Professional Documents

Culture Documents

Exponential

Uploaded by

KiaraSinghOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exponential

Uploaded by

KiaraSinghCopyright:

Available Formats

Notes on using the forecasting template:

All values in blue cells are to be entered by the user, all other values are automatically calculated, and do not need to be altered. Most ofte

Actual column. Each forecast model has a sample value set entered, make sure to clear all values before proceeding with your own da

Cells with red marks in the upper right corner have comments, let the mouse hover over those cells to read the comments to fu

model.

This spreadsheet is locked/protected in order to keep the cells with equations from being changed. If a model does need to b

needs to be unlocked/unprotected. Do this by selecting the workbook you wish to unlock, click on "Tools", highlight "Protect

Sheet". The sheet will then be unlocked so alterations can be made.

Equations for models will be given when available.

cells are to be entered by the user, all other values are automatically calculated, and do not need to be altered. Most often this is the

column. Each forecast model has a sample value set entered, make sure to clear all values before proceeding with your own data.

Cells with red marks in the upper right corner have comments, let the mouse hover over those cells to read the comments to further explain the template

This spreadsheet is locked/protected in order to keep the cells with equations from being changed. If a model does need to be altered, the spreadsheet first

needs to be unlocked/unprotected. Do this by selecting the workbook you wish to unlock, click on "Tools", highlight "Protection", and select "Unprotect

Simple Moving Average

Periods 3

MAD #DIV/0!

MSE 0

Period Actual Forecast Error

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

0

0

0

0

0

1

1

1

1

1

1

1 6 11 16 21 26

Actual Forecast

Period

Simple Moving Average

The Simple Moving Average will take the last several data points and average them to forecast the next

period. The number of data points (or periods) selected is set by the value in the

( )

1 n

F A

MSE

n

F A

MAD

periods of number Total = n

period the for demand Forecast = F

period the for demand Actual = A

number Period = t

p

A ... A A A

F

period) previous the (or 1 - t period in demand Actual A

averaged be to periods of Number = p

period) coming the (or t period for Forecast = F

n

1 t

2

t t

n

1 t

t t

p - t 3 t 2 t 1 t

t

1 - t

t

=

+ + + +

=

=

=

=

(MSE) Error Square Mean

(MAD) Deviation Absolute Mean

Average Moving Simple

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

26 31 36 41 46 51 56

Period

Simple Moving Average

will take the last several data points and average them to forecast the next

period. The number of data points (or periods) selected is set by the value in the Periods cell.

( )

1 n

F A

MSE

n

F A

MAD

periods of number Total = n

period the for demand Forecast = F

period the for demand Actual = A

number Period = t

p

A ... A A A

F

period) previous the (or 1 - t period in demand Actual A

averaged be to periods of Number = p

period) coming the (or t period for Forecast = F

n

1 t

2

t t

n

1 t

t t

p - t 3 t 2 t 1 t

t

1 - t

t

=

+ + + +

=

=

=

=

(MSE) Error Square Mean

(MAD) Deviation Absolute Mean

Average Moving Simple

Weighted Moving Average (3 period)

Weight 3 Weight 2 Weight 1

Least Recent Most Recent

MAD #DIV/0! ERROR

MSE 0 Weights must total 1

Period Actual Forecast Error

1

2

3

4 0

5 0

6 0

7 0

8 0

9 0

10 0

11 0

12 0

13 0

14 0

15 0

16 0

17 0

18 0

19 0

20 0

21 0

22 0

23 0

24 0

25 0

26 0

27 0

28 0

29 0

30 0

31 0

32 0

33 0

34 0

35 0

36 0

37 0

38 0

39 0

40 0

41 0

42 0

0

0

0

0

0

1

1

1

1

1

1

1 6 11 16 21 26

Actual Forecast

Period

Weighted Moving Average

As opposed to the Simple Moving Average which gives equal weight to each of the preceding values,

the 3-period Weighted Moving Average allows you to give a higher or lower weight to each of the three

previous periods. The number of periods is fixed at 3, and the sum of the weights must equal 1. If all

the weights are equal (for the 3-period 0.33) this is the same as a 3 period moving average. A 2

4-period or n-period weighted moving average would follow the same logic.

3 2 1

3 t 3 2 t 2 1 t 1 t

1 - t

t

w w w 1

A w A w A w F

Weight = w

period) previous the (or 1 - t period in demand Actual = A

) period coming the (or t period for Forecast = F

+ + =

+ + =

Average Moving Weighted Period - 3

43 0

44 0

45 0

46 0

47 0

48 0

49 0

50 0

51 0

52 0

53 0

54 0

55 0

56 0

57 0

58 0

59 0

60 0

26 31 36 41 46 51 56

Period

Weighted Moving Average

which gives equal weight to each of the preceding values,

allows you to give a higher or lower weight to each of the three

previous periods. The number of periods is fixed at 3, and the sum of the weights must equal 1. If all

period 0.33) this is the same as a 3 period moving average. A 2-period,

period weighted moving average would follow the same logic.

3 2 1

3 t 3 2 t 2 1 t 1 t

1 - t

t

w w w 1

A w A w A w F

Weight = w

period) previous the (or 1 - t period in demand Actual = A

) period coming the (or t period for Forecast = F

+ + =

+ + =

Average Moving Weighted Period - 3

Single Exponential Smoothing

0.5

MAD #DIV/0!

MSE 0

Period Actual Forecast Error

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

0

0

0

0

0

1

1

1

1

1

1

1 6 11 16 21 26

Actual Forecast

Period

Single Exponential Smoothing

The problem with the previous two methods, Simple Moving Average

that a large amount of historical data is required. With

data is eliminated once a new piece has been added. The forecast is calculated by using the previous

forecast, as well as the previous actual value with a weighting or smoothing factor, alpha. Alpha can

never to be greater than 1 and higher values of alpha put more weight on the most recent periods. Note

on the equations below the similarity to the 3-period weighted moving average.

( )

( )

( ) ( ) | |

( ) ( ) ( ) { } | |

( ) | | ( ) ( ) | |

( ) 3 t

3

3 t 2 t 1 t t

3 t 3 t 2 t 1 t t

t 2 t

2 t 2 t 1 t t

t 1 t

2 t 2 t 1 t

1 t 1 t t

1 - t

1 - t

t

F *

1

A * * 1 * 1 A * * 1 A * F

g simplifyin

F * 1 A * * 1 A * * 1 A * F

F for equation the nto i F ng substituti

F * 1 A * * 1 A * F

F for equation the nto i F ng substituti

F * 1 A * F

and

F * 1 A * F

constant Smoothing =

period) previous the (or 1 - t period in demand Actual = A

period) previous the (or 1 - t period for Forecast = F

) period coming the (or t period for Forecast = F

+ + + =

+ + + =

+ + =

+ =

+ =

o

Smoothing l Exponentia Simple

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

26 31 36 41 46 51 56

Period

Single Exponential Smoothing

Simple Moving Average and Weighted Moving Average is

that a large amount of historical data is required. With Single Exponential Smoothing the oldest piece of

data is eliminated once a new piece has been added. The forecast is calculated by using the previous

forecast, as well as the previous actual value with a weighting or smoothing factor, alpha. Alpha can

never to be greater than 1 and higher values of alpha put more weight on the most recent periods. Note

-period weighted moving average.

( )

( )

( ) ( ) | |

( ) ( ) ( ) { } | |

( ) | | ( ) ( ) | |

( ) 3 t

3

3 t 2 t 1 t t

3 t 3 t 2 t 1 t t

t 2 t

2 t 2 t 1 t t

t 1 t

2 t 2 t 1 t

1 t 1 t t

1 - t

1 - t

t

F *

1

A * * 1 * 1 A * * 1 A * F

g simplifyin

F * 1 A * * 1 A * * 1 A * F

F for equation the nto i F ng substituti

F * 1 A * * 1 A * F

F for equation the nto i F ng substituti

F * 1 A * F

and

F * 1 A * F

constant Smoothing =

period) previous the (or 1 - t period in demand Actual = A

period) previous the (or 1 - t period for Forecast = F

) period coming the (or t period for Forecast = F

+ + + =

+ + + =

+ + =

+ =

+ =

o

Smoothing l Exponentia Simple

Trend Adjusted Exponential Smoothing

MAD #DIV/0!

MSE #DIV/0!

Period Actual Level Trend Forecast Error

1 0 #DIV/0!

2 #DIV/0! #DIV/0! #DIV/0!

3 #DIV/0! #DIV/0! #DIV/0!

4 #DIV/0! #DIV/0! #DIV/0!

5 #DIV/0! #DIV/0! #DIV/0!

6 #DIV/0! #DIV/0! #DIV/0!

7 #DIV/0! #DIV/0! #DIV/0!

8 #DIV/0! #DIV/0! #DIV/0!

9 #DIV/0! #DIV/0! #DIV/0!

10 #DIV/0! #DIV/0! #DIV/0!

11 #DIV/0! #DIV/0! #DIV/0!

12 #DIV/0! #DIV/0! #DIV/0!

13 #DIV/0! #DIV/0! #DIV/0!

14 #DIV/0! #DIV/0! #DIV/0!

15 #DIV/0! #DIV/0! #DIV/0!

16 #DIV/0! #DIV/0! #DIV/0!

17 #DIV/0! #DIV/0! #DIV/0!

18 #DIV/0! #DIV/0! #DIV/0!

19 #DIV/0! #DIV/0! #DIV/0!

20 #DIV/0! #DIV/0! #DIV/0!

21 #DIV/0! #DIV/0! #DIV/0!

22 #DIV/0! #DIV/0! #DIV/0!

23 #DIV/0! #DIV/0! #DIV/0!

24 #DIV/0! #DIV/0! #DIV/0!

25 #DIV/0! #DIV/0! #DIV/0!

26 #DIV/0! #DIV/0! #DIV/0!

27 #DIV/0! #DIV/0! #DIV/0!

28 #DIV/0! #DIV/0! #DIV/0!

29 #DIV/0! #DIV/0! #DIV/0!

30 #DIV/0! #DIV/0! #DIV/0!

31 #DIV/0! #DIV/0! #DIV/0!

32 #DIV/0! #DIV/0! #DIV/0!

33 #DIV/0! #DIV/0! #DIV/0!

34 #DIV/0! #DIV/0! #DIV/0!

35 #DIV/0! #DIV/0! #DIV/0!

36 #DIV/0! #DIV/0! #DIV/0!

37 #DIV/0! #DIV/0! #DIV/0!

38 #DIV/0! #DIV/0! #DIV/0!

39 #DIV/0! #DIV/0! #DIV/0!

40 #DIV/0! #DIV/0! #DIV/0!

41 #DIV/0! #DIV/0! #DIV/0!

42 #DIV/0! #DIV/0! #DIV/0!

0

0

0

0

0

1

1

1

1

1

1

1 6 11 16

Actual Forecast

Trend Adjusted Exponential Smoothing

Single Exponential Smoothing

reasonably stable mean (no trend or consistent pattern of growth or decline). If

the data contains a trend, the

should be used.

Trend Adjusted Exponential Smoothing

except that two components must be updated each period: level and trend. The

level is a smoothed estimate of the value of the data at the end of each period.

The trend is a smoothed estimate of average growth at the end of each period.

Again, the weighting or smoothing factors, alpha and delta can never exceed 1

and higher values put more weight on more recent time periods.

Trend adjusted exponential smoothing

( )

( )

1 t 1 t 1 t t

1 t 1 t 1 t t

t t t

1 - t

1 - t

t

t

t

FIT F T T

FIT A FIT F

T F FIT

delta constant Smoothing =

alpha constant Smoothing =

period prior the for demand actual The = A

period prior the for made trend including forecast The = FIT

t period for trend including forecast The = FIT

t period for trend smoothed lly exponentia The = T

t period for forecast smoothed lly exponentia The = F

+ =

+ =

+ =

43 #DIV/0! #DIV/0! #DIV/0!

44 #DIV/0! #DIV/0! #DIV/0!

45 #DIV/0! #DIV/0! #DIV/0!

46 #DIV/0! #DIV/0! #DIV/0!

47 #DIV/0! #DIV/0! #DIV/0!

48 #DIV/0! #DIV/0! #DIV/0!

49 #DIV/0! #DIV/0! #DIV/0!

50 #DIV/0! #DIV/0! #DIV/0!

51 #DIV/0! #DIV/0! #DIV/0!

52 #DIV/0! #DIV/0! #DIV/0!

53 #DIV/0! #DIV/0! #DIV/0!

54 #DIV/0! #DIV/0! #DIV/0!

55 #DIV/0! #DIV/0! #DIV/0!

56 #DIV/0! #DIV/0! #DIV/0!

57 #DIV/0! #DIV/0! #DIV/0!

58 #DIV/0! #DIV/0! #DIV/0!

59 #DIV/0! #DIV/0! #DIV/0!

60 #DIV/0! #DIV/0! #DIV/0!

16 21 26 31 36 41 46 51 56

Forecast

Period

Trend Adjusted Exponential Smoothing

Single Exponential Smoothing assumes that the data fluctuate around a

reasonably stable mean (no trend or consistent pattern of growth or decline). If

the data contains a trend, the Trend Adjusted Exponential Smoothing model

Trend Adjusted Exponential Smoothing works much like simple smoothing

except that two components must be updated each period: level and trend. The

level is a smoothed estimate of the value of the data at the end of each period.

The trend is a smoothed estimate of average growth at the end of each period.

Again, the weighting or smoothing factors, alpha and delta can never exceed 1

and higher values put more weight on more recent time periods.

Trend adjusted exponential smoothing

( )

( )

1 t 1 t 1 t t

1 t 1 t 1 t t

t t t

1 - t

1 - t

t

t

t

FIT F T T

FIT A FIT F

T F FIT

delta constant Smoothing =

alpha constant Smoothing =

period prior the for demand actual The = A

period prior the for made trend including forecast The = FIT

t period for trend including forecast The = FIT

t period for trend smoothed lly exponentia The = T

t period for forecast smoothed lly exponentia The = F

+ =

+ =

+ =

Trend and Seasonal Effects

Level Trend Season

MAD 66375 Initial Seasonal Values

MSE ######## 0.735983 1.032181 1.019551 1.212285

Period Actual Level Trend Season Forecast Error

1 181532 149744 60376 1.21

2 254590 210119 60376 1.02 214227 40362

3 251475 270495 60376 1.03 279200 27725

4 299013 330871 60376 0.74 243515 55498

5 332386 391246 60376 1.21 474302 141916

6 460452

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

0

50000

100000

150000

200000

250000

300000

350000

400000

450000

500000

1 6

Actual

The Trend and Seasonal

Exponential Smoothing

adjustment for seasonality. This template is a quarterly model, where the number of

seasons is set to 4. There are three smoothing constants associated with this model.

Alpha is the smoothing constant for the basic level, delta smoothes the trend, and

gamma smoothes the seasonal index. Again, the weighting or smoothing factors,

alpha, delta and gamma can never exceed 1 and higher values put more weight on

more recent time periods.

Note: For initial calculations, when St

Seasonal Values are used. The calculation for these is done further down on the

page, starting on cell A73.

gamma constant Smoothing =

delta constant Smoothing =

alpha constant Smoothing =

t) (time demand Current = A

periods) 4 = ago year (1 season previous from value Seasonal = S

period previous from value Seasonal = S

value seasonal Current = S

period previous from value Trend = T

value trend Current = T

period previous from value Level = L

value level Current = L

period current for Forecast = F

t

4 - t

1 - t

t

1 - t

t

1 - t

t

t

o

o

Effects Seasonal and Trend with Model s Winter'

( )( )

( ) ( )

( )

( )

4 t 1 t 1 t t

1 t

t

t

t

1 t 1 t t t

1 t 1 t

4 t

t

t

S T L F

S 1

L

A

S

T 1 L L T

T L 1

S

A

L

+ =

+ =

+ =

+ +

=

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

This area is used to compute 'initial seasonal values' due to their complexity

Number of full years (set of 4 seasons) 1

Period

Year Average Year 1 2 3 4

1 246652.3 1 0.735983 1.032181 1.019551 1.2123

2 0 2 0 0 0 0

3 0 3 0 0 0 0

4 0 4 0 0 0 0

5 0 5 0 0 0 0

6 0 6 0 0 0 0

7 0 7 0 0 0 0

8 0 8 0 0 0 0

9 0 9 0 0 0 0

10 0 10 0 0 0 0

11 0 11 0 0 0 0

12 0 12 0 0 0 0

13 0 13 0 0 0 0

14 0 14 0 0 0 0

15 0 15 0 0 0 0

6 11 16 21 26 31 36 41 46 51 56

Actual Forecast

Period

Trend and Seasonal Effects

Trend and Seasonal forecasting model is an extension of the Trend Adjusted

Exponential Smoothing model. In addition to a trend, the model also adds a smoothed

adjustment for seasonality. This template is a quarterly model, where the number of

seasons is set to 4. There are three smoothing constants associated with this model.

Alpha is the smoothing constant for the basic level, delta smoothes the trend, and

gamma smoothes the seasonal index. Again, the weighting or smoothing factors,

alpha, delta and gamma can never exceed 1 and higher values put more weight on

more recent time periods.

Note: For initial calculations, when St-4 has not yet been calculated, the Initial

Seasonal Values are used. The calculation for these is done further down on the

page, starting on cell A73.

gamma constant Smoothing =

delta constant Smoothing =

alpha constant Smoothing =

t) (time demand Current = A

periods) 4 = ago year (1 season previous from value Seasonal = S

period previous from value Seasonal = S

value seasonal Current = S

period previous from value Trend = T

value trend Current = T

period previous from value Level = L

value level Current = L

period current for Forecast = F

t

4 - t

1 - t

t

1 - t

t

1 - t

t

t

o

o

Effects Seasonal and Trend with Model s Winter'

( )( )

( ) ( )

( )

( )

4 t 1 t 1 t t

1 t

t

t

t

1 t 1 t t t

1 t 1 t

4 t

t

t

S T L F

S 1

L

A

S

T 1 L L T

T L 1

S

A

L

+ =

+ =

+ =

+ +

=

Linear Trend

Intercept Slope

159959.67 34613.11

MAD 620

MSE 769311

Period Actual Forecast Error

1 181532 194573

2 254589.80 229186

3 251474.60 263799

4 ##### 298412 601

5 332386.00 333025 639

6 367638

7 402251

8 436865

9 471478

10 506091

11 540704

12 575317

13 609930

14 644543

15 679156

16 713769

17 748383

18 782996

19 817609

20 852222

21 886835

22 921448

23 956061

24 990674

25 1025287

26 1059901

27 1094514

28 1129127

29 1163740

30 1198353

31 1232966

32 1267579

33 1302192

34 1336805

35 1371419

36 1406032

37 1440645

38 1475258

39 1509871

40 1544484

41 1579097

42 1613710

0

500000

1000000

1500000

2000000

2500000

1 6 11 16 21 26

Actual Forecast

Period

Linear Trend

The Linear Trend method can be used if the data contains a trend (consistent pattern of growth or

decline). The forecasts are calculated using least squares regression to fit a straight line to the data.

This line can be extrapolated into the future to obtain the forecast.

Linear Trend

( )( )

( )

t m A b

t t

A A t t

m

periods time of Average = t

period Time = t

demands actual all of Average = A

demand Actual = A

b and m find To

b mt F

period) time first the for 1 (t interest of period Time = t

Slope = m

intercept Y = b

t period for Forecast = F

2

t

t

=

=

+ =

=

43 1648323

44 1682937

45 1717550

46 1752163

47 1786776

48 1821389

49 1856002

50 1890615

51 1925228

52 1959841

53 1994455

54 2029068

55 2063681

56 2098294

57 2132907

58 2167520

59 2202133

60 2236746

26 31 36 41 46 51 56

Period

Linear Trend

method can be used if the data contains a trend (consistent pattern of growth or

decline). The forecasts are calculated using least squares regression to fit a straight line to the data.

This line can be extrapolated into the future to obtain the forecast.

( )( )

( )

t m A b

t t

A A t t

m

periods time of Average = t

period Time = t

demands actual all of Average = A

demand Actual = A

b and m find To

b mt F

period) time first the for 1 (t interest of period Time = t

Slope = m

intercept Y = b

t period for Forecast = F

2

t

t

=

=

+ =

=

You might also like

- Future OutlookDocument3 pagesFuture OutlookKiaraSinghNo ratings yet

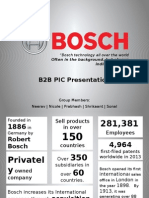

- B2B PIC Presentation: Often in The Background, But Always Indispensable."Document28 pagesB2B PIC Presentation: Often in The Background, But Always Indispensable."KiaraSinghNo ratings yet

- Warehouse AnalysisDocument45 pagesWarehouse AnalysisKiaraSingh100% (1)

- Lifebuoy Sensitivity AnalysisDocument8 pagesLifebuoy Sensitivity AnalysisKiaraSinghNo ratings yet

- MCQs on Marketing from Philip Kotler's BookDocument43 pagesMCQs on Marketing from Philip Kotler's BookMujeeb Alam79% (62)

- Push & Pull Strategy Small ToolsDocument3 pagesPush & Pull Strategy Small ToolsKiaraSinghNo ratings yet

- Sla CoffeeDocument45 pagesSla CoffeeKiaraSinghNo ratings yet

- Building SLA Contract GuideDocument17 pagesBuilding SLA Contract GuideMohammed BasharathNo ratings yet

- Mountain Dew The New Creative: Group 2Document20 pagesMountain Dew The New Creative: Group 2KiaraSinghNo ratings yet

- Synopsis by Prabhash BabbarDocument1 pageSynopsis by Prabhash BabbarKiaraSinghNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Pengenalan Icd-10 Struktur & IsiDocument16 pagesPengenalan Icd-10 Struktur & IsirsudpwslampungNo ratings yet

- Users GuideDocument34 pagesUsers GuideZaratustra NietzcheNo ratings yet

- Lesson Rubric Team Group (Lesson Plan 1)Document2 pagesLesson Rubric Team Group (Lesson Plan 1)Yodalis VazquezNo ratings yet

- Chapter 2: Science, Technology, and Society in Human Condition Lesson 1: Human FlourishingDocument5 pagesChapter 2: Science, Technology, and Society in Human Condition Lesson 1: Human FlourishingJcNo ratings yet

- Modal Analysis of Honeycomb Structure With Variation of Cell SizeDocument3 pagesModal Analysis of Honeycomb Structure With Variation of Cell Sizeprateekg92No ratings yet

- Navier-Stokes EquationsDocument395 pagesNavier-Stokes EquationsBouhadjar Meguenni100% (7)

- Outgoing Call Block BroadcastReceiver ExampleDocument3 pagesOutgoing Call Block BroadcastReceiver ExampleZainUlAbidinNo ratings yet

- Backup 2Document59 pagesBackup 2Fabiola Tineo GamarraNo ratings yet

- CIPP ModelDocument36 pagesCIPP ModelIghfir Rijal TaufiqyNo ratings yet

- Barriers To Lifelong LearningDocument4 pagesBarriers To Lifelong LearningVicneswari Uma SuppiahNo ratings yet

- The Stolen Bacillus - HG WellsDocument6 pagesThe Stolen Bacillus - HG Wells1mad.cheshire.cat1No ratings yet

- Remapping The Small Things PDFDocument101 pagesRemapping The Small Things PDFAme RaNo ratings yet

- DEMO 2 Critical Reading As ReasoningDocument3 pagesDEMO 2 Critical Reading As ReasoningConnieRoseRamosNo ratings yet

- From The Light, On God's Wings 2016-14-01, Asana Mahatari, JJKDocument26 pagesFrom The Light, On God's Wings 2016-14-01, Asana Mahatari, JJKPaulina G. LoftusNo ratings yet

- Appointment Letter JobDocument30 pagesAppointment Letter JobsalmanNo ratings yet

- 3D Holographic Projection Technology SeminarDocument28 pages3D Holographic Projection Technology Seminarniteshnks1993No ratings yet

- Antiepilepticdg09gdg 121231093314 Phpapp01Document145 pagesAntiepilepticdg09gdg 121231093314 Phpapp01Vaidya NurNo ratings yet

- 1-7 Least-Square RegressionDocument23 pages1-7 Least-Square RegressionRawash Omar100% (1)

- 10 1016@j Ultras 2016 09 002Document11 pages10 1016@j Ultras 2016 09 002Ismahene SmahenoNo ratings yet

- How To Prepare Squash Specimen Samples For Microscopic ObservationDocument3 pagesHow To Prepare Squash Specimen Samples For Microscopic ObservationSAMMYNo ratings yet

- Moment Baseplate DesignDocument10 pagesMoment Baseplate DesignNeil JonesNo ratings yet

- Past Papers - A Levels - Geography (9696) - 2018 - GCE GuideDocument9 pagesPast Papers - A Levels - Geography (9696) - 2018 - GCE GuideLee AsaNo ratings yet

- WP 2 Final Draft 1Document5 pagesWP 2 Final Draft 1api-457082236No ratings yet

- SYS600 - Visual SCIL Application DesignDocument144 pagesSYS600 - Visual SCIL Application DesignDang JinlongNo ratings yet

- JEE Test Series ScheduleDocument4 pagesJEE Test Series ScheduleB.K.Sivaraj rajNo ratings yet

- Rolfsen Knot Table Guide Crossings 1-10Document4 pagesRolfsen Knot Table Guide Crossings 1-10Pangloss LeibnizNo ratings yet

- Writing and Presenting A Project Proposal To AcademicsDocument87 pagesWriting and Presenting A Project Proposal To AcademicsAllyNo ratings yet

- DELA PENA - Transcultural Nursing Title ProposalDocument20 pagesDELA PENA - Transcultural Nursing Title Proposalrnrmmanphd0% (1)

- Factors That Affect Information and Communication Technology Usage: A Case Study in Management EducationDocument20 pagesFactors That Affect Information and Communication Technology Usage: A Case Study in Management EducationTrần Huy Anh ĐứcNo ratings yet

- CH13 QuestionsDocument4 pagesCH13 QuestionsAngel Itachi MinjarezNo ratings yet