Professional Documents

Culture Documents

87

Uploaded by

Sakib Ex-rcc0 ratings0% found this document useful (0 votes)

30 views2 pagescustom tarrif

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcustom tarrif

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

30 views2 pages87

Uploaded by

Sakib Ex-rcccustom tarrif

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

__________________________________________________________________________________________________________

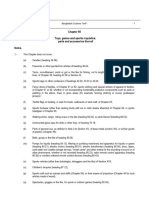

Bangladesh Customs Tariff - 1

__________________________________________________________________________________________________________

Chapter 83

Miscellaneous articles of base metal

Notes.

1. For the purposes of this Chapter, parts of base metal are to be classified with their parent articles.

However, articles of iron or steel of headings 73.12, 73.15, 73.17, 73.18 or 73.20, or simi lar articles of

other base metal (Chapter 74 to 76 and 78 to 81) are not to be taken as parts of articles of this

Chapter.

2. For the purposes of heading 83.02, the word "castors" means those having a diameter (including,

where appropriate, tyres) not exceeding 75 mm, or those having a diameter (including, where

appropriate, tyres) exceeding 75 mm provided that the width of the wheel or tyre fitted thereto is less

than 30 mm.

Heading

H.S.Code Description Statistical

Unit

Statutory

Rate of

Import Duty

Statutory

Rate of

Export Duty

(1) (2) (3) (4) (5) (6)

83.01 Padlocks and locks (key, combination or electrically operated), of base

metal; clasps and frames with clasps, incorporating locks, of base metal;

keys for any of the foregoing articles, of base metal.

8301.10.00 - Padlocks kg 25% Free

- Locks of a kind used for motor vehicles

8301.20.10 --- Locks of a kind used for motorcycle imported by VAT registered motorcycle

manufacturing industries kg 25% Free

8301.20.90 --- Other kg 25% Free

8301.30.00 - Locks of a kind used for furniture kg 25% Free

8301.40.00 - Other locks kg 25% Free

8301.50.00 - Clasps and frames with clasps, incorporating locks kg 25% Free

8301.60.00 - Parts kg 25% Free

8301.70.00 - Keys presented separately kg 25% Free

83.02 Base metal mountings, fittings and similar articles suitable for furniture,

doors, staircases, windows, blinds, coachwork, saddlery, trunks, chests,

caskets or the like; base metal hat-racks, hat-pegs, brackets and similar

fixtures; castors with mountings of base metal; automatic door closers of

base metal.

8302.10.00 - Hinges kg 25% Free

8302.20.00 - Castors kg 25% Free

8302.30.00 - Other mountings, fittings and similar articles suitable for motor vehicles kg 25% Free

- Other mountings, fittings and similar articles:

8302.41.00 -- Suitable for buildings kg 25% Free

8302.42.00 -- Suitable for furniture kg 25% Free

8302.49.00 -- Other kg 25% Free

8302.50.00 - Hat-racks, hat-pegs, brackets and similar fixtures kg 25% Free

8302.60.00 - Automatic door closers kg 25% Free

83.03 8303.00.00 Armoured or reinforced safes, strong-boxes and doors and safe deposit

lockers for strong-rooms, cash or deed boxes and the like, of base metal. kg 25% Free

83.04 8304.00.00 Filing cabinets, card-index cabinets, paper trays, paper rests, pen trays,

office-stamp stands and similar office or desk equipment, of base metal,

other than office furniture of heading 94.03. kg 25% Free

83.05 Fittings for loose-leaf binders or files, letter clips, letter corners, paper

clips, indexing tags and similar office articles, of base metal; staples in

strips (for example, for offices, upholstery, packaging), of base metal.

8305.10.00 - Fittings for loose-leaf binders or files kg 25% Free

8305.20.00 - Staples in strips kg 25% Free

8305.90.00 - Other, including parts kg 25% Free

_________________________________________________________________________________________________________

2- Bangladesh Customs Tariff

_________________________________________________________________________________________________________

83.06 Bells, gongs and the like, non-electric, of base metal; statuettes and other

ornaments, of base metal; photograph, picture or similar frames, of base

metal; mirrors of base metal.

8306.10.00 - Bells, gongs and the like kg 25% Free

- Statuettes and other ornaments:

8306.21.00 -- Plated with precious metal kg 25% Free

8306.29.00 -- Other kg 25% Free

8306.30.00 - Photograph, picture or similar frames; mirrors kg 25% Free

83.07 Flexible tubing of base metal, with or without fittings.

8307.10.00 - Of iron or steel kg 10% Free

8307.90.00 - Of other base metal kg 10% Free

83.08 Clasps, frames with clasps, buckles, buckle-clasps, hooks, eyes, eyelets

and the like, of base metal, of a kind used for clothing, footwear, awnings,

handbags, travel goods or other made up articles; tubular or bifurcated

rivets, of base metal; beads and spangles, of base metal.

8308.10.00 - Hooks, eyes and eyelets kg 25% Free

8308.20.00 - Tubular or bifurcated rivets kg 25% Free

8308.90.00 - Other, including parts kg 25% Free

83.09 Stoppers, caps and lids (including crown corks, screw caps and pouring

stoppers), capsules for bottles, threaded bungs, bung covers, seals and

other packing accessories, of base metal.

8309.10.00 - Crown corks kg 10% Free

- Other

8309.90.10 --- Lug caps kg 10% Free

8309.90.20 --- Container seal kg 5% Free

8309.90.30 --- Combination seal for vials kg 10% Free

8309.90.90 --- Other kg 25% Free

83.10 8310.00.00 Sign-plates, name-plates, address-plates and similar plates, numbers

letters and other symbols, of base metal, excluding those of, heading

94.05. kg 25% Free

83.11 Wire, rods, tubes, plates, electrodes and similar products, of base metal or

of metal carbides, coated or cored with flux material, of a kind used for

soldering, brazing, welding or deposition of metal or of metal carbides;

wire and rods, of agglomerated base metal powder, used for metal

spraying.

8311.10.00 - Coated electrodes of base metal, for electric-arc-welding kg 25% Free

8311.20.00 - Cored wire of base metal, for electric-arc-welding kg 25% Free

8311.30.00 - Coated rods and cored wire, of base metal, for soldering, brazing or welding by

flame kg 10% Free

8311.90.00 - Other kg 10% Free

You might also like

- AHTN2022 CHAPTER83 wNOTESDocument5 pagesAHTN2022 CHAPTER83 wNOTESdoookaNo ratings yet

- Other Base Metals Cermets Articles Thereof: Sub-Heading NoteDocument2 pagesOther Base Metals Cermets Articles Thereof: Sub-Heading NoteSakib Ex-rccNo ratings yet

- Ceramic Products NotesDocument2 pagesCeramic Products NotesSakib Ex-rccNo ratings yet

- BL501. Learning Pack 4 - Reinforcement Bars in Concret WorksDocument5 pagesBL501. Learning Pack 4 - Reinforcement Bars in Concret WorksLaki AlgomNo ratings yet

- Tin and Articles Thereof NoteDocument2 pagesTin and Articles Thereof NoteSakib Ex-rccNo ratings yet

- Chap 86Document4 pagesChap 86ekuthefekuNo ratings yet

- HS Code Definition PDFDocument17 pagesHS Code Definition PDFDwi Januar PribadiNo ratings yet

- NotesDocument3 pagesNotesSakib Ex-rccNo ratings yet

- POWRGARD Electrical Products Catalog 2012Document220 pagesPOWRGARD Electrical Products Catalog 2012momir8657No ratings yet

- Afd 091005 064Document444 pagesAfd 091005 064phaninittNo ratings yet

- AW50-40LE (AF14-20) AW50-42LE/LM Aisin Warner: All TransmissionsDocument4 pagesAW50-40LE (AF14-20) AW50-42LE/LM Aisin Warner: All TransmissionsAlex VoicuNo ratings yet

- Section-XVIII Chapter-90Document12 pagesSection-XVIII Chapter-90aki_47No ratings yet

- KLEEMANN Lift Modernisation SolutionsDocument18 pagesKLEEMANN Lift Modernisation SolutionsKleemmann Hellas SANo ratings yet

- Clocks and Watches and Parts Thereof: NotesDocument3 pagesClocks and Watches and Parts Thereof: NotesSakib Ex-rccNo ratings yet

- B 928 - 04 - QjkyoaDocument10 pagesB 928 - 04 - Qjkyoamercab15No ratings yet

- Chapter 952Document3 pagesChapter 952Istiaq XaowadNo ratings yet

- Chap 82Document7 pagesChap 82jawaharlaljain41No ratings yet

- Interpipe CatalogueDocument41 pagesInterpipe CatalogueDpnsHome100% (2)

- Electrical Machinery and Equipment and Parts Thereof Sound Recorders and ReproducersDocument11 pagesElectrical Machinery and Equipment and Parts Thereof Sound Recorders and ReproducersAnonymous ZXg9S1lgNo ratings yet

- RBKL Manual 20.11.23Document25 pagesRBKL Manual 20.11.23Алексей ВихляевNo ratings yet

- 1 1a 14Document1,344 pages1 1a 14annon8675309100% (2)

- CH 90Document14 pagesCH 90NishanNo ratings yet

- Custom Tariff Header - Chapter-85Document25 pagesCustom Tariff Header - Chapter-85Chickmagalur R RajeshNo ratings yet

- Electrical Machinery and Equipment GuideDocument24 pagesElectrical Machinery and Equipment GuideBooks and BooksNo ratings yet

- Caja de Conexion Metálica Wet Location - Hangzhou - Ul - E483162 - 2022.08Document16 pagesCaja de Conexion Metálica Wet Location - Hangzhou - Ul - E483162 - 2022.08andres20tjNo ratings yet

- B221M 1388261-1Document16 pagesB221M 1388261-1hh774747No ratings yet

- Cable Lugs & Connectors Price in Indian RupeesDocument5 pagesCable Lugs & Connectors Price in Indian RupeesVinit JhingronNo ratings yet

- Karcher Pressure Cleaner K 2.09 Plus SPDocument47 pagesKarcher Pressure Cleaner K 2.09 Plus SPSteve SilvertonNo ratings yet

- Oil Tempered WireDocument20 pagesOil Tempered WirePrakash ChandrasekaranNo ratings yet

- 2 PartsDocument168 pages2 PartsBappaditya AdhikaryNo ratings yet

- Industrial Cable Price ListDocument6 pagesIndustrial Cable Price Listcrazy devilNo ratings yet

- Custom Duty-Chapter 85Document25 pagesCustom Duty-Chapter 85JN ChoudhuriNo ratings yet

- Guardrail DesignDocument8 pagesGuardrail Designundf25No ratings yet

- Miscellaneous Manufactured Articles NotesDocument3 pagesMiscellaneous Manufactured Articles NotesSakib Ex-rccNo ratings yet

- Pakistan's List of High Priority Tariff Lines for Immediate Tariff Elimination from ChinaDocument14 pagesPakistan's List of High Priority Tariff Lines for Immediate Tariff Elimination from ChinaWick TodayNo ratings yet

- Spot 65-85 IngleseDocument27 pagesSpot 65-85 IngleseArda AkberkNo ratings yet

- Din 2080Document34 pagesDin 2080judas1432No ratings yet

- Main pump parts manual sectionsDocument24 pagesMain pump parts manual sectionsdavid ballen100% (1)

- Vehicles, Aircraft, Vessels and Associated Transport EquipmentDocument22 pagesVehicles, Aircraft, Vessels and Associated Transport EquipmentToni D.No ratings yet

- Spare Parts Manual AKS 32Document109 pagesSpare Parts Manual AKS 32knoppix2008No ratings yet

- UL E483162Cajas EVTDocument2 pagesUL E483162Cajas EVTYeison Alberto Murillo Guzman0% (1)

- Section Xvi: HapterDocument30 pagesSection Xvi: Hapterbhk19No ratings yet

- Connection ReportDocument1 pageConnection Reporttanmai gampaNo ratings yet

- 006 1SCC301001C0201 Switch-disconnectors OT and OETL 16-3150A_1Document49 pages006 1SCC301001C0201 Switch-disconnectors OT and OETL 16-3150A_1marius_1959No ratings yet

- Eaton FRO15210c ManualDocument34 pagesEaton FRO15210c ManualMonica Jennifer Peña100% (1)

- List of Goods - Vie - EngDocument8 pagesList of Goods - Vie - EngLâm Vĩnh TrầnNo ratings yet

- Section-Xx Chapter-95 C 95: Toys, Games and Sports Requisites Parts and Accessories ThereofDocument6 pagesSection-Xx Chapter-95 C 95: Toys, Games and Sports Requisites Parts and Accessories ThereofHema JoshiNo ratings yet

- LT/HT Power & Control Cables: Price List W.E.F. July, 2013Document10 pagesLT/HT Power & Control Cables: Price List W.E.F. July, 2013anishNo ratings yet

- LT/HT Power & Control Cables Price List (July 2013Document6 pagesLT/HT Power & Control Cables Price List (July 2013Cpgeorge JohnNo ratings yet

- Pc340nlcd P Uepb005302reducedDocument180 pagesPc340nlcd P Uepb005302reducedCompaire CompaireeNo ratings yet

- Anvil Strut Only CatalougeDocument148 pagesAnvil Strut Only CatalougericardoNo ratings yet

- Section-Xvii Chapter-86Document5 pagesSection-Xvii Chapter-86Monish MNo ratings yet

- Gasket Seating Stress Units psi ChartDocument11 pagesGasket Seating Stress Units psi ChartLcm TnlNo ratings yet

- Abb MCBDocument96 pagesAbb MCBbrightstardustNo ratings yet

- Metal Valves & Pipe Fittings World Summary: Market Values & Financials by CountryFrom EverandMetal Valves & Pipe Fittings World Summary: Market Values & Financials by CountryNo ratings yet

- Implementing 802.11 with Microcontrollers: Wireless Networking for Embedded Systems DesignersFrom EverandImplementing 802.11 with Microcontrollers: Wireless Networking for Embedded Systems DesignersNo ratings yet

- Oxy-Acetylene Welding and Cutting Electric, Forge and Thermit Welding together with related methods and materials used in metal working and the oxygen process for removal of carbonFrom EverandOxy-Acetylene Welding and Cutting Electric, Forge and Thermit Welding together with related methods and materials used in metal working and the oxygen process for removal of carbonNo ratings yet

- The Art of Welding: Practical Information and Useful Exercises for Oxyacetylene and Electric Arc WeldingFrom EverandThe Art of Welding: Practical Information and Useful Exercises for Oxyacetylene and Electric Arc WeldingNo ratings yet

- Machine Tools, Metal Cutting Types World Summary: Market Values & Financials by CountryFrom EverandMachine Tools, Metal Cutting Types World Summary: Market Values & Financials by CountryNo ratings yet

- Oxy-Acetylene Welding and Cutting: Electric, Forge and Thermit Welding together with related methods and materials used in metal working and the oxygen process for removal of carbonFrom EverandOxy-Acetylene Welding and Cutting: Electric, Forge and Thermit Welding together with related methods and materials used in metal working and the oxygen process for removal of carbonNo ratings yet

- English 2nd Paper Sentence AnalysisDocument2 pagesEnglish 2nd Paper Sentence AnalysisSakib Ex-rccNo ratings yet

- Cie o Level Syllabus Year 2015Document40 pagesCie o Level Syllabus Year 2015Sakib Ex-rccNo ratings yet

- Admission Test Result PGD KIM Intake 9 1Document9 pagesAdmission Test Result PGD KIM Intake 9 1Sakib Ex-rccNo ratings yet

- Admit Card SampleDocument1 pageAdmit Card SampleSakib Ex-rccNo ratings yet

- CIE O LEVEL SYLLABUS Physics 5054Document40 pagesCIE O LEVEL SYLLABUS Physics 5054Sakib Ex-rccNo ratings yet

- Chemistry June 2004 - Paper 1Document16 pagesChemistry June 2004 - Paper 1theyaasir0% (1)

- Notes On Ion ChemistryDocument8 pagesNotes On Ion ChemistrySakib Ex-rccNo ratings yet

- English 2nd PaperDocument3 pagesEnglish 2nd PaperSakib Ex-rccNo ratings yet

- English 1st PaperDocument1 pageEnglish 1st PaperSakib Ex-rccNo ratings yet

- Work, Energy &pressureDocument3 pagesWork, Energy &pressureSakib Ex-rccNo ratings yet

- 5070 Y07 SyDocument32 pages5070 Y07 SySakib Ex-rccNo ratings yet

- Rice Is Normally Grown As AnDocument2 pagesRice Is Normally Grown As AnSakib Ex-rccNo ratings yet

- 5070 s04 ErDocument11 pages5070 s04 ErSakib Ex-rccNo ratings yet

- MARK SCHEME For The June 2005 Question PaperDocument7 pagesMARK SCHEME For The June 2005 Question Paperkaran79No ratings yet

- Cie o Level Physics Syllabus For Year 2012Document46 pagesCie o Level Physics Syllabus For Year 2012Sakib Ex-rccNo ratings yet

- Physics SyllabusDocument45 pagesPhysics SyllabusAbdllah AnsariNo ratings yet

- EM InductionDocument20 pagesEM InductionSakib Ex-rccNo ratings yet

- Sample QuestionsDocument40 pagesSample QuestionsPracheeNo ratings yet

- Polymer - Polyesters and PolyamidesDocument18 pagesPolymer - Polyesters and PolyamidesFerdinand KMeoNo ratings yet

- Electricity - Mains - 01 - Handout FuseDocument1 pageElectricity - Mains - 01 - Handout FuseSakib Ex-rccNo ratings yet

- Gravitational FieldsDocument16 pagesGravitational FieldsSakib Ex-rccNo ratings yet

- 2009 Jan P2 QPDocument24 pages2009 Jan P2 QPSakib Ex-rccNo ratings yet

- Expanding Universe Marks SchemeDocument5 pagesExpanding Universe Marks SchemeSakib Ex-rccNo ratings yet

- 2.6 NotesDocument6 pages2.6 NotesRana Hassan TariqNo ratings yet

- Cork and Articles of Cork NoteDocument1 pageCork and Articles of Cork NoteSakib Ex-rccNo ratings yet

- Miscellaneous Articles of Base Metal NotesDocument2 pagesMiscellaneous Articles of Base Metal NotesSakib Ex-rccNo ratings yet

- Bangladesh Customs Tariff for Vegetable Textile FibresDocument1 pageBangladesh Customs Tariff for Vegetable Textile FibresSakib Ex-rccNo ratings yet

- Edible Fruit and Nuts Peel of Citrus Fruit or Melons: NotesDocument5 pagesEdible Fruit and Nuts Peel of Citrus Fruit or Melons: NotesSakib Ex-rccNo ratings yet

- Bangladesh Customs Tariff for Man-made Filaments and YarnsDocument3 pagesBangladesh Customs Tariff for Man-made Filaments and YarnsSakib Ex-rccNo ratings yet

- Edible Fruit and Nuts Peel of Citrus Fruit or Melons: NotesDocument5 pagesEdible Fruit and Nuts Peel of Citrus Fruit or Melons: NotesSakib Ex-rccNo ratings yet