Professional Documents

Culture Documents

HDFC Bank

Uploaded by

Aakash Bhargava0 ratings0% found this document useful (0 votes)

121 views90 pagesproject

Original Title

HDFC BANK

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentproject

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

121 views90 pagesHDFC Bank

Uploaded by

Aakash Bhargavaproject

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 90

A

SUMMER TRAINING PROJECT REPORT

ON

COMPARATIVE STUDY

OF FINANCIAL INSTITUTIONS

OFFERING HOME LOANS

IN

MASTER OF BUSINESS ADMINISTRATION MASTER OF BUSINESS ADMINISTRATION

(SESSION 2009-11) (SESSION 2009-11)

SUBMITTED TO:

Ms. Neha Gupa Ma!

SUBMITTED B":

Aa#ash Bha$%a&a

BBA-'

T(

SEM

RO)) NO-0*91+101,10

-AGANNAT( INTERNATIONA) MANAGEMENT

S.(OO)

/A)/A-I0 NE1 DE)(I

.ONTENTS

Acknowledgement

Executive Summary

Company Profile

Objective of the study

ajor players in the field of housing finance

!etails of loan transfer cases studies "Analysis#

$end analysis of financial

%nstitution offering home loans

&esult and suggestions

&esearch And ethodology

'imitations

(A)S

Appendix

)uestionnaire

*ibliography

2REFA.E

%ndustrial interface through project is compulsory for

the fulfilment of **A degree course+ so that student are able to

reali,e the practical experience of corporate world through

project+ we come to understand the between theories and real

aspects of business-

% feel pleasure in presenting this report title

.FINANCIAL INSTITUTIONS OFFERING HOME

LOANS which is detailed collection and survey of /!(C

*ank and other competitors-

Study of market share is very essential for an

organi,ation to position its product in the market

successfully-

% expect that the comparative analysis of offering home

loan by different financial institutions+ and various

data are beneficial to my company- $he conclusions

are drawn and recommendations have been put better

of the performance of /!(C *ank-

A./NO1)EDGEMENT

% am very thankful to M$. Aa#ash Bha$%a&a "officer0

recoveries# for giving me valuable suggestions and ideas for

completing the project report- % am also grateful to M$.

Ashu3sh Bha$45a6 (B$a78h Ma7a%e$0 De9h:) for his help and

keep interest in project-

% am grateful to Ms. Neha Gupa Ma! my project guide

who provided me valuable guidance and should a great deal of

enthusiasm and commitment for this project+ without his

guidance this project might not have reached the present stage-

All the faculty member of 1agannath %nternational anagement

School+2alkaji and all the concerned persons contacted under

the summer project report-

AAKASH BHARGAVA

BBA-5

TH

SEM

ROLL NO - 06914101710

E;E.UTI<E

SUMMAR"

E;E.UTI<E SUMMAR"

/ousing finance is one of the industries which are driven by ups

and downs in the real state industry- Although there has been an upsurge

in the demand for the home loans in the recent past+ it has not translated

into a stupendous performance by the housing finance companies

"/(C3s#-the housing finance industry is important from the point of view

of over all development of the economy -/ousing is being increasingly

viewed as being important for over all infrastructural development in the

economy- $he national housing policy reflected the trust +the government

wished to give to the housing sector and pointed out that housing was not

merely a consumption expenditure +but also a productive investment

which would provide economic activity and create a base for attaining

several national policy goals such as providing shelter and raising the

4uality of life - %t specifies the interest rate to be followed in lending and

borrowing+ income recognition 5 prudential norms+ borrowing limits 5

audits to the finance cos -%n spite of such figures there is an urging need

on the part of management to keep close look on financial institutions

offering loans- Comparative study of financial institutions that is exactly

what our project aimed at- $o give our project a more structured look we

had taken certain parameters -$his provides us a clear picture regarding

the financial institutions- %n addition to the above proper analysis was

done with the help of certain financial tools-

.OM2AN" 2ROFI)E

OF

(.D.F..

2ROFI)E OF (.D.F..

/-!-(-C was set up on 67

th

October+ 6877 by %-C-%-C-%- out of the

consideration that a specialised institution was needed to channel

household savings as well as funds from the capital market into the

housing sector- /-!-(-C- has emerged as the largest mortgage finance

institution in the country- $he primary objective of /-!-(-C is to enhance

residential housing stock and promote home ownership- One of its major

objectives is to increase flow of resources for housing through the

integration of housing financial institutions with the domestic market-

Ma$#e:7% e==3$

arketing efforts and initiatives at /!(C '$! have always revolved

around the customer- $he objective is to reach out to the customer and

provide him9her with all housing related solutions- $hus /!(C '$! has

right since inception positioned it self not just as a company providing

finance to customers+ but a company that also provides loan counselling+

technical and legal assistance and other property related solutions- Credit

appraisal skill and legal and technical expertise has been built over the

years- $hese set of skills+ supplemented with the vast database and trained

personnel is today proving to be one of /!(C '$!3 strongest assets-

App$3&a9s a74 D:s>u$se!e7s

$otal approvals during the year stood at &s-8+ :;6-<= crores as against

&s->?78-77 crores in the previous year+ representing a growth of @6A-

'oan disbursements during the year were &s-7+ >6>-=> crores against

&s-=+ ?:@-:6 crores in the previous year representing a growth of @6A-

SUBSIDIARIES AND ASSO.IATES

/ousing is the core business of /!(C '$!- while the main focus is to

grow the housing portfolio+ organically and inorganically+ in order to

capitalise on /!(C strong brand value and maximise returns for

shareholders+ /!(C '$! has made investments in various group

companies- $hese group companies have strong synergies with /!(C

'$! and such diversification will enable /!(C '$! to offer a wide

gamut of financial services and products to customers- %nvestments made

in the group companies are from borrowed funds+ where there is an

interest charge debited to the profit and loss account+ with out a

corresponding revenue flow in the initial years- Bhile these investments

are long0term in nature+ the businesses have tremendous potential+

thereby enhancing the valuations of /!(C- $he shareholding of /!(C

in its subsidiary and associate companies as at arch @6+ <::@C are

givenC0 /!(C !evelopers 'imited+ /!(C %nvestments 'imited+ /!(C

/oldings 'imited+ /!(C $rustee Company 'imited+ /!(C Chubb

Deneral %nsurance Company 'imited+ /!(C &ealty 'imited+ /!(C

Asset anagement Company 'imited+ D&E/ (inance 'imited+ %ntelenet

Dlobal Services 'imited+ Credit %nformation *ureau"%ndia# 'imited+

/!(C Securities 'imited+ /!(C *ank 'imited-

R:s# Ma7a%e!e7

/!(C manages various risks associated with the mortgage business-

$hese risks include credit risk+ li4uidity risk and interest rate risk- /!(C

manages credit risk through stringent credit norms- 'i4uidity risk and

interest rate risks arising out of maturity mismatch of assets and liabilities

are managed through regular monitoring of the maturity profiles-

2RUDENTIA) NORMS FOR (OUSING FINAN.E

.OM2ANIES((F.?s)

$he F/* has issued guidelines to /(CGs on prudential norms for income

recognition provisioning+ asset classification+ provision for *ad and

!oubtful+ Capital ade4uacy and concentration of credit 9 investment-

/!(CGs position with respect to the guidelines is as followsC0

/!(CGs capital for the purpose of determine the capital ade4uacy

companies entirely of $ier 6 Capital- $he $ier was &s- <+:>>-76

Crores- %n accordance with the norms prescribed by F/*+ /!(CGs

capital ade4uacy is at 6;-:=A of risk weighted assets-

Assets are classified as standard+ Sub0Standard+ doubtful and loss

assets- Any asset which is not standard asset is a non0performing

asset- $he principal loans outstanding"along with Preference Shares

and !ebentures for financial real

Estate projects# + where payments were in arrears for over six

months as of march @6+<:::+amounted to &s- 8?-76crores and

constituted :-8:A of the portfolio-

/!(C is in compliance with the limits prescribed by F/* in

respect of concentration of credit9investment-

OB-E.TI<E OF

T(E STUD"

OB-E.TI<E OF T(E STUD"

$o undertake competitive analysis and to understand the information

contained in the financial statement with a view to know the weakness

and strength of the firm and to make a forecast about the future

prospects of the firm-

$o assess the present profitability and operating efficiency of the firm

$o assess the long term as well as short term li4uidity position of the

firm-

$o find out the influencing features 9 benefits behind home loans-

$o find out the preferences of the people regarding certain parameters-

$/%S $A*'E S/OBS $/E C&%$E&%A $/A$ /AS *EEF

(O''OBE! %F

S$E!H%FD $/E (%FAFC%A' %FS$%$E$%OFS O((E&%FD /OE

'OAFS

C&%$E&%A

PA&AE$E&S

%nterest rate

Charges

Product offer

Advertising

Schemes

*alance sheet

$HPE O( AFA'HS%S

&atio Analysis

$rend Analysis

MA-OR 2)A"ERS IN T(E

FIE)D OF

(OUSING FINAN.E

MA-OR 2)A"ERS IN T(E FIE)D OF

(OUSING FINAN.E

ajor housing finance institutions are identified on the basis of the

following parametersC

6- Fet Sales

<- Fet Profit

@- Fet Borth

1. NET SA)ES

NET SALES

0

1000

2000

3000

H

D

F

C

L

I

C

I

C

I

C

I

C

A

N

F

I

N

S

b

i

Financial Institutions

N

e

t

S

a

l

e

s

(

I

n

C

r

o

r

e

s

)

Series1

c

%n the financial year <::@ I :; + /!(C 'td- recorded the highest net sales

of &s- <>8:-;7 crores followed by '%C /ousing (inance 'td- with net

sales of &s-?7@-<> crores+%C%C% /ome fin-co-ltd with &s-686-8> crores+

CAF(%F /omes'td- &s- 6@?-8; crores and S*% /ome (inance 'td-

&s-@8-@> crores-

2. NET 2ROFIT

NET PROFIT

-200

0

200

400

600

800

H

D

F

C

L

I

C

I

C

I

C

I

C

A

N

F

I

N

S

b

i

Financial Institutions

N

e

t

P

r

o

f

i

t

(

I

n

c

r

o

r

e

s

)

Series1

%n the year <::@ I :; + /!(C 'td- recorded the highest net profit of &s-

=?:-:6 crores followed by '%C /ousing (inance 'td-with net profit of

&s-6;7-=; crores+%C%C% /ome fin-co-ltd &s-8-=? crores+ CAF(%F /omes

'td- with &s- 6>->@ crores and S*% /ome (inance'td- &s-08:-68 crores-

@. NET 1ORT(

NET WORTH

-1000

0

1000

2000

3000

HDFC LIC ICICI CANFIN Sbi

Financial Institutions

N

e

t

W

o

r

t

h

(

i

n

c

r

o

r

e

s

)

%n the year <::;I:=+ /!(C recorded the highest net worth of &s-

<7:<-?; crores followed by '%C /ousing (inance 'td- with net worth of

&s- 7@7- <@ crores+ %C%C% /ome fin-co-ltd &s-6>6-?? crores+ CAF(%F

/omes 'td- &s- 66@-:= crores and S*% /ome (inance 'td-&s-06=;-7?

crores-

ANA)"SIS

ANA)"SIS ()OAN TRANSFER)

)6- Bhat is the reason 9 benefit that influences your choice of the

financial institution for a housing loan J

0

10

20

30

40

P

e

r

c

e

n

t

a

g

e

Reasons !enefits

&easons"A# ;: : ; ; 6< <? 6<

%nterest

&epayme

nt Pd

Scheme

Easy

Avail

Ads

%nt 9Easy

avail

%nt9Sch

AFA'HS%S

(rom the above given data we can conclude that out of a sample si,e of

<= + majority+ that is ;:A of the respondents are influenced by interest

rates+<?A by interest rates and easy availability of the loan+ ;A look out

for various schemes+ and 6<A are influenced by both interest rates and

schemes available-

)<- Allocate Hour preferences in ranking order which makes you decide

about a financial institution for a housing loan -

0

5

10

15

20

25

30

35

40

P

e

r

c

e

n

t

a

g

e

(

"

)

Preferenecs Ran#e$ %

Percentage(%) 40 1 3 4 12 28 12

Interest

Repayme

nt Pd

Scheme

Easy

Avai

Ads

Interest!

avaia"i

Interest!

Scheme

AFA'HS%S

(rom the above graph and data it can be said that ;:A of the customers

give their first priority to rate of interest+ <?A rank interest rates 9 easy

availability as their priority+6<A each are affected by advertisements and

interest rates 9 schemes+ and ;A+@A and 6A give their first preference to

easy availability+ scheme and repayment period-

)@- /ow do you rate /!(C 'td- in the following services J

a# %nterest &ates

b# &epayment Period

c# Customer Care

d# $ransaction Period

&

'&

(&

)&

*&

Ser+ices Offere$ ,- H.FC

P

e

r

c

e

n

t

a

g

e

(

"

)

E/cellent

0er- 1oo$

1oo$

Poor

0er- Poor

Excellent ? ;: ;; <:

Kery Dood >: => 6> =<

Dood <? ; 6< <;

Poor ; : ; :

Kery Poor : : <; :

%nterest &ates &epayment Period Customer Care

$ransaction

Period

)-;# Bhat is the reason of your loan transfer from /!(C 'td- J

0

5

10

15

20

25

30

35

40

P

e

r

c

e

n

t

a

g

e

(

"

)

Reasons Of Loan Transfer

Percentage(%) 40 16 16 8 20

Higher

Rate Of

Interest

Less

Loan

Amount

Lac of

Informati

on

Longer

!anction

Perio"

Annua#

Rest

AFA'HS%S

Out of a sample si,e of <= + ;:A of the respondents said that they shifted

to other financial institutions because of /igher rate of interest charged in

/!(C '$!+ 6>A transferred because they did not get the full amount

they wanted as loan+ 6>A said they were not given relevant information

time to time by the /!(C '$! staff + ?A said that disbursement period

was too long and <:A said that E% was calculated on Annual &est basis

rather than on onthly rest basis-

)=- %n what terms 9 services do you find the other institutions "in which

your loan is

transferred# is better than us J

20%

24%

12%

44%

Better Services

Customer Cre

Fu!! Lo" Amou"t

S"ctio"e#

Lo$ %te &' I"terest

AFA'HS%S

(rom the above given data we can conclude that <:A out of a sample si,e

of <=+ said that services of other financial institutions are better than

/!(C '$!+ ;;A said that they shifted to other institutions because of

low interest rate as compared to /!(C '$!+ <;A said that customer care

services are better as proper information is given and customers are

informed personally about the new schemes and 6<A said they shifted

because they got the desired loan amount sanctioned-

)>-Can we do anything to help you J

0

5

10

15

20

25

30

35

40

P

e

r

c

e

n

t

a

g

e

(

"

)

Reasons Of Loan Transfer

Percentage(%) 16 12 24 8 40

$onth#%

rest

O&tion

Im&ro'e

the

!er'ices

(ustome

r (are

)u## Loan

Amount

*othing

AFA'HS%S

(rom the above given data we can conclude that ;:A of the respondents

said nothing can be done now when $hey have already Shifted to other

financial %nstitutions+ <;A said /!(C '$! should improve its customer

care services+ 6>A said that monthly rest option should be introduced+

6<A said services should be improved and ?A said that the desired loan

amount should be sanctioned-

)7- Are you satisfied with services of the financial institution you are

currently dealing withJ

60%

40%

(es

No

AFA'HS%S

Out of the sample si,e of <= + >:A of the customers said that they are

satisfied with the services of the financing institutions they are currently

dealing with but still ;:A of the respondents said that services of /!(C

'$! were better as compared to other institutions-

)?- (inancial %nstitutions in which Customers of /!(C '$! transferred

their loan J

;;A

6>A

6>A

?A

6<A

;A

ICICI

PN!

S!I

!O!

LIC

OTHERS

AFA'HS%S

(rom the above data we can conclude that majority of customers that is

;;A have shifted to %C%C% /ome fin- co- ltd the reason being low interest

rates+ 6>A have transferred to S*% and PF*+ and ? A have shifted to

*O*+ 6<A have shifted to '%C and rest ;A to other financial institutions

like SHF!%CA$E bank+ S$AF!A&! C/A&$E&E!+A''A/A*A!

*AF2 etc-

TREND ANA)"SIS OF

FINAN.IA)

INSTITUTIONS

T$e74 a7a9As:s 3= =:7a78:a9 :7s:u:37s

/!(C 'td

"EAR

ENDING

SA)ES Rs

.$3$e

2BT Rs

.$3$e

TREND(B)SA

)ES

TREND(B)

2BT

8? 6;;=-<= @<>-=@ >6 =8

88 67><-?7 @?8-:< 7; 7:

:: <:66-?6 ;>:-8= ?= ?@

:6 <@7;-? ==>-<@ 6:: 6::

:< <>8<-;6 >8:-8@ 66@ 6<;

S*% home finance ltd-

"EAR

ENDING

SA)ES Rs

.$3$e

2BT Rs

8$3$e

TREND(B)SA

)ES

TREND(B)

2BT

8? ?<-<> 07-=> <:; @=

88 >>-88 0;;-=6 6>> <:7

:: =@-=@ 0<;-<; 6@@ 66<

:6 ;:-@7 0<6-== 6:: 6::

:< @8-;> 08:-6< 8? ;6?

'%C housing finance ltd-

"EAR

ENDING

SA)ES Rs

.$3$e

2BT Rs

.$3$e

TREND(B)SA

)ES

TREND(B)

2BT

8? ;8;-?; 66;-<@ >= 78

88 =76-76 6<;-?8 7= ?:

:: >=7-67 6@7-?@ ?> ??

:6 7><-:@ 6=>->= 6:: 6::

:< ?7@-<> 6?:-?7 66= 66=

CAF(%F homes ltd-

"EAR

ENDING

SA)ES Rs

.$3$e

2BT Rs

.$3$e

TREND(B)SA

)ES

TREND(B)

2BT

8? 6::-<> 6;-?6 7? >;

88 6:8-7> 68-;> ?> ?;

:: 66<-87 6?-<7 ?8 78

:6 6<7->@ <@-68 6:: 6::

:< 6@8-:@ <;->? 6:8 6:>

%C%C% /OE (%F- CO- '$!

"EAR

ENDING

SA)ES

Rs .$3$e

2BT Rs

.$3$e

TREND(B)SA)

ES

TREND(B)2

BT

8? FA FA : :

88 FA FA : :

:: FA FA : :

:6 =7-7= 6-8@ 6:: 6::

:< 686-8> 6<->; @@<-@8 >==

T$e74 (B) sa9es 3= =:7a78:a9 :7s:u:37 3==e$:7% h3!e 93a7s-A

83!pa$:s37

P!T Tren$ (") of financial institutions

offering ho2e loans3 A co24arison

&

'&&

(&&

)&&

*&&

H

.

F

C

S

!

I

L

I

C

C

A

N

F

I

N

I

C

I

C

I

Financilal Institutuions

P

r

o

f

i

t

!

e

f

o

r

e

T

a

/

T

r

e

n

$

(

"

)

%55*

%555

'&&&

'&&%

'&&'

&

6&

%&&

%6&

'&&

'6&

7&&

76&

H.FC S!I LIC CANFIN ICICI

Financial Institutions

T

r

e

n

$

S

a

l

e

s

"

%55*

%555

'&&&

'&&%

'&&'

ANA)"SIS

(rom the graph and the data table we can arrive the conclusion that on the

whole+ there was a continuous increase in volume as well as profit before

tax of financial institutions except S*% home finance 'td- not only the

client was arrested but positive growth was also visible from the year

688? to <::@-

*ut the figure of the S*% home finance 'td when compared with the

figure of other financial institutions reveal that the sales have reduced

year by year- $he sales of the financial institutions have continuously

over a period of five years commencing from 688?- $he over all analysis

of the financial institutions shows that the financial institutions are doing

well and financial position is bound to be good-

RESU)T

AND

SUGGESTIONS

RESU)T AND SUGGESTIONS

On the basis of the ratio analysis and trend analysis it can be said that the

position of the /!(C 'td is sound from the point of view+ of leverage+

profitability+ and solvency- On the other hand interest coverage ratio and

fixed assets turnover ratio of /!(C 'td is showing and increasing

position+ of course+ never falling below the previous year- $his means that

firm is maintaining its li4uidity and long term solvency position of the

firm seems to be stronger than other financial institutions- $he gross

profit ratio of /!(C 'td has also increase which reflects better

managerial and operational picture- $he /!(C 'td- is showing a study

and upward trend of percentage sales and the trend percentage of profit

before tax which is growing year by year- (inally we want to give some

suggestions on the basis of comparative study of financial institution

offering home loans-

&A$E O( %F$E&ES$ should be competitive with other financing

institutions-

Emphasis should be given on retaining customers-

Proper credit appraisal of the customers should be done-

&elevant information should be provided to customers time to

time-

People who deal with customers should have full knowledge about

the housing finance industry-

$he area where we lack is the area of Advertising /!(C 'td

should do more organi,ed communication between the costumer

and the branch offices-

&egular news letter should be send to the customers by post

+courier to enhance awareness of the home loan schemes -

Resea$8h Meh34393%A

Resea$8h Meh34393%A

Sa!p9e a74 Sa!p9:7% Meh34

Sampling is the process of collecting information only from a small

representative part of the population- Stratified &andom Sampling is one

amongst the most elementary random sampling techni4ues- A stratified

random sampling is a method that allows each possible sample to have an

e4ual probability of being picked and each item or individual in the entire

population have an e4ual chance of being included in the sample- (or this

project work+ without replacement sampling method is used- %t means that

a person or item once selected is not returned to the frame and therefore

cannot be selected again- $his selection process continues until the

desired sample si,e Ln3 is obtained-

Sample Selection C As the objective of the project is to study the

Employee Engagement to know the perception of the Employees+ sample

is selected from Koice and Fon voice based profiles-

S3u$8e 3= 4aa: (or the purpose of the study the following sources of

data are used-

2$:!a$A 4aaC Primary data refers to the collection of first hand data-

!ata is collected through

)uestionnaire

Observations

Cues:377a:$eC )uestionnaire is prepared and circulated to the

employees to know their opinion-

O>se$&a:37sC Observations were done during the visits to the

organi,ation-

Se8374a$A 4aaC

Secondary data refers to the data+ which is not newly generated but rather

obtained from-

Published sources-

Enpolished sources i-e-+ information about the performance of the

company

&eport on the study-

&eview of literature etc-

i- Sampling chosen with the &andom method

ii- Sampling Area would be !elhi 5 FC& and near area only

iii- Sample Si,eC 6::

)IMITATIONS

)IMITATIONS

6# $ime was a major constraint+ in completing the project- As the project

was very vast and there was paucity of time-

<# (rom the different financial institutions we could not get the data of

ending year <::= so i am not able to comparative study on the ending

year <::=-

@# !uring the analysis i have taken those financial institutions which

have the same accounting policies-

;# Some of miner factor where neglected during the analysis because of

lack of time how ever i try to put in my best in the limited period and

covered the major factor-

RO)E OF NATIONA) (OUSING BAN/

Fational housing bank was formed as a subsidiary of the &*% when

national /ousing Policy was announced in 688? regulating the housing

finance industry in %ndia- $he national housing policy reflected the trust+

the government wished to give to the housing sector and pointed out that

housing was not merely consumption expenditure+ but also a productive

investment which would provide economic activity and create a base for

attaining several national policy goals such as providing shelter and

raising the 4uality of life- $he national housing policy also envisaged that

an impetus given to housing would stimulate economic activity through

creation of substantial employment opportunities-

$he national housing bank specifies various norms to be followed

by the /(C3s and regulates the industry on line of regulation of F*(Cs

by the &*%- %t specifies the interest rate to be followed in lending and

borrowing+ income recognition and prudential norms+ borrowing limits

and audit to the housing finance companies- %t provides refinancing

facility to the housing finance companies and facilitates promotion of

these companies on the specified lines-

O>6e8:&es 3= N(B

$he following are the major objectives of F/*0

6- to promote + establish+ support or aid in the promote and

establishment of housing finance institutionsM

<- to make a loans and advances or render any other form of financial

assistance whatsoever to housing finance institutions and scheduled

bank to any authority established by 9under any central state act and

engaged in slum clearanceM

@- to subscribe to or purchase stocks+ shares+ bonds+ debentures and

securities

of every other descriptionM

;- to guarantee the financial obligations of housing finance institutions

and underwrite the issues of stocks+ shares+ bonds+ debentures and

securities of every other description of housing finance institutionsM

=- to coordinate with '%C+ E$%+ D%C and other financial institutions in

the discharge of its overall functions and

>- $o act as an agent of the central 9state government "s# or &*%9any

authority authori,ed by &*%-

NORMS FOR A22RO<A) OF (OUSING

FINAN.E .OM2ANIES B" N(B

F/* refinances only those /(C3s that are approved to be set up by it-

Some of the conditions that have to be set up by it - Some of the

conditions that have to be met for approval areC

6- inimum paid up capital of /(C should at least be &s-6 cr-

<- At least < directors on the board should be nominated by banks+

financial institutions or by F/*-

@- Any appointment of auditors should only be done by prior approval

of the F/*-

;- At least 7=A of the housing loans that are to be granted should be

of long I term nature-

=- Promoter3s contribution in /(C should at least be @:A of the total

paid0up capital- Of the remaining capital+ at least <:A of the capital

should be contributed by either one or all of banks+ financial

institutions+ and government or approved housing finance

companies-

>- $he proposed housing finance company should not promote a real

estate or a construction company and should maintain an Larm3s

length Ldistance from such companies- F/* has imposed

restrictions as regards to their names+ relationship with construction

companies and so on- $he names of /(C3s- Should not resemble

the name of any construction company and the top management of

the /(C should not hold similar offices in construction company-

TaD $ea!e7 3= )3a7s =3$ 837s$u8:7% (3uses:

Section <;"6# of the %ncome $ax Act allows deduction of interest on

borrowed capital from the Dross Annual Kalue of the house on accrual

basis- Any interest paid on the loan borrowed for the purpose of

constructing9 buying or upgrading the house for which the annual value is

assessed+ is allowed as deduction- Also+ any interest on the amount

borrowed during the pre0construction period "starting form the date of

borrowing and ending on arch @6

st

or the date of completion of the

construction+ which ever is earlier# is allowed to be deducted in five

successive years-

&educe taxable income by claiming deduction upto &s-6+ =:+:::90 p-a-

on the interest payable u9s <;"b# of the income $ax Act+ 68>6-

Claim tax rebate upto &s-;:::90p-a- subject to a maximum principal

repayment of &s-<:+ :::90p-a- u9s ??"<# "xiv# of the income $ax Act+

68>6-

The Ohe$ I7::a:&es

2$3>9e!s

$he lack of ade4uate loan security is cited as the most pernicious

stimuli,ing block of mortgage finance-

'ow mortgage tenure- $he existing loan tenure is 6= years in %ndia

while in overseas it can exceed ;: years-

/(C3s face asset mismatch problem-

Sudden spurt in credit will have an inflationary impact on housing

with regard to prices- ainly because of construction time lag-

23ss:>9e s39u:37s

One route adopted overseas to tackle defaults is by mortgage

%nsurance+ where mortgage premiums are paid along with E%S-

ortgage terms should be raised and the escalation in mortgage risk

for the /(% due to higher tenure can be mitigated by early

repayment option-

ortgage securiti,ation permits the /(C3s to offload long0term

mortgages to other investors- $he stumbling block here is high

stamp dutyIas high as @ percent-

&oute more funds through the consumer to the developer- Bhich

obviates the need for /(C3s to directly finance the developer in

addition+ if the developer is dependent on the consumer demand

simulated by mortgage availability for a large part of funds+ he will

reduce cash component to house value too-

GENERA) TERMS AND .ONDITIONS OF A

(OUSING )OAN

$he (ollowing are the terms and conditions applicable to the basic

/ousing 'oan product only- $hese are likely to vary with respect to the

different types of /ousing 'oans-

6- $he loan to value ratio cannot exceed a particular percentage- $his

differs from product to product and from one /(% to another-

<- $he maximum tenure of the loan is normally fixed by /(%s-

/owever+ /(%s do provide for different tenors with different terms

and conditions-

@- $he instalment that you pay is normally restricted to about ;:A of

your monthly gross income- $his is known as the %nstalment to

%ncome &atio "%%&#-

;- Hour total monthly outflow towards all the loans that you have

availed of including the current loan is normally restricted to =:A

of your Dross onthly %ncome- $his is known as the (ixed

Obligation $o %ncome &atio "(O%&#-

=- Hou will be eligible for a loan amount which is the lowest as per

your eligibility- $his is calculated as per the '$K norms+ the %%&

norms and the (O%& norms as mentioned above-

>- ost /(%s consider your profile before they judge your repayment

capacity- Hou are judged on the basis of age+ 4ualifications +

number of dependents + employment details + employer

credentials + work experience + previous track record of repayment

of any loans that you have availed of occupation + the industry to

which your business relates to if you are self0 employed + your turn

over in the last @ I ; years + etc-

7- Some /(%s have a team of civil engineers visit the site to get a

technical report on the 4uality of construction and compliance with

the local laws before they disburse the loan-

?- Some /(%s insist on guarantees from other individuals for due

repayment of your loan- %n such cases you have to arrange for the

personal guarantee before the disbursement of your loan takes

place-

8- ost /(%s have a panel of lawyers who go through your property

documents to ensure that the documents are clear and are not

misrepresented- $his is an added benefit that you get when you

avail of a loan from /(%-

6:-$he disbursement of your loan is as per the progress of

construction of your property unless it is a ready property in which

case the disbursement will be by one single che4ue- PE% or

Simple %nterest on the loan amount disbursed to you in case of a

part disbursement will be payable by you on the disbursement-

66- $he disbursement+ in most cases+ will be favouring the builder or

the seller or the society or the development authority as the case

may be- $he disbursement will come in your favour under special

circumstances only-

6<-Hou repay the loan either through !eduction Against Salary+ Post

!ated Che4ues+ standing instructions or by cash 9 !!-

6@-$he principal is amorti,ed either on annual reducing or monthly

reducing basis as the case may be-

$he above terms and conditions are generally true for most /(%s with

respect to /ousing 'oans- /owever+ $he specific terms and conditions

vary with respect to specific /(%s-

.$e4: D38u!e7a:37

Bhat are the typical credit documents that need to be submitted to the

/(%J

Diven below is the exhaustive list of credit documents that need to be

submitted for a general product- $he documents vary from one /(% to

another based on your employer+ 4ualifications+ etc- $he general

re4uirements are as follows C

6- %ncome documents

<- Proof of employment

@- Employer3s details "%n case of private limited companies#

;- Proof of age

=- Proof of residence

>- Proof of name change "%f applicable#

7- Proof of investments "%f re4uired#

?- A copy of the marriage certificate is re4uired by some /(C3s

I783!e D38u!e7s

Salary slips for the last three months

Appointment letter

Salary certificate

&etainership agreement+ if appointed as a consultant

(orm 6> issued by the employer in your name

'ast three years Profit 5 'oss Account Statement duly attested by

a Chartered Accountant employed-

'ast three years *alance Sheets duly attested by a Chartered

Accountant+ if self I employed-

'ast three years %ncome $ax &eturns duly filed and certified by the

%ncome $ax authorities-

2$33= 3= E!p93A!e7

%dentity card issued by your employer

Kisiting card

E!p93Ae$Es 4ea:9s (I7 8ase 3= p$:&ae 9:!:e4 83!pa7:es)

Profile of employer on employer3s letterhead "to be signed by a

senior person in the organi,ation# comprising of C

a# Fame of promoters 9 !irectors

b# *ackground of promoters 9 !irectors

c# Fature of business activity of your employer

d# Fumber of employees

e# 'ist of branches 9 factories

f# 'ist of suppliers

g# 'ist of clients 9 customers

h# $urn over of your employer-

i# Annual reports of your employer for the last two to three

years-

2$33= 3= a%e (A7A 37e 3= he =39935:7%)

Passport

Koter3s %! card

PAF card

&ation card

Employer3s %dentity card

School leaving certificate

*irth certificate-

2$33= 3= $es:4e78e.(A7A 37e 3= he =39935:7%)

PAF card

&ation card

Passport

&ent agreement+ if you are staying currently on rent

*ank pass book

Allotment letter from your company if you are residing in company

4uarters-

2$33= 3= 7a!e 8ha7%e (I= app9:8a>9e)

A copy of the official ga,ette

A copy of a newspaper advertisement publici,ing the name change

arriage certificate

2$33= 3= :7&es!e7s (I= $eFu:$e4)

*ank statement for the last six months of all operating and salary

accounts

*ank statements for the last six months of all current accounts+ if

self0employed

Any other photocopies of investments held+ if re4uired by the /(%-

)e%a9 D38u!e7a:37

Bhat are the typical legal documents that need to be submitted to the /(%

J

Diven below is a list of legal property documents that need to be

submitted to the /(% for mortgage of your property- $he name and the list

of documents vary from state and also depend on the property being

financed- A broad outline of documents re4uired is given below- (or a

detailed the documents are re4uired to be submitted+ for a property in

aharashtra-

1. A88epa78e 83pA 3= he 3==e$ 9ee$ :ssue4 >A he (FI.

2. T:9e 438u!e7s 3= he p$3pe$A ha :789u4e

Sale agreement duly registered

Own contribution receipts

Allotment letter

&egistration receipt

'and documents indicating ownership+ if applicable

Possession letter

'ease agreement+ if applicable "Property bought from a

development authority#

ortgage deed if the /(% opts for a registered mortgage

@. N3 3>6e8:37 8e$:=:8ae =$3! he 4e&e93pe$0 s38:eA 3$

4e&e93p!e7 auh3$:A as app9:8a>9e.

+. 2e$s37a9 Gua$a7ees0 := app9:8a>9e.

'. I7 8ase 3= a9e$7ae 3$ a44::37a9 se8u$:A0 438u!e7s =3$ he

sa!e 4epe74:7% up37 se8u$:A 4ea:9s.

*. 23s 4ae4 8heFues =3$ he EMIs.

$he above documents are only indicative in nature and do not cover the

entire list- %t may also be noted that in a resale case+ the previous chain of

agreements also need to be taken-

D:==e$e7 #:74s 3= 8ha$%es app9:8a>9e 3 (3us:7% )3a7 p$34u8s:-

All the different kinds of charges mentioned below may not be levied by

all /(%s- Hou will need to check the different charges that are levied by

your /(%s before availing of a loan- $he different kinds of charges

applicable to /ome 'oans are listed below-

2$e-4:s>u$se!e7 8ha$%es

6- Processing fees-

<- Administrative fees-

@- &ate of %nterest-

;- 'egal charges

=- $echnical charges-

>- Stamp duty and registration charges-

7- Personal Duarantee form charges

23s-4:s>u$se!e7 8ha$%es

6- Che4ue *ounce charges

<- !elayed Payment charges

@- Additional charges

;- %ncidental charges

=- Prepayment charges

>- P!C Swapping charges

2$e-4:s>u$se!e7 8ha$%es

2$38ess:7% =eesC $his is a charge that is levied by most /(%s to

cover the costs that they incur on the processing of your loan

application-$his has to be paid at the time of submission of the

application form-%t3s normally charged as a percentage of the loan

amount sanctioned-Some /(%s also charges a flat fee based on the

loan amount instead of a percentage- Bhen a lower Amount is

sanctioned the excess fees paid at the time of submission of the

application is adjusted with the charges+ which you make to the

/(% subse4uently- ost /(%s refund your processing fee if your

loan application is rejected

A4!:7:s$a:&e =ees: $his charge is again+ normally+ a percentage

of the loan amount sanctioned- %t is collected by the /(% for the

maintenance of your records+ issuing interest certificates+ legal

charges+ technical charges+ etc- through the tenure of the loan- %t is

payable by you when accept the offer letter given by the /(%- $his

payment has to be made before you avail of the disbursement- $he

mode of collection of these fees varies from one /(% to another-

Rae 3= I7e$es: $his is the rate of interest applicable on your loan

amount through the tenure of the loan- %t is charged on the principal

on either annual reducing method or monthly reducing method-

$he difference between the two has been detailed out in the

Dlossary section under the respective heads- ost /(%s give you

an option to select either a fixed rate of interest or a variable rate of

interest- $his is also covers in the Dlossary section under the

respective for your information-

)e%a9 8ha$%es: Some /(%s levy legal charges that they incur on

getting your property documents vetted by their panel of lawyers-

Te8h7:8a9 8ha$%es: $hese charges are also levied by certain /(%s

to meet their expenses on the technical site visits to your property-

Sa!p 4uA a74 $e%:s$a:37 8ha$%es: /(%s that go in for a

registered mortgage or English mortgage "see Dlossary for more

details# pass these charges on to you- $hese are rather heavy in

certain states depending on the laws laid down by the state where

you buy a property-

Personal Duarantee form chargesC Since the personal guarantees

provided by you need to be stamped+ these charges are also

recovered from you- $hey are charged to you by /(%s who demand

for Duarantees-

23s-4:s>u$se!e7 8ha$%es

.heFue B3u78e .ha$%es: %n case the Che4ue through which you

make a payment to /(%s gets dishonoured+ some minimum charges

are levied by the *ank- $he same are recovered from you-

De9aAe4 2aA!e7 .ha$%es: /(%s charges delayed payment charges

from you if you delay the payment of instalments beyond the due date-

A44::37a9 8ha$%es: $hese are levied as a percentage on the delayed

payment charges by most /(%s- $hey are levied if you fail to pay the

dues within the stipulated time after a delay has taken place-

I78:4e7a9 8ha$%es: $his is payable in case the /(%s sends a

representative from their organi,ation to collect their outstanding

dues- %t is normally charged at a flat rate per visit- $hese charges are

levied by most /(%s

2$epaA!e7 8ha$%es: $his is a penalty charged by /(%s from when

you make either a part prepayment or a full repayment of loan- $his

charge is levied only on lump sum payments and not on the E%S that

you pay- $his charges is levied on the amount prepaid by you and not

on the entire outstanding principal- $hese charges are gradually being

discontinued by the /(%s-

2D. s5app:7% 8ha$%es: %n case+ you wish to swap the P!Cs given

by you to the /(% for your E% repayments+ some /(%s charges a flat

fee for the same-

)33# >e=3$e A3u 9eap

6- /ow not to trip up while taking a loanJ

Applying for a loan is a complicated process where a customer is faced

with many bewildering choices- %t is important to make the right

impression on your loan officer to get the loan you want- /owever+ there

are some important to make the right impression on your loan officer to

get the loan you want- /owever+ there are some things that you should

just not do- /ere are 6: common0enough pitfalls to avoid while applying

for a loan-

D37E 9:e :7 A3u$ app9:8a:37 =3$!

All the columns in the application form are meant to provide vital

information that the prospective lender uses to evaluate your

creditworthiness- !o not leave out any important details about your

income+ your address "both temporary 5 permanent# and about your past

or existing relationship with the lender- All this information has also to be

supported by documents- 'ying in the application form amounts to

fudging documents-

D37E =u4%e sa9a$A s9:ps a74 :783!e sae!e7s

!on3t ever fudge salary slips or income statement- Hour loan officer

handles hundreds of loan cases- $he chances are+ he knows ever trick in

the book before you could even think of one- (udging salary slips is a

serious offence- %t is fraudulence of a high order- !on3t ever do it -not

only will you not get this loan+ you can even be blacklisted by not only

this lenders too "given the amount of information0sharing between

companies#-

D37E %3 :7 =3$ a 83-app9:8a7 u79ess : :s 7e8essa$A

'oan officers are notoriously conservative- $he greater the pile of

documents related to your case in their files+ the more comfortable they

feel- Hou should always put your foot sown when a loan officer asks for

more guarantors or asks you to bring another co0applicant- $he loan

officer could be convinced of your case but may be merely trying to

protect himself from all possible eventualities- %f you follow his dictates-

Hou are killing the prospects of the co0applicant to procure a loan for

herself in the future-

D37E 3==e$ p$33= 3= a 9a&:sh 9:=esA9e 3 p$3&e 8$e4:53$h:7ess

Hour loan officer is only interested in seeing the ade4uacy of your

income- $his emerges clearly out of the income documents you submit

with your loan application- So an effort to project al lifestyle merely to

impress him is a define no0no- %t could even backfire on you if he feels

that you are living beyond your means- &emember+ he can reject your

loan application on this ground- %f you ever blew your month3s salary on

your favourite perfume or that gorgeous pashmina shawl+ please don3t tell

him-

D37E >3u78e 3$ $eu$7 8heFues

Hour bank statement speaks volumes about your spending habits- %t

mirrors your spending behaviour- %t provides your loan officer with a

comprehensive view of how you manage your money- %f there are too

many che4ues bounced or returned check entries in your bank statement+

be prepared with a convincing explanation and papers to prove it-

Denerally+ though+ there should not be any Che4ue returns or bounced

che4ues- %t lowers your creditworthiness and could result in lower or no

borrowing-

D37E sh35 a 89ea7e4-3u a883u7

aintain a certain balance a show some savings in your account-

Otherwise you will come across as someone who is barely able to meet

his expenses- Savings in your account will show the loan officer that

you3ll be able to meet the E%- Otherwise you will have to come up with

a convincing plan of lowering your expenses-

D37E h:4e 4ea:9s a>3u 3he$ 93a7s

%f there is a recurring payment on an exiting loan+ make sure you3ve

mentioned the existing liability in the form- Since other loan repayments

bring sown your incomeIto Iinstalment ratio and result in a lower loan+

this is a vital piece of information- !on3t hide details about the loan-

Consider consolidating all your debt before going in for another loan-

D37E =u4%e 4ea:9s 3= p$3=ess:37a9 4e%$ees

'oans to self0employed professionals are extended on the strength of the

professional degree and the income "especially in case of a personal

loan#- %n such a case+ fudging your professional degree or income

documents can seriously jeopardi,e your loan application- Professional

4ualifications are almost always verified-

D37E e&e$ ae!p 3 >$:>e he 93a7 3==:8e$

Hou perhaps fees that your loan application is not strong enough to get

you the loan amount you are asking for- And you probably think that you

can grease the palm of the loan officer to enhance your loan eligibility-

Can3t even think about it- Even if you got lucky and your loan officer was

the bad apple in the company3s basket "it could happen#+ your loan is

reviewed by two or sometimes three other people- Hou were not planning

to bribe all of them+ were youJ

D37E a#e a 93a7 a%a:7s A3u$ FD as 8399ae$a90 B$ea# :.

A common mistake most borrowers commit is to borrow against their

fixed deposit- $hey prefer taking loan against their own money at a rate

higher than the rate they are receiving on their fixed deposit- Hou should

consider this option only when you re4uire funds for a very short term-

Otherwise+ it makes sense to encash your (!s- $his way you3d be able to

borrow less-

A22ENDI;

A22ENDI;

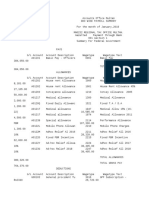

F:7a78:a9 $esu9s 3= he =:7a78:a9 :7s:u:37s =3$ he Aea$ e74e4

Ma$8h 2001 G 200@

(DF. )4

/!(C 'td &s Crore arch <::6 arch<::@

Operating income <:66-?6 <@7;-?

(und base income 68@=-8 <<76-;<

(ree base income 7=-7 6:<-?<

%nterest costs 6;@>-8= 6>?8->6

!epreciation ;6->? ;@-:>

P*!$" FF&$# =:<->@ =88-<8

P*$ "FF&$# ;>:-8= ==>-<@

PA$ "FF&$# ;:6-?6 ;7@->=

Dross fixed assets ;<;-@= =><-:>

'eased assets <>>-<8 <;<-=<

%nvestments @@;6 @:=<-6;

Stock in trade : :

Cash and bank balance 6:?6-6? 6::7-?<

&eceivables 66=>8->= 6;>7=-86

Fet worths <:8=-87 <@76-8;

E4uity capital 668-66 6<:-:?

'ong term borrowing 6<??<-?< 6=;:>-?6

Current liability and

provision

6<<>-:@ 6@;;-?;

N !ata Source C%E

SBI h3!e =:7a78e )4

S*% home finance 'td- arch <::6 arch<::@

Operating income ;:-@7 @8-;>

(und base income @7-8= @>-??

(ree base income <-;< <-=?

%nterest costs =@->> =7-><

!epreciation 6-86 6-?>

P*!$" FF&$# 068->; 0??-<>

P*$ "FF&$# 0<6-== 08:-6<

PA$ "FF&$# 0<6-== 08:-6<

Dross fixed assets @<-:= @<-6=

'eased assets <=-67 <=-67

%nvestments @<-= @;-76

Stock in trade : :

Cash and bank balance <6-7 <6-@@

&eceivables @>6-?? @7=-<>

Fet worths 0>;-=8 06=;-7?

E4uity capital 6= 6=

'ong term borrowing @?8 ;@=-8

Current liability and

provision

66:-77 6;8-==

N !ata Source C%E

)I. (OUSING FINAN.E )TD.

'%C housing finance

'td- &s Crore

arch <::6 arch<::@

Operating income 7><-:@ ?7@-<>

(und base income 7<;-8; ?<8-><

(ree base income @7-:8 ;@->;

%nterest costs =>?-<7 >;;->

!epreciation 6-6> 6-@<

P*!$" FF&$# 6=7-?6 6?<-68

P*$ "FF&$# 6=>->= 6?:-?7

PA$ "FF&$# 6<6-@= 6;=-@<

Dross fixed assets 6=-:6 <6->;

'eased assets : :

%nvestments <;6-=6 @;;-<6

Stock in trade : :

Cash and bank balance =;@-7> ==:

&eceivables =@?7-;8 >@>?-8@

Fet worths >@? 7@7-<@

E4uity capital 7= 7=

'ong term borrowing =<>-?< ><:7-:=

Current liability and

provision

<7?-8> @;;-<;

* !"! S#$%&' CMIE

.ANFIN (OMES )TD

Canfin homes 'td &s

Crore

arch <::6 arch<::@

Operating income 6<7->@ 6@8-:@

(und base income 6<<-@8 6@<-<6

(ree base income =-<; >-?<

%nterest costs 8<-; 6::-;

!epreciation :-=> :-=7

P*!$" FF&$# <@-7= <=-<=

P*$ "FF&$# <@-68 <;->?

PA$ "FF&$# 67->8 6?-8?

Dross fixed assets 7-;< 7-78

'eased assets : :

%nvestments @<-?> @<->>

Stock in trade : :

Cash and bank balance @6-?? ?<-:<

&eceivables ?7-=> 6:>:-:6

Fet worths 6::-:7 66@-:=

E4uity capital <:-;8 <:-;8

'ong term borrowing ?:>-?; 8>?-:<

Current liability and

provision

@>->@ 87-?6

N !ata Source C%E

ICICI HOME FINANCE CO( LT

%C%C% /ome finance co-

'td &s Crore

arch <::6 arch<::@

Operating income =7-78 686-8>

(und base income ;@-;8 6=8-;;

(ree base income 6;-@ @<-=<

%nterest costs @@-6? 6<8-<=

!epreciation :-:7 :-;

P*!$" FF&$# < 6@-:;

P*$ "FF&$# 6-8@ 6<->;

PA$ "FF&$# 6-;8 8-=?

Dross fixed assets :-? @-;

'eased assets : :

%nvestments : 7-?6

Stock in trade : :-6

Cash and bank balance 6:-== ><-6

&eceivables 7<6-78 6><:-==

Fet worths 8;-=7 6>6-??

E4uity capital 8= 66=

'ong term borrowing <=6-= >@:-:?

Current liability and

provision @?7-?@ 8:<-?@

* !"! S#$%&' CMIE

FAC

FAC

6# Bho can avail of a home loanJ

AnyoneO Bell+ anyone who earns a regular income that isO Bhether

youGre in business or working with a company+ as long as youGre in a

position to make repayments+ youGre eligible- $he categories of eligible

applicants are I

Salaried %ndividuals

Self0Employed %ndividuals

Partnership (irms

Private 'imited Companies

So if you belong to any of the above+ consider your loan grantedO

<# Bhen can % make an applicationJ

Hou can apply the minute youGve decided to buy or construct a houseO

$hatGs right+ no bureaucratic waiting periods hereO %n fact+ some /(Cs

"/ousing (inance companies# even assist clients in locating suitable

properties through their dedicated in0house teams- Bhile youGre in the

process of identifying and selecting your property+ you can get an in0

principal approval- $his is valid for @ months during which the interest

rates at which the loan can be taken are locked in- 1ust keep in mind+

however+ that all this depends on whether the property youGve chosen is

acceptable to the finance company+ to enable them to create a valid

mortgage against it-

@# /ow do % go about getting myself a home loanJ

Fothing could be easierO Pick up the prescribed form for loan

applications from your /(C office or download it from the company

website- (ill in all the details and submit it along with the application fee

mentioned- *esides the application fee+ you will have to pay a non0

refundable processing fee+ which will be around :-@06A of the loan

applied for- Once you accept the terms of the loan offer made to you by

the /(C+ you will be charged a minimal administrative fee 0 another :-=0

6A of the loan amount sanctioned- And thatGs it 0 youGre on your way to

buying that dream home for your familyO

Re!e!>e$C if you are not the only person who will own the property you

plan to buy+ the other proposed owners will also have to sign as co0

applicants- $hat however does not mean that all co0applicants have to be

co0owners-

1ust a point to keep in mind+ some /(Cs charges a commitment fee of

6A per annum on the amount of the loan yet to be drawn- $his fee starts

being applicable nine to twelve months from the day you accept the loan

and continues to be charged till you avail of it fully-

;# /ow much time will the loan approval takeJ

Approximately between < and @ weeks-

=# /ow much time will the loan disbursement takeJ

(ortunately+ not muchO After all the relevant documents have been

thoroughly checked and all other formalities such as payment of margin

money "your contribution# etc-+ are completed+ your loan will be

disbursed in one or two weeks+ at the most- And just in case youGre

wondering 0 your contribution is the total cost of the property minus the

amount of the loanO

># %n how many instalments can the loan be disbursedJ

$he loan will be disbursed in full or in suitable instalments "normally not

exceeding# taking into account re4uirement of funds and progress of

construction+ as assessed by the /ousing (inance company- So if youGre

in a time and a cash crunch+ youGll probably get your loan accordinglyO

7# Are there any conditions % have to fulfill to avail a home loanJ

Bell+ depending on which category you belong to+ you need to meet the

following basic re4uirements I

%n the case of self0employed9salaried individuals I

$he age of the individual+ at the time of applying for the loan+

should not be less than <6 years and not more than the retirement

age at the end of the loan tenor- (or a self0employed person+ this

outer age limit can be extended to >= years-

$he individual should be employed for the last @ years-

$he individual should be a resident of the city where the /(C has a

collection center-

%n the case of professionals9businessmen I

A professional "!octor9 Engineer9 CA etc-# should have an

established practice that has been operational over the last @ years-

A businessman should be able to prove his financial soundness over the

last @ years-

?# Bhat are the general documents re4uiredJ

$o put it in a nutshell I

Proof of %dentity

Proof of &esidence

Proof of %ncome-

8# Bhat is the maximum amount % can borrowJ

Denerally speaking+ you can borrow a maximum of ?:0?=A of the cost of

the property "this includes stamp duty and registration charges#- /owever+

do remember that this limit is also linked to your paying capacity- Esually

the installment0to0income ratio "%%&# ranges between <=0=:A of a

personGs total income- Het another factor would be the upper ceiling on

the amount that the /(C itself can lend- So depending on how much you

earn and how much the /(C is able to lend 0 the maximum amount

would vary from person to person-

6:# /ow will the /(C decide the loan amount % am eligible forJ

Dood 4uestionO 'etGs see 0 the most basic criterion will be your repayment

capacityO $hat in turn will depend upon I

Hour income+

%ts stability and continuity+

Hour age+

Hour educational 4ualifications+

$he number of dependents you have+

Hour spouseGs income+

Hour assets and liabilities+

Hour savings history-

Other factors which would influence the amount of loan granted would be

I

$he purpose for which youGre taking the loan "purchase+

construction+ extension or renovation of the house property#+the

time you need to repay it-

$o put it simply+ what the /(C is concerned with while determining loan

eligibility 0 is that you should be able to repay the loan 0 comfortablyO

66# Fow if youGre wondering how the /(C calculates your monthly

incomeC hereGs a close look at how it all adds upO

$he /(C takes into account all your recurrent credits i-e-C

*asic Salary+ /&A+ and other allowance apart from '$A and

medical any rental income that you are getting-

$he amount you save on rents thanks to your moving from a rented

house to your own house-

%f your spouse is working and is your co0applicant+ his9her income will be

clubbed together with yours-

%n short+ for salaried people+ the calculation will be+ in the form of a

simple sum I

7e 8ash :7=935s - eDpe7ses H 83!!:ss:37

(or self0employed people or private companies+ the calculation will be as

per your profit and loss account I

7e p$3=: H 2I@$4 4ep$e8:a:37 H 4:$e83$s? $e!u7e$a:37

Once the E% capacity of the person has been estimated and the tenure of

loan repayment is known+ the /(C decides on the loan amount it can

provide- $his is done with the help of an E% table-

As you can see+ itGs all very scientific and sensible+ so you donGt have to

worry your own head too muchO-

$hatGs as far as detailed calculations goes- /owever some /(Cs have

schemes for professionals like CAs+ !octors+ *As and Architects which

are delightfully termed Gplain vanilla dealsGO %n these cases the amount of

loan is simply 60< times the gross receipts of the said professional-

6<# Bhat kinds of property can be financed through a home loanJ

$o get finance+ the property you choose has to be acceptable to the /(C-

$he age of the property should not be more than <= years and the title to

the property should be clear and unencumbered- %n other words+ there

should be no hidden snags or doubtful ownership claims for the property

loan to get a go0aheadO

6@# Can % get a loan for commercial property+ like offices etc-J

Hes+ you certainly can but in that case+ the loan to property0value ratio is

much less than in the case of a residential property-

6;# Can % get a loan for renovationJ

Hes+ you can get a home improvement loan for internal and external

repairs "waterproofing+ roofing+ painting+ plumbing+ electrical work+

tiling+ flooring etc-# and other structural improvements-

$he improvements have to be those that will increase the life of your

home+ contribute towards a better living environment and at the same

time+ add to the value of your house- $o get such a loan+ you need to

submit an estimate from your architect to the /(C- /owever+ you must

remember that the maximum loan amount and the maximum loan tenor

allowable is much less in this case than if you were buying or

constructing a brand new house-

6=# Can % get a loan for a plot of landJ

Sure you canO Again+ however+ the loan to value ratio will be less than in

the case of other home loans-

6># !oes the agreement for sale have to be registeredJ

Hes+ very much so- %n many states in %ndia+ the Agreement for Sale

between the builder and the purchaser is re4uired by law to be registered-

Hou are advised+ in your own interest to lodge the Agreement for Sale at

the office of the Sub0registrar appointed by the State Dovernment under

the %ndian &egistration Act+ 68:?

%n fact+ the Enion cabinet decided to make registration of immovable

property compulsory and restrict it to the area where the property is

located in order to streamline the system+ curb malpractices and black

money generation+ and plug huge revenue leakages- As a result of this

order+ GbenamiG purchases and illegal transfers on power0of0attorney basis+

both common practices in cities like !elhi+ will hopefully be controlled

and reduced to some extent-

67# !oes the property have to be insuredJ

Hes+ you will have to ensure that the property is duly and properly insured

for fire and other appropriate ha,ards+ as re4uired by the /(C during the

period of the loan and will have to produce evidence each year and9or

whenever re4uired by the /(C- $he /(C will be the beneficiary of the

insurance policy- $his is an added cost that will add to the final cost of

purchase of the property 0 so donGt forget to account for it when youGre

planning your houseO

6?# Can % get a loan for properties held on power0of0attorney basisJ

Fo- After the measure taken by the union cabinet to make the registration

of immovable property mandatory+ the /ousing (inance companies

would not be able to grant a loan for property held on a power0of0attorney

basis-

68# Bhat is meant by the margin in a loanJ

$he finance companies do not finance the full value of the house- $hey

finance up to ?:0?=A of the property0value- $he remainder has to be

invested by the person taking the loan- $his is called margin money-

<:# Bhat is meant by the term co0applicantJ

A home loan is taken either in a single name by an individual or jointly-

%n such a case+ the other person applying for the same loan is known as a

co0applicant

<6# Bho can be my co0applicantJ

%f you are an individual 0 your spouse+ your parents+ or even your children

can be your co0applicants and their incomes can be clubbed with your

income to enhance the amount of loan you are eligible for- %t makes sense

therefore+ that the co0owner of a property has to be a co0applicant+ but a

co0applicant need not be the co0owner of the property- %f you are a

partnership or a private limited company+ any one of the directors or

partners can be your co0applicant

<<# Bhat are the various costs that have to be paid to the /ousing

(inance company to avail of a home loanJ

After all+ you need to know what youGre going in forO Bell+ the various

charges involved in availing a housing loan are I

I7e$es 83s

the interest cost for the finance provided-

2$38ess:7%0 O&e$hea4 a74 A4!:7:s$a:&e .ha$%es

these are one0time payments made for initiating the process of a

housing loan- $hey are generally taken as a percentage of the loan

amount+ subject to a maximum and minimum amount-

2$e-2aA!e7 .ha$%e

these are the charges that are levied for pre0paying the loan-

.3!!:!e7 .ha$%e

$his charge is levied on the un0drawn amount of the loan- $he period for

which it is levied commences after a breathing period of a few months

from the date of sanction- $he charge is levied after this period till the

borrower withdraws the funds-

<@# Bhat is the interest rate on a home loanJ

%nterest rates range between 6<-=06;-=A and vary depending on the loan

amount and the period of repayment-

<;# Bhich interest rate structure is better 0 daily9monthly9annual

reducing and whyJ

*efore you agree to a re0payment structure+ here are the pros and cons of

them all I

Da:9A Re4u8:7%

%n this case+ reducing principal repayments are credited at the end of

every day

M37h9A Re4u8:7%

/ere+ whatever you repay on your principal is credited at the end of every

month+ and interest is calculated on the outstanding principal remaining-

Since you end up paying interest on the reduced principal every month as

compared to interest

On the outstanding principal at the end of every year in the case of annual

reducing+ this tends to be the most beneficial structure+ and is indeed what

most people go forO

A77ua9 Re4u8:7%

Ender this arrangement+ interest is calculated on an annual basis on the

outstanding at the beginning of the year- $he E% therefore becomes

696<th the E4uated Annual %nstallment-

$he difference between daily and monthly rest is very negligible-

<=# Can % get the benefit of reduced interest rates in the intervening

period or the during the balance tenure of my loanJ

Hes you can+ but only if you have opted for the floating rate being offered

by some of the big /(Cs-

<># Bhat is meant by securityJ

Simply what you can offer as guarantees to the /(CO As you will see+

there are various types of securities acceptable I

$he first mortgage "e4uitable9registered# of the property to be

financed by way of deposit of title deeds-

$he personal guarantee of one9two individuals acceptable to the

/(C-

%n the case of loans to allottees of flats9houses built by state housing

development authorities or members of co0operative housing societies 0

interim security such as '%C policies+ pledge of marketable shares and

such other investments need to be provided-

<7# Bhat kind of security do most /ousing (inance companies

re4uireJ

%n most cases+ the property itself+ bought or intended to be bought+

becomes the security and is mortgaged to the lending institution till the

entire loan is repaid- Some companies re4uire additional security such as

life insurance policies+ (! receipts+ share or savings certificates-

<?# Bhat is E%J

E% or E4uated onthly %nstalment+ refers to the fixed sum of money

that you will be paying to the /(C every month- %t comprises both

interest and principal repayment-

$he si,e of the E% depends on various factors I

6- the 4uantum of the loan+

<- the interest rate applicable and the term of the loan-

<8# Bhat is a onthly &educing 'oanJ

A loan in which the principal on which you pay interest reduces with

every monthly payment you make- 'ike we mentioned earlier+ this is the

most beneficial type for the borrowerO

@:# Bhat is an Annual &educing 'oanJ

Ender this scheme+ the principal reduces only at the end of the year-

$herefore+ you continue to pay interest on a portion of the principal

which youGve already actually paid back to the lending company- %n

effect+ you end up paying more under the Annual &educing 'oan as

compared to a onthly &educing 'oan

@6# Bhat is (ixed &ate of %nterestJ

A fixed rate of interest means that the rate of interest on the loan amount

remains unchanged for the entire duration of the loan agreement+

irrespective of changes in the interest rates in the economy- $herefore+ if

you opt for a fixed rate of interest you will not be able to benefit if

interest rates are fallingO On the other hand+ if the rates are rising+ you end

up paying more than you had bargained forO So you see+ itGs one of those

double0edged decisionsO

@<# Bhat is (loating &ate of %nterestJ

A floating rate of interest is one that fluctuates according to the market

lending rate- /ence+ in an environment where interest rates are rising+

your budgeted expenditure on the house loan also goes upO conversely+

when they fall+ you get yourself a cheaper dealO

@@# Bhat are the tax benefits that are applicable to /ome 'oans and

/ome Extension 'oansJ

Every /ome 'oan customer is eligible for tax benefits under Section <;

of the %ncome $ax Act-

A9935a>9e 4e4u8:37 3= :7e$es pa:4 4u$:7% he Aea$ -

As per the *udget <:::0:6+ every customer can claim a deduction

on interest amount of a maximum of &s- 6+=:+::: or the actual

interest paid "whichever is lower# to the /ousing (inance

Company from his Dross $axable %ncome-

TaD eDe!p:37 37 2$:78:pa9 $epa:4 4u$:7% he Aea$ -

*udget <:::0:6 provides for tax exemption on a maximum of <:A of a

principal amount of &s- <:+::: or the actual interest paid during the year

"whichever is lower# to the /ousing (inance Company from the total tax

payable by the customer-

@;# Can % repay my loan ahead of scheduleJ

Bow+ looks like youGre li4uidO Hes+ you can pay your loan ahead of

schedule- /owever+ you must consider that /ousing (inance companies

charge a fee for early redemption of loans- $his fee can vary between 60

<A of the loan amount being prepaid-

BIB)IOGRA2("

BIB)IOGRA2("

Center for onitoring %ndustrial Economy

*ooks

-A- SA/A( 0 anagement Accounting principle and practice

&-P- &AS$OD% 0 (inancial anagement

PAF!EH %- 0 (inancial anagement

Beb I Sites

www-etinvest-com

www-hdfcindia-com

www-indiainfoline-com

CUESTIONNAIRES

CUESTIONNAIRES

% say thanks for agreeing to spare = minutes of yourGs time for filling up this

4uestionnaire- % do this survey by 6:: customers of bank-

60 !O HOE /AKE AFH A9C %F *AF2SJ %( HES D%KE $/E FAE

O( *AF2%FD O&DAF%PA$%OF-

%000000000000000000000000000000 %%0 00000000000000000000000000000

FO

<0 /OB 'OFD &E'A$%OF HOE /AKE B%$/ HOE& *AF2-

A0 'ESS $/AF 6 HEA&- *060@ HEA&S

C0@0= HEA&S- !0O&E $/AF (%KE

HEA&S-

@0B/A$ SA$%S(%E! HOE OS$ %F HOE& *AF2-

A0 &E'%A*%'%$H *0 PE&SOFA' CA&E C0(AS$ SE&K%CE

!0O$/E&S "SPEC%(%E!#

QQQQQQQQQQQQQQQQQQQ--

;0!O HOE '%2E <; /OE&S+ @>= !AHS AF! 7 !AHS A BEE2

*AF2%FD %F $/E P&ESEF$ !AHS-

A# HES *# FO

=0B/%C/ O( $/E E'C$&OF%C *AF2'%FD C/AFFE'S HOE A&E

ES%FD-$%C2

A0A$ *0 P/OFE *AF2%FD C0

O*%'E *AF2%FD

!0%F$E&FE$ *AF2%FD E 0 O$/E&S "SPEC%(%E!# 00000000

>0!O HOE (%F! E0ADE *AF2%FD C/AFFE'S A&E /E'P(E'

(O& HOE-

A# HES *# FO

70CAF E0ADE *AF2%FD C/AFFE'S &EP'ACE $&A!%$%OFA'

*AF2%FD-

A# HES *# FO

?0 (O& B/A$ PE&PESE HOE ESE E0ADE *AF2%FD C/AFFE'S-

A0 CAS/ B%$/!&AB *0 *A'AFCE

%F)E%&H

C0 CAS/ !EPOS%$ ! !0 O$/E& $/AF %$

"Specified#

00000000000000000000000000000000000000000000000000000000000000000000000000000000000000-

80 !O HOE (%F! HOE&SE'( CO(O&$A*'E B%$/ E0ADE

*AF2%FD

C/AFFE'S-

A# HES *# FO

%( FO+B/H J QQQQQQQQQQQQQQQQQQ

6:0 !O HOE $/%F2 E0ADE *AF2%FD C/AFFE'S A&E-

A0 COS$ E((EC$%KE *0 %FC&EASES

P&O!EC$%K%$H

C0 $%E SAK%FD !0 FOF O( $/ESE

660 B/%C/ *AF2 %S *E$$E& %F AFAD%FD E0ADE *AF2%FD

C/AFFE'S-

"&AF2 %F O&!E&-#

A0 %C%C% *0 /!(C C0 %!*%

!0 E$% E0 S*% (0 %F!ES %F!

Suggestions And (eed *ack "About E0Age *anking And Challenges#

QQQQQQQQQQQQQQQQQ-QQQQQQQQQQQQ

QQQQQQQQQQQQQQQQQ-QQQQQQQQQQQQ

2e$s37a9 Dea:9s:-

Fame QQQQQQQQQQQQQQQQQQQQQ--

ADE 0 6?0<=H& <=0 ;:H&-

;:0==H&- O&E $/AF ==H&-

SER 0 (

Occupation QQ-QQQQQQQQQQQQQQQQQ

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)