Professional Documents

Culture Documents

Acc 211 Midterm

Uploaded by

Rinaldi SinagaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acc 211 Midterm

Uploaded by

Rinaldi SinagaCopyright:

Available Formats

MIDTERM EXAM Accounting 211

Name_____________________________________

Section____________________________________

PART 1 Chapter 2

1- Leonard Matson completed these transactions during December of the current year: (5 points)

Prepare general journal entries to record these transactions.

Dec. 1 Began a financial services practice by investing $15,000

cash and office equipment having a $5,000 value.

2 Purchased $1,200 of office equipment on credit.

3 Purchased $300 of office supplies on credit

4 Completed work for a client and immediately received a

Payment of $900 cash.

8 Completed work for Acme Loan Co. on credit, $1,700.

10 Paid for the supplies purchased on credit on December 3.

14 Paid for the annual $960 premium on an insurance policy.

18 Received payment in full from Acme Loan Co. for the work

Completed on December 8.

27 Leonard withdrew $650 cash from the practice to pay

personal expenses.

30 Paid $175 cash for the December utility bills.

30 Received $2,000 from a client for financial services to be rendered

next year.

2- Maria Sanchez began business as Sanchez Law Firm on November 1. Record the following

November transactions by making entries directly to the T-accounts provided. Then, prepare a

trial balance, as of November 30. (15- points)

a) Sanchez invested $15,000 cash and a law library valued at $6,000.

b) Purchased $7,500 of office equipment from Johnson Bros. on credit.

c) Completed legal work for a client and received $1,500 cash in full payment.

d) Paid Johnson Bros. $3,500 cash in partial settlement of the amount owed.

e) Completed $4,000 of legal work for a client on credit.

f) Sanchez withdrew $2,000 cash for personal use.

g) Received $2,500 cash as partial payment for the legal work completed for the client in (e).

h) Paid $2,500 cash for the legal secretary's salary.

M. Sanchez,

Cash Office Equipment Withdrawals

Accounts Receivable Accounts Payable Legal Fees Earned

Law Library M. Sanchez, Capital Salaries Expense

PART 2 Chapter 3

3- Prepare general journal entries on December 31 to record the following unrelated year-end

adjustments. (10 points)

a. Estimated depreciation on office equipment for the year, $4,000.

b. The Prepaid Insurance account has a $3,680 debit balance before adjustment. An examination

of insurance policies shows $950 of insurance expired.

c. The Prepaid Insurance account has a $2,400 debit balance before adjustment. An examination

of insurance policies shows $600 of unexpired insurance.

d. The company has three office employees who each earn $100 per day for a five-day workweek

that ends on Friday. The employees were paid on Friday, December 26, and have worked full

days on Monday, Tuesday, and Wednesday, December 29, 30, and 31.

e. On November 1, the company received 6 months' rent in advance from a tenant whose rent is

$700 per month. The $4,200 was credited to the Unearned Rent account.

f. The company collects rent monthly from its tenants. One tenant whose rent is $750 per month

has not paid his rent for December.

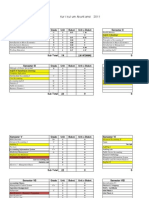

4- The following unadjusted and adjusted trial balances were taken from the current year's

accounting system for High Point. (10 points)

High Point

Trial Balances

For Year Ended December 31

Unadjusted

Trial Balance

Adjusted

Trial Balance

Debit Credit Debit Credit

Cash ..................................................... 11,300 11,300

Accounts receivable ............................. 16,340 17,140

Office supplies ..................................... 1,045 645

Prepaid advertising............................... 1,100 450

Building ............................................... 26,700 26,700

Accumulated depreciationBuilding ... 1,300 6,300

Accounts payable ................................. 3,320 3,500

Unearned services revenue .................. 4,410 3,010

D. Ruiz, Capital ................................... 17,905 17,905

Services revenue .................................. 72,400 74,600

Salaries expense ................................... 34,500 34,500

Utilities expense ................................... 5,450 5,630

Advertising expense ............................. 2,900 3,550

Supplies expense .................................. 400

Depreciation expense building ........... _____ _____ 5,000 ______

Totals ................................................... 99,335 99,335 105,315 105,315

In general journal form, present the six adjusting entries that explain the changes in the account

balances from the unadjusted to the adjusted trial balance. Answer:

PART 3-Chapter 4

5- The calendar year-end adjusted trial balance for Acosta Co. follows: (10 Points)

ACOSTA CO.

Adjusted Trial Balance

December 31

Cash ............................................................................... $ 100,000

Accounts receivable ....................................................... 7,000

Prepaid rent .................................................................... 15,000

Prepaid Insurance ........................................................... 9,000

Office supplies ............................................................... 3,300

Office equipment ........................................................... 8,000

Accumulated depreciationEquipment .......................... $ 3,200

Building ......................................................................... 350,000

Accumulated depreciationBuilding ............................. 42,000

Land ............................................................................... 700,000

Accounts payable ........................................................... 5,800

Salaries payable ............................................................. 14,500

Interest payable .............................................................. 2,500

Long-term note payable ................................................. 52,000

Margarita Acosta, Capital .............................................. 1,010,000

Margarita Acosta, Withdrawals ..................................... 200,500

Service fees earned ........................................................ 370,800

Salaries expense ............................................................. 90,000

Insurance expense .......................................................... 5,200

Rent expense .................................................................. 5,000

Depreciation expenseEquipment ................................. 800

Depreciation expenseBuilding ..................................... 7,000 _________

Totals ............................................................................. $1,500,800 $1,500,800

Required:

(a) Prepare a classified year-end balance sheet. (Note: A $7,000 installment on the long-term

note payable is due within one year.)

(b) Calculate the current ratio.

6- The adjusted trial balance of E. Pace, Consultant is entered on the partial work sheet below.

Complete the work sheet using the following information: (10 points)

(a) Salaries earned by employees that are unpaid and unrecorded, $500.

(b) An inventory of supplies showed $800 of unused supplies still on hand.

(c) Depreciation on equipment, $1,300.

E. Pace, Consulting

Work Sheet

For the year ended December 31

Account

Unadjusted Trial

Balance

Adjustments

Adjusted Trial

Balance

Income

Statement

Balance Sheet and

Statement of

Owners Equity

Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit

Cash ................................ $14,000

Supplies .......................... 1,000

Equipment ...................... 11,000

Accum. Depr. Equip. ... $ 2,000

Accounts payable ........... 500

Salaries payable ..............

E. Pace, capital ............... 6,500

E. Pace, withdrawals ...... 1,500

Fees earned ..................... 30,000

Salary expense ................ 7,500

Rent expense .................. 4,000

Supplies expense ............

Depreciation expense ..... ______ ______

Totals .............................. $39,000 $39,000

PART 4 Chapter 5.

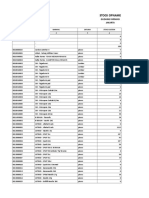

7- Ceres Computer Sales uses the perpetual inventory system and had the following transactions

during December (10 Points)

Required:

Prepare the general journal entries to record these transactions.

8- Maia's Bike Shop uses the perpetual inventory system and had the following transactions during the

month of May: (10 points)

Prepare the required journal entries that Maia's Bike Shop must make to record these transactions.

PART 5 Chapter 6

9- Evaluate each inventory error separately and determine whether it overstates or understates cost

of goods sold and net income. (10 points)

Inventory error: Cost of goods sold is: Net income is:

Dec 1 Sold merchandise on credit for $5,000, terms 3/10, n/30. The items sold had a cost of $3,500.

3 Purchased merchandise for cash, $720.

4 Purchased merchandise on credit for $2,600, terms 1/20, n/30.

5 Issued a credit memorandum for $300 to a customer who returned merchandise purchased

November 29. The returned items had a cost of $210.

11 Received payment for merchandise sold December 1.

15 Received a credit memorandum for the return of faulty merchandise purchased on December 4

for $600.

18 Paid freight charges of $200 for merchandise ordered last month. (FOB shipping point)

23 Paid for the merchandise purchased December 4 less the portion that was returned.

24 Sold merchandise on credit for $7,000, terms 2/10, n/30. The items had a cost of $4,900.

31 Received payment for merchandise sold on December 24.

May 3 Sold merchandise to a customer on credit for $600, terms 2/10, n/30. The cost of the

merchandise sold was $350.

May 4 Sold merchandise to a customer for cash of $425. The cost of the merchandise was $250.

May 6 Sold merchandise to a customer on credit for $1,300, terms 2/10, n/30. The cost of the

merchandise sold was $750.

May 8 The customer from May 3 returned merchandise with a selling price of $100. The cost of the

merchandise returned was $55.

May 15 The customer from May 6 paid the full amount due, less any appropriate discounts earned.

May 31 The customer from May 3 paid the full amount due, less any appropriate discounts earned.

Understatement of beginning inventory .........................

Understatement of ending inventory ..............................

Overstatement of beginning inventory ...........................

Overstatement of ending inventory ................................

Answer:

10- Monitor Company uses the LIFO method for valuing its ending inventory. The following financial

statement information is available for its first year of operation:

Monitor Company

Income Statement

For the year ended December 31

Sales ................................... $50,000

Cost of goods sold .............. 23,000

Gross profit ........................ $27,000

Expenses ............................ 13,000

Income before taxes ........... $14,000

Monitor's ending inventory using the LIFO method was $8,200. Monitor's accountant determined

that had the company used FIFO, the ending inventory would have been $8,500.

a. Determine what the income before taxes would have been, had Monitor used the FIFO

method of inventory valuation instead of LIFO.

b. What would be the difference in income taxes between LIFO and FIFO, assuming a 30% tax

rate?

You might also like

- Review Questions For Test #1 ACC210Document14 pagesReview Questions For Test #1 ACC210Aaa0% (1)

- NVCC Accounting ACC 211 EXAM 1 PracticeDocument12 pagesNVCC Accounting ACC 211 EXAM 1 Practiceflak27bl2No ratings yet

- Recording TransactionsDocument39 pagesRecording Transactionspranali suryawanshiNo ratings yet

- Chapter 13Document38 pagesChapter 13Kimmy ShawwyNo ratings yet

- Basic Accounting: Multiple ChoiceDocument38 pagesBasic Accounting: Multiple ChoiceErika GambolNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial PositionDocument3 pagesTrial Balance Adjustments Profit or Loss Financial PositionCoke Aidenry Saludo100% (1)

- Starting a Business Journal EntriesDocument6 pagesStarting a Business Journal EntriesI IvaNo ratings yet

- X X X X X X X X X X X X X X X X XDocument7 pagesX X X X X X X X X X X X X X X X XAmmarrylee R. WilliamsNo ratings yet

- Final Round - 1ST - QDocument6 pagesFinal Round - 1ST - QwivadaNo ratings yet

- Bsba - Bacc-1 - Midterm Exam - ADocument3 pagesBsba - Bacc-1 - Midterm Exam - AMechileNo ratings yet

- Reversing EntriesDocument9 pagesReversing EntriesHumair Ahmed100% (1)

- ACC 101 Chapter 2 Test (5Document5 pagesACC 101 Chapter 2 Test (5Ammarrylee R. Williams0% (2)

- Worksheet ProblemsDocument3 pagesWorksheet ProblemsClaren Sidnne MadridNo ratings yet

- ACCTG-SPCL-TRANSDocument8 pagesACCTG-SPCL-TRANSMikaella BengcoNo ratings yet

- Answer Guidance For c6Document13 pagesAnswer Guidance For c6thicknhinmaykhoc100% (1)

- Answers R41920 Acctg Varsity Basic Acctg Level 2Document12 pagesAnswers R41920 Acctg Varsity Basic Acctg Level 2John AceNo ratings yet

- Forum ACC WM - Sesi 3 (REV)Document9 pagesForum ACC WM - Sesi 3 (REV)Windy Martaputri100% (2)

- Self Test Questions - Chap - 4 - AnswersDocument4 pagesSelf Test Questions - Chap - 4 - AnswersFahad MushtaqNo ratings yet

- ACCT 201 Exam 1Document16 pagesACCT 201 Exam 1Steve ZaluchaNo ratings yet

- Handout 1 Adjusting Entries Adjusted Trial Balance Financial Statements Answer KeyDocument3 pagesHandout 1 Adjusting Entries Adjusted Trial Balance Financial Statements Answer KeyKris Dela CruzNo ratings yet

- ACC 211 - Review 2 (Chapters 5, 6, & 7)Document4 pagesACC 211 - Review 2 (Chapters 5, 6, & 7)Brennan Patrick WynnNo ratings yet

- Quiz 1 Final PeriodDocument3 pagesQuiz 1 Final PeriodalestingyoNo ratings yet

- Completing the Accounting Cycle: Worksheet and StatementsDocument9 pagesCompleting the Accounting Cycle: Worksheet and StatementsĐanNguyễnNo ratings yet

- Accounting Concepts and Accounting Equation DrillsDocument3 pagesAccounting Concepts and Accounting Equation Drillsken garciaNo ratings yet

- Final Exam Enhanced 1 1Document8 pagesFinal Exam Enhanced 1 1Villanueva Rosemarie100% (1)

- 12bank ReconciliationDocument17 pages12bank ReconciliationAndrei JacobNo ratings yet

- Assignment Questions With AnswersDocument8 pagesAssignment Questions With AnswersDonald CrumpNo ratings yet

- Finmar 1 5Document11 pagesFinmar 1 5Bhosx KimNo ratings yet

- Lesson 3 Completing The Accounting CycleDocument6 pagesLesson 3 Completing The Accounting CycleklipordNo ratings yet

- Accounting adjustments impact financial statementsDocument6 pagesAccounting adjustments impact financial statementsLoey ParkNo ratings yet

- Leonardo Wagster Decided To Open Wagster's Window Washing On September 1, 2020. in September, The Following Transactions Took PlaceDocument12 pagesLeonardo Wagster Decided To Open Wagster's Window Washing On September 1, 2020. in September, The Following Transactions Took PlaceJohnMurray111100% (1)

- UWI DOMS ACCT 1005 - Financial Accounting WorksheetDocument10 pagesUWI DOMS ACCT 1005 - Financial Accounting WorksheetAndre' King100% (1)

- IcebreakerDocument5 pagesIcebreakerRyan MagalangNo ratings yet

- Bookkeeping Problem Accounting CycleDocument2 pagesBookkeeping Problem Accounting CycleMa Christina EncinasNo ratings yet

- Chapter 6 - Accounting for Sales and Cash ControlsDocument11 pagesChapter 6 - Accounting for Sales and Cash ControlsFäb RiceNo ratings yet

- MIDTERM EXAM COST MANAGEMENTDocument4 pagesMIDTERM EXAM COST MANAGEMENTRogelynCodillaNo ratings yet

- Chapter 4 Accounting For Partnership AnswerDocument17 pagesChapter 4 Accounting For Partnership AnswerTan Yilin0% (1)

- Final AdjustingjyjDocument36 pagesFinal AdjustingjyjAlayka Ann Pirante50% (2)

- ACTIVITY 04 - Analyzing TransactionsDocument6 pagesACTIVITY 04 - Analyzing TransactionsJohn Luis Cordova CacayurinNo ratings yet

- II. Multiple Choice.: Archdiocese of TuguegaraoDocument3 pagesII. Multiple Choice.: Archdiocese of TuguegaraoRamojifly LinganNo ratings yet

- LECTURE 6 - Suspense - Accounts - and - Error - CorrectionDocument7 pagesLECTURE 6 - Suspense - Accounts - and - Error - CorrectionJafari SelemaniNo ratings yet

- Assignment-1 (Eco & Actg For Engineers) Exercise - 1Document4 pagesAssignment-1 (Eco & Actg For Engineers) Exercise - 1Nayeem HossainNo ratings yet

- Grade 11, Accounting, Chapter 3 Recording of Transaction IDocument75 pagesGrade 11, Accounting, Chapter 3 Recording of Transaction Ihum_tara1235563100% (1)

- Assets Liabilities Owner'S Equity Income ExpensesDocument2 pagesAssets Liabilities Owner'S Equity Income ExpensesRalph Christer Maderazo0% (1)

- Exercises Finalaccounts ExDocument2 pagesExercises Finalaccounts ExSounak NathNo ratings yet

- CFAS-MC Ques - Review of The Acctg. ProcessDocument5 pagesCFAS-MC Ques - Review of The Acctg. ProcessKristine Elaine RocoNo ratings yet

- CCDC First Grading Examination MCQDocument9 pagesCCDC First Grading Examination MCQRoldan ManganipNo ratings yet

- Journal entries for Z Company and Montrose Company transactionsDocument1 pageJournal entries for Z Company and Montrose Company transactionsyoantanNo ratings yet

- Chapter 9 Solutions PDFDocument7 pagesChapter 9 Solutions PDFAA BB MMNo ratings yet

- Basic Accounting - Final ExaminationDocument5 pagesBasic Accounting - Final ExaminationLaira Diana RamosNo ratings yet

- Accounting 1 Final Study Guide Version 1Document12 pagesAccounting 1 Final Study Guide Version 1johannaNo ratings yet

- Fundamentals of AccountingDocument1 pageFundamentals of AccountinghaggaiNo ratings yet

- Accounting Test Prep 1Document9 pagesAccounting Test Prep 1Swathi ShekarNo ratings yet

- Accounting MCQDocument15 pagesAccounting MCQsamuelkish50% (2)

- Ex-08 - Comprehensive Review 2.0Document14 pagesEx-08 - Comprehensive Review 2.0Jedidiah Smith0% (1)

- Understanding Accruals and DeferralsDocument21 pagesUnderstanding Accruals and Deferralszynab123No ratings yet

- Chapt 1,2,3,5,6 MCQDocument24 pagesChapt 1,2,3,5,6 MCQbritzNo ratings yet

- ReceivablesDocument16 pagesReceivablesJanela Venice SantosNo ratings yet

- 2019 June 23 ACT 701 Chapter 3 Problems and SolutionDocument21 pages2019 June 23 ACT 701 Chapter 3 Problems and SolutionZisanNo ratings yet

- Assignment After Week 6Document5 pagesAssignment After Week 6MUHAMMAD JAHANGIRNo ratings yet

- Date Account Title and Explanations Ref Amount (RS) Debit CreditDocument1 pageDate Account Title and Explanations Ref Amount (RS) Debit CreditRinaldi SinagaNo ratings yet

- ValidasiDocument6 pagesValidasiRinaldi SinagaNo ratings yet

- How To Reset Epson PrinterDocument1 pageHow To Reset Epson PrinterRinaldi SinagaNo ratings yet

- Submited By: Journal Entry FormDocument2 pagesSubmited By: Journal Entry FormRinaldi SinagaNo ratings yet

- AcademicDocument2 pagesAcademicRinaldi SinagaNo ratings yet

- 18Document4 pages18Aditya Wisnu P100% (1)

- Fast Moving BarangDocument14 pagesFast Moving BarangRinaldi SinagaNo ratings yet

- Sonicision 2Document2 pagesSonicision 2Rinaldi SinagaNo ratings yet

- Stock Opname Gudang FarmasiDocument60 pagesStock Opname Gudang FarmasiRinaldi SinagaNo ratings yet

- WP RestoranDocument22 pagesWP RestoranRinaldi SinagaNo ratings yet

- Jerome4 Sample Chap08Document58 pagesJerome4 Sample Chap08Basil Babym100% (7)

- 15sihwahyuni EncryptedDocument12 pages15sihwahyuni EncryptedRinaldi SinagaNo ratings yet

- PT Nano Philosophy Sales Receipt ReportDocument26 pagesPT Nano Philosophy Sales Receipt ReportRinaldi SinagaNo ratings yet

- 3.03.1 Simple Six Sigma CalculatorDocument2 pages3.03.1 Simple Six Sigma Calculatormuda1986No ratings yet

- Rinaldi Asertua academic transcript 2011-2017Document7 pagesRinaldi Asertua academic transcript 2011-2017Rinaldi SinagaNo ratings yet

- About SchleckerDocument1 pageAbout SchleckerRinaldi SinagaNo ratings yet

- Western and Indonesian Food Menu with PricesDocument2 pagesWestern and Indonesian Food Menu with PricesRinaldi SinagaNo ratings yet

- General Standards 1. 2. 3. 1. 2. 3Document4 pagesGeneral Standards 1. 2. 3. 1. 2. 3Rinaldi SinagaNo ratings yet

- Factors Affecting Changes in Profits of Manufacturing Companies Listed on the Indonesia Stock Exchange 2005-2009Document13 pagesFactors Affecting Changes in Profits of Manufacturing Companies Listed on the Indonesia Stock Exchange 2005-2009Rinaldi Sinaga100% (1)

- Monthly Report and Bookstore Price ListDocument11 pagesMonthly Report and Bookstore Price ListRinaldi SinagaNo ratings yet

- Activity Diagram - HiringDocument2 pagesActivity Diagram - HiringRinaldi SinagaNo ratings yet

- Akuntansi ManagemenDocument11 pagesAkuntansi ManagemenRinaldi SinagaNo ratings yet

- CA+ is a comprehensive mall management suite, giving shopping centre operators the toolset to better control, manage and improve their returnsDocument8 pagesCA+ is a comprehensive mall management suite, giving shopping centre operators the toolset to better control, manage and improve their returnsOla1No ratings yet

- Term Paper: On A Rising Market Giant of BangladeshDocument46 pagesTerm Paper: On A Rising Market Giant of BangladeshSanjeed Ahamed SajeebNo ratings yet

- Chapter 1: The Problem and Its BackgroundDocument3 pagesChapter 1: The Problem and Its BackgroundPatricia Anne May PerezNo ratings yet

- Report On Financial Ratio Analysis Of: Section: 01Document25 pagesReport On Financial Ratio Analysis Of: Section: 01Meher AfrozNo ratings yet

- Policy Ambivalence Hinders India's Manufacturing GoalsDocument5 pagesPolicy Ambivalence Hinders India's Manufacturing GoalsRuby SinglaNo ratings yet

- Meta Platforms Inc.Document3 pagesMeta Platforms Inc.KRISTINA DENISSE SAN JOSENo ratings yet

- Sales Individual Report Assignment 2Document20 pagesSales Individual Report Assignment 2Linh Chi NguyenNo ratings yet

- Operational Efficiency: Improvement TermsDocument56 pagesOperational Efficiency: Improvement TermsLuis Javier0% (1)

- SAMPLE of Instructions To BiddersDocument4 pagesSAMPLE of Instructions To BiddersAhmed FarajNo ratings yet

- Sean Vosler Matt Clark (PDFDrive)Document80 pagesSean Vosler Matt Clark (PDFDrive)RadwinNo ratings yet

- Marketing Plan PresentationDocument7 pagesMarketing Plan Presentationapi-454161052No ratings yet

- Mcom Sales QuotaDocument14 pagesMcom Sales QuotaShyna aroraNo ratings yet

- Xlfinplan Features SatishDocument7 pagesXlfinplan Features SatishrajsalgyanNo ratings yet

- Green Marketing: Consumers' Attitudes Towards Eco-Friendly Products and Purchase Intention in The Fast Moving Consumer Goods (FMCG) SectorDocument98 pagesGreen Marketing: Consumers' Attitudes Towards Eco-Friendly Products and Purchase Intention in The Fast Moving Consumer Goods (FMCG) SectorJonyNo ratings yet

- CMD June 2013Document94 pagesCMD June 2013Julie MerrillNo ratings yet

- Question Bank - App. Level - Audit & Assurance-Nov-Dec 2011 To May-June-2016Document41 pagesQuestion Bank - App. Level - Audit & Assurance-Nov-Dec 2011 To May-June-2016Sharif MahmudNo ratings yet

- Quiz 3 (Ramzan Albakov)Document7 pagesQuiz 3 (Ramzan Albakov)Dylan KorNo ratings yet

- G.R. No. 167603 March 13, 2013 Development Bank of The Philippines vs. Hydro Resources Contractors CorporationDocument4 pagesG.R. No. 167603 March 13, 2013 Development Bank of The Philippines vs. Hydro Resources Contractors CorporationAVNo ratings yet

- Flow ICM - STDocument7 pagesFlow ICM - STPatrícia Martins Gonçalves CunhaNo ratings yet

- Strategic Management - Business Plan ClothesDocument35 pagesStrategic Management - Business Plan ClothesMuhammad Dzikri Tesla BuwonoNo ratings yet

- CH 13Document18 pagesCH 13xxxxxxxxxNo ratings yet

- Circular Business Models in The Medical Device Industry - Paths Towards Sustainable HealthcareDocument15 pagesCircular Business Models in The Medical Device Industry - Paths Towards Sustainable HealthcareNuriaNo ratings yet

- IAS at A Glance - BDODocument28 pagesIAS at A Glance - BDONaim AqramNo ratings yet

- The Opportunity Analysis CanvasDocument186 pagesThe Opportunity Analysis Canvasjose inacio100% (7)

- Financial Markets and Services NotesDocument94 pagesFinancial Markets and Services NotesShravan Richie100% (7)

- Payroll ProjectDocument16 pagesPayroll ProjectKatrina Rardon-Swoboda68% (25)

- Case KokaDocument6 pagesCase KokaLora Hasku0% (1)

- CIF ICPO To XXXXXXXXXXXXXXXXXXXXX TemplateDocument3 pagesCIF ICPO To XXXXXXXXXXXXXXXXXXXXX Templatevijaykumarbhattad100% (5)

- The Main Elements of A Good SLADocument6 pagesThe Main Elements of A Good SLAFranz Lawrenz De TorresNo ratings yet

- Pasdec Holdings Berhad (Assignment)Document22 pagesPasdec Holdings Berhad (Assignment)Nur IzaziNo ratings yet