Professional Documents

Culture Documents

Integrating ERP and E-Business - Resource Complementarity in Business Value Creation, 2014

Uploaded by

khalalaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Integrating ERP and E-Business - Resource Complementarity in Business Value Creation, 2014

Uploaded by

khalalaCopyright:

Available Formats

Integrating ERP and e-business: Resource complementarity in business

value creation

Pei-Fang Hsu

Institute of Service Science, College of Technology Management, National Tsing Hua University, No. 101, Section 2, Kuang-Fu Road, Hsinchu 30013, Taiwan

a b s t r a c t a r t i c l e i n f o

Article history:

Received 31 October 2011

Received in revised form 15 May 2013

Accepted 28 June 2013

Available online 8 July 2013

Keywords:

Complementarity

ERP

Business integration

IT integration

Resource-based view (RBV)

Business value

We investigate the complementary effect between ERP and e-business technologies, and the impact of such

effect on business value creation. Previous studies have examined the effects of ERP and e-business technologies

independently, and show positive effects on business value from their use. However, both the resource based

view and microeconomic theory as well as practitioner experience suggest that the impacts from their joint

and complementary use should be much greater, but this proposition has not yet been examined empirically.

We use two different approaches (product termand direct measure approaches) to measure the complimentary

effect. Comparing results using rm performance accounting data with self-reported survey data of 150 U.S.

manufacturing rms, we provide conrming empirical evidence that the complementary effect between ERP

and e-business technologies in creating business value is stronger than the main effects of ERP or e-business

technologies alone. We further nd that the complementary use of these IT resources to build system and

business integration capabilities can extract the most complementarity value for rms. These ndings provide

empirical support for the theory of competitive advantage that the resource based view (RBV) proposes.

Furthermore, these ndings provide practical guidance to rms on how to utilize and deploy ERP and

e-business technologies in a mutually reinforcing manner.

2013 Elsevier B.V. All rights reserved.

1. Introduction

Enterprise resources planning (ERP) systems are large commercial

software packages that standardize business processes and integrate

business data throughout an organization [21,47,74]. These systems

codify and organize an enterprise's business data into an integrated

database, and transform the data into useful information that supports

business decisions [68]. The ability to access information from various

parts of an organization has helped rms to streamline their business

processes and reduce inefciencies [75]. In both large and medium

size rms, ERP systems represent the largest portion of the application

budget and about one-third of their IT budgets [41,53].

Although the benets of ERP are considerable, traditional ERP sys-

tems that streamline and integrate internal processes improve efciency

only within the boundaries of an enterprise [21]. Because rms' value

chains increasingly extend beyond their boundaries and include other

rms within their business ecology, it is important to improve opera-

tional performance along the whole supply chain. Inventory turnover,

asset utilization, and protability depend on improved processes

and information ows not only inside the focal rm, but also those

between rms [50]. The full potential of an ERP systemcannot be real-

ized if its integration and coordination capabilities are conned within

the walls of a rm [75].

E-business technologies have exploded on the scene in the last

decade, and some advocates claim that they are the ultimate solution

to the information exchange problemamong rms' enterprise systems.

Consistent with previous studies [5,26,87], e-business technologies are

dened as the Internet-based technologies, such as Extranets, Websites,

and EDI communication technologies that link two rms for performing

e-business functions such as online selling, online purchasing, online

coordination and online information sharing. Because of their lower

cost and greater ease of implementation/use, e-business technologies

hold the promise of enabling information made from ERP systems

to be shared among rms in the extended supply chain [4,75]. E-

business technologies serve to extend the original value proposition of

ERP [27,36], offer an ERP-based organization the opportunity to build

interactive relationships with its business partners [3,4], and bring

together their previously separate information at a very low cost [55].

E-business technologies comprise the external part of the extended

enterprise, and ERP comprises the internal portion [55].

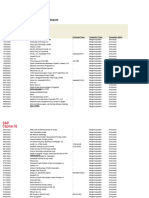

From a technical point of view, Fig. 1 shows how ERP ts with e-

business. In the middle is a focal rm's ERP system that was originally

used only inside the rm. From the left hand side, with middleware

software that is based on industry pre-dened standards such as

RosettaNet, XML (extensive markup language) and more recently

web services and service oriented architecture (SOA), information

generated by ERP systems can be shared via the Internet/EDI directly

with suppliers' ERP systems. If a supplier does not have an ERP system,

it can still receive and exchange business information through an

Decision Support Systems 56 (2013) 334347

Tel.: +886 3 5742221.

E-mail address: pfhsu@mx.nthu.edu.tw.

0167-9236/$ see front matter 2013 Elsevier B.V. All rights reserved.

http://dx.doi.org/10.1016/j.dss.2013.06.013

Contents lists available at ScienceDirect

Decision Support Systems

j our nal homepage: www. el sevi er . com/ l ocat e/ dss

Extranet website. Therefore, useful information such as inventory

levels, production planning and materials purchasing can be exchanged

between the focal rm and suppliers via ERP and e-business technolo-

gies, as referred to business to business integration. Similarly, on

the right hand side, the focal rm can exchange valuable business

data with its customers, such as order status, invoice, and online order

fulllment.

As more and more established organizations realize that they need

to form alliances with their customers and suppliers over electronic

networks, integrating e-business technologies with ERP systems

become a critical issue [3,4,47]. Several IS researchers have identied

ERP and e-business integration, as one of the most important IS areas

for future research [11,32,75]. Others indicate that reconguring and

integrating ERP systems with front-end web-based systems to support

e-business initiatives should be at the top of the list for IS executives

[67,73].

However, the extant literature investigating the value of ERP

focuses on its internal integration capability only (see literature review

below), and neglects the potential huge value fromexternal integration

enabled by the e-business technologies. Thus, this study brings a more

complete assessment of ERP value by focusing on both internal and

external integration. In other words, although existing studies have

already addressed the importance and examined the benets of using

ERP and e-business technology individually, they are limited in consid-

eration of integration between the two technologies as an important

factor for rms to fully extract the benets of IT. Our study investigates

the complementary effect between ERP and e-business technologies.

In summary, there are two gaps in our understanding that need

more research efforts. First, how to complementarily integrate the

two technologies is not well understood. We need a theoretically rigor-

ous framework and an empirically validated measure to calibrate the

complementary level of the two technologies. Based on resource based

view (RBV) and microeconomic theory that provide theoretical ratio-

nale for complementarity, this study develops a theoretical framework

and proposes two different approaches to measure the complementary

effectthe product term approach and direct measure approach.

Second, whether the complementarity between ERP and e-business

technologies contributes to business value has not been assessed

empirically. Whether ERP's full potential can be better realized in the

e-business era has not been conrmed. Our study intends to use large

scale data to validate the theoretical framework and conrm the bene-

ts of integrating ERP and e-business technologies.

2. Literature review

In this section, we rst review two streams of existing studies that

build our knowledge: (1) Business value of ERP and (2) business

value of e-business technologies. We then draw from resource based

view and microeconomic theory to develop a theoretical framework

and hypotheses for understanding the complementary effect of ERP

and e-business technology.

2.1. Business value of ERP

The Business value of ERP can be categorized into three facets,

intangible, operational, and nancial. At intangible level, Mabert et al.

[42,43] reported that the most improvements after using ERP were

in intangible areas such as increased interaction across the enterprise,

quicker response time for information, integration of business process,

and availability and quality of information. Gattiker and Goodhue [25]

showed that ERP can deliver intangible benets to rms including

better information, more efcient internal business process, and better

coordination between different units of a rm. At operational level,

Banker et al. [5] found that ERP systems have positive impact on plant

performance including product quality, product time to market, and

plant efciency, while Mabert et al. [42,43] indicated there were also

operational improvements in order management, on-time deliveries,

and customer interaction. Cotteleer and Bendoly [20] used longitudinal

data from an ERP implemented rm to show that order fulllment

lead-time was signicantly improved after ERP system deployment.

Lastly, Karimi et al. [33,34] found that ERP implementation is associated

with process efciency, effectiveness, and exibility.

At nancial level, mixed results are found in previous studies. Hitt

et al. [31] compared data of 350 ERP adopters and non adopters and

found that ERP adopters showed positive but not consistent perfor-

mance results on productivity, protability, and market value measures.

They found that while ERP adopters showed a better performance on

productivity, Return on Assets (ROA), inventory turnover, and prot

margin, they have a signicant negative performance on Return on

Equity (ROE). They also found some evidence of a decline inproductivity

and business performance shortly after completion of the implementa-

tion. Partially replicating Hitt et al.'s work, Aral et al. [2] collected nan-

cial data of 623 US rms that were ERP adopters over a 7-year-period

(1998 ~ 2005) to investigate the business value of ERP. Their results

showed that using ERP systems improves productivity, inventory turn-

over, and asset utilization, but had no association with ROA, ROE, and

Prot margin. Poston and Grabki [59] compared 54 ERP adopters and

non adopters and found that ERP implementation was associated with

an unexpectedly signicant cost increase Cost of Goods Sold (COGS)

and Selling, General and Administrative Expenses (SG&A) one year

after implementation, and no association was found with income

changes. Ranganathan and Brown [62] found that rms implement

greater ERP functional scope or greater physical scope receive greater

Middleware

Server

RosettaNet, Web Services,

SOA and XML

Supplier

ERP System

Internet

or EDI

E-Business

(with Suppliers)

Supplier

without

ERP system

Internet

Purchasing

Module

Material

Mgmt.

Module

Production

Planning

Module

Sales and

Distribution

Module

Financial

Module

Human

Resources

Module

Focal Firm sERP system

E-Business

(with Customers)

Internet

or EDI

Internet

Customer

ERP System

Customer

without

ERP system

Extranet web

Middleware

Server

RosettaNet, Web Services,

SOA and XML

Extranet web

Fig. 1. How ERP ts with e-business.

335 P.-F. Hsu / Decision Support Systems 56 (2013) 334347

shareholder returns. Appendix A shows more details about these

studies.

In summary, while the existing studies have signicantly expanded

our understanding of ERP business value, the results are mixed with

some indicating improved value and others not. A reviewof IT business

value research [50] suggests that in addition to looking at the IT within

the rm, we should also look at interrm IT linkages because some

performance improvements such as inventory turnover, better asset

utilization, or protability depend on improved processes and informa-

tion ows between rms. Jacobs and Bendoly [32] also pointed out

that most existing ERP research focuses on the impact of an ERP system

itself, but not on the much richer area of ERP extendibility. They argue

that with the growing popularity of B2B and B2C e-commerce systems,

there should be a strong interest in assessing how to best integrate the

functionality of these systems with ERP systems to provide competitive

advantage for rms.

2.2. Business value of e-business technologies

Several studies have examined the relationship between e-business

technologies and rm performance. Using self-reported survey data,

Lederer et al. [37], Barua et al. [9] and Zhu et al. [87,89] found a positive

and signicant relationship between e-business use and rm perfor-

mance. However, they stressed the limitation in their studies that the

subjective performance measures could potentially induce biases, and

therefore, rm level accounting data is needed to conrm these

ndings. Yet, using objective accounting data, Zhuet al.'s [86,88] studies

showed that e-business use is signicantly associated with Cost of

Goods Sold and inventory turnover, but it had weak or no association

with Return on Assets (ROA) and Gross Margin. Appendix B shows a

summary of these studies.

IS researchers indicate that the limitation of current e-business

studies is neglecting the important role of ERP in e-business settings,

and encourage future studies on e-business to focus on more specic

questions about how a rm integrates the Internet with its existing

internal IS such as ERP systems [10,87]. Jacobs and Bendoly [32]

pointed out that while buzzwords like B2B, B2C, and just about

anything else preceded by an e- seem to have taken center stage,

yet ironically, each of these new terms at their most basic levels repre-

sent extensions of ERP systems to the customers and to the suppliers. A

true e-business enabled rm needs the support from a well-tuned ERP

system, since ERP is the core to fulll the promises made on the web

pages. Without clean internal processes and data that are provided

by ERP systems, e-business may be just ashy web pages with no real

substance behind them [55].

Overall, the foregoing studies of ERP and e-business technologies

indicate that they each could contribute to the business value of IT.

However, none of the previous studies examinedthe role of ERP systems

linked with e-business technologies in interrm or interorganizational

systems. Melville et al. [50] and Mukhopadhyay and Kekre [54] suggest

that such interorganizational linkages might produce greater benets

than either technology alone. Consequently we propose to investigate

both the independent and the complementary effect of ERP systems

and e-business technologies on business performance. In order to have

a solid theoretical framework to guide the research, we draw from the

resource-based theory and microeconomic theory to develop theoretical

propositions.

2.3. Theoretical background: Resource complementarity in RBV and

microeconomic theory

The Resource-Based View (RBV) argues that rm resources are

heterogeneously distributed across rms. When the rm resources

are valuable, rare, imperfectly imitable, and nonsubstitutable, they

could create competitive advantages, which in turn could explain the

differences in rm performance [8,28,84]. Moreover, resources tend to

survive imitation because of isolating mechanisms such as history

dependence, causal ambiguity, and social complexity [8]. The RBV (or

its variations) has been applied by information system (IS) researchers

to analyze the business value of IT (see Wade and Hulland [81] for

a review).

Resources and capabilities are two terms that have been frequently

used in the RBV theory. This paper distinguishes between resources

and capabilities based on the denitions in RBV literature

[1,28,29,44,81]. Resources are inputs into a rm's production pro-

cess, such as capital, equipment, information systems, and individ-

ual employees. Capabilities, in contrast, refer to a rm's capacity to

deploy resources using organizational processes. Capabilities can be

viewed as the capacity of a bundle of resources to perform some task

or activity. Through continued use, capabilities become more difcult

for competitors to understand and imitate [28,29,63,81].

Most previous studies based on the RBV posit a direct relationship

between IT resources and rm performance [12,49,65]. More recently,

some researchers have emphasized that the IT resource is likely to affect

rm performance only when it is deployed to create unique comple-

mentarities with other IT or other rm resources [13,60,61,63,76].

Complementarity represents an enhancement of resource value and

arises when a resource produces greater returns in the presence of

another resource thanby itself [51]. Resources rarely act alone increating

or sustaining competitive advantage, and this is particularly true of IT

resources that, in almost all cases, act in conjunction with other rm

resources to provide strategic benets [81]. IT-based success rests on

the ability to t the pieces together complementarily [63].

The importance of complementarity is not only argued by the

RBV researchers, but also by microeconomic scholars. The idea of opti-

mization in microeconomic theory [51] provides an approach to model

complementarity formally. Using microeconomic theory, Milgromet al.

[51,52] provide a simple example in the following to explain why

integrating complements (in our paper, ERP and e-business systems)

is difcult, slow, hard to be duplicated, and if they are successfully inte-

grated, it may bring rms more prots.

Inside a rm, two managers in different departments control inputs

x and y separately. Both of them seek to maximize prots as given by

the entries in the Table 1. The payoff function f(x, y) depends on the

parameter . If increases from 0 to 2, the optimal levels of x and y

rise from (low, low) to (high, high). However, since we usually do not

know how changes (increase or decrease, and the speed of increase

or decrease as a function of x and y), it's not easy to nd the optimal

level of x and y to maximize the rm's total prots. Furthermore,

if the two managers make their decisions separately on how much x

and y should be invested, (i.e. x and y are not fully coordinated or

successfully integrated), suboptimal decisions such as (low, high) or

(high, low) will happen. Milgrom et al. [51] argue that, Suppose

increases from some value b 1 to a value N 1. No amount of indi-

vidual, uncoordinated search will nd an improvement, and the system

can get stuck at the suboptimal position. This example illustrates how

strong complementarities make it more likely that individual adapta-

tions will fail to converge upon optimal results and why change in a

system marked by complementarities may be difcult. Changing only

a few of the system elements at a time to their optimal values may

not come at all close to achieving all the benets that are available

through a fully coordinated move, and may even have negative pay-

offs. Borrowing the same idea from the example, we understand why

practitioners often claim it is not easy to integrate two complements

Table 1

Milgrom et al.'s example.

Payoff function: f(x, y) Low y High y

Low x 5 4

High x 3 4 +

336 P.-F. Hsu / Decision Support Systems 56 (2013) 334347

(ERP and e-business systems) at their optimal levels to receive the

highest total value. It takes time, effort, and experience to nd the char-

acteristics of . The know-howof extracting the most complementarity

value () is rm specic.

Insummary, why does complementarity between IT resources make

it more possible for rms to achieve competitive advantage than one

resource alone? Based on the RBV literature and microeconomic theory,

we propose two explanations for the role of complementarity in IS

context. First, in general, physical technology such as a complex infor-

mation system, by itself is typically imitable. If one rm can purchase

these physical tools of production, then other rms should also

be able to purchase these physical tools, and thus such tools should

not be a source of sustained competitive advantage [8]. On the other

hand, if a rm can exploit physical technology involving the use of

socially complex rm resources, the synergies among them are far

more difcult to imitate [9,88]. Several rms may all possess the same

physical technology, but only some of these rms may possess the social

relations, culture, traditions, etc. to fully exploit this technology in

implementing strategies [8].

Second, complementarity means not only the co-presence of the

two resources as indicated above, but also that the two resources are

used in a mutually reinforcing manner. How effective a rm is in using

two ITs in a reinforcing manner to support and enhance its business

core competencies is difcult. Therefore, complementarily leveraging

resources is considered a rm-specic capability [29,44]. Numerous

studies have commented that integrating IT resources (systems) to

build a exible and sophisticated IT infrastructure requires both consid-

erable time and expertise [6,47,61,63]. Although the individual compo-

nents that go into the infrastructure are commodity-like, the process

of integrating the components to develop an infrastructure tailored to

a rm's strategic context is complex and imperfectly understood [12].

3. Model and hypotheses

Since the above theories provide two different rationales to explain

complementarity, we propose two corresponding research models

to investigate ERP, e-business technologies, and their complementary

effect on business value. Model 1 represents the rst rationale that

the theories provide: Firm resources are considered complementary

when the presence of one resource enhances the effect of another

resource. This interaction perspective of complementarity is typically

operationalized using multiplicative terms in statistical analysis [63].

Hence, we measure the level of complementarity by the product of

ERP and e-business technologies variables (Fig. 2).

Model 2 represents the second rationale that the theories provide:

Resource complementarity is based on howresources are utilized and

deployed; complementaries arise when resources are used in a mutu-

ally reinforcing manner [63]. RBV and microeconomic theory argue

that complementarily deploying and utilizing resources is a rm-

specic capability. Model 2 assesses complementarity by measuring

how ERP and e-business technologies are integrated and utilized at

two levels (Fig. 3). The rst level measures how the two technologies

are integrated at the information system level. The second measures

how the integrated ERP and e-business system is utilized at the busi-

ness process coordination level (left-most bubbles in Fig. 3).

The reason we gage the complementarity at two levels is based on

Markus's distinction between information system integration and

business process coordination [48], which has also been proposed

by many IS researchers [6,24,61,62]. System integration refers to the

creation of tighter linkages between different computer-based infor-

mation systems and databases. Business process coordination repre-

sents the extent to which the business process of two rms are tightly

coordinated and standardized through information systems [6,78].

System integration is required to achieve business coordination;

however, even when system integration is achieved, the goals of

business coordination may not be realized. Due to the concerns about

information leakage, rms usually are reluctant to exchange business

information with their business partners [16]. Two rms might both

achieve a high level of system integration, but their business coordina-

tion level might vary. Systemintegration is viewed as a prerequisite and

facilitator of business coordination, but does not guarantee a rm's

willingness to achieve a higher level of business coordination [48,61].

Rai et al.'s study [61] on supply chain integration capabilities distin-

guishes IT infrastructure integration and supply chain process inte-

gration. They argue that lower-order IT integration capability enables

higher-order process integration capabilities. We adopt the same view

and measure both system integration and business process coordina-

tion in this study.

In addition to the theoretical arguments, there are two other

methodological advantages that motivate us to use the two different

approaches: First, guidelines for research on complementary effect

(interaction effect or t) suggest that researchers should compare the

utility of different statistical techniques using the same data set because

each technique has implied biases [77]. Studies should be designed

to permit comparative evaluation of as many forms of t as possible

[80]. Second, using the directly measured and observable items to

assess the complementarity construct, we can unpack the complemen-

tarity effect and thereby provide practical guidelines to practitioners

about how to use the two technologies to achieve complementarity.

Control Variables:

Firm Size, Industry, Year, ERP Vendor

ERP modules

E-Business

technologies for

communication

ERP*EB

Interaction

Business

Value

Cost Efficinecy

Differentiation

H

1

H2

H

3

Complementary Effect between ERP and E-Business Technologies

(Product Term Approach)

Intangible

Fig. 2. Research model 1.

337 P.-F. Hsu / Decision Support Systems 56 (2013) 334347

3.1. Hypothesis development

Based on the theoretical foundation discussed above, ERP systems

focus on internal process efciency and effectiveness, and can coordi-

nate information across different departments within a company. ERP

systems are expected to affect internal rm operations by decreasing

internal coordination costs [6,59]. On the other hand, e-business tech-

nologies are focused on external, cross-enterprise process efciency

and effectiveness. They can reduce external coordination costs and reap

the benets of supply chain integration [40,59]. Therefore, we propose

the following hypotheses:

H1. A rmwith more complete ERP modules to provide cross-functional

integration is more likely to gain business value.

H2. A rm with more complete e-business technologies to provide

inter-rm integration is more likely to gain business value.

Integrating ERP and e-business is extremely complex. First, when

implementing an ERP system alone, it comes in numerous congura-

tion tables that must be customized to suit a rm's business needs,

and the customization is a challenging task [47]. ERP implementation

also requires substantive changes in business processes, routines, and

roles, as referred to business process reengineering (BRP), which is

also a difcult project [6,47,61,63]. Going a further step to integrate

ERP and e-business technologies to build a digitalized platform that

link business partners to perform business processes electronically

is even more complicated. Business processes such as procurement

and fulllment are inherently complex, since it involves not only

the focal rm itself, but also its business partners. As rms integrating

ERP and e-business systems to link key suppliers and customers, they

have to reengineer business processes and IT systems not only the focal

rm itself, but also all the business partners in the supply chain [6,12].

The new business processes that are supported by a well integrated

ERP and e-business system are like dominoes in a row; each new

transaction sets off a cascade of new events [15,31].

Such complexity of integration requires rms' specic knowledge

and capacity, and is not easily imitated by others [66]. Therefore, inte-

grating ERP systems and e-business technologies to enable business

processes electronically transferred among focal rm and its business

partners is considered hard to be substituted from RBV's perspective,

and is proposed as a source of competitive advantage. Bendloy et al.

[11] argue that once entire value chains are acting as formidable

entities, using inter-rm ITs such as ERP and e-business technologies

to cooperate, the structures of these partnered communities are

hard to duplicate. The idiosyncrasy strengthens the sustainability

of the competitive advantages [11]. Although the individual IT itself

could contribute to rm performance, the process of integrating the

individual IT components to develop a platform tailored to a rm's

strategic context is much more complex, imperfectly understood,

and could contribute more business value to rms [12]. Accordingly,

we hypothesize that

H3. The complementary effect between ERP and e-business technolo-

gies is stronger than the main effects of ERP or e-business technologies

alone.

Lastly, since there are two perspectives on complementarity argued

in the theory: co-presence of two resources (model 1), and howthe two

resources are utilized and deployed in a rm(model 2), we want to test

the different perspectives on complementarity. This is to respond to the

call that researchers should compare the utility of different statistical

techniques and bring as many forms of t as possible using the

same data set to understand complementarity [77]. As we think that

how two resources are utilized, deployed, and used in a mutually

reinforcing manner is muchmore difcult to be imitated by competitors

than co-presence of the two resources, we hypothesize that

H4. The complementarity based on how the two resources are utilized

and deployed in a rmcould contribute more in creating business value

than the complementarity based on IT resource-copresence.

4. Methodology

4.1. Data

To test our research model, a questionnaire was designed to collect

data on each of the variables in the model. We contracted SRBI Inc.

(Schulman, Ronca & Bucuvalus), which is a professional survey rm

that specializes in large-scale survey research, to conduct a telephone

survey. The sampling was selected randomly within U.S. manufacturing

industry. Interviews were conducted only with those companies that

make use of ERP in conducting their business. Eligible respondents

to the survey were the individuals who are considered the most knowl-

edgeable about ERP and e-business use in their companies, such as a

CIO or IS manager to have the best quality of data. Our target completes

were 150 interviews. In total, 1813 potential respondents were

contacted via telephone, with 226 rms nishing the survey.

Among the 226 rms, 76 rms were not ERP users; the remaining

150 rms provided usable data. The responsible rate is comparable

to previous large-scale ERP and e-business surveys as reported in

[5,25,42,43].

Table 2 shows the sample characteristics. The distribution of rm

size measured by employee numbers reects a balance of large and

small rms. Computer, electronic products, and instruments are the

top three ERP using industries. Around half (46.7%) of the sampling

rms have 510 year ERP using experience. The majority (80%) of

ERP modules

E-Business

technologies for

communication

ERP and EB

Complementaries

H

1

H2

H

3

ERP and EB

System

Integration

ERP and EB

Business Process

Coordination

Complementary Effect between ERP and E-Business Technologies

(Direct Measure Approach)

Control Variables:

Firm Size, Industry, Year, ERP Vendor

Business

Value

Cost Efficinecy

Differentiation

Intangible

Fig. 3. Research model 2.

338 P.-F. Hsu / Decision Support Systems 56 (2013) 334347

the respondents are CIOs or IS managers. We compared the prole of

the responding rms with non-responding rms on demographic

variables such as rm size and revenue using Chi-square analysis.

The results indicated no signicant response bias. We also examined

common method bias that may potentially occur in survey data. Using

Harman's single-factor test [57], we found that one general factor can-

not account for the data variance, which indicates there is no signicant

common method bias in our dataset.

1

Although ERP systems are designed with many modules to provide

integrated support, rms seem selective when choosing modules

to implement (Table 3). Transactional-oriented ERP modules, such as

inventory, purchasing, production planning, sales/order entry, and

nance modules, are used by more than 90% of the reported cases. In

contrast, analytical modules such as advanced planning and scheduling

(APS), data warehouse, andCRMmodules that analyze data provided by

the transactional modules are used less often. As for e-business technol-

ogies, websites are used by more rms (97%), while interorganizational

networks such as Extranet and EDI technologies are used by fewer rms

(3751%).

4.2. Operationalization of constructs

Constructs and measurement items usedinthis researchare adapted

from previously validated measures, or are developed on the basis

of literature review. The process of operationalization of constructs as

well as prior research support, are discussed below and summarized

in Appendix C.

ERP modules refer to the scope of ERP system functions a rm

chooses to implement. Based on Porter's value chain concepts, ERP

modules can be of two types: value-chain based transactional modules

and enterprise support analytical modules [62]. Transactional modules

are aimed at integrating a rm's value chain activities: from upstream

material purchasing and inventory control modules, to the focal rm's

manufacturing module, to the downstream customer facing sales/

order entry module. In contrast, analytical modules focus on analyzing

the rawdata collected by the transactional modules to support business

decision making. These modules are often called ERP add-on modules

or Bolt-Ons. We include three analytical modules suggested to have

signicant impacts onrmperformance: advancedplanning andsched-

uling, data warehouse/business intelligence, and customer relationship

management. The way we measure the construct ERP modules is

similar to previous studies [5,31,42,43,75].

E-business technologies for communication refer to Internet-based

technologies that serve as channels for communication between two

rms (inter-organization) or two departments within a rm (intra-

organization) for performing e-business functions [26,87]. Following

Banker et al. [5], Geoffrion and Krishnan [26], and Zhu et al. [87], we

include three e-business technologies: extranet, websites, and EDI into

the research. Extranets are members-only networks run by individual

organizations to directly link two parties, and are implemented as

virtual private networks on the public Internet. Websites are usually

publicly assessable. They serve as the most economical and basic

means for performing e-business functions. Although websites usually

have limited e-business functionalities, they are the most affordable

electronic channels, and are included for their popularity in e-business.

EDI is included as an e-business technology for two reasons. First,

traditional EDI or VAN-based (Value Added Networks) EDI predates

the Internet, and has gradually moved toward Internet- based technol-

ogy, called Internet-based EDI. The EDI technology has been used for

more than two decades, and is still used by many rms for performing

B2B transactions. It is very common that both EDI and Internet technol-

ogies co-exist in a rm. In addition, IS researchers usually include EDI

transactions as part of e-business [5,26,50,71,87], and we adopt the

same approach to measure the e-business construct.

System integration represents the extent to whichdifferent informa-

tion systems are interconnected and can talk to one another [6,45]. It is

conceptualized to include the extent to which information systems are

integrated internally (both across functions, and between e-commerce

and traditional activities) and externally (along the value chain from

suppliers to end customers) [6,7,78,85]. Drawing upon this argument,

we measure ERP and e-business system integration by three items:

internally, (1) the extent a rm's ERP system is integrated with its

own front-end e-business systems; externally, (2) the extent a rm's

ERP systemis directly integrated withits business partners' information

systems, and (3) the extent a rm's ERP systemis assessable by its busi-

ness partners via electronic networks.

Following bothsupply chain literature and IS literature, business pro-

cess coordination is dened as the extent to which important operation-

al information is shared or conducted via electronic networks/systems

between a focal rm and its business partners [6,19,48,61,69,70].

Specially, we consider the sharing of inventory information, demand

information, production planning information, customer orders and

services as indicators of business process coordination. The ve kinds

of information are selected because they are suggested to have signi-

cant inuence on rm performance in the supply chain literature

(see discussion below), are validated items used in a previous

study [13,23,61], and are identied as information that rms are

more willing to share in practice when we examine content validity

with consultants and industry experts.

Table 2

Sample characteristics (N = 150).

Employees # % Industry sector # %

b100 23 15.3% Food 5 3.3%

100199 35 23.3% Apparel and fabric 3 2.0%

200499 40 26.7% Furniture and xtures 4 2.7%

500999 14 9.3% Chemicals and allied products 9 6.0%

10004999 25 16.7% Rubber and plastics 5 3.3%

N4999 13 8.7% Leather 4 2.7%

Metal and fabricate metal 4 2.7%

Computer 21 14%

Electronic products 40 26.7%

Transportation equipment 5 3.3%

Measuring, controlling & medical

instruments

35 13.3%

Miscellaneous manufacturing 15 10%

Years of ERP use # % Respondents # %

b1 year 3 2.0% CIO 74 49.3%

15 years 22 14.7% IS manager 46 30.7%

510 years 70 46.7% Network/database administrator 12 8.0%

1115 years 28 18.7% CFO/accounting manager 6 4.0%

N15 years 27 18.0% Others

a

12 8.0%

a

Others include vice president, general manager, COO (operation), and customer

service/sales manager.

1

Due to page limit, we do not provide details of the test results here. We will pro-

vide the full results upon request.

Table 3

Descriptive statistics for ERP and e-business technologies.

ERP Modules: Adoption Rate

Transactional modules: Inventory module 96%

Purchasing module 95%

Manufacturing module 90%

Sales/order entry module 95%

Financial and accounting module 97%

Analytical modules: Advanced planning and scheduling 59%

Data warehouse/business intelligence 40%

Customer relationship management 36%

E-business technologies

for communication:

Website 97%

Extranet 37%

EDI 51%

339 P.-F. Hsu / Decision Support Systems 56 (2013) 334347

Lee et al.'s [38] study indicates that sharing of inventory information

can reduce total inventory holding level in a rm and in a supply chain

thereby decreasing inventory costs. Sharing of demand related informa-

tion improves forecasting and replenishment [61,75]. In contrast, with

no sharing of demand related information, distorted demand signals

would be amplied and transferred upstream across the supply chain

to cause bullwhip effect [38]. Sharing of production planning informa-

tion can enhance operational efciencies through improved coordina-

tion of allocated resources, activities, and roles across the supply chain

[39,61]. Customer orders and services conducted online improve

customer satisfaction and increase efciency [61]. Our study specically

measures the level that a rm uses electronic networks (e-business

technologies) rather than traditional means (face to face, telephone,

fax etc.) to share operational information stored in ERP systems.

The reason is that only real-time information sharing enabled by

e-business technologies allows rms in supply chains to timely

synchronize production, coordinate inventory-related decisions,

and develop a shared understanding of performance bottlenecks

[14,40]. While system integration is concerned with a rm's tech-

nical capability to link information systems along the supply

chain, business process coordination measures the information that

actually is shared or conducted among supply chain partners. This

view echoes Markus's propositions [45], and is consistent with prior

studies [6,61].

Business value attributable to ERP is measured by three sub-

constructs cost efciency, differentiation, and intangible benets

the three aspects of ERP related performance that concern rms and

that the IS literature oftenuses [61,63]. They are recognizedas resources

for creating competitive advantages, and are important performance

impacts after implementing ERP [20]. While Porter [58] argues that

rms must balance cost efciency and differentiation, and may choose

either one to master, the ERP literature argues that ERP systems have

the ability to improve all the three dimensions (see literature review

of ERP discussed above). Thus, business value is conceptualized as a

second-order construct, manifested in the three dimensions.

2

Whereas

subjective measures of rm performance from the survey were used in

the study, we also validatedthese measures using objective accounting-

based rm performance data. We collected inventory costs (INVT),

Cost of Goods Sold (COGS), and Selling, General and Administrative

Expense (SG&A) data for rms inour sample, following previous studies

[31,59,86].

Firm size, industry, year, and ERP vendor are used as control variables

in the model. Literature suggests that companies of different sizes

tend to perceive different ERP benets [43]. Thus we include rm size

measured by the number of employees into the model. Furthermore,

Melville et al.'s review study of IT business value [50] concludes

that certain industries attain higher IT business impacts and greater

cost reduction than others. They argue that in time-sensitive industries

suchas personal computers, there is anample opportunity to apply IT to

reduce cycle times, better manage inventory, and improve customer

satisfaction. In our sample, we also found that high-tech manufacturing

industries (computer, electronic product, and instruments) adopt ERP

systems more often than traditional manufacturing industries. We

then add an industry dummy variable (high tech vs. traditional) to

investigate the industry effect. Finally, rms are eager to know when

their investments on ERP systems can be paid back and which ERP

vendors' product may be better. We include the year and ERP vendor

dummy variables to investigate the issues.

4.3. Instrument validation

To validate the instruments, we conducted a conrmatory factor

analysis using partial least squares (PLS-Graph version 3.00). The

ability of PLS to model both formative and reective constructs

makes it appropriate for conducting our research. For reective con-

structs, we examined convergent validity, construct reliability, and

discriminant validity. The measurement properties are provided in

Table 4. Construct reliability measures the stability of the scale based

on an assessment of the internal consistency of the items measuring

the construct. In Table 4, all the reective constructs have a composite

reliability over the cutoff of 0.70, as suggested by Straub [72].

Convergent validity is veried through the t-statistic for each factor

loading. As shown in Table 4, all factor loadings are greater than

the typical cutoff value of 0.5 and signicant at the p b 0.01 level.

Discriminant validity measures the extent to which different con-

structs diverge from one another. In Table 5, the diagonal elements

represent the square root of average variance extracted (AVE), pro-

viding a measure of the variance shared between a construct and

its indicators. The square root of AVE is required to be larger than

the correlations between constructs, i.e., the off-diagonal elements

to meet discriminant validity [22,30]. The reective constructs used

in the model meet the criterion. For formative constructs, we check

the four criteria suggest by Rai et al. [61] and Petter et al. [56],

3

and

found that the two constructs used in our study (ERP modules and

e-Business technologies) should be modeled formatively. The weights

of measurement items in the two constructs are all signicant

(Table 6), which suggest that our formative constructs have good quality

[17,56].

Two second-order constructs are used in the model: ERP and

e-business complementarity and business value. We use the second-

order construct because it is a general, more global factor that explains

all the covariation among the rst order factors [17,64]. A second order

construct is modeled as being at a higher level of abstraction, and is

usedcommonly inIS literature [17,61]. ERP ande-business complemen-

tarity is composed of two rst order factors (SI and BPC), based on IS

literature's distinction between information system integration and

business process coordination [6,48]. System integration (SI) measures

how the two technologies are integrated at the information system

level, while business process cooperation (BPC) measures how the

integrated ERP and e-business system is utilized at the business process

coordination level. System integration is viewed as a prerequisite and

facilitator of business coordination [48]. Rai et al.'s study [61] on supply

chain integration capabilities distinguishes IT infrastructure integra-

tion and supply chain process integration. We adopt the same view

and measure ERP and e-business complementarity both at system

integration level and business process coordination level. Business

value is measured by three sub-constructs cost efciency, differentia-

tion, and intangible benets, since the ERP literature argues that ERP

systems have the ability to improve all the three dimensions. Validity of

the second-order constructs is shown in Table 7. The paths from the

second-order construct to the rst-order factors are signicant and of

high magnitude, greater than the suggested cutoff of 0.7 [17].

5. Empirical results

We tested the two research models using PLS-Graph version 3.00.

Both models were run using standardized construct values, and

the standardized path coefcients can be interpreted and compared

directly.

5.1. Empirical results of model 1

Model 1 uses the most common approach of testing a complemen-

tary effect the product terms approach. Fig. 4 shows that both ERP

2

Please note these rm measures do not reect the overall performance of the rm,

but only the improvements that are related to ERP implementation.

3

Whether a construct should be modeled as formative or reective could be judged

by four criteria (Rai et al. 2006): (1) direction of causality from construct to indicators,

(2) interchangeablity of indictors, (3) covariation among indicators, and (4) nomolog-

ical net of construct indicators.

340 P.-F. Hsu / Decision Support Systems 56 (2013) 334347

modules and e-business technologies have positive and signicant

affects on business value (0.266*** and 0.247*** respectively). The

results indicate that the more comprehensive ERP modules and

e-business technologies a rm implements, the higher business

value it may receive. Hypotheses H1 and H2 are supported. The

interaction effect between ERP and e-business technologies is strong

and signicant (0.158**). The result shows that the presence of one

resource enhances the value of another resource. One unit investment

in e-business technologies could increase ERP's contribution to business

value by 0.158 units. The model canexplain18.4%of the variance inrm

performance.

We further break down the ERP construct into two items (transac-

tional and analytical modules) and compare the contribution of each

of the items. This comparison helped us understand which ERP sub-

modules are more important than others in terms of their effects on

nal rm performance. The factor weight of analytical modules is

0.712, greater than that of the transactional modules (0.510), which

indicates that the analytical modules might contribute more to business

value. Recalling that the analytical modules are used less by rms

compared to the transactional modules, here we provide evidence to

support RBV theory's argument: when a resource is rarer and valuable,

it can make a greater contribution to generating rents. The results also

suggest that rms, which have invested much in the traditional ERP

modules that focus on collecting transactional data, should now invest

in the analytical modules that can further analyze transactional data

to support business decision making.

Control variables provide some further interesting ndings. First,

rms are eager to know when their investments on ERP systems can

be paid back. Using year dummy variables, we found that rms start

to feel some business value one year after their ERP implementation

(0.165*), before that, the business value is marginal (0.066). The most

signicant business value increment happens after ve years of using

ERP systems (0.285***). Industry experts predict a four to ve year

learning time for ERP implementation [35,82], and our data conrms

their prediction. Firms need to adjust their business processes to best

t the ERP systems, and it therefore takes some time to see the perfor-

mance improvement.

Second, rm size is negatively associated with ERP business value,

whichsuggests that smaller rms perceive more performance improve-

ment. One possible reason provided by a previous study [43] as well as

our survey results is that smaller rms are more likely to change their

business processes to t ERP system, which can minimize complicated

and costly system modications and may result in higher perceived

performance improvement. On the other hand, larger rms usually

have complex operations and organizational structures, and customiza-

tion is usually unavoidable [45,46]. Mabert and Soni [43] nd that there

is signicant difference between small and large rms in terms of

their ERP customization level; large rms customize more. Third, indus-

try and ERP vendor control variables are insignicant, which suggests

that high-tech and traditional manufacturing industries, and rms that

use different ERP products, perceive no difference in business value

creation.

5.2. Empirical results of model 2

Fig. 5 shows the results of model 2. ERP modules and e-business

technologies again show positive and signicant impacts on business

value (0.202*** and 0.147***). More important, the complementary

effect between ERP and e-business technologies is stronger than the

main effects of ERP or e-business technologies alone (H3 is supported),

and the magnitude (0.321***) is also greater than that in the model 1

(0.158**). The result further shows that while the co-presence of two

technologies is likely to be a source of competitive advantage, resource

complementarity based on how the two resources are utilized and

deployed in a rm could contribute more in creating business value

for rms. Thus, hypothesis 4 is supported.

5.2.1. Robustness test of the complementary effects

While we can directly compare the path coefcients of the two

complementary constructs in model 1 and model 2, we also calculated

effective size of the two interaction terms to understand their relative

strength. Effective size provides a more robust estimation of the degree

to which a phenomenon such as an interaction effect or a complemen-

tarity effect exists in a population[18]. The standard approach for deter-

mining the strength of an interaction effect involves contrasting the

Table 5

Reective constructs: Discriminant validity of instruments.

Constructs (1) (2) (3) (4) (5)

(1) ERP and EB system integration 0.649

(2) Business process coordination 0.253 0.703

(3) Cost efciency 0.046 0.205 0.630

(4) Differentiation 0.215 0.346 0.195 0.579

(5) Intangible benets 0.042 0.092 0.289 0.460 0.865

Note: Diagonal elements are the square root of average variance extracted (AVE), which,

for discriminant validity, should be larger than interconstruct correlations (off-diagonal

elements).

Table 6

Formative constructs.

Formative constructs Indicators Weight

ERP modules TRA 0.439

ANA 0.769

E-business technologies for communication EB1 0.447

EB2 0.369

EB3 0.643

p b 0.01.

Table 7

Measurement model: Second-order constructs.

Second order

constructs

First order constructs Loadings t-stat Composite

reliability

ERP and e-business

complementarity

System integration (SI) 0.803

9.75 0.843

Business process

coordination (BPC)

0.877

19.48

Business value Cost efciency 0.705

7.36 0.805

Differentiation 0.772

8.21

Intangible benets 0.787

17.17

p b 0.01.

Table 4

Reective constructs: reliability, and convergent validity.

Reective constructs Indicators Loading Convergent

validity (t-stat)

Reliability

ERP and EB system integration SI1 0.779

17.87 0.847

SI2 0.815

21.60

SI3 0.822

23.28

Business process coordination BPC1 0.877

10.84 0.819

BPC2 0.822

7.13

BPC3 0.735

5.79

BPC4 0.744

6.79

BPC5 0.708

4.17

Cost efciency CE1 0.757

9.90 0.836

CE2 0.833

32.77

CE3 0.788

17.29

Differentiation DF1 0.808

17.77 0.805

DF2 0.748

13.21

DF3 0.723

9.33

Intangible benets IN1 0.871

61.67 0.858

IN2 0.859

22.61

p b 0.01.

341 P.-F. Hsu / Decision Support Systems 56 (2013) 334347

difference between the squared multiple correlation (R

2

) for the main

effects model (without interaction term) and the interaction models.

Then related f

2

effective size can be computed.

4

Based on the results

of the two competing models (model 1: f

2

= 0.020, small effect;

model 2: f

2

= 0.097, medium effect), we found that introducing the

direct measure approach into model 2 provides greater evidence for

complementarity. The direct measure approach signicantly adds to

the variance explained in the dependent variable. The effect of using

ERP and e-business technologies in a mutually reinforcing manner

is more important in extracting the complementarity value for rms.

5.2.2. System integration vs. business process coordination

By breaking down the complementarity effect, we can see the

relative contribution of system integration and business process

coordination to business value. Our results show that the magnitude

of business process coordination (0.728 0.321) is greater than that of

systemintegration (0.303 0.321) in creating business value. The nd-

ings suggest that although system integration is necessary and difcult

to achieve, a rm's willingness to do a higher level of business process

coordination might be more important.

5.3. Analysis with objective accounting data

To validate our results obtained with subjective measures of busi-

ness value, we collated equivalent accounting-based rm performance

data from COMPUSTAT with survey data. Among the 150 rms in our

sample, 19 rms are private organizations for which accounting-based

performance measures are not available fromCOMPUSTAT, and 8 public

rms have a serious missing value problem and were excluded in our

sample. These result in a dataset with objective and subjective perfor-

mance measures for 123 matched rms.

Because we know the year in which each sample rm implemented

its ERP system from the survey, we collected INVT, COGS, and SG&A

data for each of the 123 rms for the year of ERP implementation and

then, 1, 2, 3, 4, 5, 6 and 7 years after ERP implementation. Note that

each rm has different years of using ERP systems. Therefore, we

computed rm performance difference 1, 2, 3, 4, 5, 6, and 7 years after

ERP implementation for each rm as applicable.

5

These time series

data can reveal when rms would receive business value since ERP im-

plementation. Inventory costs, COGS, and SG&A are commonly used

accounting indices for evaluating operational efciency of a rm, and

are suggested to be impacted by ERP systems [31,59,86]. However,

performance measures for differentiation and intangible benets used

in the survey do not have equivalent accounting-based measures. Thus,

the objective performance only includes the cost efciency construct.

Table 8 shows the objective measures.

We then ran the models 1 and 2 withobjective accounting measures

(cost efciency only) as the dependent variable, while all other speci-

cations are identical to the models tested with perceptual business

value measures. Fig. 6 shows the results of model 2.

6

We found that

the signicant paths are replicated in year 1 and year 2 after ERP imple-

mentation: ERP and e-business technologies have signicant impacts

on cost efciency, while ERP and e-business complementarity is the

strongest factor to affect cost efciency. After two years of ERP imple-

mentation, the main effects of ERP and e-business technology decrease

and become insignicant, but the complementarity effect between them

remains signicant to affect cost efciency. These results provide addi-

tional support for the validity of the subjective performance measures.

6. Discussion

ERP systems, whenintegratedwithe-business technologies properly,

will support a rm's business to business integration to streamline the

owof materials and information in supply chains. This complementary

effect has been proposed by several IS researchers as being the mecha-

nism to fully exploit the value of information technology [3,4548,75],

but to our knowledge has not beenempirically testedbefore. The present

study provides empirical evidence of the complementary effect. We

found that while both ERP and e-business technologies have direct and

positive impacts on business value, the two IT resources do complement

each other. The existence of one resource enhances the value of the

other. Furthermore, the complementary effect based on how the two

resources are utilized and deployed in a rm could contribute more

than the main effects of ERP or e-business technologies alone in creating

business value. We argue that it is the complementary use of the two IT

resources to build systemintegration and business process coordination

capabilities that is the key mechanism in creating greater business

value. We further argue that it is the integration capabilities which

create competitive advantage as the technology is imitable whereas

the knowledge about how to effectively integrate the technologies

and business processes is rm specic. The complementary value that

comes from co-presence of the two ITs is weaker.

6.1. Managerial implication

Several important managerial implications follow from these

results. First, since system integration and process coordination need

4

f

2

= [R

2

(interaction model) R

2

(main effects model)] / [1 R

2

(main effect

model)]. Interaction effect sizes are small if 0.02, medium if 0.15, and large if 0.35 (Chin

2003).

5

Originally, we collected rm performance accounting data for each rm from year

1 to year 15 after ERP implementation as applicable. However, there are only 34 rms

(observations) available since year 8, which is less than the required sample size to

have a robust statistical estimation. A rule of thumb of sample size is 10 times the

number of independent variables, (Chin, 1998). We have 5 independent variables,

and 50 rms (observations) is the desired sample size. Thus, we do not report the es-

timation results after year 8.

6

Results of model 1 are similar to that of model 2, and will be provided upon

request.

ERP modules

E-Business

technologies for

communication

ERP*EB

Interaction

Business

Value

Cost Efficinecy

Differentiation

0

.

2

6

6

*

*

*

0.247***

0

.

1

5

8

*

*

0.770***

0

.

6

4

8

*

*

*

R

2

=18.4%

*** p<0.01; ** p<0.05; * p<0.1

Transactional

Analytical

0

.5

1

0

*

0

.7

1

2

***

Y 0-1 Y1-5 Y 5-10 Y 10-15

0

.

0

6

6

0

.

1

6

5

*

0

.

2

8

5

*

*

* 0

.

1

0

1

*

Firm Size

-

0

.

1

9

4

*

*

Industry

0

.0

5

5

ERP

Vendor

0

.0

0

8

Intangible

0

.

7

9

1

*

*

*

Fig. 4. Model 1 empirical results (product term approach).

342 P.-F. Hsu / Decision Support Systems 56 (2013) 334347

huge investments, both in money and in time, they are considered as

risky investments. In addition, business process coordination is a partic-

ularly challenging task since a rmhas to convince every department in

its organization, business partners, suppliers, and especially customers

that each entity along the supply chain will benet from information

sharing. Whether the cost and effort invested in the system integration

and process coordination would be justied for the organization is

questionable. Based on our results, we show that the investments

would pay off. The higher level of system and business coordination

a rm achieves, the better performance it receives.

Second, referring back to our research question about how rms

could build their complementarity between ERP and e-business tech-

nologies, we show that at the system integration level, a rm should

tightly integrate its internal ERP and front-end e-business systems.

More importantly, outside the focal rm, it should make its ERP system

accessible to its business partners either by an extranet connection, or

by integrating its ERP system directly with business partners' informa-

tion systems the two approaches illustrated in Fig. 1.

Third, at the business process coordination level, rms should

utilize the integrated ERP and e-business system to build rm specic

business coordination capability, such as sharing inventory, production

planning and sales forecasting information. Research shows that close

business process coordination can reduce the bullwhip effect, decrease

inventory level, and accelerate products' time to market [16]. A rm is

encouraged to share business information by utilizing what the inte-

grated IT system enables. Barney [8] indicates that relatively few rms

have been able to deeply embed their information processing system

into their daily business process and management decision-making

process. The inherent difculty of creating close business-IT alignment

may hold the potential of sustained competitive advantage for those

than can do so.

6.2. Contributions to theory

This study makes three specic contributions to the IS literature.

First, based on the RBV and microeconomic theory, we proposed

two research models for studying ERP, e-business technologies, and

their complementary effect. We provided a theoretical explanation

of why the complementary effect exists and why it is more important

than the resource itself. Second, we used two different approaches to

gage the complementary effect to compare the utility of different

statistical techniques using the same data set. This not only provides

a more robust assessment of the complementary effect, but unpacks

the effect from traditional black-box approach. The product-term

approach shows that the co-existence of the two complementary

technologies in a rm does provide additional performance improve-

ment. However, the direct measure approach shows that the most

complementary value can be extracted by rms that can utilize the

two complementary ITs in a mutually reinforcing manner. Using differ-

ent approaches to gage complementarity has been proposed by many

scholars for a long time, but has seldom been done in the past research

[77]. Our study shows that the direct measure of complementarity

provides greater evidence. Third, we conceptually and empirically

distinguish between two capabilities: system integration and business

process coordination. We argue that organizations vary on these capabil-

ities, which may serve as rmspecic elements that RBV argues to affect

the realization of business value.

6.3. Future research and limitations

The study has two limitations. First, due to budget limitation, this

research only asked one single subject to provide both the independent

and dependent variable measures. There may be a tendency for subjects

to give socially appropriate answers. Although we have incorporated

accounting based performance data and performed statistical examina-

tion to validate the perceptual measures, future research is encouraged

to use multiple responses in data collection to reduce the potential bias.

Furthermore, CIO and IS managers may not be the best respondents

to answer ERP impact questions related to customer service area.

Therefore, collecting data frommultiple respondents in a rmis encour-

aged in future research. Second, while ERP and e-business technologies

might lead to higher business performance, both IT value literature

[50] and ERP literature indicate that mere adoption of IT systems does

not guarantee by itself the achievement of performance improvements.

It is only when they are accompanied by the development of effective

IT capabilities and other organizational facilitators that IT investments

produce operational improvements [79]. The fact that adopters of

similar ERP systems and e-business technologies often exhibit pro-

foundly different results suggests that there are some rmspecic com-

petencies that explain why some rms succeed while others fail. The

present study has shown that system integration and business process

coordination are two rm specic capabilities that affect nal rm

performance. Future research could examine other organizational char-

acteristics such as business process changes, organizational structure,

top management involvement, and environment context that may

moderate the value of IT [83]. We plan to collect data for these variables

inour future researchto provide richer andpotentially more explanatory

models.

Table 8

Objective measures of business value.

Objective measures

[Inventory/sales]

(t = 1, 2, 3, 7)

[Inventory/sales]

(t = 0)

[COGS/sales]

(t = 1, 2, 3, 7)

[COGS/sales]

(t = 0)

[SG&A/sales]

(t = 1, 2, 3, 7)

[SG&A/sales]

(t = 0)

Note: t = 0, year of ERP implementation; t = 1, one year after ERP implementation etc.

ERP modules

E-Business

technologies for

communication

ERP and EB

Complementarity

0

.

2

0

2

*

*

*

0.147***

0

.

3

2

1

*

*

*

*** p<0.01; ** p<0.05; * p<0.1

ERP and EB

System

Integration

0

.

3

0

3

*

*

*

0

.

7

2

8

*

*

*

ERP and EB

Business Process

Coordination

Business

Value

Cost Efficinecy

Differentiation

0.785***

0

.

7

5

6

*

*

*

R

2

=25.1%

Y 0-1 Y1-5 Y 5-10 Y 10-15

0

.

0

0

5

0

.

1

1

4

0

.

1

9

4

*

* 0

.

1

0

1

Firm Size

-

0

.

2

2

0

*

*

*

Industry

-

0

.0

6

4

ERP

Vendor

0

.0

0

9

Intangible

0

.

7

8

8

*

*

*

Fig. 5. Model 2 empirical results (direct measure approach).

343 P.-F. Hsu / Decision Support Systems 56 (2013) 334347

Appendix A. Previous studies on value of ERP systems

Article Theory Sample/methodology Main results (business value of ERP)

1 Mabert, Soni, and

Venkataramanan

The International

Journal of Management Science,

2003

No specic theory

is used.

18 case studies and a survey of

215 US manufacturing rms

that were ERP adopters in year 1999.

Descriptive analysis

Intangible level:

The most improvements after using ERP

systems are in intangible areas,

such as increased Interaction across the

enterprise, quicker response

times for information, integration of business processes,

and availability and quality of information.

2 Gattiker and Goodhue

MIS Quarterly

2005

Organizational

information

processing theory

Survey of 111 manufacturing plants.

OLS regression.

Intangible level:

ERP could deliver intangible benets to rms:

Better information, more efcient internal

business process, and better coordination

between different units of the rm.

3 Banker et al.,

MIS Quarterly

2006

Dynamic capability

theory

Survey data of 1077 U.S.

manufacturing plants

WLS regression

Operational level:

Through the mediation effect

of manufacturing capabilities,

ERP systems have impacts on plant

performance including product quality,

product time to market, and plant efciency

4 Cotteleer and Bendoly

MIS Quarterly

2006

Operations

management and

continuous

improvement

Longitudinal order lead-time data

from an ERP implemented rm

ANCOVA and GLS

Operational level:

Order fulllment lead-time showed a signicant

improvement immediately

after ERP system deployment.

5 Karami, Somers,

and Bhattacherjee

JMIS

2007a,b

Innovation Diffusion

theory & Resource

Based View

Survey data of 148 US

manufacturing rms

PLS

Operational level:

Extent of ERP implementation inuences

business process outcomes,

including process efciency, effectiveness, and exibility.

6 Hitt, Wu, and Zhou

Journal of Management

Information Systems

2002

IT productivity Compares nancial performance of 350

ERP adopters from 1986 to 1998 with

non-adopters.

OLS regression.

Financial level:

ERP adopters show more positive impacts

than non-adopters on

Productivity measure (value added),

Protability measures (ROA, prot margin,

sales/emp, sales/assets,

and inventory turnover) (but not on ROE)

Market value (Tobin's q).

ERP modules

E-Business

technologies for

communication

ERP and EB

Complementarity

0

.

1

0

8

*

0.106*

0

.

3

5

3

*

*

*

*** p<0.01; ** p<0.05; * p<0.1

ERP and EB

System

Integration

Business

Process

Coordination

0

.

1

4

2

*

0

.

9

2

6

*

*

*

Cost Efficiency

Difference

R

2

=32.3%

0

.9

5

5

*

*

*

0.863***

0

.8

1

9

*

*

*

1 year firm performance difference after ERP implementation

INVT/Sales

COGS/Sales

SG&A/Sales

Dependent Variable: Cost Efficiency Difference (Objective Accounting Data )

(1,2,3,4,5,6, and 7 years after ERP implementation)

Y1 Y2 Y3 Y4 Y5 Y6 Y7

ERP Modules 0.108* 0.129* 0.107 0.030 0.090 0.108 0.187

E-B technologies for commu. 0.106* 0.199* 0.090 0.020 0.043 0.120 0.101