Professional Documents

Culture Documents

ITP Application & Rules

Uploaded by

Shahaan Zulfiqar100%(2)100% found this document useful (2 votes)

1K views8 pagesITP Application & Rules

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentITP Application & Rules

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

100%(2)100% found this document useful (2 votes)

1K views8 pagesITP Application & Rules

Uploaded by

Shahaan ZulfiqarITP Application & Rules

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 8

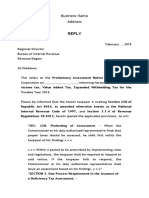

PART X OF THE FIRST SCHEDULE

Application for registration of Income Tax Practitioner

To

The Regional Commissioner

Of Income Tax,

___________ Region,

___________(City).

___________ (Jurisdiction)

Dear Sir,

With reference to section 223 of the Income Tax Ordinance, 2002, I, the undersigned,

hereby apply for registration as an Income Tax Practitioner within the meaning of the

said section.

Necessary particulars are as below:-

1. Name (in block letters)_______________________________________________;

2. Fathers name (in block letters) ________________________________________;

3. Residential address:

a. ________________________________________________________________;

b. ________________________________________________________________;

4. Date of birth ______________________________________________________;

5. Academic/ professional qualifications on the basis of which registration has been

sought ___________;

6. Present occupation ________________________________________________;

7. Particulars of Chartered Accountant/ Cost and Management Accountant/ Income Tax

Practitioner with whom apprenticeship was completed and the period and dates of

apprenticeship.

I hereby declare on solemn affirmation that whatever information has been given above

is correct to the best of my knowledge.

It is further affirmed that

a. I have not been dismissed or removed from service;

b. I am not an un-discharged insolvent;

c. I have not been disqualified to represent an income tax assessee by a

Commissioner of Income Tax or any authority empowered to take disciplinary action

against lawyers or registered accountants;

d. A period of two years elapsed since I resigned from service after having been

employed in the Income Tax Department for two years or more;

e. I have not been convicted of any offence connected with any income tax proceeding

under the Income Tax Ordinance, 2001, or the repealed Income Tax Ordinance,

1979 and Income Tax Act, 1922; and

f. I have not been convicted of any offence under the Pakistan Penal Code.

Yours faithfully____________________________

Signature _______________________________

Name of the Applicant______________________

Office Address ___________________________

Date____________________________________

PART X OF THE FIRST SCHEDULE

Application for registration of Income Tax Practitioner

To

The Chief Commissioner IR,

Regional Tax Office,

Multan.

Dear Sir,

With reference to section 223 of the Income Tax Ordinance, 2002, I, the undersigned,

hereby apply for registration as an Income Tax Practitioner within the meaning of the

said section.

Necessary particulars are as below:-

1. Name (in block letters) MUHAMMAD USMAN.

2. Fathers name (in block letters) CH. MUQSOOD ALAM.

3. Residential address:

a. House No.1, Pepols Colony, Near Social Security Office, Multan.;

4. Date of birth: 04-12-1982;

5. Academic/ professional qualifications on the basis of which registration has been

sought: M.Com;

6. Present occupation: Associated with Sh. Abdusalam & Company.

7. Particulars of Chartered Accountant/ Cost and Management Accountant/ Income Tax

Practitioner with whom apprenticeship was completed and the period and dates of

apprenticeship.

I hereby declare on solemn affirmation that whatever information has been given above

is correct to the best of my knowledge.

Yours faithfully____________________________

Signature _______________________________

Name of the Applicant: MUHAMMAD USMAN

Address: House No.1, Pepols Colony, Near Social Security Office, Multan.;

Date____________________________________

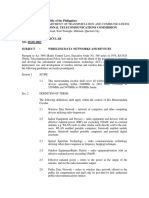

CHAPTER XIV

REGISTRATION OF INCOME TAX PRACTITIONERS

84. Application of Chapter XIV.- This chapter applies for the purposes of

section 223, which provides for the registration and regulation of income tax

practitioners.

85. Application for registration as an income tax practitioner.- (1) A

person satisfying the requirements in rule 86 and desiring to be registered as an

income tax practitioner shall make an application in the form specified in Part X

of the First Schedule to these rules.

(2) Every application under this rule shall be accompanied by

(a) a Treasury receipt for five hundred rupees required to be

deposited as a non-refundable application fee in any

Government Treasury; and

(b) such documents, statements and certificates as

specified in the form.

86. Prescribed qualification for registration as an income tax

practitioner.- (1) For the purposes of the definition of income tax practitioner in

sub-section (11) of section 223, a person applying for registration as an income

tax practitioner shall:-

(a) possess one of the following qualifications, namely:-

(i) a degree in Law at least in the second division, a

degree in Commerce (with Income Tax Law and

Accounting or Higher Auditing as subjects or

parts of subjects, whether compulsory or

optional) or a degree in Business Administration

or Business Management (with Accounting and

Income Tax law as subjects or parts of subjects,

whether compulsory or optional) conferred by a

prescribed institution; or

(ii) a pass in a prescribed accounting examination.

(b) have worked for a continuous period of one year as an

apprentice under the supervision of a chartered

accountant, cost and management accountant, legal

practitioners entitled to practice in a civil court in

Pakistan 1[or] a registered income tax practitioner 2[and

having been registered as a chartered accountant, cost

and management accountant, legal practitioner and

Income tax practitioner] for a period of not less than ten

years.

(2) For the purposes of sub-clause (i) of clause (a) of sub-rule (1), a

degree conferred by a prescribed institution that is a foreign university or

institution shall only qualify if the degree is equivalent to a degree conferred by a

Pakistani university and is recognised as such by a Pakistani university.

(3) In this rule,

(a) Institute of Chartered Accountants of Pakistan means

the Institute of Chartered Accountants of Pakistan

constituted under the Chartered Accountants Ordinance, 1961;

(b) foreign institution means any institution in a foreign

country authorised to grant a degree under the laws of

the country;

(c) foreign university means any university in a foreign

country incorporated by law, or accredited or affiliated by

any association of universities or college in the country

or by any authority formed for that purpose under the

laws of that country;

(d) prescribed accounting examination means any of the

following examinations, namely:-

(i) an examination equivalent to the intermediate

examination conducted by the Institute of

Chartered Accountants of Pakistan;

(ii) an examination equivalent to the intermediate

examination conducted by any foreign institute

of chartered accountants and recognised by the

Institute of Chartered Accountants of Pakistan

as equivalent to its intermediate certificate;

(iii) an examination equivalent the final examination

conducted by the Association of Certified and

Corporate Accountants, London; or

(iv) Part-III of examination for Cost and

Management Accountants conducted by the

Institute of Cost and Management Accountants

under the Cost and Management Accountants

Act, 1966 (XIV of 1966); and

(v) Certified public accountants of USA.

(e) prescribed institution means a university incorporated

by any law in force in Pakistan or Azad Kashmir, a

foreign university or a foreign institution.

87. Registration of income tax practitioners.- (1) On receipt of an

application under rule 85, the Regional Commissioner may make such further

enquiries and call for such further information or evidence as may be considered

necessary.

(2) If the Regional Commissioner is satisfied that an applicant

qualifies to be registered as an income tax practitioner, the RCIT shall cause the

applicants name to be entered in a register to be maintained for the purpose in

the office.

(3) The name of a person entered on the register of income tax

practitioners shall be notified to the Commissioner and the Appellate Tribunal.

(4) The Regional Commissioner shall notify the applicant, in writing,

of the decision on the application.

(5) Where the RCIT decides to refuse an application for registration,

the notice referred to in sub-rule (4) shall include a statement of reasons for the

refusal.

88. Duration of registration.- Registration of a person as an Income Tax

Practitioner shall remain in force until any of the following occurs, namely:-

(a) the person surrenders the registration by notice in writing

to the Regional Commissioner of Income Tax.

(b) the person dies; or

(c) the persons registration is terminated by the RCIT.

89. Cancellation of registration.- (1) Any person (including an income tax

authority) who considers that an income tax practitioner is guilty of misconduct in

a professional capacity may file a complaint in writing with the Commissioner.

(2) A complaint filed under sub-rule (1) shall be accompanied by

affidavits and other documents as necessary to sustain the complaint.

(3) On receipt of a complaint in writing under sub-rule (1), the

Commissioner shall fix a date, hour and place which shall be no later than twenty

one days from the receipt of the complaint for enquiry into the complaint.

(4) Within seven days of receipt of the complaint, the Commissioner

shall serve a notice of the complaint on the Income Tax Practitioner to whom the

complaint relates and such notice shall

(a) inform the practitioner of the date, hour and place of the

enquiry; and

(b) be accompanied by a copy of the complaint and any

affidavits and other documents accompanying the

complaint.

(5) If, at the date fixed for enquiry, it appears that the notice and

accompanying documents referred to in sub-rule (4) have not been served as

provided for in that sub-rule, the Commissioner shall adjourn the enquiry to a

date then to be fixed and may direct that the notice and accompanying

documents shall be served by registered post or such other means as the

Commissioner sees fit.

(6) Not less than two days before the date or adjourned date fixed

for the enquiry, the income tax practitioner concerned shall file with the

Commissioner a signed explanation in writing and any affidavit in reply intended

to be used in the enquiry.

(7) On the date or adjourned date of the enquiry, the complainant

shall file any affidavits in reply intended to be used at the enquiry.

(8) The Commissioner may adjourn the enquiry from time to time to

a date and place to be fixed at the time of adjournment and may make such

orders and give such directions in regard to the enquiry and all matters relating

thereto as the Commissioner may think fit.

(9) On the date or adjourned date fixed for the enquiry, the

Commissioner may

(a) hear and determine the complaint upon the affidavit and

other documents, if any, filed and may allow the

complainant and income tax practitioner to be cross examined

on their affidavits; or

(b) hear and determine the complaint upon oral evidence.

(10) If the Commissioner decides to hear oral evidence, the

procedure generally and as far as practicable shall be that which is followed at

the hearing of suits by Civil Courts, provided that the record of oral evidence shall

be kept in such manner as the Commissioner may direct and, if a shorthand

writer is employed to take down evidence, the transcript of the writers notes shall

be a record of deposition of the witnesses.

(11) If the Commissioner decides that the income tax practitioner to

whom the complaint relates is guilty of professional misconduct, the

Commissioner shall cancel the practitioners registration.

(12) The Commissioner shall give the complainant and the income

tax practitioner to whom the complaint relates notice, in writing, of the

Commissioners decision on the complaint.

90. Appeal to Regional Commissioner of Income Tax. The appeal against

the Commissioners decision lies with the Regional Commissioner of Income

Tax. However, the RCIT on filing of appeal may, pending decision of appeal,

allow the ITP to represent, provided such case is made at the time of filing of

appeal.

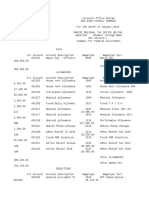

Certificate of Collection or Deduction of Tax

(See rule 42)

S. No. _______ Original/Duplicate. Date of issue__________

Certified that a sum of Rupees_________________________(Amount of tax collected/deducted in figures)

Rupees_____________________________________________________(Amount in words)

on account of Income Tax has been collected/deducted from

_________________________________________________________________________

(Name and address of the person from whom tax collected/deducted)

________________________________________________________________________

In case of an individual, his/her name in full and In case of an association of persons / company,

name and style of the association of persons/company

having National Tax Number ________________________ (if any) and holder of

CNIC No. _______________________________________ (in case of an individual only)

on _______________________________________________________ (Date of collection/deduction)

Or during the period From _____________To ______________ (Period of collection/deduction)

under section * _________________________ (Specify section of the Income Tax Ordinance, 2001)

on account of * ___________________________________________ (Specify nature)

vide _________________________________ (Particulars of LC, Contract etc.)

on the value/amount of RS._______________ (Gross amount on which tax collected/deducted in figures)

Rupees_____________________________________________(Amount in words)

This is to further certify that the tax collected/deducted has been deposited in the Federal

Government Account as per the following details:

SBP / NBP/ Branch/City. Amount. Challan Treasury No.

__________ _______________ _______________ _______________ ________

__________ _______________ _______________ _______________ ________

__________ _______________ _______________ _______________ ________

__________ _______________ _______________ _______________ ________

Company/office etc. collecting/deducting the tax:

Name. ____________________________

Address. ___________________________

Name. __________________________

NTN (if any) ______________________ Designation ____________________

Date. ___________________________

You might also like

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Taxation: 4. Other Percentage TaxDocument6 pagesTaxation: 4. Other Percentage TaxMarkuNo ratings yet

- Administrative Provisions SEC. 236. Registration Requirements.Document6 pagesAdministrative Provisions SEC. 236. Registration Requirements.Blanca Louise Vali ValledorNo ratings yet

- On Assessment ProceduresDocument5 pagesOn Assessment ProceduresMA AttariNo ratings yet

- Returns PDFDocument27 pagesReturns PDFSohaib AhmedNo ratings yet

- Rmo 35-1995Document5 pagesRmo 35-1995Juan Duma - RestauroNo ratings yet

- Independent Certified Public AccountantDocument10 pagesIndependent Certified Public Accountantmiss independentNo ratings yet

- Tax Ordinance Sub Section 114 and 115Document4 pagesTax Ordinance Sub Section 114 and 115faiz kamranNo ratings yet

- Professional Tax Flow - 24072017Document6 pagesProfessional Tax Flow - 24072017ajithNo ratings yet

- Summary NIRCDocument44 pagesSummary NIRCbebs CachoNo ratings yet

- Apply for Valuer EmpanelmentDocument5 pagesApply for Valuer Empanelment44abcNo ratings yet

- Who Are Not Required To File Income Tax ReturnsDocument2 pagesWho Are Not Required To File Income Tax ReturnsCarolina VillenaNo ratings yet

- Reply On PANDocument6 pagesReply On PANPaul Casaje88% (17)

- RMO 2014-10 AccreditationofImportersandCustomsBrokersDocument28 pagesRMO 2014-10 AccreditationofImportersandCustomsBrokersblackspearmanNo ratings yet

- Provisions of Audit Under Service Tax LawDocument3 pagesProvisions of Audit Under Service Tax Lawanon_922292293No ratings yet

- Taxation Review - Samar I Electric Cooperative Vs CIRDocument3 pagesTaxation Review - Samar I Electric Cooperative Vs CIRMaestro LazaroNo ratings yet

- Assessment ProcedureDocument47 pagesAssessment ProcedureHoor FatimaNo ratings yet

- Revenue Regulations No. 9-2001Document6 pagesRevenue Regulations No. 9-2001Anonymous GMUQYq8No ratings yet

- Sales TaxDocument4 pagesSales TaxSara NaeemNo ratings yet

- Income Tax Record KeepingDocument4 pagesIncome Tax Record KeepingMarc Darrell Masangcay OrozcoNo ratings yet

- Corporate Tax ReturnDocument40 pagesCorporate Tax ReturnMiguel CasimNo ratings yet

- Professional Tax RulesDocument8 pagesProfessional Tax RulesSundasNo ratings yet

- CTA Case - Sep 16 - Oct 15, 2022Document5 pagesCTA Case - Sep 16 - Oct 15, 2022jamNo ratings yet

- Audit under Fiscal Laws: Key SectionsDocument17 pagesAudit under Fiscal Laws: Key SectionsabhiNo ratings yet

- Sales Tax Registration RequirementsDocument6 pagesSales Tax Registration RequirementsBilal ShaikhNo ratings yet

- Rmo 1985Document58 pagesRmo 1985Mary graceNo ratings yet

- TAX AUDIT GUIDEDocument21 pagesTAX AUDIT GUIDEindraNo ratings yet

- Taxpayer'S Obligations and Privileges: I. General Audit Procedures and DocumentationDocument4 pagesTaxpayer'S Obligations and Privileges: I. General Audit Procedures and DocumentationKristen StewartNo ratings yet

- Third Division G.R. NO. 152609, June 29, 2005: Supreme Court of The PhilippinesDocument20 pagesThird Division G.R. NO. 152609, June 29, 2005: Supreme Court of The PhilippinesMarian Dominique AuroraNo ratings yet

- Tax AssignmentDocument6 pagesTax AssignmentRoha AyazNo ratings yet

- Samar-I Electric Cooperative vs. CirDocument2 pagesSamar-I Electric Cooperative vs. CirRaquel DoqueniaNo ratings yet

- Samar-I Electric Coop V CIR (2014) DigestDocument2 pagesSamar-I Electric Coop V CIR (2014) Digestviktoriavillo67% (3)

- Rmo 76-2010 PDFDocument11 pagesRmo 76-2010 PDFRain Rivera Ramas0% (1)

- PVAT Rules, 2007 With Gazette NotificationDocument54 pagesPVAT Rules, 2007 With Gazette NotificationsaaisunilNo ratings yet

- 2022MC SEC MC No. 9 S. of 2022 2023 Filing of Annual Financial Statements and General Information Sheet R 12-13-22Document5 pages2022MC SEC MC No. 9 S. of 2022 2023 Filing of Annual Financial Statements and General Information Sheet R 12-13-22jonely kantimNo ratings yet

- Samar I Electric Coop V CIR 2014 Digest 2Document5 pagesSamar I Electric Coop V CIR 2014 Digest 2freak200% (1)

- 04 - Claims For Excise Tax Refund InquiryDocument6 pages04 - Claims For Excise Tax Refund InquiryAhyz DyNo ratings yet

- Assignment on VAT provisionsDocument12 pagesAssignment on VAT provisionsBrohi ZamanNo ratings yet

- DRAFT RR-Implementing EOPT - For Public ConsultationDocument4 pagesDRAFT RR-Implementing EOPT - For Public ConsultationGennelyn OdulioNo ratings yet

- Offshore Tax Evasion (145Document23 pagesOffshore Tax Evasion (145eraraja390No ratings yet

- VICTORIAS MILLING vs. CIR, BIR REGIONAL DIRECTOR, REGION 12, BACOLOD CITYDocument13 pagesVICTORIAS MILLING vs. CIR, BIR REGIONAL DIRECTOR, REGION 12, BACOLOD CITYJeremiah JonesNo ratings yet

- Court of Tax Appeals: en BaneDocument14 pagesCourt of Tax Appeals: en BaneAudrey DeguzmanNo ratings yet

- Kuwait IncomeTax Decree PDFDocument8 pagesKuwait IncomeTax Decree PDFChristian D. Orbe100% (1)

- Sei - ItrDocument36 pagesSei - ItrMiguel CasimNo ratings yet

- 64.double Taxation ReliefDocument14 pages64.double Taxation ReliefMohit MalhotraNo ratings yet

- Republic VH IzonDocument4 pagesRepublic VH IzonanailabucaNo ratings yet

- G.R. No. 103379Document1 pageG.R. No. 103379Raffy AmosNo ratings yet

- My Tax Espresso Newsletter Apr2023Document18 pagesMy Tax Espresso Newsletter Apr2023Claudine TanNo ratings yet

- Republic Bank V EbradaDocument9 pagesRepublic Bank V Ebradacmv mendozaNo ratings yet

- TMAP Tax Updates for November 2017Document13 pagesTMAP Tax Updates for November 2017Mark Lord Morales BumagatNo ratings yet

- Chapter 2 Tax AdministrationDocument12 pagesChapter 2 Tax AdministrationGlomarie GonayonNo ratings yet

- Annual Filing Under Companies Act 2013: V Verma & CompanyDocument15 pagesAnnual Filing Under Companies Act 2013: V Verma & CompanyAnonymous rKRfW9SYtNo ratings yet

- IRR of RA 9480Document7 pagesIRR of RA 9480cmv mendozaNo ratings yet

- Mixed Income - ITRDocument71 pagesMixed Income - ITRMiguel CasimNo ratings yet

- Petitioner's Arguments:: The IssueDocument19 pagesPetitioner's Arguments:: The IssueBarnie BingNo ratings yet

- 2023forms A005Document2 pages2023forms A005Jesus Inno Jaime LoretoNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- S 0232 01Document50 pagesS 0232 01Shahaan ZulfiqarNo ratings yet

- Revised PM PACKAGEDocument14 pagesRevised PM PACKAGEShahaan ZulfiqarNo ratings yet

- Certificate EmanDocument1 pageCertificate EmanShahaan ZulfiqarNo ratings yet

- Para No Satisfactory Reply Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedDocument5 pagesPara No Satisfactory Reply Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Dependency and No Marriage CertificatesDocument5 pagesDependency and No Marriage CertificatesShahaan ZulfiqarNo ratings yet

- Summary Position of RTO Multan with Amounts Pointed Out, Recovered and PendingDocument6 pagesSummary Position of RTO Multan with Amounts Pointed Out, Recovered and PendingShahaan ZulfiqarNo ratings yet

- Regularization Application To CCIRDocument7 pagesRegularization Application To CCIRShahaan ZulfiqarNo ratings yet

- Chairman, Federal Board of Revenue, IslamabadDocument3 pagesChairman, Federal Board of Revenue, IslamabadShahaan ZulfiqarNo ratings yet

- Slip 0232 01 2019Document513 pagesSlip 0232 01 2019Shahaan ZulfiqarNo ratings yet

- Certificate UsmanDocument1 pageCertificate UsmanShahaan ZulfiqarNo ratings yet

- R 0232 01Document357 pagesR 0232 01Shahaan ZulfiqarNo ratings yet

- Assistance Package For Families of Government Employees Who Die in Service - Sanction of Full Pay and Allowances - Request RegardingDocument5 pagesAssistance Package For Families of Government Employees Who Die in Service - Sanction of Full Pay and Allowances - Request RegardingShahaan ZulfiqarNo ratings yet

- Para No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedDocument5 pagesPara No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Para No. Cases Under Process Satisfactory Reply Amount Pointed Out by Audit Amount Recovered & VerifiedDocument5 pagesPara No. Cases Under Process Satisfactory Reply Amount Pointed Out by Audit Amount Recovered & VerifiedShahaan ZulfiqarNo ratings yet

- Para No Satisfactory Reply Subjudice Amount Pointed Out by Audit Amount Recovered and VerifiedDocument4 pagesPara No Satisfactory Reply Subjudice Amount Pointed Out by Audit Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument7 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarNo ratings yet

- Para No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedDocument5 pagesPara No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument7 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarNo ratings yet

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument7 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarNo ratings yet

- Para No Satisfactory Reply Unsatisfactory Reply Amount Pointed Out by Audit Amount Recovered and VerifiedDocument5 pagesPara No Satisfactory Reply Unsatisfactory Reply Amount Pointed Out by Audit Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument6 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarNo ratings yet

- Para No Satisfactory Reply Unsatisfactory Reply Amount Pointed Out by Audit Amount Recovered and VerifiedDocument4 pagesPara No Satisfactory Reply Unsatisfactory Reply Amount Pointed Out by Audit Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument6 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarNo ratings yet

- Para No Satisfactory Reply Subjudice Amount Pointed Out by Audit Amount Recovered and VerifiedDocument4 pagesPara No Satisfactory Reply Subjudice Amount Pointed Out by Audit Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Para No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedDocument6 pagesPara No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument5 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarNo ratings yet

- Para No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedDocument6 pagesPara No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Para NO Cases Under Process Amount Pointed Out by AuditDocument6 pagesPara NO Cases Under Process Amount Pointed Out by AuditShahaan ZulfiqarNo ratings yet

- Para No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedDocument5 pagesPara No Cases Under Process Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and VerifiedShahaan ZulfiqarNo ratings yet

- Para No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedDocument5 pagesPara No Amount Pointed Out by Audit Amount Charged But Not Recovered Amount Recovered and Verified Amount Recovered But Un-VerifiedShahaan ZulfiqarNo ratings yet

- What is Aeronautical Product CertificationDocument12 pagesWhat is Aeronautical Product CertificationOscar RiveraNo ratings yet

- MC 09-09-2003Document5 pagesMC 09-09-2003Francis Nicole V. QuirozNo ratings yet

- Evidence Drop: Hawaii DOH Apparently Gave Obama Stig Waidelich's Birth Certificate Number - 3/27/2013Document62 pagesEvidence Drop: Hawaii DOH Apparently Gave Obama Stig Waidelich's Birth Certificate Number - 3/27/2013ObamaRelease YourRecords100% (3)

- Social Studies - Part 1Document96 pagesSocial Studies - Part 1Jedel GonzagaNo ratings yet

- Determining The Number of IP NetworksDocument6 pagesDetermining The Number of IP Networksonlycisco.tkNo ratings yet

- SET A - Criminal Law Book1 Digests (JD 2-1) FINAL PDFDocument904 pagesSET A - Criminal Law Book1 Digests (JD 2-1) FINAL PDFTrexiaLechoncitoNo ratings yet

- History of Freemasonry Throughout The World Vol 6 R GouldDocument630 pagesHistory of Freemasonry Throughout The World Vol 6 R GouldVak AmrtaNo ratings yet

- Pre-Incorporation Founders Agreement Among The Undersigned Parties, Effective (Date Signed)Document13 pagesPre-Incorporation Founders Agreement Among The Undersigned Parties, Effective (Date Signed)mishra1mayankNo ratings yet

- Camper ApplicationDocument4 pagesCamper ApplicationClaire WilkinsNo ratings yet

- Respondent.: (G.R. No. 227482. July 1, 2019.)Document2 pagesRespondent.: (G.R. No. 227482. July 1, 2019.)mei atienza100% (1)

- Product CAT RSTI SA - DatasheetDocument9 pagesProduct CAT RSTI SA - Datasheetvikivarma147No ratings yet

- NOTIFICATION FOR GRAMIN DAK SEVAK POSTSDocument68 pagesNOTIFICATION FOR GRAMIN DAK SEVAK POSTSShubham VermaNo ratings yet

- Fisker v. Aston MartinDocument29 pagesFisker v. Aston Martinballaban8685No ratings yet

- Election of 2000 WorksheetDocument3 pagesElection of 2000 Worksheetvasanthi sambaNo ratings yet

- Application Form For Aviation Security Personnel Certification - InstructorDocument4 pagesApplication Form For Aviation Security Personnel Certification - InstructorMoatasem MahmoudNo ratings yet

- GST Registration CertificateDocument3 pagesGST Registration CertificateChujja ChuNo ratings yet

- Organized Group Baggage HandlingDocument2 pagesOrganized Group Baggage HandlingFOM Sala Grand TuyHoaNo ratings yet

- Fourth Grade-Social Studies (Ss4 - 4)Document7 pagesFourth Grade-Social Studies (Ss4 - 4)MauMau4No ratings yet

- Activity 7 Online Activity GERIZALDocument5 pagesActivity 7 Online Activity GERIZALKc Kirsten Kimberly MalbunNo ratings yet

- Deepa Karuppiah SAP FICODocument4 pagesDeepa Karuppiah SAP FICO437ko7No ratings yet

- How To Sell On ScribdDocument2 pagesHow To Sell On ScribdHugiies TydedNo ratings yet

- Hilltop Market Fish VendorsDocument7 pagesHilltop Market Fish Vendorsanna ticaNo ratings yet

- 0 PDFDocument1 page0 PDFIker Mack rodriguezNo ratings yet

- Admin Cases PoliDocument20 pagesAdmin Cases PoliEunice Iquina100% (1)

- I Love GanzonDocument22 pagesI Love Ganzonarnel tanggaroNo ratings yet

- Separation, Delegation, and The LegislativeDocument30 pagesSeparation, Delegation, and The LegislativeYosef_d100% (1)

- Summary - Best BuyDocument4 pagesSummary - Best BuySonaliiiNo ratings yet

- Chapter06 ProblemsDocument2 pagesChapter06 ProblemsJesús Saracho Aguirre0% (1)

- Obligations of The VendeeDocument55 pagesObligations of The VendeerchllmclnNo ratings yet

- List Atrazine PDFDocument4 pagesList Atrazine PDFGriffin NuzzoNo ratings yet