Professional Documents

Culture Documents

NMDC LTD: Metals & Mining Sector Outlook - Positive

Uploaded by

mtnit07Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NMDC LTD: Metals & Mining Sector Outlook - Positive

Uploaded by

mtnit07Copyright:

Available Formats

Sunidhi Research |

1

NMDC Ltd

Valuations nearing fair value

NMDC Q4FY14 results were broadly in line with our estimates. We expected

Revenue/Ebidta/PAT of `36bn/24bn/21bn against which company reported

38bn/25bn/19bn. Blended NSRs stood at `3991/tonne, which were in line with our

estimates. We expected higher ralizations i) from Chattisgarh due to price hike taken

by the company, and ii) higher auction premium in Karnataka. However,

EBIDTA/tonne was marginally disappointing due to higher expenses like employee

costs etc. We believe NMDC is in a sweet spot given acute shortage of iron ore in

domestic market. Price cuts look quite distant from here on despite weak

international prices. We are structuraly very positive on Indian resource stocks against

the pure converters. Post strong run up of the stock price we maintain our Neutral

rating on the stock despite increasing our valuation multiple to 6x from 5x earlier on

FY16E EV/EBITDA basis with a target price of `190.

Volume growth on course with domestic shortage and ESSAR pipeline

commissioning

NMDC reported 9.62mnt volumes in Q4FY14,17% higher YoY. Such remarkable growth

in volume has set the tone right for NMDC. IT has ramped up its volume after the

restart of Essar pipeline during Q4FY14. The company had earlier guided for a volume

of 32- 35 mt for FY15, which should not be a problem assuming there wont be any

major disruption in this pipeline again. Also, the company has been ramping up its

volume in Karnataka. In addition, the recent ban on 26 mines including 16 merchant

mines in Odisha has created an opportunity for NMDC to supply to various end users

in and around Odisha and Chhattisgarh.

Domestic Price outlook stronger albeit weak international prices

West coast steel mills in India could resort to import substitution for iron ore as

landed cost for imported iron ore lumps is c.USD106/t compared to USD111/t for

NMDC ore. However sudden demand from eastern coast and central Indian mills

would tempt NMDC not to cut its ore prices in near term. Closure of 26 mines in

Odisha, particularly merchant miners closure would help NMDC to not match the

falling international prices. Though fines still continue to trade at discount, thus we do

not foresee any reduction in ore prices by NMDC over near term. However price rise

looks bit aggressive as NMDC may not allow import price gap to widen.

Valuation and Recommendation

We maintain our positive stance on the company and continue to believe its dominant

position in iron supply especially in restricted iron ore supply market domestically.

However recent run up in stock price seems to discount much of the positives.

Additionally capital allocation to steel plant will accelerate from here on and which

could continue to haunt investor sentiments. However higher dividend payout

remains the silver lining for returns. At the same time we would still like to play for

the uncertainty ride prevailing in Odisha. We tweak our multiples higher ( to 6x from

5x earlier) to incorporate higher than expected annual volume guidance of 35mnt. We

maintain Neutral recommendation with price objective of `190 (earlier 167).

R

e

s

u

l

t

U

p

d

a

t

e

Metals & Mining

Sector Outlook - Positive

June 03, 2014

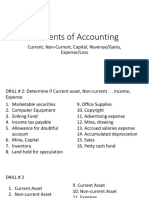

Financials Revenues EBIDTA Adj NP Adj. EPS P.E EV/EBIDTA ROE

` mn

` x x %

FY12 113689 86462 64992 16.4 8.8 4.7 39

FY13 112619 89259 72654 18.5 7.9 4.2 33

FY14 107043 73752 63405 16.0 9.1 4.9 24

FY15E 119130 77026 64834 16.4 8.9 4.6 23

FY16E 124897 80424 67774 17.1 8.5 4.7 22

Source: Company, Sunidhi Research

8.2%

5.4%

3.6% 3.6%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

Revenue EBIDTA PBT APAT

FY13-FY16E CAGR

Recommendation Neutral

CMP (`) 175

Price Target (`) 190

Upside (%) 9%

52 Week H / L ` 189/93

BSE 30 24685

Key Data

No.of Shares, Mn. 3964.7

Mcap, ` Mn 693824.3

Mcap,USD Mn @ `60 11563.7

2 W Avg Qty (BSE+NSE) Mn 6.0

Share holding, Mar'14

Promoters 80.0

FII 6.2

DII 10.6

Public & Others 3.2

Performance 1 M 3 M 6 M 12 M

Stock Return % 17.5 32.4 31.3 47.7

Relative Return % 7.9 15.5 -8.0 19.9

-30.0%

-20.0%

-10.0%

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

60.0%

M

a

y

-

1

3

J

u

l

-

1

3

A

u

g

-

1

3

S

e

p

-

1

3

O

c

t

-

1

3

N

o

v

-

1

3

D

e

c

-

1

3

J

a

n

-

1

4

F

e

b

-

1

4

M

a

r

-

1

4

A

p

r

-

1

4

M

a

y

-

1

4

J

u

n

-

1

4

NMDC NIFTY

Chintan J.Mehta

Chintan.m@sunidhi.com

Phone: +91-022-66106838

NMDC Ltd

Sunidhi Research |

2

Karnataka e-auction volumes were good in Q4FY14, Realizations could be firmer

Q3FY14 results main highlights were higher e-auction realizations from Karnataka. In Q4FY14,

fines realization saw sharp fall, lumps prices were firmer. Moreover than that Lumps volume were

17% higher QoQ against 10% volume growth in fines during Q4FY14. Such higher lump volumes

with firm prices could see better realization from Karnataka as well.

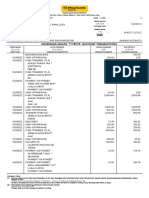

Realization Break up

NMDC sold 10.1 MnT Iron Ore (6 MnT Fines & 4.1 MnT Lumps) in Karnataka E-auction in FY14

Lumps Fines

Month W.A. Grade W.A. Bid Price Allotted Qty W.A. Grade W.A. Bid Price Allotted Qty

Apr-13 63 4,053 232,000 61.2 2,600 420000

May-13 62.5 3,950 332,000 60.8 2,255 524000

Jun-13 63 3,990 308,000 60.5 2,525 496000

Jul-13 62.3 3,826 136,000 60.5 2,037 556000

Aug-13 62.6 3,655 324,000 60.7 2,170 524000

Sep-13 63 3,627 476,000 60.5 2,450 476000

Oct-13 63 3,795 376,000 60.5 2,287 468000

Nov-13 63 3,756 312,000 60.5 2,901 476000

Dec-13 62.2 3,810 364,000 60 3,448 460000

Jan-14 62.4 3,800 524,000 60 2,610 460000

Feb-14 62.8 3,926 400,000 60 2390 672000

Mar-14 62.2 3,888 304,000 60 2370 412000

Total 62.67 3907 4088000 60.43 2380 5944000

Source: Sunidhi Research

Quarterly Performance

Q4FY12 Q1FY13 Q2FY13 Q3FY13 Q4FY13 Q1FY14 Q2FY14 Q3FY14 Q4FY14 YoY QoQ

Net revenues 25,937 28,379 26,118 20,477 30,767 28706 24799 28232 38845 26% 38%

Stock adj -396 -131 -487 -495 -500 243 488 -58 -803 61% 1280%

Raw material charges 61 86 62 85 85 39 80 88 59 -31% -33%

Stores and spares 808 537 398 640 738 618 615 833 1389 88% 67%

Employee costs 1,265 1,353 1,440 1,392 1,420 1483 1447 1574 2559 80% 63%

Royalty and cess 2,928 2,231 2,211 2,047 2,870 2236 1824 2256 3289 15% 46%

SGA -23 361 2,127 1,764 2,460 2911 3664 2432 4467 82% 84%

Other expenses 1,529 946 1,020 1,131 1,476 2125 1745 2081 3189 116% 53%

Total expenditure 6,172 5,383 6,771 6,564 8,549 9654 9863 9204 14148 65% 54%

EBITDA 19,765 22,996 19,347 13,913 22,218 19052 14936 19028 24697 11% 30%

Depreciation 321 328 332 339 359 364 348 362 431 20% 19%

EBIT 19,443 22,668 19,016 13,574 21,859 18688 14588 18666 24266 11% 30%

Other income 5,477 5,546 5,832 5,563 5,507 5209 5384 5077 5275 -4% 4%

Interest 15

18.5

PBT 24,905 28,214 24,848 19,137 27,365 23,897 19,972 23,743 29,523 8% 24%

Extra-ordinary items 513

-454.8

Reported PBT 24,392 28,214 24,848 19,137 27,365 23,897 19,972 23,743 29,978 10% 26%

Current taxes 7,970 9,154 8,062 6,209 8,878 8175.5 6788.3 8070.4 10356 17% 28%

PAT 16,423 19,060 16,786 12,928 18,487 15,722 13,184 15,673 19,621 6% 25%

Adj PAT 15,910 19,060 16,786 12,928 18,487 15,722 13,184 15,673 19,621 6% 25%

E.P.S 4.1 4.8 4.2 3.3 4.7 4 3.3 4.0 4.9 5% 25%

Operating Matrix

Production (mn

tonnes) 7 6.87 5.37 5.32 8.2 6.94 5.95 7.28 10.01 22% 37%

Dispatches (mn

tonnes) 6.5 6.85 5.87 5.32 8.2 7.24 6.51 7.5 9.62 17% 28%

Blended realization

(`/tonne) 4,005 4,143 4,449 3,849 3,752 3,954 3,779 3,764 3,991 6% 6%

EBIDTA/tonne 3041 3357 3296 2615 2710 2631 2294 2537 2567 -5% 1%

Source: Sunidhi Research

NMDC Ltd

Sunidhi Research |

3

Assumptions and recommendation

We maintain our positive stance on the company and continue to believe its dominant position in

iron supply especially in restricted iron ore supply market domestically. However recent run up in

stock price seems to discount much of the positives. Aggressive returns from here on looks

difficult considering 9-10% volume growth for FY15E. Additionally capital allocation to steel plant

will accelerate from here on and which could continue to haunt investor sentiments. However

higher dividend payout remains the silver lining for returns. We tweak our estimates for FY15 to

incorporate higher volumes and higher other expenses as well. We maintain Neutral

recommendation with price target of `190. However any meaningful correction in stock prices

could be used as an entry point for the stock.

2015E 2016E

Iron-ore realization (`/ton)

Domestic lumps (including royalty) 4,758 4,468

Domestic fines (Including royalty) 3,042 2,888

Blended (Including royalty) 3,796 3,640

Export 6,600 6,237

Iron-ore volumes (mn tons)

Chhattisgarh 23.0 23.5

Karnataka 11.0 13.5

Total 34.0 37.0

Lumps 11 12

Fines 22 24

Lumps (%) 33 33

Domestic (%) 92 94

EBITDA/ton (`) 2,389 2,312

Source: Sunidhi Research

Valuation Methodology

EBITDA(FY16E) EV/EBITDA EV

Value per

share

(` mn) (X) (` mn) (`)

EBITDA 86,420 6.0 518,518 131

Net debt (208,291) (53)

CWIP (steel plant) 23,493 6

Target price (`) 750,302 189

Source: Sunidhi Research

NMDC Ltd

Sunidhi Research |

4

Valuations Summary

Balance Sheet (` mn)

Year End-March FY12 FY13 FY14P FY15E FY16E Year End-March FY12 FY13 FY14P FY15E FY16E

Per share (`)

Sources of Funds

EPS 18.5 16.0 17.0 17.4 17.8 Equity Share Capital 3965 3965 3965 3965 3965

CEPS

Reserves & Surplus 240099 271145 280872 308153 332495

BVPS 61.5 69.4 71.8 78.7 84.9 Net Worth 244064 275110 284837 312118 336460

DPS 4.5 7.0 12.5 9 10

Loan Funds 0 0 0 0 0

Payout (%) 24% 44% 73% 52% 56%

Deferred Tax Liability 1001 1045 1045 1045 1045

Valuation (x)

Capital Employed 245065 276155 285882 313163 337505

P/E 9.5 10.9 10.3 10.1 9.8

Application of Funds

P/BV 2.8 2.5 2.4 2.2 2.1

Gross Block 23882 25820 40530 46480 52980

EV/EBITDA 5.5 6.6 5.7 5.9 5.6

Less: Depreciation 11994 13173 14997 17390 20125

Dividend Yield (%) 3% 4% 7% 5% 6%

Net Block 11888 12647 25532 29089 32854

Return ratio (%)

WIP 14942 32361 44851 72551 99551

EBIDTA Margin 79% 69% 65% 63% 64%

Net Fixed Assets 26830 45008 70383 101640 132405

PAT Margin 65% 59% 54% 53% 52%

Investments 2478 2496 2496 2496 2496

ROAE 33% 24% 24% 23% 22%

Current Assets 237111 261385 285141 265088 263374

ROACE 33% 24% 24% 23% 22%

Debtors 7370 10822 11383 12510 13079

Leverage Ratios (x)

Inventory 4589 6375 7385 7736 8073

Total D/E 0.0 0.0 0.0 0.0 0.0

Cash 202646 210258 232441 210911 208291

Net Debt/Equity -0.8 -0.8 -0.8 -0.7 -0.6

Others 22506 33931 33931 33931 33931

Interest Coverage - - - - -

Current Liabilities 21420 32788 72192 56116 60824

Current ratio 11.1 8.0 3.9 4.7 4.3

Creditors 1658 1608 1826 1913 1996

Growth Ratios (%)

Provisions 19762 31181 70366 54204 58828

Income growth -1% -5% 16% 5% 4%

Net Current Asset 215691 228597 212949 208972 202550

EBITDA growth 3% -17% 10% 1% 5%

Misc Expenses 66 54 54 54 54

PAT growth 12% -13% 6% 2% 2%

Total 245065 276155 285882 313163 337506

Turnover Ratios

Cash flow Statement

F.A Turnover x 9.5 8.5 4.9 4.5 4.1

Year End-March FY12 FY13 FY14P FY15E FY16E

Inventory Days 12.6 17.5 20.2 21.2 22.1

PBT 107595 94624 102217 101251 105270

Debtors Days 20.2 29.6 31.2 34.3 35.8

Depreciation 1878 1446 1825 2393 2735

Income Statement (` mn)

Interest Exp -11075 -19643 -22029 -20731 -18964

Year End-March FY12 FY13 FY14P FY15E FY16E Others 45 -36 39185 -16163 4624

Revenues 112619 107043 124012 129907 135566

CF before W.cap 89875 74023 120575 66312 91439

Op. Expenses 23360 33291 43001 47820 49147

Inc/dec in W.cap -8908 -2312 -1353 -1391 -823

EBITDA 89259 73752 81011 82087 86420

Op CF after W.cap 80967 71711 119222 64921 90616

Other Income 20165 22389 23031 21556 21586

Less Taxes -35021 -41000 -34754 -32400 -34739

Depreciation 1302 1385 1825 2393 2735

Net CF From

Operations 45946 30711 84468 32521 55877

EBIT 87958 72367 79186 79695 83684

Inc/(dec) in F.A +

CWIP -15088 -19774 -27200 -33650 -33500

Interest 15 132 0 0 0

(Pur)/sale of

Investments -1042 -19 0 0 0

PBT 107595 94624 102217 101251 105270

others 19658 22010 22652 21169 21191

Tax 34941 31219 34754 32400 34739

CF from Invst

Activities 3528 2216 -4548 -12481 -12309

PAT 72654 63405 67463 68850 70531

Loan Raised/(repaid) 0 0 0 0 1

Source: Company, Sunidhi Research

Dividend -9942 -19109 -23094 -23094 -23094

CF from Fin Activities -19109 -25343 -57736 -41570 -46188

Net inc /(dec) in cash 30365 7612 22184 -21530 -2620

Op. bal of cash 172281 202646 210258 232441 210911

Cl. balance of cash 202646 210258 232441 210911 208291

NMDC Ltd

Sunidhi Research |

5

Sunidhis Rating Rationale

The price target for a large cap stock represents the value the analyst expects the stock to reach over next 12 months. For a stock to be

classified as Outperform, the expected return must exceed the local risk free return by at least 5% over the next 12 months. For a stock

to be classified as Underperform, the stock return must be below the local risk free return by at least 5% over the next 12 months.

Stocks between these bands are classified as Neutral.

(For Mid & Small cap stocks from 12 months perspective)

BUY Absolute Return >20%

ACCUMULATE Absolute Return Between 10-20%

HOLD Absolute Return Between 0-10%

REDUCE Absolute Return 0 To Negative 10%

SELL Absolute Return > Negative 10%

Apart from Absolute returns our rating for a stock would also include subjective factors like macro environment, outlook of the industry

in which the company is operating, growth expectations from the company vis a vis its peers, scope for P/E re-rating/de-rating for the

broader market and the company in specific.

SUNIDHI SECURITIES & FINANCE LTD

Member: National Stock Exchange (Capital, F&O & Debt Market) & The Stock Exchange, Mumbai

SEBI Registration Numbers: NSE: INB 230676436 BSE: INB 010676436

Maker Chamber IV, 14th Floor, Nariman Point, Mumbai: 400 021

Tel: (+91-22) 6636 9669 Fax: (+91-22) 6631 8637 Web-site: http://www.sunidhi.com

Disclaimer: "This Report is published by Sunidhi Securities & Finance Ltd.("Sunidhi") for private circulation. This report is

meant for informational purposes and is not be construed as a solicitation or an offer to buy or sell any securities or related

financial instruments. While utmost care has been taken in preparing this report, we claim no responsibility for its accuracy.

Recipients should not regard the report as a substitute for the exercise of their own judgment. Any opinions expressed in

this report are subject to change without any notice and this report is not under any obligation to update or keep current

the information contained herein. Past performance is not necessarily indicative of future results. This Report accepts no

liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this report. Sunidhi and its

associated companies, directors, officers and employees may from time to time have a long or short position in the

securities mentioned and may sell or buy such securities, or act upon information contained herein prior to the publication

thereof. Sunidhi may also provide other financial services to the companies mentioned in this report."

You might also like

- Thermalnet Methodology Guideline On Techno Economic AssessmentDocument25 pagesThermalnet Methodology Guideline On Techno Economic Assessmentskywalk189No ratings yet

- Grade 5 English Module 1 FinalDocument19 pagesGrade 5 English Module 1 FinalAlicia Nhs100% (4)

- Inclusive Fintech - Blockchain, Cryptocurrency and IcoDocument548 pagesInclusive Fintech - Blockchain, Cryptocurrency and IcoAnonymous b4uZyiNo ratings yet

- Deposit EP BVADocument3 pagesDeposit EP BVAThirunavukarasuMunusamyNo ratings yet

- Islami Bank Bangladesh LimitedDocument1 pageIslami Bank Bangladesh LimitedAbdur RahimNo ratings yet

- ALLPAGO Brazil Online PaymentsDocument5 pagesALLPAGO Brazil Online PaymentsBernard PortNo ratings yet

- NMDC (Natmin) : Outlook Remains BleakDocument10 pagesNMDC (Natmin) : Outlook Remains BleakGauriGanNo ratings yet

- Jindal Steel & Power: Return Ratios Start Looking UpDocument8 pagesJindal Steel & Power: Return Ratios Start Looking UpSUKHSAGAR1969No ratings yet

- J. P Morgan - NMDCDocument12 pagesJ. P Morgan - NMDCvicky168No ratings yet

- NMDC 1qfy2013ruDocument12 pagesNMDC 1qfy2013ruAngel BrokingNo ratings yet

- NTPC - Edelweiss - May 2011Document8 pagesNTPC - Edelweiss - May 2011Deepti_Deshpan_7988No ratings yet

- Gail LTD: Better Than Expected, AccumulateDocument5 pagesGail LTD: Better Than Expected, AccumulateAn PNo ratings yet

- Tata Power: CMP: Inr87 TP: INR77 (-11%)Document8 pagesTata Power: CMP: Inr87 TP: INR77 (-11%)Rahul SainiNo ratings yet

- Madras Cements: Performance HighlightsDocument10 pagesMadras Cements: Performance HighlightsAngel BrokingNo ratings yet

- Hindustan Zinc, 1Q FY 2014Document11 pagesHindustan Zinc, 1Q FY 2014Angel BrokingNo ratings yet

- Performance Highlights: AccumulateDocument12 pagesPerformance Highlights: AccumulateAngel BrokingNo ratings yet

- NTPC, 1Q Fy 2014Document11 pagesNTPC, 1Q Fy 2014Angel BrokingNo ratings yet

- Sterlite, 1Q FY 2014Document13 pagesSterlite, 1Q FY 2014Angel BrokingNo ratings yet

- Godawari Power, 1Q FY 2014Document10 pagesGodawari Power, 1Q FY 2014Angel BrokingNo ratings yet

- Godawari Power 4Q FY 2013Document10 pagesGodawari Power 4Q FY 2013Angel BrokingNo ratings yet

- SharpDocument6 pagesSharppathanfor786No ratings yet

- Shree Cement: Performance HighlightsDocument10 pagesShree Cement: Performance HighlightsAngel BrokingNo ratings yet

- Tata Sponge Iron Result UpdatedDocument11 pagesTata Sponge Iron Result UpdatedAngel BrokingNo ratings yet

- JSW Steel: CMP: INR1,176 TP: INR1,678 BuyDocument8 pagesJSW Steel: CMP: INR1,176 TP: INR1,678 BuySUKHSAGAR1969No ratings yet

- Sarda Energy, 30th January 2013Document12 pagesSarda Energy, 30th January 2013Angel BrokingNo ratings yet

- Amara Raja 4Q FY 2013Document11 pagesAmara Raja 4Q FY 2013Angel BrokingNo ratings yet

- Sarda Energy and MineralsDocument12 pagesSarda Energy and MineralsAngel BrokingNo ratings yet

- Bharat Petroleum Corporation Limited - Oil & Gas: CMP-'728.1 "Hold" TP-'794.0Document4 pagesBharat Petroleum Corporation Limited - Oil & Gas: CMP-'728.1 "Hold" TP-'794.0sakiv1No ratings yet

- Coal India, 15th February 2013Document10 pagesCoal India, 15th February 2013Angel BrokingNo ratings yet

- JSW Steel (JINVIJ) : Performs WellDocument11 pagesJSW Steel (JINVIJ) : Performs Wellarun_algoNo ratings yet

- Grasim Q1FY05 Results PresentationDocument46 pagesGrasim Q1FY05 Results PresentationDebalina BanerjeeNo ratings yet

- Madras Cements, 1Q FY 2014Document10 pagesMadras Cements, 1Q FY 2014Angel BrokingNo ratings yet

- Tata Sponge Iron (TSIL) : Performance HighlightsDocument11 pagesTata Sponge Iron (TSIL) : Performance HighlightsAngel BrokingNo ratings yet

- JMV PreferredDocument25 pagesJMV PreferredAnonymous W7lVR9qs25No ratings yet

- India Cements: Performance HighlightsDocument10 pagesIndia Cements: Performance HighlightsAngel BrokingNo ratings yet

- MRF 1Q Fy2013Document12 pagesMRF 1Q Fy2013Angel BrokingNo ratings yet

- Sarda Energy 4Q FY 2013Document12 pagesSarda Energy 4Q FY 2013Angel BrokingNo ratings yet

- Acc LTD Rs 1020: Top Line Increases On Back of Higher Realization and Robust Dispatch GrowthDocument6 pagesAcc LTD Rs 1020: Top Line Increases On Back of Higher Realization and Robust Dispatch GrowthPearl MotwaniNo ratings yet

- Sembawang Marine 3 August 2012Document6 pagesSembawang Marine 3 August 2012tansillyNo ratings yet

- IDirect JSWSteel CoUpdate Oct16Document5 pagesIDirect JSWSteel CoUpdate Oct16arun_algoNo ratings yet

- Madras Cements 4Q FY 2013Document10 pagesMadras Cements 4Q FY 2013Angel BrokingNo ratings yet

- JSW Steel (JINVIJ) : Muted PerformanceDocument11 pagesJSW Steel (JINVIJ) : Muted Performancearun_algoNo ratings yet

- Q4 FY16 Industry Update & Key Performance Highlights (Company Update)Document62 pagesQ4 FY16 Industry Update & Key Performance Highlights (Company Update)Shyam SunderNo ratings yet

- Gujarat GAS, 22nd February, 2013Document10 pagesGujarat GAS, 22nd February, 2013Angel BrokingNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document11 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Metals & Mining: Strong Quarter, Aided by Healthy RealisationDocument6 pagesMetals & Mining: Strong Quarter, Aided by Healthy RealisationForam SukhadiaNo ratings yet

- MRF 2Q Sy 2013Document12 pagesMRF 2Q Sy 2013Angel BrokingNo ratings yet

- Performance in Line We Upgrade Stock To Hold: Reuters: NMDC - BO Bloomberg: NMDC IN 29 May 2012Document7 pagesPerformance in Line We Upgrade Stock To Hold: Reuters: NMDC - BO Bloomberg: NMDC IN 29 May 2012narsi76No ratings yet

- JSW Steel (JINVIJ) : Mixed Set of NumbersDocument11 pagesJSW Steel (JINVIJ) : Mixed Set of Numbersarun_algoNo ratings yet

- NMDC - FpoDocument10 pagesNMDC - FpoAngel BrokingNo ratings yet

- Amara Raja Batteries: Performance HighlightsDocument11 pagesAmara Raja Batteries: Performance HighlightsAngel BrokingNo ratings yet

- KEC International, 1Q FY 14Document11 pagesKEC International, 1Q FY 14Angel BrokingNo ratings yet

- Hindustan Zinc Result UpdatedDocument11 pagesHindustan Zinc Result UpdatedAngel BrokingNo ratings yet

- td140502 2Document12 pagestd140502 2Joyce SampoernaNo ratings yet

- Sail 1Q FY 2014Document11 pagesSail 1Q FY 2014Angel BrokingNo ratings yet

- Monnet Ispat 4Q FY 2013Document12 pagesMonnet Ispat 4Q FY 2013Angel BrokingNo ratings yet

- Godawari Power, 12th February 2013Document10 pagesGodawari Power, 12th February 2013Angel BrokingNo ratings yet

- India Cements Result UpdatedDocument12 pagesIndia Cements Result UpdatedAngel BrokingNo ratings yet

- ABG ShipyardDocument9 pagesABG ShipyardTejas MankarNo ratings yet

- Idea Cellular: Wireless Traffic Momentum To SustainDocument10 pagesIdea Cellular: Wireless Traffic Momentum To SustainKothapatnam Suresh BabuNo ratings yet

- Market Outlook: Dealer's DiaryDocument22 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- KEC International 4Q FY 2013Document11 pagesKEC International 4Q FY 2013Angel BrokingNo ratings yet

- Gujarat Gas: Performance HighlightsDocument10 pagesGujarat Gas: Performance HighlightsAngel BrokingNo ratings yet

- Canara Bank, 1Q FY 2014Document11 pagesCanara Bank, 1Q FY 2014Angel BrokingNo ratings yet

- 4 May Opening BellDocument8 pages4 May Opening BelldineshganNo ratings yet

- The Ultimate Guide To Logo Design 40 Pro TipsDocument1 pageThe Ultimate Guide To Logo Design 40 Pro TipsSNo ratings yet

- TaxUnderstandingDocument IndianDocument10 pagesTaxUnderstandingDocument Indianmtnit07No ratings yet

- Steel Making Processfinal LowDocument1 pageSteel Making Processfinal Lowmtnit07No ratings yet

- Material and Powder Properties - Dec - 2013Document116 pagesMaterial and Powder Properties - Dec - 2013mtnit07No ratings yet

- Content HacksDocument77 pagesContent HackstothajNo ratings yet

- Srimad Bhagavad Gita (Hindi, Sanskrit, English)Document119 pagesSrimad Bhagavad Gita (Hindi, Sanskrit, English)nss1234567890No ratings yet

- Carburetors TypesDocument28 pagesCarburetors Typesmtnit07No ratings yet

- Dislocation TheoryDocument39 pagesDislocation Theorymtnit07No ratings yet

- Stay Connected Address Change FormDocument2 pagesStay Connected Address Change Formmtnit07No ratings yet

- Isri 2012Document56 pagesIsri 2012mtnit07No ratings yet

- Chapter 18Document19 pagesChapter 18mtnit07No ratings yet

- JSW Investorsteel 1373878301results Presentation Q4March31 2013Document39 pagesJSW Investorsteel 1373878301results Presentation Q4March31 2013mtnit07No ratings yet

- Influence of IronDocument20 pagesInfluence of Ironmtnit07No ratings yet

- A Brief Description of NDTDocument22 pagesA Brief Description of NDTranjana3006No ratings yet

- OxideDocument6 pagesOxidemtnit07No ratings yet

- Aluminum Cast AlloysDocument68 pagesAluminum Cast AlloysPablo JuarezNo ratings yet

- Effect of Corrugated FluteDocument8 pagesEffect of Corrugated Flutemtnit07No ratings yet

- Admin Docs Cepi ContainerBoard List EnglishDocument22 pagesAdmin Docs Cepi ContainerBoard List Englishmtnit07No ratings yet

- 6th Sem MetallurgyDocument13 pages6th Sem Metallurgymtnit07No ratings yet

- Roger Federer-Quest For PerfectionDocument289 pagesRoger Federer-Quest For PerfectionRahul100% (3)

- SemDocument31 pagesSemEddy Pengen Jadi HokageNo ratings yet

- Gate Syllabus For Metallurgical EngineeringDocument3 pagesGate Syllabus For Metallurgical EngineeringSachin GaurNo ratings yet

- KPMG Flash News Draft Guidelines For Core Investment CompaniesDocument5 pagesKPMG Flash News Draft Guidelines For Core Investment CompaniesmurthyeNo ratings yet

- 15 Multiples AnalysisDocument100 pages15 Multiples AnalysisSkander lakhalNo ratings yet

- Needles POA 12e - P 12-07Document4 pagesNeedles POA 12e - P 12-07SamerNo ratings yet

- Internship Report On UBLDocument62 pagesInternship Report On UBLbbaahmad89No ratings yet

- Simple Interest Compounded Interest Population Growth Half LifeDocument32 pagesSimple Interest Compounded Interest Population Growth Half LifeCarmen GoguNo ratings yet

- A Senior Essay Submitted To The Department of in The Partial Fulfillment of The Requirement For The Degree of Bachelor of Art (B.A) OFDocument48 pagesA Senior Essay Submitted To The Department of in The Partial Fulfillment of The Requirement For The Degree of Bachelor of Art (B.A) OFmubarek oumerNo ratings yet

- Fundamentals of Accountancy Business and ManagementDocument24 pagesFundamentals of Accountancy Business and ManagementAshley Judd Mallonga Beran100% (1)

- ReceiptDocument2 pagesReceiptRamazan AkyüzNo ratings yet

- Kotak Mahindra Bank FinalDocument57 pagesKotak Mahindra Bank FinalTejrajsinh100% (2)

- Lesson 1Document47 pagesLesson 1WilsonNo ratings yet

- Assignment of Banking Company 22-23Document6 pagesAssignment of Banking Company 22-23DARK KING GamersNo ratings yet

- Superior Cabinets Maintains A Petty Cash Fund For Minor BusinessDocument1 pageSuperior Cabinets Maintains A Petty Cash Fund For Minor BusinessTaimur TechnologistNo ratings yet

- Maria Theresia ThalerDocument5 pagesMaria Theresia ThalerZoltan NagyNo ratings yet

- Giro Form FinalDocument2 pagesGiro Form FinalJulius Putra Tanu SetiajiNo ratings yet

- Stock Exchange Listing and Firm Performance in GhanaDocument20 pagesStock Exchange Listing and Firm Performance in GhanaSaint Hilary Doe-Tamakloe100% (3)

- Scrip Bitcoin v1Document5 pagesScrip Bitcoin v1Mostafa KamjooNo ratings yet

- MBBsavings - 164017 212412 - 2022 08 31 PDFDocument4 pagesMBBsavings - 164017 212412 - 2022 08 31 PDFAdeela fazlinNo ratings yet

- Budget SheetDocument10 pagesBudget Sheetshrestha.aryxnNo ratings yet

- 18security Trading StatisticsDocument410 pages18security Trading StatisticsYasith WeerasingheNo ratings yet

- Mathematics in Financial Risk ManagementDocument10 pagesMathematics in Financial Risk ManagementJamel GriffinNo ratings yet

- Useful Auditors Menus in DOP FinacleDocument7 pagesUseful Auditors Menus in DOP FinacleKalpesh JayswalNo ratings yet

- Bank Secrecy Act/Anti-Money Laundering Examination ManualDocument439 pagesBank Secrecy Act/Anti-Money Laundering Examination ManualMilton RechtNo ratings yet

- Andleeb Abbas - Declaration of Assets Liabilities - Dec 2013Document4 pagesAndleeb Abbas - Declaration of Assets Liabilities - Dec 2013PTI Official100% (1)

- Simple and Compound InterestDocument3 pagesSimple and Compound InterestSanjay SNo ratings yet