Professional Documents

Culture Documents

Textile Sector 2012-13

Uploaded by

Shahaan Zulfiqar0 ratings0% found this document useful (0 votes)

67 views26 pagesTextile Sector 2012-13

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTextile Sector 2012-13

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

67 views26 pagesTextile Sector 2012-13

Uploaded by

Shahaan ZulfiqarTextile Sector 2012-13

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 26

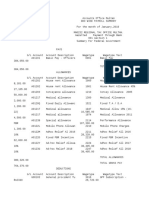

DAC MEETING OF APPORTIONMENT OF EXPENSES IN TEXTILE SECTOR

AUDIT REPORT 2012-13 (HEALD ON 21.08.2013 AT LAHORE)

Para 9.1:Short levy of tax due to incorrect apportionment of expenses between normal income and PTR income.

S.No. Audit

Para/A

O No.

Name of taxpayer Amount

involved

Tax

Year

Departmental reply

Audit Remarks

29.07.2013 &

30.07.2013

DAC Directives

21.08.2013

1 9.1/49

Special

Zone

M/s Shah Shamash

Cotton Industries, (Pvt)

Ltd NTN 0133527-8

30.820

2011

Under process.

Assessment

proceedings may be

finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

2 9.1/50

Special

Zone

M/s Al-Hamad

Corporation (Pvt) Ltd

NTN 0101016-6

30326

2011

Under process

Latest Compliance 13.01.2014

Show cause notice u/s 122(5A)/122(9) of the Income

Tax Ordinance, 2001 have been issued vide No.656

dated 22.06.2013. Proceedings will be concluded in

the instant month.

Assessment

proceedings may be

finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

3 9.1/52

Special

Zone

M/s Fazal Rehman

Fabrics Ltd.

NTN 254644-0

9.344

2011

Under process

Latest Compliance 13.01.2014

Show cause notice u/s 122(5A) of the Income Tax

Ordinance, 2001 have been issued vide No.655 dated

22.06.2013. Proceedings will be concluded in the

instant month.

Assessment

proceedings may be

finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

4 9.1/53

Special

Zone

M/s Mehmood Textile

Mills Ltd.

NTN 0133340-2

100.633

2011

Under process.

Assessment

proceedings may be

finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

5 9.1/54

Special

Zone

M/s Maqbool Textile

Mills Ltd.

NTN 0711064-2

4.938

2011

Under process

Latest Compliance 13.01.2014

Show cause notice u/s 122(5A) of the Income Tax

Ordinance, 2001 have been issued vide No.661 dated

22.06.2013. Proceedings will be concluded in the

instant month.

Assessment

proceedings may be

finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

6 9.1/60

Special

Zone

M/s. Abbasi Almadni

Cotton Industries

(3624992-7)

0.249

2011

Under process

Latest Compliance 13.01.2014

Show cause notice issued for compliance dated

30.07.2013.

. DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

7 9.1/61 M/s. Muhammad

Akram & Co.

2543003-3

0.335

2011

Under process

Latest Compliance 13.01.2014

Show cause notice issued for compliance dated

30.07.2013.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

8 9.1/70 M/s. Barat & Brother

Cotton Industries and

oil Mills 1827360-2

0.737

2011

The proceedings under section 122(5A) of the Income

Tax Ordinance, 2001 are under process. Reply of the

taxpayer is awaited.

Assessment

proceedings may be

finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

9 9.1/71 M/s. Bukhari Industries

1450279-8

1.018

2011

The proceedings under section 122(5A) of the Income

Tax Ordinance, 2001 are under process. Reply of the

taxpayer is awaited.

Assessment

proceedings may be

finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

10 9.1/112

Special

Zone

M/s. Shujabad

Weaving Mills Ltd

2700524-7

10.368

2011

Under process

Latest Compliance 13.01.2014

Show cause notice u/s 122(5A) of the Income Tax

Ordinance, 2001 have been issued vide No.658 dated

22.06.2013. Proceedings will be concluded in the

instant month.

Assessment

proceedings may be

finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

11 9.1/115

Special

Zone

M/s Ahmad Fine

Textile Mills Ltd.

NTN 0698059-7

8.332

2011

Under process

Latest Compliance 13.01.2014

Show cause notice u/s 122(5A) of the Income Tax

Ordinance, 2001 have been issued vide No.660 dated

22.06.2013. Proceedings will be concluded in the

instant month.

Assessment

proceedings may be

finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

Para 9.2: Excess assessment of loss due to incorrect adjustment of losses & apportionment of expenses between normal income

and PTR income with potential tax effect

12 9.2/58 M/s Fatima Enterprises

NTN 0101073-5

47.793

2011

Under process Assessment

proceedings may be

finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

Para 9.3:Non apportionment of turnover between FTR & PTR resulting short recovery of minimum tax

13 9.3/51

Special

Zone

M/s Colony Mills Ltd,

NTN 2585135-7

1.313

2011

Under process

Latest Compliance 13.01.2014

Show cause notice u/s 122(5A) of the Income Tax

Ordinance, 2001 have been issued vide No.653 dated

22.06.2013. Proceedings will be concluded in the

instant month.

Assessment

proceedings may be

finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

14 9.3/55

Special

Zone

M/s Reliance

Weaving Mills Ltd.

NTN 0133480-8

42.266

2011

Under process

Latest Compliance 13.01.2014

Show cause notice u/s 122(5A) of the Income Tax

Ordinance, 2001 have been issued vide No.654 dated

22.06.2013. Proceedings will be concluded in the

instant month.

Assessment

proceedings may be

finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

15 9.3/57

Special

Zone

M/s Ahmad Hassan

Textile Mills Ltd.

Multan NTN

0100978-8

15.090

2011

Under process Assessment

proceedings may be

finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

16 9.3/59

Special

Zone

M/s Fatima

Enterprises

NTN 0101073-5

0.099

2011

Under process

Latest Compliance 13.01.2014

Show cause notice u/s 122(5A) of the Income Tax

Ordinance, 2001 have been issued vide No.643 dated

22.06.2013. Proceedings will be concluded in the

instant month.

Assessment

proceedings may be

finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

17 9.3/62 M/s. Ikhlaq Brothers

Cotton Ginning

Factory & Oil Mills

2144907-4

3.238

2011

The notice u/s 122(5A) has been issued to the

taxpayer as per observation raised by Audit

Authorities for compliance by 02.07.2013 but

remained un attended. The proceedings in this case

Assessment

proceedings may be

finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

are under process. 15.09.2013.

18 9.3/65 M/s. Amjad Farooq

Cotton Industries

1615637-4

0.224

2011

Contested

The turnover declared by the taxpayer in return of

income for the tax year under consideration other than

FTR is less than 50M and Section 113(3) (a) provides

exemptions from levy of turnover tax to all such

taxpayers whose declared turnover other than FTR

is less than 50M. The term turnover has been

defined in Section 113(3)(a) of the Income Tax

Ordinance, 2001. Moreover, an agreement was

executed between the PCGA and the department,

which also provides exemption of levy of tax on

supplies of Cotton Seed to the Cotton Ginners if they

have paid tax on cotton lint @ 1%. The CBR (now

FBR) further clarified vide letter c.no.1(4)dt-14/91

dated June, 27, 1994 that no separate addition in

income shall be made on account of sales of cotton

seed and oil cake. The Audit observation of the Audit

Authorities is regarding non-payment of tax on cotton

seeds which in the light of above discussion incorrect.

The contention of

the department is

not acceptable as

turnover from all

sources is greater

than 50 (m). RTO

to reconsider the

case for levy of

minimum tax.

Further department

to see the

applicability of

Circular dated

June,27,1994,

which was

applicable to ITO

1979 which has

been repealed.

Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

to audit/FBR by

15.09.2013.

19 9.3/66

Sahiwal

Zone

M/s. Awais Cotton

Factory & Oil Mills

25331507

0.429

2011

As per the definition of turnover tax provided in the

section 113 of the Income Tax Ordinance,2001. The

normal turnover remains below the thrash hold

provided for AOPs & IND.

Latest compliance 28.10.2013

Total declared turnover is Rs.620,561,864/- out of

which Rs.570,886,194/- is pertaining to final tax

regime the balance turnover of Rs.49,675,670/-

pertaining to normal turnover. As per the

definition of turnover tax provided in the section

113 of the Income Tax Ordinance,2001. The

normal turnover remains below the thrash hold

provided for AOPs & IND.

Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

to audit/FBR by

15.09.2013.

20 9.3/67

Sahiwal

Zone

M/s. Awais Cotton

Factory & Oil Mills

Unit-2 2738837-9

0.285

2011

As per the definition of turnover tax provided in the

section 113 of the Income Tax Ordinance,2001. The

normal turnover remains below the thrash hold

provided for AOPs & IND.

Latest compliance 28.10.2013

Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

Total declared turnover is Rs.298,199,489/- out of

which Rs.263,159,144/- is pertaining to final tax

regime the balance turnover of Rs.35,040,705/-

pertaining to normal turnover. As per the

definition of turnover tax provided in the section

113 of the Income Tax Ordinance,2001. The

normal turnover remains below the thrash hold

provided for AOPs & IND.

to audit/FBR by

15.09.2013.

21 9.3/68

Sahiwal

Zone

M/s. Baba Farid

Corporation

1744311-3

0.239

2011

As per the definition of turnover tax provided in the

section 113 of the Income Tax Ordinance,2001. The

normal turnover remains below the thrash hold

provided for AOPs & IND.

Latest compliance 28.10.2013

Total declared turnover is Rs.244,483,673/- out of

which Rs.396,552,920/- is pertaining to final tax

regime the balance turnover of Rs.25,930,753/-

pertaining to normal turnover. As per the

definition of turnover tax provided in the section

113 of the Income Tax Ordinance,2001. The

normal turnover remains below the thrash hold

provided for AOPs & IND.

Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

to audit/FBR by

15.09.2013.

22 9.3/69

Multan

Zone

M/s. Bajwa Model

Cotton ginning

Factory & Oil Mills

3151755-2

0.471

2011

Contested The notice u/s 122(5A) has been issued

to the taxpayer. In response to the same the taxpayer

has replied that turnover declared for the tax year

under consideration is inclusive of sales of cotton

seed. If the same is subtracted from total declared

sales the balance amount becomes less than 50M

which is exempt from levy of turnover tax u/s 113

(3)(a) of the Income Tax Ordinance, 2001. Moreover,

an agreement was executed between the PCGA and

the department, which also provides exemption of

levy of tax on supplies of Cotton Seed to the Cotton

Ginners if they have paid tax on cotton lint @ 1%.

The CBR (now FBR) further clarified vide letter

c.no.1(4)dt-14/91 dated June, 27, 1994 that no

separate addition in income shall be made on account

of sales of cotton seed and oil cake. The Audit

observation of the Audit Authorities is regarding non-

payment of tax on cotton seeds which in the light of

The contention of

the department is

not acceptable as

turnover from all

sources is greater

than 50 (m). RTO

to reconsider the

case for levy of

minimum tax.

Further department

to see the

applicability of

Circular dated

June,27,1994,

which was

applicable to ITO

1979 which has

been repealed.

Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

to audit/FBR by

15.09.2013.

above discussion incorrect.

Moreover, in response to show cause notice u/s

122(5A) the taxpayer has furnished bifurcation of

sales pertaining to ginning section and oil Mills section

separately in support of his declared results which is

reproduced as under

Ginning Section

1. Sales of cotton lint. Rs.418,693,445/- Tax has been

paid @ 1%

2. Cotton Seeds. Rs. 38,918,836/- (not liable to

turnover tax).

Total Sales. Rs. 457,612,281/-

Oil Mills Section.

1. Cotton Seed Oil. Rs. 11,637,313/-

2. Oil Cake. Rs. 34,069,616/--

Total:- Rs.45,706,929/-

The turnover is less than 50M

23 9.3/72

Sahiwal

Zone

M/s. Chaudhary

Model Cotton

Ginners 2145798-7

0.235

2011

As per the definition of turnover tax provided in the

section 113 of the Income Tax Ordinance,2001. The

normal turnover remains below the thrash hold

provided for AOPs & IND.

Latest compliance 28.10.2013

Total declared turnover is Rs.304,328,583/- out of

which Rs.257,613,752/- is pertaining to final tax

regime the balance turnover of Rs.46,714,831/-

pertaining to normal turnover. As per the

definition of turnover tax provided in the section

113 of the Income Tax Ordinance,2001. The

normal turnover remains below the thrash hold

provided for AOPs & IND.

Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

to audit/FBR by

15.09.2013.

24 9.3/73

Special

Zone

M/s. Elahi Fabrics

1525690-1

0.334 2011

Under process

Latest Compliance 13.01.2014

Show cause notice u/s 122(5A) of the Income Tax

Ordinance, 2001 have been issued vide No.649 dated

22.06.2013. Proceedings will be concluded in the

instant month.

Assessment

proceedings may

be finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

25 9.3/74

special

Zone

M/s Ghaffar Cotton

Ginning, Pressing &

oil Mills, multan

0.618 2011 Under process

Latest Compliance 13.01.2014

The notice u/s 122(5A) has been issued to the

taxpayer as per observation raised by Audit

Authorities for compliance by 02.07.2013 but

remained un attended. The proceedings in this case

are under process.

Assessment

proceedings may

be finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

26 9.3/75

Multan

Zone

M/s. Habib Cotton

Industries & Oil Mills,

MmianCchannu

1.215 2011 The notice u/s 122(5A) has been issued to the

taxpayer as per observation raised by Audit

Authorities for compliance by 02.07.2013 but

remained un attended. The proceedings in this case

are under process.

Assessment

proceedings may

be finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

27 9.3/76

Sahiwal

Zone

M/s. Haji Ghafoor&

Co. 1298909-6

0.731

2011

Show cause notice issued for compliance dated

30.07.2013.

Latest Compliance 28.10.2013

Assessment u/s 122(5A) has been completed on

02.09.2013 creating demand of Rs.819586/-. Copy

of order enclosed.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

28 9.3/77

Sahiwal

Zone

M/s. Hajvery Cotton

Factory & Oil Mills

2490908-4

0.540

2011

Show cause notice issued for compliance dated

30.07.2013.

Latest Compliance 28.10.2013

Assessment u/s 122(5A) has been completed on

02.09.2013 creating demand of Rs.568980/-. Copy

of order enclosed.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

29 9.3/78

Multan

Zone

M/s Hiraj Cotton

Ginning Pressing &

Oil Mills

KABIRWALA.

0.615 2011 Contested

The notice u/s 122(5A) has been issued to the

taxpayer. In response the taxpayer has replied that

turnover declared amounting to Rs.138813594/-

pertaining to the NTR for the tax year under

consideration is inclusive of sale of cotton seed

amounting to Rs.59005093/-. On balance amount of

Rs.79808501/- turnover tax under section 113 has

properly been paid @1% by the taxpayer as per

agreement with the PCGA as discussed above. The

Audit observation of the Audit Authorities is regarding

non-payment of tax on cotton seeds which in the light

of above discussion incorrect.

The contention of

the department is

not acceptable as

turnover from all

sources is greater

than 50 (m). RTO

to reconsider the

case for levy of

minimum tax.

Further department

to see the

applicability of

Circular dated

Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

to audit/FBR by

15.09.2013.

Moreover, in response to show cause notice

u/s 122(5A) the taxpayer has furnished bifurcation of

sales pertaining to ginning section and oil Mills section

in support of his declared results which is reproduced

as under

1. Sales of cotton lint. Rs. 690,574,906/- Tax has

been paid @ 1%

2. Cotton Seeds. Rs. 32,551,930/- ( not liable

to turnover tax).

3. Oil cake. Rs.46,391,115/-

4. Waste. Rs. 358,054/-

5. Oil dirt. Rs,.507,402/-

6.Coton Seeds. Rs.59,005,093/- (Not liable

to turnover tax )

Total Sales. Rs. 829,388,500/-

June,27,1994,

which was

applicable to ITO

1979 which has

been repealed.

30 9.3/79

Multan

Zone

M/s Al-Hhussain

Cotton Ginners,

DGK

0.343 2011 Contested

The turnover declared by the taxpayer in return of

income for the tax year under consideration other than

FTR is less than 50M and Section 113(3) (a) provides

exemptions from levy of turnover tax to all such

taxpayers whose declared turnover other than FTR

is less than 50M. The term turnover has been define

in Section 113(3)(a) of the Income Tax Ordinance,

2001. Moreover, an agreement was executed

between the PCGA and the department, which also

provides exemption of levy of tax on supplies of

Cotton Seed to the Cotton Ginners if they have paid

tax on cotton lint @ 1%. The CBR (now FBR) further

clarified vide letter c.no.1(4)dt-14/91 dated June, 27,

1994 that no separate addition in income shall be

made on account of sales of cotton seed and oil cake.

The Audit observation of the Audit Authorities is

regarding non-payment of tax on cotton seeds which

in the light of above discussion incorrect.

The contention of

the department is

not acceptable as

turnover from all

sources is greater

than 50 (m). RTO

to reconsider the

case for levy of

minimum tax.

Further department

to see the

applicability of

Circular dated

June,27,1994,

which was

applicable to ITO

1979 which has

been repealed.

Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

to audit/FBR by

15.09.2013.

31 9.3/80

Multan

Zone

M/s HussainIrfan

Cotton Ginners,

D.G.KHAN

0.130 2011

-do-

-do- Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

to audit/FBR by

15.09.2013.

32 9.3/81

Multan

Zone

M/s. AttahurRehman

Cotton Industries

0100989-3

Show cause notice issued for compliance dated

30.07.2013.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

33 9.3/82

Multan

Zone

M/s Ittefaq Cotton

Ginners & Oil Mills,

D.G.KHAN

0.164 2011 Contested

The turnover declared by the taxpayer in return of

income for the tax year under consideration other than

FTR is less than 50M and Section 113(3) (a) provides

exemptions from levy of turnover tax to all such

taxpayers whose declared turnover other than FTR

is less than 50M. The term turnover has been define

in Section 113(3)(a) of the Income Tax Ordinance,

2001. Moreover, an agreement was executed

between the PCGA and the department, which also

provides exemption of levy of tax on supplies of

Cotton Seed to the Cotton Ginners if they have paid

tax on cotton lint @ 1%. The CBR (now FBR) further

clarified vide letter c.no.1(4)dt-14/91 dated June, 27,

1994 that no separate addition in income shall be

made on account of sales of cotton seed and oil cake.

The Audit observation of the Audit Authorities is

regarding non-payment of tax on cotton seeds which

in the light of above discussion incorrect.

The contention of

the department is

not acceptable as

turnover from all

sources is greater

than 50 (m). RTO

to reconsider the

case for levy of

minimum tax.

Further department

to see the

applicability of

Circular dated

June,27,1994,

which was

applicable to ITO

1979 which has

been repealed.

Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

to audit/FBR by

15.09.2013.

34 9.3/83

Sahiwal

Zone

M/s. Ittefaq

Industries Cotton

Ginning Factory

2029783-1

0.049

2011

As per the definition of turnover tax provided in the

section 113 of the Income Tax Ordinance,2001. The

normal turnover remains below the thrash hold

provided for AOPs & IND.

Latest compliance 28.10.2013

Total declared turnover is Rs.257,568,849/- out of

which Rs.243,187,187/- is pertaining to final tax

regime the balance turnover of Rs.14,381,662/-

pertaining to normal turnover. As per the

definition of turnover tax provided in the section

113 of the Income Tax Ordinance,2001. The

normal turnover remains below the thrash hold

provided for AOPs & IND

Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

to audit/FBR by

15.09.2013.

35 9.3/84

Multan

Zone

M/s.

JannatIndustries

KABIRWALA.

0.698 2011 The case pertains to the RTO, Faisalabad.

Request for transfer of audit observation has

already been submitted vide this office letter

No.1685 dated 26.06.2013.

Incorporation

certificate to be

produce to audit.

DAC directed the RTO

to provide the

incorporation

certificate to audit by

15.09.2013.

36 9.3/87

Multan

Zone

M/s. Khan Cotton

Iindustries, CHOWK

AZAM/

1.288 2011 The proceedings under section 122(5A) of the Income

Tax Ordinance, 2001 are under process. Reply of the

taxpayer is awaited.

Assessment

proceedings may

be finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

37 9.3/88

Multan

Zone

Mian Cotton

Industries & Oil Mills

1.82

2011

As per online verification, NTN mentioned in the

audit observation for Mian Cotton Industries is

actually allotted to M/s. JhoolayLaal Cotton

Ginning.

Discussed in detail.

DAC directed the RTO

to get the position

verified by audit by

15.09.2013.

38 9.3/89

Multan

Zone

M/S Mehar Cotton

Iindustries, KHANEWAL

1.171 2011 Contested

The notice u/s 122(5A) has been issued to the

taxpayer. In response whereto the taxpayer has

replied that turnover declared for the tax year under

consideration is inclusive of sale of cotton seed etc. If

the same is subtracted from total declared sales the

balance amount becomes less than 50M which is

exempt from levy of turnover tax u/s 113 (3)(a) of the

Income Tax Ordinance, 2001. Moreover, an

agreement was executed between the PCGA and the

department, which also provides exemption of levy of

tax on supplies of Cotton Seed to the Cotton Ginners

if they have paid tax on cotton lint @ 1%. The CBR

(now FBR) further clarified vide letter c.no.1(4)dt-

14/91 dated June, 27, 1994 that no separate addition

in income shall be made on account of sales of cotton

seed and oil cake (copy enclosed). The Audit

observation of the Audit Authorities is regarding non-

payment of tax on cotton seeds which in the light of

above discussion incorrect.

Moreover, in response to show cause notice u/s

122(5A) the taxpayer has furnished bifurcation of

sales pertaining to ginning section and oil Mills section

separately in support of his declared results which is

reproduced as under

The contention of

the department is

not acceptable as

turnover from all

sources is greater

than 50 (m). RTO

to reconsider the

case for levy of

minimum tax.

Further department

to see the

applicability of

Circular dated

June,27,1994,

which was

applicable to ITO

1979 which has

been repealed.

Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

to audit/FBR by

15.09.2013.

Ginning Section

1. Sales of cotton lint. Rs. 698,642,971/- Tax has

been paid @ 1%

2. Cotton Seeds. Rs.85,674,821/- ( not

liable to turnover tax.)

3. Waste. Rs. 601,664/-

Total Sales. Rs. 784,919,456/-

Oil Mills Section.

1. Cotton Seed Oil. Rs. 25,054,867/-

2. Oil Cake. Rs. 24,718,658/-

3. Oil Dirt. Rs. 153,085/-

Total:- Rs.49,576,563/-

Turnover is less than 50(M)

39 9.3/90

Multan

Zone

AL-Manzoor Cotton

Industries 1725600-3

0.767 2011 Contested

The notice u/s 122(5A) has been issued to the

taxpayer. In response whereto the taxpayer has

replied that turnover declared for the tax year under

consideration is inclusive of sale of cotton seed etc. If

the same is subtracted from total declared sales the

balance amount becomes less than 50M which is

exempt from levy of turnover tax u/s 113 (3)(a) of the

Income Tax Ordinance, 2001. Moreover, an

agreement was executed between the PCGA and the

department, which also provides exemption of levy of

tax on supplies of Cotton Seed to the Cotton Ginners

if they have paid tax on cotton lint @ 1%. The CBR

(now FBR) further clarified vide letter c.no.1(4)dt-

14/91 dated June, 27, 1994 that no separate addition

in income shall be made on account of sales of cotton

seed and oil cake (copy enclosed). The Audit

observation of the Audit Authorities is regarding non-

payment of tax on cotton seeds which in the light of

above discussion incorrect.

Moreover, in response to show cause notice u/s

122(5A) the taxpayer has furnished bifurcation of

sales pertaining to ginning section and oil Mills section

separately in support of his declared results which is

reproduced as under

Ginning Section

1. Sales of cotton lint. Rs.323,152,217/- Tax has

been paid @ 1%

The contention of

the department is

not acceptable as

turnover from all

sources is greater

than 50 (m). RTO

to reconsider the

case for levy of

minimum tax.

Further department

to see the

applicability of

Circular dated

June,27,1994,

which was

applicable to ITO

1979 which has

been repealed.

Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

to audit/FBR by

15.09.2013.

2. Cotton Seeds. Rs.33,867,928/- (not liable to

turnover tax.)

3. Waste. Rs.198,470/-

Total Sales. Rs.357,218,615/-

Oil Mills Section.

1. Cotton Seed Oil. Rs.16,367,347/-

2. Oil Cake. Rs.33,369,750/-

3. Oil Dirt. Rs. 67,371/-

Total:- Rs.49,804,468/-

Turnover is less than 50(M)

40 9.3/91

Multan

Zone

M/S MACCA COTTON

INDUSTRIES,

RAJANPUR

0.269 2011 Contested

The turnover declared by the taxpayer in return of

income for the tax year under consideration other than

FTR is less than 50M and Section 113(3) (a) provides

exemptions from levy of turnover tax to all such

taxpayers whose declared turnover other than FTR is

less than 50M. The term turnover has been define in

Section 113(3)(a) of the Income Tax Ordinance, 2001.

Moreover, an agreement was executed between the

PCGA and the department, which also provides

exemption of levy of tax on supplies of Cotton Seed to

the Cotton Ginners if they have paid tax on cotton lint

@ 1%. The CBR (now FBR) further clarified vide

letter c.no.1(4)dt-14/91 dated June, 27, 1994 that no

separate addition in income shall be made on account

of sales of cotton seed and oil cake. The Audit

observation of the Audit Authorities is regarding non-

payment of tax on cotton seeds which in the light of

above discussion incorrect.

Moreover, in response to show cause notice

u/s 122(5A) the taxpayer has furnished bifurcation of

sales pertaining to ginning section and oil Mills section

separately in support of his declared results which is

reproduced as under

Ginning Section

1. Sales of cotton lint. Rs.323,152,217/- Tax has

been paid @ 1%

2. Cotton Seeds. Rs.33,867,928/- (not liable to

turnover tax).

3. Waste. Rs.198,470/-

The contention of

the department is

not acceptable as

turnover from all

sources is greater

than 50 (m). RTO

to reconsider the

case for levy of

minimum tax.

Further department

to see the

applicability of

Circular dated

June,27,1994,

which was

applicable to ITO

1979 which has

been repealed.

Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

to audit/FBR by

15.09.2013.

Total Sales. Rs.357,218,615/-

Oil Mills Section.

1. Cotton Seed Oil. Rs.16,367,347/-

2. Oil Cake. Rs.33,369,750/-

3. Oil Dirt. Rs. 67,371/-

Total:- Rs.49,804,468/-

Turn over is less than 50(M)

41 9.3/92

Multan

Zone

Khalil Cotton Industries,

D.G.K

0.059 2011 Contested

The turnover declared by the taxpayer in return of

income for the tax year under consideration other than

FTR is less than 50M and Section 113(3) (a) provides

exemptions from levy of turnover tax to all such

taxpayers whose declared turnover other than FTR

is less than 50M. The term turnover has been

defined in Section 113(3)(a) of the Income Tax

Ordinance, 2001. Moreover, an agreement was

executed between the PCGA and the department,

which also provides exemption of levy of tax on

supplies of Cotton Seed to the Cotton Ginners if they

have paid tax on cotton lint @ 1%. The CBR (now

FBR) further clarified vide letter c.no.1(4)dt-14/91

dated June, 27, 1994 that no separate addition in

income shall be made on account of sales of cotton

seed and oil cake. The Audit observation of the Audit

Authorities is regarding non-payment of tax on cotton

seeds which in the light of above discussion incorrect.

The contention of

the department is

not acceptable as

turnover from all

sources is greater

than 50 (m). RTO

to reconsider the

case for levy of

minimum tax.

Further department

to see the

applicability of

Circular dated

June,27,1994,

which was

applicable to ITO

1979 which has

been repealed.

Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

to audit/FBR by

15.09.2013.

42 9.3/93

Multan

Zone

M/s. Mukhtar Cotton

Ginners, Khanewal.

1.179 2011 The proceedings under section 122(5A) of the Income

Tax Ordinance, 2001 are under process. Reply of the

taxpayer is awaited.

Assessment

proceedings may

be finalized at the

earliest.

Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

to audit/FBR by

15.09.2013.

43 9.3/94

Multan

Zone

M/s. MuzamamalLatif

Cotton Industries

2396490-1

0.466

2011

Case pertains to Multan Zone Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

to audit/FBR by

15.09.2013.

44 9.3/95

Multan

Zone

M/s. Nasuha Model

Cotton Industries, DGK

0.948 2011 The proceedings under section 122(5A) of the Income

Tax Ordinance, 2001 are under process. Reply of the

taxpayer is awaited.

Assessment

proceedings may

be finalized at the

earliest.

Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

to audit/FBR by

15.09.2013.

45 9.3/96

Sahiwal

Zone

M/s. Pak Millat Cotton

Ginning Factory

2210406-2

2.019

2011

Show cause notice issued for compliance dated

30.07.2013.

Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

to audit/FBR by

15.09.2013.

46 9.3/97

Multan

Zone

M/s. Prime Cotton

Industries, Khanewal

1.677 2011 The proceedings under section 122(5A) of the Income

Tax Ordinance, 2001 are under process. Reply of the

taxpayer is awaited.

Assessment

proceedings may

be finalized at the

earliest.

Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

to audit/FBR by

15.09.2013.

47 9.3/98

Sahiwal

Zone

M/s. Quality Cotton

ginners 2475548-6

0.557

2011

Show cause notice issued for compliance dated

310.07.2013.

Assessment

proceedings may

be finalized at the

earliest.

Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

to audit/FBR by

15.09.2013.

48 9.3/99

Multan

Zone

M/s. Rehmat Industries,

Khanewal.

0.758 2011 Contested

The notice u/s 122(5A) has been issued to the

taxpayer. In response whereto the taxpayer has

replied that turnover declared for the tax year under

consideration is inclusive of sale of cotton seed. If the

same is subtracted from total declared sales the

balance amount becomes less than 50M which is

exempt from levy of turnover tax u/s 113 (3)(a) of the

Income Tax Ordinance, 2001. Moreover, an

The contention of

the department is

not acceptable as

turnover from all

sources is greater

than 50 (m). RTO

to reconsider the

case for levy of

minimum tax.

Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

to audit/FBR by

15.09.2013.

agreement was executed between the PCGA and the

department, which also provides exemption of levy of

tax on supplies of Cotton Seed to the Cotton Ginners

if they have paid tax on cotton lint @ 1%. The CBR

(now FBR) further clarified vide letter c.no.1(4)dt-

14/91 dated June, 27, 1994 that no separate addition

in income shall be made on account of sales of cotton

seed and oil cake. The Audit observation of the Audit

Authorities is regarding non-payment of tax on cotton

seeds which in the light of above discussion incorrect.

Further department

to see the

applicability of

Circular dated

June,27,1994,

which was

applicable to ITO

1979 which has

been repealed.

49 9.3/100

Multan

Zone

Nishat Ashraf Cotton

Ginners, Khanewal

0.287 2011 Contested

The turnover declared by the taxpayer in return of

income for the tax year under consideration other than

FTR is less than 50M and Section 113(3) (a) provides

exemptions from levy of turnover tax to all such

taxpayers whose declared turnover other than FTR

is less than 50M. The term turnover has been define

in Section 113(3)(a) of the Income Tax Ordinance,

2001. Moreover, an agreement was executed

between the PCGA and the department, which also

provides exemption of levy of tax on supplies of

Cotton Seed to the Cotton Ginners if they have paid

tax on cotton lint @ 1%. The CBR (now FBR) further

clarified vide letter c.no.1(4)dt-14/91 dated June, 27,

1994 that no separate addition in income shall be

made on account of sales of cotton seed and oil cake.

The Audit observation of the Audit Authorities is

regarding non-payment of tax on cotton seeds which

in the light of above discussion incorrect.

The contention of

the department is

not acceptable as

turnover from all

sources is greater

than 50 (m). RTO

to reconsider the

case for levy of

minimum tax.

Further department

to see the

applicability of

Circular dated

June,27,1994,

which was

applicable to ITO

1979 which has

been repealed.

Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

to audit/FBR by

15.09.2013.

50 9.3/101

Multan

Zone

M/s. Sattar Cotton

Ginners 3170041-1

0.450

2011

Case pertains to Multan Zone DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

51 9.3/102

Sahiwal

Zone

M/s. Nizami Cotton

Factory & Oil Mills

2632769-4

0.362

2011

As per the definition of turnover tax provided in the

section 113 of the Income Tax Ordinance,2001. The

normal turnover remains below the thrash hold

provided for AOPs & IND. Latest

compliance 28.10.2013

Total declared turnover is Rs.850,098,230/- out of

which Rs.803,499,412/- is pertaining to final tax

regime the balance turnover of Rs.46,598,818/-

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

pertaining to normal turnover. As per the definition

of turnover tax provided in the section 113 of the

Income Tax Ordinance,2001. The normal turnover

remains below the thrash hold provided for AOPs

& IND

52 9.3/103

Multan

Zone

M/s. ShurjeelAmjad

Cotton Industries

0.187

2011

Contested The turnover declared by the taxpayer in

return of income for the tax year under consideration

other than FTR is less than 50M and Section 113(3)

(a) provides exemptions from levy of turnover tax to all

such taxpayers whose declared turnover other than

FTR is less than 50M. The term turnover has been

define in Section 113(3)(a) of the Income Tax

Ordinance, 2001. Moreover, an agreement was

executed between the PCGA and the department,

which also provides exemption of levy of tax on

supplies of Cotton Seed to the Cotton Ginners if they

have paid tax on cotton lint @ 1%. The CBR (now

FBR) further clarified vide letter c.no.1(4)dt-14/91

dated June, 27, 1994 that no separate addition in

income shall be made on account of sales of cotton

seed and oil cake. The Audit observation of the Audit

Authorities is regarding non-payment of tax on cotton

seeds which in the light of above discussion incorrect.

The contention of

the department is

not acceptable as

turnover from all

sources is greater

than 50 (m). RTO

to reconsider the

case for levy of

minimum tax.

Further department

to see the

applicability of

Circular dated

June,27,1994,

which was

applicable to ITO

1979 which has

been repealed.

Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

to audit/FBR by

15.09.2013.

53 9.3/104

Multan

Zone

M/s. Subhan Allah

Cotton Industries

1885325-3

0.382

2011

Case returned to Audit authorities as the same

does not fall within the jurisdiction of RTO Multan.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

54 9.3/105`

Multan

Zone

M/s. Subhan Cotton

Industries

0.168

2011

Contested

The turnover declared by the taxpayer in return of

income for the tax year under consideration other than

FTR is less than 50M and Section 113(3) (a) provides

exemptions from levy of turnover tax to all such

taxpayers whose declared turnover other than FTR

is less than 50M. The term turnover has been define

in Section 113(3)(a) of the Income Tax Ordinance,

2001. Moreover, an agreement was executed

between the PCGA and the department, which also

provides exemption of levy of tax on supplies of

Cotton Seed to the Cotton Ginners if they have paid

tax on cotton lint @ 1%. The CBR (now FBR) further

clarified vide letter c.no.1(4)dt-14/91 dated June, 27,

The contention of

the department is

not acceptable as

turnover from all

sources is greater

than 50 (m). RTO

to reconsider the

case for levy of

minimum tax.

Further department

to see the

applicability of

Circular dated

June,27,1994,

Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

to audit/FBR by

15.09.2013.

1994 that no separate addition in income shall be

made on account of sales of cotton seed and oil cake.

The Audit observation of the Audit Authorities is

regarding non-payment of tax on cotton seeds which

in the light of above discussion incorrect.

which was

applicable to ITO

1979 which has

been repealed.

55 9.3/106

Multan

Zone

M/s. Waseem Cotton

Industries

1686610-0

0.061

2011

Contested The turnover declared by the taxpayer in

return of income for the tax year under consideration

other than FTR is less than 50M and Section 113(3)

(a) provides exemptions from levy of turnover tax to all

such taxpayers whose declared turnover other than

FTR is less than 50M. The term turnover has been

define in Section 113(3)(a) of the Income Tax

Ordinance, 2001. Moreover, an agreement was

executed between the PCGA and the department,

which also provides exemption of levy of tax on

supplies of Cotton Seed to the Cotton Ginners if they

have paid tax on cotton lint @ 1%. The CBR (now

FBR) further clarified vide letter c.no.1(4)dt-14/91

dated June, 27, 1994 that no separate addition in

income shall be made on account of sales of cotton

seed and oil cake. The Audit observation of the Audit

Authorities is regarding non-payment of tax on cotton

seeds which in the light of above discussion incorrect.

The contention of

the department is

not acceptable as

turnover from all

sources is greater

than 50 (m). RTO

to reconsider the

case for levy of

minimum tax.

Further department

to see the

applicability of

Circular dated

June,27,1994,

which was

applicable to ITO

1979 which has

been repealed.

Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

to audit/FBR by

15.09.2013.

56 9.3/107

Sahiwal

Zone

M/s. YousafAyub

Corporation 2495892-1

0.405

2011

As per the definition of turnover tax provided in the

section 113 of the Income Tax Ordinance,2001. The

normal turnover remains below the thrash hold

provided for AOPs & IND.

Latest compliance 28.10.2013

Total declared turnover is Rs.460,492,365/- out of

which Rs.410,956,473/- is pertaining to final tax

regime the balance turnover of Rs.49,535,892/-

pertaining to normal turnover. As per the definition

of turnover tax provided in the section 113 of the

Income Tax Ordinance,2001. The normal turnover

remains below the thrash hold provided for AOPs

& IND

Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

to audit/FBR by

15.09.2013.

57 9.3/108

Special

Zone

M/s. Shaoib Sulman

Textile Mills 2555230-9

3.692

2011

Show cause notice u/s 122(5A) of the Income Tax

Ordinance, 2001 have been issued vide No.651 dated

22.06.2013. Proceedings will be concluded in the

instant month.

Assessment

proceedings may

be finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

58 9.3/109

Multan

Zone

M/s Ashiq Ali Chudary,

Multan.

2.367 2011 The proceedings under section 122(5A) of the Income

Tax Ordinance, 2001 are under process. Reply of the

taxpayer is awaited.

Assessment

proceedings may

be finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

59 9.3/110

Multan

Zone

M/s. Khalid & Co. C/o

Khalid Ali 3211406-7

0.073 2011 Contested

The turnover declared by the taxpayer in return of

income for the tax year under consideration other than

FTR is less than 50M and Section 113(3) (a) provides

exemptions from levy of turnover tax to all such

taxpayers whose declared turnover other than FTR

is less than 50M. The term turnover has been define

in Section 113(3)(a) of the Income Tax Ordinance,

2001. Moreover, an agreement was executed

between the PCGA and the department, which also

provides exemption of levy of tax on supplies of

Cotton Seed to the Cotton Ginners if they have paid

tax on cotton lint @ 1%. The CBR (now FBR) further

clarified vide letter c.no.1(4)dt-14/91 dated June, 27,

1994 that no separate addition in income shall be

made on account of sales of cotton seed and oil cake.

The Audit observation of the Audit Authorities is

regarding non-payment of tax on cotton seeds which

in the light of above discussion incorrect.

The contention of

the department is

not acceptable as

turnover from all

sources is greater

than 50 (m). RTO

to reconsider the

case for levy of

minimum tax.

Further department

to see the

applicability of

Circular dated

June,27,1994,

which was

applicable to ITO

1979 which has

been repealed.

Discussed in detail.

DAC directed the RTO

to initiate the

proceedings as per

content of audit

observation and report

to audit/FBR by

15.09.2013.

60 9.3/116

Special

Zone

M/s Arain Mills Ltd.

NTN 0225871-4

6.271

2011

Under process

Latest Compliance 13.01.2014

Show cause notice u/s 122(5A) of the Income Tax

Ordinance, 2001 have been issued vide No.646 dated

22.06.2013. Proceedings will be concluded in the

instant month.

Assessment

proceedings may

be finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

61 9.3/117

Special

Zone

M/s Arain Textile Mills

Ltd.

NTN 0658181

3.423

2011

Under process

Latest Compliance 13.01.2014

Show cause notice u/s 122(5A) of the Income Tax

Ordinance, 2001 have been issued vide No.648 dated

22.06.2013. Proceedings will be concluded in the

instant month.

Assessment

proceedings may

be finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

62 9.3/118

Special

Zone

M /s Maqbool Usman

Fibers Ltd,

NTN 2232163

9.509

2011

Under process

Latest Compliance 13.01.2014

Show cause notice u/s 122(5A) of the Income Tax

Ordinance, 2001 have been issued vide No.644 dated

22.06.2013. Proceedings will be concluded in the

instant month.

Assessment

proceedings may

be finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

63 9.3/119

Special

Zone

M/s Marral Fibers (Pvt)

Ltd.

NTN 22664438-5

0.820

2011

Under process

Latest Compliance 13.01.2014

Show cause notice u/s 122(5A) of the Income Tax

Ordinance, 2001 have been issued vide No.645 dated

22.06.2013. Proceedings will be concluded in the

instant month.

Assessment

proceedings may

be finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

64 9.3/120

Special

Zone

M/s Raheem Bakhsh

Textile Mills Ltd. NTN

11466215-4

3.516

2011

Under process

Latest Compliance 13.01.2014

Show cause notice u/s 122(5A) of the Income Tax

Ordinance, 2001 have been issued vide No.647 dated

22.06.2013. Proceedings will be concluded in the

instant month.

Assessment

proceedings may

be finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

65 9.3/121

Special

Zone

M/s Suleman Spinning

Mills Ltd.

NTN 1146615-4

6.507

2011

Under process

Latest Compliance 13.01.2014

Show cause notice u/s 122(5A) of the Income Tax

Ordinance, 2001 have been issued vide No.652 dated

22.06.2013. Proceedings will be concluded in the

instant month.

Assessment

proceedings may

be finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

66 9.3/122

Special

Zone

M/s Nippon Carliner (Pvt)

Ltd.

NTN 1146615-4

8.633

2011

Under process Assessment

proceedings may

be finalized at the

earliest.

DAC directed to RTO

to complete the

proceedings report to

audit/FBR BY

15.09.2013.

Para 9.4: Non declaration of proceeds from cotton seed resulting short levy of tax

67 9.4/111

Multan

Zone

Abdullah Cotton Ginners,

Multan

380866 2011 CONTESTED

An agreement was executed between the PCGA and

the department (copy enclosed), which provides

RTO to revisit the

case with respect

to applicability of

DAC directed to RTO to

complete the

proceedings report to

exemption of levy of tax on supplies of Cotton Seed to

the Cotton Ginners if they have paid tax on cotton lint

@ 1%. The CBR (now FBR) further clarified vide

letter c.no.1(4)dt-14/91 dated June, 27, 1994 that no

separate addition in income shall be made on account

of sales of cotton seed and oil cake (copy enclosed).

The Audit observation of the Audit Authorities is

regarding non-payment of tax on cotton seeds which

in the light of above discussion incorrect.

Circular dated

27,June 1994. The

said circular was

applicable for

Income Tax

Ordinance, 1979.

audit/FBR BY

15.09.2013.

68 9.4

Multan

Zone

Allah Tawakal Cotton

Ginners, Multan

301569 2011 CONTESTED

An agreement was executed between the PCGA and

the department (copy enclosed), which provides

exemption of levy of tax on supplies of Cotton Seed to

the Cotton Ginners if they have paid tax on cotton lint

@ 1%. The CBR (now FBR) further clarified vide

letter c.no.1(4)dt-14/91 dated June, 27, 1994 that no

separate addition in income shall be made on account

of sales of cotton seed and oil cake (copy enclosed).

The Audit observation of the Audit Authorities is

regarding non-payment of tax on cotton seeds which

in the light of above discussion incorrect.

RTO to revisit the

case with respect

to applicability of

Circular dated

27,June 1994. The

said circular was

applicable for

Income Tax

Ordinance, 1979.

DAC directed to RTO to

complete the

proceedings report to

audit/FBR BY

15.09.2013.

69 9.4

Multan

Zone

Data Cotton Ginners,

Multan.

124192 2011 --do-- -do- DAC directed to RTO to

complete the

proceedings report to

audit/FBR BY

15.09.2013.

70 9.4

Multan

Zone

Darishak Cotton

Industries, Rajanpur.

304072 2011 --do-- -do- DAC directed to RTO to

complete the

proceedings report to

audit/FBR BY

15.09.2013.

71 9.4

Multan

Zone

Global Cotton Industries,

Rajanpur.

338393 2011 --do-- -do- DAC directed to RTO to

complete the

proceedings report to

audit/FBR BY

15.09.2013.

72 9.4

Multan

Zone

Hassan Cotton Factory

360517 2011 --do-- -do- DAC directed to RTO to

complete the

proceedings report to

audit/FBR BY

15.09.2013.

73 9.4 Abdullah Maaz Cotton 987391 2011 --do-- -do- DAC directed to RTO to

Multan

Zone

Ind., D.G.K complete the

proceedings report to

audit/FBR BY

15.09.2013.

74 9.4

Multan

Zone

Mastooi Cotton Factory,

D.G.K

479672 2011 --do-- -do- DAC directed to RTO to

complete the

proceedings report to

audit/FBR BY

15.09.2013.

75 9.4

Multan

Zone

Mohib Cotton Industry,

Rajanpur

785248 2011 --do-- -do- DAC directed to RTO to

complete the

proceedings report to

audit/FBR BY

15.09.2013.

76 9.4

Multan

Zone

Al-nasar Cotton Industry

663772 2011 --do-- -do- DAC directed to RTO to

complete the

proceedings report to

audit/FBR BY

15.09.2013.

77 9.4

Multan

Zone

Ahmed Saad Cotton

Industries

318478 2011 --do-- -do- DAC directed to RTO to

complete the

proceedings report to

audit/FBR BY

15.09.2013.

78 9.4

Multan

Zone

Al-talib Cotton Industries

358622 2011 --do-- -do- DAC directed to RTO to

complete the

proceedings report to

audit/FBR BY

15.09.2013.

79 9.4

Multan

Zone

ZahidSadiq Cotton Ind.

579831 2011 --do-- -do- DAC directed to RTO to

complete the

proceedings report to

audit/FBR BY

15.09.2013.

80 9.4

Sahiwal

Zone

Ajmeer Cotton Ginners

3157556-7

303272 2011 The sale of cotton seed is covered under the tax paid

@1% on cotton lint.

DAC directed to RTO to

complete the

proceedings report to

audit/FBR BY

15.09.2013.

81 9.4

Sahiwal

Zone

Akram& Co. Cotton

Ginners 2120116

251213 2011 The sale of cotton seed is covered under the tax paid

@1% on cotton lint.

DAC directed to RTO to

complete the

proceedings report to

audit/FBR BY

15.09.2013.

82 9.4

Sahiwal

Zone

Ali Sammad Trader,

Cotton Ginners & Pressing

Factory.

2492546-2

329414 2011 The sale of cotton seed is covered under the tax paid

@1% on cotton lint.

DAC directed to RTO to

complete the

proceedings report to

audit/FBR BY

15.09.2013.

83 9.4

Multan

Zone

Anmol Cotton Ginners 225086 2011 The sale of cotton seed is covered under the tax paid

@1% on cotton lint.

DAC directed to RTO to

complete the

proceedings report to

audit/FBR BY

15.09.2013.

84 9.4

Sahiwal

Zone

Five Star Cotton Ginners

2151100-4

322515 2011 The sale of cotton seed is covered under the tax paid

@1% on cotton lint.

DAC directed to RTO to

complete the

proceedings report to

audit/FBR BY

15.09.2013.

85 9.4

Sahiwal

Zone

Hafiz Cotton Ginners

1270338-9

617336 2011 The sale of cotton seed is covered under the tax paid

@1% on cotton lint.

DAC directed to RTO to

complete the

proceedings report to

audit/FBR BY

15.09.2013.

86 9.4

Sahiwal

Zone

Kashmir Cotton Factory 390439 2011 The sale of cotton seed is covered under the tax paid

@1% on cotton lint.

DAC directed to RTO to

complete the

proceedings report to

audit/FBR BY

15.09.2013.

87 9.4

Multan

Zone

Zafar Brothers Cotton

Ginning & Pressing

Factory

531259 The sale of cotton seed is covered under the tax paid

@1% on cotton lint.

DAC directed to RTO to

complete the

proceedings report to

audit/FBR BY

15.09.2013.

Para 9.6:Incorrect adjustment of carried forward losses resulting non/short levy of tax

88 9.6/56

Special

Zone

M/s. Roomi Cotton

Ginning Industries (Pvt)

Ltd

2.015

2011

Under process Assessment

proceedings may be

finalized at the

earliest.

DAC directed to

RTO to complete

the proceedings

report to audit/FBR

BY 15.09.2013.

Para 9.7:Acceptance of invalid returns of taxpayer against the provisions of the Income Tax Ordinance, 2001

89 9.7/113

Special

Zone

M/s Al-Hilal Industries

(Pvt) Ltd, NTN 0800582-6

2011

Contested

Since taxpayer filed audited accounts.

Audited Accounts

duly certified by the

Charted Accountant

not furnished by the

taxpayer. RTO to

enforce the filing of

audited accounts by

the taxpayer.

DAC directed the

RTO to provide the

requisite

documents and get

the position verified

to audit by

15.09.2013.

90 Special

Zone

M/s FazalRehman Fabrics

Ltd.

NTN 2546440-0

2011

Contested

Since taxpayer filed audited accounts.

-do- DAC directed the

RTO to provide the

requisite

documents and get

the position verified

to audit by

15.09.2013.

91 Special

Zone

M/s Maqbool Textile Mills

Ltd.

NTN 0711064-2

2011

Contested

Since taxpayer filed audited accounts.

-do- DAC directed the

RTO to provide the

requisite

documents and get

the position verified

to audit by

15.09.2013.

92 Special

Zone

M/s Masood Fabrics Ltd.

NTN 1417347-6

2011

Contested

Since taxpayer filed audited accounts.

-do- DAC directed the

RTO to provide the

requisite

documents and get

the position verified

to audit by

15.09.2013.

93 Special

Zone

M/s Mehmood Textile

Mills Ltd.

2011

Contested

Since taxpayer filed audited accounts.

Audited Accounts

duly certified by the

DAC directed the

RTO to provide the

NTN 0133340-2 Charted Accountant

not furnished by the

taxpayer. RTO to

enforce the filing of

audited accounts by

the taxpayer.

requisite

documents and get

the position verified

to audit by

15.09.2013.

94 Special

Zone

M/s RCA (Pvt) Ltd.

NTN 0133459-0

2011

Contested

Since taxpayer filed audited accounts.

-do- DAC directed the

RTO to provide the

requisite

documents and get

the position verified

to audit by

15.09.2013.

95 Special

Zone

M/s Roomi Industries

NTN 2963239-7

2011

Contested

Since taxpayer filed audited accounts.

-do- DAC directed the

RTO to provide the

requisite

documents and get

the position verified

to audit by

15.09.2013.

96 Special

Zone

M/s Shah Shamash

Cotton Industries (Pvt) Ltd.

NTN 0133527-8

2011

Contested

Since taxpayer filed audited accounts.

-do- DAC directed the

RTO to provide the

requisite

documents and get

the position verified

to audit by

15.09.2013.

97 Special

Zone

M/s Shujabad Weaving

Mills Ltd.

NTN 2700524-7

2011

Contested

Since taxpayer filed audited accounts.

-do- DAC directed the

RTO to provide the

requisite

documents and get

the position verified

to audit by

15.09.2013.

98 Special

Zone

M/s Allah Wasaya

Spinning Mills Ltd. NTN

2195628-6

2011

Contested

Since taxpayer filed audited accounts.

-do- DAC directed the

RTO to provide the

requisite

documents and get

the position verified

to audit by

15.09.2013.

99 Special M/s Zainab Textile Mills 2011 Contested -do- DAC directed the

Zone (Pvt) Ltd.

NTN 2497365-3

Since taxpayer filed audited accounts. RTO to provide the

requisite

documents and get

the position verified

to audit by

15.09.2013.

Para 9.8: Excess adjustment of brought forward depreciation and business losses against declared income

100 9.8/114

Special

Zone

M/s Acro Spinning &

Weaving Mills Ltd. NTN

0709640-2

2011

Under process Assessment

proceedings may be

finalized at the

earliest.

DAC directed to

RTO to complete

the proceedings

report to audit/FBR

BY 15.09.2013.

101 Special

Zone

M/s Ahmad Hassan

Textile Mills Ltd. NTN

0100978-8

2011

Under process

Latest Compliance 13.01.2014

Show cause notice u/s 122(5A) of the Income Tax

Ordinance, 2001 have been issued vide No.650 dated

22.06.2013. Proceedings will be concluded in the

instant month.

Assessment

proceedings may be

finalized at the

earliest.

DAC directed to

RTO to complete

the proceedings

report to audit/FBR

BY 15.09.2013.

102 Special

Zone

M/s Al-Hamad

Corporation (Pvt) Ltd.

NTN 0101016-6

2011

Under process Assessment

proceedings may be

finalized at the

earliest.

DAC directed to

RTO to complete

the proceedings

report to audit/FBR

BY 15.09.2013.

103 Special

Zone

M/s Ghafoor Cotton Mills

(Pvt) Ltd.

NTN 0133398-4

2011

Under process Assessment

proceedings may be

finalized at the

earliest.

DAC directed to

RTO to complete

the proceedings

report to audit/FBR

BY 15.09.2013.

104 Special

Zone

M/s Kh.Bashir Ahmad &

Co. (Pvt) Ltd. NTN

3179847-7

2011

Under process Assessment

proceedings may be

finalized at the

earliest.

DAC directed to

RTO to complete

the proceedings

report to audit/FBR

BY 15.09.2013.

105 Special

Zone

M/s Reliance Weaving

Mills Ltd.

NTN 0133480-8

2011

Under process

Latest Compliance 13.01.2014

Assessment

proceedings may be

finalized at the

earliest.

DAC directed to

RTO to complete

the proceedings

report to audit/FBR

Show cause notice u/s 122(5A) of the Income Tax

Ordinance, 2001 have been issued vide No.654 dated

22.06.2013. Proceedings will be concluded in the

instant month.

BY 15.09.2013.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- S 0232 01Document50 pagesS 0232 01Shahaan ZulfiqarNo ratings yet

- Certificate UsmanDocument1 pageCertificate UsmanShahaan ZulfiqarNo ratings yet

- Revised PM PACKAGEDocument14 pagesRevised PM PACKAGEShahaan ZulfiqarNo ratings yet

- Chairman, Federal Board of Revenue, IslamabadDocument3 pagesChairman, Federal Board of Revenue, IslamabadShahaan ZulfiqarNo ratings yet

- Regularization Application To CCIRDocument7 pagesRegularization Application To CCIRShahaan ZulfiqarNo ratings yet

- Certificate EmanDocument1 pageCertificate EmanShahaan ZulfiqarNo ratings yet

- Slip 0232 01 2019Document513 pagesSlip 0232 01 2019Shahaan ZulfiqarNo ratings yet

- NO Marriage CertificateDocument5 pagesNO Marriage CertificateShahaan ZulfiqarNo ratings yet

- Para No. Cases Under Process Satisfactory Reply Amount Pointed Out by Audit Amount Recovered & VerifiedDocument5 pagesPara No. Cases Under Process Satisfactory Reply Amount Pointed Out by Audit Amount Recovered & VerifiedShahaan ZulfiqarNo ratings yet

- Para No Satisfactory Reply Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedDocument5 pagesPara No Satisfactory Reply Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- R 0232 01Document357 pagesR 0232 01Shahaan ZulfiqarNo ratings yet

- Assistance Package For Families of Government Employees Who Die in Service - Sanction of Full Pay and Allowances - Request RegardingDocument5 pagesAssistance Package For Families of Government Employees Who Die in Service - Sanction of Full Pay and Allowances - Request RegardingShahaan ZulfiqarNo ratings yet

- Para No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedDocument5 pagesPara No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Para NO Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedDocument6 pagesPara NO Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument7 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarNo ratings yet

- Para No Satisfactory Reply Unsatisfactory Reply Amount Pointed Out by Audit Amount Recovered and VerifiedDocument5 pagesPara No Satisfactory Reply Unsatisfactory Reply Amount Pointed Out by Audit Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument7 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarNo ratings yet

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument7 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarNo ratings yet

- Para No Satisfactory Reply Subjudice Amount Pointed Out by Audit Amount Recovered and VerifiedDocument4 pagesPara No Satisfactory Reply Subjudice Amount Pointed Out by Audit Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Para No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedDocument5 pagesPara No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument6 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarNo ratings yet

- Para No Satisfactory Reply Unsatisfactory Reply Amount Pointed Out by Audit Amount Recovered and VerifiedDocument4 pagesPara No Satisfactory Reply Unsatisfactory Reply Amount Pointed Out by Audit Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Para No Satisfactory Reply Subjudice Amount Pointed Out by Audit Amount Recovered and VerifiedDocument4 pagesPara No Satisfactory Reply Subjudice Amount Pointed Out by Audit Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Para No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedDocument6 pagesPara No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Para No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedDocument5 pagesPara No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Para No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedDocument6 pagesPara No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument6 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarNo ratings yet

- Para NO Cases Under Process Amount Pointed Out by AuditDocument6 pagesPara NO Cases Under Process Amount Pointed Out by AuditShahaan ZulfiqarNo ratings yet