Professional Documents

Culture Documents

Accounts Individual Processing Centrally: How To Create G/L General Ledger Account Master Record

Uploaded by

Anonymous 0v9zwXz6hFOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounts Individual Processing Centrally: How To Create G/L General Ledger Account Master Record

Uploaded by

Anonymous 0v9zwXz6hFCopyright:

Available Formats

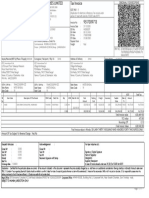

How to Create G/L General Ledger Account Master Record

G/L General Ledger Account Master Record can be created at different levels

Centrally (FS00 Centrally)

Chart of Account Level creation (FSP0 In Chart of Accounts)

Company Code Level Creation (FSS0 In Company Code)

SAP R/3 Menu Path :- Accounting >Financial Accounting >General Ledger >Master records >G/L

Accounts >Individual Processing >Centrally

Transaction Code :- FS00

Steps to create New General Ledger Account Master Record

Step 1 :- On the Edit G/L Account Centrally screen, update the following entries:

1. G/L Account :- Enter the account number of the G/L account that is being created

2. Company code :- Enter Company code ID Key

3. Choose Create icon to create a new General ledger Account.

Step 2 :- After click on Create icon update the following fields

Control in Chart of Accounts

1. Account Group :- The account group determines the fields for the entry screens . The account group

determines which number interval the account must be GL account to be created. Click the drop

down menu and select appropraite account group for the GL account

2. P&L statement account type :- If GL account is for P&L account, select this field

3. Balance sheet account :- If GL account is for Balance Sheet account, select this field

Short text :- Enter the Short description of the GL Account

G/L acct long text :- Enter the long description of the GL Account.

Consolidation Data in Chart of Accounts

Trading partner :- Trading Parting partner is used to prepare consolidated financial statements

Step 3:- Choose the Control Data tab and update the following

Account control in Company Code :-

1. Account currency :- Update the currency in which the account will be managed

2. Only Balances in Local Currency :- This field used to update the balance only in local currency when

users post items to this G/L account

3. Exchange Rate Difference Key :- Use the drop down Menu and select Exchange Rate Difference Key

4. Tax category :- Use the drop down menu and choose tax code key if account is tax relevant

5. Posting with out tax allowed :- Select box if posting for the accounts is without tax

6. Recon. account for account type :- select the drop down menu and select Asset or Customer or

Vendor if account is for Reconciliation account.

7. Alternative account number :- It may be used to indicate the account number from the legacy system.

8. Tolerance group :- Select this field for open item clearing differences

Account Management in Company Code :-

9. Open item management :- Select this field if account to be display as per open item lines, open item

management is used for only balance sheet accounts.

9. Line item Display :- Select this field if account to be display as per line item.

10.Sort key :- Select Drop down menu and select appropriate sort key for the account

Step 4:- Select Create/Bank/Interest tab

Control of Document Creation in Company Code :-

1. Field status group :- FSG determines the screen layout for document entry. select drop down button and

select appropriate FSG Key.

2. Post automatically only :- Check box if account can posted by the system using account determination

table

Bank/Financial Details in Company Code :-

3. Planning level :- planning level field is used to control displays in Cash Management.

4. Relevant to cash flow :- Relevant to cash flow field determines that the GL account is a cash flow account

5. House bank :- click drop down menu and select if account is Indicator for the company bank

6. Account ID :- Account ID field determines House Banks of account

Interest Calculation Information in company code :-

7. Interest indicator :- Click drop drop button and select interest calculation indicator if the account is to be

included in automatic interest calculation.

8. Interest calc. Frequency :- Click drop drpp button and select Interest calc. Frequency if the interest is to be

calculated automatically for this account at intervals

9. Key date of last int. calc :- Click drop drop button and select Key date of last int. calc, that the date of last

time interest calculation program processed for this account.

10. Date of last interest run :-The date of the last interest run calculation for this account

Step 5 :- Click on Save icon to save the configured entries.

You might also like

- ANIRUDDHADocument68 pagesANIRUDDHAAniruddha ChakrabortyNo ratings yet

- Accounts PayableDocument24 pagesAccounts PayablepreetijasmitaNo ratings yet

- Automatic Payment Program Run in SapDocument13 pagesAutomatic Payment Program Run in SapManoj Kumar YNo ratings yet

- Automatic Payment ProgramDocument15 pagesAutomatic Payment Programsmart sriniNo ratings yet

- How To Create A Company in SAPDocument17 pagesHow To Create A Company in SAPNaveen Kumar RudrangiNo ratings yet

- Sap Fico Guru99Document63 pagesSap Fico Guru99sreevanisathyaNo ratings yet

- COA Creation in SAPDocument8 pagesCOA Creation in SAPHouda BoussettaNo ratings yet

- Fi-Sd Integration End To End ProcessDocument65 pagesFi-Sd Integration End To End ProcessBiranchi Mishra100% (1)

- Drawing SheetDocument165 pagesDrawing SheetRajan S PrasadNo ratings yet

- GL Master Data - FS00Document25 pagesGL Master Data - FS00keeru_bioNo ratings yet

- SAP Account ReceivablesDocument18 pagesSAP Account ReceivablesNavyaChNo ratings yet

- MakalahDocument14 pagesMakalahImam Ank RezpectorNo ratings yet

- Aysha Samina MCO19-035Document23 pagesAysha Samina MCO19-035Sidra ButtNo ratings yet

- Fico and SD NotesDocument29 pagesFico and SD NotesViswanadha Sai MounikaNo ratings yet

- Ax2009 Enus FINII07Document36 pagesAx2009 Enus FINII07Timer AngelNo ratings yet

- Sage 300 Training Manual IESLDocument82 pagesSage 300 Training Manual IESLalabiolamide728No ratings yet

- FI Vs SDDocument148 pagesFI Vs SDSonia Gonzalez Mariño100% (1)

- How To Create Vendor Account Groups in SAPDocument3 pagesHow To Create Vendor Account Groups in SAPakshay8shinde-13No ratings yet

- FSV Documents ReferenceDocument4 pagesFSV Documents ReferencesaigrameshNo ratings yet

- Retained Earning Account Is An Equity Account (Of A Balance Sheet) That Records CumulativeDocument6 pagesRetained Earning Account Is An Equity Account (Of A Balance Sheet) That Records CumulativeDipankar DasNo ratings yet

- 05 - Transactions in Office AccountsDocument18 pages05 - Transactions in Office AccountsSreepada k100% (1)

- General Ledger End User Training ManualDocument47 pagesGeneral Ledger End User Training Manualsudheer1112No ratings yet

- SAP FICO Practice2Document33 pagesSAP FICO Practice2yashpalNo ratings yet

- Creating A Customer LedgerDocument7 pagesCreating A Customer Ledgermubarakm123No ratings yet

- SAP FICO Create Vendor Master DataDocument13 pagesSAP FICO Create Vendor Master DataGiri RajNo ratings yet

- Advanced Accounting in Tally ERP 9Document30 pagesAdvanced Accounting in Tally ERP 9Nam NamNo ratings yet

- Advanced Accounting in Tally ERP 9Document30 pagesAdvanced Accounting in Tally ERP 9Nam NamNo ratings yet

- SAP Chart of AccountsDocument4 pagesSAP Chart of AccountsVenkata KishoreNo ratings yet

- Computerised AccountingDocument4 pagesComputerised AccountingVinod Bhaskar100% (1)

- Taxes in Tally8 - 15Document8 pagesTaxes in Tally8 - 15CehNo ratings yet

- FIN.1.1.1. - (General Ledger Setup - Chart of Accounts) : Direct Aid COA Coding Will Be 8 Digits As Follows: XXXXXXXXDocument12 pagesFIN.1.1.1. - (General Ledger Setup - Chart of Accounts) : Direct Aid COA Coding Will Be 8 Digits As Follows: XXXXXXXXIslam SultanNo ratings yet

- Unit 1. Introduction: Computerised AccountingDocument27 pagesUnit 1. Introduction: Computerised Accountingdrtomy100% (1)

- Sap Financials - Interest CalculationDocument3 pagesSap Financials - Interest CalculationSuresh ParamasivamNo ratings yet

- JAWABAN UAS FINANCING AC010 (Elang SAP-AC10 Dua Jawatengah Bandung)Document16 pagesJAWABAN UAS FINANCING AC010 (Elang SAP-AC10 Dua Jawatengah Bandung)REG.A/0117101094/SITI SOBARIAH63% (8)

- Account T24Document1 pageAccount T24Luis Maria CepedaNo ratings yet

- Sap Fi AP Frequently User ProceduresDocument39 pagesSap Fi AP Frequently User ProcedureskerasaktibangetNo ratings yet

- Petty Cash SampleDocument12 pagesPetty Cash Sampleraji letchumiNo ratings yet

- 21enter Global ParametersDocument3 pages21enter Global ParametersDipuPalaiNo ratings yet

- Configuration of FSVDocument9 pagesConfiguration of FSVrsr.1985.rsr9280No ratings yet

- How To Create Customer Account Group: Financial AccountingDocument5 pagesHow To Create Customer Account Group: Financial AccountingchonchalNo ratings yet

- Vat Reporting For France Topical EssayDocument17 pagesVat Reporting For France Topical EssayMiguel FelicioNo ratings yet

- House Rental SystemDocument15 pagesHouse Rental Systemsaugat sthaNo ratings yet

- Sage Accounting 100 TrainingDocument3 pagesSage Accounting 100 TrainingAmba FredNo ratings yet

- Create Financial Statement Versions in SAPDocument9 pagesCreate Financial Statement Versions in SAPSandeep KonarNo ratings yet

- Sap - Fi TrainingDocument54 pagesSap - Fi TrainingThummala Penta Sudhakar RaoNo ratings yet

- Create GL MasterDocument5 pagesCreate GL MasterSubhash ReddyNo ratings yet

- Interest Calculation in SAPDocument7 pagesInterest Calculation in SAPnaysarNo ratings yet

- User Manual V1Document10 pagesUser Manual V1meny212No ratings yet

- Tuski 9Document1 pageTuski 9syed shabbirNo ratings yet

- Sap Interview QuestionDocument29 pagesSap Interview QuestionJRK SOFTWARE SOLUTIONS PVT LTDNo ratings yet

- Sap Fi General Ledger Frequently Used ProceduresDocument88 pagesSap Fi General Ledger Frequently Used Proceduresvenkat6299No ratings yet

- Bad Debt ConfigrationDocument4 pagesBad Debt Configrationsudershan9No ratings yet

- GR&IR Clearing AccountDocument8 pagesGR&IR Clearing AccountWupankNo ratings yet

- FI - SD IntegrationDocument13 pagesFI - SD IntegrationchonchalNo ratings yet

- GL Master DataDocument7 pagesGL Master Datajayaprakashb290No ratings yet

- Configuration Example: SAP Electronic Bank Statement (SAP - EBS)From EverandConfiguration Example: SAP Electronic Bank Statement (SAP - EBS)Rating: 3 out of 5 stars3/5 (1)

- Issue in SDDocument1 pageIssue in SDAnonymous 0v9zwXz6hFNo ratings yet

- Vendor RegistrationDocument2 pagesVendor RegistrationAnonymous 0v9zwXz6hFNo ratings yet

- Lesson 15:: Difference Between PARAMETERS and SELECT-OPTIONSDocument4 pagesLesson 15:: Difference Between PARAMETERS and SELECT-OPTIONSAnonymous 0v9zwXz6hFNo ratings yet

- Lesson 15:: Difference Between PARAMETERS and SELECT-OPTIONSDocument4 pagesLesson 15:: Difference Between PARAMETERS and SELECT-OPTIONSAnonymous 0v9zwXz6hFNo ratings yet

- Steps To Edit Standard TableDocument2 pagesSteps To Edit Standard TableAnonymous 0v9zwXz6hFNo ratings yet

- En 10624/din 7991Document5 pagesEn 10624/din 7991Dasdasd SadasdNo ratings yet

- ECL Module PoolDocument178 pagesECL Module PoolAnonymous 0v9zwXz6hFNo ratings yet

- OLA Y. Anil Gopal: Fare Breakup Tax BreakupDocument1 pageOLA Y. Anil Gopal: Fare Breakup Tax BreakupAnonymous 0v9zwXz6hFNo ratings yet

- Unit - IDocument45 pagesUnit - IAnonymous 0v9zwXz6hFNo ratings yet

- ActiProcess SS Trail DetailsDocument1 pageActiProcess SS Trail DetailsAnonymous 0v9zwXz6hFNo ratings yet

- SAP MM CIN GuideDocument175 pagesSAP MM CIN GuideMohit Jain100% (2)

- Everything in AccountingDocument322 pagesEverything in Accountingrohitwarman100% (2)

- SAP PP Master Data Configuration PDFDocument130 pagesSAP PP Master Data Configuration PDFmrahma19100% (1)

- BI Production S LawDocument4 pagesBI Production S LawAnonymous 0v9zwXz6hFNo ratings yet

- Sap MM-WM ConfigurationDocument112 pagesSap MM-WM ConfigurationMirko100% (3)

- InfoSet QueryDocument32 pagesInfoSet QueryAnonymous 0v9zwXz6hFNo ratings yet

- 3.ECL FI ABAP ABAPDictionary ObjectsDocument79 pages3.ECL FI ABAP ABAPDictionary ObjectsAnonymous 0v9zwXz6hFNo ratings yet

- International Standard: Low-Voltage Fuses - General RequirementsDocument11 pagesInternational Standard: Low-Voltage Fuses - General RequirementsAnonymous 0v9zwXz6hF25% (8)

- AG Technologies - Vendor PortalFeatureDocument14 pagesAG Technologies - Vendor PortalFeatureAnonymous 0v9zwXz6hFNo ratings yet

- 3.ECL FI ABAP ABAPDictionary ObjectsDocument79 pages3.ECL FI ABAP ABAPDictionary ObjectsAnonymous 0v9zwXz6hFNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- C2 FAF Chapter 3 PDFDocument0 pagesC2 FAF Chapter 3 PDFAnonymous Q4mhHlNo ratings yet

- BS1387 1995Document23 pagesBS1387 1995balabhavini100% (1)

- Is 3459-2004Document12 pagesIs 3459-2004Anonymous 0v9zwXz6hFNo ratings yet

- LH Rotary ValveDocument1 pageLH Rotary ValveAnonymous 0v9zwXz6hFNo ratings yet

- Bridge Code ManagementDocument11 pagesBridge Code ManagementAnonymous 0v9zwXz6hFNo ratings yet

- FIDocument2 pagesFIAnonymous 0v9zwXz6hFNo ratings yet

- Is 458-1988Document46 pagesIs 458-1988Rajashekhar Katta100% (2)

- 001058Document65 pages001058ponutyokeNo ratings yet

- Form 1040-ES: Purpose of This PackageDocument12 pagesForm 1040-ES: Purpose of This PackageBill ChenNo ratings yet

- How To Design A Decision-Making TreeDocument11 pagesHow To Design A Decision-Making Treedross_14014No ratings yet

- Bdo Cash It Easy RefDocument2 pagesBdo Cash It Easy RefJC LampanoNo ratings yet

- Hima16 SM 11Document53 pagesHima16 SM 11vahid teymooriNo ratings yet

- IILM Graduate School of ManagementDocument15 pagesIILM Graduate School of ManagementMd. Shad AnwarNo ratings yet

- KEQ FV and PV TablesDocument4 pagesKEQ FV and PV TablesRaj ShravanthiNo ratings yet

- A Study On Awareness About Mobile Banking Services Provided by BanksDocument20 pagesA Study On Awareness About Mobile Banking Services Provided by BanksakhyatiNo ratings yet

- Credit Risk PlusDocument14 pagesCredit Risk PlusAliceNo ratings yet

- Ife761 Final AssessmentDocument12 pagesIfe761 Final AssessmentElySya SyaNo ratings yet

- Magaling Vs Ong Case DigestDocument1 pageMagaling Vs Ong Case DigestRaje Paul Artuz100% (1)

- Indian Aluminium IndustryDocument6 pagesIndian Aluminium IndustryAmrisha VermaNo ratings yet

- Tci Freight NL01AA2959 261354914 31.12.2020Document1 pageTci Freight NL01AA2959 261354914 31.12.2020Doita Dutta ChoudhuryNo ratings yet

- Financial Statements Ratio Analysis of InfosysDocument15 pagesFinancial Statements Ratio Analysis of InfosysVishal KushwahaNo ratings yet

- Corporate ValuationDocument9 pagesCorporate ValuationSwapnil KolheNo ratings yet

- BPS Research Paper On NordstromDocument17 pagesBPS Research Paper On NordstromelizabethvuNo ratings yet

- COOPERATIVEDocument15 pagesCOOPERATIVEGiann Lorrenze Famisan RagatNo ratings yet

- CEMA Brochure PDFDocument2 pagesCEMA Brochure PDFKumar RajputNo ratings yet

- Chap015 Auditing Debt and Equity CapitalDocument31 pagesChap015 Auditing Debt and Equity CapitalStevia Tjioe100% (6)

- Bank of The South An Alternative To The IMF World BankDocument45 pagesBank of The South An Alternative To The IMF World BankCADTMNo ratings yet

- Random Walk TheoryDocument2 pagesRandom Walk TheorySuraj TheruvathNo ratings yet

- Income Statement and Statement of Financial Position Prepared byDocument7 pagesIncome Statement and Statement of Financial Position Prepared byFakhrul IslamNo ratings yet

- Week 1 - Don - Optimizing Your Real Estate Investment in 2023Document4 pagesWeek 1 - Don - Optimizing Your Real Estate Investment in 2023Don J AsuncionNo ratings yet

- Segregation of DutiesDocument1 pageSegregation of DutiesjadfarranNo ratings yet

- Resume - Aansh DesaiDocument2 pagesResume - Aansh Desaisiddhant jainNo ratings yet

- 2021 JCI Philippines Awards ManualDocument42 pages2021 JCI Philippines Awards ManualKing Erlano100% (1)

- 2012 International Performance Measurement and Verification Protocol (IPMVP®)Document143 pages2012 International Performance Measurement and Verification Protocol (IPMVP®)Ravi ShankarNo ratings yet

- Fin304 1midterm2Document5 pagesFin304 1midterm2darkhuman343No ratings yet

- Quiz 8 - BTX 113Document3 pagesQuiz 8 - BTX 113Rae Vincent Revilla100% (1)

- Profit Prior To IncorporationDocument4 pagesProfit Prior To Incorporationgourav mishraNo ratings yet

- Motex AssignmentDocument13 pagesMotex Assignmentmotuma dugasaNo ratings yet