Professional Documents

Culture Documents

Greenspan Return To Gold Newspaper Art

Uploaded by

LostWOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Greenspan Return To Gold Newspaper Art

Uploaded by

LostWCopyright:

Available Formats

/-:-

THE WALL STREET 'OUN,NAI. TUESDAY. SEPTEMBERI. I9EI

ffi Return to a Giokf$tandard?

BY Aux Gnnrnsmri los. or subsequentlyproves to be tm low, ernment-lnducedcredtt enrtlon wodd be (l77cl and tle lonrard dellvery premlums

heavy demandat tle offerlng prtce cmld a stmng pollUcd Sgnal. Evm alter lnlla. of goltl (16% ennual ratel Inferr€d fmm

The growlngdlsllluslonrnentlrlth pollu' qulckly depletethe tota.lU.S. government' tbn is brought uder contml the extraordl- June l$Il futures contnrcts. Presumably-

cally contmlledmonetarypoUcleshas pro stockol gold. as well as any goltl borrowed nary current pollttcal s€nsluvlty to lnlla- llveyear note lssueswould reflect a siml-

ducedan Increaslngnumber of advaates to tlwarl tle assault.At that point, wlti no tion wtll surely rernaln. lar relatlonshlp.

fDr a return to the pld standad-lnclud'

'lng addlUonalgoldavallable.the U.S.wouldbe Concreteactbns to lnstall a gold nan-

at tlmes hesldent Reagan. off Oe gold standardand llkely to remain dard are prernature.Nonetleless. there A ruk of Exchange [.oss

ln years past tie deslre !o rcturn to a are certaln preparatorypollcy acttonsthat

monetary s'.stem basedon gold was per' ' off for decades. The exchangerlsk of the Treasurygold

Alterna[vely.lf the bld price is inlually couldtesl the eventualfeaslbllltyof return- notes,ol course.ls the sarneas that asso

.celvedas nostalSlafor an era when tlrnes set too hlgt. or zubsequentlyb€comestoo lng to a gold staDdard.that would have

were slmpler, problemsless complexand, elatedwlth our forelgncurFencyTre:rsury

hlgh. the Treasury would be lnundat€d pcltlve short lerm sntl-lnflatlonbenefits note s€rles.The U.S. Treasury has, over

the yorld not tlreatenedwlth nuclearannl' wlth gold offerlngs. The paymentslor the and llttle costll they lalt.

hltatlon.But after a decadeof destabllltlng the years. sold slgnlflcantquantttiesof

gold drawn on'the Treasury'saccountat The major msdblock to restoring the both Germu mark. and Swtss franc-de

innatlon and economicstagladon, the res' Oe Federal Reserryewould add substan- gold standardh the problemof reentry.

toration of a gol{ standad hes b€comean nominatedlssues,and both made and lost'

Ually t0 commercla.lbank resenres and \Yith the vast quantlty of dollan world- money In tenns of dollars as exchange"

lssuethat ls cteally ilslng on the economlc

policy agenda.A commlsslonto sludy tle rates have fluetuated.And indeedthere ls

lssue.wlth strong support fmm ffident a risk of exehangelcs wlth gold notes.

Reagan,ls In place. Tlw restrietionsol goll. conaertiffiity wouW pro' However,unlessthe price of gold dou-

The lncreaslngly numerots proponents

of a gold standardpersuaslvelyargrtetiat loutdly alter tfu politics "f liscal policy'*he) lwue bles over a fiveyear period tl69c com-'

poundedannuallyl, interest paymentson

large budgetdeflclts and large federalbor' prnailed lor l*U o century. gold notesIn terms of dollars rvill be less

rcwtng requlrementswould be dlfflcult to than corwenllonalfinancingrequlres.The

finanee under such e standard. Hearry run-up to t8?5per ouncein early 1980was

clatms against paper dollan cause few probablyaet, at least temporarily,to ex- wide laying claim' to the U.S. Treasury's surelyan ab€rratlon.reflectingspecialclr-

technlcal problems. for the Tr€asury can pand the moneysupplywith all the inna' 26{ million ouncesof gold. an overnlght cunstancesin the }tiddle East whlch are

legally bormw as many dollars as Con' tlonary lmpllcatlonsthereof. transitionto gold eonvertlbtlltywould cre unHkelyto be repeatd ln the near future.

gress authorizes. '

Monetary offsets to neutralize or ate a major discontinuityfor the U.S. fl- Hence.anythingclo6eto a doublingof gold

But with unlimited dollar conversion "earmark" gold are, of course,possiblein nancial system.But there ls no need for prices in 4fie next five years appearsim-

into gold.the ablllty to issuedollar clalms tle shorl run. But as tie lvest German the whole block of current-dollarobllga-- ppbable. On the other hand,if gold prices

. wouldbe severelyllmited.Obvlouslyif you monetary autiorilies soon learned from tionsto becomean immhlaie claim. remalnstableor rise moderatety.the sav-

cannotflnancefederaldeflclts,you cannot thelr past endeavorsto suppon the dollar, ings could be large: Each 310billion in

createthem. Elther taxeswouldthen have Convertlbllltvean be instltuted srad.

there are limlts to monetarycountermea- ,"riv tvfin"rir..r.'.r"iti1g i-ou.l"cur- equivalent gold notes outstandingwould,

to be ralsd or expendltureslowered.The

restrictions of gold convertlbillty would

sunes, ;;;;, ,afi'; ii;niieir-rsr";-6r oorrirs ion- -under stable gold prices,save Sl.i biilion

The only seeming solution is for the urrttUf. into Sota. Inltially they could be per year in interestoutlays.

therefore profoundly alter the polltics of U.S.to cr€atea fiscal and monetaryenvl' deferredclaims to gold, for example.fiv*

fixal pollcy that have prevailedfor half a

century.

ronment which tn effect males the dollar

as gmd as gold, i.e., srabilizesthe genera.l iear

rreasury notes-wiur tnterestinapnn- **ffil$,f#S n','r$ffi!!?foffi $;

' price cipal payablein grarnsor ouneesof gold. " ,t"no".o ln terms at prices and lnterest

Dlsnrbed by Alternatlves level and by interencethe dollar

prlce of gold bullion itself. Then a rnodest Witi the passage of time and several is- _rates that could put ddditional political

Even some of thosewho concludea re

Feserveof bu.llloncould reducetle remain- sues of thes€ notes we would smn have a Dressureon the administration and Con-

turn to gold ls lnfeaslbleremain deeplydis' series of "near monies'ltn tgrms of gold

turbedby the currentalternauves.For ex' ing narmw gold price fluctuations effec' Lressto moveexpeditiously towardnon-in-

demand claims on gold.

ample, William Fellner of the Amerlcan Uvelyto zem,allowlngany changesin gold and evenlually, ha1onary polici*. Gold nbtescould be a

-reversing

The degfee of success ir restoring long' case of Gresham's [aw. Gmd

EnterpriseInstltute ln a forthcomingpubll' ,supplyand demandto be absorbed,influc' term tiscal confidencewill showup clearly

". . . I find lt difficult not tuatlonsin the T'reasury'sinventory. rnoneywould drive out bad. :

cation remarks yield spreads behr/e€n gold and fiat

What tle abovesuggestsis tlat a neces' in the -oUtigations

to be gTea0ylmpressedby the very large aottar of the same maturities. Thosewho advocatea return to a fold

damage done to the economlesof the in' sary condltlonof returnhg to a gold stan' skndad should be aware that returning

dard ls the financlal envircnmentwhtch f'Ut con"e"rtibllltywould rqulre that tle

dustrlallzed world . . . by the monetary yreld spreadsfoi all maturities vlrtually our monetarys'tstemto goldeonvertibility

managementthat has lollwed the era of the gold standad ltseUls presurnedto cr*

(gold) convertibittty.. . . It has placedthe iisappe'ar. If they do not, convertibility ls no'mere techntcal,financialrestruclur'

ate. But, lf we restore financia.lstabiliry, probably impossibld. ing. It is a baslc changein our economic

Westerneconomles ln acutedanger." what pulAoseis then xrved by a return to wrll'be very dlfftcirlt. processes. However,eonsldering wherethe

'tet even thoseof us who are attracted a gold standard? to implemdnt

to the prospect of Sold convertlblltty are Certalnly a gold-basedmonetarys)Gtem Asecond advanrage orcol9l9!:'r, p1l H'*A:LT.',*#'Kfi,'ffHijyj*

confrontedwlth a seemlnglylmPmstbleots ' .will not necessartlypneventflscal lmprud' theyare

llkelyto dyl_:Ynlt - past..

ligg.gi ;ilrfi;i,i-rne,it-iiitint'iilo.stanoaro

stacle: the latest clalms to gold repre ence,as'20ti Centuryhistoryclearly dem' deficits.Tleasurygold notis tn today's

onstrates.Nonetleless.onceachleved.the marketscouldbesold at interestrates ap -

sentedby the huge world overhangof flat

currency,malnly dollars. dlsclpltne of the gold standard would proximatlng2% or less. In fact fmm to

The lmmedlate problem 0f Festortnga surrly relnforte anU-lnflatlonpollcles,and day's marketsoneeanconstructthe equlv' Mr. Greensrr'n,ol the econornit'consult.

gold standardls flxlng a gold price that ls make tt far more dlfflcult to resurneflnan' alent of a 22-monthTreasury gold note ' ing lirm ol Twcnsend-Greenspan & C'o.,

conslstentwlth market forces.Obvlotslyif clal pmtllgacy.The redemptionof dollars yielding l%, by arbitra$ng regular T?ea- wos clwirman of the Councilof Econotrtic

for gold tn respooseto excessfederal gov; surf note yrelG lor -June,lllS3.rnatudues. Aduisers"l97l-n.,. - 1..--- ,, .: --- - , ,

tle offerlng prlce by the.Treasuty-lstm-

A ,Gonversation

With the French-ForcjgnMinister

"ln the beglnnlng lt seemedthat you and the Carlbbean.and thls ls what we

By Krnrw Eu.rmr House supportleftists; hencetielr Joint declara-

tion over the weekendwlth Mexico that were only interested ln Soutlr Africa be shallsay all over tie world.Our positionis --,

, and.Felu.KBssLnn. they recognlz€leftlst guerrillas ln El Sal' eauseSouti'Afrlca has mlnerds. a stmng,' much.cleareuthan any prlvious-pvern'

PARIS-Wien the SoilalFs dame to -fiese , strate8lc posltion, a very bn8tt hdustry ment."

vador, though the U.S.-refusesto,

power in France this sprlng, the govern' prlorlUesand pollcles.so sharply at odds and a develop€dsoclety.Why botler wlth For all these reasons. Mr. Cheysson

ment's first emlssery to the Whlte House wlth the U.S., puzde and annoy many tie rest? But pro8Tesslvely, one coujd see

was Claude Cheysson,thls country's re tie rest of Alrica comlnglnto tle plcture." s3y5,France wlll pusl hard at tlle meeting

Amerlcans. of leaders from lndustrtal and developlng

-^-l,olrlv nrrlcm|ran mlnlc?er nf eyterntl lF a wont (ntdnr{drrt lfr /rhorrccnn --..--- l- F^--rt- rt^vl^^ navt h^hth t^.

You might also like

- Towards HyperinflationDocument14 pagesTowards Hyperinflationpaganrongs100% (1)

- 1982a Bpea Cooper Dornbusch HallDocument56 pages1982a Bpea Cooper Dornbusch Hallluchi lovoNo ratings yet

- M3.1 - Lectura El Periodo Oro ClásicoDocument14 pagesM3.1 - Lectura El Periodo Oro ClásicoAlf LozNo ratings yet

- Gold Anchor Federal ReserveDocument3 pagesGold Anchor Federal ReserveAnatol GamartaNo ratings yet

- The First Pillar of Sound Money and CreditDocument4 pagesThe First Pillar of Sound Money and CreditcvolffNo ratings yet

- Gold Boiling in OilDocument11 pagesGold Boiling in Oilbillythekid10No ratings yet

- Angela Redish: Anchors Aweigh: The Transition From Commodity Money To Fiat Money in Western EconomiesDocument22 pagesAngela Redish: Anchors Aweigh: The Transition From Commodity Money To Fiat Money in Western EconomiesSufian Andres GallegoNo ratings yet

- A e Fwo B Blly Anchor 3312012Document6 pagesA e Fwo B Blly Anchor 3312012New AustrianeconomicsNo ratings yet

- International Financial Management 7Th Edition Eun Resnick 9780077861605 0077861604 Test Bank Full Chapter PDFDocument36 pagesInternational Financial Management 7Th Edition Eun Resnick 9780077861605 0077861604 Test Bank Full Chapter PDFdale.reed280100% (15)

- Gold Bonds and Silver AgitationDocument20 pagesGold Bonds and Silver AgitationIoproprioio0% (1)

- National Housing PolicyDocument2 pagesNational Housing Policykrvia 2019No ratings yet

- Economics AssignmentDocument14 pagesEconomics Assignment10nov1964No ratings yet

- Gold Standard and Bretton Woods SystemDocument6 pagesGold Standard and Bretton Woods SystemSrinivas ShirurNo ratings yet

- Bordo Classical Gold Standard 1981Document16 pagesBordo Classical Gold Standard 1981ecrcauNo ratings yet

- Will Import Curbs On Gold Be EffectiveDocument3 pagesWill Import Curbs On Gold Be EffectiveMonu SharmaNo ratings yet

- The Currency Famine of 1893, John DeWitt WarnerDocument12 pagesThe Currency Famine of 1893, John DeWitt Warnervanveen1967No ratings yet

- Nine (Rings) For Mortal Men: Janus AnalysisDocument12 pagesNine (Rings) For Mortal Men: Janus AnalysisResearchtimeNo ratings yet

- Of Gold, Gods & AliensDocument6 pagesOf Gold, Gods & AlienssnapeaNo ratings yet

- 1939 - A Program For Monetary ReformDocument43 pages1939 - A Program For Monetary Reformcraggy_1No ratings yet

- The Golden RevolutionDocument3 pagesThe Golden RevolutionAkash MehtaNo ratings yet

- Trade and Barter 12 May 2012Document2 pagesTrade and Barter 12 May 2012woojerNo ratings yet

- Full Download International Financial Management Eun 7th Edition Test Bank PDF Full ChapterDocument36 pagesFull Download International Financial Management Eun 7th Edition Test Bank PDF Full Chapterbiolyticcrotonicvud19100% (18)

- A New Standard of ValueDocument3 pagesA New Standard of ValueJorge MoraesNo ratings yet

- Gold Standard 1Document4 pagesGold Standard 1Hung Ngoc LeNo ratings yet

- International Financial Management Eun 7th Edition Test BankDocument36 pagesInternational Financial Management Eun 7th Edition Test Bankburinsaphead.y0jq100% (42)

- Investing in GoldDocument3 pagesInvesting in GoldVasan MohanNo ratings yet

- Would A Return To A Gold Standard HelpDocument6 pagesWould A Return To A Gold Standard HelpCharlesFlanaganNo ratings yet

- Buiter Gold A Six Thousand YearDocument8 pagesBuiter Gold A Six Thousand YearInigo GarciandiaNo ratings yet

- FREE, 6-20-21, SilverChartist ReportDocument24 pagesFREE, 6-20-21, SilverChartist ReporthabomuninNo ratings yet

- International EconomicsDocument13 pagesInternational EconomicsMAYNo ratings yet

- The Gold Standard Journal 22Document13 pagesThe Gold Standard Journal 22ulfheidner9103No ratings yet

- WP 9205 The Gold Standard As A Rule PDFDocument65 pagesWP 9205 The Gold Standard As A Rule PDFgopal sharmaNo ratings yet

- BDNG 3103Document11 pagesBDNG 3103prithinahNo ratings yet

- Eichengreen, Globalising Capital - NotesDocument8 pagesEichengreen, Globalising Capital - NotesChristopher JohnsonNo ratings yet

- Hamilton - 1988 - The Role of The Gold Standard in Propogating The Great DepressionDocument23 pagesHamilton - 1988 - The Role of The Gold Standard in Propogating The Great DepressionjpkoningNo ratings yet

- Aef Whither GoldDocument40 pagesAef Whither GoldJohn SchappertNo ratings yet

- 1966 - Morris - The Balance of Payments CrisesDocument11 pages1966 - Morris - The Balance of Payments Crisesrogue_lettuceNo ratings yet

- Choice of Technique in Gold Assay of JewelleryDocument11 pagesChoice of Technique in Gold Assay of Jewelleryamukti27No ratings yet

- The Classical Gold Standard: Central BanksDocument10 pagesThe Classical Gold Standard: Central BanksBHAVYA GUPTANo ratings yet

- ASC 2008 Gold StandardDocument20 pagesASC 2008 Gold Standardlbrty4all9227No ratings yet

- AEF Gold Bills DoctrineDocument4 pagesAEF Gold Bills DoctrinebetancurNo ratings yet

- 2140578private TokenDocument26 pages2140578private TokenRichard eldon woodNo ratings yet

- Dow Gold RatioDocument21 pagesDow Gold RatioPrimo KUSHFUTURES™ M©QUEENNo ratings yet

- Keynes FineGoldv 1930Document6 pagesKeynes FineGoldv 1930Jorge “Pollux” MedranoNo ratings yet

- Wiley Canadian Economics AssociationDocument20 pagesWiley Canadian Economics AssociationsauravjhaNo ratings yet

- Hardman & Company Gold Update Jan 2020Document60 pagesHardman & Company Gold Update Jan 2020TFMetals100% (1)

- Arthur J. Rolnick, François R. Velde e Warren E. Weber, The Debasement PuzzleDocument21 pagesArthur J. Rolnick, François R. Velde e Warren E. Weber, The Debasement PuzzlePedro PuntoniNo ratings yet

- A New Standard of ValueDocument6 pagesA New Standard of ValueRanZinza SmurphNo ratings yet

- How to Invest in Gold: A guide to making money (or securing wealth) by buying and selling goldFrom EverandHow to Invest in Gold: A guide to making money (or securing wealth) by buying and selling goldRating: 3 out of 5 stars3/5 (1)

- Under The GoldenDocument2 pagesUnder The GoldenArien MercadoNo ratings yet

- 20 Year Gold Price History in US Dollars Per Ounce. TopDocument3 pages20 Year Gold Price History in US Dollars Per Ounce. TopIshan RathodNo ratings yet

- 5commodity Cycle-April 2013Document3 pages5commodity Cycle-April 2013Rajat KaushikNo ratings yet

- GoldDocument4 pagesGoldchivotrader100% (1)

- Gold Standard PDFDocument3 pagesGold Standard PDFkutaNo ratings yet

- The Great Depression: Presented By: Aaron Deutch Sawyer Goldberg Alex Ottenheimer Camille FougerolDocument41 pagesThe Great Depression: Presented By: Aaron Deutch Sawyer Goldberg Alex Ottenheimer Camille FougerolAaron DeutschNo ratings yet

- Assignment IFMDocument2 pagesAssignment IFMVijay Kumar VasamNo ratings yet

- Erste Group Bank Gold ReportDocument55 pagesErste Group Bank Gold ReportLostWNo ratings yet

- Irwin Schiff - How An Economy Grows and Why It Doesn'tDocument108 pagesIrwin Schiff - How An Economy Grows and Why It Doesn't5uw5i6y580% (5)

- HOW MUCH DID BANKS PAY TO BECOME TOO-BIG-TO-FAIL AND TO BECOME SYSTEMICALLY IMPORTANT? Philadelphiafed - wp09-34 - 2009Document58 pagesHOW MUCH DID BANKS PAY TO BECOME TOO-BIG-TO-FAIL AND TO BECOME SYSTEMICALLY IMPORTANT? Philadelphiafed - wp09-34 - 2009LostWNo ratings yet

- The Kingdom of Moltz - Irwin SchiffDocument65 pagesThe Kingdom of Moltz - Irwin SchiffLostWNo ratings yet

- The Opium WarsDocument19 pagesThe Opium WarsLostW100% (4)

- FedDocument164 pagesFedwarhed76No ratings yet

- Maintaining Automatic Teller Machine (ATM) Services PDFDocument41 pagesMaintaining Automatic Teller Machine (ATM) Services PDFnigus83% (6)

- BANKINGDocument20 pagesBANKINGShazia TasneemNo ratings yet

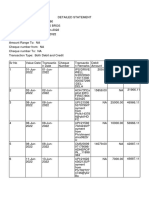

- Treatment:-: Less From Bank StatementDocument4 pagesTreatment:-: Less From Bank StatementSafi SheikhNo ratings yet

- Charges Details: Statement DateDocument1 pageCharges Details: Statement DateIbrahim LaminNo ratings yet

- Week1 - Electronic CommerceDocument3 pagesWeek1 - Electronic CommerceMary Joy Emjhay BanalNo ratings yet

- Article AssgnmentDocument27 pagesArticle AssgnmentNurul NadiaNo ratings yet

- Solved Sonia A Retailer Has The Following Assets A Factory WorthDocument1 pageSolved Sonia A Retailer Has The Following Assets A Factory WorthAnbu jaromiaNo ratings yet

- Shring Construction Quo-20-21-196Document1 pageShring Construction Quo-20-21-196chitranjan4kumar-8No ratings yet

- Negotiable Instrument Hand OutsDocument51 pagesNegotiable Instrument Hand OutsHenry Jones UrsalesNo ratings yet

- 7.2 Bond ValuationDocument59 pages7.2 Bond ValuationAlperen KaragozNo ratings yet

- Funding Your COL Account PDFDocument11 pagesFunding Your COL Account PDFNAi IAnNo ratings yet

- Detailstatement - 19 9 2022@13 54 2Document12 pagesDetailstatement - 19 9 2022@13 54 2credit cardNo ratings yet

- CRM AssignmentDocument13 pagesCRM AssignmentAaron RodriguesNo ratings yet

- Kauna - Effect of Credit Risk Management Practices On Financial Performance of Commercial Banks in KenyaDocument68 pagesKauna - Effect of Credit Risk Management Practices On Financial Performance of Commercial Banks in KenyaGizachew100% (1)

- Worldpay PayFac Dynamic Payout FAQ V2.3Document22 pagesWorldpay PayFac Dynamic Payout FAQ V2.3Louiz MarianoNo ratings yet

- Loan Documentation PDFDocument16 pagesLoan Documentation PDFMuhammad Akmal HossainNo ratings yet

- Report On Bank IslamiDocument25 pagesReport On Bank IslamiFaseeh-Ur-RehmanNo ratings yet

- On-The-Job Traning at Rizal Commercial Banking Corporation (RCBC)Document1 pageOn-The-Job Traning at Rizal Commercial Banking Corporation (RCBC)rodel amorNo ratings yet

- Bangalore University - Provisional Examination ResultsDocument2 pagesBangalore University - Provisional Examination ResultsMegha PkNo ratings yet

- AfmDocument144 pagesAfmvssutsinha90No ratings yet

- Federal Reserve What Everyone Needs To Know (Axilrod)Document156 pagesFederal Reserve What Everyone Needs To Know (Axilrod)bassfreakstirsNo ratings yet

- Cis Ets GueyeDocument3 pagesCis Ets GueyeLaert RuttembergNo ratings yet

- Short - Term Sources of FinanceDocument10 pagesShort - Term Sources of FinanceRadha ChoudhariNo ratings yet

- General Form 74-A RCEDocument2 pagesGeneral Form 74-A RCEMark LeeNo ratings yet

- Resume ImranDocument2 pagesResume Imranfahadffareed100% (2)

- Pay Offline: Learn About Changes To Your IELTS Test Arrangements Due To Coronavirus (COVID-19)Document2 pagesPay Offline: Learn About Changes To Your IELTS Test Arrangements Due To Coronavirus (COVID-19)k.a.awan889950No ratings yet

- April 2018 PDFDocument16 pagesApril 2018 PDFPallaviNo ratings yet

- fkchegg.comDocument4 pagesfkchegg.commisssunshine112No ratings yet

- Auto Repair Invoice TemplateDocument2 pagesAuto Repair Invoice TemplateEscapayd ENo ratings yet

- Cca Questions All Merged by VKG PDFDocument75 pagesCca Questions All Merged by VKG PDFabhishekNo ratings yet