Professional Documents

Culture Documents

UCITS Money Market Funds

Uploaded by

Tapiwam0 ratings0% found this document useful (0 votes)

73 views4 pagesucits, money markets, funds

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentucits, money markets, funds

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

73 views4 pagesUCITS Money Market Funds

Uploaded by

Tapiwamucits, money markets, funds

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

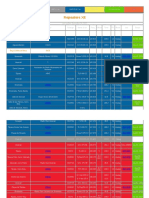

Table of risks covered by measures implemented by UCITS regulations

& European Money Market Funds

Shadow banking issues UCITS (including

ETFs) & Money

Market Funds

1

regulations

coverage

with the following measures

Specific risks identified

for Money Market Funds

(MMF)

In addition to general UCITS provisions described below Money Market

Funds (MMF) are also subject to the following provisions which reduce

specific risks identified:

UCITS MMF

- Liquidity/credit risk

(addressed)

- Valuation: (risks of

discrepancy with

amortisation cost

basis/stable NAV funds)

(addressed)

- Risk Management

Process (RMP)

Art. 1(o) & Art. 50

of Dir. 2009/65/EC

2

Art. 3, Art. 4 & Art.

5 of Dir.

2007/16/EC

3

CESR/07-

044 b4,

items 18 & 19

CESR/10-049

5

item 20

restriction on eligible money market instruments

(MMI) (e.g. maturity 397 days) & assessment of

liquidity of MMI (at the instrument & fund levels).

This ensures that MMF have sufficient planning

in the structuring of the portfolio and in

foreseeing cash flows [] (CESR/07-434).

value must be accurately determined at any time

& if UCITS consider that an amortisation method

can be used [they] must ensure that this will

not result in a material discrepancy at MMI or

UCITS level

RMP should include for MMF a prudent approach

to the management of currency, credit, interest &

liquidity risk & a proactive stress-testing regime.

UCITS & non UCITS MMF

6

(liquidity risk, credit risk :

addressed)

CESR/ 10-049 Short-term MMF MMF

NAV Floating NAV or

stable NAV (only if

strict requirements

apply to credit quality,

sensitivity to market

parameters,

diversification &

maturity of these

holdings, and

portfolio be marked to

market on a regular

basis according to the

law of the juridiction

in which the MMF is

Floating NAV

only

1

The managers of non-UCITS ETFs and non-UCITS MMF in addition, fall under AIFMD coverage

2

Directive of 13 July 2009 on the coordination of laws, regulations and administrative provisions relating to undertakings for collective investment in

transferable securities (UCITS)

3

Directive of 19 March 2007 "Eligible Assets Directive"

4

CESR Guidelines concerning eligible assets for investment by UCITS March 2007

5

CESR Guidelines on a common definition of European money market funds 19 May 2010 and Q&A ESMA/2011/273

6

Scope of CESR Guidelines relating to a common definition on money market funds (box 1 of the Guidelines):

a) The regime is applicable to both UCITS and non UCITS :

b) Any fund labelling or marketing itself (it goes beyond the mere naming convention or labelling of a fund) as a money market fund must

be compliant with the Guidelines.

authorised or

supervised (items 21

and 22))

Required

security

maturity

Max. 397 days Max. two

years if

interest rate

reset date is

less than 397

days

WAM Max. 60 days Max. 6

months

WAL Max. 120 days Max. 12

months

Credit

ratings

one of the two

highest short-term

credit ratings or

equivalent

one of the

two highest

short-term

credit ratings

or equivalent

(exception for

sovereign

issue).

General risks identified

for funds (incl. ETFs &

MMFs) & use of securities

lending &repos

Risk of run off

(addressed)

Art. 84 (2) a) & b) of

Dir 2009/65/EC

NAV temporary suspension at UCITS' or

supervisory authority initiative (if in the best interest

of unitholder or required by public interest)

Liquidity risk

(limited & adequately

monitored)

Art. 84 & Art. 51 et

seq. of Dir.

2009/65/EC

Recital 5 of Dir.

2009/65/EC

Dir. 2007/16/EC

CESR/07-434

Dir. 2010/43/EU

7

(section 2/Art. 40.3)

Art. 1.2 of Dir.

2009/65/EC

UCITS must redeem their units at shareholders'

request & are subject to strict diversification rules

invest only in liquid assets.

adequate management of liquidity risk

appropriateness of liquidity profile with

redemption policy

stress tests enabling assessment of liquidity risk

under exceptional circumstances

ETFs: liquidity for investors ensured through

secondary market markers & authorised

participants. Are assimilated to redemptions,

actions taken by a UCITS to ensure that stock

value does not significantly vary from UCITS'

NAV

Transfer of credit risks

(addressed)

Art. 50 et seq. of

Dir. 2009/65/EC

UCITS have to comply with credit & counterparty

risks limits, especially with the overall 20% limit &

5/10% limit for OTCderivatives like TRS

7

Commission Directive 2010/43/EU of 1 July 2010 implementing Directive 2009/65/EC of the European Parliament and of the Council as regards

organisational requirements, conflicts of interest, conduct of business, risk management and content of the agreement between a depositary and a

management company

Art. 43 of Dir.

2010/43/EU

CESR/10-788

8

(box

26/27)

adequate monitoring of counterparty risk in

OTCderivatives & use of collateral allowed to

reduce counterparty risk which must meet strict

criteria regarding liquidity, diversification,

reinvestment (see third bullet point in securities

lending & repurchase agreement section below)

The counterparty risk net exposure in securities

lending & repos, has to be aggregated within the

20% limit above.

cf securities lending & repos section below

Financial leverage risk

(limited risk & adequate

monitoring)

Art. 83 of Dir.

2009/65/EC

Art. 51.3 of Dir.

2009/65/EC

CESR/10-788

(Boxes 24 & 25)

UCITS cannot use borrowing other than on a

temporary basis & up to a maximum of 10% of

their NAV.

UCITS shall employ a RMP & must ensure that

their global exposure resulting from the use of

derivatives (& securities lending & repos) may

not exceed their NAV

UCITS using VaR to calculate their global

exposure must disclose in their prospectus, the

expected level of leverage & in their annual

reports, the actual level of leverage

Securities lending &

repurchase transactions

(repos) & related risks

of such activities

(strict limitation of their use

& additional forthcoming

regulations regulating

strictly collateral)

Art. 51.2 of Dir.

2009/65/EC

Art. 41.4 Dir.

2010/43/EU

CESR/10-788

ESMA Consultation

ESMA/2012/44

9

(Box 6 item 6)

UCITS may only use these techniques for

efficient portfolio management (EPM)

these techniques must be taken into account in

calculation of global exposure when they

increase leverage or exposure to market risk

ESMA suggests applying (to all UCITS) the same

rules to collateral received within the context of

securities lending & repos as those currently

applicable to collateral received within the

context of OTC derivatives. Those rules are

essentially related to liquidity, valuation, issuer

credit quality, non-correlation between the

counterparty & the collateral received,

diversification, operational & legal risks, holding

of collateral by a 3rd party custodian which is

subject to prudential supervision, prohibition to

sell, re-use or pledge the collateral received &

only authorise reinvestment of cash collateral in

risk free assets.

= limits any systemic risk that may be implied (i)

by the use/re-use of the same securities in

several transactions (ii) leverage effect

generated by reinvestment of cash collateral in

non-risk free assets

8

CESR Guidelines on Risk Measurement and the Calculation of Global Exposure and Counterparty Risk for UCITS 28 July 2010

9

Consultation paper ESMA Guidelines on ETFs and other UCITS issues

Systemic risk contribution

(efficient supervision &

monitoring)

Art. 51 et seq. of Dir.

2009/65/EC

UCITS or management companies shall notify on

an ongoing basis to supervisory authority for

each UCITS the type of derivatives used,

underlying risks, quantitative limits &

methodologies used to manage the risk

restrictions on use of borrowings, on use of

derivatives, on global exposure & disclosure of

leverage (see above)

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- MCQ PharmacokineticsDocument10 pagesMCQ PharmacokineticsHarshit Sharma100% (1)

- Economics of Money Banking and Financial Markets 12th Edition Mishkin Solutions ManualDocument3 pagesEconomics of Money Banking and Financial Markets 12th Edition Mishkin Solutions Manualalexanderyanggftesimjac100% (15)

- Gert-Jan Van Der Heiden - 'The Voice of Misery - A Continental Philosophy of Testimony' PDFDocument352 pagesGert-Jan Van Der Heiden - 'The Voice of Misery - A Continental Philosophy of Testimony' PDFscottbrodieNo ratings yet

- Past Tense Irregular Verbs Lesson Plan 02Document7 pagesPast Tense Irregular Verbs Lesson Plan 02drdineshbhmsNo ratings yet

- PDFDocument72 pagesPDFGCMediaNo ratings yet

- Test Initial Engleza A 8a Cu Matrice Si BaremDocument4 pagesTest Initial Engleza A 8a Cu Matrice Si BaremTatiana BeileșenNo ratings yet

- Margiela Brandzine Mod 01Document37 pagesMargiela Brandzine Mod 01Charlie PrattNo ratings yet

- City of Manila vs. Hon CaridadDocument2 pagesCity of Manila vs. Hon CaridadkelbingeNo ratings yet

- Dragonfly Tech BlockchainsDocument13 pagesDragonfly Tech BlockchainsTapiwamNo ratings yet

- Causes of Hedge Fund Operational StateDocument2 pagesCauses of Hedge Fund Operational StateTapiwamNo ratings yet

- Causes of Hedge Fund Operational StateDocument2 pagesCauses of Hedge Fund Operational StateTapiwamNo ratings yet

- Asset Management Report 2013Document44 pagesAsset Management Report 2013TapiwamNo ratings yet

- Waters Big Data Report Sep2013Document12 pagesWaters Big Data Report Sep2013TapiwamNo ratings yet

- Asset Management Report 2013Document44 pagesAsset Management Report 2013TapiwamNo ratings yet

- IRD Managing Risk Report Sep2013Document16 pagesIRD Managing Risk Report Sep2013TapiwamNo ratings yet

- Waters Big Data Report Sep2013Document12 pagesWaters Big Data Report Sep2013TapiwamNo ratings yet

- Where Are The Dollars in Carbon Credits?: Al TankDocument5 pagesWhere Are The Dollars in Carbon Credits?: Al TankTapiwamNo ratings yet

- How Euroclear Manages The Interoperability With The Different MarketsDocument18 pagesHow Euroclear Manages The Interoperability With The Different MarketsTapiwamNo ratings yet

- Repeaters XE PDFDocument12 pagesRepeaters XE PDFenzzo molinariNo ratings yet

- Leases 2Document3 pagesLeases 2John Patrick Lazaro Andres100% (1)

- Amgen Inc. v. F. Hoffmann-LaRoche LTD Et Al - Document No. 423Document19 pagesAmgen Inc. v. F. Hoffmann-LaRoche LTD Et Al - Document No. 423Justia.comNo ratings yet

- Tong Hop Bai Tap Tieng Anh 8 Chuong Trinh Moi Co Dap AnDocument317 pagesTong Hop Bai Tap Tieng Anh 8 Chuong Trinh Moi Co Dap Anmrxuan tesol93No ratings yet

- 2 Obligations General Provisions 1156 1162Document15 pages2 Obligations General Provisions 1156 1162Emanuel CenidozaNo ratings yet

- FedSupport Codebook FY2020Document259 pagesFedSupport Codebook FY2020Aaron BlackmonNo ratings yet

- Bible TabsDocument8 pagesBible TabsAstrid TabordaNo ratings yet

- Old Testament Books Bingo CardsDocument9 pagesOld Testament Books Bingo CardsSiagona LeblancNo ratings yet

- Kristy Gallazin Edte 431 - Assignment 2 Newsletter pdf12Document4 pagesKristy Gallazin Edte 431 - Assignment 2 Newsletter pdf12api-301047467No ratings yet

- An Equivalent SDOF System Model For Estimating The Earthquake Response of R/C Buildings With Hysteretic DampersDocument8 pagesAn Equivalent SDOF System Model For Estimating The Earthquake Response of R/C Buildings With Hysteretic DampersAlex MolinaNo ratings yet

- Gautam KDocument12 pagesGautam Kgautam kayapakNo ratings yet

- Work-Life Balance: Before ReadingDocument5 pagesWork-Life Balance: Before ReadingJulianna AvilaNo ratings yet

- Week 10 8th Grade Colonial America The Southern Colonies Unit 2Document4 pagesWeek 10 8th Grade Colonial America The Southern Colonies Unit 2santi marcucciNo ratings yet

- Boundless - 5 Steps For High Impact Work ExperienceDocument3 pagesBoundless - 5 Steps For High Impact Work ExperienceCameron WinnettNo ratings yet

- Economy 1 PDFDocument163 pagesEconomy 1 PDFAnil Kumar SudarsiNo ratings yet

- Rizal's First Return Home to the PhilippinesDocument52 pagesRizal's First Return Home to the PhilippinesMaria Mikaela MarcelinoNo ratings yet

- Manoj KR - KakatiDocument5 pagesManoj KR - Kakatimanoj kakatiNo ratings yet

- Talha Farooqi - Assignment 01 - Overview of Bond Sectors and Instruments - Fixed Income Analysis PDFDocument4 pagesTalha Farooqi - Assignment 01 - Overview of Bond Sectors and Instruments - Fixed Income Analysis PDFMohammad TalhaNo ratings yet

- Tribal Ethics of Mizo and Ao NagasDocument8 pagesTribal Ethics of Mizo and Ao NagasVincent TharteaNo ratings yet

- Potato Tuber CropsDocument103 pagesPotato Tuber CropsNani NazirNo ratings yet

- Unit 20: Where Is Sapa: 2.look, Read and CompleteDocument4 pagesUnit 20: Where Is Sapa: 2.look, Read and CompleteNguyenThuyDungNo ratings yet

- SMS Romantis Bhs Inggris Buat Pacar TercintaDocument5 pagesSMS Romantis Bhs Inggris Buat Pacar TercintaAdnan MaruliNo ratings yet