:

marketing (making calls to customers in order to arrange visits, giving information via

e-mail or fax, making customer visits, advertising, and making promotional campaigns),

front ofce (reservation and information, check-in and check-out, meeting and

welcoming customers, settling customers in the rooms, opening customers accounts,

controlling customers spending, accompanying customers when they are leaving, and

closing customers accounts), housekeeping (cleaning the rooms, making beds,

vacuuming, and replenishing linens), food preparation and service (taking orders,

preparing the kitchen for breakfast, lunch, and dinner, cooking, preparing and serving

breakfast, lunch, and dinner, cleaning the kitchen and the restaurant), beverage

preparation and service (preparing the bar for beverage service, servicing the beverages,

carrying out entertainment activities, and cleaning), and banqueting (making

preparations for catering events such as wedding ceremonies, parties, and meetings).

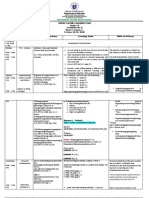

Allocation of costs to the customer groups under traditional ABC

In the case hotel, costs were initially totaled in cost centers along with their dollar value

(Table I). These cost centers were: personnel, stationary, telephone, marketing

(advertising, promotion, billboard, and customer visit costs), accounting and nance,

human resource, administrating, energy (electricity and heating costs), storing (rent,

air conditioning, and insurance costs), cleaning and laundry, purchasing, repair and

maintenance (material and personnel costs), entertainment, food and beverage (cost

of foods and beverage used for restaurant, bar, and catering events), and depreciation.

Then, the costs which were directly associated with particular activities were imputed

to relevant activity-cost pools. The direct costs that the accountants of the hotel

identied were: depreciation costs of equipment, furniture, and xtures that are used in

particular departments, personnel costs, and telephone costs. On the other hand, the

costs not directly related to the activities were allocated to the activity-cost pools by

means of relevant cost drivers. The activity cost-pools were: front ofce, housekeeping,

marketing, food preparation, beverage preparation, and banqueting.

IJCHM

22,5

618

According to traditional ABC literature (Cooper, 1990; Kaplan and Cooper, 1998),

facility-sustaining costs (i.e. accounting, nance, human resource, training, and

administrating costs) should be attributed to the activity centers rather than be traced to

individual customers. Since facility-sustaining costs cannot be determined as specic

costs for particular customers in the case hotel, these costs were rst apportioned to the

activity-cost pools. Then, fromthe activity-cost pools theywere allocatedto the customer

groups. This approach is also consistent with the ABC literature. Since it is difcult

to determine appropriate cost drivers and relevant consumption rates for the costs

of these types, they were apportioned to the activity-cost pools according to some

relevant pattern of usage. For allocating the costs of general support activities such as

administrating, accounting and nance, and human resource, the estimated percentage

of total personnel time spent for different departments was used as an allocation base.

Information about the time that the personnel, who are engaged in the general support

activities, spent for different departments were not documented in the case hotel.

Therefore, allocation of these costs was based on staff estimates of the time they spent on

each department.

For storing the goods, a 120-square meter warehouse was rented next to the hotel

building. The costs (rent, air conditioning, and insurance costs) gathered in the storing

cost center were allocated to the activity-cost pools based on the amount of oor

space occupied in the warehouse, which was measured in terms of square footage.

On the other hand, the costs of the purchasing cost center were allocated using the

number of purchase orders as an allocation base. The costs gathered in the repair

and maintenance cost center were allocated based on the actual maintenance time

spent. Information about the maintenance time was documented by the accounting

department.

The stationery and food and beverage costs were allocated according to actual usage

of stationary materials and food and beverage goods. The actual usage of these

resources was documented and maintained by the accounting department. The laundry

and cleaning costs (i.e. costs of personnel, depreciation cost of laundry machine, and cost

of cleaning materials) were apportioned among activities according to number of

cleaning hours spent. As can be seen in Table I, a major part of the cleaning costs were

allocated to the housekeeping activity because the laundry personnel take the most

time to wash and clean the linens of the rooms.

On the other hand, depreciation and insurance costs relating to the hotel building

were combined with energy costs in the same cost center (because these costs were

allocated using the same cost driver) and they were allocated to the activities based on

the amount of oor space that each department (restaurant, front ofce, banqueting

hall, rooms, bars, and disco) occupies. The entertainment costs were directly imputed to

the beverage preparation activity. Likewise, the costs (advertising, promotion,

personnel, and customer visit costs) which were gathered in the marketing cost center

were directly assigned to the marketing activity (Table I).

In allocating the indirect costs to the activities, cost pool rates were used (some

numbers in Table I were rounded to the nearest dollars therefore the numbers represent

approximate gures). For example, the total amount of purchasing costs was divided

by 662 orders (which is the total number of orders made during the study period) in order

to calculate a cost pool rate of $250 ($165,603/662 orders) per order. Then the rate of $250

was multiplied by the total number of orders made for each activity or department

Customer

protability

analysis

619

in order to allocate the purchasing costs to the activities. For example, the cost pool rate

of $250 was multiplied by 72 (total number of orders made for the purchase of the goods

to be used in the restaurant) in order to compute $18,000 (Table I).

After the costs were allocated to the activity-cost pools, the amounts were summed

up and the total amount of costs for each cost pool was calculated. For example, after

the amounts in the fth column in Table I were summed up, the total amount of costs

for the front ofce cost pool was computed as $125,105. Once the total costs of the

activity-cost pools were computed, the costs of each activity-cost pool were allocated to

the customers via second-stage activity cost drivers which were unique to each

activity-cost pool (Table II). The activity cost drivers used by the accounting personnel

in order to allocate the cost of front ofce, housekeeping, marketing, and food

preparation activity-cost pools were: the number of arrivals, number of nights spent by

customers, number of customer visits, and number of covers, respectively.

The costs allocated to the customer groups were calculated using the activity driver

rates which were computed by dividing the total amount of costs gathered in each

activity-cost pool by the quantity of the relevant activity cost driver. The activity

driver rate computed for each activity-cost pool was multiplied by the quantity of

related activity cost driver that each customer group consumes. For example, the total

cost ($125,105) of the front ofce activity-cost pool was divided by the total number

of arrivals (17,993) in order to calculate the activity driver rate of $6.9529 per arrival.

Then, the rate of $6.9529 was multiplied by the number of arrivals (quantity of cost

driver) related to a particular customer group in order to compute the amount of front

ofce costs that should be assigned to that group. For example, the activity driver rate

of $6.9529 was multiplied by 5,123 (total number of arrivals made by customers

clustered in group 1) in order to compute $35,619, which was the amount allocated to

the customer group 1. The rate per activity driver ($6.9529) was used as a single rate

for the front ofce cost pool because it was assumed that each cost driver activity

(arrival) consumes the same amount of resources. In fact, this approach is consistent

with the traditional ABC literature (Cooper and Kaplan, 1992).

One of the customer groups of the case hotel is the bar customers who come to the

hotel in order to utilize solely the bar services. As a result of the interviews, it was

realized that the bar of the case hotel operates to serve the bar customers rather than

the customers staying in the hotel. It was also realized that customers who stay in the

hotel receive food and beverage services in the restaurant rather than in the bar.

Therefore, the accountants of the hotel assigned the total cost of the beverage

preparation activity-cost pool ($413,782) only to the customer group 8. Likewise,

the total cost of the banqueting activity-cost pool ($468,241) was assigned to the

customer group 6 and customer group 7.

Allocation of costs under TDABC

The calculations made under the conventional ABC system were based on an

assumption that the resources of the hotel were utilized at full capacity. Moreover,

tracing the costs of activities such as food and beverage preparation, making customer

visits, and front ofce may become a challenging task for the hotel management.

This is due to the fact that, the way each customer consumes these activities differs

from one another. For instance, some customers take more of the personnels time to

decide what to eat and drink when they come to the restaurant of the hotel, while some

IJCHM

22,5

620

of them decide quite quickly. Some customers consume all of the available services in

the restaurant, whereas some of them do not. Likewise, some of the customers need

more advice about the services of the hotel at the front ofce, while some of them leave

the front ofce quickly. Moreover, when making visits to particular customers, the

marketing personnel need to travel and stay longer. Furthermore, the marketing staff

members spend more time giving information to some customers before making

customer visits. However, some customers do not consume that much effort and

resources. Thus, diversity in the use of resources by customers is likely to make it

difcult for the hotel management to analyze the costs using a traditional ABC system

because ABC uses single cost driver rate for each activity. This is because, the use of a

single cost driver does not adequately reect resource demands associated with the

activities performed in the hotel. In that respect, the TDABC, with its time equations, is

considered to better reect the resource demands of the activities in the case hotel.

The time unit (in terms of minutes) used for the calculations made under TDABC

were average times. These averages were calculated by taking the average of the times

we obtained through interviews and observations. The staff members in the case hotel

work six days a week and daily working hours vary between seven and 12 hours

depending on the department in which the personnel work. For example, the

receptionists who are employed at front ofce work eight hours and 15 minutes a day,

whereas the administrative personnel such as the accountant and human resource

managers work 12 hours per day. However, the above-mentioned working hours

represent theoretical capacity of the personnel, while we based our TDABC calculations

on the practical capacity.

In implementing the TDABC approach, we did not assign the costs of accounting,

nance, human resource, purchasing and administrating departments directly to the

customer groups because these costs cannot be determined as specic costs for

particular customers in the case hotel. Instead, we considered the ABC cost pools (in

which the costs of support activities were already included) as activity costs for

making calculations under TDABC.

Under the TDABC approach, as it was done under the traditional ABC approach, we

assigned the total cost of the beverage preparation activity-cost pool ($413,782) only

to customer group 8. Likewise, the total cost of the banqueting activity-cost pool is

related solely to customer group 6 and customer group 7. Therefore, we assigned

the cost of the banqueting activity ($468,241) only to customer groups 6 and 7.

Allocation of the costs of front ofce activities under TDABC

The front ofce activity-cost pool consists of direct and indirect costs such as

depreciation, personnel, energy, stationery, telephone, repair and maintenance, and

purchasing. In addition, it includes the costs which are allocated from human resource,

accountingand nance, andadministrating cost centers. The costs gatheredinthe front

ofce cost pool were allocated to the customer segments based on the practical capacity

of the receptionists. This approach is also consistent with the TDABC literature (Kaplan

and Anderson, 2004). Subtasks related to the main front ofce activity are: taking

reservations, giving information to a customer, welcoming the customer, settling the

customer in the room, opening the customers account, monitoring the room in order

to control customers spending, closing the customers account, and accompanying the

customer as he\she leaves the hotel. Indeed, the length of time spent on the front ofce

Customer

protability

analysis

621

activities varies depending on the type of customer coming to the hotel. For instance,

walk-in-customers (group 4) come to the hotel without making reservations, while

customers in group 1, who come to the hotel more frequently than the others, need four

minutes to make a reservation and 2.5 minutes to get information. On the other hand,

it takes totally nine minutes for the personnel to make a reservation (six minutes) and

give information (three minutes) for a customer in group 3. When bar customers

come to the hotel, they only ask where the bar is. Therefore, it takes only 30 seconds for

the personnel to give information to these customers.

The total time needed for the main front ofce activity is obtained by summing up

the times spent on the related subtasks. For example, for a customer clustered in

group 1, the reservation activity starts with taking reservations (four minutes) and

giving necessary information to the customer (2.5 minutes). After the customer arrives

at the hotel, the receptionist welcomes the customer (1.5 minutes), settles the customer

in the room (two minutes), and opens the customers account (1.5 minutes). At the end

of the customers stay, the personnel controls the customers spending and closes

his/her account (four minutes) and accompanies the customer as he/she leaves the hotel

(two minutes). In this case, the total length of time, spent at the front ofce for a

customer in group 1, is 17.5 minutes.

Table III reveals the unit times of consumption of the front ofce activities by

each customer group. For instance, for the customers clustered in group 2, the

receptionists spent 107,352 (5,964 18 minutes) minutes in a year. As Table III shows,

the total time actually needed for performing the front ofce activities during the

study period was 326,600 minutes. Table III also demonstrates the allocation of the

front ofce costs using TDABC.

Through the inclusion of the data presented in Table III (total unit time column of

Table III), we developed the following time equation for estimating the time needed for

performing the front ofce activities:

Total time min for front office activities

17:5

*

#customres

if customer group 1

18

*

#customers

if customer group 2

22

*

#customers

if customer group 3

18

*

#customers

if customer group 4

12

*

#customers

if customer group 5

17

*

#customers

if customer group 6

0:5

*

#customers

if customer group 7

2:5

*

#customers

if customer group 8

The case hotel employs four receptionists to do the front-ofce work and normal

working hours (theoretical capacity) for each person is around eight hours and

15 minutes per day. Each receptionist works six days a week and 26 days in a month.

In this case, normal working hours for one receptionist corresponds to 12,870

8:25 hour 60 minutes 26 days minutes per month and 154,440 minutes per

year. Thus, the theoretical capacity for four receptionists is 617,760 minutes per year.

However, each receptionist spends around 75 minutes for breaks, arrival and

departure, and resting every day. Therefore, each receptionist actually works only

seven hours (which is practical capacity of one receptionist) per day. In this respect,

each receptionist practically supplies about 10,920 minutes per month or 131,040

minutes per year. Therefore, the practical capacity of 4 receptionists is about 524,160

minutes per year. Hence, the practical capacity corresponds to around 85 percent

(524,160/617,760 minutes) of the theoretical capacity.

IJCHM

22,5

622

C

u

s

t

o

m

e

r

g

r

o

u

p

s

U

n

i

t

t

i

m

e

(

m

i

n

u

t

e

)

s

p

e

n

t

o

n

r

e

s

e

r

v

a

t

i

o

n

a

c

t

i

v

i

t

y

U

n

i

t

t

i

m

e

(

m

i

n

u

t

e

)

s

p

e

n

t

o

n

i

n

f

o

r

m

a

t

i

o

n

a

c

t

i

v

i

t

y

U

n

i

t

T

i

m

e

(

m

i

n

u

t

e

)

s

p

e

n

t

o

n

w

e

l

c

o

m

i

n

g

c

u

s

t

o

m

e

r

(

c

h

e

c

k

-

i

n

)

U

n

i

t

t

i

m

e

(

m

i

n

u

t

e

)

s

p

e

n

t

o

n

s

e

t

t

l

i

n

g

c

u

s

t

o

m

e

r

i

n

t

h

e

r

o

o

m

(

c

h

e

c

k

-

i

n

)

U

n

i

t

t

i

m

e

(

m

i

n

u

t

e

)

s

p

e

n

t

o

n

o

p

e

n

i

n

g

c

u

s

t

o

m

e

r

s

a

c

c

o

u

n

t

(

c

h

e

c

k

-

i

n

)

U

n

i

t

t

i

m

e

(

m

i

n

u

t

e

)

s

p

e

n

t

o

n

c

o

n

t

r

o

l

l

i

n

g

c

u

s

t

o

m

e

r

s

s

p

e

n

d

i

n

g

a

n

d

c

l

o

s

i

n

g

t

h

e

a

c

c

o

u

n

t

U

n

i

t

t

i

m

e

(

m

i

n

u

t

e

)

s

p

e

n

t

o

n

a

c

c

o

m

p

a

n

y

i

n

g

c

u

s

t

o

m

e

r

(

c

h

e

c

k

-

o

u

t

)

T

o

t

a

l

u

n

i

t

t

i

m

e

(

m

i

n

u

t

e

)

A

c

t

i

v

i

t

y

q

u

a

n

t

i

t

y

T

o

t

a

l

m

i

n

u

t

e

s

R

a

t

e

(

$

/

m

i

n

)

A

l

l

o

c

a

t

e

d

c

o

s

t

G

r

o

u

p

1

4

2

.

5

1

.

5

2

1

.

5

4

2

1

7

.

5

5

,

1

2

3

8

9

,

6

5

3

0

.

2

3

8

6

8

2

1

,

3

9

7

G

r

o

u

p

2

5

3

2

2

.

5

1

.

5

2

2

1

8

5

,

9

6

4

1

0

7

,

3

5

2

0

.

2

3

8

6

8

2

5

,

6

2

3

G

r

o

u

p

3

6

3

2

2

.

5

1

.

5

4

3

2

2

1

,

2

5

6

2

7

,

6

3

2

0

.

2

3

8

6

8

6

,

5

9

3

G

r

o

u

p

4

0

4

3

2

1

4

4

1

8

3

,

7

6

7

6

7

,

8

0

6

0

.

2

3

8

6

8

1

6

,

1

8

4

G

r

o

u

p

5

1

4

0

.

5

1

1

.

5

2

2

1

2

1

,

5

0

4

1

8

,

0

4

9

0

.

2

3

8

6

8

4

,

3

0

8

G

r

o

u

p

6

4

3

1

2

1

3

3

1

7

3

1

4

5

,

3

3

8

0

.

2

3

8

6

8

1

,

2

7

4

G

r

o

u

p

7

0

0

.

5

0

0

0

0

0

0

.

5

1

1

,

9

4

0

5

,

9

7

0

0

.

2

3

8

6

8

1

,

4

2

5

G

r

o

u

p

8

2

0

.

5

0

0

0

0

0

2

.

5

1

,

9

2

0

4

,

8

0

0

0

.

2

3

8

6

8

1

,

1

4

6

T

o

t

a

l

2

2

2

0

.

5

1

0

1

2

8

1

9

1

6

1

0

7

.

5

3

1

,

7

8

8

3

2

6

,

6

0

0

7

7

,

9

5

0

Table III.

Costs of front ofce

activities allocated under

TDABC

Customer

protability

analysis

623

The cost per minute of capacity supplied is calculated by dividing the cost of capacity

supplied by the practical capacity of resources (Kaplan and Anderson, 2004). Thus, we

calculated the cost per minute of supplying capacity for the front ofce activities as

$0.23868 [$125,105 (Table I)/524,160 minutes]. Then, the rate of $0.2368 per minute

was multiplied by the total time (in terms of minutes), needed for each customer group,

in order to allocate the costs of the front ofce cost pool to the customer segments.

As revealed by the calculations, around 62 percent [326,600 minutes

(Table III)/524,160 minutes] of the practical capacity of the resources supplied for

the front ofce activities had actually been used for productive work during the

study period. Hence, only 62 minutes ($77,950/$125,105) of the total cost of $125,105

was assigned to the customer groups using TDABC. In this case, the total cost of

unused resources supplied to perform the front ofce activities was computed as

$47,155 ($125,105 2 $77,950).

Allocation of the costs of housekeeping activities under TDABC

The housekeeping activity-cost pool includes depreciation, personnel, energy,

cleaning and laundry, repair and maintenance, storing, and purchasing costs. The

housekeeping cost pool also comprises the costs allocated from accounting and

nance, administrating, and human resource cost centers. The total cost of the

housekeeping activity-cost pool was allocated to the customer segments based on the

practical capacity of the housekeepers. The housekeeping activities are classied as

activities that take place before a customer comes to the hotel and activities after

check-out. These activities constitute several subtasks as follows: cleaning and

vacuuming the rooms, making beds, and replenishing linens. The length of time spent

on the housekeeping activities is almost the same for all customer segments except

for the customers clustered in group 5. The customers in group 5 (football players)

come to the hotel after training and football matches and they leave their rooms dirtier

than the other customers. Therefore, it takes more time and effort for the housekeepers

to clean these rooms when compared to the rooms of other customers.

The total time for the main housekeeping activity is sum of the times spent on the

activities performed before check-in and after check-out. For example, before a

customer (group 1) checks in, the housekeeper controls (three minutes), as well as

cleans and vacuums the reserved room (seven minutes). After the customer settles in,

the housekeeper cleans and vacuums the reserved room during customers stay (four

minutes). After the customer leaves the hotel, the housekeeper cleans and vacuums the

room and replenishes the linens (16 minutes). In this case, the total length of time, spent

on the housekeeping activity for a customer in group 1, is 30 minutes. Table IV

portrays the average unit times of consumption of resources of the main

housekeeping activities by each of the customer groups. Table IV also shows the

amount of costs allocated under TDABC. Based on the gures presented in Table IV,

the total time needed for performing the housekeeping activities was calculated as

566,154 minutes.

The case hotel employs seven housekeepers and each housekeeper works 6.5 hours

per day (excluding time for breaks, meetings, arrival and departure, and resting hours).

In this case, each housekeeper supplies about 10,140 minutes per month and 121,680

minutes per year. Thus, the practical capacity of seven housekeepers is 851,760

minutes per year. We combined the unit time gures in Table IV (total unit time

IJCHM

22,5

624

C

u

s

t

o

m

e

r

g

r

o

u

p

s

U

n

i

t

t

i

m

e

(

m

i

n

u

t

e

)

s

p

e

n

t

o

n

c

o

n

t

r

o

l

l

i

n

g

t

h

e

r

e

s

e

r

v

e

d

r

o

o

m

(

b

e

f

o

r

e

c

h

e

c

k

-

i

n

)

U

n

i

t

t

i

m

e

(

m

i

n

u

t

e

)

s

p

e

n

t

o

n

c

l

e

a

n

i

n

g

a

n

d

v

a

c

u

u

m

i

n

g

t

h

e

r

e

s

e

r

v

e

d

r

o

o

m

(

b

e

f

o

r

e

c

h

e

c

k

-

i

n

)

U

n

i

t

t

i

m

e

(

m

i

n

u

t

e

)

s

p

e

n

t

o

n

c

l

e

a

n

i

n

g

t

h

e

r

o

o

m

s

a

n

d

r

e

p

l

e

n

i

s

h

i

n

g

l

i

n

e

n

s

d

u

r

i

n

g

c

u

s

t

o

m

e

r

s

s

t

a

y

U

n

i

t

t

i

m

e

(

m

i

n

u

t

e

)

s

p

e

n

t

o

n

c

l

e

a

n

i

n

g

t

h