Professional Documents

Culture Documents

T P Chí Containerisation Informa - Ci - 201405 PDF

Uploaded by

vantaibaohiem0 ratings0% found this document useful (0 votes)

115 views61 pagesWebsite : transilam.ftu.edu.vn

Original Title

Tạp chí containerisation informa_ci_201405.pdf

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document0 ratings0% found this document useful (0 votes)

115 views61 pagesT P Chí Containerisation Informa - Ci - 201405 PDF

Uploaded by

vantaibaohiemYou are on page 1of 61

www.containershipping.

com MAY 2014

Data Hub: Load Factors ..............................08

Data Hub: World Fleet Update ...............10

Trade Routes: Transatlantic ......................14

Equipment: Buy or lease? .........................36

EVERGREEN:

EMBARKING ON A

NEW GROWTH PATH

P32

CONFERENCE

HAMBURG HEADLINES:

NEWS FROM GLOBAL

LINER SHIPPING 2014

P40

CARRIERS

MEDITERRANEAN:

2013 BOX PORT

THROUGHPUTS

P16

MORE INSIGHT PORTS

THE

CAREFUL

OPTIMIST

LINER PRESIDENT

& CHIEF EXECUTIVE

MOL

THE

TOSHIYA K KONISHI

INTERVIEW

May 2014

THIS issue of Containerisation International has a distinctly

German flavour.

That is in part down to the fact that the merger between

Hapag-Lloyd and CSAV took another step forward this month

when shareholders in the Chilean shipping line gave their

support to the deal.

The merger now requires the approval of the Senate of

Hamburg and has to make it past regulators before it can be

completed.

Also, Containerisation Internationals Global Liner Shipping

Conference this year took place in Hamburg.

We have full coverage of the conference on page 40,

with the merger deal taking centre stage as speakers

agreed it would be a boost for the city by protecting jobs,

generating business and strengthening the local maritime

cluster.

However, it wasnt all good news for the city as shipping line

executives expressed their concerns for the Port of Hamburgs

future if a project to dredge the River Elbe is declined by

Germanys Federal Administrative Court.

The conference didnt just centre on Hamburg though:

CMA CGM executive officer Rodolphe Saad a last minute

addition to the speaker line up told attendees that the P3

alliance members had rented temporary offices in London as

they prepared for a July start and Maersk Line north Europe

region chief executive Karsten Kildahl told the conference that

eastbound Asia-Europe rates would need to increase as space

on these service was becoming tight at certain times of the

year.

Editor-in-chief Containers Janet Porter

(+44 (0) 20 7017 4617) janet.porter@informa.com

Editor Damian Brett

(+44 (0) 20 7017 5754) damian.brett@informa.com

Sub-editing, design and production Heather Swift

(+44 (0) 20 7017 3207) heather.swift@informa.com

Advertising production Russell Borg

(+44 (0) 20 7017 4495) russell.borg@informa.com

Advertising sales Alan Hart

(+44 (0) 20 3377 3820) alan.hart@informa.com

Advertising sales manager Niraj Kapur

(+44 (0) 20 3377 3868) niraj.kapur@informa.com

Marketing manager Louise Challoner

(+44 (0) 20 7017 5445) louise.challoner@informa.com

Subscription sales William Purchase

Tel: +44 (0) 20 7551 9529 ci.subscriptions@informa.com

Retentions Pauline Seymour

(+44 (0) 20 7017 5063) pauline.seymour@informa.com

Informa plc, Christchurch Court, 10-15 Newgate Street, London EC1A 7AZ

Telephone: +44 20 7017 5000

Incorporating

www.containershipping.com MAY2014

Data Hub: LoadFactors..............................08

Data Hub: WorldFleet Update...............10

TradeRoutes: Transatlantic......................14

Equipment: Buyor lease?.........................36

EVERGREEN:

EMBARKINGONA

NEWGROWTHPATH

P32

CONFERENCE

HAMBURGHEADLINES:

NEWSFROMGLOBAL

LINERSHIPPING2014

P40

CARRIERS

MEDITERRANEAN:

2013BOXPORT

THROUGHPUTS

P16

MOREINSIGHT PORTS

THE

CAREFUL

OPTIMIST

LINER PRESIDENT

& CHIEF EXECUTIVE

MOL

THE

TOSHIYA K KONISHI

INTERVIEW

an informa business

Audited by ABC.

Total circulation 10,017

Jan Dec 2011

Containerisation International is published monthly by

Informa plc. Printed by Wyndeham Grange, Southwick,

Sussex. Distributed in the US by Pronto Mailers

Association. US Periodicals Postage Paid at Middlesex

NJ 08846. POSTMASTER: please send US address

corrections to: Containerisation International c/o Pronto

Mailers Association, P.O.Box 177, Middlesex, NJ 08846.

Sources, uses and disclosures of personal data held by

Informa plc are described in the Official Data Protection

Register. No part of this publication may be reproduced,

reprinted or stored in any electronic medium without the

express permission of the publishers.

Informa plc ISSN: 0010-7379

From Hamburg to Liverpool via Dubai,

Containerisation International is gathering the

best and brightest to discuss what the future

holds for the container shipping industry

A MEETING OF MINDS

The shake-up of the industry since the two shipping lines,

along with Mediterranean Shipping Co, announced plans to

launch the P3 Network also continued this month, with carriers

breaking their joint services with non-alliance members and

moving closer to their partners.

Containerisation International will continue its conference

flavour during the coming months as the Global Liner Shipping

Middle East and Indian Subcontinent has just taken place in

Dubai and we host a debate on the future of Liverpool as a

shipping destination on June 16.

Rest assured, Containerisation International will provide full

coverage of both events.

Damian Brett, editor

Join us on:

Group name:

Containerisation International

@ContainersInt

Subscription rates

UK: 940/Europe

EUR1,230

ROW: USD1,825

Subscriptions hotline:

Tel: +44 (0) 20 7551 9529

Fax: +44 (0) 20 7017 7860

ci.subscriptions@informa.com

Customer services:

Tel: +44 (0) 20 7017 5540

Fax: +44 (0) 20 7017 4614

subscriptions@informa.com

MAY 2014

www.containershipping.com CONTAINERISATION INTERNATIONAL 01

ONWARDS AND

UPWARDS

Box volumes at leading Mediterranean

terminals buoyed by economic recovery

P16

COUNTING THE COSTS

MOLs liner president and chief executive

Toshiya K Konishi on why he thinks the

worst is over for the box trades and dealing

with the fallout from the MOL Comfort

incident

P18

May 2014

OPPORTUNITY

KNOCKS

DP World set for an improved year but still

has to contend with larger vessels and the

growth of alliances

P23

OUR FRIENDS IN

THE NORTH

Free trade agreement between Canada and

Europe means new opportunities

P26

DATA HUB

TRADE STATISTICS

Asia-Europe trade remains dominant as

an increase in demand and fall in capacity

helps boost vessel utilisation

P04

DATA HUB

LOAD FACTORS

Looking at the likely vessel utilisation rates

for the key Asian trade lanes

P08

DATA HUB

WORLD FLEET UPDATE

Box lines struggle with surplus capacity as

newbuilding deliveries continue at a brisk

pace

P10

TRADE ROUTE

INTELLIGENCE

New alliances on the transatlantic trade lane

are set to dominate the market in capacity

terms

P14

26

Its not really the

size of ships

that matter, but

slot costs

DATA HUB

PORTS PORTS

VIEW FROM THE BRIDGE

PORTS

02 CONTAINERISATION INTERNATIONAL www.containershipping.com

CONTENTS / MAY 2014

P18

TOSHIYA K KONISHI

VIEW FROM THE BRIDGE

May 2014

NEW DAWN FOR

LIVERPOOL?

Containerisation International and Lloyds

List to hold debate to consider the future of

the port and Merseyside as a maritime hub

P30

THE GREEN LIGHT

Former number one box line Evergreen

embarks on a new growth path

P32

ASKING THE RIGHT

QUESTIONS

BMT oers non-industry investors the

answers they need when buying

terminal assets

P50

SOCIAL CLIMBING

Joining the digital conversation takes more

than just old-school marketing tactics,

says Agenda Strategies managing partner

Klavs Valskov

P55

ULTRALARGE SHIPS

SEE VALUE INCREASE

VesselsValue head of valuation Toby

Mumford takes a look at the divergence in

the value of containerships

P56

EVENTS

C

M

Y

CM

MY

CY

CMY

K

01662_CI_185X130_HR.pdf 2 2013/10/30 3:34 PM

GUEST COLUMNIST

NEWS ROUNDUP

How Maersk Line rose to the top

P33

London Gateway, Southampton get G6 calls

P34

Language problems contributed to CMA

CGM ship collision

P35

BUY OR LEASE?

Container lessors set to expand but prots

may be harder to earn, says Alastair Hill

P36

THE HEADLINES

FROM HAMBURG

The biggest names in shipping gather for

Containerisation Internationals annual

Global Liner Shipping conference

P40

CARRIERS

BOX WORLD BRIEFING

EQUIPMENT

CONFERENCE

SERVICES

GUEST COLUMNIST

www.containershipping.com CONTAINERISATION INTERNATIONAL 03

ISSUE 4/VOL 47

04 CONTAINERISATION INTERNATIONAL www.containershipping.com May 2014

DATA HUB

TRADE STATISTICS

SUPPLY/DEMAND INDICATORS

FOR CONTAINER SHIPPING

DATA PROVIDED BY:

MDS Transmodal estimates that global

container volumes (excluding intra-regional

trades) will increase by some 6%-7% year on

year in 2014, following on from an increase of

around 4% in 2013.

This month, MDST concentrates on the

Asian trades. Based upon trade data available

in mid-April, MDST estimates that the

transpacific eastbound and the Asia-Europe

westbound trades together accounted for

some 20% of the global container market in

the fourth quarter of 2013 (excluding intra-

regional trades) and are expected to remain

the two major trade lanes in the container

market in 2014.

MDST estimates that the two trade lanes

together increased by around 7% in the last

three months of 2013 compared with the

fourth quarter in 2012. Positive growth is

estimated for the container traffic loaded in

Asia for all other destinations, which overall

are estimated to have increased by some 8%

between the fourth quarter of 2012 and the

same quarter in 2013. For the near future

MDST forecasts trade from Asia might grow by

about 9% for 2014.

Focusing on the most dominant trade

lanes, if on the one hand demand has grown

in the last few quarters, on the other hand the

level of capacity has fallen, leading to more

comfortable level of utilisations for the lines.

From the preliminary results regarding the

first quarter of 2014, MDST estimates these

trends will remain for the rest of the year. For

instance, for the Asia-Europe westbound lane,

which is the busiest trade lane in the deepsea

ASIAEUROPE TRADE

REMAINS DOMINANT

Asia to North Europe Asia to Mediterranean

Leading indicators: headhaul from Asia 000 teu. Italics = projected

Commodity 2012 2013 2014 2015

89 Miscellaneous Manufactures 1131 1133 1274 1328

77 Electrical Machinery 664 705 759 797

83 Travel Goods & Handbags 598 605 587 611

76 Telecom & Recording Equipment 594 586 712 725

69 Metal Manufactures Other 584 599 591 624

Overall headhaul index 100 102 111 116

Overall backhaul index 100 100 101 107

Leading indicators: headhaul from Asia 000 teu. Italics = projected

Commodity 2012 2013 2014 2015

65 Textiles & Made-Up Articles 401 442 509 535

89 Miscellaneous Manufactures 301 323 357 373

83 Travel Goods & Handbags 283 298 320 333

69 Metal Manufactures Other 259 275 295 309

77 Electrical Machinery 238 250 269 285

Overall headhaul index 100 105 120 125

Overall backhaul index 100 106 109 119

Asia to North Europe (000 teu)

Asia includes NE and SE Asia

Asia to Mediterranean (000 teu)

Asia includes NE and SE Asia

9,397 4,250

4,661 1,593

9,586

2%

4,482

5.5%

4,666

0.1%

1,695

6.4%

10,414

8.6%

5,079

13.3%

4,694

0.6%

1,739

2.6%

10,872

4.4%

5,325

4.8%

5,007

6.7%

1,890

8.7%

2012 2012 2013 2013 2014 2014 2015 2015

North Europe to Asia (000 teu)

North Europe includes northern Europe, Scandinavia and the Baltic

Mediterranean to Asia (000 teu)

Mediterranean includes North Africa and the Black Sea

Underlying westbound trade grew by 2% in 2013 and is expected

to grow by 9% in 2014.

Underlying eastbound trade was stable in 2013 and is forecast to

grow by 1% 2014.

Of the leading headhaul commodities all show some growth by

2014.

Annual headhaul growth from 2013 to 2017 is forecast at 5.2%.

Service capacity in the first quarter of 2014 is expected to be 3%

below the first quarter last year.

Year-on-year in the first quarter of 2014, estimated utilisation,

profits and rates are expected to increase.

Underlying westbound trade grew by 6% in 2013 and is expected

to grow by 13% in 2014.

Underlying eastbound trade grew by 6% in 2013 and is forecast to

grow by 3% in 2014.

Of the leading headhaul commodities all are showing signs of

growth.

Annual headhaul growth from 2013 to 2017 is forecast at 6.8%.

Service capacity in the first quarter of 2014 is expected to be 5%

below the first quarter last year.

Year-on-year in the first quarter of 2014, estimated utilisation,

profits and rates are expected to increase.

2012

2012

2013

2013

2014

2014

2015

2015

Increase in demand and fall in capacity helps boost utilisation

container market, MDST forecasts that utilisation levels may reach 85% in the first

quarter of 2014.

However, despite the simultaneous increase in demand and cut in capacity,

freight rates after an early April jump following the general rate increase

announcements have continued to fall. Both the Asia-Europe and Asia-

Mediterranean components of the Shanghai Containerised Freight Index have

decreased during the last few weeks, reaching a level of $1,077 per teu for North

Europe and $1,182 per teu for the Mediterranean in late April, before a May 1

rally.

As illustrated in Graph A on the next page, with index 2006 Q1=100, the marginal

increase in the level of global capacity estimated for the fourth quarter of 2013,

combined with a decreased estimate in demand, has led to a widening in the gap

between supply and demand to 24 points, versus 21 observed in the third quarter

of 2013.

In so far as the individual trade lanes covered in this edition are concerned,

trade between Asia and Europe is estimated to have grown in 2013; by some

2% to North Europe and by 5.5% to the Mediterranean. Positive results are also

expected for the near future. For 2014, MDST forecasts an 8.6% rise to North

Europe and 13.3% to Mediterranean. Electrical equipment, textiles articles

and miscellaneous manufactures are the principal commodities exported

westbound.

Asia to Mid-East Gulf & Indian subcontinent Northeast Asia to Australia & Oceania

Asia to Mid-East Gulf & Indian subcontinent (000 teu)

Asia includes NE and SE Asia

Northeast Asia to Australia & Oceania (000 teu)

Northeast Asia includes China, Hong Kong, Taiwan, Japan, North Korea & South Korea

7,215 1,320

3,204 1,257

7,831

8.5%

1,331

0.8%

3,406

6.3%

1,208

-3.9%

8,871

13.3%

1,509

13.4%

3,849

13%

1,271

5.2%

9,378

5.7%

1,565

3.7%

4,107

6.7%

1,343

5.7%

2012

2012

2013

2013

2014

2014

2015

2015

Mid-East Gulf & Indian subcontinent to Asia (000 teu)

Mid-East Gulf & Indian subcontinent includes Gulf states, India, Pakistan, Sri Lanka & Bangladesh

Australasia & Oceania to northeast Asia (000 teu)

Australasia & Oceania includes Australia, New Zealand and Pacific Islands

Underlying westbound trade grew by 9% in 2013 and is forecast to

grow a further 13% in 2014.

Underlying eastbound trade grew by 6% in 2013 and is expected to

grow by 13% in 2014.

Of the leading headhaul commodities textiles shows the most

growth.

Annual headhaul growth from 2013 to 2017 is forecast at 7.6%.

Service capacity in the first quarter of 2014 is expected to be 1%

above the first quarter last year.

Year-on-year in the first quarter of 2014, estimated utilisation and

profits are expected to increase and rates are expected to decrease.

Underlying northbound trade fell by 4% in 2013 but is expected to

grow by 5% in 2014.

Underlying southbound trade grew by 1% in 2013 and is expected

to grow by 13% in 2014.

There appears some growth in all the leading headhaul commodities.

Annual headhaul growth from 2013 to 2017 is forecast at 6.3%.

Service capacity in the first quarter of 2014 is expected to be 5%

below the first quarter last year.

Year-on-year in the first quarter of 2014, estimated utilisation

is expected to remain substantially stable, rates are expected to

decrease and profit is anticipated to improve.

2012 2012 2013 2013 2014 2014 2015 2015

* Excludes intra-regional trade. ** Forecast. On the basis of trade data available in mid-April

the consultancy projects the following changes in underlying demand along the main trade lanes

for loaded containers for the forthcoming 12 months (4Q 2013 3Q 2014 as compared with the

previous 12 months). For explanatory notes that define how data has been organised please see

www.boxtradeintelligence.co.uk.

2011-

2012

2012-

2013

2013-

2017**

North America to Europe -6% +4% +4.1%

North America to Asia (Far East) +5% +7% +5.1%

Asia (Far East) to Europe -2% +3% +5.3%

Asia (Far East) to North America +6% +5% +3.5%

Europe to Asia (Far East) +1% +2% +4.6%

Europe to North America +6% +6% +4.8%

North America exports * +2% +5% +4.9%

North America imports * +6% +4% +3.8%

Asia (Far East) Exports * +3% +5% +5.3%

Asia (Far East) Imports * +7% +5% +5.2%

Europe & Med Exports * +5% +4% +5.2%

Europe & Med Imports * -2% +3% +4.9%

Intra Asia (Far East) +6% +4% +4.9%

Intra Europe +4% +6% +4.9%

Global overview +5% +4% +5.0%

Leading indicators: headhaul from Asia 000 teu. Italics = projected

Commodity 2012 2013 2014 2015

77 Electrical Machinery 611 637 764 815

65 Textiles & Made-Up Articles 586 645 687 735

66 Mineral Manufactures 551 544 555 594

76 Telecom & Recording Equipment 526 702 1032 1075

62 Rubber Manufactures 481 506 526 565

Overall headhaul index 100 109 123 130

Overall backhaul index 100 106 120 128

Leading indicators: headhaul from NE Asia 000 teu. Italics = projected

Commodity 2012 2013 2014 2015

89 Miscellaneous Manufactures 155 161 213 217

62 Rubber Manufactures 121 119 119 122

82 Furniture 94 94 114 117

69 Metal Manufactures - Other 88 91 101 105

77 Electrical Machinery 77 81 91 95

Overall headhaul index 100 101 114 119

Overall backhaul index 100 96 101 107

Underlying unitised annual trade growth rates

www.containershipping.com CONTAINERISATION INTERNATIONAL 05 May 2014

DATA HUB

TRADE STATISTICS

06 CONTAINERISATION INTERNATIONAL www.containershipping.com May 2014

DATA HUB

TRADE STATISTICS

Trade between Asia and the Gulf and Indian subcontinent

continues to expand. MDST recorded an 8.5% annual growth rate for

2013 on the westbound direction and 6.3% in the opposite direction.

Increasing industrialisation in the Gulf can be expected to sustain

eastbound growth but at lower levels in the long term. Electrical

equipment and rubber manufacturers are both growing strongly

westbound.

Trade between northeast Asia and Australasia (northbound) is

estimated to have decreased by 3.9% in 2013; however MDST

forecasts an increase of more than 5% in 2014. Southbound traffic

is estimated to have grown by 0.8% in 2013 and is forecast to grow

13.4% in 2014.

Trade growth between North Asia and Asean countries is dominated

by the southbound direction, with an estimated annual growth of

1.4% in 2013 (traffic growing particularly in textiles goods). That rate is

expected to become negative by 0.3% in 2014. Growth northbound is

estimated to have been 1.2% in 2013, but is expected to increase to

some 6% in 2014.

Trade from China to Asean countries expanded rapidly in 2013

(11.6%) and growth is expected to be nearly 22% in 2014. Asean

trade to China was up 9% in 2013 and is forecast to be 14.4% in

2014.

Finally, trade between China and North Asia eastbound is

estimated to have grown at a modest 2.1% in 2013 and can be

North Asia to Asean China & Hong Kong to Asean

North Asia to Asean (000 teu)

North Asia includes Russia, Taiwan, Japan, North Korea & South Korea

China & Hong Kong to Asean (000 teu)

2,106

3,957

1,940 2,625

2,135

1.4%

4,415

11.6%

1,964

1.2%

2,860

9%

2,128

-0.3%

5,379

21.8%

2,087

6.3%

3,271

14.4%

2,241

5.3%

5,698

5.9%

2,182

4.6%

3,440

5.2%

2012 2012 2013 2013 2014 2014 2015 2015

Asean to North Asia (000 teu)

Asean includes SE Asia and Myanmar

Asean to China & Hong Kong (000 teu)

Asean includes SE Asia and Myanmar

Overall southbound trade grew by 1% in 2013 but is expected to

decrease in 2014.

Underlying northbound trade grew by 1% in 2013 and is expected

to grow by 6% in 2014.

Of the leading headhaul commodities, most showed some

growth.

Annual headhaul growth from 2013 to 2017 is forecast at 3.6%.

Overall southbound trade grew by 12% in 2013 and is expected to

grow by 22% in 2014.

Underlying northbound trade grew by 9% in 2013 and is expected

to grow by 14% in 2013.

Of the leading headhaul commodities, textiles and mineral

manufactures are showing most growth.

Annual headhaul growth from 2013 to 2017 is forecast at 9.8%.

2012

2012

2013

2013

2014

2014

2015

2015

This data is provided by Box Trade Intelligence in collaboration with MDS Transmodal.

Much more detail is available directly from BTI (www.boxtradeintelligence.co.uk),

including tonnages and estimated teu at the country x country x 3,000 commodities level,

individual ship deployment and estimated revenue, profit, rates and utilisation at the

tradelane and individual ship level.

Leading indicators: headhaul from N Asia 000 teu. Italics = projected

Commodity 2012 2013 2014 2015

78 Road Vehicles 167 162 154 163

26 Textile Fibres 160 156 157 162

65 Textiles & Made-Up Articles 154 159 161 165

57 Plastics In Primary Forms 139 143 145 153

77 Electrical Machinery 125 128 134 140

Overall headhaul index 100 101 101 106

Overall backhaul index 100 101 108 113

Leading indicators: headhaul from N Europe 000 teu. Italics = projected

Commodity 2012 2013 2014 2015

65 Textiles & Made-Up Articles 396 470 539 583

66 Mineral Manufactures 357 384 542 568

89 Miscellaneous Manufactures 272 292 364 382

05 Vegetables & Fruit, Nuts 228 245 287 310

76 Telecom & Recording Equipment 217 221 249 262

Overall headhaul index 100 112 136 144

Overall backhaul index 100 109 125 131

Supply - based on actual data Demand - based on actual data

Demand seasonally adj

60

80

100

120

140

160

180

2

0

1

3

Q

4

2

0

0

6

Q

2

2

0

0

6

Q

3

2

0

0

6

Q

4

2

0

0

7

Q

1

2

0

0

7

Q

2

2

0

0

7

Q

3

2

0

0

7

Q

4

2

0

0

8

Q

1

2

0

0

8

Q

2

2

0

0

8

Q

3

2

0

0

8

Q

4

2

0

0

9

Q

1

2

0

0

9

Q

2

2

0

0

9

Q

3

2

0

0

9

Q

4

2

0

1

0

Q

1

2

0

1

0

Q

2

2

0

1

0

Q

3

2

0

1

0

Q

4

2

0

1

1

Q

1

2

0

1

1

Q

2

2

0

1

1

Q

3

2

0

1

1

Q

4

2

0

1

2

Q

1

2

0

1

2

Q

2

2

0

1

2

Q

3

2

0

1

2

Q

4

2

0

1

3

Q

1

2

0

1

3

Q

2

2013 Q4

Supply Index=169

2012 Q4 - 2013 Q4

% change quarter on quarter

Supply=4.5%

Demand=6.7%

2013 Q4

Demand Index=146

2

0

1

3

Q

3

Graph A: Global supply v demand and seasonally adjusted

demand index 2006 (Q1=100)

expected to grow by 5.2% in 2014, whilst westbound is estimated

to have fallen by 1.9% in 2013 with a smaller decline in 2014

(-0.9%).

May 2014 8 CONTAINERISATION INTERNATIONAL www.containershipping.com

DATA HUB

LOAD FACTORS

UTILISATION BOOST

Damian Brett takes a look at the likely impact of supply and demand on some of

the key Asian trade lanes

2

Asia to West Africa

VESSEL utilisation levels on services from Asia to western Africa are set for good second and third

quarters, reaching an average of 86% in the April-June quarter and 92% during the July-September

period.

As the year progresses, utilisation levels will decline in line with a seasonal slowdown, slipping to

78% in the final quarter of the year and 83% at the beginning of 2015.

However, utilisation levels are stronger than last year on the back of impressive cargo growth, and

projections show volumes are expected to increase by 11.6% year on year in 2014 and by a further

8.2% in 2015.

Shipping lines continue to add capacity to the trade lane, but it is not enough to outstrip demand

growth.

In terms of service developments since Containerisation Internationals analysis of the trade

lane in February, Maersk Line and CMA

CGM have now fully combined their direct

services.

But this hasnt affected overall capacity;

while one small loop was discontinued, larger

ships are being used in three of the four

remaining services.

Also, NileDutch has added some larger

vessels to its service and PIL has filled two gaps

in its services, although a third loop is still not

weekly. Capacity for 2014 is estimated to be

8.8% ahead of 2013.

3

Asia to west coast North America

Peak season

transpacific west

coast utilisation

levels of 88%

are expected to

put carriers in a

good position

to increase

rates compared

with the second

quarter.

Carriers are

also set for a good fourth quarter with load factors remaining above

the 80% mark. Utilisation levels are also expected to be stronger

than last year as analysts have forecast volumes will increase by

around 5% while capacity additions are being carefully managed.

During the first quarter of the year, carriers decreased capacity

on the trade lane by 0.3%; Coscos Cosea loop was suspended but

larger ships were introduced on several other services.

Also, following the Chinese new year, gaps in several service were

filled.

For the full year, carriers are expected to increase capacity by

2.4% as they adopt a cautious approach to service additions as

they await Chinese regulators response to the P3 Network and G6

Alliance expansion.

1

Asia to west coast US: average utilisation rates

0

20%

40%

60%

80%

100%

Q1

15

Q4

14

Q3

14

Q2

14

Q1

14

Q4

13

Q3

13

Q2

13

Q1

13

Asia to West Africa: average vessel utilisation

0

20%

40%

60%

80%

100%

Q1

15

Q4

14

Q3

14

Q2

14

Q1

14

Q4

13

Q3

13

Q2

13

Q1

13

1

May 2014 www.containershipping.com CONTAINERISATION INTERNATIONAL 9

OUR METHODOLOGY: The freight rate forecasts shown in the tables are mainly based on projections of estimated average vessel utilisation in each trade lane, combined

with other relevant circumstances. The fuller the ship, the more likely rates will rise and vice versa. Cargo forecasts are based on the latest information from all sources available to

Containerisation Internationals editorial team. These will always be conservative, and only take account of normal seasonal variations. Fleet capacity information is derived from

Lloyds List Intelligence. Current shipboard capacity in each route is estimated by deducting space lost for broken stows and wayport cargo from the operating capacity offered on

every vessel in that tradelane. This is projected forward by estimating where newbuildings are likely to be deployed, as well as where replaced vessels are likely to be cascaded into.

Average vessel utilisation is simply one divided by the other. It should be noted, therefore, that the resulting freight rate trends only reflect what should theoretically happen if ocean

carriers continue acting according to form. They do not take into account dramatic changes in strategy, such as mass lay-ups, service consolidation and more hub and spoke operations.

Northeast Asia to Oceania

Demand growth on

services from north east

Asia to Oceania is set

for a strong year with

analysts projecting a

double-digit percentage

increase in carryings.

While volumes are

projected to expand by

more than 10%, our

projections show capacity

will increase by the lower

amount of 7.6% year on year in 2014.

This will result in improved vessel load factors compared with last year,

but it is not expected to be enough of an improvement to lift utilisation

levels above the 80% mark.

During the first quarter, carriers increased capacity by 4% as gaps

were filled in Australian loops following the Chinese new year. There are

still some gaps in other services, but these are expected to have vessels

introduced in time for the southbound peak season.

4

DATA HUB

FREIGHT FORECASTER

NEXT EDITION: AMERICAS

DATA HUB

LOAD FACTORS

Asia to east coast North America

As with services from Asia to the North American

west coast, carriers are adopting a cautious

approach to capacity additions to the east coast

as they await to see if the P3 Network is approved

by regulators.

Over the first quarter, carriers increased

capacity by 1.1% as larger vessels were deployed

and gaps in other services were filled. For the full

year, capacity is expected to increase by 2.6%

compared with 2013.

Meanwhile, demand is expected to grow by

around 5% year on year in 2014.

2

3

1

4

Asia to east coast US: average vessel utilisation

0

20%

40%

60%

80%

100%

Q1

15

Q4

14

Q3

14

Q2

14

Q1

14

Q4

13

Q3

13

Q2

13

Q1

13

Northeast Asia to Oceania: average vessel utilisation

0

20%

40%

60%

80%

100%

Q1

15

Q4

14

Q3

14

Q2

14

Q1

14

Q4

13

Q3

13

Q2

13

Q1

13

KEY: Green (84% and above): Carriers should be able to protect rates or even improve prices, unless the market has hit the top or sentiment dictates otherwise. Grey (80%-83%):

Freight rates should be fairly steady compared with the previous quarter unless market sentiment dictates otherwise. Red (79% and below): Carriers are likely to have a tough time

improving rates and prices could well decline compared with the previous quarter, unless the market has hit the bottom or sentiment dictates otherwise.

BOX LINES STRUGGLE

WITH SURPLUS CAPACITY

Newbuilding deliveries continue at a brisk pace, reports James Baker

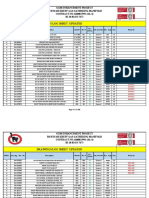

Teu Size range In service April 2014 On Order 2014 On Order 2015 On Order 2016+ Total vessels

on order

Total teu

on order

No Teu No Teu No Teu No Teu

0-499 335 92,625 2 251 2 210 - - 4 510

500-999 724 546,408 7 5,597 1 606 1 540 9 6,743

1,000-2,999 1,855 3,362,251 51 87,064 64 125,950 22 44,032 137 257,046

3,000-4,999 924 3,824,433 28 118,023 10 38,200 9 34,600 47 190,823

5,000-7,499 616 3,715,879 26 145,400 10 62,200 - - 36 207,600

7,500-9,999 347 2,979,832 33 292,788 61 552,100 27 249,648 121 1,094,536

10,000-12,999 68 758,432 15 157,686 13 134,362 9 90,000 37 382,048

13,000-15,999 138 1,869,856 13 175,408 23 323,850 25 352,500 61 851,758

16,000+ 10 175,950 11 197,220 31 556,910 1 18,800 43 772,930

Total 5,017 17,325,666 186 1,179,437 215 1,794,388 94 790,120 495 3,763,994

World Cellular Fleet April 2014 (excluding newbuild postponements and cancellations under negotiation)

Total world fleet capacity

rose by 99.626 teu to

17.3m teu in April.

WITH the first-quarter

earnings season already

upon us, it is possible to

consider whether the much-

anticipated improvement in

container lines performance

has occured. While industry

bellwethers including Maersk

Line do not report until later in

the month, some evidence is

emerging.

To date, the picture remains

mixed. Orient Overseas

Container Line experienced

weaker rates in the first quarter

compared with a year ago, but

was still able to inch up its

revenue and volumes.

Meanwhile, MOLs box line

unit reported an 18% rise in

revenue, but a operating loss

of 14.5bn ($142m). At China

Shipping Container Lines,

revenues were up on higher

volumes, but profitability

remained elusive.

The first-quarter earnings

reflect the traditional slow

season for box rates. But prices

have recently bounced back as

carriers appear to be pushing

through rate increases, at least

temporarily.

The latest Shanghai

Containerised Freight Index

shows that the component

covering the Shanghai-Europe

route reached $1,305 per teu

at the beginning of May. That

compares to a recent low of

$843 per teu in late March. But

whether lines will be able to

maintain these higher rates is

questionable.

The issue facing operators

remains overcapacity, and this

months fleet data will offer

little comfort, with vessels

comprising 138,725 teu

being delivered during April.

That is nearly a third more

than the 106,000 teu that

Source: Lloyds List Intelligence

DATA HUB

WORLD FLEET UPDATE

10 CONTAINERISATION INTERNATIONAL www.containershipping.com May 2014

joined the fleet the previous

month.

Total world fleet capacity

in April rose by 99,626 teu

compared with a month ago, to

17.3m teu. Despite the gain in slot

capacity, the number of vessels

in the fleet decreased over the

month by 10 units, pointing to

further increases in the size of

ships entering service, and the

scrapping of smaller tonnage.

DATA HUB

WORLD FLEET UPDATE

12 CONTAINERISATION INTERNATIONAL www.containershipping.com May 2014

Vessels laid-up Week ending April 27, 2014

Notes: Lloyds List Intelligence monitors reported and AIS movements of commercial vessels worldwide. This extract identies vessels with no recorded

movement in the past 25 days.

Inactive teu

size range

Owner operator Chartered in /unknown Total % total fleet

No of ships Teu No of ships Teu No of ships Teu

0-499 14 4,951 86 20,352 100 25,303 27.3%

500-999 11 6,911 51 36,641 62 43,552 8.0%

1,000-2,999 17 27,814 41 70,761 58 98,575 2.9%

3,000-4,999 12 51,837 26 108,058 38 159,895 4.2%

5,000-7,499 5 29,530 6 37,863 11 67,393 1.8%

7,500-9,999 1 8,200 1 9,572 2 17,772 0.6%

10,000-12,999 - - - - - - -

13,000+ - - - - - - -

Total 60 129,243 211 283,247 271 412,490 2.4%

Source: Lloyds List Intelligence

Vessels delivered April 2014

Vessel name Shipyard Teu Reefer

plugs

DWT Knots Beneficial owner Operator Deployment

Maribo Maersk Daewoo Shipbuilding & Marine

Engineering

18,270 600 194,433 23 A.P. Moller-Maersk Maersk Line Asia-Europe

OOCL Korea Samsung Shipbuilding & Heavy

Industries

13,208 1,150 142,340 OOIL NYK Asia-Europe

Ludwigshafen

Express

Hyundai Heavy Industries 13,200 142,036 Hapag-Lloyd Hapag-Lloyd Asia-Europe

Ulsan Express Hyundai Heavy Industries 13,200 140,700 24.7 Hapag-Lloyd Hapag-Lloyd Asia-Europe

Cap San

Artemissio

Hyundai Heavy Industries 9,700 1,600 124,426 22.8 N.S. Lemos Hamburg Sud Asia-Africa

APL Houston Daewoo Shipbuilding & Marine

Engineering

9,200 700 108,635 22.8 NOL APL Transpacific

APL Santiago Daewoo Shipbuilding & Marine

Engineering

9,200 108,617 22.8 NOL APL Middle East

Gulf/Indian

Subcontinent-Asia

MOL Contribution Mitsubishi Heavy Industries 8,560 89,893 MOL MOL Transpacific

Ever Lissome CSBC Corporation Taiwan 8,000 105,000 24.5 Evergreen Evergreen Transpacific

YM Moderation Imabari Shipbuilding 6,350 500 72,370 Shoei Kisen Kaisha Yang Ming Transpacific

Carl Schulte Hanjin Heavy Industries 5,400 650 62,292 21.5 Bernhard Schulte

Group

Maersk Line Asia-Africa

Clemens Schulte Hanjin Heavy Industries 5,400 650 62,292 21.5 Bernhard Schulte

Group

Maersk Line Asia-Africa

Jogela Jiangsu New Yangzijiang

Shipbuilding

4,957 600 58,032 21.5 Peter Dohle

Schiffahrts-KG

Maersk Line Asia-Africa

Jin Ling 59 Jiangsu Jinling Ships 4,800 57,500 Reederei Dietrich

Tamke KG

Maersk Line Asia-Africa

Jadrana Jiangsu New Yangzijiang

Shipbuilding

4,800 600 58,037 21.5 Peter Dohle

Schiffahrts-KG

Maersk Line Asia-Africa

MOL Hope Guangzhou Wenchong Shipyard 1,740 300 23,579 19.5 Yong Hai Agencies Mitsui O.S.K. Lines

Limited (MOL)

Regional Asia

San Pedro Guangzhou Wenchong Shipyard 1,740 300 23,579 19.5 Eastern

Mediterranean

Maritime

Heung-A Shipping

Company Limited

Sunny Lily Hyundai Mipo Dockyard 1,000 12,244 Dong-A Tanker

Source: Lloyds List Intelligence

The situation will not

improve anytime soon, either.

Braemar Seascope estimates

that 120 newbuildings in

excess of 10,000 teu will be

delivered over the coming

three years, with an average

nominal capacity of 14,000

teu.

Lloyds List Intelligence

figures show that orders are in

place for 106 ships in this size

band this year and next alone,

with a total capacity of over

1.5m teu. Braemar Seascope

warns that this will lead to

persistent overcapacity at least

until 2017.

The containership fleet is

expected to increase by some

5.5% this year after vessel

scrapping is taken into account.

After slowing in March, boxship

demolition picked up again

slightly in April, with 16 vessels

comprising 46,600 teu going

to the breakers. The youngest

of these was just 16 years old

and nearly half fell into the

unloved panamax category.

Braemar Seascope points

to static time charter rates

over the past two years as a

key driver behind scrapping.

Owners holding onto older

vessels in the hope that

rates may increase are now

throwing in the towel. Some

brokers expect that as much

as 400,000 teu could be

demolished this year.

However, as the capacity of

the fleet relentlessly rises

Braemar Seascope suggests

the growth over the next three

years to be sufficient to set

up another dozen Asia-Europe

strings any hopes of a

meaningful recovery for rates

and lines probably remain a

long way off.

www.containershipping.com CONTAINERISATION INTERNATIONAL 13 May 2014

DATA HUB

WORLD FLEET UPDATE

Valuations for post-panamax, panamax and handymax container vessels

Note: All values in $m

Age Capacity (teu) April 22,

2014 ($m)

March 22,

2013 ($m)

Monthly change

($m)

April 22,

2013 ($m)

Yearly change

($m)

0 4,250 33.1 33.0 0.1 36.3 -3.2

5 4,250 22.9 22.8 0.1 25.2 -2.3

10 4,000 13.3 13.1 0.2 15.0 -1.7

15 4,000 9.6 9.2 0.4 8.9 0.7

20 3,750 9.0 8.7 0.3 7.6 1.4

25 3,750 9.1 8.7 0.4 7.9 1.2

Panamax Source: Vesselsvalue.com

Note: All values in $m

Age Capacity (teu) April 22,

2014 ($m)

March 22,

2013 ($m)

Monthly change

($m)

April 22,

2013 ($m)

Yearly change

($m)

0 1,400 16.2 17.9 -1.7 18.8 -2.6

5 1,400 11.8 12.9 -1.1 13.0 -1.2

10 1,400 8.0 8.5 -0.5 8.0 0.0

15 1,400 5.0 5.1 -0.1 4.6 0.4

20 1,400 3.7 3.6 0.1 3.1 0.6

25 1,400 3.7 3.6 0.1 3.2 0.5

Handymax Source: Vesselsvalue.com

Current and historical values for tankers, bulkers and containers.

Daily updated sales lists, vessel specications and ownership

information.

Data exports, valuation certicates, interactive charts and

automated alerts

Age Capacity (teu) April 22,

2014 ($m)

March 22,

2013 ($m)

Monthly change

($m)

April 22,

2013 ($m)

Yearly change

($m)

0 7,000 64.1 64.1 0.0 59.5 4.6

5 7,000 47.7 47.7 0.0 41.3 6.4

10 6,500 29.6 29.4 0.2 24.2 5.4

15 5,500 15.0 14.6 0.4 14.4 0.6

20 4,500 10.0 9.6 0.4 8.5 1.5

Post-panamax Source: Vesselsvalue.com

Note: All values in $m

Vessel name Teu DWT Speed (knots) Config Year built Price ($m) Purchaser

ESM Amanda 787 12,600 18.0 Gearless 2000 4.3 Vietnam

Montana 1,294 17,350 20.0 Geared 2007 8.6 UK

Rafflesia 1,675 24,548 18.0 Gearless 1997 4 China

Tatiana Schulte 2,826 39,400 22.0 Gearless 2005 13.5 Germany

Santa Rosanna 4,112 52,800 23.5 Gearless 2002 12.5 Norway

Santa Roberta 4,112 52,800 23.5 Gearless 2002 12.5 Norway

Santa Rufina 4,112 52,800 23.5 Gearless 2002 12.5 Norway

Vessels sale and purchase April 2014

Notes: C=cellular; GL=gearless; G=geared; NC=non-cellular; MPP=multipurpose; U/D=undisclosed Source: Braemar Seascope

Vessels demolished April 2014

Vessel name Built Teu Broken date Broken place Shipbreakers Previous Beneficial owner

Hanjin Oslo 1998 5,308 01-Apr-14 Alang Indian Breakers Hanjin Shipping

Hanjin London 1996 5,302 16-Apr-14 Alang Indian Breakers Hanjin Shipping

Hanjin Berlin 1997 5,302 28-Apr-14 Alang Indian Breakers Hanjin Shipping

MSC Socotra 1995 4,743 30-Apr-14 Alang Indian Breakers Dragnis Group

Commodore 1992 4,651 29-Apr-14 Alang Indian Breakers Danaos

Sun 1993 4,229 16-Apr-14 Alang Indian Breakers Seafarers Shipping

Da He 1994 3,800 08-Apr-14 Xinhui Chinese Breakers Cosco

S. Trader 1995 2,227 19-Apr-14 Alang Indian Breakers Lomar Shipping

Jolly 1993 2,098 02-Apr-14 Alang Indian Breakers Euroseas

Finisterre 1991 1,960 28-Apr-14 Alang Indian Breakers Kotani Shipping

Northern Delight 1994 1,717 16-Apr-14 Alang Indian Breakers Conti Holding

Asia Star 1994 1,512 27-Apr-14 Alang Indian Breakers Israel Corporation

Kota Wijaya 1991 1,160 14-Apr-14 Alang Indian Breakers Pacific International Lines

Source: Lloyds List Intelligence

DATA HUB

14 CONTAINERISATION INTERNATIONAL www.containershipping.com May 2014

THE current average vessel capacity on the

transatlantic trade lane is 4,700 teu and it is

covered by 21 carriers.

According to Lloyds List Intelligence, the

average vessel capacity operated by the

three that are set to form the P3 Network

Maersk, Mediterranean Shipping Co and

CMA CGM on this route is 5,400 teu.

The current average capacity operated by

members of the G6 alliance APL, Hapag-

Lloyd, Hyundai Merchant Marine, Mitsui OSK

Lines, NYK Line and OOCL is 4,500 teu.

The P3 and G6 alliances may cascade

their larger vessels onto this trade to benefit

from economies of scale. The P3 Network

is likely to begin operating in mid-2014

with five services on this route, while

the G6 alliance has announced plans to

extend cooperation to the Atlantic, with five

services in the second quarter of 2014.

However, larger ships on the trade could

put pressure on east coast North American

ports, as they may not be ready to handle

bigger vessels.

Currently around 30% of service capacity

on the Europe to North America route is

provided by alliances. Through slot-charters

and partnerships, the three P3 carriers

currently offer 52% of available capacity on

the Europe to North America route.

As much as 80% of service capacity

New alliances on the transatlantic trade lane

are set to dominate the market in capacity

terms, writes Sarah Bennett

A CHANGING

LANDSCAPE

250 vessels on 35 fully

containerised services

Average weekly capacity:

150,000 teu.

Most capacity on this route is made

up by 3,000 teu-4,999 teu ships

DATA HUB

ports. However, operators fail to gain from

economies of scale. The P3 and G6 alliances

will most likely cascade its larger vessels

into this trade.

MSCs Golden Gate pendulum service

currently offers the largest ships between

the Mediterranean and North America with

six vessels of 9,000 teu, although it mainly

covers Asian and North American ports with

Haifa in Israel as the only call in between.

The next largest ships serve Maersks TP7

service, which uses three 8,000 teu units. This

service also mainly serves ports in Asia and

North America, but also calls at Port Said and

Tangier-Med as it transits the Suez Canal. These

larger ships have been cascaded onto this

trade route during the first quarter of 2014.

It is likely that we will see more services

that cover more than one trade route to

acquire efficiency benefits when using the

larger boxships, such as combining

Asia-Europe and Europe-North America

loops via the Suez Canal.

The largest vessels on the North Europe

to North America trade are three 6,700 teu

vessels on MSCs US Gulf service calling at

15 ports across North Europe, the Americas

and the Caribbean.

The addition of larger ships onto this

trade will put pressure on east coast North

DATA HUB

TRADE ROUTES

7,500-9,999 1,000-2,999

3,000-4,999

5,000-7,499 500-999

% of total Asia-Europe (teu)

0

10

20

30

40

50

60

70

80

90

100

6.1%

33.3%

47.8%

12.7%

Figure 1: Teu range proportion among

Europe-North America

operators

Source: Lloyds List Intelligence

could be operated by alliances when the P3

begins operations, depending on its service

consolidations. The Grand and New Alliance

service revisions, once the G6 Alliance enters

the North Europe-North America trade in the

second quarter of 2014, will also affect the

extent of alliance capacity on this route.

Larger containerships are deployed on

the Mediterranean-North America route

than its northern counterpart. Ships sized

between 7,500 teu and 9,999 teu hold

20% of capacity on the trade lane, while

3,000 teu-4,999 teu ships account for the

majority of capacity on the North Europe-

North America route at 67% and there are

no ships larger than 7,000 teu.

Smaller ships may be deployed between

North Europe and North America to make

it quicker for services to call at more

www.containershipping.com CONTAINERISATION INTERNATIONAL 15 May 2014

TRADE ROUTE INTELLIGENCE

The addition of larger ships onto the trade will put pressure on

east coast North American ports such as New York, where the

height of the Bayonne Bridge is a limiting factor.

DATA HUB

TRADE ROUTES

American ports. The largest containerships

calling at the east coast come from Asia via

the Suez Canal, with vessels of up to 9,000

teu. These are former transpacific services

that have been switched to the Suez

Canal route because of Panama Canal size

restrictions, but the height of the Bayonne

Bridge in New York is another limiting factor.

Container Trade Statistics data shows

a year-on-year growth in 2013 container

0 5,000 10,000 15,000 20,000 25,000 30,000

Eimskip

NYK

HMM

Yang Ming

CMM

Turkon

Evergreen

ICL

Hamburg Sd

UASC

Coscon

CSAV

Zim

Hanjin Shipping

APL

OOCL

MOL

CMA CGM

Maersk Line

Hapag-Lloyd

MSC

Figure 2: Weekly operated capacity on the Europe-North America trade route by line (teu)

Source: Lloyds List Intelligence

volumes from Europe to North America of

8.5% since 2011, with volumes nearing

300,000 teu per month. But it has dropped

from North America to Europe by 2.7%

with volumes around 200,000 teu per

month. The difficult trade resulted in Hanjin

Shipping deciding to remove its vessels

from CKYHs transatlantic service in May.

The focus for operators is reduced slot

costs that can be attained from deploying

larger vessels on the route. However, there

are still many smaller operators in the trade

that may struggle to maintain market share

when the new alliances begin service.

These include carriers such as Turkon

Line and Independent Container Lines,

which have an average vessel capacity of

just 2,000 teu in this route. Most of Turkon

Lines services are focused on regional

Europe and the transatlantic trade, while

Independent Container Line focuses on the

northern Europe-US trades.

Alliances could contribute up to between

80% and 90% of capacity on this route, which

is a similar outlook for the other two main

trades of Asia-Europe and the transpacific,

leaving a smaller market share for independent

carriers. However, smaller carriers can maintain

market share by providing shippers with

flexibility by carrying breakbulk and project

cargoes as well as containerised freight and by

offering calls at alternative ports.

16 CONTAINERISATION INTERNATIONAL www.containershipping.com May 2014

THE leading Mediterranean ports last year

saw volumes increase by 5.5% compared

with 2012 to reach 28.5m teu.

The growth comes as the Eurozone

countries, where the majority of the

leading ports are located, continue to

recover after the difficulties they have

faced over the last few years.

Spain and Greece were hit particularly

hard and both required support packages

from the stronger European economies.

Luckily for the countries ports over

the last few years, the region also acts as

a transhipment hub for a range of trade

lanes, meaning those ports affected by the

crisis have been able to benefit from this

type of traffic heading to other areas.

However, as transhipment containers

arent captive to a particular port or

region, shipping lines can easily switch

from one port to another to escape

operational issues, as part of a wider

network re-organisation or simply because

they have been offered a better deal.

The trend for transhipment has been

on the increase as shipping lines look

to fill their ultra-large vessels, create

network efficiencies, use up spare ships

and benefit from avoiding a costly Panama

Canal transit.

When asked how it managed to keep

its big Asia-Europe containerships full in a

low growth environment, one shipping line

executive recently told Containerisation

International that it topped up the ships by

using them for transhipment cargo.

For instance, containers from Asia

destined for west Africa can be carried

on an Asia-Europe vessel and then

transhipped in Algeciras. Traffic destined

for northern Europe from other regions

of the world can then be picked up at the

transhipment port and carried on the final

leg of the journey.

Maersk Line has similarly included calls

from its Triple-E vessels at a Mediterranean

transhipment hub.

While this trend is benefitting

transhipment facilities in the short term,

and possibly the medium term, the use of

direct services could eventually return as

cargo volumes on the mainline services

increase and capacity on larger vessels is

dedicated to catering for these trade lanes.

This trend is reflected by Mediterranean

Shipping Cos decision to launch a direct

service from China to West Africa rather

than tranship in Valencia.

For now though, Mediterranean ports

are able to benefit from the introduction

of larger vessels that the carriers need to

work hard to fill.

Looking at 2013 volumes, the Spanish

port of Algeciras finally completed its

march to become the regions leading

container port.

This is a remarkable turnaround from

2010 when the port saw its box volumes

tumble by 7.6% year-on-year to 2.8m

teu, the third annual decline in a row, as it

faced competition from Moroccos Tanger

Med complex.

It has been rebuilding volumes since

then, thanks in part to the development

of Hanjin Shippings semi-automated TTI

terminal which opened in 2010. Last year,

Box volumes at leading terminals jumped by more

than 4% last year, buoyed by economic recovery

and transhipment, reports Damian Brett

ONWARDS

AND UPWARDS

MEDITERRANEAN PORTS/VOLUMES

PORTS

Selected Mediterranean port volumes

Country Port 2013 teu 2013 %

+/-

2013 teu +/- 2012 teu 2011 teu Last

years

ranking

Spain Algeciras 4,336,459 5.5% 224,610 4,111,849 3,602,631 2

Spain Valencia 4,327,838 -3.2% -152,597 4,469,754 4,327,371 1

Turkey Ambrali

(Istanbul)

3,405,800 9.9% 308,336 3,097,464 2,686,000 3

Greece Piraeus 3,164,000 15.7% 429,986 2,734,014 1,680,133 4

Italy Gioia Tauro 3,087,000 13.4% 365,896 2,721,104 2,305,000 5

Malta Marsaxlokk 2,750,000 8.3% 211,920 2,538,080 2,360,489 6

Italy Genoa 1,988,013 -3.7% -76,793 2,064,806 1,847,102 7

Spain Barcelona 1,720,383 -2.2% -38,264 1,758,647 2,033,549 8

Turkey Mersin 1,378,800 9.1% 115,305 1,263,495 1,126,588 9

Italy La Spezia 1,300,432 4.3% 53,214 1,247,218 1,307,274 11

France Marseille-Fos 1,097,740 3.4% 36,547 1,061,193 944,047 12

Total 28,556,465 5.5% 1,478,160 27,067,624 24,220,184

Source: Port authorities, terminal operators * Estimated ** Fiscal Year

www.containershipping.com CONTAINERISATION INTERNATIONAL 17 May 2014

volumes increased by 5.5% compared

with 2012 to reach 4.3m teu.

Algeciras growth comes as Maersk Line

began calling at the APM Terminals facility

at the port with its 18,270 teu Triple-E

vessels.

In contrast, its main Spanish rival

Valencia, which has developed a mixed-

model approach of both transhipment and

gateway traffic, reported a 3.2% year-on-

year decline in volumes to 4.3m teu.

But investments are being made in the

ports terminals.

Earlier this year, JP Morgan Asset

Management received approval from the

Port Authority of Valencia for a 100m

($138m) investment in facilities controlled

by terminal operator Noatum.

Following the announcement of the

investment, JP Morgan Asset Management

global head of infrastructure Paul Ryan said:

We firmly believe the Spanish economy

has turned the corner, which will have a

positive effect on trade activity. Growth

rates were positive in the second half of

2013 ending a nine-quarter double-dip

recession. We expect around 1% growth in

2014 and 2% in 2015 and beyond.

Total trade volumes and the activity

in Spanish ports have just ended a very

over operation of its second container

terminal to Cosco Pacific.

With improving productivity, the

port is enjoying a renaissance and also

benefitting from the recovery of the Greek

economy. That said, growth levels are

slowing; in 2012 volumes increased by

63% to 2.7m teu.

In contrast to Piraeus, Genoa suffered

the largest percentage decline in volumes.

The Italian port reported a 3.7% slip in

container throughput to 2m teu.

So far this year, trade lanes covered by

Mediterranean ports have had a mixed

start to the year.

The latest figures from Container Trades

Statistics has revealed that volumes from

Asia to the eastern Mediterranean and

Black Sea increased by 8.4% year on year

in January but then declined by 10.1% in

February.

On services from Asia to the western

Mediterranean and North Africa, volumes

increased 11.5% in January compared

with the same month a year earlier. In

February, the trend reversed and volumes

slumped 11.5% year on year.

Over the last few years there has been

a surge in volumes in January as shippers

look to move cargo before factories close

for the Chinese new year holiday period.

This year, the holiday was earlier than in

2013, which distorted container volume

comparisons for January and February.

Analyst MDS Transmodal also recently

told Containerisation International that

shippers had this year brought forward

shipments prior to the Chinese New Year

because in 2013 there was not enough

capacity to cater for demand, resulting

in delays.

Adding together the volumes for January

and February perhaps gives a better

reflection of how this important trade lane

has begun the year as it strips out some of

the effect of the holiday.

When doing this, it can been seen that

shipping line volumes on services from

Asia to the entire Mediterranean region

increased by 1.2% year on year in the first

two months of 2014 to hit 789,607 teu.

The transatlantic trade lane has

seen a more successful start to the

year, with volumes increasing from the

Mediterranean to the US in January and

February by 12.2% year-on-year to

135,766 teu.

rough period, and as economic recovery

is starting, the recovery in seaborne trade

volumes will even be stronger.

The expansion will include increased

quay and yard space and improved

intermodal connectivity.

In early April, it was also announced that

business enterprise organisation Mitsubishi

Corporation and port transporation provider

Kamigumi Corporation would take a 25%

stake in Valencia terminal operator TCV

Stevedoring Company, owned by Grup

Maritim TCB.

The deal is part of a wider global

agreement between Grup Maritim TCB

and Mitsubishi that will see the two work

together in terminal projects around the

world.

This particular terminal had a succesful

2013 with volumes increasing by 25%

year on year to 700,000 teu.

The Mediterranean port which

benefitted from the largest percentage

growth in volumes was Piraeus in Greece,

which reported an annual volume increase

of 15.7% to 3.2m teu.

The port has been going from

strength to strength since 2008 when

it was hit by a series of labour strikes

in protest at government plans to hand

Algeciras is now the top-ranked Mediterranean port.

MEDITERRANEAN PORTS/VOLUMES

PORTS

THE VIEW FROM THE BRIDGE

INSIGHT FROM THE CSUITE /TOSHIYA K KONISHI

www.containershipping.com CONTAINERISATION INTERNATIONAL 19 May 2014

THE VIEW FROM THE BRIDGE

INSIGHT FROM THE CSUITE /TOSHIYA K KONISHI

TOSHIYA K Konishi believes the worst could

be over for container shipping lines.

The senior executive from Mitsui OSK

Lines doesnt sound overly pessimistic about

the current status of the industry.

A 30-year veteran with the Japanese

shipping giant, Mr Konishi was appointed

executive vice president of MOLs container

and logistics business unit right before the

collapse of Lehman Brothers.

Last June, he became MOLs liner

president and chief executive.

While recognising a persistent supply

overhang, Mr Konishi suggests the financial

position of container lines is on the mend.

Most carriers are still suffering from

losses in the container sector, including

us. But compared to last year or after the

Lehman shock freight rates now are low,

but can cover costs of voyages. Thats a fact,

says Mr Konishi, who is widely known in the

industry as TK.

We are not so far from the [rate] level

where we can be profitable. Thats the

reason carriers can hang in there.

Indeed, no major box carriers have

been squeezed out despite a general weak

rate environment since 2008. They just stay

on.

For MOL, its container division made only

one yearly ordinary profit during fiscal years

2008 to 2012 and has forecast another loss

in 2013. The carrier has also refrained from

placing any newbuilding orders and kept the

fleet size at some 110 vessels.

In its latest mid-term business plan, MOL

announced it will route most investments

over the next six years to the liquefied

natural gas shipping and offshore sectors,

COUNTING

THE COSTS

MOLs liner president and chief executive Toshiya K Konishi explains to

Max Tingyao Lin why he believes the worst is over for the box trades and

talks about dealing with the fall-out from the MOL Comfort incident

where the group expects higher returns

compared to merchant vessels.

This approach is not really surprising. The

bottom might be near for container shipping,

yet a true recovery is not yet in sight, says Mr

Konishi.

Since summer last year, exports from Asia

to Europe and to the US have been stronger

than the year-ago level, and intra-Asia trade

has still been growing as well, he explains.

But the underlying overcapacity issue is

there. Its fair to say this year may be better

than last year, but perhaps there wont be a

big turnaround.

Like many of its peers, the carrier has

been engaged in alliance expansion and

increasing the average vessel size of its

fleet to reduce unit costs apparently the

most common way for box lines to improve

bottom lines when rates are pressured.

One area where we can control is cost,

Mr Konishi says.

Size matters

One of the more active measures is to

operate larger containerships. Mr Konishi

says the G6 Alliance of which MOL is

a member is likely to have two loops

of 18,000 teu containerships by 2020 or

shortly after.

G6 member lines Hapag-Lloyd, NYK ,

OOCL, APL and Hyundai Merchant Marine,

as well as MOL currently have no vessels

of that capacity on their orderbooks but are

studying plans to acquire some.

We are always looking for options

and studying but have not yet made any

decision, Mr Konishi says.

Perhaps [well have] a maximum two sets

of 18,000 teu-19,000 teu ships by 2020, or

by 2022 or 2023. Its a long-term issue.

The remark echoed comments from

Hapag-Lloyds executive board member

Ulrich Kranich, who previously told

Containerisation International that all G6

members must be thinking about 18,000

teu ships and that the alliance could have a

string of such vessels within three years.

A loop usually requires 10 to 12

vessels, so each member would need to

contribute up to four ships if all share equal

responsibility.

However, even if those predictions

come true, G6s approach seems rather

conservative compared to one of the rival

alliances.

The P3 Network, formed by Maersk Line,

Mediterranean Shipping Co and CMA CGM,

is due to operate at least 29 ships of 18,000

teu-19,000 teu by 2016.

The careful measure is partly due to the

G6s smaller market share on Asia-Europe

routes, where such giant ships are deployed.

Moreover, Mr Konishi points out the largest

ships within the G6 network at 13,000 teu-

14,000 teu could be just as competitive as

P3s bigger vessels.

Its not really the size of ships that

matters, but slot costs, Mr Konishi says.

Well have 48 ships [of 13,000 teu-14,000

teu] by 2016, mostly by 2015 only five of

them are ordered before the Lehman shock

[at high prices].

Overall, the G6 deploys 65 vessels on four

Asia-North Europe services and one Asia-

Mediterranean service, including 40 vessels

larger than 13,000 teu. In the latest move,

NYK signed time charter agreements with a

THE VIEW FROM THE BRIDGE

INSIGHT FROM THE CSUITE /TOSHIYA K KONISHI

20 CONTAINERISATION INTERNATIONAL www.containershipping.com May 2014

Japanese owner for eight 14,000 teu ships

under construction at Japan Marine United,

due for delivery from February 2016 to

January 2018.

Those [48] ships are very cost

competitive even when compared to

Maersks 18,000 teu-19,000 teu vessels.

There is not so much difference in slot costs

[between them].

The Danish giant booked 20 Triple-E

18,270 teu vessels for an average of

around $185m each in 2011, a far

higher price compared to todays quote

at $130m-$150m, depending on

specifications.

Maersks vessels are awfully expensive

of course they have some edge in fuel costs,

but the difference is very small [between the

P3 and G6 fleets] when slow-steaming, Mr

Konishi says.

If we order 18,000 teu-19,000 teu ships

now, those ships can be much cheaper

then there will be some cost benefits.

Investment challenges

Having forecast high capital expenditures

in other sectors, MOL will likely seek

charter opportunities to avoid an increase

in debt ratio if it needs to expand its

boxship fleet.

Our focus is LNG and offshore sectors

and it require lots of our investment it

makes sense to charter for overall balance

sheet management, Mr Konishi says.

Chartered-in tonnage is off balance sheet.

But we probably have one of the highest

charter ratios versus owned tonnage in the

industry already so maybe our ratio will

stay at the current level for a while.

Whether we charter or own tonnage

may not be the most important thing. What

matters more is our fleet component.

G6 has managed to win approval from the

US Federal Maritime Commission to widen

its network to cover transpacific west coast

and transatlantic trades from this quarter,

having submitted further materials over the

expansion proposals in mid-February.

In mid-January, the FMC had halted the

45-day processing schedule and asked the

alliance to address competition concerns,

with commissioner Richard Lidinsky

raising the point that MOL is the only G6

member not a member of the Transpacific

Stabilization Agreement, which has antitrust

immunity under the US Shipping Act of

1984.

We have been operating in accordance

with our FMC filings from that perspective

we have antitrust immunity, Mr Konishi

says.

As long as we discuss all sorts of things

fully lawful as filed in agreements, I dont

really see any particular reason why we have

to be in the TSA to operate in the alliance.

[The TSA and G6] are totally different

agreements, which have different

discussions [among members].

Vicious circle

Mr Konishi also reflects on the worst parts of

the industry trend of liner alliances upsizing

vessels in their own networks. He points out

the phenomenon helped create the vicious

circle of recurring overcapacity, despite the

obvious benefit of lower unit costs.

[Ordering larger ships] is kind of a

vicious circle but one of the simplest, most

straightforward ways to lower our slot costs,

he points out.

Because every carrier is trying to do its

best to manage costs, eventually carriers are

building ships. Then here comes another

round of overcapacity.

So in a sense, thats the kind of circle we

are already in over the past two years.

Rather than voluntary efforts from

carriers, Mr Konishi suggests that the Suez

Canals physical constraint would be the

determining factor in ending the circle.

Basically, the Suez Canal is going to be

the physical constraint for now. The 19,000

PATH TO

THE TOP

TOSHIYA K Konishi, widely known

as TK in the liner shipping industry,

joined Mitsui OSK Lines in April 1983

and held a number of managerial

positions before being appointed

executive vice president and chief

operating officer of MOL (America)

in February 2003.

In June 2008, he took the position

of executive vice president and chief

operating officer of MOL Liner, the

container and logistics business

unit of MOL, and was also named

executive officer of MOL.

He was recently promoted to

president and chief executive of MOL

Liner and managing executive officer

of MOL in June 2013.

Mr Konishi now spends the

majority of his time in Hong Kong

where the global headquarters of

MOL Liner is based. He also has an

office at MOLs Tokyo headquarters.

He has a law degree from the

University of Tokyo. He is a Japanese

citizen and holds a permanent

resident card in the US.

Brookfield Asset

Management took

shares in the holding

firm of MOL-owned

TraPac terminal

at the port of Los

Angeles.

www.containershipping.com CONTAINERISATION INTERNATIONAL 21 May 2014

THE VIEW FROM THE BRIDGE

INSIGHT FROM THE CSUITE /TOSHIYA K KONISHI

teu ships, currently the largest, are very close

to suezmax, he says.

Because the main trade lanes that

megaships are deployed on are from Asia

to Europe, I dont think ships that cannot

go through the Suez Canal are practically

viable.

Carriers would struggle to sell slots if they

send ships via the Cape of Good Hope due

to longer transit time, Mr Konishi explains.

[And] the African market is too small. In

South Africa, there is no port facility that can

efficiently receive big ships yet.

Based on MOLs estimates, a suezmax

boxship would be able to carry 20,000 teu

of containers in 24 rows, with a 415 m length

overall, a 61.8 m beam, a 31 m depth and a

16.3 m draft.

In comparison, a Triple-E class vessel has

23 rows, with a 400 m length overall, a 59 m

beam, a 30.5 m depth and a 16 m draft.

Ships can probably be larger for another

10% in nominal capacity but weve come

very close to suezmax now, Mr Konishi says.

Another positive factor for operators is the

Panama Canal expansion, which would draw

8,000 teu-9,000 teu vessels from the

Asia-Europe trades to Asia-US east coast

trades, squeezing out panamax vessels or

smaller, Mr Konishi says.

Those 8,000 teu-9,000 teu ships

will have better employment the

surplus of panamax sector is more of

a problem for owners, rather than for

operators.

Owners will have very a difficult time

to find employment for panamax boxships

and smaller. Even now, charter hires for

small ships are very low, and this sector will

continue to be under heavy pressure.

We also have too many panamax ships.

But from now to 2016, we will redeliver

many of them.

Mr Konishi is relatively optimistic about

MOLs logistics business, though.

Logistical thinking

Earlier this year, the group sold 49% of

its US terminal assets in Los Angeles and

Oakland, California and Jacksonville, Florida

to Brookfield Asset Management. The

Canadian asset manager took the shares in

International Transportation Inc, the holding

firm of MOL-owned TraPac, which operates

terminals in those ports.

Mr Konishi suggests the deal was more

about forming a partnership than raising

funds. Both sides are looking for expansion

opportunities in Latin America and other

regions.

Our logistics business is not huge but

offers a stable return. Brookfield is not a

short-term [asset] pursuer; it came to hold

those assets for long term, Mr Konishi says.

I think its a very good match they have

a long history of investing in South America

and we have an extensive shipping network

and cargoes. Brookfield can offer expertise

for new ventures in countries where MOL

may not necessarily have the know-how.

Mr Konishi adds that TraPac is actively

looking at a couple of projects and could make

a firm investment decision later this quarter.

Repairing reputations

Aside from the business operations, MOL

is also carefully repairing its reputation

within the liner industry in the aftermath

of the MOL Comfort incident.

The five-year-old, 8,110 teu vessel split

in two and sank off Yemen in mid-2013

without any collision, along with all 4,372