Professional Documents

Culture Documents

Polyester Prince Revisited

Uploaded by

Joel Eljo Enciso SaraviaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Polyester Prince Revisited

Uploaded by

Joel Eljo Enciso SaraviaCopyright:

Available Formats

INSIGHT

september 13, 2014 vol xlIX no 37 EPW Economic & Political Weekly 50

Paranjoy Guha Thakurta (paranjoy@gmail.

com) is a senior journalist whose most recent

book is Gas Wars: Crony Capitalism and the

Ambanis.

Polyester Prince Revisited

Paranjoy Guha Thakurta

The polyester wars of the

mid-1980s that pitted one

industry group against another

are back with us. On the basis of

an investigation begun by the

United Progressive Alliance

government, the National

Democratic Alliance government

has imposed an anti-dumping

duty on puried terephthalic acid,

an important input for production

of many polyester products. The

user companies argue that there

is no evidence of dumping of

imports and allege that the duty

has been imposed to benet

domestic producers of PTA, of

which there are only three and of

whom the public sector producer

has not complained of dumping.

T

he Polyester Prince is the title of

a biography of Dhirubhai Ambani,

founder of the Reliance group of

companies, Indias biggest private corpo-

rate conglomerate, written by Austral-

ian journalist Hamish McDonald in

1998. Among other things, the book high-

lighted how, during the 1980s, the govern-

ment changed rules relating to imports of

raw materials used in the manufacture of

polyester bre to help the group at the

expense of its competitors.

Dhirubhais arch-rival used to be Nusli

Wadia, who headed the Bombay Dyeing

group which, like Reliance Industries

Limited (RIL), manufactures synthetic

textiles. The two fought bitterly to inu-

ence government policies relating to the

manufacture of synthetic bres and fab-

rics. Dhirubhai passed away in July 2002.

His older son Mukesh Ambani now heads

the Reliance group. But some things have

not changed. A new version of an old story

is being played out all over again.

Anti-Dumping Duty on PTA

In the teeth of opposition from the poly-

ester using industry in India, the central

government on 25 July imposed an anti-

dumping duty on imports of puried

terephthalic acid (PTA), a critical inter-

mediate that is used in the production of

various polyester products. This decision

will almost entirely benet only one cor-

porate entity, that is, RIL. The move to im-

pose an anti-dumping duty was staunchly

opposed, unsuccessfully, by at least 10

large companies in India, individually and

through various industry associations.

These corporate entities include Bom-

bay Dyeing, Indo Rama Synthetics and

Garden Silk Mills. In written represent-

ations to different government autho-

rities, these rms and associations with

which they are afliated had argued that

the imposition of the anti-dumping duty

on PTA would be detrimental to the

interests of around 20,000 small- and

medium-sized industrial units employing

hundreds of thousands of workers across

the country. These units use PTA to make

various polyester products. The views of

these companies and associations have

been ignored by the government.

A provisional anti-dumping duty has

been imposed on imports of PTA and its

variants medium quality terephthalic

acid and qualied terephthalic acid en-

tering India from the Peoples Republic of

China, South Korea, Thailand and the

European Union (EU). The PTA Users Asso-

ciation has claimed that the sole beneci-

ary of this decision to impose the anti-

dumping duty ranging between $19 and

$117 per tonne, depending on the quality

of the PTA will be RIL, Indias largest

integrated polyester bre manufacturer

and the eighth largest of its kind in the

world. RIL has installed capacity to pro-

duce 2,050 kilo-tonnes per annum (KTA)

of polyester bre.

PTA is the preferred feedstock used to

produce high-performance plastics such as

polyester which, in turn, is used to manu-

facture a wide range of products from

textiles and clothing to bottles and lm.

Polyester accounts for roughly 70% of all

synthetic bres produced in the country.

According to the ofcial website of the

Chemicals and Petrochemicals Manufac-

turers Association of India, roughly two-

thirds of PTA used across the world goes

into the production of polyester bre, a

little over a quarter is used for the manu-

facture of polyethylene terephthalate (PET)

resin that is used to produce bottles and

containers, while the rest is used to make

lm and other plastic products. PTA is used

in making various petrochemicals such as

cyclohexane dimethanol, terephthaloyl

chloride, co-polyester-ether elastomers,

plasticisers and liquid crystal polymers.

During the tenure of the United Progres-

sive Alliance government when Anand

Sharma was union minister of industry

and commerce, the directorate general of

anti-dumping and allied duties (DGAD) in

the Department of Commerce, Ministry of

Industry and Commerce, had initiated

investigations on 8 October 2013 into

whether the PTA imports were causing

injury to the domestic industry on the

INSIGHT

Economic & Political Weekly EPW september 13, 2014 vol xlIX no 37 51

basis of an application submitted by RIL

and another company, Mitsubishi Chem-

ical Corporation PTA India (MCPI). (See

the initiation notication of the DGAD

issued by the designated authority in the

Department of Commerce: http://com-

merce.nic.in/writereaddata/tradereme-

dies/adint_PTA_ChinaPR_EU_KoreaRP_

Thailand.pdf)

Arguments against Duty

Earlier this year, on the last day of March,

exactly a week before the general elec-

tions began on 7 April, the department

reportedly decided to impose an anti-

dumping duty on PTA imports from China,

South Korea, Thailand and the EU. A

month earlier, PTA users had sensed that

the anti-dumping duty may be in the off-

ing and had started lobbying against its

imposition. On 25 February, the PHD

Chamber of Commerce and Industry

(earlier known as the Punjab, Haryana,

Delhi Chamber) issued a press release

stating that an anti-dumping duty on

PTA imports was uncalled for.

Pointing out that there was a mis-

match between the annual demand for

and domestic supply of PTA 40,96,952

metric tonnes and 34,20,000 tonnes

respectively the chambers executive

director Saurabh Sanyal claimed that

domestic manufacturers of PTA were

acting in an unreasonable manner to

place an additional burden on the user

industry with the sole objective of earn-

ing super normal prots which would

work to the detriment of a large number

of small and medium enterprises.

In his representation to the government,

Sanyal pointed out that PTA is the major

material used in the production of polyes-

ter lament yarn (PFY), polyester staple

bre (PSF) and polyester lm. Sanyal added

that in December 2013, both Egypt and the

EU had initiated anti-dumping investiga-

tions against imports of PSF from India.

He asserted that imported PTA was not

causing any injury to domestic producers.

The PHD Chamber representative said it

should be noted that a leading public sec-

tor company, Indian Oil Corporation,

which manufactures PTA, had not sought

the imposition of an anti-dumping duty.

A little more than a month after the

PHD Chamber issued its press release, on

31 March, the day the commerce depart-

ment decided to impose the anti-dumping

duty, another apex industry association,

the Associated Chambers of Commerce

and Industry of India (Assocham) urged

the government not to impose the duty as

the domestic user industry is struggling

to survive due to the wide gap between

demand and availability of PTA, adding

that this would severely impact exports.

In a note submitted to the government,

Assochams secretary general D S Rawat

stated that capacity utilisation by domestic

PTA manufacturers (without mentioning

Reliance by name) was more than 100%

and that the gap between demand and

supply of PTA had to be lled by imports.

He put out a slightly different set of statis-

tics than the PHD: during 2012-13, total

domestic production stood at 34,76,144

tonnes, imports were 6,47,959 tonnes

against a demand of 41,24,103 tonnes,

excluding consumption by PTA producers.

Rawat said that if an anti-dumping duty

was imposed, the more expensive import-

ed PTA would render the user industry

in India...uncompetitive. The Assocham

representative apprehended that Indias

exports of PFY, PSF and synthetic textiles

to EU would be affected, pointing out

that the country exported 63,241 tonnes

of PSF to EU during the calendar year 2012.

It was further stated that there was an

absolute as well as a proportional decline

in Indias imports of PTA from China, EU,

South Korea and Thailand in each of the

three years between 2010-11 and 2012-13

and that the landed value of PTA from

these countries had gone up substan-

tially in the four-year period between

2009-10 and 2012-13. Again, without men-

tioning Reliance, Rawat said a domestic

producer was indulging in double prot

booking by producing naphtha and PX

in one plant and then selling PX at arti-

cially high rates to another plant (of

the same company) for the manufacture

of PTA. Sanyal of PHD claimed that dur-

ing 2011-12 and 2012-13, the rise in the

price of naphtha (used to produce para-

xylene or PX) was slower than the rise in

the price of PX. The rise in the prices of

naphtha and PTA were, however, com-

mensurate with each other, he added.

As already mentioned, these representa-

tions had no impact on the government.

The imposition of the anti-dumping duty

on the basis of preliminary ndings

was recommended on 19 June through a

notication [No 14/7/2013-DGAD] and

issued by the Department of Revenue,

Ministry of Finance, six days later through

another notication [No 36/2014-Customs

(ADD)]. The imposition of the anti-

dumping duty will not exceed a period

of six months from the date of imposi-

tion, that is, 25 June, unless revoked,

amended or superseded.

According to the preliminary ndings

of the DGAD, PTA imports from the three

Asian countries of China, South Korea

and Thailand as well as EU were found

to be below their normal value and

could thus be construed as a case of

dumping. The normal value is the

comparable price at which goods are

sold in the ordinary course of trade in

the domestic market of the exporting

country or territory. Dumping is said to

have occurred when goods are exported

by a country to another at a price lower

than this normal value. Since it results

in material injury to domestic industry,

it is considered an unfair trade practice.

Fear of Impact

After the imposition of the anti-dumping

duty, one of the aggrieved companies,

Indo Rama Synthetics (India), put out a

press release which stated that the recom-

mendation to impose an anti-dumping

duty was done in a hurry (and) without

understanding its implications. Accord-

ing to the company, the per tonne duty on

imported PTA from China works out to

$62.82; $117.09 in the case of PTA imported

from South Korea and $99.51 in the case of

imports from other countries (including

Thailand) highly impacting the polyester

bre chain. After the imposition of an

anti-dumping duty, domestic PTA produc-

ers have started charging between $30

and $40 per tonne over and above the FOB

(freight-on-board or free-on-board) prices

of imported PTA. Indo Ramas press re-

lease pointed out that the pleas and rep-

resentations made by associations such

as the Federation of Indian Chambers of

Commerce and Industry (FICCI), the Con-

federation of Indian Industry (CII), the

Confederation of Indian Textile Industry

(CITI), the All Indian Spinners Association

INSIGHT

september 13, 2014 vol xlIX no 37 EPW Economic & Political Weekly 52

and the PTA Users Association (over and

above the two already mentioned), had

not made any impact on the authorities.

Arguing that the anti-dumping duty

would retard the growth of the polyester

bre industry and increase the price of

the poor mans fabric, Indo Rama high-

lighted what it claimed were the econo-

mics of the business: domestic producers

of polyester are at a cost disadvantage

of approximately $100 per tonne of PTA

on account of the impact of a 5% customs

duty which works out to around $50 per

tonne, freight differential of between $35

and $40 a tonne and an additional $10 a

tonne on account of port handling charges

and miscellaneous expenses.

Unlike the press releases by the PHD

Chamber and Assocham, the Indo Rama

release did not pull any punches by di-

rectly naming RIL. It may be noted that

there are no integrated polyester bre

players except Reliance Industries Ltd

and this move will solely benet (RIL) the

major producer of PTA. The Indian poly-

ester industry will become less competi-

tive... The release stated that this un-

timely and undesirable decision would

make it difcult to achieve the $60 billion

target for exports by increasing the prices

of Indian exports of synthetic bre, yarns,

fabrics and ready-made garments.

The companys release pointed out

that the government notication had cat-

egorically stated the following on page

60, paragraph 95(d): None of the inter-

ested parties have furnished any evi-

dence to demonstrate signicant chang-

es in technology that could have caused

injury to the domestic industry. If this

was indeed the case, Indo Rama won-

dered why RIL is putting up a 2.4 million

tonnes (per annum capacity) PTA plant in

India, adding that changes in technology

had indeed made the establishment of

bigger PTA plants economically viable.

The company claimed that the protec-

tion already being provided to domestic

PTA producers was reasonable. This was

in the form of duty-free imports of PX

and a 5% customs duty on PTA. The anti-

dumping duty would be highly detri-

mental to the polyester bre industry

which is currently utilising 60%-70% of

its installed capacity due to shortages in

the supply of PTA. Producers of polyester

bres were already nancially burdened

by high debts and low prot margins,

Indo Rama argued, claiming that the

impending closure of many of the 20,000-

odd small and medium sized textile

units in the country would render many

workers unemployed.

Criticism of Findings

There are other dimensions to this story

which are revealed in the 28 July repre-

sentation made to the DGAD in the Depart-

ment of Commerce by the PTA Users

Association, an umbrella body of major

importers of PTA, including Filatex India,

Indo Rama Synthetics, Bombay Dyeing,

and Garden Silk Mills.

The association argued that the DGADs

investigations and subsequent ndings

were erroneous and should not be imple-

mented as there was no evidence of injury

and that no causal link between injury

and imports of PTA had been established.

The PTA Users Association claimed its

members are upset because the DGAD

had not cited any cogent reasons to im-

pose the anti-dumping duty and described

the preliminary ndings as bad in law.

The association accused the DGAD of

making inaccurate statements and not

applying its mind because its preliminary

ndings claimed that production and

sales of RIL and MCPI had not increased in

proportion to demand. The association,

however, claimed that in the two years

2010-11 and 2011-12 (the period of inves-

tigation or POI), production of PTA rose by

12.21% and then fell by 0.03%, domestic

sales increased by 12.49% and then

declined by 0.77% and demand went up

by 14% and then decreased by 1.9%. This

meant that during the POI, production

rose by 6.46%, domestic sales went up by

6.1% while demand increased by 6%.

The association also challenged the

DGADs claims that the domestic manu-

facturers of PTA witnessed declining pro-

duction, sales, capacity utilisation, prots,

return on capital employed and market

shares. It argued that the two companies,

RIL and MCPI, only witnessed a reduction

in prots and return on capital during the

POI, that too, on account of two factors:

technical problems in MCPIs second PTA

plant and a substantial increase in installed

capacity to 3.42 million tonnes resulting

in higher xed costs, and not on account of

alleged dumping of cheap imported PTA.

It was then argued that the injury

margins and anti-dumping duty rates

were not proportionate to the landed val-

ue of imports. The association said if RIL

and MCPI are claiming losses on PTA sales,

this was not borne out by the records

maintained by the central excise authori-

ties in the Ministry of Finance. More sub-

stantive arguments were thereafter for-

warded by the PTA Users Association.

Foreign or Indian Company?

According to the association, RILs co-

petitioner MCPI cannot be held to be a

constituent of domestic industry in India

since Mitsubishi Chemical Corporation

(MCC) of Japan, the worlds second largest

producer of PTA, is a majority (66%) share-

holder in MCPI and also holds a controlling

(40%) stake in Samnam Petrochemicals,

one of the suppliers of PTA from South

Korea. The other shareholders of Sam-

nam are Samyang Corporation (40%) and

GS Caltex (20%), both based out of South

Korea. Samnam has been described as one

of MCCs overseas subsidiaries.

Thus, the association argued that MCPIs

stake in Samnam is signicant and falls

under the denition and scope of control.

In MCPI, besides MCC, four foreign com-

panies held 29% of the companys shares:

10% by Mitsubishi Corporation, 8% by

Sojitz Corporation, 6% by Marubeni Cor-

poration and 5% by Toyota Tsusho. The

remaining 5% of MCPIs shares was held

by the West Bengal Industrial Develop-

ment Corporation. Thus, in short, the as-

sociation argued that MCPI should have

been disqualied from being considered

as a constituent of the domestic PTA manu-

facturing industry.

MCPI, which has its PTA manufactur-

ing facilities in Haldia, West Bengal, has

been declared a sick industrial unit and

referred to the Board for Industrial and

Financial Reconstruction (BIFR). In its

annual report for 2012-13, MCPI mentions

the unstable intermittent operation of its

plant: The below par nancial perf or-

mance of the company during the year

under review, inter alia, was owing to

several constraints and deterrent factors

like abysmally low PTA-PX (paraxylene)

spread, persistent inationary trends,

INSIGHT

Economic & Political Weekly EPW september 13, 2014 vol xlIX no 37 53

acute rigidity and inexibility in the

market, unstable, intermittent operation

at its PTA manufacturing facility

The association has made out that MCPIs

losses have been crucial in making out a

case of injury in the anti-dumping investi-

gation. However, RILs PTA plants are

reportedly operating at above 100% ca-

pacity. Claiming that it was highly likely

that RIL would have satised the deni-

tion of domestic industry on its own, the

association claimed that MCPI was not eli-

gible to be investigated by the DGAD.

RIL accounted for around 60% of

domestic production in PTA production in

2012-13, while MCPI manufactured a little

under a quarter of total production, the

balance being taken up by Indian Oil.

According to the estimates made by the

DGAD in its preliminary ndings, bet ween

MCPI and RIL, a signicant capa city expan-

sion took place in 2010-11 from 2.59 million

tonnes to 3.42 million tonnes, or an

increase of 32%. In addition, capacity

utilisation improved from 81% to 86%

after the capacity expansion (Table 1).

According to the asso ciation, actual manu-

facturing capa city for PTA installed is

lower than what has been claimed. The

PTA Users As sociation has claimed that

actual capa city is 3.24 million tonnes RIL:

2.05 million tonnes and MCPI: 1.19 million

tonnes and consequently, capacity utili-

sation during 2012-13 was 102% in the

case of RIL and 70% in the case of MCPL.

The association has further claimed that

RIL will earn extra-normal prots on ac-

count of the imposition of the anti-dump-

ing duty. Its plant that produces naphtha,

which is used to manufacture PX in the

rst two stages towards the production of

PTA effects a sale of PX to the plant pro-

ducing PTA which is used to report losses

on the manufacture of PTA. Besides RIL,

companies like Indian Oil consume the

PX that is manufactured from naphtha.

RIL also sells naphtha in the open market.

Incidentally, as already stated, Indian Oil

has neither supported RILs application

for imposition of anti-dumping duty nor

reported any losses in the PTA business.

Malaysian Subsidiary

What is particularly noteworthy is the

fact that while RIL and MCPI applied for

imposition of an anti-dumping duty on

imports of PTA from China, South Korea,

EU and Thailand, the applicants did not

ask for a similar duty on PTA imported

from Malaysia. Why? The association

points out that in September 2012, Reli-

ance Global Holdings (part of the Reli-

ance group) bought BP Chemicals (Ma-

laysia) Sdn Bhd (BPCM) from the British

Petroleum (BP) group for $230 million.

BPCMs PTA plant was commissioned in

1996 and has an annual production ca-

pacity of 6,10,000 tonnes.

The PTA Users Association drew an

inference...that the raw material for the

production of PTA (PX) was sent to

M alaysia, converted into PTA and then re-

imported and sold in India. The quantum

of PTA imported into India from the Reli-

ance groups PTA plant in Malaysia was

19,228 tonnes between December 2012

and July 2013, the association stated.

All these arguments did not convince the

DGAD that it should not impose an anti-

dumping duty on imports of PTA. The DGAD

uses several tools to determine whether

material interest has been harmed and

injury has been caused. The directorate

in the department of commerce examines

the extent to which there could have

been a signicant increase in the volume

of dumped imports, either in absolute

terms or in relation to production or

consumption in India, and its effect on the

domestic industry. The DGAD also looks at

the existence of price undercutting and

the extent to which the dumped imports

are causing price depression or prevent-

ing appreciation of the price for the goods

(which otherwise would have occurred).

Negative Impact on Textile Imports

Polyester bre makers in India import

substantial quantities of PTA because de-

mand exceeds supplies made by domes-

tic manufacturers. Demand for PTA is

predicted to go up by around 20% a year

in the near future. India is the second

largest consumer of PTA in Asia after

China. In 2013-14, the country exported

textiles worth $40 billion, of which

roughly a quarter was in the form of syn-

thetic textiles. The Department of Com-

merce wants to increase this gure to

$50 billion during the current nancial

year but this may not happen if the high-

er costs of PTA make Indian fabrics, tex-

tiles and garments relatively expensive.

The imposition of anti-dumping duties

on imported PTA from a select group of

countries (excluding Malaysia) will clearly

prove detrimental to the users of the mate-

rial, including exporters of s ynthetic fab-

rics and garments from India, while bene-

ting one company the most, which is RIL.

On 3 August, this writer emailed a

detailed questionnaire to the corporate

communications department of RIL. The

email was followed up by telephone calls

to two representatives of the company.

Written responses were solicited to the

claims and arguments that had been made

by companies and different associations

against RIL. These include the claim that

the governments decision to impose an

anti-dumping duty is against the interests

of users of PTA and exporters of synthetic

yarn, fabrics and garments, while prima-

rily beneting one company; that RIL is

earning super-normal prots through

pricing of internal transfers of raw mate-

rials and intermediates; and that RIL and

MCPI did not deliberately seek the impo-

sition of an anti-dumping duty on PTA im-

ports from Malaysia where the Reliance

group has interests in a PTA plant. More

than two weeks later, there was no re-

sponse to the questionnaire at the time of

completing this article on 18 August.

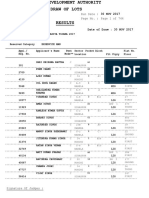

Table 1: Production, Capacity and Capacity Utilisation of Indian Manufacturers of PTA

Unit 2009-10 2010-11 2011-12 POI

Production of IOC* Metric Tonnes 5,30,604 4,31,000 5,54,084 5,54,084

Capacity of IOC** Metric Tonnes 5,50,000 5,50,000 5,50,000 5,50,000

Capacity utilisation of IOC % 96 78 101 101

Production of RIL* Metric Tonnes 20,48,512 20,33,169 20,72,998 20,89,083

Capacity of RIL** Metric Tonnes 20,50,000 20,50,000 20,50,000 20,50,000

Capacity utilisation of RIL % 99.9 99.17 101 102

Production of MCPI* MT 4,06,971 7,24,023 6,79,834 8,32,977

Capacity of MCPI** MT 5,45,000 11,90,000 11,90,000 11,90,000

Capacity utilisation of MCPI % 75 61 57 70

IOC: Indian Oil Corporation; RIL: Reliance Industries Ltd; MCPI: Mitsubishi Chemical Corporation PTA India.

POI: Period of Investigation.

*: Petition filed by the applicants, RIL and MCPI. **: As per the understanding of the PTA Users Association.

You might also like

- Thewire - Anand 2023in-How Years of Neglect and Wrong Policies Hit Indias Promising Textile and Apparel SectorsDocument6 pagesThewire - Anand 2023in-How Years of Neglect and Wrong Policies Hit Indias Promising Textile and Apparel SectorsAmlan RayNo ratings yet

- PlasticsDocument8 pagesPlasticsAAYUSHI VERMA 7ANo ratings yet

- A Study On Environmental Compliance of Indian Leather Industry & Its Far Reaching Impact On Leather ExportsDocument40 pagesA Study On Environmental Compliance of Indian Leather Industry & Its Far Reaching Impact On Leather Exportsryo ShuklaNo ratings yet

- Chapter-1: Part A: About Industry Part B: Company Profile Part C: About The TopicDocument56 pagesChapter-1: Part A: About Industry Part B: Company Profile Part C: About The TopicTuhin RoyNo ratings yet

- 0QpUa0LN - Vietnam Plastics BriefingDocument10 pages0QpUa0LN - Vietnam Plastics BriefingMiley Minh HuyenNo ratings yet

- Roy 2012Document40 pagesRoy 2012SELVA BHARATHINo ratings yet

- Final ReportDocument30 pagesFinal Reportramupushpa753No ratings yet

- Als, EtcDocument8 pagesAls, Etc218-Harsh NarangNo ratings yet

- Kowledge Paper PlasticDocument185 pagesKowledge Paper PlasticNishant MishraNo ratings yet

- Polyamide MRKT IndiaDocument14 pagesPolyamide MRKT IndiagautamahujaNo ratings yet

- Effects of Globalization On Indian Industry Started When The Government Opened TheDocument8 pagesEffects of Globalization On Indian Industry Started When The Government Opened TheAmit SinghNo ratings yet

- Reliance Industries in ChinaDocument24 pagesReliance Industries in ChinaSanddeepTirukoveleNo ratings yet

- Plastics - DolatDocument90 pagesPlastics - DolatSaurabh LohariwalaNo ratings yet

- Porter's Five Forces Analysis On Plastic IndustriesDocument23 pagesPorter's Five Forces Analysis On Plastic IndustriesRezaul Karim RajuNo ratings yet

- 10 Chapter2 PDFDocument54 pages10 Chapter2 PDFModi HaniNo ratings yet

- NCJ May 2011Document102 pagesNCJ May 2011techkasambaNo ratings yet

- Pretochemical Swot AnalysisDocument2 pagesPretochemical Swot AnalysisMamtha MNo ratings yet

- Chemical IndustryDocument15 pagesChemical Industryprasadtsiva100% (1)

- Chemical Industry of IndiaDocument3 pagesChemical Industry of IndiaRitikaNo ratings yet

- Diagnostic Study Report of Cotton Knitwear - TirupurDocument30 pagesDiagnostic Study Report of Cotton Knitwear - TirupurDebopriyo J Burman RoyNo ratings yet

- Sintex Industries Companyanalysis92384293424Document16 pagesSintex Industries Companyanalysis92384293424Vijay Gohil100% (1)

- New Polyurethane Capacity Closes in On Tight MarketDocument5 pagesNew Polyurethane Capacity Closes in On Tight Marketkatie farrellNo ratings yet

- The Petrochemical Industry in India Has Been One of The Fastest Growing Industries in The CountryDocument6 pagesThe Petrochemical Industry in India Has Been One of The Fastest Growing Industries in The CountryVishakh KrishnanNo ratings yet

- Organization Study (12354Document39 pagesOrganization Study (12354Gobs Mix100% (1)

- Covi̇d Teksti̇l SektörüDocument23 pagesCovi̇d Teksti̇l SektörüemreNo ratings yet

- Assignment 4Document7 pagesAssignment 4Yash DNo ratings yet

- Petrochemicals - A SWOT AnalysisDocument2 pagesPetrochemicals - A SWOT AnalysisShwet KamalNo ratings yet

- PetrochemicalsDocument25 pagesPetrochemicalsNilton Rosenbach Jr100% (1)

- The Incompatibility of Anti-Dumping LawsDocument9 pagesThe Incompatibility of Anti-Dumping LawsIJEMR JournalNo ratings yet

- Ailing Indian PVC IndustryDocument5 pagesAiling Indian PVC IndustryCharu SharmaNo ratings yet

- Dismantling Quota Restrictions (QR) in International Textile Trade - India S ResponseDocument12 pagesDismantling Quota Restrictions (QR) in International Textile Trade - India S ResponseDr. Bina Celine DorathyNo ratings yet

- Industry ProfileDocument17 pagesIndustry ProfileSreelal P M LalNo ratings yet

- Sector Update - Chemical Industry - Aug 2019-201908291312319244043Document6 pagesSector Update - Chemical Industry - Aug 2019-201908291312319244043Krishna KumarNo ratings yet

- Final Project MrunalDocument53 pagesFinal Project MrunalPravin RamtekeNo ratings yet

- PUdaily Weekly Newsletter 201846Document2 pagesPUdaily Weekly Newsletter 201846Dasun NirmalaNo ratings yet

- Chlor Alkali Industry in India StatusDocument2 pagesChlor Alkali Industry in India StatusVM ONo ratings yet

- Literature ReviewDocument4 pagesLiterature Reviewsnravi100% (1)

- Apparel Merchandising and MarketingDocument87 pagesApparel Merchandising and MarketingBhuva_jana100% (1)

- Annual Report 2012 EngDocument2 pagesAnnual Report 2012 EngIndra Chandra SetiawanNo ratings yet

- Role of Polymer in Growth of Indian EconomyDocument4 pagesRole of Polymer in Growth of Indian EconomymuzammilshaikhNo ratings yet

- Reliance Industries Limted Company AnalysisDocument10 pagesReliance Industries Limted Company AnalysisDivya Prakash MishraNo ratings yet

- Plastic IndustryDocument9 pagesPlastic IndustryYepuru ChaithanyaNo ratings yet

- Pest Analysis of KTMDocument23 pagesPest Analysis of KTMorakzai_496_547831500% (1)

- Chemical Industries and Their Mismanagement Punishable by LawDocument10 pagesChemical Industries and Their Mismanagement Punishable by LawEditor IJTSRDNo ratings yet

- Chemical Petrochemical SectorDocument6 pagesChemical Petrochemical SectorKu RatheeshNo ratings yet

- National Textile Policy 2000-ReviewDocument20 pagesNational Textile Policy 2000-ReviewNarasimha Reddy DonthiNo ratings yet

- Khushboo Plastics Project 2Document42 pagesKhushboo Plastics Project 2vishalNo ratings yet

- A Future Challenge To Pakistan Exports: Industrial PollutionDocument3 pagesA Future Challenge To Pakistan Exports: Industrial Pollutionaa_dawoodiNo ratings yet

- 2g Spectrum: Political CorruptionDocument4 pages2g Spectrum: Political Corruptioncoolaayush18716No ratings yet

- 160 P16che4b 2020051801115246Document3 pages160 P16che4b 2020051801115246ca23m008No ratings yet

- Final ProjectDocument66 pagesFinal ProjectVikram VrmNo ratings yet

- Case Study - Valuation of Ultra Tech CementDocument26 pagesCase Study - Valuation of Ultra Tech CementKoushik BiswasNo ratings yet

- A Brief Report On Textile Industries in IndiaDocument10 pagesA Brief Report On Textile Industries in IndiaShreshta KhimesraNo ratings yet

- Recent Trends and Developments in Textile Industry in India: October 2015Document5 pagesRecent Trends and Developments in Textile Industry in India: October 2015Dhimas AditamaNo ratings yet

- ExportsDocument5 pagesExportsGaurav MehtaNo ratings yet

- Polymer Demand in IndiaDocument2 pagesPolymer Demand in IndiasarafonlineNo ratings yet

- Plastic IndsutryDocument28 pagesPlastic IndsutryJagdish LamtureNo ratings yet

- Reaching Zero with Renewables: Biojet FuelsFrom EverandReaching Zero with Renewables: Biojet FuelsNo ratings yet

- Ethical Hacking ManualDocument134 pagesEthical Hacking ManualJoel Eljo Enciso SaraviaNo ratings yet

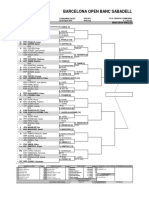

- Barcelona Open Banc Sabadell: City, Country Tournament Dates Surface Total Financial CommitmentDocument1 pageBarcelona Open Banc Sabadell: City, Country Tournament Dates Surface Total Financial CommitmentJoel Eljo Enciso SaraviaNo ratings yet

- Workshop: Hacking Societies, Habits and Rituals, Berkeley 2019Document3 pagesWorkshop: Hacking Societies, Habits and Rituals, Berkeley 2019Joel Eljo Enciso SaraviaNo ratings yet

- Hacking The Waveform: Generalized Wireless Adversarial Deep LearningDocument30 pagesHacking The Waveform: Generalized Wireless Adversarial Deep LearningJoel Eljo Enciso SaraviaNo ratings yet

- Viruses: Development of American-Lineage Influenza H5N2 Reassortant Vaccine Viruses For Pandemic PreparednessDocument11 pagesViruses: Development of American-Lineage Influenza H5N2 Reassortant Vaccine Viruses For Pandemic PreparednessJoel Eljo Enciso SaraviaNo ratings yet

- Barcelona Open Banc Sabadell: City, Country Tournament Dates Surface Total Financial CommitmentDocument1 pageBarcelona Open Banc Sabadell: City, Country Tournament Dates Surface Total Financial CommitmentJoel Eljo Enciso SaraviaNo ratings yet

- 2222Document55 pages2222Joel Eljo Enciso Saravia100% (1)

- Root Insurance: Car Insurance Based On How People Drive, Not Who They AreDocument4 pagesRoot Insurance: Car Insurance Based On How People Drive, Not Who They AreJoel Eljo Enciso SaraviaNo ratings yet

- Jail Roster Report: Charges 1 2 Offense Level Order TypeDocument44 pagesJail Roster Report: Charges 1 2 Offense Level Order TypeJoel Eljo Enciso SaraviaNo ratings yet

- Rates PDFDocument1 pageRates PDFkrunal24No ratings yet

- Rates PDFDocument1 pageRates PDFkrunal24No ratings yet

- SSC MTS Notification PDFDocument47 pagesSSC MTS Notification PDFTopRankersNo ratings yet

- Westwide SNOTEL Current Snow Water Equivalent (SWE) % of NormalDocument1 pageWestwide SNOTEL Current Snow Water Equivalent (SWE) % of NormalJoel Eljo Enciso SaraviaNo ratings yet

- List of Broadcaster BouquetsDocument47 pagesList of Broadcaster BouquetsNareshram LNo ratings yet

- 1 PDFDocument50 pages1 PDFJoel Eljo Enciso SaraviaNo ratings yet

- PDF Apple SR 2019 Progress ReportDocument66 pagesPDF Apple SR 2019 Progress ReportJack Purcher100% (1)

- 1 PDFDocument12 pages1 PDFJoel Eljo Enciso SaraviaNo ratings yet

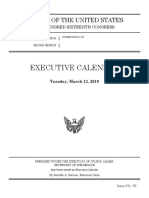

- Executive Calendar: Senate of The United StatesDocument28 pagesExecutive Calendar: Senate of The United StatesJoel Eljo Enciso SaraviaNo ratings yet

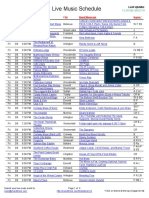

- Live Music Schedule: Everett RockDocument9 pagesLive Music Schedule: Everett RockJoel Eljo Enciso SaraviaNo ratings yet

- 1Document8 pages1Joel Eljo Enciso SaraviaNo ratings yet

- Blockchain Technology Overview: NISTIR 8202Document68 pagesBlockchain Technology Overview: NISTIR 8202Joel Eljo Enciso SaraviaNo ratings yet

- SSC CHSL 2019 NotificationDocument56 pagesSSC CHSL 2019 NotificationLokesh Gupta100% (3)

- USB Promoter Group Announces USB4 SpecificationDocument2 pagesUSB Promoter Group Announces USB4 SpecificationJakub ČížekNo ratings yet

- Bpxa500 v2r3Document1,120 pagesBpxa500 v2r3Joel Eljo Enciso SaraviaNo ratings yet

- FFFFFDocument744 pagesFFFFFJoel Eljo Enciso SaraviaNo ratings yet

- DFDocument6 pagesDFJoel Eljo Enciso SaraviaNo ratings yet

- 2 PDFDocument21 pages2 PDFJoel Eljo Enciso SaraviaNo ratings yet

- 4 PDFDocument24 pages4 PDFJoel Eljo Enciso SaraviaNo ratings yet

- 4Document4 pages4Joel Eljo Enciso SaraviaNo ratings yet

- Enso - Evolution Status Fcsts WebDocument32 pagesEnso - Evolution Status Fcsts WebJerauld BucolNo ratings yet

- Hope You Had An Enjoyable Ride!: Your Grab E-ReceiptDocument3 pagesHope You Had An Enjoyable Ride!: Your Grab E-ReceiptaslfkjNo ratings yet

- FDFGDocument3 pagesFDFGHemanth DevaiahNo ratings yet

- Intl LiquidityDocument3 pagesIntl LiquidityAshneet BhasinNo ratings yet

- Saregamapa L'il Champs 2011 June 03 '11 - Sanjana BholaDocument12 pagesSaregamapa L'il Champs 2011 June 03 '11 - Sanjana BholaGagan Deep SinghNo ratings yet

- Marco Glisson April 15Document127 pagesMarco Glisson April 15glimmertwinsNo ratings yet

- Tire City AssignmentDocument6 pagesTire City AssignmentXRiloXNo ratings yet

- Taxation of CorporationsDocument78 pagesTaxation of CorporationsGlory Mhay67% (12)

- Cassava Business Proposal LBPDocument12 pagesCassava Business Proposal LBPjunieNo ratings yet

- 2.4 Fractions-Of-An-AmountDocument8 pages2.4 Fractions-Of-An-AmountAboo HafsaNo ratings yet

- GA55Document2 pagesGA55chandra vadanNo ratings yet

- Jos Tech Academy (Lusaka, Zambia)Document3 pagesJos Tech Academy (Lusaka, Zambia)Cristian RenatusNo ratings yet

- Slum TourismDocument10 pagesSlum TourismJudalineNo ratings yet

- .Au Evidence Historical Details For ABN 72 066 207 615 - ABN LookupDocument2 pages.Au Evidence Historical Details For ABN 72 066 207 615 - ABN LookupricharddrawsstuffNo ratings yet

- Credit CardDocument3 pagesCredit Cardprashant1807No ratings yet

- Godrej Loud-PresentationDocument12 pagesGodrej Loud-PresentationBhargavNo ratings yet

- Engineering Economy 3Document37 pagesEngineering Economy 3Steven SengNo ratings yet

- Brenner.a Thousand Leaves.2009 23pp PRDocument23 pagesBrenner.a Thousand Leaves.2009 23pp PRpeoplesgeography8562No ratings yet

- Chapter 3 Problem 9: R&E Supplies Facts and Assumptions ($ Thousands) Actual Forecast Forecast 2017 2018 2019Document5 pagesChapter 3 Problem 9: R&E Supplies Facts and Assumptions ($ Thousands) Actual Forecast Forecast 2017 2018 2019阮幸碧No ratings yet

- Arch Act - Ar Intan PDFDocument89 pagesArch Act - Ar Intan PDFIhsan Rahim100% (1)

- SDP SI Acetal Gear Mod 05 144 TeethDocument1 pageSDP SI Acetal Gear Mod 05 144 Teethgoooga299No ratings yet

- Sample/Pre-Board Paper 9 Class X Term 1 Exam Nov - Dec 2021 English Language and Literature (Code 184)Document6 pagesSample/Pre-Board Paper 9 Class X Term 1 Exam Nov - Dec 2021 English Language and Literature (Code 184)Tamil FutureNo ratings yet

- Problems in ConstructionDocument2 pagesProblems in Constructionjkrs1990No ratings yet

- Assignment EcoDocument5 pagesAssignment EcoFatima AlsiddiqNo ratings yet

- Final Intern ReportsDocument123 pagesFinal Intern ReportsKAWSER RAFINo ratings yet

- BPTP Floors, Sec-70 A Master - NewDocument27 pagesBPTP Floors, Sec-70 A Master - NewSachin100% (2)

- Ap Macro 2017-2018-BurbineDocument10 pagesAp Macro 2017-2018-Burbineapi-366462466No ratings yet

- Segmentation of Indian ConsumerDocument16 pagesSegmentation of Indian Consumerdeepak asnora0% (1)

- Anansit QP-DOC-01 Context of OrganizationDocument5 pagesAnansit QP-DOC-01 Context of OrganizationTan Tok Hoi100% (2)

- Budget Analysis and Deficit Financing 91: ApplicationDocument1 pageBudget Analysis and Deficit Financing 91: ApplicationpenelopegerhardNo ratings yet