Professional Documents

Culture Documents

Answer in Budgeting

Uploaded by

kheymiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answer in Budgeting

Uploaded by

kheymiCopyright:

Available Formats

.

Answer: A

The amount of fixed costs in operating branches 10 warehouses is P400,000 (the fixed cost line intercepts

the vertical axis).

Total operating costs P2,900,000

Less fixed costs 400,000

Total variable costs (10 warehouses) P2,500,000

Variable costs per branch: P2,500,000 10 P 250,000

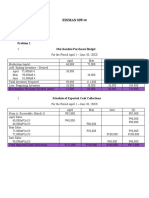

. Answer: A

Cost of units sold (0.65 x P800,000) P520,000

Add Desired ending inventory 140,000

Total cost of goods available for sale 660,000

Deduct Beginning inventory 130,000

Budgeted purchases P530,000

. Answer: A

Cost of goods sold P750,000 x 0.6 P450,000

Add Ending Inventory P800,000 x 0.6 x 0.5 240,000

Total available for sale P690,000

Deduct Beginning inventory P450,000 x 0.5 225,000

Budgeted purchases, February P465,000

. Answer: D

Cost of sales P120,000

Add Desired ending inventory 42,000

Total available for sale 162,000

Deduct Budgeted purchases 100,000

Beginning inventory P 62,000

. Answer: A

Total payments for purchases in June P140,000

Deduct payments applicable to purchase of:

June (P100,000 x 0.6) P60,000

May (P200,000 x 0.30) 60,000 120,000

Payments applicable to April purchase P 20,000

Credit purchase in April: P20,000 0.10 P200,000

. Answer: C

Budgeted sales, First Quarter 120,000 units

Add Required Ending Finished goods: 30% x 160,000 48,000 units

Total units required 168,000 units

Less Beginning Finished goods 36,000 units

Budgeted production in units 132,000 units

. Answer: C

Sales for three-month period:

July 400,000

August 400,000 x 1.05 420,000

September 420,000 x 1.05 441,000

Total 1,261,000

Inventory, September 30 (441,000 x 1.05 x 0.8) 370,440

Total Requirements 1,631,440

Less July Inventory 300,000

Budgeted Production 1,331,440

. Answer: C

Beginning Inventory (8000 x 3.5) 28,000

Required Purchases 8,000

Direct Materials Used for Production (8000 x 3) (24,000)

Desired Ending Inventory 12,000

. Answer: C

LL MM NN

Budgeted production 622,000 622,000 622,000

Required materials per unit of product 0.50 1.00 1.2

Materials required 311,000 622,000 746,400

Unit cost P0.60 P1.70 P1.00

Peso amounts of materials used by

units produced

P186,600

P1,057,400

P746,400

Budgeted sales in units 640,000

Add Finished goods, end 90,000

Total 730,000

Deduct Finished goods, beginning 108,000

Budgeted production 622,000

. Answer: D

Required pounds by production 180,000

Ending raw materials required 60,000

Beginning raw materials ( 30,000)

Budgeted purchases 210,000

. Answer: B

Materials required by June production 1,300 x 2 2,600

Add Ending raw materials inventory 1,600 x 2 x 0.5 1,600

Total materials required 4,200

Deduct Beginning materials inventory 1,300 x 2 x 0.5 1,300

Materials to be purchased 2,900

. Answer: D

Budgeted sales 18,000

Add Finished goods inventory, end 11,400

Total 29,400

Deduct Finished good inventory, beginning 15,000

Budgeted production 14,400

Raw materials required by production (14,400 x 6 0.9) 6,000

Desired Raw materials inventory end 24,400

Total 120,400

Deduct Raw materials inventory, beginning 21,000

Budgeted purchase of raw materials 99,400

. Answer: D

Raw materials required by June production: 1,200 x 2 2,400

Add: Ending materials inventory 1,300 x 2 . 1.5 3,900

Total materials required 6,300

Deduct Beginning material inventory 2,400 x 1.5 3,600

Budgeted materials purchase 2,700

. Answer: A

Budgeted sales 300,000

Less decrease in Finished goods inventory 10,000

Budgeted production 290,000

Material Q required by production 290,000 x 3 870,000

Less decrease in Material Q inventory 60,000 80,000 20,000

Budgeted purchase in pounds, Material Q 850,000

. Answer: B

Materials required by production 500,000 x 2 1,000,000

Increased in materials inventory (50,000 40,000) 10,000

Purchases 1,010,000

. Answer: B

Materials required by 2nd Quarters production 45,000 x 2.5 kgs. 112,500

Add: Materials inventory, end: 40,000 x 2.5 x0.25 25.000

Total materials required 137,500

Less: Materials inventory, beginning: 112,500 x 0.25 28,125

Total budget purchases in kilograms 109,375

. Answer: D

Under flexible budget, analysis should be based on actual level achieved.

Indirect labor cost per unit (P360,000 200,000 units) P1.80

Flexible budget allowance: 14,500 units x P1.80 P26,100

. Answer: C

Cash sales (March) 0.2 x P420,000 P 84,000

Collections of account sales:

March sales: (P420,000 x 0.8 x 0.7) 235,200

February sales: (P300,000 x 0.8 x 0.25) 60,000

January sales: (P240,000 x 0.8 x .05) 9,600

Total cash from sales P388,800

. Answer: B

Total cash collections P57,000

Deductions collections on September sales (P80,000 x 0.6) 48,000

Collections applicable to July and August sales P 9,000

Credit sales in July: P9,000 2 0.15 P30,000

. Answer: D

Collections from:

January sales (P860,000 x 0.8 x 0.75) P516,000

December sales (January 1 Accounts) 299,000

Collections of credit sales 815,000

Cash sales (P860,000 x 0.2) 172,000

Total cash received P987,000

. Answer: A

Collections sales of:

June: P8,000 x 0.7 P5,600

May: P7,000 x 0.3 2,100

Total collections from sales P7,700

. Answer: B

October 90,000 x .95 P 85,500

November 100,000 x .85 85,000

December 85,000 x .70 59,500

Fourth quarter sales collected in fourth quarter P230,000

. Answer: D

Cash sales P 70,000

Collections from account sales:

January (P340,000 x 0.60) 204,000

December (P50,000 x 30/40) 37,500

November 20,000

Total cash receipts in January P331,500

. Answer: B

The balance of Accounts Receivable, based on the collection pattern for Liberal Sales Company, equals 40

percent of credit sales for that month:

P1,500,000 x 0.8 x 0.4 = P480,000

. Answer: C

Gross receivable collected months sales

November 2,000,000 x .12 P 240,000

October 1,800,000 x .75 1,350,000

September 1,600,000 x .06 96,000

August 1,900,000 x .04 76,000

Total credit P1,762,000

. Answer: A

The balance of Accounts Receivable as of January 31, its first month of operations, will increase by P400,000

because the first collection on account sales will be in February.

However, a question of how much increase in Accounts Receivable in February will equal to the difference

between the February credit sales and 70% of January sales.

. Answer: D

Cost of goods sold P1,680,000

Deduct desired decrease in inventories 70,000

Budgeted purchases P1,610,000

Add decrease in Accounts Payable 150,000

Budgeted payments for purchases P1,760,000

. Answer: A

November costs (P1,952,000 P288,000) x 0.75 P1,248,000

October costs (P1,568,000 P288,000) x 0.25) 320,000

Total disbursements P1,568,000

. Answer: C

Beginning Cash P 20,000

Add:Cash collected on June's sales (P300,000 x .8 x .98) 235,200

Cash collected on May's sales ((P300,000/1.25) x .2) 48,000 283,200

Total P303,200

Less:Cash paid on June's purchases (P240,000 x .6 x .99) 142,560

Cash paid on May's purchases (P200,000 x .4) 80,000 222,560

Ending cash balance P80,640

. Answer: C

January February

Budgeted sales 11,900 11,400

Add: Ending inventory (130%) 14,820 15,600

Total 26,720 27,000

Less: Beginning inventory 15,470 14,820

Budgeted purchases (units) 11,250 12,180

Unit purchase price 200 200

Budgeted peso purchases P2,250,000 P2,436,000

Budgeted inventories:

December 31 130% x 11,900 15,470

January 31 130% x 11,400 14,820

February 28 130% x 12,000 15,600

March 31 130% x 12,200 15,860

. Answer: D

Payments for:

February purchases 54% x P2,436,000 P1,315,440

January purchases 46% x P2,250,000 1,035,000

Total payments for purchases P2,350,440

Selling, general and administrative expenses:

February: [(P3,420,000 x 0.15) P20,000]0.54 266,220

January: [(P3,570,000 x 0.15) P20,000]0.46 237,130

Total cash disbursements P2,853,790

. Answer: A

Billings of December 31:

Collections with 3% discount P3,630,000 x 0.6 x 0.97 P2,112,660

Collections end of January P3,630,000 x 0.25 907,500

Billings of November 30: P3,540,000 x 0.09 318,600

Total collections P3,338,760

. Answer: B

Budgeted March sales 12,000

Add: Ending inventory units 15,860

Total units required 27,860

Less: Beginning inventory units 15,600

Budgeted purchases in units, March 12,260

. Answer: A

Payments for purchases in the month of:

December (0.2 x P120,000 x 0.6) P14,400

January (0.2 x P160,000 x 0.4) 12,800

Total January disbursements for purchases P27,200

. Answer: C

Payments for purchases:

May purchase (0.2 x P200,000 x 0.6) P24,000

June purchase (0.2 x P220,000 x 0.4) 17,600

Total 41,600

Labor costs 60,000

Fixed Overhead 30,000

Interest payments 45,000

Commission (0.03 x P1,020,000) 30,600

Total disbursements P207,200

. Answer: C

June cash sales (P390,000 x 0.1) P 39,000

Collections from account sales:

April sales (P390,000 x 0.9 x 0.7) 245,700

May sales (P420,000 x 0.9 x 0.3) 113,400

Total cash receipts, June P398,100

. Answer: B

Marketable securities purchased on:

June P 5,600

July 126,900

Cumulative purchase of MS P132,500

. Answer: A

Cash Budget (P000)

June July Aug Sept

Cash receipts P398.1 P404.9 P382.2 P374.9

Cash disbursements 367.5 278.0 296.5 702.5

Net cash inflow (outflow) 30.6 126.9 85.7 ( 327.6)

Beginning cash balance 25.0 50.0 50.0 50.0

Cumulative cash balance 55.6 176.9 135.7 ( 277.6)

M/S sold (purchased) - 5.6 - 126.9 - 85.7 218.2

Cash loan 0.0 0.0 0.0 109.4

Cash balance, end P 50.0 P 50.0 P 50.0 P 50.0

Cash Receipts (P000)

June July Aug Sept

Account sales (90%) P351.0 P315.0 P378.0 P369.0

Cash sales P 39.0 P 35.0 P 42.0 P 41.0

Collection of accounts

First month (30%) 245.7 105.3 94.5 113.4

Second month (70%) 113.4 264.6 245.7 220.5

Total P398.1 P404.9 P382.2 P374.9

Cash Payments (P000)

June July Aug Sept

Purchases P210.0 P240.0 P320.0 P230.0

First month (45%) P 99.0 P 94.5 P108.0 P144.0

Second month (55%) 110.0 121.0 115.5 132.0

Total purchases paid 209.0 215.5 223.5 276.0

Labor 58.5 52.5 63.0 61.5

General overhead 10.0 10.0 10.0 10.0

Interest 35.0 35.0

Cash dividend 25.0

Taxes 30.0 30.0

Purchase of equipt. 290.0

Total payments P367.5 P278.0 P296.5 P702.5

. Answer: A

Budgeted Production

January February March Total

Sales 1,700,000 1,200,000 1,400,000 4,300,000

Inventory, end 2,600,000 3,400,000 4,500,000 4,500,000

Total 4,300,000 4,600,000 5,900,000 8,800,000

Inventory, beg. (2,900,000 (2,600,000 (3,400,000 (2,900,000

Budgeted production 1,400,000 2,000,000 2,500,000 5,900,000

. Answer: B

Payments for Purchases:

January (December purchases - 1,800,000 x 0.052) P 93,600

February (January purchases 1,400,000 x 0.06) 84,000

March (February purchases 2,000,000 x 0.06) 120,000

Total for the quarter P297,600

. Answer: B

Budgeted Collections on Accounts Receivable

January February March Total

November sales 87,500 87,500

December sales 116,250 116,250 232,500

January sales 131,750 131,750 263,500

February sales 93,000 93,000

Total 203,750 248,000 224,750 676,500

. Answer: C

A months sales is collected 50 percent each in the first and second month. Therefore, the accounts receivable

outstanding as of March 31 includes Marchs sales as well as 50 percent of February sales.

Februarys accounts (P186,000 x 0.5) P 93,000

Marchs sales 217,000

Outstanding accounts receivable, March 31 P310,000

. Answer: A

Current unit cost per 1,000

Material P 52

Labor 20

Overhead 10

Total P 82

Effective January 1, 2007, the price of materials will be raised to P60. The unit cost for 2007 production will be

P90. Since the sales of January and February come from December production, only the March sales will have

cost of P90 per thousand.

January and February cost of goods sold (1,700 + 1,200) x P82 P237,800

March 1,400 x P90 126,000

Cost of goods sold (first quarter) P363,800

. Answer: A

January February March

Cash collections 203,750 248,000 224,750

Cash disbursements

Payments for materials 93,600 84,000 120,000

Labor expenses 28,000 40,000 50,000

Overhead 14,000 20,000 25,000

Selling & administrative 52,700 37,200 43,400

Interest 8,000

Taxes 64,560

Dividends . . 48,420

Total disbursements 188,300 181,200 359,380

Net Cash Inflow (Outflow) 15,450 66,800 (134,630)

Cash Balance, Beginning 30,000 25,000 25,000

Cumulative cash balance 45,450 91,800 (109,630)

Marketable securities 20,450 66,800 ( 87,250)

Cumulative MS 20,450 87,250

Borrowings 0 0 47,380

Cash Balance, End 25,000 112,250 25,000

. Answer: C

Proforma Income Statement

January February March Total

Sales 263,500 186,000 217,000 666,500

Cost of goods sold 139,400 98,400 126,000 363,800

Gross profit 124,100 87,600 91,000 302,700

Selling expenses, 20% 52,700 37,200 43,400 133,300

Operating income 71,400 50,400 47,600 169,400

Interest expense 2,667 2,667 2,666 8,000

Income before tax 68,733 47,733 44,934 161,400

Income tax, 40% 27,493 19,093 17,974 64,560

Net income 41,240 28,640 26,960 96,840

. Answer: A

August sales

Billed 8/20 P350,000 x 18% P 63,000

Billed 9/10 P350,000 x 80% x 98% 274,400

Collections in Sept of Aug sales P337,400

. Answer: B

Russon provides 25 percent of next months quantity sales.

25% x P400,000 x 80% = P80,000

. Answer: D

May sales billed June 10 250,000x18% P 45,000

June Sales:

Billed June 20 300,000 x 18% 54,000

Billed July 10 300,000 x .80 z .98 235,200

July sales

Billed July 20 P350,000 x .80 x .98 P274,400

July Collections P608,600

You might also like

- EXCEL Professional Services Management Firm PTRC Open Final Preboard ProblemsDocument37 pagesEXCEL Professional Services Management Firm PTRC Open Final Preboard ProblemsAnonymous Lih1laaxNo ratings yet

- Sept 21 ExercisesDocument12 pagesSept 21 ExercisesPeachyNo ratings yet

- Post Test - Answer KeyDocument6 pagesPost Test - Answer KeyLynn A. NuestroNo ratings yet

- CVP Analysis of Lisa Company's Automotive Product DistributionDocument11 pagesCVP Analysis of Lisa Company's Automotive Product Distributionarman_277276271No ratings yet

- Chapter 06 - Variable Costing As A Tool To Management PlanningDocument10 pagesChapter 06 - Variable Costing As A Tool To Management PlanningBryan Ramos100% (1)

- Digos Company Financial StatementsDocument2 pagesDigos Company Financial Statementsannewilson100% (1)

- BTNC3 - Nhom 8Document7 pagesBTNC3 - Nhom 8Lê LinhhNo ratings yet

- Boomstick Corp quarterly budgets and financial statementsDocument14 pagesBoomstick Corp quarterly budgets and financial statementsDivya GoyalNo ratings yet

- Bud GettingDocument8 pagesBud GettingLorena Mae LasquiteNo ratings yet

- Advanced Accounting Multiple Choice ProblemsDocument15 pagesAdvanced Accounting Multiple Choice ProblemsKryscel ManansalaNo ratings yet

- Chapter 16Document8 pagesChapter 16Rahila RafiqNo ratings yet

- April May June Quarter Product: 1 Budgeted Sales (Units) Selling Price Per Unit Total RevenueDocument18 pagesApril May June Quarter Product: 1 Budgeted Sales (Units) Selling Price Per Unit Total Revenueyonna anggrelinaNo ratings yet

- Mid Term Exam Answer KeyDocument6 pagesMid Term Exam Answer KeyJames R JunioNo ratings yet

- Financial Planning MC Problems Chapter 7Document6 pagesFinancial Planning MC Problems Chapter 7Maria Kathreena Andrea AdevaNo ratings yet

- 04 Cost-Volume Profit Relationships SolDocument42 pages04 Cost-Volume Profit Relationships SolDea Lyn BaculaNo ratings yet

- Home Office, Branch and Agency Accounting: Acctg 8d 8:30-9:30Document35 pagesHome Office, Branch and Agency Accounting: Acctg 8d 8:30-9:30Danica100% (1)

- Oliveros, John RenzDocument6 pagesOliveros, John RenzRonnel BrusasNo ratings yet

- Chapter 5 - Inventories and Related ExpensesDocument13 pagesChapter 5 - Inventories and Related ExpensesiCayeeee100% (5)

- AsdsfDocument21 pagesAsdsfJeressa Mamhot0% (1)

- Victoria Home Garden inventory cost calculationsDocument6 pagesVictoria Home Garden inventory cost calculationsJenny BooNo ratings yet

- Financial and Management and Accouting MBA0041 Assingment FALL 2014 LC-02009 Name: Nandeshwar Singh ROLL NO.1408001255Document7 pagesFinancial and Management and Accouting MBA0041 Assingment FALL 2014 LC-02009 Name: Nandeshwar Singh ROLL NO.1408001255Nageshwar singhNo ratings yet

- Dayag Chapter 14 Home Office and Branch Accounting Special ProceduresDocument31 pagesDayag Chapter 14 Home Office and Branch Accounting Special ProceduresPaula De Rueda100% (4)

- Chapter 13 - Gross Profit MethodDocument7 pagesChapter 13 - Gross Profit MethodLorence IbañezNo ratings yet

- Chapter 6 - 2013 EdDocument17 pagesChapter 6 - 2013 EdJean Palada33% (6)

- Supply Chain Management Strategy Planning and Operation 6th Edition Chopra Solutions ManualDocument10 pagesSupply Chain Management Strategy Planning and Operation 6th Edition Chopra Solutions Manualdammar.jealousgvg6100% (19)

- CHAPTER-9 Advance Accounting SolmanDocument26 pagesCHAPTER-9 Advance Accounting SolmanShiela Gumamela100% (1)

- Feu Mas Midterm Summer 2019Document27 pagesFeu Mas Midterm Summer 2019louise carinoNo ratings yet

- Financial Statement Analysis RatiosDocument12 pagesFinancial Statement Analysis RatiosArvin John MasuelaNo ratings yet

- Multiple Choice Answers and Solutions: Realized Gross Profit, 2008 P 675,000Document26 pagesMultiple Choice Answers and Solutions: Realized Gross Profit, 2008 P 675,000Kristine Astorga-NgNo ratings yet

- Functional Budgets GuideDocument14 pagesFunctional Budgets Guidelinh nguyễnNo ratings yet

- Income Statement Comparison Absorption vs Variable CostingDocument3 pagesIncome Statement Comparison Absorption vs Variable CostingAnonymous duzV27Mx3No ratings yet

- StratCostMgmt 4 - Mock Test For Quiz 1 Answer KeyDocument5 pagesStratCostMgmt 4 - Mock Test For Quiz 1 Answer KeyFoshAtokNo ratings yet

- BudgetingDocument74 pagesBudgetingRevathi AnandNo ratings yet

- Home Office and Branch (Special Problems) - Ch9Document24 pagesHome Office and Branch (Special Problems) - Ch9PausanosKiray45% (11)

- Chapter 4 - Receivables and Related RevenuesDocument11 pagesChapter 4 - Receivables and Related RevenuesiCayeeee80% (5)

- CMA April - 14 Exam Question SolutionDocument55 pagesCMA April - 14 Exam Question Solutionkhandakeralihossain50% (2)

- Chapter 9Document18 pagesChapter 9Kate RamirezNo ratings yet

- Seminar 11answer Group 11Document115 pagesSeminar 11answer Group 11Shweta SridharNo ratings yet

- 1 PhototecDocument3 pages1 PhototecKaishe RamosNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Goat Breeds External Parasites Internal ParasitesDocument7 pagesGoat Breeds External Parasites Internal ParasiteskheymiNo ratings yet

- Common Abbreviations For MeasurementsDocument2 pagesCommon Abbreviations For MeasurementskheymiNo ratings yet

- Road To Sobriety: Steps of The Addiction Rehabilitation ProcessDocument3 pagesRoad To Sobriety: Steps of The Addiction Rehabilitation ProcesskheymiNo ratings yet

- Tuesday, July 27, 2010: Featured Articles Philippines - Hog Industry UpdatesDocument2 pagesTuesday, July 27, 2010: Featured Articles Philippines - Hog Industry UpdateskheymiNo ratings yet

- Problem Review Set Stock ValuationDocument5 pagesProblem Review Set Stock ValuationkheymiNo ratings yet

- Comparison and ContrastDocument8 pagesComparison and ContrastkheymiNo ratings yet

- Beginning:: Letter SampleDocument2 pagesBeginning:: Letter SamplekheymiNo ratings yet

- Econ Term PaperDocument6 pagesEcon Term PaperkheymiNo ratings yet

- SociologyDocument10 pagesSociologykheymiNo ratings yet

- Theory For Friction On Inclined PlaneDocument2 pagesTheory For Friction On Inclined PlanekheymiNo ratings yet

- Sd12 The Residual Income ModelDocument6 pagesSd12 The Residual Income ModelkheymiNo ratings yet

- Sd9 Free Cash Flow and Model AnalysisDocument7 pagesSd9 Free Cash Flow and Model AnalysiskheymiNo ratings yet

- Chapter 141Document90 pagesChapter 141kheymiNo ratings yet

- To Bear Children Is Very Important Element in Creating A Family and Establishing Better Relationship Between Husband and WifeDocument3 pagesTo Bear Children Is Very Important Element in Creating A Family and Establishing Better Relationship Between Husband and WifekheymiNo ratings yet

- CPA Quizbowl 2008 1Document10 pagesCPA Quizbowl 2008 1kheymiNo ratings yet

- Chapter 006 - Valuing Stocks: True / False QuestionsDocument9 pagesChapter 006 - Valuing Stocks: True / False QuestionskheymiNo ratings yet

- C 3 A F S: Hapter Nalysis of Inancial TatementsDocument27 pagesC 3 A F S: Hapter Nalysis of Inancial TatementskheymiNo ratings yet

- Wedding DanceDocument9 pagesWedding DancekheymiNo ratings yet

- Problem Review Set Stock ValuationDocument5 pagesProblem Review Set Stock ValuationkheymiNo ratings yet

- The Small Key - Paz M. LatorenaDocument5 pagesThe Small Key - Paz M. LatorenaCZEmb100% (1)

- CarloDocument2 pagesCarlokheymiNo ratings yet

- The Wedding Dance by Amador TDocument3 pagesThe Wedding Dance by Amador Tkheymi100% (1)

- MemberDocument3 pagesMemberkheymiNo ratings yet

- Problem Review Set Stock ValuationDocument5 pagesProblem Review Set Stock ValuationkheymiNo ratings yet

- TB-Raiborn - Capital BudgettingDocument43 pagesTB-Raiborn - Capital BudgettingkheymiNo ratings yet

- Chap018 Text Bank (1) SolutionDocument71 pagesChap018 Text Bank (1) SolutionkheymiNo ratings yet

- Test Review 2 Chapter 4 Time Value of MoneyDocument63 pagesTest Review 2 Chapter 4 Time Value of MoneyChiaLoiseNo ratings yet

- Sonnets To GardenerDocument1 pageSonnets To GardenerkheymiNo ratings yet

- PlotDocument2 pagesPlotkheymiNo ratings yet

- Marketing Strategy for Small Business: An IntroductionDocument9 pagesMarketing Strategy for Small Business: An IntroductionraifmusaNo ratings yet

- Tekle Mamo DemeDocument42 pagesTekle Mamo DemeTesfaye DegefaNo ratings yet

- Uganda Handicrafts Export Strategy: by The Sector Core Team (SCT)Document45 pagesUganda Handicrafts Export Strategy: by The Sector Core Team (SCT)Astrid Vidalón CastroNo ratings yet

- Group 5 Diesel Case StudyDocument6 pagesGroup 5 Diesel Case Studyabdullah mughalNo ratings yet

- What Is A SWOT Analysis?: BenchmarkingDocument3 pagesWhat Is A SWOT Analysis?: BenchmarkingSe SathyaNo ratings yet

- Vertical Integration in Apparel IndustryDocument15 pagesVertical Integration in Apparel IndustryAyushi ShuklaNo ratings yet

- The Entrepreneur's Unified Business Model FrameworkDocument10 pagesThe Entrepreneur's Unified Business Model FrameworkShazAkramNo ratings yet

- Develop and Apply Small Business SkillsDocument11 pagesDevelop and Apply Small Business SkillsMarc O AliNo ratings yet

- PFRS 2 Share-Based Payments GuideDocument18 pagesPFRS 2 Share-Based Payments GuideRaezel Carla Santos FontanillaNo ratings yet

- Case Analysis Celebritics Kelvin OngDocument3 pagesCase Analysis Celebritics Kelvin OngKelvin Andrew OngNo ratings yet

- Marketing Director ResumeDocument1 pageMarketing Director ResumeHimadripeeu PeeuNo ratings yet

- THE IMPACT OF ADVERTISING ON CONSUMER PATRONAGEDocument14 pagesTHE IMPACT OF ADVERTISING ON CONSUMER PATRONAGEVaibhav Kedia0% (1)

- Tesco CRM ReportDocument2 pagesTesco CRM ReportSoham PradhanNo ratings yet

- Final Best Research Chapter One-FiveDocument108 pagesFinal Best Research Chapter One-FivealeNo ratings yet

- Investor Behavior Toward Stock Market and Fundamental &Document16 pagesInvestor Behavior Toward Stock Market and Fundamental &Nurshid AlamNo ratings yet

- P/E RatioDocument4 pagesP/E Ratio15vinayNo ratings yet

- Late Hull Delivery CompensationDocument13 pagesLate Hull Delivery CompensationAnonymous h4o5zvp4No ratings yet

- FAR Practical Exercises InvestmentDocument5 pagesFAR Practical Exercises InvestmentAB CloydNo ratings yet

- JBF Winter2010-CPFR IssueDocument52 pagesJBF Winter2010-CPFR IssueakashkrsnaNo ratings yet

- Leveraged Buyout (LBO) : The LBO Analysis - Main StepsDocument9 pagesLeveraged Buyout (LBO) : The LBO Analysis - Main StepsaminafridiNo ratings yet

- Marketing Plan - SampleDocument35 pagesMarketing Plan - SampleTUMMALAPENTA BHUVAN SAI KARTHIKNo ratings yet

- BASL Ratio Analysis Highlights Strong Financial PositionDocument18 pagesBASL Ratio Analysis Highlights Strong Financial PositionSreeram Anand IrugintiNo ratings yet

- Inventory Management 1Document16 pagesInventory Management 1Tabish BhatNo ratings yet

- Chapter4 Feasibility of Idea ContinueDocument27 pagesChapter4 Feasibility of Idea ContinueCao ChanNo ratings yet

- Myka Eleonor Estole Quiz 5Document8 pagesMyka Eleonor Estole Quiz 5Julienne UntalascoNo ratings yet

- Debdatta Das Roll No:-521029844 Centre Code:-02783 Master of Business Administration - Semester III Project ReportDocument16 pagesDebdatta Das Roll No:-521029844 Centre Code:-02783 Master of Business Administration - Semester III Project ReportDebdatta DasNo ratings yet

- Economics For Managers GTU MBA Sem 1 Chapter 4Document24 pagesEconomics For Managers GTU MBA Sem 1 Chapter 4Rushabh VoraNo ratings yet

- Limitations of BCG MatrixDocument3 pagesLimitations of BCG MatrixShovon BanikNo ratings yet

- Bajaj Auto Salesforce StrategyDocument18 pagesBajaj Auto Salesforce Strategym omprakashNo ratings yet

- Equity in Victorian Education and Deficit ThinkingDocument24 pagesEquity in Victorian Education and Deficit ThinkingRussell HodgesNo ratings yet