Professional Documents

Culture Documents

CRM Project

Uploaded by

KiranGaikwad0 ratings0% found this document useful (0 votes)

60 views96 pages"FINAL report ON CAPSTONE PROJECT" submitted to Lovely Professional University in partial fulfillment of the requirements for the award of degree of Master of Business Administration. This project represents thier original work and is worthy of consideration.

Original Description:

Original Title

31349315-CRM-PROJECT.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document"FINAL report ON CAPSTONE PROJECT" submitted to Lovely Professional University in partial fulfillment of the requirements for the award of degree of Master of Business Administration. This project represents thier original work and is worthy of consideration.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

60 views96 pagesCRM Project

Uploaded by

KiranGaikwad"FINAL report ON CAPSTONE PROJECT" submitted to Lovely Professional University in partial fulfillment of the requirements for the award of degree of Master of Business Administration. This project represents thier original work and is worthy of consideration.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 96

1

FINAL REPORT ON CAPSTONE PROJECT

PROJECT TITLE

TO STUDY THE IMPACT OF CRM TECHNIQUES ADOPTED

BY SMALL CAR SEGMENT DEALERS IN THE REGION OF

PUNJAB OF THE DISTRICTS OF JALANDHAR, NAWASHER

AND LUDHIANA

Submitted to Lovely Professional University

In partial fulfillment of the requirements for the award of degree of

MASTER OF BUSINESS ADMINISTRATION

Submitted By: Submitted To:

Group No : R152 Mr. Manish Kumar

Ashwani Kumar(10807616) Mr. Pushpinder Singh

Mithun Saxena(10810750) Dr. Girish Taneja

Munish vardhan (10810337)

2

TO WHOMSOEVER IT MAY CONCERN

This is to certify that the project report titled to study the impact of crm techniques

adopted by small car segment dealers in the region of punjab of the districts jalandhar

ludhiana and nawasher carried out by Ashwani Kumar , Mithun Saxena , Munish

Vardhan has been accomplished under my guidance & supervision as a duly registered

MBA student of the Lovely Professional University, Phagwara. This project is being

submitted by them in the partial fulfillment of the requirements for the award of the Master of

Business Administration from Lovely Professional University.

Thier dissertation represents thier original work and is worthy of consideration for the award

of the degree of Master of Business Administration.

___________________________________

(Name & Signature of the Faculty Advisor)

Date:

3

DECLARATION

I, "Ashwani Kumar , hereby declare that the work presented herein is genuine work done

originally by me and has not been published or submitted elsewhere for the requirement of a

degree programme. Any literature, data or works done by others and cited within this

dissertation has been given due acknowledgement and listed in the reference section.

Ashwani Kumar

10807616

Date: May 3, 2010

4

DECLARATION

I, Mithun Saxena, hereby declare that the work presented herein is genuine work done

originally by me and has not been published or submitted elsewhere for the requirement of a

degree programme. Any literature, data or works done by others and cited within this

dissertation has been given due acknowledgement and listed in the reference section.

Mithun Saxena

10810750

Date:-3 May 2010

5

DECLARATION

I, Munish Vardhan,, hereby declare that the work presented herein is genuine work done

originally by me and has not been published or submitted elsewhere for the requirement of a

degree programme. Any literature, data or works done by others and cited within this

dissertation has been given due acknowledgement and listed in the reference section.

Munish Vardhan

10810337

Date:-3 May 2010

6

ACKNOWLEDGEMENTS

We place on record our sincere thanks to one and all who at different occasions given

valuable suggestions for the development of the project. Our sincere thanks to our honorable

professor Mr. Manish Kumar who as our Faculty Guide has always motivated us to put our

best foot forward by setting high standards for us.

We specially extend our grateful thanks to Mr. Girish Taneja and Mr. Pushpinder

Singh for providing us the valuable suggestions and precious recommendation at different

phases during our research project which help us in making it a success. We want to extend

our sincere gratitude to both Panel heads who has been the guiding force throughout this

research project.

We also thank our peers for being so supportive as well as being so cooperative in

sharing their valuable views and discussing about relevant points while preparing this report.

Ashwani Kumar

Mithun Saxena

Munish Vardhan

7

Table of Contents

Sr. No. CHAPTERS Page No.

1. INTRODUCTION TO CRM 8-18

2. INDUSTRY ANALYSIS 19-21

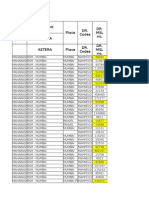

3. PRICING STRATEGY ( HYUNDAI , MARUTI SUZUKI AND TATA) 21-23

4. AUTOMOBILE DEALERS IN INDIA 24

5. LIST OF DEALERS IN JALANDHAR, LUDHIANA AND NAWANSHER 25-29

6. TOOLS OF CRM 30

7. RESEARCH METHODOLOGY 31-33

8. LITERATURE REVIEW AND REFRENCES 33-36

9. QUESTIONNAIRE 37-40

10. ANALYSIS AND DATA-INTERPRETATION 41-90

11. FINDINGS 91

12. LIMITATIONS 92

13. RECOMMENDATIONS AND CONCLUSION 93-94

14. REFERENCES 95

8

What is Customer Relationship management?

Customer relationship management is creating a team relationship among sales,

marketing, and customer support activities within an organization. Another narrow, yet

relevant, viewpoint is to consider CRM only as customer retention in which a variety of after

marketing tactics is used for customer bonding or staying in touch after the sale is made.

Shani and Chalasani define relationship marketing as an integrated effort to

identify, maintain, and build up a network with individual consumers and to

continuously strengthen the network for mutual benefit of both sides, through

interactive, individualized and value-added contacts over a period of time.

The core theme of all CRM and relationship marketing perspectives is its focus on co-

operative and collaborative relationships between the firm and its customers, and/or other

marketing actors. CRM is based on the premise that, by having a better understanding of the

customers needs and desires we can keep them longer and sell more to them.

There are three parts of application architecture of CRM:

operational - automation to the basic business processes (marketing, sales, service)

analytical - support to analyze customer behavior, implements business intelligence

alike technology

co operational - ensures the contact with customers (phone, email, fax, web...)

Improving customer service

CRMs are claimed to improve customer service. Proponents say they can improve customer

service by facilitating communication in several ways:

Provide product information, product use information, and technical assistance on web

sites that are accessible 24 / 7

Help to identify potential problems quickly, before they occur

Provide a user-friendly mechanism for registering customer complaints (complaints that

are not registered with the company cannot be resolved, and are a major source of customer

dissatisfaction)

9

Provide a fast mechanism for handling problems and complaints (complaints that are

resolved quickly can increase customer satisfaction)

Provide a fast mechanism for correcting service deficiencies (correct the problem before

other customers experience the same dissatisfaction)

Identify how each individual customer defines quality, and then design a service strategy

for each customer based on these individual requirements and expectations

use internet cookies to track customer interests and personalize product offerings

accordingly

use the internet to engage in collaborative customization or real-time customization

There are a number of reasons why CRM has become so important in the last 10

years. The competition in the global market has become highly competitive, and it has

become easier for customers to switch companies if they are not happy with the service they

receive. One of the primary goals of CRM is to maintain clients. When it is used effectively,

a company will be able to build a relationship with their customers that can last a lifetime.

Customer relationship management tools will generally come in the form of software. Each

software program may vary in the way it approaches CRM. It is important to realize that

CRM is more than just a technology.

Customer support is directly connected to CRM. If a company fails to provide quality

customer support, they have also failed with their CRM system. When a customer makes

complaints, they must be handled quickly and efficiently. The company should also seek to

make sure those mistakes are not repeated. When sales are made, they should be tracked so

that the company can analyze them from various aspects. It is also important to understand

the architecture of Customer relationship management. The architecture of CRM can be

broken down into three categories, and these are collaborative, operational, and analytical.

The collaborative aspect of CRM deals with communication between companies and their

clients

10

Privacy and ethical concerns

CRMs are not however considered universally good - some feel it invades customer privacy

and enable coercive sales techniques due to the information companies now have on

customers - see persuasion technology. However, CRM does not necessarily imply gathering

new data, it can be used merely to make "better use" of data the corporation already has. But

in most cases they are used to collect new data.

Key CRM principles

Differentiate Customers: All customers are not equal; recognize and reward best customers

disproportionately. Understanding each customer becomes particularly important. And the

same customers reaction to a cellular company operator may be quite different as compared

to a car dealer. Besides for the same product or the service not all customers can be treated

alike and CRM needs to differentiate between a high value customer and a low value

customer.

11

What CRM needs to understand while differentiating customers is?

- Sensitivities, Tastes, Preferences and Personalities

- Lifestyle and age

- Culture Background and education

- Physical and psychological characteristics

Differentiating Offerings

Low value customer requiring high value customer offerings

Low value customer with potential to become high value in near future

High value customer requiring high value service

High value customer requiring low value service

S

e

r

v

i

c

e

R

e

q

u

i

r

e

m

e

n

t

High Low value customers who

Require high levels of service

Must either purchase the higher

level of service or become our

High value customers who

require a high level of

service are maintained

without expanding the costly

offering to the entire

customer population

Low

Low

High

12

Keeping Existing Customers

Grading customers from very satisfied to very disappoint should help the organization in

improving its customer satisfaction levels and scores. As the satisfaction level for each

customer improve so shall the customer retention with the organization.

Maximizing Life time value

Exploit up-selling and cross-selling potential. By identifying life stage and life event trigger

points by customer, marketers can maximize share of purchase potential. Thus the single

adults shall require a new car stereo and as he grows into a married couple his needs grow

into appliances.

Increase Loyalty

Loyal customers are more profitable. Any company will like its mind share status to improve

from being a suspect to being an advocate.

Company has to invest in terms of its product and service offerings to its customers. It has to

innovate and meet the very needs of its clients/ customers so that they remain as advocates on

the loyalty curve. Referral sales invariably are low cost high margin sales.

Summarizing CRM activities:

The CRM cycle can be briefly described as follows:

1. Learning from customers and prospects, (having in depth knowledge of customer)

2. Creating value for customers and prospects

3. Creating loyalty

4. Acquiring new customers

5. Creating profits

13

Learning from

customers &

Creating

Profits

Acquiring new

Fig.3

customers 1

5

3 Creating value

CRM Activities 4 for customers &

prospects

Creating loyal

2 customers

Customer Relationship Life Cycle

CRM facilitates closed- loop customer interactions through all phases of the customer relation

life cycle including:

1. Customer Engagement 2. Business Transaction

Marketing Planning and

Campaign Management

Order Acquisition

Telemarketing and Lead

Internet Pricing and

Generation

Configuration

Opportunity Management

E-Selling

Sales Activity and Contact

Telesales

Management

Field Sales

Customer Segmentation,

Profitability Analysis

Product, and Service Profiling

Collaborative

Content

One Step Buying and Selling

Management

3. Order Fulfillment

Complete Order Life Cycle

Process

Real-Time Availability Checks

Contract, Billing, and Financials

Management

Fulfillment Visibility and Order

Tracking

Customer Engagement

14

4. Customer Service

Interaction Center

Internet Customer Self-Service

Service Management

Claims Management

Field Service -- Mobile Service

Field Service -- Dispatch

Integration of Marketplace

Services

Marketing Planning and Campaign Management -- Enables complete marketing

campaigns, including content development, audience definition, market segmentation,

and communications

Telemarketing and Lead Generation -- Facilitates customer segmentation, lead

qualification, call list management, and monitoring of campaign progress by using

integrated analytical CRM functionality

Opportunity Management -- Provides sales tracking and sales forecasting; helps

plan sales approaches, identify key decision makers, and estimate potential-to-buy

and potential closing dates

15

Sales Activity and Contact Management -- Organizes daily workloads and

customer contact information for display in calendar application; provides links to

Business Intelligence reporting capabilities

Business Transaction

In the business transaction phase of the relationship life cycle Customer Relationship

Management supports the following key functional areas:

Order Acquisition -- Enables planning, organizing, and implementation of sales

strategy; monitors sales pipeline, sales portfolio, and sales budget; facilitates

coordination of budgets, forecasts, and reports on product and pricing trends

Internet Pricing and Configuration -- Delivers online systems that allow users to

configure products online and compare prices across different catalogs and

marketplaces; includes shopping basket functions

E-Selling -- Provides solution for selling products and services via the Internet;

covers all phases of sales cycle, including one-to-one marketing, catalog browsing,

search, order placement, payment, contract completion, and customer support

Telesales -- Manages inbound and outbound calls; handles high call volumes;

provides efficient user interface; integrates sales information from back-office

systems and product information from online catalogs

Field Sales -- Delivers key customer and prospect information to sales personnel at

any place, at any time; facilitates planning and maintenance of sales activities, such as

appointments, visits, and calls, and provides activity reports; creates quotations and

takes orders; includes support for mobile and wireless devices

Order Fulfillment

In the order fulfillment phase of the relationship life cycle Customer Relationship

Management supports the following key functional areas:

Complete Order Life Cycle Process -- Provides the ability to track and trace orders

at all points along order management, manufacturing, distribution, and service

processes; proactively notifies customers of changes that affect delivery

16

Real-time Availability Checks -- Enables allocation of resources in real-time at the

front-end; includes real-time access to inventory levels, production capacity, and lead-

time requirements across the entire supply chain; enables visibility into product and

service delivery dates

Contract, Billing, and Financials Management -- Provides information about

customer contracts, billing status, and accounts; integrates back-office functions

Fulfillment Visibility and Order Tracking -- Enables real-time tracking of order

fulfillment; provides unique, customized and "guided" content for customers; allows

sharing of information with customers via the Internet

Customer Service

In the customer service phase of the relationship life cycle Customer Relationship

Management supports the following key functional areas:

Interaction Center -- Provides inbound and outbound call processing, e-mail

management, and activity management to track, monitor, and enhance all customer

contact; supports multiple channels for customer communication, including telephony

and Web; integrates industry-leading eFrontOffice call center applications from

Nortel Networks Clarify; provides certified interfaces to leading computer telephony

integration (CTI) solutions

Internet Customer Self-Service -- Offers customers and prospects access to

information and customer service functions via Internet; supports effective

customer self service; includes case-logic system featuring advanced decision support

for problem determination and resolution

Service Management -- Meets varied demands of service management business;

handles customer installations; facilitates simple and complex services; supports

services carried out at customer site or in-house repair center (depot); supports

involvement of external service providers; integrates contract management; checks

customer warranties when services are performed; calculates services charges;

integrates information from materials management, cost accounting, billing, and

accounts receivable; monitors day-to-day operations; helps decision makers with

strategic management issues

Claims Management -- Facilitates handling of entire claims process

17

Field Service - (Mobile Service) -- Delivers and tracks customer and account

information for field service personnel; provides service planning and forecasting,

scheduling, and dispatching functionality through tight integration with fulfillment

systems; includes support for mobile and wireless devices

Field Service - (Dispatch) -- Enables rapid allocation of service engineers and

materials to meet incoming service requests

Integration of Marketplace Services -- Provides access to a broad range of

applications and services hosted on virtual marketplace

Figure 4 Customer Life Cycle Management

Business Transaction

Customer

and referrals

customers

Customer Order Fulfillment

Engagement

Customer Service

18

CRM Formation Process

In the formation process, three important decision areas relate to defining the purpose (or

objectives) of engaging in CRM, selecting parties (or customer partners) for appropriate

CRM programs and developing programs (or relational activity schemes) for relationship

engagement with the customer.

Purpose

Increase

Effectiveness

Planning Process

Programs

Account

Management

Partners

Criteria

Team Structure

Role

Planning Process

Process Alignment

Monitoring

Communication

Employee Motivation

Employee Training

Evolution

Enhancement

Relationship

Performance

Strategic

Financial

Marketing

19

INDUSTRY ANALYSIS

GLOBAL FOUR WHEELER INDUSTRY

Evolution

The automobile industry has undergone significant changes since Henry Ford first

introduced the assembly line technique for the mass production of cars. Production

concepts, processes and the associated technologies have changed dramatically since the

first cars were built. Some 70 years ago car assembly was primarily manual work. Today,

the process of car assembly is almost fully automated. In the old days, firms attached

importance to the production of virtually every part in a single plant, while today,

carmakers concentrate on only a few specific production stages. Parts and module

production, services and related activities have been shifted to other, specialised firms

(outsourcing of production steps).Since the 1980s, it has become clear that further

productivity gains to retain competitiveness can be possible only by outsourcing and

securing greater flexibility. For example, firms, especially small car producers whose

markets have been threatened by imports, have diversified their production programmes

(e.g. by building off-road cars or convertibles) thereby introducing greater flexibility in

the production process. Also, firms and their production have become more

internationalized in lieu of outsourcing.

Current Scenario

The global passenger car industry has been facing the problem of excess capacity for

quite some time now. For the year 2002, the global capacity in the automotive industry

was 75 million units a year, against production of only 56 million units (excess capacity

estimated at 25%). Efforts to shore up capacity utilization have prompted severe price

competition, thus affecting margins and forcing fundamental changes in the industry. The

pressure on sales and margins is driving players to emerging markets in pursuit of better

growth opportunities and/or access to low-cost manufacturing bases.

20

The concept of selling in the passenger car industry is changing from original sales

towards lifecycle value generation, encompassing financing, repairs & maintenance,

cleaning, provision of accessories, and so on.

Vehicle manufacturers are moving into completely new materials and technologies

partly guided by environmental legislationin striv ing to come up with radically

different products. Some of these new technologies involve parts that can be bolted on to

an existing vehicle with relatively few implications for the rest of the vehicle. Others are

much more fundamental, and are likely to have a profound impact throughout the supply

chain. The examples include battery, electric or hybrid power trains, and alternatives to

the all-steel body. Carmakers are increasingly outsourcing component production, and

focusing on product design, brand management and consumer care, in contrast to the

traditional emphasis on manufacturing and engineering.

The increasing need to attain global scales underscores the importance of platform

sharing among carmakers. All original equipment manufacturers (OEMs) are trying to

reduce the number of vehicle platforms, but raise the number of models produced from

each platform. This means producing a number of seemingly distinct models from a

common platform.

As in manufacturing, distribution in the automobile industry is undergoing

significant changes, involving Internet use, retailer consolidation, and unbundling of

services provided by retailers.

21

INDIAN FOUR WHEELER INDUSTRY

EVOLUTION

The Indian automobile industry developed within the broader context of import

substitution during the 1950s. The distinctive feature of the automobile industry in India

was that in line with the overall policy of State intervention in the economy, vehicle

production was closely regulated by an industrial licensing system till the early 1980s that

controlled output, models and prices. The cars were built mostly by two companies,

Premier Automobiles Limited and HM. However, the Indian market got transformed after

1983 following the relaxation of the licensing policy and the entry of MUL into the car

market. IN 1991 car imports ere insignificant, while component imports were equivalent

to 20% of the domestic production, largely because of the continuing import of parts by

MUL. The liberalization of the Indian automotive industry that began in the early 1990s

was directed at dismantling the system of controls over investment and production, rather

than at promoting foreign trade. Multinational companies were allowed to invest in the

assembly sector for the first time, and car production was no longer constrained by the

licensing system. However, QRs on built-up vehicles remained and foreign assemblers

were obliged to meet local content requirements even as export targets were agreed with

the Government to maintain foreign exchange neutrality. The new policy regime and

large potential demand led to inflows of foreign direct investment (FDI) by the mid-

1990s. By the end of 1997, Daewoo, Ford India, GM, DaimlerChrysler and Peugeot had

started assembly operations in India. They were followed by Honda, HMIL, and

Mitsubishi.

Current Scenario

Major Players

Bajaj Tempo Limited, DaimlerChrysler India Private Limited, Fiat India Automotive

Private Limited, Ford India Limited, General Motors India Limited, Hindustan

Motors Limited, Honda Siel Cars India Limited, Hyundai Motor India Limited,

Mahindra & Mahindra Limited, Maruti Udyog Limited, Skoda Auto India Limited,

Tata Motors Limited, Toyota Kirloskar Motors Limited.

22

HYUNDAIS PRICING STRATEGY

With the launch of Maruti Swift recently a price war was expected to kick in .

Immediately after maruti raised prices on its debutante Hyundai Motor India hit back with

a Rs 16,000-19,000 markdown on three new variants of Santro Xing.The company has

introduced the XK and XL variants at a lower tag of Rs 3,26,999 and Rs .3,45,999

respectively.The new price variants are likely to give Marutis existing B-segment

models, Zen and WagonR a run for their money. Hyundai has also launched a new non-

AC variant of the Santro at Rs 2.79 lakh, a tad higher than what the existing non-Ac

Santro costs. The next offensive is due from Maruti. With the Santros new price

positioning, Zen and particularly WagonR may be due for a correction, or at least a

limited-period subvention. If that happens the domino effect will kick in across the B-

segment.

Hyundai is positioning its new variants on the tech platform. Strapped with 1.1 litre

engine with eRLX Active Intelligence technology, the new variants also come with new

colour-coordinated interiors, a new front grill and a 4-speed AC blower that makes the air

conditioning more efficient

TATAS PRICING STRATEGY

After the price war being triggered off by Hyundai being the first company to

introduce what came to be known as, pricing based on customer's value perceptions , all

others followed suit.Telco's Indica came in the range of Rs 2.56 lakh to Rs 3.88 lakh with

4 models. The price-points in the car market were replaced by price-bands. The width of a

price-band was a function of the size of the segment being targeted besides the intensity

of competition. The thumb rule being 'the higher the intensity, the wider the price-band.'

PRICING STRATEGY OF MARUTI

Maruti caters to all segment and has a product offering at all price points. It has a

car priced at Rs.1,87,000.00 which is the lowest offer on road. Maruti gets 70% business

from repeat buyers who earlier had owned a Maruti car. Their pricing strategy is to

provide an option to every customer looking for up gradation in his car. Their sole

motive of having so many product offering is to be in the consideration set of every

passenger car customer in India. Here is how every price point is covered.

23

Sl.No. BRAND VARIANTS PRICE IN (Rs.)

1 GRAND VITARA XL7 16,97,000.00

2 MARUTI BALENO LXi 5,72,000.00

VXi 6,42,000.00

3 MARUTI ESTEEM LX 4,66,000.00

VX 5,39,000.00

4 MARUTI VERSA DX 4,19,000.00

DX2 4,58,000.00

5 MARUTI SWIFT LXi 3,95,000.00

VXi 4,05,000.00

ZXi 4,85,000.00

6 MARUTI WAGON-R LX 3,35,000.00

LXi 3,62,000.00

AX 4,63,000.00

VXi 3,87,000.00

VXi ABS 4,20,000.00

7 MARUTI GYPSY ST 5,06,000.00

HT 5,29,000.00

8 MARUTI ZEN D 3,58,000.00

24

CUSTOMER CENTRIC APPROACH

Marutis customer centricity is very much exemplified by the five times consecutive

wins at J D Power CSI Awards. Focus on customer satisfaction is what Maruti lives with.

Maruti has successfully shed off the public- sector laid back attitude image and has

inculcated the customer-friendly approach in its organization culture. The customer

centric attitude is imbibed in its employees. Maruti dealers and employees are

answerable to even a single customer complain. There are instances of cancellation of

dealerships based on customer feedback.

Maruti has taken a number of initiatives to serve customer well. They have even

changed their showroom layout so that customer has to walk minimum in the showroom

and there are norms for service times and delivery of vehicles. The Dealer Sales

Executive, who is the first interaction medium with the Maruti customer when the

customer walks in Maruti showroom, is trained on greeting etiquettes. Maruti has proper

customer complain handling cell under the CRM department. The Maruti call center is

another effort which brings Maruti closer to its customer. Their Market Research

department remains on its toes to study the changing consumer behaviour and market

needs.Maruti enjoys seventy percent repeat buyers which further bolsters their claim of

being customer friendly. Maruti is investing a lot of money and effort in building

customer loyalty programmes.

25

AUTOMOBILE DEALER IN INDIA

The automobile dealer in India is the ninth largest in the world with an annual

production of over 2.3 million units in 2008. In 2009, India emerged as Asia's fourth largest

exporter of automobiles, behind Japan, South Korea and Thailand.

Following economic liberalization in India in 1991, the Indian automotive dealer has

demonstrated sustained growth as a result of increased competitiveness and relaxed

restrictions. Several Indian automobile manufacturers such as Tata Motors, Maruti Suzuki and

Mahindra and Mahindra, expanded their domestic and international operations. India's robust

economic growth led to the further expansion of its domestic automobile market which

attracted significant India-specific investment by multinational automobile manufacturers. In

February 2009, monthly sales of passenger cars in India exceeded 100,000 units bryonic

automotive dealer emerged in India in the 1940s. Following the independence, in 1947, the

Government of India and the private sector launched efforts to create an automotive

component manufacturing dealer to supply to the automobile dealer. However, the growth

was relatively slow in the 1950s and 1960s due to nationalisation and the license raj which

hampered the Indian private sector. After 1970, the automotive dealer started to grow, but the

growth was mainly driven by tractors, commercial vehicles and scooters. Cars were still a

major luxury. Japanese manufacturers entered the Indian market ultimately leading to the

establishment of Maruti Udyog. A number of foreign firms initiated joint ventures with Indian

companies.

Notable Indian Automobile Manufacturers

Hyundai Motors: Santro. i10 , i20

Maruti Suzuki[: 800, Alto, WagonR, Zen Estilo, A-Star, Ritz, Swift, Omni, Versa, Gypsy

Tata Motors: Nano, Indica

26

List of Maruti Suzuki Car Dealers in Jalandhar

Lovely Autos Stan Autos Pvt Ltd

Dr. Ambedkar Chowk, Jullundur, G.T.Road,Opp.D.P.S,, Jullundur,

Jalandhar, Punjab Jalandhar, Punjab

Tel: 0181-2237001-5 2227611,2242555 Tel: 0181-3952521

Swani Motors Ltd

19, G.T. Road,Near Bmc Chowk, Jullundur,

Jalandhar, Punjab

Tel: 0181-2240001/02/03 2240006

List of Maruti Suzuki Car Dealers in Ludhiana

Libra Autocar

Company Limited

Gulzar Motors Limited

G T Road,Dholewal, Ludhiana,

Near Airport, Po

Ludhiana, Punjab

Pawa,G.T.

Road,Ludhiana,

Tel: 0161-2541777 2541965-66

Ludhiana,

Ludhiana, Punjab

Tel: 0161-2512701 -

04

27

Stan Autos Pvt Ltd

Sandhu Automobiles Pvt. Ltd.

Near Sherpur Chowk,G

Link Road, Dholewal Chowk,Ludhiana, Ludhiana, T Road, Ludhiana,

Ludhiana, Punjab Ludhiana, Punjab

Tel: 0161- 2545656 2534514 Tel: 0161-2542100

2542300,2542600

Swani Motors Pvt. Ltd

12, Feroze Gandhi Market,Ferozepur Road,Ludhiana, Ludhiana,

Ludhiana, Punjab

Tel: 0161-5012274,5012774 2770774, 2773774

The major Maruti Showroom at Nawanshahr in Punjab is as

follows:

LOVELY AUTOS

Address: VPO LANGROYA NAWANSHAHR -

CHANDIGARH ROAD DIST. NAWANSHAHR

Ph. No.: 1823-251500 251501

Email: lovelyautosnws@yahoo.co.in

28

Hyundai Car Dealers in Jallandhar-

NAME ADDRESS TELEPHONE NO FAX

Goyal G.T.Road , 0181- 5063662

Hyundai Paragpur. 5062222/5061111/5063672/75

Pin:144005,

Jalandhar.

Kosmo Opp Delhi 0181-5009501/10 5009513 /

Hyundai Public School , 5009504

G.T.Road

Pin:144001,

Jalandhar.

Hyundai Car Dealers in Ludhiana

NAME ADDRESS TELEPHONE FAX

NO

Godawri 5th Milestone, Ferozpur 0161 2808440-5 0161

Hyundai Road, 2808446

Pin:142021, Ludhiana

Pioneer B-XXIX-104/1, 0161- 5095803

Hyundai Sherpur, G.T.Road 5095800/802

Pin:141 003, Ludhiana

Tata Car Dealers in Jalandhar -

NAME ADDRESS TELEPHONE

NO

Cargo Motors BSF Chowk, G. T. Road, Jalandhar. 0181-2243004-8

9814328686

29

Tata Car Dealers in Ludhiana -

NAME ADDRESS TELEPHONE

NO

Garyson Sherpur Chowk, G T Road, 0161-5025655-

Motors Ludhiana. 56

5069948

9855121449

981462565

Dada Motors Savitri I, G. T. Road, Ludhiana. 0161-3295821

9876188000

9876903232

987691323

KOSMO HYUNDAI

Opp Dps Main Rd, Main G T Rd, Basti Jodhewal, Jalandhar, Punjab, India

0181-5009501, 5009502

Hyundai Motor India Limited (HMIL) is a wholly owned subsidiary of Hyundai Motor

Company, South Korea and is the second largest and the fastest growing car manufacturer in

India. HMIL presently markets 34 variants of passenger cars across segments. The Santro in

the B segment, the Getz Prime and the i10 in the B+ segment, the Accent and the Verna in

the C segment, the Sonata Embera in the E segment and the Tucson in the SUV segment.

Hyundai Motor India, continuing its tradition of being the fastest growing passenger car

manufacturer, registering total sales of 327,160 vehicles in the calendar year (CY) 2007, an

increase of 9.2 percent over CY 2006. In the domestic market it clocked a growth of 7.6

percent as compared to 2006 with 200,412 units, while overseas sales grew by 11.8 percent,

with exports of 126,748 units

30

STAN AUTOS

Opp Dps, G T Rd, Jalandhar, Punjab, India

0181-2660366

stanauto@sify.com\

Stan Autos is the leading car and bike magazine, Latest road test on cars and bikes, reviews,

first drives, news, features, helping you buy used cars, answering car and bike queries, best

places to travel, results of Formula 1 drivers standings, updates on A1gp, aprc, wrc, inrc,

prices for all cars and bikes.

31

THE COMMON CRM TOOLS USED BY ALL THE DEALERS

32

NEED OF THE STUDY

The need of this study is to find the impact made by the CRM activities by the different

automobile dealer on the customer satisfaction and sale. On this study will let us know about

the various aspects of the CRM activities and automobile dealer in India. What are the

various factors affecting it positively and negatively? This study will enhance our knowledge

and will help us in times to come. We all find this area of study very lucrative so we have

chosen it as our topic of project.

SCOPE OF THE STUDY

This research study throws light on the CRM activities of the automobile dealer in punjab and

it will let all those who are interested in Indian automobile dealer with CRM to know

impacts of CRM activities by automobile sector.

This research work and survey would help to future researchers and students to know the

impact of crm activities by automobile sector in the broader areas and field and over all

employability and economic growth of the country in this very aspect.

Region of study:

Jalandhar

Banga (nawasehear)

Ludhiana

OBJECTIVES OF STUDY

What are the different CRM techniques being adopted by various dealers in small car

segment in the region of Punjab.

How much the CRM initiative of the companies helps them to retain their existing

customer and acquiring new customers.

Does the CRM activities have any impact on customer locality

To critically analyze the CRM initiative taken by automobile dealers to enhance

customer satisfaction.

33

RESEARCH METHDOLOGY:

PERIOD OF STUDY:

The period of the study for this project cover near about three months. Further, this much

period is a reasonable period to study the performance of target person and to gain knowledge

with respect to the objective of study.

TYPES OF THE RESEARCH:

It is a Descriptive Research and the main objective of Descriptive Research is to learn about

who, what, when and how. It includes study and fact finding inquiries of different kinds.

Thus the major purpose of descriptive research is the description of the state of affairs, as it

exits at present. To understand the various CRM activities and the impact of those activities

on customer loyalty an on the sale of the company we will design a questionaries that in

clued all the above said objectives

It also include Exploratory Research as we are focusing on the what are the recent trends in

the CRM activities in the automobile dealers and what are their consequences.

Population: Population includes the people of Jalandhar, banga (nawasher), Ludhiana

Proposed Sample Size: 100 customers

Research Tool: Questionnaire

FRAMEWORK OF ANALYSIS:

The study has been undertaken to examine and understand the marketing aspect of customer

relationship management for a business playing a crucial role in the growth. The framework

of study is concern with the CRM activities by automobile dealer in the region defined above

34

LITERATURE REVIEW

CRM techniques are the most widely techniques that had been used by the companies

but as our study revolves around the small car dealers so we have collected some of the data

on the existing structure of the CRM in the automobile industry by taking into consideration

the main three companies that is Maruti Suzuki, Hyundai, Tata Motors. To respond to high

customer expectations companies are finding they have to use both traditional and emerging

channels to deliver more effective efficient and profitable marketing sales.

In an article that is free take back network for Tata Motorss ELV that they have

developed an programme of appreciation to the previous Tata customers who wished to

dispose off their car at end of life vehical in UK and give that certificate of destruction and

that is free of charge.

An article that is being posted by delearelite.ca that what actually is the crm in the

automobile industry in that they have explained about the diffrrence between the CRM and

DMS as a dealer management software should have

Also an CRM-DMS initiative that is taken by tata motors has connected company to

1200 dealers and to the end customers. Of course we should also know about the choosing of

CRM software and that can be well got from the article that is poste on CRM guru blog that

is CRM Software Selection Does Not Have to Be Daunting Task which explains that

Choosing CRM software can be a daunting task, it does not have to be an insurmountable

one.

Simply defining the right goals and how the CRM software enables the company to

meet those goals will go a long way in preparing the company to make the smart choice.

Another aricle that is being posted on emerland insight that explains about the digital

loyality networks being adopted by the automobile dealers to enhance their CRM

activities. digital loyalty network, including the implementation of an integrated network

connecting the company with suppliers, alliance partners, dealers and customers .

One of the greatest example of CRM being adopted by maruti Suzuki when it recalled

its A star car due to some of the discrepancies article by arnab RC Bhargava, who is the

chairman of the company said that Maruti Suzuki is committed to the safety of the customers.

Another article that explains about the common CRM requirement to run the small car

dealership effectively and also explain the most suitable CRM solution the article named as

35

Which vendor is the best automotive CRM solution for today's small dealerships?

Typically a smaller dealership will not have that many departments or unnecessary

complexity to worry about, hence a lot simpler CRM solution is required, but at the same time

the system should be powerful and proven solution to their unique marketing challenges.

Some of the challenges facing the smaller dealers are: one the price tag, the smaller dealers

wouldn't want to pay a setup fee from $2000 to $10000, and they certainly don't want to pay a

monthly cost of $1500 - $500. The second challenge is I.T support, because many of the

smaller dealers will not have the luxury of having constant I.T support, therefore their CRM

solution should require minimal user training, with intuitive user interfaces. It should be

easily understood and used by the management, instead of leaving all the CRM problems to

your I.T department. Another feature that is required by the smaller dealer is quick turn

around, when they receive a vehicle, or stocking in a vehicle into their inventory.

In one of the article being posted by sharla sikes she has explained about the

increasing level of customer satisfaction due to the changing CRM that is 360 degree CRM

which maintain from all aspects a complete record of that consumers information. Data and

processes factor large in traditional CRM setups. The article is named as more than just

CRM.

Another article that is being posted by articlebase.com has resulted the parameters

that can be used to measure the customer satisfaction and the maruti was one of the first to

rank highest in customer satisfaction and the parameters on which the customer satisfaction

level was measured were problems experienced, service quality, service advisor, service

initiation, user-friendly service, service delivery, and in-service experience.

on demand automotive crm software solution: (car dealer software This is an

article written by salesboom.com that has explained Automotive CRM software systems are

designed to meet the most demanding Automotive sales software, marketing, call center,

Automotive shop software and field service requirements for car companies, importers, used

car dealers, parts shops, auto repair shops, distributors, and retailers. Salesboom Automotive

CRM tools encompass very comprehensive Automotive Software Applications that facilitate

management, synchronization, and coordination of all customer touch points, including Web,

call center, field organization, Automotive shop, showroom and partner networks.

36

In one of the article that is posted on the blogspot.com the article named as six reason why

crm initiative fails .There can be many reasons why CRM initiatives fail but here its going

to focus specifically on six of them pertaining to small businesses and startups. These CRM

activities has some points to be discussed like Counting v. Creating Customers, Measuring

the Wrong Thing, Structured v. Unstructured Data, Ease-of-Use, "Feeding the Monster",

Transactional Systems v. Solution/Relationship Systems. CRM guru has one of the article

being posted on it that explained about the strategic framework of CRM in automobile

sector. The authors emphasize the need for a cross-functional, process-oriented approach that

positions CRM at a strategic level. They identify five key cross-functional CRM processes: a

strategy development process, a value creation process, a multichannel integration process,

an information management process, and a performance assessment process.

ARTICLE REFRENCES

http://www.articlesbase.com/automotive-articles/why-are-the-dealers-still-using-outdated-

software-as-their-crm-solution-1944208.html

http://gmj.gallup.com/content/28297/what-price-car-customer-loyalty.aspx

http://www.salesboom.com/products/web-based_automotive_crm_software_solution.html

http://www.atypon-link.com/AMA/doi/abs/10.1509/jmkg.2005.69.4.167

http://blog.hubspot.com/Default.aspx?TabId=6307&bid=52

http://www.acastle.com/?gclid=CKe9tMSOsKACFQoupAodDiAiTg

http://www.tmcnet.com/channels/crm-software/articles/5594-crm-software-selection-

does-not-have-be-daunting.htm

http://blog.taragana.com/index.php/archive/maruti-a-star-recalled/

http://www.emeraldinsight.com/10.1108/10878570310505541

http://www.business-standard.com/india/news/auto-companies-need-to-deliver-atdealer\s-

level/367948/

http://www.articlesbase.com/advertising-articles/maruti-suzuki-rolls-high-on-

customer-satisfaction-627273.html

37

Questionnaire

Q:1 What is your family income p.a ?

2-3 lakh 3-4 lakh 4-5 lakh More than 5 lakh

Q: 2 Do you own any car ?

Yes_________ No__________

Q: 3 Please specify the number of cars?

1 2 More than 2

Q: 4 Which company car do you have?

Hyundai Maruti Suzuki Tata motors Any other

Q: 5 How long had you been using their services?

Less than six months More than six months but less than one year

1-3 years More than 3 years

Q: 6 On the scale of 1-5 where 1 represent extremely satisfied and 5 represent extremely

dissatisfied how would you rate your level of overall satisfaction with company?

Extremely Satisfied Neutral Dissatisfied Extremely

satisfied dissatisfied

Why do you say that? What specifically are you satisfied or dissatisfied with company ? enter

response below:

38

Q: 7 Please rate your level of agreement with the following statements (1-5 scale with 1 being

strongly agree,2 being agree,3 being neutral,2 disagree and 1 being completely disagree):

1 2 3 4 5

I believe Company deserves my loyalty

Over the past year, my loyalty to Company has grown

stronger

Company values people and relationships ahead of short-

term goals

Q: 8 Please rate your level of satisfaction with sale representative in the following areas

5- Strongly 4- satisfied 3- Neutral 2 2-Strongly

satisfied dissatisfied dissatisfied

responsiveness

professionalism

Understanding

of my needs

Q: 9 Thinking of your most recent experience with the product/service, how much do you

agree with the following statements?

5- strongly 2- somewhat 3- neutral 4- somewhat 5- strongly

agree agree disagree disagree

It was worth to

purchase

Relationship

maintainers

was good

It is easy to use

You were ask

for feedback

39

You will

repurchase it

Q:10. Thinking of similar products/services offered by other companies, how would you

compare our product/service offered to them?

Much better Somewhat About the Somewhat Much worse Dont know

better same worse

Q:11 Based upon your overall experience, please rate your satisfaction with Customer

Service in the following areas:

5 - Very 4 - Somewhat 3 - Neither 2 - Somewhat 1 - Very

satisfied satisfied satisfied nor dissatisfied dissatisfied

dissatisfied

Issue resolution

Quality of advice

Promptness of

answering phone

Overall quality of

issue handling

Professionalism of

Representative

Helpfulness of

Representative

Ease of contacting

Customer Service

Promptness of email

response

40

Q: 12 I trust the brand image of the company?

Strongly agree Agree Neutral Disagree Strongly

disagree

Q:13 Would you use our service in the future, if you have had a need for it?

Definitely Probably Not sure Probably not Definitely not

Q: 14 how likely are you to recommend company product to a friend a relative? Would you

say the chances are :

Excellent Very good Good

Fair Poor N.A

Q: 15 Amongst all the touch point being used by the company please mention the most of the

effective tools in the following table:

Front desk

Sales representative

Sms

Website

Feedback

Calling

Thank you for your time and valuable input

NAME : AGE:

SEX: OCCUPATON

ADRESS:

41

ANALYSI S AND DATA-INTERPRETATION

What is your family income ?

Which company car do you h ave?

42

Do you own any car ?

Specify the number of car?

How long had you been using their service ?

43

Overall satisfaction with com pany = satisfied

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

ANOVA

Sum of Squares df Mean Square F Sig.

representative Between Groups 3.420 5 .684 .572 .721

Within Groups 112.420 94 1.196

Total 115.840 99

isuueresolution Between Groups 143.649 5 28.730 1.017 .412

Within Groups 2656.061 94 28.256

Total 2799.710 99

customerservice Between Groups 2.609 5 .522 .763 .579

Within Groups 64.262 94 .684

Total 66.871 99

88

89

ANALYSIS OF THE DATA

From the research study it is being found that most of the customers of small car

segment lies in the income level of 2-3 and 3-4 lakh and then after some of the

respondent were also lying in the 4-5 lakh but small in number where as more than 5

lakh is an rare chance.

The number of customer studied who have maruti Suzuki were 42 and Hyundai (28)

whereas tata motors (25) where as 5 were using other cars.

All of the 100 customers own the car.

60 of them were having one car, 35 have 2 cars and 5 have more than 2 cars.

Most of the old customers were attached to maruti as they were using mostly the

service more than 2 years.

The over all satisfaction average of maruti Suzuki customers are more than other

company customers.

Most of the Hyundai customer were responding to their recent experience with the

product that they strongly agree that it was worth to purchase but on an average the

worthiness of tata motors and maruti Suzuki was more in the analysis.

The user friendly award is being given to maruti Suzuki by the customer it is may be

due to the comfort and economical nature of their product and it could be analyse that

they are even using their brand image as a crm tool.\

The repurchase behaviour of all the customers of different companies are matching

but somewhat comparatively the repurchase pattern of tata motors is better resulted.

The study reveale that the feedback pattern used by maruti Suzuki and Hyundai

motors is comparatively good than that of the tata motors as according to the resposes

of 100 people so the result may be somewhat baised.

The loyality of the maruti Suzuki customer can been seen from their rating by

comparing the existing product with other companies they have rated their company

product much better in more frequencies than other customers.

As according to the customers response the brand image of the maruti Suzuki and

tata motors is much more than that of Hyundai and comparatively the brand image of

the maruti Suzuki is much rated by the customer it may be due to their customer

loyality programme and the number of service station available.

90

Most of the maruti Suzuki and tata motors customers are willing to recommend their

product to others but in this parameter Hyundai is also contributing some of the

efforts.

The touch point that have been asked from the customers and on an average the touch

point of the maruti Suzuki and the tatamotors are more effective which shows their

senstiveness towards crm activities but most of the effective tool for maruti is their

sales representative and their front desk where as tata motor is best at their email and

sms response. The effective tool of Hyundai is their email response.

91

FINDINGS

Crm that is customer relationship management is an very emerging activity in the

automobile sector as many of the firms are competing on the basis of this as their

competitive edge.

Punjab has an great hub for small car segment customer as according to the income

level.

As according to the income level people are interested to buy a small car inspite of

their more income.

Some of the software implication are also there in crm for companies.

Customer satisfaction lies in the services and the brand image of the company that is

positioning of the company

Sales representative plays an important role in the customer satisfaction and customer

retention of the given company

As according to the customer response more the company does to maintain the good

relationship with customer the more customer is willing to spread word of mouth as it

is maximum in case of maruti Suzuki.

The hypothesis we have selected that is null hypothesis that is crm has no impact on

the customers is being rejected by one way anova test and the alternative hypothesis is

selected as it is being proved that it has impact on the customer satisfaction.

Hyundai motors are not concentrating much on the crm activities as much as the tata

and the maruti Suzuki are doing.

The number of dealers of tata and Hyundai in the jalandhar and Ludhiana are some

what less than that of maruti.

92

LIMITATIONS

The period of study we were having with was not appropriate with the region defined

in the study as it require more time.

The response that is given by some of the customers about the company whos car

they own may contain some biasness.

It was very difficult to get the data from the dealers in the region because they are not

willing to disclose the data and hence the analysis that has been done on the basis of

available data may contain some biased results.

As we have taken the sample size of 100 people so it is confined to only 100 people

and hence we have taken the whole population as 100 so the result could vary if the

sample size has been changed or the people were changed.

The result of the study is applicable to the survey area alone.

Unwilling respondents also affect the result of the research.

93

RECOMMENDATIONS

In CRM the automobile dealers have to learn from other service industry such as

airline service industry. Each time a customer approaches the service agent his entire

history was flashed on the screen.

Customer knowledge can be used to offer customer specific offer on purchase of

second vehicle in family.

Many organizations operating in automobile market still do not differentiate their

CRM activities at the segment level. They contact each prospect with the same

frequency instead of applying a level effort consistent with the cost of acquisition and

profit potential. Their unrefined use of resources not only leads to wasted investment

but also can cause annoyance among customers who are either being oversupplied or

undersupplied with attention.

Proper training should be given to the employees on the new crm technology that is

being adopted by the organization.

There should be implementation of Microsoft dynamic CRM which is specially

designer for multitasking for businesses to maximize their investment and enhance

productivity.

Our research has analyzed that the most of the customer are diverting their loyalty

from the one dealer due to the reason of some kind of discrepancies in issue resolution

so each dealer should have an independent issue resolution department under their

CRM to better understand their need.

94

CONCLUSION

As our study is being confined to the study of crm by automobile dealers in the region of

Punjab ( jalandhar, ludhiana,nawasher) from the study we have reveal that some of the

customers have no knowledge about the CRM of the company after the purchase of the

car it may be due to the lack of awareness in that area but they could understand when

we explained to them. Now coming to the three companies under study the conclusion

can be stated in one line only that all the CRM initiative taken by the dealers of these

companies have impacted the customer loyalty and customer satisfaction ofcouse some

of the points are there where the dealers have to work on which we have explained in

the recommendation. So by working more on crm they can achive the heights of

customer satisfaction.

95

REFERENCES

www.lovelyautos.net/la_contact.htm

http://www.cardekho.com/Tata/Jalandhar/cardealers

http://www.automobileindia.com/cars/dealers/punjab/tata.html

http://www.deskera.com/crm?googcrm&gclid=CKCS58DQpqECFcVR6wodoiC9EA

www.mouthshut.com/.../Stan_Motors_-_Jalandhar-925104545.html

www.consumercomplaints.in/?search=maruti%20ritz

jalandhar.justdial.com/stan-auto_Jalandhar_qyowveujwfq.htm

www.indiaautomall.com/used_cars.../Punjab.html

iplextra.indiatimes.com/article/05wkedCf8v4JD?q=Missouri

www.capterra.com/auto-dealer-software

www.autobase.net/

www.marutisuzuki.com/

www.hyundai.com/in/en/mai

mydma09.bdmetrics.com/...CRM-Hyundai...CRM/Overview.aspx

www.tatamotors.com

Journals: Auto week

Text book : Kumar, Sinha and Sharma CRM Biztantra Publication

You might also like

- Marketing of Insurance ProductsDocument69 pagesMarketing of Insurance ProductsSaily Pillewar90% (29)

- DivyaDocument60 pagesDivyaKiranGaikwadNo ratings yet

- Curriculum Vitae: Jigar Prakash Polshivneri Chawl No.10, Indira Nagar-1. Sainath Nagar Road, Ghatkopar (W), Mumbai-400086Document2 pagesCurriculum Vitae: Jigar Prakash Polshivneri Chawl No.10, Indira Nagar-1. Sainath Nagar Road, Ghatkopar (W), Mumbai-400086KiranGaikwadNo ratings yet

- DivyaDocument60 pagesDivyaKiranGaikwadNo ratings yet

- RSM - Mumbai 2015Document206 pagesRSM - Mumbai 2015KiranGaikwadNo ratings yet

- Marketing of Insurance ProductsDocument69 pagesMarketing of Insurance ProductsSaily Pillewar90% (29)

- Pooja PowerpntDocument3 pagesPooja PowerpntKiranGaikwadNo ratings yet

- Coverage Feb15Document2 pagesCoverage Feb15KiranGaikwadNo ratings yet

- Dipali Laxman JoriDocument2 pagesDipali Laxman JoriKiranGaikwadNo ratings yet

- Name of Student: Fees Paid AmountDocument2 pagesName of Student: Fees Paid AmountKiranGaikwadNo ratings yet

- Amudha MDocument8 pagesAmudha MKiranGaikwadNo ratings yet

- DD 25Document3 pagesDD 25KiranGaikwadNo ratings yet

- Marketing of Insurance ProductsDocument69 pagesMarketing of Insurance ProductsSaily Pillewar90% (29)

- Pooja PowerpntDocument3 pagesPooja PowerpntKiranGaikwadNo ratings yet

- Gautam I PDFDocument41 pagesGautam I PDFKiranGaikwadNo ratings yet

- Investment Banking FinalDocument74 pagesInvestment Banking FinalSagar ModiNo ratings yet

- BarryDocument25 pagesBarryKiranGaikwadNo ratings yet

- List of Courses Conducted by The University of MumbaiDocument38 pagesList of Courses Conducted by The University of MumbaiKiranGaikwadNo ratings yet

- Evaluation of Performance of Maruti Suzuki India LTD PDFDocument10 pagesEvaluation of Performance of Maruti Suzuki India LTD PDFHomi_nathNo ratings yet

- Investment Banking FinalDocument74 pagesInvestment Banking FinalSagar ModiNo ratings yet

- DD 25Document3 pagesDD 25KiranGaikwadNo ratings yet

- Mane Sarkar 10Document598 pagesMane Sarkar 10KiranGaikwadNo ratings yet

- DD 25Document3 pagesDD 25KiranGaikwadNo ratings yet

- Staff Selection CommissionDocument1 pageStaff Selection CommissionKiranGaikwadNo ratings yet

- DD 25Document3 pagesDD 25KiranGaikwadNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Entrep Business PlanDocument5 pagesEntrep Business PlanElisha Roselle C. LabaneroNo ratings yet

- Please Refer To The Funnel Map.: BrewedfunnelsmediaDocument18 pagesPlease Refer To The Funnel Map.: BrewedfunnelsmediaCam WilkesNo ratings yet

- Dominion Motor Case StudyDocument9 pagesDominion Motor Case StudypranayNo ratings yet

- Internship ReportDocument51 pagesInternship ReportRashid Hussain Wadho0% (1)

- 14 Sales Strategies To Increase Sales and RevenueDocument4 pages14 Sales Strategies To Increase Sales and Revenuenurul aminNo ratings yet

- Chapter 5Document20 pagesChapter 5LAUWA LUM DAUNo ratings yet

- Nten Workbook Getting Started With Data Driven Decision Making Editable 2 pdf0 s7wtDocument17 pagesNten Workbook Getting Started With Data Driven Decision Making Editable 2 pdf0 s7wtapi-366064574100% (1)

- Goff Inglis, KatherineDocument109 pagesGoff Inglis, KatherineMiguel Flores FloresNo ratings yet

- 10 Fast Facts Core Plus Discretionary Incentive Program - English PDFDocument2 pages10 Fast Facts Core Plus Discretionary Incentive Program - English PDFAman DalalNo ratings yet

- Buyer Resume SampleDocument6 pagesBuyer Resume Samplejyw0zafiwim3100% (2)

- Vice President Customer Care in Dallas TX Resume Susan RardinDocument2 pagesVice President Customer Care in Dallas TX Resume Susan RardinSusanRardin100% (1)

- Sales IQ - Create Pipeline CourseDocument4 pagesSales IQ - Create Pipeline CourseChris MuddellNo ratings yet

- WhatsappWaves - Best Bulk Whatsapp Message Sender Made in India - Get 100 Whatsapp Messages Free For Trial PeriodDocument6 pagesWhatsappWaves - Best Bulk Whatsapp Message Sender Made in India - Get 100 Whatsapp Messages Free For Trial Periodwhatsapp waveNo ratings yet

- Financial Management 1 - Chapter 16Document6 pagesFinancial Management 1 - Chapter 16lerryroyceNo ratings yet

- Costco Case StudyDocument7 pagesCostco Case Studymusangz8110No ratings yet

- Revised Business PlanDocument22 pagesRevised Business Planglydel marie nudaloNo ratings yet

- MARS Model of BehaviourDocument5 pagesMARS Model of BehaviourDennish ChandNo ratings yet

- CEL 2105 Worksheet 3 (Week 3) SEM220202021Document5 pagesCEL 2105 Worksheet 3 (Week 3) SEM220202021Luqman A-refNo ratings yet

- Notes - Crown Cork & Seal in 1989Document4 pagesNotes - Crown Cork & Seal in 1989rae sNo ratings yet

- Business Marketing Module 1 - Principles of Marketing and StrategiesDocument22 pagesBusiness Marketing Module 1 - Principles of Marketing and StrategiesMarisse Bagalay Tejamo100% (2)

- Dba1607 Legal Aspects of Business PDFDocument404 pagesDba1607 Legal Aspects of Business PDFsantha3e100% (12)

- Ft232062 - Sec 2 - Rohit Gupta - SHG Business PlanDocument8 pagesFt232062 - Sec 2 - Rohit Gupta - SHG Business PlanKanika SubbaNo ratings yet

- Senior Account Executive in San Francisco, CA ResumeDocument2 pagesSenior Account Executive in San Francisco, CA ResumeRCTBLPONo ratings yet

- Case Study TPCSMM Bmm1302Document6 pagesCase Study TPCSMM Bmm1302Flori May Casakit100% (1)

- Marketing Plan Project - KirbyDocument30 pagesMarketing Plan Project - KirbySondra KirbyNo ratings yet

- Distribution Channel of Mahavir Straw Board Mills (P) LTDDocument44 pagesDistribution Channel of Mahavir Straw Board Mills (P) LTDJaydeep PatelNo ratings yet

- Key Performance Indicators For New Business DevelopmentDocument6 pagesKey Performance Indicators For New Business Developmentvishal_mehta_19No ratings yet

- Vice President Sales Consumer Products in Milwaukee Chicago Resume Daniel NordsieckDocument2 pagesVice President Sales Consumer Products in Milwaukee Chicago Resume Daniel NordsieckDanielNordsieckNo ratings yet

- SBL - Further Question and Practice 2022Document48 pagesSBL - Further Question and Practice 2022Mazni HanisahNo ratings yet

- Asian Development Foundation College Tacloban CityDocument31 pagesAsian Development Foundation College Tacloban CityAmos NioNo ratings yet