Professional Documents

Culture Documents

Tire City 1997 Pro Forma

Uploaded by

XRiloX0 ratings0% found this document useful (0 votes)

215 views6 pagesThe document provides instructions for a homework assignment requiring students to complete a pro forma forecast for Tire City for 1997 by filling in cells on a provided worksheet. Students must also calculate key performance ratios for 1997 using formulas. Finally, students must print both the worksheets with numerical results and formulas revealed to receive full credit.

Original Description:

Tire City Assignment solution

Original Title

Tire City Assignment

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides instructions for a homework assignment requiring students to complete a pro forma forecast for Tire City for 1997 by filling in cells on a provided worksheet. Students must also calculate key performance ratios for 1997 using formulas. Finally, students must print both the worksheets with numerical results and formulas revealed to receive full credit.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

215 views6 pagesTire City 1997 Pro Forma

Uploaded by

XRiloXThe document provides instructions for a homework assignment requiring students to complete a pro forma forecast for Tire City for 1997 by filling in cells on a provided worksheet. Students must also calculate key performance ratios for 1997 using formulas. Finally, students must print both the worksheets with numerical results and formulas revealed to receive full credit.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 6

Homework Assignment 1: Tire City Pro Forma for 1997

Homework Assignment 1: Tire City Pro Forma for 1997

Due: Tuesday, January 18, 2005

Assignment:

First, complete the pro forma forecast for Tire City for 1997. In other words, fill in all the yellow

shaded cells on the worksheet tabbed Pro Forma. For all forecast items (anything that is not listed as an

assumption) you must use a formula, not a number.

Second, calculate Tire Citys key performance ratios for 1997. That is, fill in all the yellow shaded

cells on the worksheet tabbed Performance Ratios. For all these ratios, you must use a formula, not a

number.

Third, print out your work. Print the two worksheets with the numerical results on them, and then print

the two worksheets in formula reveal(or audit) mode. To reveal the formulas, press control accent (the

accent key is the one above the tab key on the left of the keyboard). You must print out both numerical results

and formulas to get full credit.

Have fun and good luck.

Homework Assignment 1: Tire City Pro Forma for 1997

Homework Assignment 1: Tire City Pro Forma for 1997

Due: Tuesday, January 18, 2005

Assignment:

First, complete the pro forma forecast for Tire City for 1997. In other words, fill in all the yellow

shaded cells on the worksheet tabbed Pro Forma. For all forecast items (anything that is not listed as an

assumption) you must use a formula, not a number.

Second, calculate Tire Citys key performance ratios for 1997. That is, fill in all the yellow shaded

cells on the worksheet tabbed Performance Ratios. For all these ratios, you must use a formula, not a

number.

Third, print out your work. Print the two worksheets with the numerical results on them, and then print

the two worksheets in formula reveal(or audit) mode. To reveal the formulas, press control accent (the

accent key is the one above the tab key on the left of the keyboard). You must print out both numerical results

and formulas to get full credit.

Have fun and good luck.

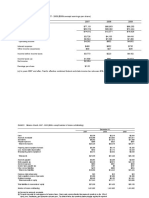

For years ending 12/31 1993 1994 1995

INCOME STATEMENT

Net sales 16,230 $ 20,355 $ 23,505 $

Cost of sales 9,430 $ 11,898 $ 13,612 $

Gross Profit 6,800 $ 8,457 $ 9,893 $

Selling, general, and administrative expenses5,195 $ 6,352 $ 7,471 $

Depreciation 160 $ 180 $ 213 $

Net interest expense 119 $ 106 $ 94 $

Pre-tax income 1,326 $ 1,819 $ 2,115 $

Income taxes 546 $ 822 $ 925 $

Net income 780 $ 997 $ 1,190 $

Dividends 155 $ 200 $ 240 $

BALANCE SHEET

Assets

Cash balances 508 $ 609 $ 706 $

Accounts receivable 2,545 $ 3,095 $ 3,652 $

Inventories 1,630 $ 1,838 $ 2,190 $

Total current assets 4,683 $ 5,542 $ 6,548 $

Gross plant & equipment 3,232 $ 3,795 $ 4,163 $

Accumulated depreciation 1,335 $ 1,515 $ 1,728 $

Net plant & equipment 1,897 $ 2,280 $ 2,435 $

Total assets 6,580 $ 7,822 $ 8,983 $

Liabilities and equity

Current maturities 125 $ 125 $ 125 $

Accounts payable 1,042 $ 1,325 $ 1,440 $

Accrued expenses 1,145 $ 1,432 $ 1,653 $

Total current liabilities 2,312 $ 2,882 $ 3,218 $

Long-term debt 1,000 $ 875 $ 750 $

Common stock 1,135 $ 1,135 $ 1,135 $

Retained earnings 2,133 $ 2,930 $ 3,880 $

Total shareholders' equity 3,268 $ 4,065 $ 5,015 $

Total liabilities and equity 6,580 $ 7,822 $ 8,983 $

Exhibit 1 Financial Statements for Tire City, Inc.

3

1993 1994 1995 Average

Cost of sales/Sales 58.10% 58.45% 57.91% 58.2%

SG&A/Sales 32.01% 31.21% 31.78% 31.7%

Income tax/Pretax income41.18% 45.19% 43.74% 43.4%

Dividends/Net income 19.87% 20.06% 20.17% 20.0%

Cash/Sales 3.13% 2.99% 3.00% 3.0%

Receivables/Sales 15.68% 15.21% 15.54% 15.5%

Inventories/Sales 10.04% 9.03% 9.32% 9.5%

Payables/Sales 6.42% 6.51% 6.13% 6.4%

Accrued exp/Sales 7.05% 7.04% 7.03% 7.0%

Tire City: Historical Ratios

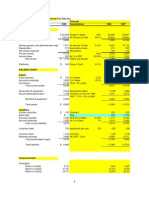

For years ending 12/31 1993 1994 1995 1996 1997

INCOME STATEMENT

Net sales 16,230 $ 20,355 $ 23,505 $ 28,206 $

Cost of sales 9,430 $ 11,898 $ 13,612 $ 16,403 $

Gross Profit 6,800 $ 8,457 $ 9,893 $ 11,803 $

Selling, general, and administrative expenses5,195 $ 6,352 $ 7,471 $ 8,932 $

Depreciation 160 $ 180 $ 213 $ 213 $

Net interest expense 119 $ 106 $ 94 $ 112 $

Pre-tax income 1,326 $ 1,819 $ 2,115 $ 2,545 $

Income taxes 546 $ 822 $ 925 $ 1,104 $

Net income 780 $ 997 $ 1,190 $ 1,442 $

Dividends 155 $ 200 $ 240 $ 289 $

BALANCE SHEET

Assets

Cash balances 508 $ 609 $ 706 $ 858 $

Accounts receivable 2,545 $ 3,095 $ 3,652 $ 4,365 $

Inventories 1,630 $ 1,838 $ 2,190 $ 1,625 $

Total current assets 4,683 $ 5,542 $ 6,548 $ 6,848 $

Gross plant & equipment 3,232 $ 3,795 $ 4,163 $ 6,163 $

Accumulated depreciation 1,335 $ 1,515 $ 1,728 $ 1,941 $

Net plant & equipment 1,897 $ 2,280 $ 2,435 $ 4,222 $

Total assets 6,580 $ 7,822 $ 8,983 $ 11,070 $

Liabilities

Current maturities 125 $ 125 $ 125 $ 125 $

Bank Debt (Plug) 374 $

Accounts payable 1,042 $ 1,325 $ 1,440 $ 1,792 $

Accrued expenses 1,145 $ 1,432 $ 1,653 $ 1,986 $

Total current liabilities 2,312 $ 2,882 $ 3,218 $ 4,277 $

Long-term debt 1,000 $ 875 $ 750 $ 625 $

Common stock 1,135 $ 1,135 $ 1,135 $ 1,135 $

Retained earnings 2,133 $ 2,930 $ 3,880 $ 5,033 $

Total shareholders' equity 3,268 $ 4,065 $ 5,015 $ 6,168 $

Total liabilities and shareholder's equity6,580 $ 7,822 $ 8,983 $ 11,070 $

Memo:Total liabs and equity less Plug debt 6,580 $ 7,822 $ 8,983 $ 10,695 $

Pro forma assumptions Source 1996 1997

Sales growth given in case 20%

Cost of sales/Sales historical average 58.2%

SG&A/Sales historical average 31.7%

Depreciation given in case 213 $

Interest rate (blended) given in case 10.0%

Income tax rate historical average 43.4%

Dividend payout rate historical average 20.0%

Cash to sales ratio historical average 3.0%

Receivables to sales ratio historical average 15.5%

Inventory assumption 96 given in case; 97 per historical average 1,625 $

Gross CAPEX given in case 2,000 $

Current maturity LTD historical amortization 125 $

Payables to sales ratio historical average 6.4%

Accruals to sales ratio historical average 7.0%

Additions to common stock given in case - $

Historical Pro Forma

Historical and Pro Forma Financial Statements for Tire City, Inc.

3

1993 1994 1995 1996 1997

Profitability

Return on Sales 4.81% 4.90% 5.06% 5.11%

Return on Assets ##### ##### ##### #####

Return on Equity ##### ##### ##### #####

Liquidity

Current Ratio 2.03 1.92 2.03 1.60

Quick Ratio 1.32 1.29 1.35 1.22

Leverage

Assets/Equity 2.01 1.92 1.79 1.79

Debt/Total Capital 0.50 0.48 0.44 0.44

Interest Coverage 10.14 16.16 21.50 21.64

Activity Ratios

Asset Turnover 2.47 2.60 2.62 2.55

Days of Receivables57.24 55.50 56.71 56.48

Days of Inventory 63.09 56.39 58.72 36.16

Days of Payables 39.95 37.64 41.29

Performance Ratios Tire City, Inc.

You might also like

- Tire City Case Financial ForecastDocument14 pagesTire City Case Financial ForecastXRiloXNo ratings yet

- Epicor ERP Order Management Course 10.0.700.2Document67 pagesEpicor ERP Order Management Course 10.0.700.2nerz8830100% (1)

- Case 4 - Tire CityDocument4 pagesCase 4 - Tire Cityfriendsaks100% (1)

- Tire City CaseDocument12 pagesTire City CaseAngela ThorntonNo ratings yet

- (S3) Butler Lumber - EnGDocument11 pages(S3) Butler Lumber - EnGdavidinmexicoNo ratings yet

- Improperly Accumulated Earnings TaxDocument4 pagesImproperly Accumulated Earnings TaxSophia OñateNo ratings yet

- Tire City Spreadsheet SolutionDocument7 pagesTire City Spreadsheet SolutionSyed Ali MurtuzaNo ratings yet

- Section A - Group DDocument6 pagesSection A - Group DAbhishek Verma100% (1)

- Tire - City AnalysisDocument17 pagesTire - City AnalysisJustin HoNo ratings yet

- Tire City Spreadsheet SolutionDocument6 pagesTire City Spreadsheet Solutionalmasy99100% (1)

- Tire City-Spread SheetDocument6 pagesTire City-Spread SheetVibhusha SinghNo ratings yet

- Toy World Case ExhibitsDocument24 pagesToy World Case ExhibitsFrancisco Aguilar PuyolNo ratings yet

- Butler Lumber Operating Statements and Balance Sheets 1988-1991Document17 pagesButler Lumber Operating Statements and Balance Sheets 1988-1991karan_w3No ratings yet

- Tire City AssignmentDocument7 pagesTire City AssignmentShivam Kanojia100% (1)

- Wells Fargo CaseDocument58 pagesWells Fargo CaseMeenaNo ratings yet

- Clarkson Lumber Company Operating ExpensesDocument7 pagesClarkson Lumber Company Operating Expensespawangadiya1210No ratings yet

- Ocean Carriers FinalDocument5 pagesOcean Carriers FinalsaaaruuuNo ratings yet

- Clarkson Lumbar CompanyDocument41 pagesClarkson Lumbar CompanyTheOxyCleanGuyNo ratings yet

- The Body Shop Plc 2001: Historical Financial AnalysisDocument13 pagesThe Body Shop Plc 2001: Historical Financial AnalysisNaman Nepal100% (1)

- Quick Progress Test 4Document6 pagesQuick Progress Test 4amNo ratings yet

- Sample Deed of Absolute Sale of SharesDocument3 pagesSample Deed of Absolute Sale of SharesGela Bea BarriosNo ratings yet

- Tire City AssignmentDocument6 pagesTire City AssignmentderronsNo ratings yet

- Tire City Case AnalysisDocument10 pagesTire City Case AnalysisVASANTADA SRIKANTH (PGP 2016-18)No ratings yet

- Tire City Inc.Document6 pagesTire City Inc.Samta Singh YadavNo ratings yet

- Tire City Case 1Document28 pagesTire City Case 1Srikanth VasantadaNo ratings yet

- Flash Memory ExcelDocument4 pagesFlash Memory ExcelHarshita SethiyaNo ratings yet

- Tire City SolutionDocument4 pagesTire City SolutionUmeshKumarNo ratings yet

- Tire CityDocument5 pagesTire CitySudip BrahmacharyNo ratings yet

- Tire City IncDocument12 pagesTire City Incdownloadsking100% (1)

- 93-Tire-City 22 22Document26 pages93-Tire-City 22 22Daniel InfanteNo ratings yet

- Tire City, Inc - Examen FinalDocument3 pagesTire City, Inc - Examen Finalmacro_jNo ratings yet

- Final AssignmentDocument15 pagesFinal AssignmentUttam DwaNo ratings yet

- Tire City IncDocument5 pagesTire City IncAfrin FarhanaNo ratings yet

- Clarkson Lumber - Cash FlowDocument1 pageClarkson Lumber - Cash FlowSJNo ratings yet

- Airthread Acquisition Operating AssumptionsDocument27 pagesAirthread Acquisition Operating AssumptionsnidhidNo ratings yet

- Tire City Spreadsheet SolutionDocument8 pagesTire City Spreadsheet SolutionsuwimolJNo ratings yet

- ACC406 - Chapter - 13 - Relevant - Costing - IIDocument20 pagesACC406 - Chapter - 13 - Relevant - Costing - IIkaylatolentino4No ratings yet

- Mercury Athletic CaseDocument3 pagesMercury Athletic Casekrishnakumar rNo ratings yet

- Hampton MachineDocument7 pagesHampton MachineMurali SubramaniamNo ratings yet

- Tire City - WorksheetDocument3 pagesTire City - WorksheetBach CaoNo ratings yet

- Flash Memory AnalysisDocument25 pagesFlash Memory AnalysisaamirNo ratings yet

- Jones Electrical SlidesDocument6 pagesJones Electrical SlidesRohit AwadeNo ratings yet

- Tire City AnalysisDocument3 pagesTire City AnalysisKailash HegdeNo ratings yet

- Vyaderm-Case Analysis 2006Document4 pagesVyaderm-Case Analysis 2006Mridul SharmaNo ratings yet

- Sampa VideoDocument24 pagesSampa VideodoiNo ratings yet

- S2 G9 Hanson CaseDocument2 pagesS2 G9 Hanson CaseShraddha PandyaNo ratings yet

- AIRTHREAD ACQUISITION Revenue Projections and Operating AssumptionsDocument7 pagesAIRTHREAD ACQUISITION Revenue Projections and Operating AssumptionsAlex Wilson0% (1)

- New Heritage DoolDocument9 pagesNew Heritage DoolVidya Sagar KonaNo ratings yet

- Sampa Video Financials 2000-2006 Home Delivery ProjectionsDocument1 pageSampa Video Financials 2000-2006 Home Delivery ProjectionsOnal RautNo ratings yet

- Nestle and Alcon - The Value of ADocument33 pagesNestle and Alcon - The Value of Akjpcs120% (1)

- Tire RatiosDocument7 pagesTire Ratiospp pp100% (1)

- World Wide Paper CompanyDocument2 pagesWorld Wide Paper CompanyAshwinKumarNo ratings yet

- HP Case Competition PresentationDocument17 pagesHP Case Competition PresentationNatalia HernandezNo ratings yet

- Britannia DCF CapmDocument12 pagesBritannia DCF CapmRohit Kamble100% (1)

- BurtonsDocument6 pagesBurtonsKritika GoelNo ratings yet

- Sneaker Excel Sheet For Risk AnalysisDocument11 pagesSneaker Excel Sheet For Risk AnalysisSuperGuyNo ratings yet

- Pacific Grove Spice Company CalculationsDocument12 pagesPacific Grove Spice Company CalculationsJuan Jose Acero CaballeroNo ratings yet

- Tire City ExhibitsDocument7 pagesTire City ExhibitsAyushi GuptaNo ratings yet

- HBS Tire City Solution 1Document5 pagesHBS Tire City Solution 1Abhinav KumarNo ratings yet

- Financial Analysis Project Segement 1and 2.edited Final 2Document15 pagesFinancial Analysis Project Segement 1and 2.edited Final 2chris waltersNo ratings yet

- Financial ForecastingDocument22 pagesFinancial ForecastingKaustav BanerjeeNo ratings yet

- Trabajo Final DireccionDocument17 pagesTrabajo Final DireccionAnani RomeroNo ratings yet

- Tire City SpreadsheetDocument7 pagesTire City Spreadsheetp23ayushsNo ratings yet

- ACCOUNTING GroupProjectDocument17 pagesACCOUNTING GroupProjectAshna KoshalNo ratings yet

- Activity Based Costing (ABC) .Document70 pagesActivity Based Costing (ABC) .irwansyah1617100% (4)

- E Jeep Co.: Electronic Jeepney CorporationDocument30 pagesE Jeep Co.: Electronic Jeepney CorporationAshyyy123 GomezNo ratings yet

- Far 01 Introduction To AccountingDocument11 pagesFar 01 Introduction To AccountingRafael Renz DayaoNo ratings yet

- Brand Positioning - (WWW - Students3k.com)Document86 pagesBrand Positioning - (WWW - Students3k.com)varun goel33% (3)

- Osbert Oglesby Case StudyDocument48 pagesOsbert Oglesby Case Studymallikarjun BandaNo ratings yet

- Consumer Behavior and Business Buyer InsightsDocument31 pagesConsumer Behavior and Business Buyer InsightsatariatomNo ratings yet

- Ross Brown ResumeDocument1 pageRoss Brown Resumeapi-490019329No ratings yet

- Trade Sales PromotionDocument29 pagesTrade Sales PromotionashishNo ratings yet

- Thela Culture: Affan Ahmed Khan BSMS 1215140-Sec BDocument4 pagesThela Culture: Affan Ahmed Khan BSMS 1215140-Sec BAffan Ahmed KhanNo ratings yet

- ProjectDocument52 pagesProjectRakesh0% (1)

- Br100 SCM - OmDocument83 pagesBr100 SCM - OmFranciscoRBNo ratings yet

- Master Key Systems America LLC - ST Louis Locksmiths (314) 266-1533: Credit Cards Used To Duplicate KeysDocument8 pagesMaster Key Systems America LLC - ST Louis Locksmiths (314) 266-1533: Credit Cards Used To Duplicate KeysfwilcoNo ratings yet

- BCAS 12: Kaizen Costing StandardsDocument7 pagesBCAS 12: Kaizen Costing StandardsAnjell ReyesNo ratings yet

- Org Structure Presentation OctDocument55 pagesOrg Structure Presentation OctJyotiraditya Banerjee100% (1)

- Marketing Communications Exam SummaryDocument22 pagesMarketing Communications Exam SummaryAdeel Qurashi67% (3)

- Building The Marketing Plan Blueprint HubspotDocument21 pagesBuilding The Marketing Plan Blueprint HubspotSyed Masroor HussainNo ratings yet

- Break-Even Analysis Guide for ManagersDocument8 pagesBreak-Even Analysis Guide for ManagersParamartha BanerjeeNo ratings yet

- Ethics in The MarketplaceDocument19 pagesEthics in The MarketplaceTameem YousafNo ratings yet

- EntrepDocument31 pagesEntrepGaudie MoreNo ratings yet

- Internal Control Questionnaires for Sales CycleDocument7 pagesInternal Control Questionnaires for Sales CycleandengNo ratings yet

- Transforming Traditional Retailers for the New Retail EraDocument27 pagesTransforming Traditional Retailers for the New Retail EraShyam KiranNo ratings yet

- CaseDocument6 pagesCaseG Abhishek RaoNo ratings yet

- Monopolistic CompetitionDocument33 pagesMonopolistic CompetitionVedant KarwandeNo ratings yet

- Job Order Costing SystemsDocument38 pagesJob Order Costing SystemsNived Lrac Pdll Sgn50% (2)

- Developing New Products and Services: © 2006 Mcgraw-Hill Ryerson Ltd. All Rights ReservedDocument36 pagesDeveloping New Products and Services: © 2006 Mcgraw-Hill Ryerson Ltd. All Rights ReservedSav SinghNo ratings yet

- Chapter 5 - Supply Chain Management & E-CommerceDocument24 pagesChapter 5 - Supply Chain Management & E-CommerceIRTAZA SIDDIQUINo ratings yet