Professional Documents

Culture Documents

Training Material Tax 220210 ITPS

Uploaded by

Raja RamCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Training Material Tax 220210 ITPS

Uploaded by

Raja RamCopyright:

Available Formats

23/02/2010 1

Remuneration taxability & compliances under Income tax act

Presented

by

Niranjan Swain, LLB,ACS,FICWA.

23/02/2010 2

Breaking News --------

Taxation system in India wins the contest

of 8

th

wonder of the world next to Taj

23/02/2010 3

.

.

Indian Tax System

CST

Central

Excise Duty

Customs Duty

Service Tax

Income Tax

Wealth Tax

Tonnage Tax

CST /VAT/

Sales Tax

State Excise /

Luxury Tax

Entry Tax/Octroi

Stamp / Elect. Duty

LF/RDT/R&D Cess

State Tax

Centre-DT

Centre-Ind. Tax

23/02/2010 4

I

n

c

o

m

e

T

a

x

A

c

t

/

R

u

l

e

s

W

o

r

k

i

n

g

m

e

t

h

o

d

o

l

o

g

y

H

a

r

m

o

n

i

z

i

n

g

w

i

t

h

G

o

v

t

o

f

f

i

c

i

a

l

S

u

p

p

o

r

t

f

r

o

m

T

a

x

e

x

p

e

r

t

s

&

c

o

n

s

u

l

t

a

n

t

s

C

l

a

r

i

t

y

o

n

P

r

o

v

i

s

i

o

n

23/02/2010 5

Jai Bharat !

Religion

Caste

Colour

Language

Culture

Taxation

Integration of minds is still possible ---

23/02/2010 6

Some Important Terms

Tax planning.

Tax Avoidance.

Tax Evasion.

23/02/2010 7

Objectives

Employees point of view

Remuneration received by

employees

is taxable in their hand at

concessional rate

minimization of tax liability

maximization of take home

salary.

23/02/2010 8

Different Sources of Income in the hands of

Employees.

Income from

Salary

House Property

Short Term Capital Gain

Long Term Capital Gain

Other Sources

23/02/2010 9

What Constitute Remuneration

Salary

Allowances

Perquisites

Monetary

Non Monetary

23/02/2010 10

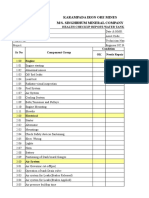

What Constitute Salary and Allowances

Basic Pay,

Grade Pay,

Dearness Allowance,

House Rent Allowance

Thermal Allowance

Generation Incentive

Safety Incentive

Education Allowance /

Reimbursement

Hostel Allowance

Advance/Arrear Salary,

23/02/2010 11

What Constitute Salary and Allowances

Salary in lieu of notice,

Remuneration for extra

work

Gratuity

Leave encashment [exempt

up to a certain limit under

section 10(10A)]

Monthly Medical allowance

Messenger Reimbursement

Conveyance

Reimbursement

Contribution to PF

23/02/2010 12

Perquisites

Accommodation at

Concessional Rate.

Water supply

Electricity

Free education

Interest free / concessional

loan / Advances

Use of movable assets

Sale of movable assets at

nominal price

23/02/2010 13

Perquisites

Canteen Facilities

Club Facilities

Medical Reimbursements

News Paper

Reimbursement

Membership Fee

Reimbursement

Uniforms

Motor Cars

23/02/2010 14

Taxability in the hands of Employees.

Grade Pay

Salary in lieu of notice

Generation Incentive

Thermal Allowance

Safety Incentive

Dearness allowance

Taxable

Basic Pay

Position Different items

23/02/2010 15

Taxability in the hands of Employees.

Taxable Messenger Reimbursement

Exempted to the extent spent Conveyance Reimbursement

Taxable Monthly Medical Allowances

Taxable Salary in lieu of notice

Taxable Extra Work

Taxable on receipt basis if not taken

earlier

Advance Salary / Arrear Salary

Exempted to the extent Rs.3,00,000/- Leave Encashment

Exempted to the extent of Rs.3,50,000/- Gratuity

Taxable

Bonus

Tax Treatment Different items

23/02/2010 16

Taxability in the hands of Employees.

Non specified Hospital- Taxable in excess of

Rs.15,000

Specified Hospital - Exempted

Medical Expenses

Exempted to the extent spent Tour expenses

Use of Laptop Computers exemted

Other cases 10% of original cost

Use of Assets

Exempted Supply of Uniforms

Rs.300/- per month maximum 2 children Hostel Expenditure

Rs.100/- per month maximum 2 children

Tution fees

Tax Treatment Items

23/02/2010 17

Tax Incident in the hands of Employees.

Taxable = difference between SBI rate less interest

charged by OPGC (Loan upto Rs.20,000/- is exempted)

SBI Rate=Car Loan 12%

Two Wheeler Loan 16.25%

Housing Loan 10.5%

Education loan 11.75%,13.25% / 12.5%

Computer Loan 16.5%

Loan for medical treatment Rule 3A - exempted

Interest free/

concessional

loans

Maintenance expenditure in excess of Rs1000/- PM per

child

Free Education

Taxable at the cost to employer - recovery Electricity

Taxable at the cost to employer - recovery Water Supply

Tax Treatment Different items

23/02/2010 18

Tax Incident in the hands of Employees.

7.5% of salary during which accommodation

Occupied less recovered from employee.

House Accommodation

Non specified Hospital- Taxable in excess

of Rs.15,000

Specified Hospital - Exempted

Medical Expenses

Exempted to the extent spent Tour expenses

Use of Laptop Computers exemted

Other cases 10% of original cost

Use of Assets

Tax Treatment Different items

23/02/2010 19

Obligation of Tax Payer

Allotment of PAN

Payment of Advance Tax / Monthly deduction

Submission of correct data to DDO

Quote PAN in returns, certificates &

correspondences of certain transaction u/s 139A.

Cooperate with assessment / reassessment.

Avoid best Judgment Assessment.

Avoid penalties / precautions.

23/02/2010 20

Obligations of DDO

DDO is required to deduct the tax at source from

salary.

Tax to be deducted on the basis of estimated Income.

It is optional to declare other Incomes than salary for

deduction at source.

Contribution U/S 80G will not be allowed except

some specified Scheme.

DDO should satisfy genuineness before allowing

any exemption or deduction.

23/02/2010 21

General points for discussion

Please submit the genuine documents / certificates

while claiming exemption & deduction.

False deduction and submission along with return is

liable to penalties / prosecution .

Avoid huge cash transactions.

Do not claim dues from employer in cash if

exceeding Rs.20,000/-as the same is covered u/s 40

(A) for disallowance.

23/02/2010 22

Advance Tax

100% 100% March 15th

60% 75% Dec-15

th

30% 45% Sept-15

th

0 15% June-15

th

non Corporate

Assessee

Corporate

Assessee

Tax payable Due date of payment

23/02/2010 23

Computation of Income

XXX Taxable Income from Salary

XXX X Professional Tax

X Entertainment Allowances

Less Standard Deduction

XXX Gross Salary

X Perquisites ( Annexure -1)

X Allowances ( Annexure-1)

X Gross Salary ( Annexure-1)

Income From Salary : A

Amt.

in Rs.

Amt.

in Rs.

Amt.

in Rs. Particulars

23/02/2010 24

Computation of HP.

Positive or

Negative Always negative Taxable Income

Max.Rs.30,000

on repair etc.

No Limit.

Max. Rs.30,000/-- on

repair etc.

Rs.1,50,000/- for

construction

Interest on Borrowed

Capital

30% NAV NIL Standard Deduction

Less: Deduction U/S-24

XXX NIL NAV

XX NIL Less: Municipal Tax

XXXX NIL Gross Annual Value

Let Out Self Occupied Particular

23/02/2010 25

Computation of Income

XXX Taxable Income from House Property

X X b) Interest on borrowed Capital

X a) Standard Deduction

Less - Deduction U/s-24

XXX Net Annual Value

X Less- Municipal Tax.

XXX Gross Annual Value .

Income from House Property: B

23/02/2010 26

Computation of Income

XXX Taxable Income from Capital Gain

x x Expenses

x

Cost of Improvement /

Index Cost of Imp.

x Cost of acquisition / Index of CA

Less:

XXX xxx Consideration

Income from Capital Gain C.

23/02/2010 27

Computation of Income

xxx xxx Total

xxx b) Payment of L.I. Premium etc.

XXX a) Employee Cont. to EPF

Deduction U/S 80C & 80CCC etc

Less: Deduction Under Ch -VI A C

XXX Gross Total Income( A+B+C+D ) B

XXX x x Less Expenses

XXX xxx Others

xxx Interest on Investment Deposit

Income from Other Sources D

23/02/2010 28

Computation of Income

XXXXX Less Relief U/S 89(1)

XXXX Total Payable

XXX Add Interest 1 month @ 1%

XXXX Balance Tax to be Payable

XXX Less: Tax Deducted at Source.

XXXX Total Tax to be Payable

X Add Education Cess

XXX Tax On Total Income.

XXXXXX Total Taxable Income (E - F ) D

23/02/2010 29

Deduction Under Chapter VIA

U/S-80C

U/S-80CCC-Contribution to

pension fund

U/S-80D-Medical Insurance

Premium

U/S-80DD-Maintenance of

Physical handicapped

dependant

U/S-80DDB-Medical treatment

of dependant

U/S-80G- Donation

U/S-80GG-Rent paid

U/S-80-Person with Disability

23/02/2010 30

Deductions fro Gross Total Income

Two Children 1,00,000 Tution Fee 80C

1,00,000

Contribution to

Superannuation fund 80C

Lock in period 1,00,000 Contribution to PPF 80C

In excess of 12%

is taxable 1,00,000 Contribution to E PF 80C

Policy should

continue for 3 years 1,00,000 LIC Premium 80C

Remarks Maximum

Particulars of Investment /

Scheme Section

23/02/2010 31

Deductions fro Gross Total Income

Ownership

should be 5 years 1,00,000

Exp. on Acquisition of House

including Registration fee. 80C

Ownership

should be 5 Yrs. 1,00,000

Principal Repayment of BHL /

HBA 80C

Lock in period 1,00,000 Notified MF 80C

SpecifiedScheme 1,00,000 ULIP 80C

Lock in period 1,00,000 National Savings Scheme 80C

Lock in period 1,00,000

NSC including Accrued

Interest 80C

Remarks Maximum

Particulars of Investment/

Scheme Section

23/02/2010 32

Deductions fro Gross Total Income

Receipt of

annuity is taxable 10,000 Deposit under any annuity plan 8CCC

Minimum 5 Yrs.

Scheme formed

by Central Govt. 1,00,000 Term deposit 80C

Lock in period 1,00,000

Approved debentures/ equity

in specific Public Company 80C

Remarks Maximum

Particulars of Investment/

Scheme Section

23/02/2010 33

Deductions fro Gross Total Income

For self & dependant.

Not to be allowed by

DDO. Reimbursesmt.

will be deducted

40,000 /

60,000

Incurred expenditure on

treatment of Specified

Disease 80DDB

Specific disability

certification from

specific authority.

50,000 /

75,000 /

1,00,000

Deposit with scheme of

insurer or incurred

expenditure including

Nurshing & Rehabilitation 80DD

Rs.15,000/- for Senior

Citizen. 10,000 Medical Insurance premia 80D

Remarks Maximum

Particulars of Investment /

Scheme Section

23/02/2010 34

IMOSSIBLE IS NOTHING

The more faith you have

The more you believe

The more goals you set

The more you will achieve

So reach for the stars

Pick a mountain to climb

Dare to think big

And give yourself a time

And remember no matter

How futile things seem

With faith, there is dream

No impossible dream

- A. J. Davidson

23/02/2010 35

Thank You for your Co-operation

A presentation

by

Niranjan Swain

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Electric Machinery and Transformers - I. L. KosowDocument413 pagesElectric Machinery and Transformers - I. L. KosowRaja Ram50% (2)

- Stewart, Mary - The Little BroomstickDocument159 pagesStewart, Mary - The Little BroomstickYunon100% (1)

- Participant Observation: Qualitative Research Methods: A Data Collector's Field GuideDocument17 pagesParticipant Observation: Qualitative Research Methods: A Data Collector's Field GuideMarta CabreraNo ratings yet

- Asan Visa Ae102901499Document2 pagesAsan Visa Ae102901499hardeep ranaNo ratings yet

- 02 Fundamentals of Neural Network - CSE TUBEDocument39 pages02 Fundamentals of Neural Network - CSE TUBERaja RamNo ratings yet

- Ocp For Oil Handling-ModiDocument3 pagesOcp For Oil Handling-ModiRaja RamNo ratings yet

- Tidal Power: Its Meaning, Causes of Tides and Their Energy Potential, Enhancement ofDocument1 pageTidal Power: Its Meaning, Causes of Tides and Their Energy Potential, Enhancement ofRaja RamNo ratings yet

- Dealer PresentationDocument39 pagesDealer PresentationRaja RamNo ratings yet

- What Is An Electric Motor?: - Electromechanical Device That Converts - Mechanical Energy Used To E.GDocument37 pagesWhat Is An Electric Motor?: - Electromechanical Device That Converts - Mechanical Energy Used To E.GRaja RamNo ratings yet

- Exide Industries Ltd. Welcomes You: Presentation On Inverter BatteriesDocument33 pagesExide Industries Ltd. Welcomes You: Presentation On Inverter BatteriesRaja RamNo ratings yet

- Industrial Batteries - Product ProfileDocument10 pagesIndustrial Batteries - Product ProfileRaja RamNo ratings yet

- Programmer's Guide To The Oracle PrecompilersDocument395 pagesProgrammer's Guide To The Oracle PrecompilersRaja RamNo ratings yet

- Air CompressorsDocument68 pagesAir CompressorsRaja RamNo ratings yet

- Oracle Advanced Security: Administrator's GuideDocument282 pagesOracle Advanced Security: Administrator's GuideRaja RamNo ratings yet

- Oracle8 I Visual Information Retrieval Java Client: User's Guide and ReferenceDocument52 pagesOracle8 I Visual Information Retrieval Java Client: User's Guide and ReferenceRaja RamNo ratings yet

- Iii. Recovery BoilerDocument9 pagesIii. Recovery BoilerSai SwaroopNo ratings yet

- Electro-Pneumatic Converters TEIP 11, TEIP 11-Ex Specification SheetDocument4 pagesElectro-Pneumatic Converters TEIP 11, TEIP 11-Ex Specification SheetRaja RamNo ratings yet

- Multi Vision™: Multivariable TransmitterDocument10 pagesMulti Vision™: Multivariable TransmitterRaja RamNo ratings yet

- 210T, 211T, 210K Transcope®Pneumatic Transmitter & IndicatorDocument4 pages210T, 211T, 210K Transcope®Pneumatic Transmitter & IndicatorRaja RamNo ratings yet

- ABB Instrumentation: Specification SheetDocument6 pagesABB Instrumentation: Specification SheetRaja RamNo ratings yet

- SLC 220 UniversalDocument4 pagesSLC 220 UniversalRaja Ram67% (3)

- Lesson: The Averys Have Been Living in New York Since The Late NinetiesDocument1 pageLesson: The Averys Have Been Living in New York Since The Late NinetiesLinea SKDNo ratings yet

- 2a Unani Medicine in India - An OverviewDocument123 pages2a Unani Medicine in India - An OverviewGautam NatrajanNo ratings yet

- Explore The WorldDocument164 pagesExplore The WorldEduardo C VanciNo ratings yet

- ICD10WHO2007 TnI4Document1,656 pagesICD10WHO2007 TnI4Kanok SongprapaiNo ratings yet

- Lecture Notes 3A - Basic Concepts of Crystal Structure 2019Document19 pagesLecture Notes 3A - Basic Concepts of Crystal Structure 2019Lena BacaniNo ratings yet

- IFR CalculationDocument15 pagesIFR CalculationSachin5586No ratings yet

- Building A Pentesting Lab For Wireless Networks - Sample ChapterDocument29 pagesBuilding A Pentesting Lab For Wireless Networks - Sample ChapterPackt PublishingNo ratings yet

- 0 BA Design ENDocument12 pages0 BA Design ENFilho AiltonNo ratings yet

- Docsity Detailed Lesson Plan 5Document4 pagesDocsity Detailed Lesson Plan 5Sydie MoredoNo ratings yet

- Bag Technique and Benedict ToolDocument2 pagesBag Technique and Benedict ToolAriel Delos Reyes100% (1)

- Optimal Dispatch of Generation: Prepared To Dr. Emaad SedeekDocument7 pagesOptimal Dispatch of Generation: Prepared To Dr. Emaad SedeekAhmedRaafatNo ratings yet

- Revit 2023 Architecture FudamentalDocument52 pagesRevit 2023 Architecture FudamentalTrung Kiên TrầnNo ratings yet

- CDR Writing: Components of The CDRDocument5 pagesCDR Writing: Components of The CDRindikuma100% (3)

- Oracle SOA Suite 11g:buildDocument372 pagesOracle SOA Suite 11g:buildMohsen Tavakkoli100% (1)

- Water Tanker Check ListDocument8 pagesWater Tanker Check ListHariyanto oknesNo ratings yet

- Blake 2013Document337 pagesBlake 2013Tushar AmetaNo ratings yet

- Unit 1 and 2Document4 pagesUnit 1 and 2Aim Rubia100% (1)

- Business CombinationsDocument18 pagesBusiness Combinationszubair afzalNo ratings yet

- Feds Subpoena W-B Area Info: He Imes EaderDocument42 pagesFeds Subpoena W-B Area Info: He Imes EaderThe Times LeaderNo ratings yet

- Lect.1-Investments Background & IssuesDocument44 pagesLect.1-Investments Background & IssuesAbu BakarNo ratings yet

- Journal of Atmospheric Science Research - Vol.5, Iss.4 October 2022Document54 pagesJournal of Atmospheric Science Research - Vol.5, Iss.4 October 2022Bilingual PublishingNo ratings yet

- Holiday AssignmentDocument18 pagesHoliday AssignmentAadhitya PranavNo ratings yet

- Historical Exchange Rates - OANDA AUD-MYRDocument1 pageHistorical Exchange Rates - OANDA AUD-MYRML MLNo ratings yet

- Dissertation 7 HeraldDocument3 pagesDissertation 7 HeraldNaison Shingirai PfavayiNo ratings yet

- Unit 1 - Lecture 3Document16 pagesUnit 1 - Lecture 3Abhay kushwahaNo ratings yet

- TMPRO CASABE 1318 Ecopetrol Full ReportDocument55 pagesTMPRO CASABE 1318 Ecopetrol Full ReportDiego CastilloNo ratings yet