Professional Documents

Culture Documents

Accounting Assignment PDF

Uploaded by

Isha_120 ratings0% found this document useful (0 votes)

205 views58 pages#accounting #firstyearmba #completepractice

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document#accounting #firstyearmba #completepractice

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

205 views58 pagesAccounting Assignment PDF

Uploaded by

Isha_12#accounting #firstyearmba #completepractice

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 58

Assignment I - Journal

Q.1 Journalize the following relating to April 2009:

Particulars Rs.

1. R. started business with 1,00,000

2. He purchased furniture for 20,000

3. Paid salary to his clerk 1,000

4. Paid rent 5,000

5. Received interest 2,000

Solution:

Date Particulars Ledger Folio

Debit Amount

(Rs)

Credit

Amount (Rs)

1 Cash A/c Dr 100,000

To Capital A/c

100,000

2 Furniture A/c Dr 20,000

To Cash A/c

20,000

3 Salary A/c Dr 1,000

To Cash A/c

1,000

4 Rent A/c Dr 5,000

To Cash A/c

5,000

5 Cash A/c Dr 2,000

To Interest A/c

2,000

Q.2 Journalize transactions of M/s X & Co. for the month of March 2009 on the basis of

double entry system:

1. X introduced cash Rs. 4,00,000.

2. Cash deposited in the Citibank Rs. 2,00,000.

3. Cash loan of Rs. 50,000 taken from Y.

4. Salaries paid for the month of March 2009, Rs. 30,000 and Rs. 10,000 is still payable for the

month of March 2009.

5. Furniture purchased Rs. 50,000.

Solution:

Date Particulars Ledger Folio

Debit Amount

(Rs)

Credit Amount

(Rs)

1 Cash A/c Dr 400,000

To Captial (X) A/c 400,000

2 Bank A/c Dr 200,000

To Cash A/c 200,000

3 Cash A/c Dr 50,000

To Y A/c 50,000

4 Salary A/c Dr 40,000

To Cash A/c 30,000

To Outstanding Salary A/c 10,000

5 Furniture A/c Dr 50,000

To Cash A/c 50,000

Q.3 Journalize the following transactions.

1. December 1, 2008, Ajit started-business with cash Rs. 4,00,000.

2: December 3, he paid into the bank Rs. 20,000.

3. December 5, he purchased goods for cash Rs. 1,50,000.

4. December 8, he sold goods for cash Rs. 60,000.

5. December 10, he purchased furniture and paid by cheque Rs. 50,000.

6. December 12, he sold goods to Arvind Rs. 40,000.

7. December 14, he purchased goods from Amrit Rs. 1,00,000.

8. December 15, he returned goods to Amrit Rs. 50,000.

9. December 16, he received from Arvind Rs. 39,600 in full settlement.

10. December 18, he withdrew goods for personal use Rs. 10,000.

11. December 20, he withdrew cash from business for personal use Rs. 20,000.

12. December 24, he paid telephone charges Rs. 10,000.

13. December 26, cash paid to Amrit in full settlement Rs. 49,000.

14. December 31, paid for stationery Rs. 2,000, rent Rs. 5,000 and salaries to staff Rs. 20,000.

15. December 31, goods distributed by way of free samples Rs. 10,000.

16. December 31, wages paid for erection of Machinery Rs. 80,000.

17. Personal income tax liability of X of Rs. 17,000 was paid out of petty cash of business.

18. Purchase of goods from Naveen of the list price of Rs. 20,000. He allowed 10% trade

discount, Rs. 500 cash discount was also allowed for quick payment.

Solution:

Date Particulars Ledger Folio

Debit Amount

(Rs)

Credit Amount

(Rs)

1-Dec-08 Cash A/c Dr 400,000

To Capital A/c 400,000

3-Dec-08 Bank A/c Dr 20,000

To Cash A/c 20,000

5-Dec-08 Purchase A/c Dr 150,000

To Cash A/c 150,000

8-Dec-08 Cash A/c Dr 60,000

To Sales A/c 60,000

10-Dec-08 Furniture A/c Dr 50,000

To Bank A/c 50,000

12-Dec-08 Arvind A/c Dr 40,000

To Sales A/c 40,000

14-Dec-08 Purchase A/c Dr 100,000

To Amrit A/c 100,000

15-Dec-08 Amrit A/c Dr 50,000

To Purchase Returns A/c 50,000

16-Dec-08 Cash A/c Dr 39,600

Discount A/c Dr 400

To Arvind A/c 40,000

18-Dec-08 Drawings Dr 10,000

To Purchase A/c 10,000

20-Dec-08 Drawings Dr 20,000

To Cash A/c 20,000

24-Dec-08 Telephone A/c Dr 10,000

To Cash A/c 10,000

26-Dec-08 Amrit A/c Dr 50,000

To Cash A/c 49,000

To Discount A/c 1,000

31-Dec-08 Stationery A/c Dr 2,000

Rent A/c Dr 5,000

Salary A/c Dr 20,000

To Cash A/c 27,000

31-Dec-08 Advertising A/c Dr 10,000

To Purchase A/c 10,000

31-Dec-08 Machinery A/c Dr 80,000

To Cash A/c 80,000

31-Dec-08 Drawings Dr 17,000

To Petty Cash A/c 17,000

31-Dec-08 Purchase A/c Dr 18,000

Discount A/c Dr 500

To Cash A/c 17,500

Q 4 Transactions of Ramesh for April are given below. Journalize them.

2009 Rs.

April 1 Ramesh started business with 1,00,000

April 2 Paid into bank 70,000

April 3 Bought goods for cash 5,000

April 5 Drew cash from bank for credit 1,000

April 13 Sold to Krishna goods on credit 1,500

April 20 Bought from Shyam goods on credit 2,250

April 24 Received from Krishna 1,450

Allowed him discount 50

April 28 Paid Shyam cash 2,150

Discount allowed 100

April 30 Cash sales for the month 8,000

Paid Rent 500

Paid Salary 1,000

Solution:

Date Particulars Ledger Folio

Debit Amount

(Rs)

Credit Amount

(Rs)

1-Apr Cash A/c Dr 100,000

To Capital (X) A/c 100,000

2-Apr Bank A/c Dr 70,000

To Cash A/c 70,000

3-Apr Purchase A/c Dr 5,000

To Cash A/c 5,000

5-Apr Cash A/c Dr 1,000

To Bank A/c 1,000

13-Apr Krishna A/c Dr 1,500

To Sales A/c 1,500

20-Apr Purchase A/c Dr 2,250

To Shyam A/c 2,250

24-Apr Cash A/c Dr 1,450

Discount A/c Dr 50

To Krishna A/c 1,500

28-Apr Shyam A/c Dr 2,250

To Discount A/c 100

To Cash A/c 2,150

30-Apr Cash A/c Dr 8,000

To Sales A/c 8,000

Rent A/c Dr 500

Salary A/c Dr 1,000

To Cash A/c 1,500

Assignment II Ledger

Q. 1 Prepare the Stationery Account of a firm for the year ended December 31, 2008:

2008 Particulars Rs.

January 1 Stock in hand 480

April 5 Purchase of stationery by cheque 800

November 15 Purchase of stationery on credit from Five Star Stationery Mart 1,280

December 31 Stock in hand 240

Solution:

Stationery A/c

Date Particulars

Amount

(Rs) Date Particulars Amount (Rs)

1-Jan To Balance b/d

480

5-Apr To Bank A/c

800

15-Nov

To Five Star

Stationery Mart

1,280

By Profit and

Loss A/c 2,320

31-Dec By Balance c/d 240

2,560 2,560

Q.2 Prepare a ledger from the following transactions in the books of a trader

Debit Balance on January 1, 2008:

Cash in Hand Rs. 8,000, Cash at Bank Rs. 25,000, Stock of Goods Rs. 20,000, Building Rs.

10,000. Sundry Debtors: Vijay Rs. 2,000 and Madhu Rs. 2,000.

Credit Balances on January 1, 2008:

Sundry Creditors: Anand Rs. 5,000.

Following were further transactions in the month of January 2008:

January 1 Purchased goods worth Rs. 5,000 for cash less 20% trade discount and 5%

cash discount.

January 4 Received Rs. 1,980 from Vijay and allowed him Rs. 20 as discount.

January 8 Purchased plant from Mukesh for Rs. 5,000 and paid Rs. 100 as cartage for

bringing the plant to the factory and another Rs. 200 as installation charges.

January 12 Sold goods to Rahim on credit Rs. 600.

January 15 Rahim became insolvent and could pay only 50 paise in a rupee.

January 18 Sold goods to Ram for cash Rs. 1,000.

Solution:

Cash A/c

Date Particulars

Amount

(Rs) Date Particulars

Amount

(Rs)

1-Jan To Balace b/d

8,000 1-Jan By Purchase A/c

3,800

4-Jan To Vijay A/c

1,980

8-Jan

To Plant & Machinery

A/c

300

15-Jan To Rahim A/c

300

18-Jan To Ram A/c

1,000

31-Jan By Balance c/d

7,780

11,580

11,580

Bank A/c

Date Particulars

Amount

(Rs) Date Particulars

Amount

(Rs)

1-Jan To Balance b/d

25,000

31-Jan By Balance c/d

25,000

25,000

25,000

Purchase A/c

Date Particulars

Amount

(Rs) Date Particulars

Amount

(Rs)

1-Jan To Balance b/d

20,000

1-Jan To Cash A/c

3,800

1-Jan To Discount A/c

200

31-Jan By Balance c/d

24,000

24,000

24,000

Building A/c

Date Particulars

Amount

(Rs) Date Particulars

Amount

(Rs)

1-Jan To Balance b/d

10,000

31-Jan By Balance c/d

10,000

10,000

10,000

Vijay A/c

Date Particulars

Amount

(Rs) Date Particulars

Amount

(Rs)

1-Jan To Balance b/d

2,000

4-Jan By Cash A/c

1,980

4-Jan By Discount A/c

20

2,000

2,000

Madhu A/c

Date Particulars

Amount

(Rs) Date Particulars

Amount

(Rs)

1-Jan To Balance b/d

2,000

31-Jan By Balance c/d

2,000

2,000

2,000

Anand A/c

Date Particulars

Amount

(Rs) Date Particulars

Amount

(Rs)

1-Jan By Balance b/d

5,000

31-Jan To Balance c/d

5,000

5,000

5,000

Discount A/c

Date Particulars

Amount

(Rs) Date Particulars

Amount

(Rs)

1-Jan By Purchase A/c

200

4-Jan To Vijay A/c

20

31-Jan To Balance c/d

180

200

200

Mukesh A/c

Date Particulars

Amount

(Rs) Date Particulars

Amount

(Rs)

8-Jan

By Plant & Machinery

A/c

5,000

31-Jan To Balance c/d

5,000

5,000

5,000

Sales A/c

Date Particulars

Amount

(Rs) Date Particulars

Amount

(Rs)

12-Jan By Rahim A/c

600

18-Jan By Cash A/c

1,000

31-Jan To Balance c/d

1,600

1,600

1,600

Rahim A/c

Date Particulars

Amount

(Rs) Date Particulars

Amount

(Rs)

12-Jan To Sales A/c

600

15-Jan By Cash A/c

300

15-Jan By Bad Debt A/c

300

600

600

Plant & Machinery A/c

Date Particulars

Amount

(Rs) Date Particulars

Amount

(Rs)

8-Jan To Mukesh A/c

5,000

8-Jan To Cash A/c

300

31-Jan By Balance c/d

5,300

5,300

5,300

Bad Debt A/c

Date Particulars

Amount

(Rs) Date Particulars

Amount

(Rs)

15-Jan To Rahim A/c

300

31-Jan By Balance c/d

300

300

300

Q. 3 The following data is given by Mr. S, the owner, with a request to compile only the two

personal accounts of Mr. H and Mr. R, in his ledger, for the month of April 2008.

1 Mr. S owes Mr. R Rs. 15,000; Mr. H owes Mr. S Rs. 20,000.

4 Mr. R sold goods worth Rs. 60,000 @ 10% trade discount to Mr. S.

5 Mr. S sold to Mr. H goods prices at Rs.30,000.

17 Record purchase of Rs. 25,000 net from R, which were sold to H at profit of Rs. 15,000.

18 Mr. S rejected 10% of Mr. Rs goods of 4

th

April.

19 Mr. S issued a cash memo for Rs. 10,000 to Mr. H who came personally for this

consignment of goods, urgently needed by him.

22 Mr. H cleared half his total dues to Mr. S, enjoying a % cash discount (of the payment

received, Rs. 20,000 was by cheque).

26 Rs total dues (less Rs. 10,000 held back) were cleared by cheque, enjoying a cash discount

of Rs. 1,000 on the payment made.

29 Close Hs Account to record the fact that all but Rs. 5,000 was cleared by him, by a

cheque, because he was declared bankrupt.

30 Balance Rs Account.

Solution:

Mr H A/c

Date Particulars

Amount

(Rs) Date Particulars

Amount

(Rs)

1-Apr To Balance b/d

20,000

5-Apr To Sales A/c

30,000

17-Jan To Sales A/c

40,000

22-Apr By Cash A/c

24,775

22-Apr By Discount A/c

225

22-Apr By Bank A/c

20,000

29-Apr By Bank A/c

40,000

29-Apr By Bad Debt A/c

5,000

Mr R A/c

Date Particulars

Amount

(Rs) Date Particulars

Amount

(Rs)

1-Apr By Balance b/d

15,000

4-Apr By Purchase A/c

54,000

17-Jan By Purchase A/c

25,000

18-Apr To Purchase returns A/c

5,400

To Bank A/c

77,600

To Discount A/c

1,000

To Balance c/d

10,000

Assignment III Trial Balance

Q. 1 Given below is a ledger extract relating to the business of X and Co. as on March 31, 2009.

You are required to prepare the Trial Balance.

Cash Account

Dr. Cr.

Particulars Rs. Particulars Rs.

To Capital A/c 10,000 By Furniture A/c 3,000

To Rams A/c 25,000 By Salaries A/c 2,500

To Cash Sales 500 By Shyams A/c 21,000

By Cash Purchases 1,000

By Capital A/c 500

By Balance c/d 7,500

35,500 35,500

Furniture Account

Dr. Cr.

Particulars Rs. Particulars Rs.

To Cash A/c 3,000 By Balance c/d 3,000

3,000 3,000

Salaries Account

Dr. Cr.

Particulars Rs. Particulars Rs.

To Cash A/c 2,500 By Balance c/d 2,500

2,500 2,500

Shyams Account

Dr. Cr.

Particulars Rs. Particulars Rs.

To Cash A/c 21,000 By Purchases A/c

(Credit Purchases)

25,000

To Purchase Returns A/c 500

To Balance c/d 3,500 -

25,000 25,000

Purchases Account

Dr. Cr.

Particulars Rs. Particulars Rs.

To Cash A/c (Cash Purchases) 1,000 By Balance c/d 26,000

To Sundries as per Purchases

Book (Credit Purchases) 25,000

-

26,000 26,000

Purchases Returns Account

Dr. Cr.

Particulars Rs. Particulars Rs.

To Balance c/d 500 By Sundries as per Purchases

Return Book

500

500 500

Rams Account

Dr. Cr.

Particulars Rs. Particulars Rs.

To Sales A/c (Credit Sales) 30,000 By Sales Returns A/c 100

By Cash A/c 25,000

By Balance c/d 4,900

30,000 30,000

Sales Account

Dr. Cr.

Particulars Rs. Particulars Rs.

To Balance c/d 30,500 By Cash A/c (Cash Sales) 500

By Sundries as per Sales Book

(Credit sales) 30,000

30,500 30,500

Sales Returns Account

Dr. Cr.

Particulars Rs. Particulars Rs.

To Sundries as per Sales

Return Book 100

By Balance c/d 100

100 100

Capital Account

Dr. Cr.

Particulars Rs. Particulars Rs.

To Cash A/c 500 By Cash A/c 10,000

To Balance c/d 9,500 -

10,000 10,000

Solution:

Trial Balance X and Co. as on March 31, 2009

S. No. Ledger Account L.F. No.

Debit Amount (Total)

Rs

Credit Amount (Total)

Rs

1. Cash Account

7,500

2. Furniture Account

3,000

3. Salaries Account

2,500

4. Shyam's Account

3,500

5. Purchases Account

26,000

6. Purchase Returns Account

500

7. Ram's Account

4,900

8. Sales Account

30,500

9. Sales Returns Account

100

10. Capital Account

9,500

44,000

44,000

Q.2 From the following ledger balances, prepare a trial balance of Anuradha Traders as on

March 31, 2009:

Account Head Rs.

Capital 1,00,000

Sales 1,66,000

Purchases 1,50,000

Sales return 1,000

Discount allowed 2,000

Expenses 10,000

Debtors 75,000

Creditors 25,000

Investments 15,000

Cash at bank and in hand 37,000

Interest received on investments 1,500

Insurance paid 2,500

Solution:

Trial Balance Anuradha Traders as on March 31, 2009

S. No. Ledger Account L.F. No.

Debit Amount (Total)

Rs

Credit Amount (Total)

Rs

Capital

100,000

Sales

166,000

Purchases

150,000

Sales return

1,000

Discount allowed

2,000

Expenses

10,000

Debtors

75,000

Creditors

25,000

Investments

15,000

Cash at bank and in hand

37,000

Interest received on investments

1,500

Insurance paid

2,500

292,500

292,500

Q.3 One of your clients, X has asked you to finalize his accounts for the year ended March 31,

2009. Till date, he himself has recorded the transactions in books of accounts. As a basis for

audit, X furnished you with the following statement.

Dr. Balance Cr. Balance

Xs Capital 1,556

Xs Drawings 564

Leasehold premises 750

Sales 2,750

Due from customers 530

Purchases 1,259

Purchases return 264

Loan from bank 256

Creditors 528

Trade expenses 700

Cash at bank 226

Bills payable 100

Salaries and wages 600

Stock (1.4.2008) 264

Rent and rates 463

Sales return 98

5,454 5,454

The closing stock on March 31, 2009 was valued at Rs. 574. X claims that he has recorded every

transaction correctly as the trial balance is tallied. Check the accuracy of the above trial balance.

Solution:

Trial Balance of X as on March 31, 2009

S. No. Ledger Account L.F. No. Dr. Balance Cr. Balance

Xs Capital 1,556

Xs Drawings 564

Leasehold premises 750

Sales 2,750

Due from customers 530

Purchases 1259

Purchases return

264

Loan from bank 256

Creditors 528

Trade expenses 700

Cash at bank 226

Bills payable 100

Salaries and wages 600

Stock (1.4.2008) 264

Rent and rates 463

Sales return 98

5,454 5,454

Assignment IV Final Accounts

Q.1 From the following information, prepare a Trading Account of M/s. ABC Traders for the

year ended March 31, 2009: Rs.

Opening Stock 1,00,000

Purchases 6,72,000

Carriage Inwards 30,000

Wages 50,000

Sales 11,00,000

Returns inward 1,00,000

Returns outward 72,000

Closing stock 2,00,000

Solution:

Trading Account of M/s. ABC Traders for the year ended March 31, 2009

Particulars

Debit Amount

(Rs) Particulars

Credit Amount

(Rs)

Opening Stock

100,000 Sales

1,100,000

Purchases

672,000 Less: Return Inwards

(100,000)

Less: Return Outwards

(72,000)

Carriage Inwards

30,000

Wages

50,000

Gross Profit

420,000 Closing Stock

200,000

1,200,000

1,200,000

Q.2 Revenue expenses and gross profit balances of M/s ABC Traders for the year ended on

March 31, 2009 were as follows:

Gross Profit Rs. 4,20,000, Salaries Rs. 1,10,000, Discount (Cr.), Rs. 18,000, Discount (Dr.) Rs.

19,000, Bad Debts Rs. 17,000, Depreciation Rs. 65,000, Legal Charges Rs. 25,000, Consultancy

Fees Rs. 32,000, Audit Fees Rs. 1,000, Electricity Charges Rs. 17,000, Telephone, Postage and

Telegrams Rs. 12,000, Stationery Rs. 27,000, Interest paid on Loans Rs. 70,000.

Prepare Profit and Loss Account of M/s ABC Traders for the year ended on March 31, 2009.

Solution:

P&L Account of M/s ABC Traders for the year ended on March 31, 2009

Particulars

Debit Amount

(Rs) Particulars

Credit Amount

(Rs)

Salaries

110,000 Gross Profit

420,000

Discount (Dr)

19,000 Discount (Cr)

18,000

Bad Debts

17,000

Depreciation

65,000

Legal Charges

25,000

Consultancy Fees

32,000

Audit Fees

1,000

Electricity Charges

17,000

Telephone, Postage &

Telegrams

12,000

Stationery

27,000

Interest paid on loans

70,000

Net Profit

43,000

438,000

438,000

Q.3 Mr. X submits you the following information for the year ended March 31, 2009:

Rs.

Stock as on April 1, 2008 1,50,000

Purchases 4,37,000

Manufacturing expenses 85,000

Expenses on sale 33,000

Expenses on administration 18,000

Financial charges 6,000

Sales 6,25,000

Gross profit is 20% of sales.

Compute the net profit of Mr. X for the year ended March 31, 2009. Also prepare Trading &

Profit & Loss A/c.

Solution:

Trading Account of Mr X for the year ended on March 31, 2009

Particulars

Debit Amount

(Rs) Particulars

Credit Amount

(Rs)

Opening Stock

150,000 Sales

625,000

Purchases

437,000

Manufacturing Expenses

85,000

Gross Profit

125,000 Closing Stock

172,000

797,000

797,000

P&L Account of Mr X for the year ended on March 31, 2009

Particulars

Debit Amount

(Rs) Particulars

Credit Amount

(Rs)

Expenses on Sale

33,000 Gross Profit

125,000

Expenses on

administration

18,000

Financial charges

6,000

Net Profit

68,000

125,000

125,000

Q.4 A book keeper has submitted to you the following trial balance of X wherein the total of

debit and credit balances is not equal:

Particulars Debit Balances

Rs.

Credit Balances

Rs.

Capital - 7,670

Cash in hand - 30

Purchases 8,990 -

Sales - 11,060

Cash at bank 885 -

Fixtures & fittings 225 -

Freehold premises 1,500 -

Lighting and heating 65 -

Bills receivable - 825

Returns inwards - 30

Salaries 1,075 -

Creditors - 1,890

Debtors 5,700 -

Stock (1.1.2008) 3,000 -

Printing 225 -

Bills payable 1,875 -

Rates, taxes and insurance 190 -

Discounts received 445 -

Discounts allowed - 200

24,175 21,705

You are required to:

(i) Redraft the Trial Balance correctly.

(ii) Prepare a Trading and Profit and Loss Account and a Balance Sheet after taking into account

the following adjustments:

(a) Stock in hand on 31.12.2008 was valued at Rs. 1,800

(b) Depreciate fixtures and fittings by Rs. 25.

(c) Rs. 350 was due and unpaid in respect of salaries.

(d) Rates and insurance had been in paid in advance to the extent of Rs. 40.

Solution:

Trial Balance of X

S. No. Ledger Account L.F. No. Dr. Balance Cr. Balance

Capital

7,670

Cash in hand

30

Purchases

8,990

Sales

11,060

Cash at bank

885

Fixtures & fittings

225

Freehold premises

1,500

Lighting and heating

65

Bills receivable

825

Returns inwards

30

Salaries

1,075

Creditors

1,890

Debtors

5,700

Stock (1.1.2008)

3,000

Printing

225

Bills payable

1,875

Rates, taxes and insurance

190

Discounts received

445

Discounts allowed

200

22,940

22,940

Trading Account of Mr X for the year ended December 31,2008.

Particulars

Debit Amount

(Rs) Particulars

Credit Amount

(Rs)

Stock (1.1.2008.)

3,000 Sales

11,060

Purchases

8,990 Less: Return Inwards

(30)

Gross Profit

840 Stock (31.12.2008.)

1,800

12,830

12,830

P&L Account of Mr X for the year ended December 31,2008.

Particulars

Debit Amount

(Rs) Particulars

Credit Amount

(Rs)

Depreciation F&F

25 Gross Profit

840

Outstanding Salaries

350 Discount received

445

Rates, taxes & Insurance

190

Less: Advance

(40)

Lighting & Heating

65

Salaries

1,075

Printing

225

Discount allowed

200

Net Profit

(805)

1,285

1,285

Balance Sheet of Mr X as on December 31,2008.

Particulars

Credit Amount

(Rs) Particulars

Debit Amount

(Rs)

Reserves & Capital Fixed Assets

Capital

7,670 Fixtures & Fittings

225

Net Profit

(805) Less: Depreciation

(25)

Liabilities Freehold premises

1,500

Creditors

1,890 Current Assets

Bills Payable

1,875 Cash in hand

30

Outstanding Salaries

350 Cash at bank

885

Bills receivable

825

Debtors

5,700

Stock

1,800

Advance rates &

insurance

40

10,980

10,980

Q.5 The following is trial balance extracted from the books of X as on 31 March 2009:

Debit Amount

Rs.

Credit Amount

Rs.

Capital Account - 1,00,000

Plant and Machinery 78,000 -

Furniture 2,000 -

Purchases and Sales 60,000 1,27,000

Returns 1,000 750

Opening stock 30,000 -

Discount 425 800

Sundry Debtors/Creditors 45,000 25,000

Salaries 7,550 -

Manufacturing wages 10,000 -

Carriage outwards 1,200 -

Provision for doubtful debts - 525

Rent, rates and taxes 10,000 -

Advertisements 2,000 -

Cash 6,900 -

2,54,075 2,54,075

Prepare trading and profit and loss account for the year ended 31 March 2009 and a balance

sheet on that date after taking into account the following adjustments:

(a) Closing stock was valued at Rs. 34,220.

(b) Provision for doubtful debts is to be kept at Rs. 500

(c) Depreciate plant and machinery @ 10% p.a.

(d) The proprietor has taken goods worth Rs. 5,000 for personal use and additionally

distributed goods worth Rs. 1,000 as samples.

(e) Purchase of furniture Rs. 920 has been passed through purchases book.

Solution:

Trading Account of Mr X for the year ended March 31, 2009.

Particulars

Debit Amount

(Rs) Particulars

Credit Amount

(Rs)

Opening Stock

30,000 Sales

127,000

Purchases

60,000 Less: Sales Returns

(1,000)

Less: Purchase Returns

(750)

Provision for doubtful

debts

25

Less: Furniture

(920)

Less: Drawings

(5,000)

Less: Advertisement

(1,000)

Manufacturing Wages

10,000

Gross Profit

67,915 Closing Stock

34,220

160,245

160,245

P&L Account of Mr X for the year ended March 31, 2009.

Particulars

Debit Amount

(Rs) Particulars

Credit Amount

(Rs)

Dicount allowed

425 Gross Profit

67,915

Salaries

7,550 Discount received

800

Carriage Outwards

1,200

Deprecitation P&M

7,800

Rent, rates & taxes

10,000

Distributed goods

1,000

Advertisements

2,000

Net Profit

38,740

68,715

68,715

Balance Sheet of Mr X as on March 31,2009.

Particulars

Credit Amount

(Rs) Particulars

Debit Amount

(Rs)

Reserves & Capital Fixed Assets

Capital

100,000 Plant & Machinery

78,000

Net Profit

38,740 Less: Depreciation

(7,800)

Less: Drawings

(5,000) Furniture

2,000

Add: Provision

920

Liabilities Current Assets

Creditors

25,000 Stock

34,220

Debtors

45,000

Less: Provision for

doubtful debts

(500)

Cash

6,900

158,740

158,740

Q.6 From the following trial balance and other information prepare profit and loss account for

the year ended 31 March 2009 and a balance sheet on that date:

Debit

Rs.

Credit

Rs.

Xs Capital Account - 10,00,000

Withdrawals of goods for personal use 1,000 -

Balance at bank 1,76,000 -

Motor Vehicle 1,50,000 -

Debtors and Creditors 2,94,000 2,30,000

Printing and stationery 6,600 -

Gross Profit - 5,71,400

Provision for doubtful debts - 5,000

Bad debts 11,400 -

Freehold premises 8,00,000 -

Repairs to Premises 47,600 -

General Reserve - 2,00,000

Proprietors remuneration 20,000 -

Stock 2,80,000 -

Delivery expenses 99,000 -

Administrative expenses 1,31,400 -

Rates and taxes 15,000 -

Drawings 1,00,000 -

Unpaid wages - 1,600

Last Year Profit and Loss Account Balance - 1,24,000

21,32,000 21,32,000

Adjustments

(i) Depreciation on Motor Vehicles @ 50%

(ii) Creditors include a claim for damages of Rs. 30,000 and which was settled by paying Rs.

20,000.

(iii) Rates paid in advance Rs. 3,000.

(iv) Provision for bad debts is to be reduced to Rs. 3,500.

(v) The item of repairs to premises includes Rs. 20,000 for acquisition of capital asset.

(vi) Stock of stationery in hand on 31 March 2009 is Rs. 2,200.

Solution:

P&L Account for the year ended March 31, 2009.

Particulars

Debit Amount

(Rs) Particulars

Credit Amount

(Rs)

Bad Debts

11,400 Gross Profit

571,400

Repair to premises

47,600

Discount for damages

paid

10,000

Less: Capital expense

(20,000) Provison for bad debts

1,500

Proprietor's remuneration

20,000

Delivery expenses

99,000

Administrative expenses

131,400

Rates & taxes

15,000

Less: Rates paid in

advance

(3,000)

Depreciation on Motor

Vehicles

75,000

Printing & stationery

6,600

Less: adjustments

(2,200)

Net Profit

202,100

582,900

582,900

Balance Sheet as on March 31, 2009.

Particulars

Credit Amount

(Rs) Particulars

Debit Amount

(Rs)

Capital

1,000,000 Motor Vehicle

150,000

Less: Drawings

(1,000) Less: Depreciation

(75,000)

Less: Drawings

(100,000) Freehold premises

800,000

General Reserve

200,000 Add: Capital asset

20,000

P&L balance

124,000 Balance at Bank

176,000

Net Profit Less: Damage settlement

202,100 (20,000)

Creditors

230,000 Stock of Stationery

2,200

Less: damages settlement

(30,000) Stock

280,000

Unpaid Wages

1,600 Debtors

294,000

Less: Provision for

doubtful debts

(3,500)

Rates paid in advance

3,000

1,626,700

1,626,700

Q.7 The following trial balance has been extracted from the books of Ms. X. Prepare the final

accounts for the year ended 31 March 2009 and a balance sheet on that date:

Debit

Rs.

Credit

Rs.

Drawings 35,000 -

Buildings 60,000 -

Debtors and creditors 50,000 80,000

Returns 3,500 2,900

Purchases and sales 3,00,000 4,65,000

Discount 7,100 5,100

Life insurance 3,000 -

Cash 30,000 -

Stock (opening) 12,000 -

Bad debts 5,000 -

Reserve for bad debts - 17,000

Carriage inwards 6,200

Wages 27,700

Machinery 8,00,000

Furniture 60,000

Salaries 35,000

Bank commission 2,000

Bills receivable/payable 60,000 40,000

Trade expenses/Capital 13,500 9,00,000

15,10,000 15,10,000

Adjustments:

(i) Depreciate building by 5%; furniture and machinery by 10% p.a.

(ii) Trade expenses Rs. 2,500 and wages Rs. 3,500 have not been paid as yet.

(iii) Allow interest on capital at 5% p.a.

(iv) Make provision for doubtful debts at 5%.

(v) Machinery includes Rs. 2,00,000 of a machine purchased an 31 December 2008. Wages

include Rs. 5,700 spent on the installation of machine.

Stock on 31 March 2009 was valued at Rs. 50,000.

Solution:

Trading Account of Mr X for the year ended March 31, 2009.

Particulars

Debit Amount

(Rs) Particulars

Credit Amount

(Rs)

Opening Stock

12,000 Sales

465,000

Purchases

300,000 Less: Sales Returns

(3,500)

Less: Purchase Returns

(2,900) Reserve for bad debt

14,500

Trade expenses

13,500

Unpaid trade expenses

2,500

Wages

27,700

Less: Installation charges

(5,700)

Carriage Inwards

6,200

Unpaid wages

3,500

Gross Profit

169,200 Closing Stock

50,000

526,000

526,000

P&L Account of Mr X for the year ended March 31, 2009.

Particulars

Debit Amount

(Rs) Particulars

Credit Amount

(Rs)

Dicount allowed

7,100 Gross Profit

169,200

Salaries

35,000 Discount received

5,100

Depreciation building

3,000

Depreciation furniture

6,000

Depreciation machinery

65,143

Bank Commission

2,000

Interest on Capital

45,000

Bad Debts

5,000

Net Profit

6,058

174,300

174,300

Balance Sheet of Mr X as on March 31, 2009.

Particulars

Credit Amount

(Rs) Particulars

Debit Amount

(Rs)

Capital

900,000 Buildings

60,000

Less: Drawings

(35,000) Less: Depreciation

(3,000)

Less: Life Insurance

(3,000) Machinery

800,000

Interest on Capital

45,000 Add: Provision

5,700

Less: Depreciation

(65,143)

Net Profit

6,058 Furniture

60,000

Less: Depreciation

(6,000)

Creditors

80,000 Stock

50,000

Bills Payable

40,000 Debtors

50,000

Less: Provision for bad

debts

(2,500)

Unpaid Trade expenses

2,500 Bills Receivable

60,000

Unpaid wages

3,500 Cash

30,000

1,039,058

1,039,058

Q.8 The following is the Trial Balance of X on 31 March 2009:

Debit

Rs.

Credit

Rs.

Capital - 8,00,000

Drawings 60,000 -

Opening Stock 75,000 -

Purchases 15,95,000 -

Freight on Purchases 25,000 -

Wages (11 months upto 28-2-2009) 66,000 -

Sales - 23,10,000

Salaries 1,40,000 -

Postage, Telegrams, Telephones 12,000 -

Printing and Stationery 18,000 -

Miscellaneous Expenses 30,000 -

Creditors - 3,00,000

Investments 1,00,000 -

Discounts Received - 15,000

Debtors 2,50,000 -

Bad Debts 15,000 -

Provision for Bad Debts - 8,000

Building 3,00,000 -

Machinery 5,00,000 -

Furniture 40,000 -

Commission on Sales 45,000 -

Interest on Investments - 12,000

Insurance (Year up to 31-7-2009) 24,000 -

Bank Balance 1,50,000 -

34,45,000 34,45,000

Adjustments:

(i) Closing Stock Rs. 2,25,000.

(ii) Machinery worth Rs. 45,000 purchased on 1-10-08 was shown as Purchases. Freight paid on

the Machinery was Rs. 5,000, which is included in Freight on Purchases.

(iii)Commission is payable at 2% on Sales.

(iv) Investments were sold at 10% profit, but the entire sales proceeds have been taken as Sales.

(v) Write off Bad Debts Rs. 10,000 and create a provision for Doubtful Debts at 5% of Debtors.

(vi) Depreciate Building by 2% p.a. and Machinery and Furniture at 10% p.a. Prepare Trading

and Profit and Loss Account for the year ending 31 March 2009 and a Balance Sheet as on

that date.

Solution:

Trading Account of Mr X for the year ended March 31, 2009.

Particulars

Debit Amount

(Rs) Particulars

Credit Amount

(Rs)

Opening Stock

75,000 Sales

2,310,000

Purchases

1,595,000

Less: Proceeds from

investments

(110,000)

Less: Purchase of

Machinery

(45,000)

Freight on purchases

25,000

Less: Freight on purchase

of machinery

(5,000)

Wages

66,000

Outstanding wages

6,000

Gross Profit

708,000 Closing Stock

225,000

2,425,000

2,425,000

P&L Account of Mr X for the year ended March 31, 2009.

Particulars

Debit Amount

(Rs) Particulars

Credit Amount

(Rs)

Depreciation: Building

7,500 Gross Profit

708,000

Depreciation: Furniture

4,000 Discount Received

15,000

Depreciation: Machinery

52,500 Intereset on investments

12,000

Salaries

140,000

Proceeds from

investments

10,000

Postage, telegrams &

telephones

12,000

Printing & Stationery

18,000

Miscellaneous Expenses

30,000

Insurance

24,000

Less: Prepaid Insurance

(8,000)

Commission on Sales

45,000

Outstanding commission

on Sales

10,000

Bad Debts

15,000

Add: Write off

10,000

Provision for bad debts

4,000

Net Profit

381,000

745,000

745,000

Balance Sheet of Mr X as on March 31, 2009.

Particulars

Credit Amount

(Rs) Particulars

Debit Amount

(Rs)

Capital

800,000 Machinery

500,000

Less: Drawings

(60,000)

Add: Purchase of

machinery

45,000

Net Profit

381,000

Add: Freight on purchase

of machinery

5,000

Less: Depreciation

(52,500)

Building

300,000

Less: Depreciation

(7,500)

Furniture

40,000

Less: Depreciation

(4,000)

Bank Balance

150,000

Stock

225,000

Investments

100,000

Outstanding commission

on Sales

10,000 Less: Sale of investments

(100,000)

Outstanding wages

6,000 Debtors

250,000

Less: Write off bad debts

(10,000)

Creditors

300,000

Less: Provision for bad

debts

(12,000)

Prepaid Insurance

8,000

1,437,000

1,437,000

Assignment V - Financial Statement Analysis

Q.1 From the following particulars relating to AB Co. prepare a Balance Sheet as on 31.12.2009:

Fixed assets / turnover ratio 1:2

Debt collection period Two months

Gross profit 25%

Consumption of raw materials 40% of cost

Stock of Raw materials 4 months consumption

Finished goods 20% of turnover at cost

Fixed Assets to Current Assets 1:1

Current Ratio 2:1

Long Term loan to current Liability 1:3

Capital to Reserve 5:2

Value of Fixed Assets Rs. 10,50,000

Solution:

Fixed Assets = Rs. 10,50,000

Fixed assets / turnover ratio = Fixed assets / Sales =1:2

Sales = Rs 21,00,000

Fixed assets / current assets = 1:1

Current assets = Rs 10,50,000

Gross Profit = 25% * Sales

Gross Profit = Rs 5,25,000

Cost of Goods Sold = Sales Gross Profit

Cost of Goods Sold (COGS) = Rs 15,75,000

Consumption of raw material = 40% * COGS

Consumption of raw material = Rs 6,30,000

Stock of raw material = COGS /12 *4

Stock of raw material = Rs 2,10,000

Finished goods = 20% * COGS

Finished goods = Rs 3,15,000

Debt Collection Period = Average debtors * 12 / Net Credit Sales

Average Debtors = Net credit Sales/12 * debt collection period

Average debtors = Rs 21,00,000 * 2/12

Average debtors = Rs 3,50,000

Current ratio = Current Assets / Current Liabilities = 2 :1

Current Liabilities = Rs 5,25,000

Long term loan to current liability = 1: 3

Long term loan = Rs 1,75,000

Total Assets = Fixed Assets + Current Assets = Rs 21,00,000

Total Liabilities = Rs 21,00,000

Networth = ESC + R&S = Total Liabilities Current Liabilities Long Term Debt

Networth = 21,00,000 - 5,25,000 - 1,75,000

Capital + Reserves & Surplus = Rs 14,00,000

Capital to Reserves = 5:2

Capital = Rs 10,00,000

Reserves = Rs 4,00,000

Balance Sheet of AB Co. as on 31.12.2009

Particulars Credit Amount (Rs) Particulars Debit Amount (Rs)

Shareholders

Funds

Capital

Reserves

Current Liabilities

Long Term Debt

Rs 14,00,000

Rs 10,00,000

Rs 4,00,000

Rs 5,25,000

Rs 1,75,000

Fixed Assets

Current Assets

Debtors

Stock of raw

material

Finished Goods

Cash (B.f.)

Rs 10,50,000

Rs 10,50,000

Rs 3,50,000

Rs 2,10, 000

Rs 3,15,000

Rs 1,75,000

Total Liabilities Rs 21,00,000 Total Assets Rs 21,00,000

Q.2 From the following particulars prepare the Balance Sheet of A Ltd.:

Current Ratio 1.50

Current Assets/Fixed Assets 1:2

Fixed Assets to turnover 1:1

Gross Profit 25%

Debtors Velocity 2 months

Creditors Velocity 2 months

Stock Velocity 3 months

Debt equity ratio 2:5

Working Capital Rs. 2,00,000

Solution:

Working Capital = Current Assets Current Liabilities = Rs 2,00,000

Current Ratio = Current Assets / Current Liabilities

=> Current Assets = Rs 6,00,000

=> Current Liabilities = Rs 4,00,000

Current Assets to Fixed Assets = 1: 2

Fixed Assets = Rs 12,00,000

Total Assets = Total Liabilities = Rs 18,00,000

Fixed Assets to Turnover = 1:1

Turnover = Sales = Rs 12,00,000

Gross Profit = 25* Sales = Rs 4,00,000

Cost of Goods Sold (COGS) = Rs 9,00,000

Debtors Velocity = 2 months

Debtors = 12,00,000 /12 *2 = Rs 2,00,000

Creditors Velocity = 2 months

Creditors = Rs 9,00,000 /12 * 2 = Rs 1,50,000

Stock Velocity = 3 months

Stock = Rs 9,00,000 /12 * 3 = Rs 2,25,000

Debt to Equity Ratio = 2: 5

& Debt + Equity = Total Liabilities Creditors = 18,00,000 4,00,000 = 14,00,000

Debt = Rs 4,00,000

Equity = Rs 10,00,000

Balance Sheet of A Limited

Particulars Credit Amount (Rs) Particulars Debit Amount (Rs)

Equity Rs 10,00,000 Fixed Assets Rs 12,00,000

Current Liabilities

Long Term Debt

Rs 4,00,000

Rs 4,00,000

Current Assets

Debtors

Stock

Cash (B.f.)

Rs 6,00,000

Rs 1,50,000

Rs 2,25, 000

Rs 2,75,000

Total Liabilities Rs 18,00,000 Total Assets Rs 18,00,000

Q.3 From the following information, you are required to prepare a Balance Sheet:

Current Ratio 1.75

Liquid Ratio 1.25

Stock Turnover ratio (Closing Stock) 9

Gross profit ratio 25%

Debt collection period 1.50 months

Reserves and surplus to capital 0.20

Turnover to fixed assets 1.20

Fixed assets to net worth 1.25

Sales for the year Rs. 12,00,000

Solution:

Sales (Turnover) = Rs 12,00,000

Turnover to Fixed Assets = 1.2

Fixed Assets = Rs 10,00,000

Fixed Assets to Networth = 1.25

Networth = Rs 8,00,000 = Reserves & Surplus + Capital

Gross Profit = 25 * Sales = Rs 3,00,000

Cost of Goods Sold (COGS) = Sales Gross Profit

Cost of Goods Sold (COGS) = Rs 9,00,000

Stock Turnover ratio = 9

Stock = 9,00,000/9 = Rs 1,00,000

Debt Collection Period = 1.5 Months

Debtors = 12,00,000/12*1.5 = Rs 1,50,000

Reserves & Surplus to Capital = 0.2

Capital = Rs 6,66,667

Reserves & Surplus = Rs 1,33,333

Current Ratio = Current Assets / Current Liabilities = 1.75

Liquid Ratio = (Current Assets Stock ) / Current Liabilities = 1.25

(1.75 CL 1,00,000) / CL =1.25

Current Liabilities = Rs 2,00,000

Current Assets = Rs 3,50,000

Total Assets = Fixed Assets + Current Assets = Rs 13,50,000

Long Term Liabilities = Total Liabilities Current Liabilities Networth

Long Term Liabilities = 13,50,000 2,00,000 8,00,000 = Rs 3,50,000

Balance Sheet

Particulars Credit Amount (Rs) Particulars Debit Amount (Rs)

Networth

Capital

Reserves & Surplus

Current Liabilities

Long Term Debt

Rs 8,00,000

Rs 6,66,667

Rs 1,33,333

Rs 2,00,000

Rs 3,50,000

Fixed Assets

Current Assets

Debtors

Stock

Cash (B.f.)

Rs 10,00,000

Rs 3,50,000

Rs 1,50,000

Rs 1,00, 000

Rs 1,00,000

Total Liabilities Rs 13,50,000 Total Assets Rs 13,50,000

Q. 4 Mr. Desai intends to supply goods on credit to A Ltd. and B Ltd. The relevant financial data

relating to the companies for the year ended 30

th

June, 2009 are as under:

A Ltd. B Ltd.

Stock 8,00,000 1,00,000

Debtors 1,70,000 1,40,000

Cash 30,000 60,000

Trade Creditors 3,00,000 1,60,000

Bank overdraft 40,000 30,000

Creditors for expenses 60,000 10,000

Total purchases 9,30,000 6,60,000

Cash purchases 30,000 20,000

Advice with reasons, as to which of the companies he should prefer to deal with

Solution:

Financ

ial

Ratio

A Ltd B Ltd

Credit

Turnov

er

=(9,30,000-30,000)/3,00,000

=3

=(6,60,000-20,000)/1,60,000

=4

Credit

Payme

nt

Period

4 Months 3 Months

Curren

t Ratio

=(8,00,000+1,70,000+30,000)/(3,00,000+

40,000+60,000)

=2.5

=(1,00,000+1,40,000+60,000)/(1,60,000+

30,000+10,000)

=1.5

Quick

Ratio

=(1,70,000+30,000)/( 3,00,000+60,000)

=0.56

=(1,40,000+60,000)/(1,60,000+10,000)

=1.18

Mr Desai should prefer to deal with B Ltd. Reasons are mentioned below: -

1. Quick ratio of 1.18 of B Ltd is better than .56 of A Ltd.

2. Credit Payment Period of 3 months of B Ltd is better than 4 months of A Ltd.

3. Current ratio of 2.5 of A Ltd is better than 1.5 of B Ltd.

Since stock can not be converted into cash quickly, quick ratio and credit payment period of

B Ltd are more important in view of requirement of Mr Desai. Therefore, he must choose B

Ltd for dealing.

Q.5 The following is the Trading & Profit & Loss A/c of X Ltd. As on December 31, 2008:

Trading & P&L Account (31.12.2008)

Opening Stock 1,30,000 Cash Sales 80,000

Purchases 4,20,000 Credit Sales 3,20,000

G.P. 60,000 Stock 2,10,000

Depreciation 13,100 G.P. 60,000

G. Expenses 20,900

Directors Fees 10,000

N.P. 16,000

60,000 60,000

Balance Sheet as at 31

st

December, 2008

Share Capital 3,60,000 Fixed Assets 2,05,600

Profit & Loss A/c 24,600 Stock 2,10,000

Creditors 1,40,000 Debtors 1,60,000

Bank overdraft 51,000

5,75,000 5,75,000

1. The rate of stock turnover is to be doubled.

2. Stock is to be reduced by Rs. 60,000 by the end of the financial year.

3. The ratio of cash sales to Credit sales is to be doubled.

4. Directors remuneration are to be increased by Rs. 15,000.

5. Rate of gross profit to sales is to be increased by 33

1

/

3

%.

6. The ratio of trade creditors to closing stock and the ratio of debtors to credit sales will remain

the same as in the year just ended.

7. General expenses and depreciation are to remain the same.

Draft budgeted Trading and Profit and loss account and balance sheet, assuming that the

objectives had been achieved.

Solution:

Financial figure/ ratio Existing figure / ratio (2008) Desired figure /

ratio (2009)

Stock turnover =3,40,000*2/(2,10,000+1,30,000)

=2

4

Stock 2,10,000 1,50,000

Cash Sales / Credit Sales 1:4 1:2

Directors Remuneration 10,000 25,000

Gross Profit to Sales 15% 20%

Trade Creditors to Closing Stock =1,40,000/2,10,000

=66.67%

66.67%

Debtors to Credit Sales 1:2 1:2

General Expenses 20,900 20,900

Depreciation 13,100 13,100

Solution:

Since Stock in 2009 = Rs 1,50,000

Cost of goods sold = Rs (2,10,000+1,50,000)/2 * 4 = Rs 7,20,000

Let Sales be x

=> 20%x = x 7,20,000

=> Sales = Rs 9,00,000

=> GP = Rs 1,80,000

=> Cash Sales = Rs 3,00,000

=> Credit Sales = Rs 6,00,000

=> Debtors = Rs 3,00,000

Trade Creditors = 1,50,000 *66.67% = Rs 1,00,000

7,20,000 = 2,10,000 + Purchases 1,50,000

=> Purchases = Rs 6,60,000

Drafted Trading & Profit and Loss Account and Balance Sheet: -

Trading & P&L Account (31.12.2009)

Opening Stock 2,10,000 Cash Sales 3,00,000

Purchases 6,60,000 Credit Sales 6,00,000

G.P. 1,80,000 Stock 1,50,000

Depreciation 13,100 G.P. 1,80,000

G. Expenses 20,900

Directors Fees 25,000

N.P. 1,21,000

1,80,000 1,80,000

Balance Sheet as at 31

st

December, 2009

Share Capital 3,60,000 Fixed Assets 2,05,600

Profit & Loss A/c 24,600 Stock 1,50,000

Net Profit 1,21,000 Debtors 3,00,000

Bank overdraft 36,900 Less : Depreciation -13,100

Creditors 1,00,000

6,42,500 6,42,500

Q.6 You are given the following figures worked out from the profit and loss account and balance

sheet of Z Ltd. relating to the year 2008. Prepare the balance sheet.

Fixed Assets (net after writing off 30%) Rs. 10,50,000

Fixed Assets Turnover ratio 2

Finished goods turnover ratio 6

Rate of gross profit to sales 25%

Net profit (before interest) to sale 8%

Fixed charges cover (debenture interest 7%) 8

Debt collection period 1 months

Material consumed to sales 30%

Stock of raw materials (in terms of number of months consumption) 8

Current ratio 2.4

Quick ratio 1.0

Reserves to capital 0.20

Solution:

Fixed Assets = Rs 10,50,000

Sales (Turnover) = Rs 21,00,000

Gross Profit = Rs 5,25,000

Cost of Goods Sold (COGS) = Rs 15,75,000

Finished Goods = Rs 2,62,500

Net Profit before interest = Rs 1,68,000

Annual Interest Payments = Rs 21,000

Net Profit after interest = Rs 1,47,000

Debentures (7%) = Rs 3,00,000

Debtors = Rs 2,62,500

Material Consumed = Rs 6,30,000

Stock of Raw Material = Rs 4,20,000

Current Ratio Quick Ratio = Stock / Current Liabilities = 1.4

Stock = 2,62,500 + 4,20,000 = 6,82,500

Current Liabilities = Rs 4,87,500

Current Assets = Rs 11,70,000

Capital + Reserves & Surplus = 22,20,000 4,87,500 -3,00,000 = Rs 14,32,500

Capital = Rs 11,93,750

Reserves & Surplus = Rs 2,38,750

Balance Sheet of Z Ltd as at 31

st

December, 2008

Capital 11,93,750 Fixed Assets 10,50,000

Reserves & Surplus Current Assets 11,70,000

Profit & Loss A/c b/d 91,750

Net Profit after interest 1,47,000 Debtors 2,62,500

7% Debentures 3,00,000 Stock of Raw Materials 4,20,000

Finished Goods 2,62,500

Current Liabilities 4,87,500 Cash (B. f.) 2,25,000

22,20,000 22,20,000

Net Profit is part of Reserves & Surplus.

Q.7 The summarized Balance Sheet of X Ltd. as at 31

st

December 2008 and its summarized

Profit and Loss Account for the year ended on that date, are as follows. The corresponding

figures of the previous year are also shown:

Balance Sheet

Liabilities 2008 2007 Assets 2008 2007

(Rs. in lakhs ) (Rs. in lakhs)

Share capital

60,000 shares of

Rs. 100 each

60.00 60.00

Fixed Assets

At cost less

Depreciation:

Reserve & Surplus

29.25 24.00

Property

Plant

21.00

61.50

18.00

48.00

8% Debenture 15.00 15.00 82.50 66.00

Current Liabilities

& Provisions :

Current Assets -

Sundry Creditors 45.75 24.00 Stock of finished

goods

42.75 31.50

Provision for

Taxation

13.50 10.50 Sundry Debtors 41.25 30.00

Proposed

Dividend

4.50

63.75

3.00

Bank 1.50

85.50

9.00

Total : 168.00 136.50 168.00 136.50

Trading & Profit and Loss Account

2008 2007 2008 2007

(Rs. in lakhs) (Rs. in lakhs)

Cost of Sales 162.00 135.00 Sales (all credit) 225.00 180.00

Gross Profit C/d 63.00 45.00

225.00 180.00 225.00 180.00

Overhead Expenses 43.50 30.00 Gross Profit b/d 63.00 45.00

Net Profit before taxation 19.50 15.00

63.00 45.00 63.00 45.00

Provision for taxation 8.25 6.30 Net profit b/d 19.50 15.00

Dividend-paid and

Proposed 6.00 4.50

Surplus for the year

carried to Balance Sheet 5.25 4.20

19.50 15.00 19.50 15.00

You are required to interpret the above statement using significant accounting ratios.

Solution:

Following are the five steps in examining the performance of the company in the year 2008 as

compared to the year 2007.

Step 1: Calculation of the ratios

Financial Ratio 2008 2007

Return on Capital

Employed (RoCE)

=(19.5+1.2)/(60+29.25+15)

=19.86 %

=(15+1.2)/(60+24+15)

=16.36%

Net Profit Ratio (NPR) =19.5/225*100%

=8.67%

=15/180*100%

=8.34%

Capital Employed Turnover

Ratio (CETR)

=225/(60+29.25+15)

=2.16

=180/(60+24+15)

=1.82

Current Ratio (CR) =85.5/63.75

=1.34

=70.5/37.5

=1.88

Stock Turnover Ratio (STR) =162/42.75

=3.79

=135/31.5

=4.29

Average Collection Period

(ACP)

=41.25/225*365

=66.91 Days= ~67 days

=30/180*365

=60.83 Days = ~61 days

Debt / Equity Ratio (D/E) =15/89.25

=.17

=15/84

=.18

Earning per share (EPS) =11,25,000/60,000

=18.75

=8,70,000/60,000

=14.5

Dividend payout ratio (DPS

/ EPS)

=(6,00,000/60,000)/18.75*100%

=53.33%

=(4,50,000/60,000)/14.5*100%

=51.72%

Gross Profit Ratio (GPR) =63/225*100%

=28%

=45/180*100%

=25%

2. Comment on Individual Ratios: -

1. Return on Capital Employed (RoCE) has increased from 16.36% in 2007 to 19.86%

in 2008. This is achieved with the help of increased profitability on sales and more

efficient utilization of capital employed.

2. Net Profit Ratio (NPR) has increased from 8.34% in 2007 to 8.67% in 2008. This is

achieved with the help of increased profitability on sales.

3. Capital employed turnover ratio (CETR) has increased from 1.82 in 2007 to 2.16 in

2008. This is increased with the help of more efficient use of capital employed.

4. Current ratio (CR) has decrease to 1.34 in 2008 from 1.88 in 2007. This indicates that

Working Capital Management (WC Mgt) of the company is not showing healthy signs.

The reason for decline in CR is financing fixed assets out of working capital (WC).

During the year, there is substantial increase in fixed assets without any efforts to raise

long term funds. Long term funds have increased by 5.25 lacs on account of retained

profits.

5. Stock Turnover ratio (STR) has decreased from 4.29 in 2007 to 3.79 in 2008. This

indicates that Stock is not being efficiently utilized.

6. Average Collection Period (ACP) has increased to 67 days in 2008 from 61 days in

2007. This indicates poor collection as compared to previous year.

7. There is no noticeable change in debt/equity ratio. The debt/equity ratio (.18) of the

company is low which indicates presence of less long term debt as compared to equity

capital.

8. Earning per share (EPS) has increased to 18.75 in 2008 from 14.5 in 2007 (growth of

29.31% over previous year) indicates healthy growth of EPS.

9. Dividend payout ratio (DPR) has increased to 53.33% in 2008 from 51.72% in 2007

which is not a healthy sign in view of difficult working capital situation of the company.

Dividend per share (DPS) has increased to 10 in 2008 from 7.5 in 2007.

10. Gross profit ratio (GPR) has increase to 28% in 2008 from 25% in 2007 which

indicates 12% y/y growth in gross profit ratio.

Step 3: Critical Appraisal

The profitability of the company increased in account of increase in sales. Overheads have

increased considerably.

Working capital management is not satisfactory. Dividend payout should not have been so high

in view of working capital problems.

Step 4: Overall Performance

Overall performance of the company is satisfactory (RoCE has improved)

Step 5: Suggestion for the future

1. Try to improve working capital situation.

2. Try to control the overheads.

3. Funds may be raised through debentures, long term loans etc as the companys

debt/equity ratio is low. Such funds may be used to improve working capital situation and

also for expansion and diversification of the business.

Q.8 X Ltd. has been existence for two years. Summarized Balance Sheets as on 31

st

December, 2007 and 31

st

December, 2008 are given below:

Balance Sheet (Figures in lakhs of rupees)

Liabilities 2008 2007 Assets 2008 2007

Equity shares of Rs. 100 each 2 2 Fixed Assets (Less Dep.) 4.16 3.96

Reserves .20 .40 Stock .60 1.20

Profit & Loss A/c .28 .04 Debtors .80 1.60

Loans on Mortgage 2.20 1.60 Cash and Bank Balances .60 .04

Bank overdraft .40

Creditors .60 1.80

Provision for Taxation .68 .26

Proposed Dividend .20 .30

6.16 6.80 6.16 6.80

You are also given the Profit and Loss Account of the Company for the two years.

Profit & Loss Account (Figures in lakhs of rupees)

2008 2007 2008 2007

Interest on Loan .048 .096 Balance B/F - .28

Directors

Remuneration

.20 .60

Profit for the year after

running costs &

Depreciation 1.608 1.216

Provision for Taxation .68 .26

Dividends .20 .30

Transfer to Reserve .20 .20

Balance C/F .28 .04

1.608 1.496 1.608 1.496

Total Sales amounted to Rs. 12 lakhs in 2007 and Rs. 10 lakhs in 2008.

Make a through overall analysis of this company.

Solution:

Step 1: Calculation of Financial Ratios

S. No. Financial ratio 2008 2007

1 Return on Capital Employed

(RoCE)

=(1.608-

.2)/(2+.2+.28+2.2)

=30.09%

=(1.216-.3)/(2+.4+.04+1.6)

=22.67%

2 Net Profit Ratio (NPR) =.68/10*100%

=6.8%

=.54/12*100%

=4.5%

3 Capital Employed Turnover

Ratio (CETR)

=10/(2+.2+.28+2.2)

=2.14

=12/(2+.4+.04+1.6)

=2.97

4 Current Ratio (CR) =(.6+.8+.6)/(.6+.68+.2)

=1.35

=(1.2+1.6+.04)/(1.8+.26+.3)

=1.20

5 Stock Turnover Ratio (STR) =(10-1.608)/.6

=13.99

=(12-1.216)/1.2

=8.99

6 Average Collection Period

(ACP)

=.8/10*365

=29.2 Days

=1.6/12*365

=48.67 Days

7 Debt / Equity Ratio (D/E) =2.20/2.48

=.89

=1.6/2.44

=.66

8 Earning per share (EPS) =68,000/2000

=34

=54,000/2000

=27

9 Dividend payout ratio (DPS /

EPS)

=.2/.68

=29.41%

=.3/.54

=55.56%

10 Gross Profit Ratio (GPR) =.1.608/10*100%

=16.08%

=1.216/12*100%

=10.13%

Step 2: Comments on individual ratios

1. Sales have decreased to 10 lacs in 2008 from 12 lacs in 2007. This is not a positive

signal since topline has decreased by 16.67% y/y.

2. Return of Capital Employed (RoCE) has increased by 32.73% to 30.09% in 2008

from 22.67% in 2007. This is attributed to higher return on sales and but less efficient

utilization of capital employed.

3. Net Profit Ratio (NPR) has increased to 6.8% in 2008 from 4.5% in 2007. This is a

healthy signal since profitability on sales has increased 51.11% y/y basis.

4. Capital Employed Turnover Ratio (CETR) has decreased to 2.14 in 2008 from 2.97

in 2007. This is not a healthy signal since CETR has decreased by 28%.

5. Current Ratio has increased by 12.5% to 1.35 in 2008 from 1.20 in 2007.. This

indicates that current assets have increased more w.r.t. current liabilities and is a healthy

signal.

6. Stock Turnover Ratio (STR) has increased to 13.99 in 2008 from 7.08 in 2007 which

is a healthy signal since stock activity has improved compared to cost of goods sold.

7. Average Collection Period (ACP) has decreased to 29.2 days from 48.67 days which

indicates that collection of credit sales has improved as compared to previous year and

cash is collected faster.

8. Debt / Equity Ratio has increased to .88 in 2008 from .66 in 2007 which indicates that

company has raised long term debt (Mortgage debt) to finance its activities in the year

2008.

9. Earning per share (EPS) has increased to 34 in 2008 from 27 in 2007 which is a

healthy sign since EPS growth is a strong signal for investors and creditors for the

business.

10. Dividend payout ratio (DPR) has decreased to 29.41% in 2008 from 55.56% in 2007

which indicates that company prefers to retain its profits for future expansions.

11. Gross Profit Ratio (GPR) has increased to 16.08% in 2008 from 10.13% in 2007

which is 58.74% increase on y/y basis. This indicates that overall profitability of the

business has significantly improved.

Step 3: Critical Appraisal

It is noticed that sales have decreased but all other performance indicators for the company have

significantly improved over previous year. 32.73% increase in RoCE is surely a very good

performance indicator of increased profitability. CETR decreased indicates less efficient

utilization of resources. Improved current ratio, lower collection period and higher stock turnover

ratio indicated enhanced activity in many aspects of the business. It seems that the firm is poised

for rapid growth path.

Step 4: Overall Performance

The overall performance of the company is good. Since all major indicators are better but sales

and CETR have decreased over previous year.

Step 5: Suggestions for the future

The company should improve the utilization of resources. It is required to improve turnover to

increase topline growth.

You might also like

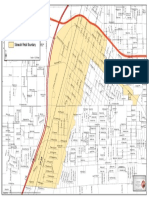

- Downtown Sidewalk Dining Area Map 5-13-2020Document1 pageDowntown Sidewalk Dining Area Map 5-13-2020susanstapletonNo ratings yet

- District and Community Contact InformationDocument3 pagesDistrict and Community Contact Informationapi-543728028No ratings yet

- SD Config Checklist 21-01-2015Document47 pagesSD Config Checklist 21-01-2015saurabhkmr25No ratings yet

- Management in English Language Teaching SummaryDocument2 pagesManagement in English Language Teaching SummaryCarolina Lara50% (2)

- Funds Management - Public Sector - SCN WikiDocument2 pagesFunds Management - Public Sector - SCN WikibhangaramNo ratings yet

- General ControllingDocument53 pagesGeneral ControllingsannjanaaNo ratings yet

- Financial Accounting AssignmentDocument4 pagesFinancial Accounting AssignmentRana SohailNo ratings yet

- TeamViewer12 Manual MSI Deployment enDocument21 pagesTeamViewer12 Manual MSI Deployment enLeonardo Da Silva CamposNo ratings yet

- FI504 Case Study 1 The Complete Accounting CycleDocument16 pagesFI504 Case Study 1 The Complete Accounting CycleElizabeth Hurtado-Rivera0% (1)

- As01-Create Normal AssetDocument9 pagesAs01-Create Normal AssetAnonymous Q3J7APoNo ratings yet

- Alignment Matrix - 256520 - Control TrafficDocument1 pageAlignment Matrix - 256520 - Control TrafficChristian MakandeNo ratings yet

- HR2008 2Document65 pagesHR2008 2prakash_kumNo ratings yet

- MM SCN 4Document16 pagesMM SCN 4swapnilkrNo ratings yet

- Sap TablesDocument7 pagesSap TablesrathirohitrNo ratings yet

- 2012 Downtown Traffic Flow MapDocument1 page2012 Downtown Traffic Flow MapjmarkusoffNo ratings yet

- S No Knowledge Area Process Process Grou Inputs Tools & Techniques OutputsDocument8 pagesS No Knowledge Area Process Process Grou Inputs Tools & Techniques Outputsdude1989No ratings yet

- Assignment Accounting FundamentalsDocument2 pagesAssignment Accounting FundamentalsRajshree DewooNo ratings yet

- Flexible J&T 2.0Document2 pagesFlexible J&T 2.0Francesco SpezialeNo ratings yet

- Erpscm MM Srvinterfaces 180915 0416 1150Document10 pagesErpscm MM Srvinterfaces 180915 0416 1150ronnzaaNo ratings yet

- BUS 1.3 - Financial Awareness - Level 4 AssignmentDocument9 pagesBUS 1.3 - Financial Awareness - Level 4 AssignmentDave PulpulaanNo ratings yet

- Nee Indri Naan IllaiDocument120 pagesNee Indri Naan IllaipramelaNo ratings yet

- Process Process Group Inputs Tools & Techniques Outputs: Sno Knowledge AreaDocument7 pagesProcess Process Group Inputs Tools & Techniques Outputs: Sno Knowledge AreaMohamed AfsalNo ratings yet

- RFSUMB00 Year End Closing in Italy 3Document36 pagesRFSUMB00 Year End Closing in Italy 3Jaswinder KaurNo ratings yet

- Assets Accounting PDFDocument8 pagesAssets Accounting PDFjagadish100No ratings yet

- The Power of Business Process Improvement: Capt. Dante P. Narciso, MBA MGT-304 ProfessorDocument18 pagesThe Power of Business Process Improvement: Capt. Dante P. Narciso, MBA MGT-304 ProfessorJonalyn May De VeraNo ratings yet

- Procurement of Consumable ItemsDocument16 pagesProcurement of Consumable ItemsnandhakumarmeNo ratings yet

- Account Assignment, Notice To DebtorDocument2 pagesAccount Assignment, Notice To DebtorBea MokNo ratings yet

- MM - 1.1 DumpDocument16 pagesMM - 1.1 Dumptrip100% (1)

- Sap MM TcodesDocument4 pagesSap MM TcodesAsif Ali HNo ratings yet

- FinalDocument8 pagesFinalapi-278450852No ratings yet

- MB21 TemplateDocument5 pagesMB21 TemplateHarsheshNo ratings yet

- Sop ErpDocument11 pagesSop ErpAmirul AkhmalNo ratings yet

- Common Tables of SAPDocument3 pagesCommon Tables of SAPshaanj99No ratings yet

- List of SAP T-CodesDocument6 pagesList of SAP T-CodesSKAMEERNo ratings yet

- A Work Out ProgramDocument4 pagesA Work Out ProgramNicholas ConnorsNo ratings yet

- The Balance SheetDocument14 pagesThe Balance SheetHeherson CustodioNo ratings yet

- Smart Goal Sheet: Goal Sheet, Individual Development Plan, Jaipuria Institute of Management, NoidaDocument2 pagesSmart Goal Sheet: Goal Sheet, Individual Development Plan, Jaipuria Institute of Management, Noidahimanshu shuklaNo ratings yet

- Special CyclesDocument20 pagesSpecial CyclesAnton RichardNo ratings yet

- TablesDocument15 pagesTablesSheila TolsonNo ratings yet

- Results-Based Management (RBM)Document170 pagesResults-Based Management (RBM)Juan AlayoNo ratings yet

- FDN Eng'g - Chapter 4Document50 pagesFDN Eng'g - Chapter 4Nikko LaurasNo ratings yet

- Ways To Make A Loop in A Rope: Bowline Yosemite Bowline Figure Eight Slippery Eight LoopDocument3 pagesWays To Make A Loop in A Rope: Bowline Yosemite Bowline Figure Eight Slippery Eight LoopSusavan MandalNo ratings yet

- Business Requirements Document Template RFP360Document2 pagesBusiness Requirements Document Template RFP360Kapunza MbevyaNo ratings yet

- Iso 14001 General Information and Action DirectivesDocument47 pagesIso 14001 General Information and Action DirectivesJohan KaufmannNo ratings yet

- SAP ConfigrationDocument3 pagesSAP ConfigrationNaveed ArshadNo ratings yet

- Creating A Controlling ScenarioDocument4 pagesCreating A Controlling ScenarioRamanareddy AnathapurNo ratings yet

- Examq AngshuDocument17 pagesExamq Angshuelango_babuNo ratings yet

- Introduction To Project Management (Lectures For Distribution To Students) Definition of A ProjectDocument14 pagesIntroduction To Project Management (Lectures For Distribution To Students) Definition of A ProjectMary Grace Manimtim100% (1)

- SAP R3 SD Senior and Certified SAP CRM ConsultantDocument714 pagesSAP R3 SD Senior and Certified SAP CRM ConsultantJana MeinertNo ratings yet

- Not Able To Define G.L Account in FTXP For New ... - SCNDocument3 pagesNot Able To Define G.L Account in FTXP For New ... - SCNSidharth Kumar100% (1)

- FMA Financial Accounting Assignments SolutionsDocument58 pagesFMA Financial Accounting Assignments SolutionskrishanptfmsNo ratings yet

- Ledger Posting and Trial Balance: Date Particulars JF Amount Date Particulars JF AmountDocument4 pagesLedger Posting and Trial Balance: Date Particulars JF Amount Date Particulars JF AmountChristina FingtonNo ratings yet

- Abdullah JuttDocument31 pagesAbdullah Juttabdullah0336.juttNo ratings yet

- The Schram Academy: Accounts ProjectDocument17 pagesThe Schram Academy: Accounts ProjectVarshini KNo ratings yet

- 104c Unit 1 SolutionDocument23 pages104c Unit 1 SolutionDevil 5103No ratings yet

- Basic Account 1Document10 pagesBasic Account 1COMPUTER WORLDNo ratings yet

- 5 0Document14 pages5 0Shashwat sai VyasNo ratings yet

- Sums of Journal EntryDocument8 pagesSums of Journal Entryiiidddkkk 230No ratings yet

- 1Document5 pages1Steve JacobNo ratings yet

- JournalDocument4 pagesJournalHARIKIRAN PRNo ratings yet

- 30 Transactions With Their Journal EntriesDocument9 pages30 Transactions With Their Journal EntriesPrashant BhardwajNo ratings yet

- CNG Fabrication Certificate16217Document1 pageCNG Fabrication Certificate16217pune2019officeNo ratings yet

- Gmo EssayDocument4 pagesGmo Essayapi-270707439No ratings yet

- Lemon AidDocument17 pagesLemon AidJade Anne Mercado BalmesNo ratings yet

- Digital Documentation Class 10 NotesDocument8 pagesDigital Documentation Class 10 NotesRuby Khatoon86% (7)

- 133 The Science and Understanding of TheDocument14 pages133 The Science and Understanding of TheCarlos RieraNo ratings yet

- Liga NG Mga Barangay: Resolution No. 30Document2 pagesLiga NG Mga Barangay: Resolution No. 30Rey PerezNo ratings yet

- Durga Padma Sai SatishDocument1 pageDurga Padma Sai SatishBhaskar Siva KumarNo ratings yet

- C Sharp Logical TestDocument6 pagesC Sharp Logical TestBogor0251No ratings yet

- Guidelines Use of The Word AnzacDocument28 pagesGuidelines Use of The Word AnzacMichael SmithNo ratings yet

- PHP IntroductionDocument113 pagesPHP Introductionds0909@gmailNo ratings yet

- August 2015Document96 pagesAugust 2015Cleaner MagazineNo ratings yet

- Introduction Into Post Go-Live SizingsDocument26 pagesIntroduction Into Post Go-Live SizingsCiao BentosoNo ratings yet

- United States v. Manuel Sosa, 959 F.2d 232, 4th Cir. (1992)Document2 pagesUnited States v. Manuel Sosa, 959 F.2d 232, 4th Cir. (1992)Scribd Government DocsNo ratings yet

- INTERNSHIP PRESENTATION - Dhanya - 2020Document16 pagesINTERNSHIP PRESENTATION - Dhanya - 2020Sanitha MichailNo ratings yet

- Unit 13 - Business Hotels and Sales ConferencesDocument24 pagesUnit 13 - Business Hotels and Sales ConferencesMiguel Angel Escoto CanoNo ratings yet

- La Salle Lipa Integrated School Senior High School Community 1 Quarter Summative Assessment Earth Science AY 2021-2022 Household Conservation PlanDocument4 pagesLa Salle Lipa Integrated School Senior High School Community 1 Quarter Summative Assessment Earth Science AY 2021-2022 Household Conservation PlanKarlle ObviarNo ratings yet

- The Concept of ElasticityDocument19 pagesThe Concept of ElasticityVienRiveraNo ratings yet

- Sales Manager Latin AmericaDocument3 pagesSales Manager Latin Americaapi-76934736No ratings yet

- Milestone 9 For WebsiteDocument17 pagesMilestone 9 For Websiteapi-238992918No ratings yet

- Methods of Teaching Syllabus - FinalDocument6 pagesMethods of Teaching Syllabus - FinalVanessa L. VinluanNo ratings yet

- Indictment - 17-Cr-00601-EnV Doc 1 Indictment 11-1-17Document6 pagesIndictment - 17-Cr-00601-EnV Doc 1 Indictment 11-1-17C BealeNo ratings yet

- Steam Source Book PDFDocument108 pagesSteam Source Book PDFJose Levican A100% (1)

- Study of Risk Perception and Potfolio Management of Equity InvestorsDocument58 pagesStudy of Risk Perception and Potfolio Management of Equity InvestorsAqshay Bachhav100% (1)

- Service Manual: Model: R410, RB410, RV410, RD410 SeriesDocument116 pagesService Manual: Model: R410, RB410, RV410, RD410 SeriesJorge Eustaquio da SilvaNo ratings yet

- Microeconomics: Production, Cost Minimisation, Profit MaximisationDocument19 pagesMicroeconomics: Production, Cost Minimisation, Profit Maximisationhishamsauk50% (2)

- Paul Milgran - A Taxonomy of Mixed Reality Visual DisplaysDocument11 pagesPaul Milgran - A Taxonomy of Mixed Reality Visual DisplaysPresencaVirtual100% (1)

- SC-Rape-Sole Testimony of Prosecutrix If Reliable, Is Sufficient For Conviction. 12.08.2021Document5 pagesSC-Rape-Sole Testimony of Prosecutrix If Reliable, Is Sufficient For Conviction. 12.08.2021Sanjeev kumarNo ratings yet

- BACE Marketing Presentation FINALDocument14 pagesBACE Marketing Presentation FINALcarlosfelix810% (1)

- Fracture and FatigueDocument15 pagesFracture and FatigueZou JiaweiNo ratings yet