Professional Documents

Culture Documents

Determinents of Inflation

Uploaded by

Kashif SafeerOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Determinents of Inflation

Uploaded by

Kashif SafeerCopyright:

Available Formats

Email: nafees_swat@hotmail.

com

CHAPTER 01

INTRODUCTION

Introduction

The main focus of our study is to determine the different aspects of inflation in Pakistan

from local and global perspective. Pakistan achieves an extraordinary economic growth

and poverty decline from the first ! years of its independence among the developing

countries. "n the late #$%! Pakistan &'P growth rate was ( percent per annum and

poverty rate was lowered to #% percent. 'ue to large population the inflation rate was

critically low. "n #$$! the economy of Pakistan was inverted and it was not a good period

for the economy. The level of inflation starts to raise) poverty level increased to **

percent and growth rate becomes lowered.

The high inflation over the last +! years in Pakistan had been unpredictable. This is

because of decelerating economic growth) output set,backs) loose monetary policies)

higher duties and taxes) political instability) a depreciating Pak rupees and fre-uently

ad.ustments in the administered prices of gas) electricity) P/0 products as well as the

support prices of wheat. The basic ob.ectives of the study are the attempt to analy1e

the factors of inflation in Pakistan. The following are the basic ob.ectives of the study.

Page #

1.2. OBJECTIVES OF STUDY

The ob.ective of study is to test how inflation is effected by 2oney 3upply and "nterest

4ate in Pakistan. This includes:

i. To show the short,term and long term relationship between the variables

ii. To identify the appropriate and ma.or model of inflation for Pakistan

iii. To imply policy makers for solving the dilemma of inflation in Pakistan.

#.*. R!"rc# $u!tion

%"in $u!tion

5hat is the relationship between "nflation) 2oney 3upply and "nterest 4ate6

Su& $u!tion!

4elationship between "nflation and 2oney 3upply

4elationship between "nflation and "nterest 4ate

1.'. HYPOTHESIS OF STUDY

7

8

: There is no relationship between "nflation) 2oney 3upply) &'P &rowth and "nterest 4ate

7# : There is relationship between "nflation) 2oney 3upply) &'P &rowth and "nterest 4ate)

Page +

1.(. I%PORTANCE OF THE STUDY

This study determines the strong relationship between inflation 2oney 3upply and "nterest

4ate in Pakistan

This study shows the important factors that 2oney 3upply contributes in rise of "nflation

because of loose monetary policy of 3tate 9ank of Pakistan

The study of money supply) interest rate and inflation will help the policy makers to

review the monetary policy and to control the effect of inflation on the economy

This study shows that inflation has great impact on the poor segment of society and low

"ncome people

Page *

C#")tr * 2

+ITERATURE REVIE,

"nflation) 2oney supply and interest rate are the most important factors of the economy

and it needs greater importance from the authorities. The writers have given different

views regarding these issues which are as follows.

2eenai :#$((; noted that the circulation of currency and 9ank deposits is involved in

2oney 3upply. The government and private sectors are the two main important factors

that bring changes in 2oney 3upply. 5hen loan from commercial banks and 3tate bank

increases or decreases will bring changes in 2oney 3upply. <ny changes in 3tate 9ank

holdings of &old and foreign reserves will bring changes in 2oney 3upply. <ll these

factors can be controlled by controlling the foreign exchange reserves) credit to private

sectors and government sectors.

0indauer :#$(%; observed that inflation is the raise in the price level of an economy=s

prices that bring changes in a production level of goods and services by keeping the

money income fixed and falling the purchasing power of consumers. "nflation affects the

production level of an economy and the purchase of those things whose prices rise due to

inflation. "nflation reduces the prices of bonds and saving level of people. The purchasing

of commodities in an inflationary economy is more expansive while it less expansive in

Page

other economy so the consumer will move to that economy where the prices are low. "t

clearly shows that inflation is an evil for the economy.

>airn >ross :#$?@; observed the relationship of inflation and money supply. 5hen

money supply increases in an economy then there is increase in the prices which bring

inflation and vice versa. 3ometimes inflation occurs due to oil prices. The government

blame that the importing countries increase the oil prices which is the signal for inflation.

3ometimes the government increases the taxes and tariffs which create an opportunity for

deflation and inflation. The value of money sometimes decreases due to natural disaster)

harvest failure or in a situation of war) which creates a possibility for inflation.

7arberler :#$?@; observed that the monetary phenomenon is not the only factor but there

are various factors which affect the inflation that is the pressure of labor union on wages)

government credits and monopoly. "f labor union pressure is the main cause of inflation

then we will use fiscal policies to put pressure on the authorities of monetary policies to

achieve e-uilibrium in inflation to control labor union pressure.

<ccording to harberler monopoly and labor union are the most important factors

of inflation. 2onopolist increase the prices of their specific products while labor union

put pressure on increasing wages while production remains constant thus cause the

inflation. "ncreasing money supply in an economy results in increase in the level of

inflation so) in this situation fiscal policies are used to control the evil of inflation.

3taats :#$%+; explore the concept of money supply and mentioned that stock of money is

Page @

important for the economy. The rate at which money supply circulates in the economy is

important because it affect the rate of economic activities. The permanent definition of

money supply does not exist but there are different types of financial assets which are

used as a part of definition. The different types of money are 2

#

) 2

+

and 2

*.

2# is the

most important part of money supply which includes currency in circulation) deposits and

bank=s demand deposits.

3hilling and 3okoloff :#$%*; indicate the signs of inflation. the first sign is that the new

buyers cause to rise inflation in securities business and take it to the peak. 3econdly

inflation occurs due to speculation. Thirdly the money borrowed for speculation also

turns a cause of inflation. Price advance in investment can also a cause of peak inflation.

7e indicates that inflation severely occurs when money is drawn from an assets

investment to the speculation purpose. 7e indicates that inflation rises one may see the

volume of trade to be increased in speculation instead of normal investment. 7e noted

that when a frantic search is looked for speculation resulting inflation occurs in the

market. 7e further mentioned that inflation takes place when the basic fundamentals are

tried to change. 7e indicates that inflation can be seen by market action. The good index

when usually shows a price hike. The last sign is when it is expected that inflation would

continue for a long time in future can cause a sever inflation.

9urstein :#$%(; discussed inflation and money supply and removed the confusion

between money and credits. 7e explains that due to the reflux principle the demand

function for credit are debt repayment) money supply and its growth. "ncrease in credit

Page (

demand will lead to growth in money and temporary rise in money supply may be

deducted from debt reimbursement. 7e said that money supply and inflation are

correlated. The correlation between inflation and money supply is important thing. 7e

explained that rate of growth is less than inflation rate then there will be decrease in real

stock of money.

7ale and 7anon :#$$!; observed that the money supply should be controlled and it is

very important issue. 7e concluded that demand level in the economy can de control by

controlling the money supply. "t has a greater importance in monetarist government and

they use different tools for measuring the money supply. The uses different types of

money i.e 2

!

) 2

#)

2

+

for measuring. There are different ways for controlling the inflation

rate which affect the level of demand. There should tightened monetary and fiscal

policies to reduce the level of demand in the economy. The government should reduced

their spending) they should increase the tax will decrease the total demand. The inflation

rate can also be control by exchange rate.

3hapiro :#$$+; noted that due to inflation some people of the society affect badly and

some people get advantage from it. The price level changes due to inflation which affects

the economic rate of growth. 'ue to this the rich people become richer and poor people

become poorer. 3ometimes it has an adverse affect on high level income people because

of unknown factors. <uthors explain the affects of inflation and also explain the different

procedures of controlling it by using fiscal and monetary policy. Aiscal and monetary

policies are use to control the evil of inflation but there need a great care of using these

Page ?

policies because inflation is of different types) some of the inflation is demand side

inflation and the other is supply side inflation so the fiscal and monetary policies don=t

match with supply side inflation ."f fiscal policy is used it will affect little and will

reduced inflation.

9rono and Easterlty :#$$(; explained that at the annual rate of inflation less than !B

there is no association between inflation and growth. They found negative or medium

type association during high inflation. They report that due to high inflation crises there

were no damage to growth because the countries recover their position which was before

the crises.

&hosh and Phillips :#$$%; using large time series of data and found that at very low

inflation rate of +,* percent there is strong association between inflation and growth and

negative association at high inflation rate.

3hahid :+!!; explained the behavior of money supply as it is determined by central bank

and commercial banks. To understand the money supply he considers the collective

behavior of &overment) commercial banks and central bank. The commercial take money

from the central and public banks and lend this money to the people) governments and

investors and put a certain proportion of demand deposits and time. "t will help in the

determination of money supply.

Cinghan :+!!@; explain the various types of money supply. 2#is the narrow type of

money which include currency in circulation) deposits in state bank and bank demand

Page %

deposits.2+ is a broad money and 2* includes 2+ and bank time deposits but 2* is not

satisfactory and it does not use as medium of exchange and cannot perform the function

of money. 7e said that inflation is a monetary phenomenon. 3ome economists believe

that money supply is not the only factor of inflation but there are other factors like

increase in public expenditure) financing deficit) natural disaster) existing of black market

and expansion of private sectors etc.

<bdul Dayum :+!!(; >oncluded that the rise in prices is due to the excess of 2oney 3upply)

growth in velocity E real income. 7e furthers indicated that there is positive relationship

between money growth E inflation. The money supply growth affect the real &'P E inflation)

this is due to the loose monetary policy of the central bank of Pakistan.

Theoretical Aramework

"nflation is defined and categori1ed on the basis of various factors that can cause inflation.

"nflation is a burning issue in present period across the world. Every economy is trying to control

it for a better result. 5e may control inflation by adopting various techni-ues. The different

studies and researches have been conducted by the economists and researchers to control the

inflation) and they have also concluded various strategies) methodologies and techni-ues to

describe the effect of inflation. They explore a relationship between the two or more variable and

define independent variables and further discuss the variable which generally cause inflation in a

country.

Page $

D-"nd Pu.. T#or/

"t is the type of inflation in which demand of the consumer is increases in the country. 5hen

many consumers trying to purchase the same goods the demand of that goods increases due to

which price increases if the supply of that product is lacking. 5hen this occurs across the whole

economy for all goods is known as demand pull inflation. The causes of the demand pull

inflation in Pakistan is the 2oney 3upply because 2oney 3upply in the economy increases and

consumers have a purchasing power to buy the product.

< famous economist said that F itGs also shown that

2oney growth has positive and lasting effects on inflation but possibly will affect output only in

the short run or in the long run. 2oney is probably neutral. H

Co!t Pu!# In0."tion

"t is the type of inflation in which cost of production of important goods and services is

increases where there is no alternative is available. "t consist of cost of wages) raw material)

factory overhead) administrative and selling expanses. 5hen the cost of production increases

there is increase in prices of goods and services.

Page #!

Theoretical Aramework

"n this study an attempt was made to show the effect of "nterest 4ate and 2oney 3upply on

"nflation. "n this study "nterest 4ate and 2oney 3upply are independent variables and inflation is

dependent variable.

D)ndnt V"ri"&.

"nflation

Independent Variables

2oney 3upply

"nterest 4ate

Page ##

"nflation

2oney 3upply

"nterest 4ate

CHAPTER 01

DATA %ETHODO+O2Y

T/) o0 R!"rc#: 'escriptive) Empirical) Dualitative and explanatory.

S"-).: #$$!,+!#!

Sourc o0 d"t": 3econdary data is used in the study which is taken from the publication of

"nternational 2onetary Aund :"2A;) publication of economics surveys of Pakistan and the website of

3tate 9ank of Pakistan.

%od.: "IAt J K8 LK#23t L K+&&'Pt L K*"4t L M

t

D0inition o0 3"ri"&.!:

In0."tion:

FThe increase in the general price level of goods and services over a period of timeH

%on/ !u))./:

F 2oney 3upply is the total amount of money circulated in an economy at a particular point of time.

H

Intr!t R"t:

"nterest rate is the surplus money on the total money. The amount charge from

customers for their services "t is usually calculated as an annual basis.

Page #+

D"t" %t#odo.o4/

The Nariables which are used for study are "nflation) 2oney supply and "nterest 4ate.

"nflation :'ependent Nariable;

3ymbol Osed: "nflation :"IA;

2oney 3upply :"ndependent Nariable;

3ymbol Osed: 2oney 3upply :23;

"nterest 4ate :"ndependent Nariable;

3ymbol Osed: "nterest 4ate :"4;

This study describes the regression and correlation and relationship between G"nflation and

2oney 3upplyG and G"nflation and "nterest 4ateG in Pakistan in long run as well as in short run.

3o) in the study the "nterest 4ate used as the independent Nariables. Aor the research the annual

data will be used on "nflation) 2oney 3upply and "nterest 4ate for the period of #$$! to +!#!.

<s the purpose of the study is to investigate the correlation relationship between G"nflation

and 2oney 3upplyG and G"nflation and "nterest 4ateG in Pakistan in long run so we collect annual

data from #$$! to +!#! from Pakistan for the research. 5e used the data of +! years as we

want to investigate the macroeconomics impact of 2oney 3upply and "nterest 4ate on

"nflation.

Page #*

%t#odo.o4/

St"tion"r/ )roc!!

< stationary has constant mean and variance but covariance difference must be same

between two times period. 5e cannot get consistent estimators without it.

"t will be checked that the series of data are stationary or not6 To test the stationary property of

all the data series) the augmented 'ickey,Auller :<'A; test and Philips,Perron test will be used. "n

an econometrics) an augmented 'ickey,Auller test :<'A; is a test used to make non stationary time

series data into stationary data.

T!tin4 Procdur

The following are the <'A testing procedure.

P "IAt J K8LQ#"IAt,# L K#t LRP"IAt,# L R+ P "IAt,+ LSS.LRpP"IAt,T L Mt

5here P "IAt J "IAt , "IAt,#

P 23T J K8 LQ+23t,# L K+t LR#P23t,# L R+P23t,+ LSS.. L RP P 23t,p L Mt

5here P 23T J 23t U 23t,#

P"4T J K8 LQ"4t,# L Kt L R#P"4t,# L R+ P"4t,+LSS.L RpP"4t,pL Mt

5here P "4T J "4t U "4t,#

5here)

K8 J shows the constant

R J shows the parameter

Page #

T J shows the lag order

The following hypothesis will be checked by <'A test.

Aor checking the stationary Property in time series of "nflation.

7ypothesis #

7 8 : "IAt is a non,stationary) Q# J !.

7 # : "IAt is stationary) Q# V !

7ypothesis + for checking the series of 2oney 3upply :23t;

7 ! : 23t is non,stationary) Q+ J /

7 # : 23t is stationary) Q+ V /

7ypothesis * for checking the series of "nterest 4ate :"4t ;

7 ! : "4t is non,stationary) Q J /

7 # : "4t is stationary) Q V /

Page #@

Dci!ion ru.5

"f p , value W @B tabulated value) X not re.ect null hypothesis) i.e. unit root exists.

"f p , value V @B tabulated value) X re.ect null hypothesis) i.e. unit root does not exist.

Si-). Co6Int4r!!ion An"./!i!

5hen the time series data are non, stationary) the simple co integration test will be

conducted between "nflation and 2oney 3upply and "nflation and "nterest 4ate individually and

the scatter diagramY line diagram will be drawn for checking the relationship between "nflation

and 2oney 3upply and "nflation and "nterest 4ate respectively.

The 3imple estimation e-uation for "nflation and 2oney 3upply is given as

"IAt J R LK#23t L Mt

The 3imple estimation e-uation for "nflation and "nterest 4ate is given as

"IAt J R LK*"4t L Mt

Corr."tion :

The correlation is one of the important and useful statistics. < correlation is a single number

that explain the level of relationship between two variables. The correlation test will be perform

to check the correlation relationship between "nflation and 2oney 3upply) "nflation and "nterest

4ate.

T!t o0 2oodn!! o0 Fit "nd Corr."tion5

5e will test the overall explanatory variables of the whole regressionZ this is done by

calculating the coefficient of determination and is generally denoted by 4

+

.The coefficient of

determination :4

+

; measure the proportion of the total variation in dependent variable

Page #(

describe by the regression model. "n my study the 4

2

will measure that how much of the

variations in the "nflation in Pakistan at long run is describe by the variation in 2oney 3upply

and "nterest 4ate correspondingly in Pakistan at long run.

Explained Nariation in "nflation :"IAt;

R

2

=

Total Nariation in "nflation (INFt)

[ (INF - INF)

2

R

2

=

(INF INF)

2

The s-uare root of the coefficient of determination (4

2

) in the 3imple regression analysis is

the total value of the coefficient of correlation) which is denoted by 4. That is)

4J

<bsolute

This is simply to evaluate the degree of relation or co variation that exists between variables

"nflation and 2oney 3upply) and "nflation and "nterest 4ate.

Co6int4r"tion t!t5

>o integration is the procedure for testing the co Uintegration of time series.5hen two or

more than two series are not stationary and if their linear combination is stationary then this

Page #?

type of series are said to be co,integrated. This test is more applicable than Engle U &ranger

test which shows the short run relationship between variables and if there is no co,

integration then Error >orrection 2odel will be used to show the long run relationship

between variables.

The two main methods for testing for cointegration are:

#. The Engle,&ranger method.

+. The Cohansen co,integration test.

"n the study) the Cohnson co,integration test is used to check the co integration between variables.

Co6int4r"tion t!t 0or In0."tion "nd %on3 Su))./ "r "! 0o..o7!5

"IAit J K8LKi23.t L M

t

5here) " J #)+)*))..S.

H/)ot#!i!

78: There is no co integration is present between "nflation and 2oney 3upply :23t; at the

significance level in Pakistan) K J !

7#: There is co integration is present between "nflation and 2oney 3upply :23t; at the

significance level in Pakistan) K\ !

Iow the trace statistics will be used for testing the above hypothesis.

"f the trace value is greater than the tabulated value which indicates that there is a long run

relationship between "nflation and 2oney 3upply

Page #%

Error corrction -od. 8EC%9

The E>2 will be run with the data at level from as well as at "

st

difference form also.

+on4 run r."tion!#i)

H/)ot#!i!

7/J There is no relationship exist between "nflation and 2oney 3upply in Pakistan in long run

at the significant level) K J !

7#J There is relationship exists between "nflation and 2oney 3upply in Pakistan in long run at

the significant level) K \ !

The A,test and t,test will be used for testing the above hypothesis.

S#ort run r."tion!#i)

H/)ot#!i!

78J There is no relationship exist between "nflation and 2oney 3upply in Pakistan in short

run at the significant level) K J !

7#J There is relationship exists between "nflation and 2oney 3upply in Pakistan in short run at

the significant level) K \ !

T6St"ti!tic!

<fter an evaluation of a coefficient) the t,statistics for that coefficient is the proportion

of the coefficient to its standard error. "t can be tested against at distribution to findout how

feasible it is that the coefficient value is truly 1ero. "t can be defined by the following e-u-tion

Page #$

T J ]:"IAt , 23t; , d^ Y 3E.

An"./!i! o0 V"ri"nc

"t can be used to test the explanatory powers of the whole regression. The A statistics is used to

check the hypothesis that how much significant proportion of the change in the dependent

variable is explained by the change in independent variable. Aor this purpose the A statistics is

used to test the null hypothesis that all the regression coefficient are e-ual to 1ero against the

alternative hypothesis which is not e-uall to 1ero.

The value of the A statistic is given by

A J Explained variation Y :k , #;

Total variationY :n , k;

5here) n shows the number of observation and k shows the number of parameters. "t is because

the A statistics test is the ratio of two variances therefore this test is often referred to as the

analysis of variance. "t will determine the A statistics in terms of the coefficient of determination

as follows:

4

+

Y:k,l;

A J :" ,4

+

;Y:n,k;

7ere 4

+

shows the coefficient of determination between "nflation and 2oney 3upply in

Pakistan in long run. <fter this we will compare the calculated value of the A statistics with a

tabulated value taken from the table of the A distribution. "f the calculated value of the A

statistics is greater the tabulated value of A distribution the null hypothesis is re.ected as

Page +!

there is no relationship between "nflation and 2oney 3upply in Pakistan in long run) and

the alternative hypothesis is accepted that not all the coefficient e-ual to 1ero) and vice versa at

@B significant level.

Co6int4r"tion t!t 0or In0."tion "nd Intr!t R"t

"IAit J K8 LKi"4 L Mt

5here) iJ#)+)*))@) (SS

H/)ot#!i!

78: There is no co integration is exists between "nflation and "nterest 4ate at the significance

level in Pakistan) K J !

7#: There is co integration is exists between "nflation and "nterest 4ate at the significance level in

Pakistan) K \ !

Iow for testing the above hypothesis the trace statistics will be used

Then if there is no co integration exists between "nflation and "nterest 4ate) the &ranger

>ausality test will be used to indicate the short run relationship between "nflation and

"nterest 4ate) while if there is co integration exists between "nflation and "nterest 4ate at

significance level then the E>2 will be used between "nflation and "nterest 4ate) so that the

result about both short run and long run relationship can be achieved.

Page +#

Error corrction -od. 8EC%9

The E>2 will be run with the data at level from as well as at "

st

difference form also.

+on4 run r."tion!#i)

7ypothesis

7/J There is no relationship exist between "nflation and "nterest 4ate in Pakistan in long run at

the significant level) K J !

7#J There is relationship exists between "nflation and "nterest 4ate in Pakistan in long run at

the significant level) K \ !

Iow for testing the above hypothesis the trace statistics will be used.

S#ort run r."tion!#i)

H/)ot#!i!

7/J There is no relationship exist between "nflation and "nterest 4ate in Pakistan in short run at

the significant level) K J !

7#J There is relationship exists between "nflation and "nterest 4ate in Pakistan in short run at

the significant level) K \ !

T,3tatistics

<fter an evaluation of a coefficient) the t,statistics for that coefficient is the proportion

of the coefficient to its standard error. "t is calculated as

T J ]:"IAt , 4Tt; , d^ Y 3E.

Page ++

F6 T!t "nd An"./!i! o0 V"ri"nc

The A statistic is used to show that the model is statistically stable. The value of the A statistic is

given by

A J Explained variation Y :k , #;

Total variationY :n , k;

5here) n shows the number of observation and k shows the number of parameters."t is because

the A statistics test is the ratio of two variances therefore this test is often referred to as the

analysis of variance. " will determine the A statistics in terms of the coefficient of determination

as follows:

A J 4

+

Y:k,l;

:" ,4

+

;Y:n,k;

7ere 4

+

shows the coefficient of determination between "nflation and "nterest 4ate in

Pakistan in long run. <fter this we will compare the calculated value of the A statistics with a

tabulated value taken from the table of the A distribution. "f the calculated value of the A

statistics is greater the tabulated value of A distribution the null hypothesis is re.ected as

there is no relationship between "nflation and "nterest 4ate in Pakistan in long run) and the

alternative hypothesis is accepted that not all the coefficient e-ual to 1ero) and vice versa at @B

significant level.

Page +*

%u.ti coint4r"tion An"./!i!

T# %u.ti co6int4r"tion %od.

The multi co,integration model will be used for testing the co,integration between

"nflation) 2oney supply and "nterest 4ate.

"IAt J Ko L K#23t L K+"4t L M

t

"IA is dependent variable while 23 and "4 are the explanatory variables. M

t

is the error

term that affect the "nflation in Pakistan and we will .ust test that how much changes in 2oney

3upply and "nterest 4ate.

The values of Ko) K#) K+)4

+

and ad.usted 4

+

will be calculated and at end we will use A

statistics to check the hypothesis that the variation in the 2oney 3upply and "nterest 4ate

explains a significant proportion of the variation in the "nflation.

Coint4r"tion T!t

H/)ot#!i!

78: There is no co,integration exist between "nflation) 2oney 3upply and "nterest 4ate at

significance level in Pakistan) K J !

7#: There is cointegration is exists between "nflation) 2oney 3upply and "nterest 4ate at the

significance level in Pakistan)K\!

Iow for testing the above hypothesis the trace statistics will be used.

Page +

Error Corrction %od. 8EC%9

The E>2 model will be used to find out the effects of changes in 2oney 3upply and "nterest

4ate on "nflation in Pakistan and to check that whether 2oney 3upply and "nterest 4ate

explains significant changes of "nflation or nor6 "s yes) then how much6

H/)ot#!i!

78: The 2oney 3upply and "nterest 4ate combine do not describe a significance proportion of the

changes in "nflation in Pakistan in long run) K J !

7#: The 2oney 3upply and "nterest 4ate combine describe a significance proportion of

the changes in "nflation in Pakistan in long run) K \ !

A statistics will be used for testing the above hypothesis

A J 4

+

Y:k,l;

:",4

+

;Y:n,k;

7ere 4

+

shows the coefficient of determination between "nflation) 2oney 3upply and

"nterest 4ate in Pakistan in long run. <fter this we will compare the calculated value of the A

statistics with a tabulated value taken from a table. "f the calculated value of the A statistics is

greater than tabulated value of A distribution the null hypothesis is re.ected as there is no

relationship between "nflation) 2oney 3upply and "nterest 4ate in Pakistan in long run) and

the alternative hypothesis is accepted that not all the coefficient e-ual to 1ero) and vice versa at

@B significant level.

:

Page +@

CHAPTER 0'

E-)iric". An"./!i!

This chapter include the analysis and its results. "t include the descriptive statistics) <ugmented

'ucky,Auller test for "nflation) 2oney supply and interest rate) the correlation test the Cohnson

co,integration test and Error >orrection 2odel test and their interpretations.

T"&. '.1 D!cri)ti3 St"ti!tic!5

V"r N %in %"; %"n Std. D3

"IA

+# #.$! +#.@! $.(#$ .?%%%$

23

+# *#.+! @???.+! +.!@@!E* #((!.!+$@#

"4

+# ?.@! +!.!! #+.#@+ *.(?*+*

INF: inflation, MS: money supply, IR: interest rate, Min: minimum value, Ma

: maimum value, st!" #ev: stan!ar! !eviation"

The table .# describes the statistics of the findings. The dependent and independent variables

are shown in the first column and different statistics are shown in the rows. I represents the

number of observation which is +#.

"n my study the 2ean and 3td. 'eviation of inflation are $.(#$ and .?%%%$ respectively and

#.$! is the minimum and +#.@! is the maximum mean value similarly the mean and std.

Page +(

deviation of money supply are +.!@@!E* and #((!.!+$@# respectively and *#.+! is the

minimum and *#.+! is max mean value. The mean and 3td. deviation of "nterest rate are

#+.#@+ and *.(?*+* respectively and the minimum value of its mean is ?.@! and maximum is

+!.!!.

Unit root t!t5

<ugmented 'ickey Auller test is used to see that the data is stationary or not on the level) #st

difference and +nd difference. "nflation and "nterest 4ate are stationary in #

st

difference level and

2oney 3upply is stationary on +

nd

difference level.

Au4-ntd dic</ 0u..r t!t

In0."tion

T"&. '.2 In0."tion

t,3tatistics Probability

Test statistics ,(.+%*@ (.+!#e,!!@

Tabulated values #B level ,*.?@+$

@B level ,+.$$%!

#!B level ,+.(*%?

ProbZ stands for p,value,statistics for tau,value) tabulated value are taken from the table

5e apply <ugmented 'ickey Auller test to check the stationarity property of inflation at level)

"

st

difference and +

nd

difference therefore the data of "nflation is stationary on #

st

difference at

#B significance level as the <ugmented 'ickey,Auller t,statistic value :(.+%*@$; is greater

than the tabulated value at #B level :*.?@+$(;. The null hypothesis will be re.ected in the

support of alternative hypothesis because the P value is less than :!.!@; which tell us that the

series of inflation is stationary and unit root does not exists.

Page +?

%on/ Su))./

T"&. '.1 %on/ Su))./

t,3tatistics Probability

Test statistics ,@.!(+ !.!!!%(

Tabulated values #B level ,*.?@+$

@B level ,+.$$%!

#!B level ,+.(*%?

ProbZ stands for p,value.t,statistics for tau,value) tabulated values are taken from the table

5e apply <ugmented 'ickey Auller test to check the stationarity property of 2oney 3upply at

level) "

st

difference and +

nd

difference therefore the data of 2oney 3upply is stationary on

#

st

difference at #B significance level as the <ugmented 'ickey,Auller t,statistic

value:@.!(+@; is greater than the tabulated value at #B level :*.?@+$(;. 5e re.ect the null

hypothesis in support of alternative hypothesis because the P value is less than :!.!@; which tell

us that the series of 2oney 3upply is stationary and there is no unit root exists.

Intr!t R"t

T"&. '.' Intr!t r"t

t,3tatistics Probability

Test statistics ,*.(*$? !.!#%

Tabulated values #B level ,*.?@+$

@B level ,+.$$%!

#!B level ,+.(*%?

ProbZ stands for p,value,statistics for tau,value) tabulated value are taken from the table

Page +%

5e apply <ugmented 'ickey Auller test to check the stationary property of "nterest 4ate at

level) #

st

difference and +

nd

difference therefore the data of "nterest 4ate is stationary on

#

st

difference at @B significance level as the <ugmented 'ickey,Auller t,statistic value :*.(*$?;

is greater than tabulated value at @B level :,+.$$%!(;. 5e re.ect the null hypothesis in support

of alternative hypothesis because the P value is less than :!.!@; which tells us that the series of

"nterest 4ate is stationary and there is no unit root exists.

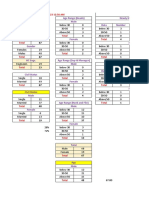

T"&. '.( Corr."tion!

< correlation explains the level of relationship between two variables. The

correlation test will be done to check the correlation relationship between "nflation

and 2oney 3upply) "nflation and "nterest 4ate.

"IA: "nflation) 23: 2oney 3upply) "4: "nterest 4ate

"n this table "IA represent "nflation) 23 represent the 2oney 3upply and "4 represent the

"nterest 4ate. 7ere "nflation is dependent variable 2oney 3upply and "nterest 4ate are

independent variables. Table .@ shows that there exists a strong positive correlation between

"nflation and 2oney 3upply and "nterest 4ate. The value .#$# shows that there is positive

correlation between "nflation and 2oney 3upply and .*?? shows that there is positive correlation

Page +$

"IA 23 "4

"IA #

23 .#$# #

"4 .*?* .!%# #

between "nflation and "nterest 4ate but ,.!%# shows that "nterest 4ate and 2oney 3upply has a

negative correlation as shown above

Jo#"n!n Co6int4r"tion T!t5

Co6int4r"tion5

>o integration is the procedure for testing the coUintegration of time series. 5hen two or

more than two series are not stationary and if their linear combination is stationary then this

type of series are said to be co,integrated. This test is more applicable than Engle U &ranger

test which shows the short run relationship between variables and if there is no co,

integration then Error >orrection 2odel will be used to show the long run relationship

between variables.

Co6int4r"tion T!t 0or %on/ Su))./= Intr!t R"t "nd In0."tion5

3ample :ad.usted;: #$$! +!#!

"ncluded observations: +! after ad.ustments

3eries: 23 "IA "4

0ags interval first differences;: " to "

T"&. '.> co6int4r"tion

7ypothesi1ed

Io. of >E:s;

Eigen value Trace 3tatistic Tabulated Nalue

!.!@

Probability__

Ione _ !.%**(# (.*%+ +$.?$? !.!!!@

<t most " _ !.?*%#? *+.#!! #@.$ !.!!!?

<t most + _ !.*@%!% ?.$?$* *.%# !.!!?

__2ac`innon,7aug,2ichelins :#$$$; p,values

"IAt J K

o

L K#23t L K+"4t L M)

Page *!

5here) " J #)+)*))@S..

78: There is no co integration is present between "nflation) 2oney 3upply and "nterest 4ate

atthe significance level in Pakistan) K J !

Nersus 7#: There is co integration is present between "nflation) 2oney 3upply and "nterest 4ate

at the significance level in Pakistan) K \ !

Aor testing the above hypothesis we will use the trace statistics

The above analysis shows that the trace value is larger than the tabulated value which indicates

that there is a long run relationship between "nflation) 2oney 3upply and "nterest 4ate.

The co integration test shows that there are three co,integration e-uations and accept the

alternative hypothesis and re.ect the null hypothesis at !.!@ level of significance as shown

Error Corrction %od.5 :E>2;

'ependent Nariable: :"IA;

2ethod: 0east 3-uares

3ample: #$$! +!#!

Io of observations: +!

T"&. '.? EC%

Nariable >oefficient 3td. Error t,3tatistic Prob.

> ,*.!(@%( #.@+$! ,+.!!@# !.!%$%

23 !.!!++ !.!!+! ##.##+! !.!!!!#

"4 !.*$*! !.!%?* .$?? !.!!+%#

uhat* !.(!++ !.#(@% *.(*#@ !.!!%*%

uhat*_+ ,!.%#!# !.#!$@ ,?.*$%! !.!!!#@

uhat*_* ,!.(?+ !.#+#* ,@.@@@@ !.!!!%@

4,3-uared !.$%

<d.usted 4,s-uared !.$%

Page *#

'urbain,5atson +.!+

A,statistic %%.*$%?+

Prob:A,statistic; *.!(e,!(

The E>2 is run with the data at level form and at #

st

difference form.

H/)ot#!i!

7/J There is no relationship exists between "nflation) 2oney 3upply and "nterest 4ate in

Pakistan in long run at the significant level) K J !

Nersus

7#J There is relationship exists between "nflation) 2oney 3upply and "nterest 4ate in Pakistan

in long run at the significant level) K \ !

The above hypothesis will be tested by using A statistics and t, statistics.

E>2 is mostly used to determine the long run and short run relationship between the

variables. 9y applying it we obtain the following results.

"n these results) > J ,*.!(@%( shows constant coefficient. The value of K# is !.!!++ shows that

one unit increase in 2oney 3upply brings !.!!++ units change in dependent variable

"nflation and there is a positive relationship between the "nflation and 2oney 3upply in long

run and redirects the null hypothesis at !.!!!!# probability. 5hile the value of K

+

is !.*$*!

shows that one unit increase in "nterest 4ate brings !.*$*! units change in dependent

variable "nflation and there is a positive relationship between the "nflation and "nterest

4ate in long run and redirect the null hypothesis at !.!!+%# probability.

Page *+

4

+

measures the percentage of variation in the values of the dependent variable inflation

describe by the independent variables 2oney 3upply and "nterest 4ate in Pakistan at long

run.The value of 4

+

in my study is !.$% represents that the change in dependent variable

"nflation are $B explained by the independent variables "nterest 4ate and 2oney 3upply in

Pakistan.

The value of ad.usted 4

+

in my study is !.?$(@# shows that the change in dependent

variable "nflation is ?$B explained by the independent variables "nterest 4ate and 2oney

3upply in

Pakistan.

"f A,statistics value is greater than its probability then 7

8

will be re.ected and 7

# will be accepted.

"n my study A,statistics value %%.*$% is greater than its probability *.!(e,!(. 3o) it shows

that independent variables "nterest 4ate and 2oney 3upply both affect the dependent variable

"nflation. <t the end) the value of 'urbin 5atson test is +.!+ shows positive auto correlation.

<ll these result shows that our model is good fit.

Page **

>hapter !@

A"I'"I&3 4E>/22EI'<T"/I <I' >/I>0O3"I

FINDIN2S

"n this study some of the findings regarding inflation money supply and interest rate are as

follows.

#.

The data of 2oney 3upply) "nflation and "nterest 4ate has been proved non stationary at base

level it becomes stationary by taking #

st

and +

nd

difference.

+.

>orrelation suggests that there exists a strong positive relationship between "nflation) 2oney

3upply and "nterest 4ate.

*.

>o,integration test suggest that the "nflation) 2oney 3upply and "nterest 4ate are co,

integrated with each other.

.

E>2 shows that there exists a long run relationship between "nflation and 2oney 3upply.

@.

E>2 suggests that there exists a long run relationship between "nflation and "nterest 4ate.

Page *

RECO%%ENDATION

"nflation is a serious problem in both developed and developing economies. Pakistan is a

developing country and is facing this dilemma of consistent rise in inflation rate. "nflation

could not be controlled by taking a single measure. There are different determinants of

inflation which need to be monitored. <mong them money supply and interest rate should

be given keen attention to reduce the consistent rise in inflation.

#. The existence of the significant positive relationship "nflation and 2oney 3upply suggested

that the &overnment should adopt a tighten monetary policy to control 2oney 3upply to

decrease the "nflation

+. &overnment should impose strict monetary policies. The money supply should be

reduced to the market) so that there is e-uilibrium between demand and supply. Excess of

money in the market increases spending and unemployed resources increase output.

*. The existence of a long run relationship between 2oney 3upply and "nflation has great ef

fect on the economy) therefore the &overnment should adopt an ade-uate policy to control

the long run effect.

. The import prices should be reduced. 3o that necessary products could be easily available

in the market. &overnment should decrease tax duties on importsa

@. The problem of inflation can be resolved through b3trategic planning=. This process will

give a plan for future unfortunate situations. The unstable prices of oil in the international

market) the political instability and other such problems can be coped.

Page *@

(. Pakistan is an agricultural country) so agriculture sector should be supported by taking

subsidies. Aoreign investment should be invited to invest and take benefits from their

expertise.

?. "nflation has a direct relationship with interest rate. >entral bank uses the "nterest 4ate to

control 2oney 3upply. 7igh "nterest 4ate discourage the borrowing and low interest rate

encourage the lending resulting in increase in money) so the central bank of Pakistan

should sit the variation in the rate of interest to control the "nflation by controlling the

2oney 3upply.

CONC+USION

"n this study an attempt was made to understand the relationship between "nterest 4ate) 2oney

3upply and "nflation in Pakistan. "n this study "nflation is used as dependent variable and

2oney 3upply) "nterest 4ate are independent variables which are taken to investigate their

relationship with inflation. The period for investigating this effect is from #$$! to +!#!.

This study uses the co,integration analysis and Error >orrection 2odel to achieve the results of

the study. Error >orrection 2odel results suggest a long run relationship between binflation and

interest rate= and binflation and money supply=. The Cohansen co,integration statistics are

significant so the null hypothesis is re.ected with !.!@ significance level.

The correlation statistics shows that the independent variables have strong relationship with

inflation rate in Pakistan economy. The results show that there is significant relationship between

binflation and money supply= and binflation and interest rate=. <nd there is a long run relationship

between these variables. 3o whenever a policy is made to control inflation) these variables

should be given deep attention.

Sco) o0 0utur r!"rc#5

Page *(

"n this study there are some limitations. /ne of the important limitations is the use of only "nterest

4ate and 2oney 3upply with inflation but there are other variables which also effect the "nflation in

Pakistan like economic growth) import prices) higher duties and taxes) depreciating Pak rupees)

political instability) output set,backs etc. 4esearchers interested in the expansion of this study

should try to investigate the effect of other variables on inflation in the model. They should increase

the time frame of data. The researchers should use other model for the determinants of inflation.

This will help to understand the impact of inflation on the economy in Pakistan.

a

4EAE4EI>E3

Page *?

9runo) 2. and 5. Easterly :#$$(;. F"nflation and &rowth: "n 3earch of 3table 4elationshipH.

Aederal 4eserve 9ank of 3t. 0ouis 4eview) Nolume. ?%) Io. *. 9urstein) 2.0 :#$%(;. 2odern

2onetary Theory) The 2acmillan Press 0td. 7ong `ong.

>airncross) 3.< :#$?@; "nflation) &rowth and "nternational Ainance) &eorge <llen and Onwin

0td) &reat 9ritain.

>oghlan) 4. :#$%*; The Theory of 2oney and AinanceH. The 2acmillan Press 0td) 7ong

`ong.

Aischer) 3. :#$$*;. FThe 4ole of 2acro Economic Aactors in &rowthH. Cournal of 2onetary

Economcis) N/l. *+: %+,@#+.

&hosh) <. and 3. Phillips :#$$%;. "nflation) 'isinflation and &rowth. "2A 5orking paper Io.

5PY$%Y(%. 5ashington) '.>.: "2A.

7anan) 3. and &. 7ale :#$$!;. Economic "n Aocus. 7oarder and 3toughto 0td. &reat 9ritain.

7arberler) &. :#$?@;. The Phenomena of 5orld 5ide "nflation. <merican Enterprise "nstitute

for Public Policy 4esearch) 5ashington) '.>.

Chingan) 2.0. :+!!@;. 2onetary Theory. `onark Publishers Pvt. 0td.

0indauer) C. :#$(%;. 2acro Economics Cohn 5iley and 3ons 0td. >anada) O3<.

2eenai) 3.< :#$((; 2oney and 9anking in Pakistan. The <llies 9ook >orporation. `arachi)

Pakistan.

Page *%

Iasir) 2.3 :+!!;. 2acro Economic and Economic 'evelopment. "02" `itab `hana)

0ahore) Pakistan. asir) 2.3 and 3.` 7yder :+!!!;. Economics of Pakistan. "mtia1 Publishers)

0ahore) Pakistan.

3hahid) <.7. :+!!;. 2onetary Economics and Public Ainance. "02" `itab `hana) 2an1oor

Printing Press) 0ahore) Pakistan.

3hapiro) E. :#$$+;. 2acro Economic <nalysis &algotia Publications Pvt 0td. Iew 'elhi.

3hilling) <.& and `. 3okoloff :#$%*;. "s "nflation Ending6 <re cou 4eady6 2c &raw,7ill)

O3<.

3taats) 5.A. :#$%+;. 2oney and 9anking <merican 9ankers <ssociation) O3<.

Page *$

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- History of Technical AnalysisDocument23 pagesHistory of Technical AnalysisShubham BhatiaNo ratings yet

- Child Care Business PlanDocument15 pagesChild Care Business Plandeepakpinksurat100% (5)

- CemDocument6 pagesCemSamaresh ChhotrayNo ratings yet

- BFN 405-LendingDocument207 pagesBFN 405-Lendingjoshua omondiNo ratings yet

- USAA - USAA Growth & Income Fund - USGRX - Summary Prospectus 12.01.2017Document4 pagesUSAA - USAA Growth & Income Fund - USGRX - Summary Prospectus 12.01.2017anthonymaioranoNo ratings yet

- Chapter 2: Analyzing The Business Case: Kp24103 System Analysis & DesignDocument17 pagesChapter 2: Analyzing The Business Case: Kp24103 System Analysis & DesignMae XNo ratings yet

- Carter CleaningDocument1 pageCarter CleaningYe GaungNo ratings yet

- q2 Long Quiz 002 EntreDocument8 pagesq2 Long Quiz 002 EntreMonn Justine Sabido0% (1)

- Check AccountabilityDocument12 pagesCheck Accountabilityjoy elizondoNo ratings yet

- BSBA in Financial ManagementDocument4 pagesBSBA in Financial ManagementJOCELYN NUEVONo ratings yet

- Employee Data Sheet As of June 21, 2023Document90 pagesEmployee Data Sheet As of June 21, 2023Marie Anne RemolonaNo ratings yet

- Return of Organization Exempt From Income TaxDocument31 pagesReturn of Organization Exempt From Income TaxRBJNo ratings yet

- Chapter 4 EnterpriseDocument5 pagesChapter 4 Enterpriseapi-207606282No ratings yet

- ACT450 - Fa20 - Project Deliverable PDFDocument10 pagesACT450 - Fa20 - Project Deliverable PDFHassan SheikhNo ratings yet

- Off-Highway ResearchDocument30 pagesOff-Highway ResearchAlireza NazariNo ratings yet

- Pinku 123Document91 pagesPinku 123bharat sachdevaNo ratings yet

- Chap 13Document18 pagesChap 13N.S.RavikumarNo ratings yet

- Bursa Suq Al SilaDocument23 pagesBursa Suq Al SilaUzair ZulkiflyNo ratings yet

- Harmonic Pattern by Jay PurohitDocument35 pagesHarmonic Pattern by Jay PurohitNickKr100% (5)

- Cotton IndustryDocument18 pagesCotton IndustrySakhamuri Ram'sNo ratings yet

- D4Document6 pagesD4crap talkNo ratings yet

- 79MW Solar Cash Flow enDocument1 page79MW Solar Cash Flow enBrian Moyo100% (1)

- Activity Based CostingDocument8 pagesActivity Based CostingAli AhmiiNo ratings yet

- Accounting CycleDocument21 pagesAccounting CycleJc GappiNo ratings yet

- Uber Case StudyDocument16 pagesUber Case StudyHaren ShylakNo ratings yet

- Ekonomi Paint SectorDocument4 pagesEkonomi Paint SectorDilansu KahramanNo ratings yet

- Ismt LTD (2018-2019)Document10 pagesIsmt LTD (2018-2019)Nimit BhimjiyaniNo ratings yet

- 33 Money LessonsDocument37 pages33 Money Lessonsraj100% (3)

- Inventory PeriodDocument4 pagesInventory PeriodIlham HamzahNo ratings yet

- Liquidity Adjustment FacilityDocument1 pageLiquidity Adjustment FacilityPrernaSharma100% (1)