Professional Documents

Culture Documents

Problem Set 4

Uploaded by

HoangluciaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem Set 4

Uploaded by

HoangluciaCopyright:

Available Formats

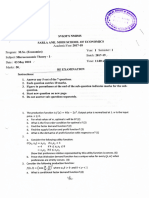

Game Theory. Master in Economics. 2013-2014.

Problem Set 4: (Static games with incomplete information).

Exercise 1: Two buyers, J1 and J2 take part in a first-price sealed-bid auction.

The bidders can only bid 100 ! or 200 !. Each of them knows his/her own

valuation and moreover:

J1 believes that J2s value is 200 !.

J2 believes that J1s value is 0 ! with probability " or 300 ! with

probability ".

You are asked to:

a) Represent the decision tree of the game.

b) Determine the strategy set of each buyer.

c) Find Bayesian Nash equilibria.

Exercise 2: In the auction of the previous exercise, assume now that each

bidder knows his own value and moreover:

J1 believes that J2 has a value of 100 ! with probability " and of 200 !

with probability ".

J2 believes that J1 has a value of 0 ! with probability " and of 300 !

with probability ".

You are asked to:

a) Represent the decision tree.

b) Determine the strategy set of each buyer.

c) Find Bayesian Nash equilibria.

Exercise 3: Prove that in a first-price auction with N symmetric buyers whose

valuations are distributed according to F, the symmetric equilibrium strategy can

be written in this way:

dx

v F

x F

v v b

N

v

1

0

) (

) (

) (

!

" #

#

$

%

&

&

'

(

! =

To see that, apply integration by parts to the solution obtained at class.

Exercise 4: Consider a one-object, first-price sealed-bid auction with two

bidders. Their valuations

i

v are independent and uniformly distributed on [0, 1].

The bids are [ ] 1 , 0 ) ( !

i i

v b . Both bidders are risk-adverse and the utility of each

of them is a strictly concave function of the profit:

2 / 1

) ( ) (

i i i i i

b v b v u ! = ! . Prove

that the pair of strategies 3 / 2 ) (

1 1 1

v v b = and 3 / 2 ) (

2 2 2

v v b = form a Bayesian

Nash equilibrium of the game.

Exercise 5: Consider a Cournot duopoly operating in a market with inverse

demand P(Q)=a-Q, where Q=q

1

+q

2

is the aggregate quantity on the market.

Both firms have total costs c

i

(q

i

)=cq

i

, but demand is uncertain: it is high (a=a

H

)

with probability p and low (a=a

L

) with probability 1-p. Furthermore, information is

asymmetric: firm 1 knows whether demand is high or low, but firm 2 does not.

All of this is common knowledge. The two firms simultaneously choose

quantities. What are the strategy spaces of the two firms? Make assumptions

concerning a

H

, a

L

, p and c such that all equilibrium quantities are positive. What

is the Bayesian Nash equilibrium of this game?

Exercise 6: Jerry wants to buy a used car and Freddie offers a fifteen-year-old

sedan for sale. Suppose there is some fixed market price p for fifteen-year old

sedans of this type. Nature first chooses whether the car is a peach or a lemon.

If the car is a peach, then it is worth 3000 ! to Jerry and 2000 ! to Freddie. If

the car is a lemon, then it is worth 1000 ! to Jerry and 0 ! to Freddie. Notice

that, in both cases, Jerry values the car more than does Freddie, so efficiency

requires that the car be traded and the surplus (in each case 1000 !) be divided

between them. But there is incomplete information: Freddie observes natures

choice, whereas Jerry knows only that the car is a peach with probability q.

Then the players simultaneously and independently decide whether to trade (T)

or not (N) at the market price p. If both elect to trade, then the trade takes place.

Otherwise, Freddie keeps the car.

a) Represent the game in its extensive form and in its strategic form.

b) Discuss the existence of (pure-strategy) Bayesian Nash equilibrium,

depending on the values of the probability q and the price p.

c) Is there some situation in which only the lemon is traded? Comment on

the malfunction of the market from the viewpoint of efficiency.

You might also like

- Game Theory Exercises 2Document3 pagesGame Theory Exercises 2endu wesenNo ratings yet

- HW4Monopoly, Game TheoryDocument3 pagesHW4Monopoly, Game TheoryShivani GuptaNo ratings yet

- Problem2 PDFDocument7 pagesProblem2 PDFLucas PiroulusNo ratings yet

- Tha 5Document3 pagesTha 5Abhinash BorahNo ratings yet

- Extra Practice QuestionsDocument7 pagesExtra Practice QuestionsBobNo ratings yet

- Problem Set 3Document2 pagesProblem Set 3Hoanglucia0% (1)

- Game Theory Exam QuestionsDocument13 pagesGame Theory Exam QuestionsPaulNo ratings yet

- Exam 2011Document3 pagesExam 2011Sjef PappersNo ratings yet

- GTHW4Document2 pagesGTHW4danny.rq.yeoNo ratings yet

- 206 HW6 BneDocument9 pages206 HW6 Bneamit_singhal_110% (1)

- EC203 - Problem Set 9Document3 pagesEC203 - Problem Set 9Yiğit KocamanNo ratings yet

- KUL Advanced Microeconomics 2019 Problem Set 1Document4 pagesKUL Advanced Microeconomics 2019 Problem Set 1Fedor DostNo ratings yet

- Econ Grad Compexam Micro 2018Document4 pagesEcon Grad Compexam Micro 2018Momal IshaqNo ratings yet

- Final Exam May 2022Document3 pagesFinal Exam May 2022Sheikh Sahil MobinNo ratings yet

- Nash Equilibrium: IllustrationsDocument45 pagesNash Equilibrium: IllustrationsAugust Majer IIINo ratings yet

- Problems Repeated and Bayesian Game PDFDocument6 pagesProblems Repeated and Bayesian Game PDFvictorginer8No ratings yet

- Problem Set 8Document3 pagesProblem Set 8Le MoustierNo ratings yet

- Exercises Part2Document9 pagesExercises Part2christina0107No ratings yet

- Competition and Strategy Sample FinalDocument5 pagesCompetition and Strategy Sample FinalJason LaiNo ratings yet

- Exercises Part6Document14 pagesExercises Part6Inder Mohan0% (1)

- Final Exam 2021-22 QuestionsDocument6 pagesFinal Exam 2021-22 QuestionsDiego LeyvaNo ratings yet

- EC 005: Introduction To Game Theory - Problem Set 1: L R C Player 2Document4 pagesEC 005: Introduction To Game Theory - Problem Set 1: L R C Player 2Aayush PandeyNo ratings yet

- Final EC3312 2012 - 13Document5 pagesFinal EC3312 2012 - 13bakpengsengNo ratings yet

- Monopoly SolutionsDocument2 pagesMonopoly SolutionszamirNo ratings yet

- Exam2008 07A KeyDocument15 pagesExam2008 07A KeyRajaaeajasd Gausdj100% (2)

- Ec 3260Document3 pagesEc 3260John CenaNo ratings yet

- EMO 2020-2021 Final QuestionsDocument8 pagesEMO 2020-2021 Final QuestionsBobNo ratings yet

- Microeconomics Qualifying ExaminationDocument3 pagesMicroeconomics Qualifying ExaminationMin Jae ParkNo ratings yet

- Rec 07Document9 pagesRec 07Trang LeNo ratings yet

- Managerial Economics - Examen Juni 2013Document4 pagesManagerial Economics - Examen Juni 2013Thục LinhNo ratings yet

- Econ 2022.2022.23. Assignment 1.WoADocument2 pagesEcon 2022.2022.23. Assignment 1.WoABereket AdamssegedNo ratings yet

- Test - Game Theory PDFDocument4 pagesTest - Game Theory PDFAmmi Julian100% (1)

- Test - Game TheoryDocument4 pagesTest - Game TheoryAmmi Julian100% (1)

- ProblemSet1 NewDocument2 pagesProblemSet1 Newsamx9950No ratings yet

- POLI 204C D: M 22, G T: UE Arch by Noon AME HeoryDocument2 pagesPOLI 204C D: M 22, G T: UE Arch by Noon AME HeorySky ShepheredNo ratings yet

- Assignment 3Document3 pagesAssignment 3Rohan Lansakara0% (1)

- HW9Document2 pagesHW9Ahmad S GrewalNo ratings yet

- Problem Set OligopolyDocument3 pagesProblem Set Oligopolyasmitamittal1998No ratings yet

- Ignou Ma Eco Assignemnts July 2015 SessionDocument11 pagesIgnou Ma Eco Assignemnts July 2015 SessionAnonymous IL3nivBcNo ratings yet

- Sampleexam 2024Document4 pagesSampleexam 2024fwm949fwxrNo ratings yet

- FDocument18 pagesFdinh_dang_18No ratings yet

- Microeconomics Corso Di Laurea in Economics and Finance Mock 1 Partial ExamDocument9 pagesMicroeconomics Corso Di Laurea in Economics and Finance Mock 1 Partial ExamĐặng DungNo ratings yet

- Revision NotesDocument20 pagesRevision NotesZ ONo ratings yet

- Lecture I-II: Motivation and Decision Theory - Markus M. MÄobiusDocument9 pagesLecture I-II: Motivation and Decision Theory - Markus M. MÄobiuskuchbhirandomNo ratings yet

- Garratt Wooders Exercises in Game Theory PDFDocument9 pagesGarratt Wooders Exercises in Game Theory PDFĐỗ Huy HoàngNo ratings yet

- Class Test-I Intermediate Microeconomics-II Time: 1 Hour Maximum Marks: 25Document2 pagesClass Test-I Intermediate Microeconomics-II Time: 1 Hour Maximum Marks: 25amrat meenaNo ratings yet

- Microeconomic Theory - I769 Cd935kPqDXDocument2 pagesMicroeconomic Theory - I769 Cd935kPqDXMeenal ChaturvediNo ratings yet

- Econ 5502 TestDocument71 pagesEcon 5502 TestAnonymous ZLQDHZGNo ratings yet

- Micro2 Homw6 Post AY2020 21 T1Document2 pagesMicro2 Homw6 Post AY2020 21 T1TAN CHUN LIN BOBBY DOWNo ratings yet

- Introduction To Game Theory (Harvard) PDFDocument167 pagesIntroduction To Game Theory (Harvard) PDFAndresMartinez28No ratings yet

- 2013homework3 PDFDocument2 pages2013homework3 PDFEdmund ZinNo ratings yet

- EC2066Document49 pagesEC2066Josiah KhorNo ratings yet

- XET 301-CEC 305 October-Jan 2022 ExaminantionDocument5 pagesXET 301-CEC 305 October-Jan 2022 ExaminantionABDULLAHI MUSA MOHAMEDNo ratings yet

- Zy 170478719146681Document3 pagesZy 1704787191466817xy29kg2zcNo ratings yet

- PS 3Document2 pagesPS 3alikberovaadeliaNo ratings yet

- Freq2 11jan12Document7 pagesFreq2 11jan12crod123456No ratings yet

- Notes On Akerlof Ho 09Document4 pagesNotes On Akerlof Ho 09David ReinsteinNo ratings yet

- ME - Problem Set 7Document4 pagesME - Problem Set 7AbhiNo ratings yet

- Master Problem Set 091123 Ecv5J1sEHlDocument5 pagesMaster Problem Set 091123 Ecv5J1sEHlMeenal ChaturvediNo ratings yet

- Paco de Lucia Gitanos Andaluces Bulerias 2Document15 pagesPaco de Lucia Gitanos Andaluces Bulerias 2Hoanglucia0% (1)

- Paco de Lucia Gitanos Andaluces Bulerias 2Document15 pagesPaco de Lucia Gitanos Andaluces Bulerias 2Hoanglucia0% (1)

- Paco de Lucia Guitar Tab PDFDocument102 pagesPaco de Lucia Guitar Tab PDFHoangluciaNo ratings yet

- Gibbons 2.3Document2 pagesGibbons 2.3HoangluciaNo ratings yet

- Ps 4 SolutionDocument2 pagesPs 4 SolutionAparna HowladerNo ratings yet

- Static Games With Incomplete InformationDocument8 pagesStatic Games With Incomplete InformationHoangluciaNo ratings yet

- Problem Set 3Document2 pagesProblem Set 3Hoanglucia0% (1)

- Problem Set 2Document1 pageProblem Set 2Hoanglucia0% (1)

- Dear Fellow Shareholders,: Indra K. Nooyi, Chairman and Chief Executive OfficerDocument4 pagesDear Fellow Shareholders,: Indra K. Nooyi, Chairman and Chief Executive OfficerSathish SatzNo ratings yet

- What Are The Advantages and Disadvantages For Companies of Product EndorsementsDocument12 pagesWhat Are The Advantages and Disadvantages For Companies of Product EndorsementsHồn BóngNo ratings yet

- Classified Advertising: DriverDocument7 pagesClassified Advertising: DriverSwamy Dhas DhasNo ratings yet

- External Factors Influencing PricingDocument5 pagesExternal Factors Influencing PricingProf. Dr. Prakash SinghNo ratings yet

- 4Ps of Marketing of A Company Blue Star LTDDocument9 pages4Ps of Marketing of A Company Blue Star LTDteexpeeNo ratings yet

- Strategy DocumentDocument1 pageStrategy Documentapi-587421676No ratings yet

- Himanshu Goyal: ExperianceDocument3 pagesHimanshu Goyal: Experianceabc goyalNo ratings yet

- ECON1000 Midterm2 2012FDocument5 pagesECON1000 Midterm2 2012FexamkillerNo ratings yet

- Allied Van Lines: Case StudyDocument3 pagesAllied Van Lines: Case StudyNayyab ButtNo ratings yet

- Gujarat Technological University: Learning Outcome Component Learning OutcomeDocument4 pagesGujarat Technological University: Learning Outcome Component Learning OutcomeArchu001No ratings yet

- Account Manager - Ad Sales: DescriptionDocument2 pagesAccount Manager - Ad Sales: DescriptionAbhishek GoyalNo ratings yet

- Free Printable Home BinderDocument22 pagesFree Printable Home BinderJessica Garcia100% (1)

- Bhangar Vegetable Producer CompanyDocument13 pagesBhangar Vegetable Producer CompanySaikat GhoshNo ratings yet

- Epn 27 eDocument22 pagesEpn 27 eskuduchkarNo ratings yet

- Value Based PricingDocument13 pagesValue Based PricingumairNo ratings yet

- Strategic Marketing Plan Sbarro, Inc.: EstablishedDocument26 pagesStrategic Marketing Plan Sbarro, Inc.: EstablishedshineNo ratings yet

- Moin Afzal CV 1Document2 pagesMoin Afzal CV 1api-302094286No ratings yet

- Production and Export of TeaDocument4 pagesProduction and Export of TeaJose Tenny100% (1)

- ECON211 Sample Final ExamDocument24 pagesECON211 Sample Final ExamMerlina CuareNo ratings yet

- Bánh Ta ReportDocument34 pagesBánh Ta Reportduyenhtnbds160037No ratings yet

- Klajnscek K CV2014Document2 pagesKlajnscek K CV2014kaylekayprNo ratings yet

- Patterns of Cooperation During New Product Development Among Marketing, Operations and R&D Implications For Project PerformanceDocument14 pagesPatterns of Cooperation During New Product Development Among Marketing, Operations and R&D Implications For Project Performanceapi-3851548No ratings yet

- Industry Analysis PDFDocument8 pagesIndustry Analysis PDFCate MasilunganNo ratings yet

- Resume Christie JonesDocument4 pagesResume Christie JonesParis RoseNo ratings yet

- Texana Petroleum Corporation HistoryDocument9 pagesTexana Petroleum Corporation HistoryDhyana Mohanty100% (1)

- Nirma in Sri Lankan Market: Team Number 4Document26 pagesNirma in Sri Lankan Market: Team Number 4Tharindu DhananjayaNo ratings yet

- Conflicts Between Divisional HeadsDocument5 pagesConflicts Between Divisional HeadscarladelrosarioNo ratings yet

- Project Report On Fine SwitchesDocument62 pagesProject Report On Fine SwitchesbawaNo ratings yet

- The Story of Konark CinemaDocument25 pagesThe Story of Konark Cinemaप्रताप जय हिन्दNo ratings yet

- MIDiA Research - Amuse - Independent Artists - September 2020Document20 pagesMIDiA Research - Amuse - Independent Artists - September 2020Marco100% (1)