Professional Documents

Culture Documents

Financial Statement Analysis - Dabur India LTD

Uploaded by

Vishranth ChandrashekarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Statement Analysis - Dabur India LTD

Uploaded by

Vishranth ChandrashekarCopyright:

Available Formats

Introduction of the Company: Dabur India Ltd

With a portfolio of over 400 products, Dabur is todays Indias largest Natural Health & Personal Care

Company. It has two major strategic business units - Consumer Care Business and International Business

Division (IBD). Its products are marketed in over 60 countries. Consumer Care Business adresses

consumer needs across the entire FMCG spectrum through four distinct business portfolios of Personal

Care, Health Care, Home Care & Foods where as its International Business Division (IBD) caters to the

health and personal care needs of customers across different international markets, spanning Nepal,

Bangladesh, the Middle East, North & West Africa, EU and the US with its brands Dabur & Vatika. Below

is a snapshot of financial performance of the domestic as well as the global business of Dabur for the

year 2013-14 and 2012-13. Figures of Consolidated company have been used for further analysis.

Presentation of the Standalone Company and Consolidated Company:

(Rs. in crores)

Particulars Consolidated Standalone

2013-14 2012-13 2013-14 2012-13

Revenue from Operations 7225.89 6277.96 4979.65 4443.62

(including other Income)

Less Expenses:

Cost of goods sold 3400.03 3019.13 2562.63 2313.96

Employee benefits 607.67 498.91 343.93 305.43

expenses

Finance cost 54.15 58.9 19.35 18.4

Depreciation 97.49 84.72 53.89 49.05

Other Expenses 1930.3 1663.3 1137.8 1007.11

Total Expenses 6089.64 5324.96 4117.6 3693.95

Profit before exceptional 1136.25 953 862.05 749.67

and extraordinary

items and tax

Exceptional items 0.00 -4.66 0.00 0.00

Profit before extraordinary 1136.25 948.34 862.05 749.67

items and tax

Extraordinary items -0.72 0.08 -0.72 0.00

Profit before tax 1135.53 948.42 861.33 749.67

Tax expense 219.08 182.63 189.23 158.69

Profit for the year from 916.45 765.79 672.1 590.98

continuing operations

Minority interest 2.53 2.37 0.00 0.00

Profit after minority 913.92 763.42 672.1 590.98

Interest

As we see in the above table, the consolidated topline of the company has increased by 15% over the

previous year as against 12% increase over the previous year of the standalone company. The profit

growth after minority interest is also substantially higher for the consolidated company as against the

standalone company (Close ~20% growth as against ~14% growth of the standalone company)

Topline Growth:

Revenue is a crucial part of financial statement analysis. A companys performance is measured to the

extent to which its asset inflows (revenues) compare with its asset outflows (expenses). If a company

displays solid top-line growth, analysts could view the periods performance as positive even if

earnings growth, or bottom-line growth is stagnant. Conversely, high net income growth would be

tainted if a company failed to produce significant revenue growth. Consistent revenue growth, if

accompanied by net income growth, contributes to the value of an enterprise and therefore the stock

price. Revenue is used as an indication of earnings quality. There are several financial ratios attached to

it, the most important being gross margin and profit margin.

Break-up of the Topline of the consolidated company:

Particulars yr

ended

'14

yr

ended

'13

I Gross Revenue from sale of products 7,132.65 6,199.76

Less: Excise Duty -59.44 -53.38

Net Revenue from sale of products 7,073.21 6,146.38

Sale of Services 0.17 0.3

Other operating Revenues 21.05 22.42

Revenue from operations 7,094.43 6,169.10

II Other Income 131.46 108.86

III Total Revenue 7,225.89 6,277.96

Gross revenue from sale of products has seen a growth of close to 15%. Sale of services and other

operating revenues has seen a decline in growth of close to (43%) and (6%) respectively. However, other

income has seen a growth of close to 21%. A glance into the notes of the report tells us that domestic

revenue from operations has increased from 6,169 crs to 7,094 crs.

Below is the break-up of revenue of operations:

Revenue from operations

Particulars Yr ended march

2014

Yr ended march

2013

A Sale of Products 7,132.65 6,199.76

B Sale of Services 0.17 0.3

C Other Operating Revenues 21.05 22.42

Capital Subsidy - -

Export Subsidy 4.43 6.89

Sale of Scrap 14.17 13.51

Miscellaneous Receipts 2.45 2.02

D Less Excise Duty -59.44 -53.38

Total 7,094.43 6,169.10

Below is the break-up of other income:

Other income Yr

ended

2014

Yr

ended

2013

A Interest Income 92.12 77.47

B Net gain/(loss) on sale of Current Investments (other than

trade)

16.31 9.56

C Revaluation (gain)/ loss on Investments 0.72 6

D Gain on Sale of Fixed Assets 1.15 -

E Miscellaneous Receipts 11.44 8.49

F Rent Received 9.72 7.34

Total 131.46 108.86

Interest income as you see has a growth of close to 19% whereas gain from sale of current investments

has seen a growth of close to 71%. This has mainly brought about a growth in the other income section

by close to 21%.

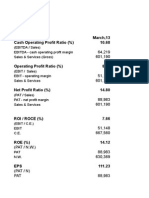

Profitability ratios:

Profitability ratios measure a companys ability to generate earnings relative to sales, assets and equity.

These ratios assess the ability of a company to generate earnings, profits and cash flows relative to

relative to some metric, often the amount of money invested. They highlight how effectively the

profitability of a company is being managed. Different profitability ratios provide different useful

insights into the financial health and performance of a company. For example, gross profit and net profit

ratios tell how well the company is managing its expenses. Return on capital employed (ROCE) tells how

well the company is using capital employed to generate returns. Return on investment tells whether the

company is generating enough profits for its shareholders.

P/L Account of Dabur India Ltd

Consolidated in Rupees Crs

yr ended

'14

yr ended

'13

Total Income 7,225.89 6,277.96

Expenditure

Cost of materials consumed 2,739.04 2,422.11

Purchase of stock in trade 704.44 572.14

Finished Goods -26.43 -2.48

Work in Progress 5.93 -0.87

Stock in Trade -22.95 28.23

Employee benefits expenses 607.67 498.91

Other expenses 1,930.30 1,663.30

EBITDA 1,287.89 1,096.62

Less : Depreciation 97.49 84.72

EBIT 1,190.40 1,011.90

Less: Finance Costs 54.15 58.9

PBT Before Exceptional and Extraordinary

items 1,136.25 953.00

Less :Exceptional item 0 4.66

PBT Before Extraordinary items 1,136.25 948.34

Less: Extraordinary items 0.72 0.08

PBT 1,135.53 948.26

Less: Tax Expense 219.08 182.63

PAT 916.45 765.63

Less: Minority interest 2.53 2.37

Profit after Minority Interest 913.92 763.26

EBITDA

EBITDA is essentially net income with interest, taxes, depreciation, and amortization added back to it,

and can be used to analyze and compare profitability between companies and industries because it

eliminates the effects of financing and accounting decisions.

EBIT

An indicator of a company's profitability, calculated as revenue minus expenses, excluding tax and

interest. EBIT is also referred to as "operating earnings", "operating profit" and "operating income". An

important factor contributing to the widespread use of EBIT is the way in which it nulls the effects of the

different capital structures and tax rates used by different companies. By excluding both taxes and

interest expenses, the figure hones in on the company's ability to profit and thus makes for easier cross-

company comparisons.

PBT

A profitability measure that looks at a company's profits before the company has to pay corporate

income tax. This measure deducts all expenses from revenue including interest expenses and operating

expenses, but it leaves out the payment of tax. This measure combines all of the company's profits

before tax, including operating, non-operating, continuing operations and non-continuing operations.

PBT exists because tax expense is constantly changing and taking it out helps to give an investor a good

idea of changes in a company's profits or earnings from year to year.

PAT

A financial performance ratio, calculated by dividing net income after taxes by net sales. A company's

after-tax profit margin is important because it tells investors the percentage of money a company

actually earns per dollar of sales. This ratio is interpreted in the same way as profit margin - the after-tax

profit margin is simply more stringent because it takes taxes into account.

Computation of different types of margin:

Profitability

Ratios

2014-13 % 2013-12 %

EBITDA

margin

EBITDA/Topline =1287.89/7225.89 17.82% =1096.62/6277.96 17.46%

EBIT Margin EBIT/Topline =1190.40/7225.89 16.47% =1011.90/6277.96 16.11%

PBT Margin PBT/Topline =1135.53/7225.89 15.71% =948.26/6277.96 15.10%

PAT Margin PAT/Topline =916.45/7225.89 12.68% =765.63/6277.96 12.19%

ROCE: Return on Capital Employed

A financial ratio that measures a company's profitability and the efficiency with which its capital is

employed. Return on Capital Employed (ROCE) is calculated as:

ROCE = Earnings before Interest and Tax (EBIT) / Capital Employed

Capital Employed as shown in the denominator is the sum of shareholders' equity and debt liabilities;

it can be simplified as (Total Assets Current Liabilities). Instead of using capital employed at an

arbitrary point in time, analysts and investors often calculate ROCE based on Average Capital

Employed, which takes the average of opening and closing capital employed for the time period.

A higher ROCE indicates more efficient use of capital. ROCE should be higher than the companys capital

cost; otherwise it indicates that the company is not employing its capital effectively and is not

generating shareholder value.

Computation of ROCE for Dabur India Ltd

= EBIT/ Capital Employed

Yr 13-14 Yr 12-13

EBIT 1,190.40 1,011.90

Capital Employed 3017.99 2732.35

ROCE 39.44% 37.03%

Calculation of Capital Employed Yr 13-14 Yr 12-

13

Total Assets 5311.78 4708.54

Less: Current Liabilities 2293.79 1976.19

Capital Employed 3017.99 2732.35

We see that the ROCE has gone up only marginally from the previous year. However, we see that in the

year 13-14, a higher capital employed was observed. This means that the company is able to generate

around 40 Rupees for every 100 rupees invested in the business in the year 13-14 and 37 Rupees for

every 100 rupees invested in the business in the 12-13.

ROE: Return on Equity

The amount of net income returned as a percentage of shareholders equity. Return on equity measures

a corporation's profitability by revealing how much profit a company generates with the money

shareholders have invested.

ROE is expressed as a percentage and calculated as:

Return on Equity = Net Income/Shareholder's Equity

The ROE is useful for comparing the profitability of a company to that of other firms in the same

industry.

There are several variations on the formula that investors may use:

1. Investors wishing to see the return on common equity may modify the formula above by subtracting

preferred dividends from net income and subtracting preferred equity from shareholders' equity, giving

the following: return on common equity (ROCE) = net income - preferred dividends / common equity.

2. Return on equity may also be calculated by dividing net income by average shareholders' equity.

Average shareholders' equity is calculated by adding the shareholders' equity at the beginning of a

period to the shareholders' equity at period's end and dividing the result by two.

Calculation of ROE for Dabur India Ltd:

Yr 13-14 Yr 12-13

PAT 916.45 765.63

Equity (Shareholders funds +

Reserves and surplus) 2655.96 2095.21

ROE 34.50% 36.54%

The ROE for the year 13-14 has come fallen marginally. This is because of the increase in the reserves

and surplus in the year 13-14 by close to 30%.

Return on Income:

Return on income provides us with an indicator as to for every rupee of sale generated, what is the

ability of the company to retain its earnings after paying interests and taxes. Here in this case, PAT is

taken as a measure for calculating return on income.

Calculation of Return on Income:

Yr 13-14 Yr 12-13

PAT 916.45 765.63

Income 7,225.89 6,277.96

Return on Income 12.68% 12.20%

The return on Income for the year 13-14 has gone up very marginally.

Return on Sales:

Profit and Loss Account of Indian companies as it is presented, it is not prima facie convenient to

calculate Return on Sales. Because ,while we can segregate other income form top line or income we

cannot segregate corresponding costs included in generation of other income.

Here I have taken the example of Consumer Care business and Foods business.

Company Consumer Care Business Foods

13-14 12-13 13-14 12-13 13-14 12-13

A. Segment

results

1474.76 1268.41 1330.33 1147.98 139.65 115.05

B. Sales

revenue

7073.21 6146.38 5988.02 5141.89 878.25 744.88

ROS 20.85% 20.64% 22.22% 22.33% 15.90% 15.45%

We find that ROS figure for the entire company as a whole has marginally gone up. It has also gone up

marginally for the two businesses here i.e. Consumer care business and the foods business. It should be

noted here that the total sales revenue is not only the sales revenue of consumer care business and

foods business and that it includes other businesses also.

DuPont Analysis of Dabur India Ltd: Return on Equity

ROE

= Net Income/Shareholders equity = (Net Income/PBT) * (PBT/EBIT)*(EBIT/ Revenue)*(Revenue/Total

Assets)*(Total Assets/Shareholders Equity)

Lets have a look at the 2014 figures for the calculation of Dupont Analysis:

ROE = Net Income/Shareholders equity = 916.45/2655.96 = 34.50%

Return on Assets = PAT/ Total Assets = 916.45/5311.78 = 17.25%

Leverage = Total Assets/Shareholders Equity = 5311.78/2655.96 = 1.99

Return on Assets can be further decomposed to:

Net Profit margin and Total Assets Turnover

Net Profit Margin: PAT/ Income = 916.45/7225.89 =12.68%

Total Assets Turnover = Income/ Total Assets = 7225.89/5311.78 = 1.36

Net Profit Margin is further broken down to:

Tax Burden, Interest Burden and EBIT Margin

Tax Burden = PAT/PBT = 916.45/1135.53 =80.70%

Interest Burden = PBT/EBIT = 1135.53/1190.40 = 95.39%

EBIT Margin = EBIT/Income = 1190.40/7225.89 =16.47%

Above we see that ROE 34.50% can be decomposed into Return on assets 17.25%) and leverage

(1.99). Further, ROA can be broken down into Net profit margin (12.68%) and Total Assets Turnover

(1.36). Further, Net Profit Margin is broken down into Tax Burden (80.7%), Interest Burden (95.3%),

EBIT Margin (16.47%).

Cost Structure Analysis: Dabur India Ltd.

An examination of the cost structure of the company is equally important as compared to the

profitability of the company. Let us examine the cost structure of the company for the year 2013-14

2013-14

A. Income 7225.89

B. Costs

Cost of material consumed Variable 2739.04

Purchase of stock in Trade Variable 704.44

Finished Goods Variable (26.43)

Work in Progress Variable 5.93

Stock in Trade Variable (22.95)

Total Variable Costs 3400.03

Total Costs 6089.64

Fixed Costs 2689.61

Contribution (Income Variable

costs)

3825.86

Contribution Margin Ratio 0.52

BEP Volume of Income 5079.85

Excess Sales 2146.032

PBT 1136.25

From the analysis above, we find out that the company reached BEP volume of income at 5079.85 crore

rupees. This leaves 2146.03 crores of sales where the company has to make profit after taking into

account its variable costs which is rupee 0.47 per rupee of sales. The company reaches BEP Sales at 70%

of its turnover, leaving only 30% of the sales available to make profit. Since the contribution margin ratio

is 0.52, excess sales, multiplied by the contribution margin ratio would give the profit for the

company.i.e. 1136.25 crores. In the cost structure, fixed costs amount to 44% of the total costs. If the

fixed costs were lowered further, it could be have brought about more profit to the company.

Liquidity Ratios:

Liquidity refers to the companys ability to meet its current obligations. Thus liquidity tests focus on the

size of, and relationships between current liabilities and current assets. (Current assets, presumably, will

be converted into cash in order to pay the current liabilities.) The importance of adequate liquidity in

the sense of the ability of a firm to meet current/short-term obligations when they become due for

payment can hardly be overstressed. In fact, liquidity is a prerequisite for the very survival of a firm. The

short-term creditors of the firm are interested in the short-term solvency or liquidity of a firm. But

illiquidity implies, from the viewpoint of utilization of the funds of the firm, that funds are idle or they

earn very little. A proper balance between the two contradictory requirements, that is, liquidity and

profitability is required for efficient financial management. The liquidity ratios measure the ability of a

firm to meet its short-term obligations and reflect the short-term financial strength and solvency of a

firm. The ratios which indicate the liquidity of a firm are: (i) Net working capital, (i) Current ratios, (iii)

Acid test/quick ratios.

Working Capital of Dabur India Ltd

A firms total capital is found from its balance sheet by subtracting its total liabilities from its total

assets. This is represented by the balance sheet equation:

Assets (A) Liabilities (L) = Capital (C)

Working capital can similarly be found by subtracting current liabilities from current assets:

Current assets Current liabilities = Working capital

CA CL = WC

Working Capital of Dabur India Ltd: 2013-14

Current Assets Current Liabilities = Working Capital

=3055.85 2293.79 = 762.08

Working Capital of Dabur India Ltd: 2012-13

Current Assets Current Liabilities = Working Capital

=2689.07- 1976.19 = 712.88

Working capital, also known as circulating capital, is the amount of money which a business needs to

survive on a day-to-day basis. It should be sufficient to cover:

1. Paying creditors (without difficulty);

2. Allowing trade credit to debtors;

3. Carrying adequate stocks.

Working capital is the kind of short-term capital required to finance a firm on a day-to-day basis. It

is a key measure of business liquidity. The more working capital a firm has, the less risk there is of

the firm not being able to pay its creditors when the bills become due. Conversely the less working

capital a firm has, the greater the risk of the firm not being able to pay its creditors when the bills

are due.

Current Ratio:

This ratio, also called the working capital ratio2, measures the relationship between current assets and

current liabilities. As current liabilities should technically be paid from current assets, this ratio highlights

the firms ability to meet its short-term liabilities from its short-term assets. In other words the firm

should not have to sell fixed assets to pay suppliers for raw materials: if it does then it is clearly in

trouble. The current ratio will be very important to anyone who is supplying short-term funds to the firm

such as banks and trade creditors. It is usually shown in the following way:

Current Assets: Current Liabilities

Dabur Indias Current Ratio in 2013 - 14 = 1.33

Dabur Indias Current Ratio in 2012 - 13 = 1.36

Dabur India has a desirable current ratio. It has the ability to meet its current liabilities with the help of

the current assets that it owns.

A firm with a higher percentage of this current assets in the form of cash would be more liquid, in the

sense of being able to meet obligations as and when they become due, than one with a higher

percentage of slow moving and un-saleable inventory and /or slow-paying receivables, even though

both have the same current ratio. In fact, the latter type of firm may encounter serious difficulties in

paying its bills even though it may have a current ratio of 2:1, whereas the former may do well with a

ratio lower than the conventional norm. Besides, a higher current ratio may indicate two aspects: (a)

more deployment of the long term fund of the company which is costly proposition in real sense; (b)

company may not be able to draw more support from its creditors to build its current assets may be

due to its creditworthiness. Thus, the current ratio is not a conclusive index of the real liquidity of a firm.

It fails to answer questions, such as, how liquid are the receivables and the inventory? What effect does

the omission of inventory have on the liquidity of a firm? To answer these and related questions, an

additional analysis of the quality of current assets is required. This is known in Acid-Test or Quick Ratio.

Quick Ratio/ Acid Test Ratio:

This is a more stringent test of liquidity than the current ratio. It is the acid test of liquidity and

compares the firms quick assets (i.e. current assets less stocks) to its current liabilities. By stripping the

stock figures out of the equation, it is suggested that this ratio gives a more immediate indication of the

firms ability to settle its current debts.

Computation of Acid Test ratio of Dabur India:

2013-14 2012-13

Current Assets 3055.87 2689.07

Inventories 972.29 844.44

Quick Assets 2083.58 1844.63

Current Liabilities 2293.79 1976.19

Current Ratio 1.332236 1.360735

Quick ratio 0.908357 0.933427

It is observed that Dabur India has a sound quick ratio. This means its ability to meet its current liabilities

with its quick assets excluding stock. Stock is excluded as the realization time for stock takes about few

days and hence excluded from the analysis of acid test ratio.

Asset Growth:

Growth in the asset indicates that the companies are making a planned effort to ensure future revenue

earning capacity as well as targeting higher profitability. Expansion or addition of fixed assets indicates

future production capacity there by indicates sustainable top line growth. In case of addition of

balancing equipment it will indicate the company is trying to achieve competitiveness by managing its

cost structure and there by enhance its bottom line. Addition to the current asset indicates inventory

and debtors build up in a systematic manner to strengthen cash to cash cycle and making the operating

cycle move faster thereby trying to ensure top line growth for the current period. However, there are

cases in companies where current asset is growing by default that is the company is not able to push it

inventory in the market neither it is able to realize its debtors at a faster rate.

Assets of Dabur India Ltd

Assets

2013-14 2012-2013 Change

Fixed Assets

Tangible Assets 1,132.99 945.68 19.8%

Intangible Assets 633.91 636.2 -0.4%

Capital WIP 21.71 92.57 -76.5%

Non Current

Investments 424.69 163.17 160.3%

Long Term Loans and

Advances 24.54 43.36 -43.4%

Other non current

assets 18.07 138.49 -87.0%

Current Assets 3055.87 2689.07 13.64%

Maximum growth has been registered for Non-Current Investments. This has seen a growth of about

160%.. Many other forms of fixed assets have seen a decline in growth. Tangible assets have recorded a

growth of about close to 20% from the previous year.

Capital Structure Analysis:

Capital Structure Analysis indicates about solvency of any company. Solvency pertains to the

companys ability to meet the interest costs and the repayment schedules associated with its long-

term obligations. When a company borrows money, it promises to make a series of fixed payments.

Because the shareholders get only what is left over after the debt holders have been paid, debt is

said to create financial leverage. Capital Structure Ratios measures these leverage. From the

companys standpoint the greater the proportion of its invested capital that is obtained from

shareholders, the less worry the company has in meeting its fixed obligations. But in return for this

lessened worry, the company must expect to pay overall cost of obtaining capital. Conversely, the

more funds that are obtained from debenture or bonds, overall cost of capital becomes relatively

low for the company. For a growing, tax paying company higher debt ensures better return for

shareholders.

Capital Structure of Dabur India:

2013-14 2012-13

1. Share capital 174.38 174.29

Reserves and Surplus 2481.58 1920.92

Sub Total 2655.96 2095.21

2. Minority Interest 15.91 12.06

3. Non Current Liabilities

Long Term Borrowings 260.4 539.93

Deferred Tax Liabilites 44.83 36.21

Other Long Term Liabilities - 0.12

Long term provisions 40.89 48.8

Sub Total 346.12 625.06

Current Liabilities:

Short-term borrowings 447.74 611.42

Trade payables 1,096.53 716.74

Other current liabilities 479.42 432.54

Short-term provisions 270.1 215.49

Sub Total 2293.79 1976.19

Grand Total 5311.78 4708.54

Debt Equity Ratio of Dabur:

Calculation of Debt

2013-14 2012-13

Long Term Borrowings 260.4 539.93

Short Term Borrowings 447.74 611.42

Less: Current Investments 651.78 765.45

Less: Cash and cash equivalent 519.38 361.81

Total Debt -463.02 24.09

Calculation of Equity

Shareholders funds + reserves

2013-14 2012-13

Share Capital 174.38 174.29

Reserves 2,481.58 1,920.9

Equity 2655.96 2095.19

Debt Equity Ratio:

2013-14 Debt/ Equity = -463/2655 =-0.17

2012-13 Debt/ Equity = 24/2095 =-0.011

Dabur has a very high Equity as compared to its debt.

Too high and too low debt-equity ratio is not desirable. In case of high debt equity lead to inflexibility in

the operations of the firm as it would face the pressures of lenders to meet its fixed commitment of

interest servicing. So the firm has to sustain ever increasing top-line growth to service the debt. A low

debt equity ratio does not help the equity investors to maximize their return. Hence striking a balance

between debt and equity is desirable. There is no rule regarding this balance between debt and equity,

however very often a 2:1 debt equity is quoted as rule of thumb in India though a large number of

companies may not maintain that.

Interest Coverage ratio:

This ratio is examined by the lenders to assess whether the borrowing firm is having enough earnings to

meet the interest payment obligation. This can be done by comparing how much is the EBIT vis-a-vis

interest payment obligation in a period.

Interest Coverage ratio of Dabur:

2013-14 EBIT/ Interest = 1,190.40/54.15 = 21.98

2012-13 EBIT/ Interest = 1,011.90/58.9 = 17.17

Consolidated Balance Sheet of Dabur India Ltd

Consolidated P/L Account of Dabur India Ltd

You might also like

- 4.1-Hortizontal/Trends Analysis: Chapter No # 4Document32 pages4.1-Hortizontal/Trends Analysis: Chapter No # 4Sadi ShahzadiNo ratings yet

- Valuation Healthcare IndustryDocument7 pagesValuation Healthcare IndustryProbal BiswasNo ratings yet

- Appropriations Dividend To Shareholders of Parent CompanyDocument30 pagesAppropriations Dividend To Shareholders of Parent Companyavinashtiwari201745No ratings yet

- ONGC ValuationDocument34 pagesONGC ValuationMoaaz AhmedNo ratings yet

- Gail India LTD ReferenceDocument46 pagesGail India LTD Referencesharadkulloli100% (1)

- Precision Turned Products World Summary: Market Values & Financials by CountryFrom EverandPrecision Turned Products World Summary: Market Values & Financials by CountryNo ratings yet

- Valuation Cash Flow A Teaching NoteDocument5 pagesValuation Cash Flow A Teaching NotesarahmohanNo ratings yet

- PFA Vegetron CaseDocument14 pagesPFA Vegetron CaseKumKum BhattacharjeeNo ratings yet

- Guide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesFrom EverandGuide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesNo ratings yet

- Britannia Industries LTD Industry:Food and Dairy Products - MultinationalDocument22 pagesBritannia Industries LTD Industry:Food and Dairy Products - MultinationalArghya SenNo ratings yet

- FM Assignment - Prashant KhombhadiaDocument3 pagesFM Assignment - Prashant Khombhadiavicky54321inNo ratings yet

- Investment Decision MethodDocument44 pagesInvestment Decision MethodashwathNo ratings yet

- SBDC Valuation Analysis ProgramDocument8 pagesSBDC Valuation Analysis ProgramshanNo ratings yet

- DCF Application - Asian PaintsDocument6 pagesDCF Application - Asian PaintsKashish PopliNo ratings yet

- Ballance Sheet of Lucky Cement FactoryDocument9 pagesBallance Sheet of Lucky Cement FactoryTanvir Khan MarwatNo ratings yet

- Britania ValuationDocument28 pagesBritania ValuationSantanu DasNo ratings yet

- M&A PitchDocument13 pagesM&A PitchMatt EilbacherNo ratings yet

- Peer - To - Peer Lending and The P2PfaDocument12 pagesPeer - To - Peer Lending and The P2PfaCrowdfundInsiderNo ratings yet

- ACC Cement Research Report and Equity ValuationDocument12 pagesACC Cement Research Report and Equity ValuationSougata RoyNo ratings yet

- Annual Report of Maruti Suzuki IndiaDocument4 pagesAnnual Report of Maruti Suzuki Indiajanurag1993No ratings yet

- Valuation of Tata SteelDocument3 pagesValuation of Tata SteelNishtha Mehra100% (1)

- TCS ValuationDocument264 pagesTCS ValuationSomil Gupta100% (1)

- Asian Paints Equity ValuationDocument24 pagesAsian Paints Equity ValuationYash DangraNo ratings yet

- Initiating Coverage Maruti SuzukiDocument13 pagesInitiating Coverage Maruti SuzukiAditya Vikram JhaNo ratings yet

- 59 Ratio AnlysisDocument21 pages59 Ratio Anlysissaurabhbakshi89No ratings yet

- DuPont AnalysisDocument3 pagesDuPont AnalysisChirag JainNo ratings yet

- List of Acquisitions by NokiaDocument6 pagesList of Acquisitions by NokiaprisinNo ratings yet

- Indian Capital Goods - HSBC Jan 2011Document298 pagesIndian Capital Goods - HSBC Jan 2011didwaniasNo ratings yet

- Consultancy For Business Plan Writer For E-SignatureDocument11 pagesConsultancy For Business Plan Writer For E-Signaturegolevila100% (1)

- Vegetron ExcelDocument21 pagesVegetron Excelanirudh03467% (3)

- Valuationofshares Fa 2943Document204 pagesValuationofshares Fa 2943chaitanyaNo ratings yet

- Africa Webcast Slides Diageo - FINALDocument30 pagesAfrica Webcast Slides Diageo - FINALLeila HamidouNo ratings yet

- Kellogg: Balance SheetDocument14 pagesKellogg: Balance SheetSubhajit KarmakarNo ratings yet

- BCBL Financial StatementDocument2 pagesBCBL Financial StatementTanvirNo ratings yet

- India's Pharmaceutical TradeDocument21 pagesIndia's Pharmaceutical Tradeprat1401No ratings yet

- Mindtree Model ReferenceDocument66 pagesMindtree Model Referencesaidutt sharma100% (1)

- APV MethodDocument18 pagesAPV Methodrohitoberoi11No ratings yet

- JUBlifeDocument37 pagesJUBlifeavinashtiwari201745No ratings yet

- Larsen & ToubroDocument15 pagesLarsen & ToubroAngel BrokingNo ratings yet

- Advanced Finacial ModellingDocument1 pageAdvanced Finacial ModellingLifeis BeautyfulNo ratings yet

- List of Top 25 Audit Firms and Their Audit FeesDocument37 pagesList of Top 25 Audit Firms and Their Audit Feesibelieveinmagic000No ratings yet

- Eco ProjectDocument29 pagesEco ProjectAditya SharmaNo ratings yet

- Financial Ratio AnalysisDocument26 pagesFinancial Ratio AnalysisMujtaba HassanNo ratings yet

- Managerial EconomicsDocument3 pagesManagerial EconomicsGuruKPONo ratings yet

- ITC Analysis FMDocument19 pagesITC Analysis FMNeel ThobhaniNo ratings yet

- Capital Budgeting TechniquesDocument10 pagesCapital Budgeting TechniqueslehnehNo ratings yet

- Valuation of A FirmDocument13 pagesValuation of A FirmAshish RanjanNo ratings yet

- Mergers Complete Mini CourseDocument7 pagesMergers Complete Mini CoursensalemNo ratings yet

- Ratio Analysis Tata MotorsDocument14 pagesRatio Analysis Tata MotorsvinayputhurNo ratings yet

- BEL - RatiosDocument8 pagesBEL - RatiosVishal Kumar100% (1)

- Ratio AnalysisDocument13 pagesRatio AnalysisGaurav PoddarNo ratings yet

- Financial ModellingDocument22 pagesFinancial ModellingSyam MohanNo ratings yet

- Godrej AgrovetDocument37 pagesGodrej AgrovetBandaru NarendrababuNo ratings yet

- Cost Analysis of Apollo Tyres: Submitted byDocument24 pagesCost Analysis of Apollo Tyres: Submitted byNikhil AgarwalNo ratings yet

- Grand Project On NANO CarDocument110 pagesGrand Project On NANO Carjignay100% (28)

- New Heritage Doll CompanyDocument8 pagesNew Heritage Doll CompanyKDNo ratings yet

- MMW Problem Set 2 Part IIDocument6 pagesMMW Problem Set 2 Part IITricia Mae TorresNo ratings yet

- CORPORATE FINANCE GROUP ASSIGNMENT Final 1Document7 pagesCORPORATE FINANCE GROUP ASSIGNMENT Final 1ChristinaNo ratings yet

- IMG Presentation - Http://imgtrmsg - Blogspot.sgDocument37 pagesIMG Presentation - Http://imgtrmsg - Blogspot.sgIMG - Truly Rich Maker (Singapore)No ratings yet

- General Maths - Investment and Loans Investigation - ExampleDocument10 pagesGeneral Maths - Investment and Loans Investigation - ExampleTerry HarperNo ratings yet

- OIS DiscountingDocument25 pagesOIS DiscountingAakash Khandelwal100% (1)

- Business Studies Notes: Unit 3Document13 pagesBusiness Studies Notes: Unit 3Matt Robson100% (1)

- Financial LeverageDocument63 pagesFinancial LeverageShubham GoelNo ratings yet

- Micro InsuranceDocument262 pagesMicro InsuranceFanny Sylvia C.67% (3)

- Bonds ReviewerDocument7 pagesBonds ReviewerDM MontefalcoNo ratings yet

- 14 Alpha Insurance and Surety vs. Reyes (Tan)Document2 pages14 Alpha Insurance and Surety vs. Reyes (Tan)Rudejane TanNo ratings yet

- Loans ReceivableDocument4 pagesLoans ReceivableDianna Dayawon0% (1)

- Debt FinancingDocument30 pagesDebt FinancingCris Joy BiabasNo ratings yet

- NTPCDocument395 pagesNTPCJyothsna DeviNo ratings yet

- Ca 79-3136 Roger Dolese and the Dolese Company, Transferees of Dolese Bros. Co., a Dissolved Corporation v. United States of America, the Dolese Company and Dolese Concrete Company (Wholly-Owned Subsidiary of Thedolese Company) v. United States of America, Roger Dolese v. United States, 605 F.2d 1146, 10th Cir. (1979)Document11 pagesCa 79-3136 Roger Dolese and the Dolese Company, Transferees of Dolese Bros. Co., a Dissolved Corporation v. United States of America, the Dolese Company and Dolese Concrete Company (Wholly-Owned Subsidiary of Thedolese Company) v. United States of America, Roger Dolese v. United States, 605 F.2d 1146, 10th Cir. (1979)Scribd Government DocsNo ratings yet

- myFICO Understanding Your Credit ScoreDocument20 pagesmyFICO Understanding Your Credit Scorecolonelcash100% (1)

- Peng Plasma Solutions Tables PDFDocument12 pagesPeng Plasma Solutions Tables PDFDanielle WalkerNo ratings yet

- Banking and Financial Institution: Midterms ReviewerDocument9 pagesBanking and Financial Institution: Midterms ReviewerLyka FaneNo ratings yet

- Flexible Budget Healthy Hospital STDNTDocument4 pagesFlexible Budget Healthy Hospital STDNTFalguni ShomeNo ratings yet

- Qualified Written Request - 1st Step of Forensic Loan Audit - Predatory Lending ViolationsDocument9 pagesQualified Written Request - 1st Step of Forensic Loan Audit - Predatory Lending ViolationsUnemployment Hotline100% (30)

- 1789 1811 Statutes at Large 401-600Document201 pages1789 1811 Statutes at Large 401-600ncwazzyNo ratings yet

- CH 18 IFM10 CH 19 Test BankDocument12 pagesCH 18 IFM10 CH 19 Test Bankajones1219100% (1)

- Chapter Twenty: Managing Credit Risk OnDocument21 pagesChapter Twenty: Managing Credit Risk OnSagheer MuhammadNo ratings yet

- Math in Finance MITDocument22 pagesMath in Finance MITkkappaNo ratings yet

- Credit Transaction Case Outline-2013Document6 pagesCredit Transaction Case Outline-2013HNicdaoNo ratings yet

- Deposition of Claire SwazeyDocument119 pagesDeposition of Claire SwazeySTOP RCO NOWNo ratings yet

- Banking Theory and Practice Chapter ThreeDocument36 pagesBanking Theory and Practice Chapter Threemubarek oumerNo ratings yet

- Executive Summary: Financial AnalysisDocument67 pagesExecutive Summary: Financial AnalysisSachin JainNo ratings yet

- LevDocument6 pagesLevYaseen SaleemNo ratings yet

- Question Sheet AFMDocument48 pagesQuestion Sheet AFMGoku SayienNo ratings yet

- PD 198 Local Water DistrictDocument16 pagesPD 198 Local Water DistrictPaul Pleños TolomiaNo ratings yet