Professional Documents

Culture Documents

FAQ On Ombudsman Scheme

Uploaded by

ashish gill0 ratings0% found this document useful (0 votes)

51 views5 pagesOmbudsman

Original Title

FAQ on Ombudsman Scheme

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentOmbudsman

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

51 views5 pagesFAQ On Ombudsman Scheme

Uploaded by

ashish gillOmbudsman

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

FAQ on Ombudsman Scheme

Scheme of Insurance Ombudsman.

With an objective to provide a forum for resolving disputes and complaints from the aggrieved

insured public or their legal heirs against Insurance Companies, the Government of India, in

exercise of powers conferred on it u/s 114(1) of Insurance Act, 1938 framed "Redressal of Public

Grievances Rules, 1998", which came into force w.e.f. 11th November, 1998. These Rules aim at

resolving complaints relating to the settlement of disputes with Insurance Companies on

personal lines of insurance, in a cost effective, efficient and impartial manner. These Rules apply

to all the Insurance Companies operating in General Insurance business and Life Insurance

business, in Public and Private Sectors.

To implement the above Rules, the Institution of Insurance Ombudsman has been established

and is functioning since 1999. The Ombudsman functions within a set geographical jurisdiction

and can entertain disputes relating to partial/total repudiation of claims, delay in settlement of

claims, any dispute on the legal construction of the policies in so far as such disputes relate to

claims, disputes regarding premium paid or payable in terms of the policy and non-issuance of

insurance documents.

The Insurance Ombudsman is provided with a Secretarial Staff by the Governing Body of

Insurance Council and such staff is drawn from Insurance Companies. The total expenses on

running the Institution are shared by all Insurance Companies, who are Members of the

Insurance Council.

FREQUENTLY ASKED QUESTIONS (FAQs):

1) With whom is a complaint to be lodged?

Complaint is to be lodged with the Insurance Ombudsman under whose territorial jurisdiction

the insurers office falls, at the address given in CONTACT US.

2) Does Insurance Ombudsman operate in any territorial jurisdiction?

Yes, Insurance Ombudsman operates only within the territorial limits specified in CONTACT

US.

3) How is this territorial jurisdiction to be applied to complaints?

The complaint will lie with the Insurance Ombudsman under whose territorial jurisdiction the

Branch or Office of the Insurer complained against is located. However, in case of Group

Insurance policies, the complaint may be lodged with the Insurance Ombudsman under whose

territorial jurisdiction the place of residence of the complainant falls.

4) Who can approach Ombudsman?

Any aggrieved individual who has taken an Insurance Policy on personal lines (or if deceased,

the legal heir(s) under such policy) can approach Ombudsman.

5) What is the meaning of Insurance on Personal Lines?

Insurance on personal lines means a policy taken or given in an individual capacity, e.g. life

insurance, personal accident insurance, mediclaim insurance, insurance of personal property of

the individual such as motor vehicle, household articles, etc.

6) What are the complaints that are entertained by the Ombudsman?

Complaints pertaining to repudiation of claims totally or partially, delay in settlement of claims,

any dispute on the legal construction of the policies in so far as such disputes relate to claims,

disputes regarding premiums paid / payable and non-issue of insurance documents.

7) How is the complaint to be lodged?

The complaint is to be made in writing and may be lodged through personal approach or

through post / fax / email (followed by hard copy).

8) Is there any time limit to approach the Ombudsman?

Yes. Within one year of the rejection by the insurer of the representation of the complainant or

the Insurer's final reply to the representation.

9) Is there any maximum limit for the amount under dispute that can be entertained by the

Ombudsman?

Yes. The maximum limit for the amount under dispute for which the Ombudsman can entertain

a complaint is up to Rs.20 lakhs.

10) Can a complainant, who has already approached Consumer Forum/court on the same

subject, approach the Ombudsman?

No. Any complainant, whose complaint on the same subject matter is or was before a

Court/Consumer Forum cannot approach Ombudsman.

11) What are the pre-requisite conditions in short, for lodging a complaint?

a.The complaint must be by an individual on a Personal Lines insurance and within the terms

of reference of the Insurance Ombudsman as set out under FAQ 6.

b.A representation should be made to the Insurance Company and either an unsatisfactory

reply should have been received or the representation should stand as un-replied for at least 1

month.

c.The complaint must be lodged within 1 year of the events mentioned in b. above

d.The total relief sought must be within an amount of Rs.20 lakhs.

e.The subject matter of the complaint should not currently be or have earlier been before a

Court/Consumer Forum.

12) Should a complainant approach the Ombudsman through a lawyer?

Not necessary, as formal court procedures are not involved.

13) Within what time shall the Ombudsman dispose of the complaint?

In case both parties agree for mediation, the Ombudsman shall give his Recommendation

within 1 month; otherwise, he shall pass his Award within 3 months.

14) Can the Ombudsman award ex-gratia payment?

Yes. If the Ombudsman deems it fit in the circumstances of the case, he may award ex-gratia

payment.

15) Are there any fees / charges payable for lodging a complaint?

No fees / charges are required to be paid.

16) Does the Ombudsman conduct hearings of the parties?

Yes, wherever considered necessary, the Ombudsman will conduct hearing of both the Parties.

17) If so, can the hearings be conducted outside headquarters?

Yes, hearings may be conducted outside headquarters, where warranted.

18) Can a complaint be lodged against a Private Insurer?

Yes, complaints can be lodged against any Insurer both in Public Sector and Private Sector in

both Life and Non-Life sectors.

19) Can a Sole-Proprietor of a business approach the Ombudsman for a complaint arising out

of business interests?

No, it was clarified in 2006 that since in such cases the subject matter of insurance is of

commercial interest, the insurance policy thereon cannot be deemed to fall under the definition

of personal lines insurance.

20) Can Partnership Firms/Corporate Clients/Co-operative Societies/ Associations/Trusts

approach Ombudsman?

No, only individual policyholders who have taken insurance on personal lines are eligible.

However, a member covered under a Master Policy or a Group Insurance (or if deceased, the

legal heir) can approach the Ombudsman, provided the payment of the claim under such policy

is to be made to the individual, as beneficiary.

21) Is there any appeal against a decision given by the Ombudsman?

No, as the Recommendation or Award of the Insurance Ombudsman are both subject to

acceptance by the complainant in full and final settlement of the complaint. If such acceptance is

not agreeable, the complainant may exercise the right to take recourse to the normal process of

law against the insurance company. Further, dismissal of a complaint by the Insurance

Ombudsman does not vitiate the complainants right to seek legal remedy against the insurers

complained against, as per normal process of law.

22) Are routine administrative issues concerning agents (like non-issue of licence, non-

receipt of commission etc.) or employees grievances or policy servicing matters (like transfer

of policies etc.) and complaints against staff of the member companies also entertained by

the Ombudsman?

No, such matters do not fall within the terms of reference of the Ombudsman and hence are not

to be referred.

23) Are copies of complaints or queries and correspondence related thereto required to be

forwarded to the Office of the Governing Body of Insurance Council?

No, the Ombudsman deals directly with complaint matters.

24) Can information be sought under the Right to Information Act?

Yes, where required, information can be sought from the Public Information Officer of the

concerned Ombudsman Centre in the prescribed format, forwarded together with the requisite

prescribed fee. The Appellate Authority vests with a higher ranking official from the concerned

Ombudsman Centre.

In the case of Governing Body of Insurance Council, information can be sought from the Public

Information Officer of the Office of the Governing Body of Insurance Council in the prescribed

format, forwarded together with the requisite prescribed fee. The Appellate Authority vests

with the Dy. Secretary-in-charge or Dy. Secretary-General or Secretary-General (as the case may

be) of the Governing Body of Insurance Council.

You might also like

- Colgate's Full Year Net Sales Up 15%, Net Profit Up 9% Colgate's 4Q Net Sales Up 13%, Net Profit Up 7%Document2 pagesColgate's Full Year Net Sales Up 15%, Net Profit Up 9% Colgate's 4Q Net Sales Up 13%, Net Profit Up 7%ashish gillNo ratings yet

- Job Description 08072013 11Document1 pageJob Description 08072013 11ashish gillNo ratings yet

- List of Case LawsDocument1 pageList of Case Lawsashish gillNo ratings yet

- Understanding Principles of InsuranceDocument6 pagesUnderstanding Principles of Insuranceantranhoaih2No ratings yet

- Companies Act 2013 Notes by AhmDocument71 pagesCompanies Act 2013 Notes by AhmaashishhpatilNo ratings yet

- Employment Contract FormatDocument5 pagesEmployment Contract FormatAnkit TiwariNo ratings yet

- A Brief Note On Ninth ExceptionDocument2 pagesA Brief Note On Ninth Exceptionashish gillNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Synopsis/ Key Facts:: TAAR V. LAWAN (G.R. No. 190922. October 11, 2017)Document16 pagesSynopsis/ Key Facts:: TAAR V. LAWAN (G.R. No. 190922. October 11, 2017)Ahmed GakuseiNo ratings yet

- Foreign Affairs March April 2021 Issue NowDocument236 pagesForeign Affairs March April 2021 Issue NowShoaib Ahmed0% (1)

- Indian National Movement and the Rise of Nonviolent ResistanceDocument4 pagesIndian National Movement and the Rise of Nonviolent ResistanceMohammad Hammad RashidNo ratings yet

- Chapter Four Higher Education and Life AbroadDocument28 pagesChapter Four Higher Education and Life AbroadLeonesa Ananias LausNo ratings yet

- Blue Star Limited: Accounting Policies Followed by The CompanyDocument8 pagesBlue Star Limited: Accounting Policies Followed by The CompanyRitika SorengNo ratings yet

- TOA Reviewer (2T AY1516) PDFDocument25 pagesTOA Reviewer (2T AY1516) PDFabbyNo ratings yet

- MFIN Case Write-UpDocument7 pagesMFIN Case Write-UpUMMUSNUR OZCANNo ratings yet

- Gordon Blair Cafe Trail Balance and Financial StatementsDocument2 pagesGordon Blair Cafe Trail Balance and Financial StatementsSam SamNo ratings yet

- 125 and DV Simultaneously.Document2 pages125 and DV Simultaneously.Tushar GundNo ratings yet

- Payment Transaction Report: Stanbic Bank Zimbabwe Limited, Company Registration No. 3387/89Document2 pagesPayment Transaction Report: Stanbic Bank Zimbabwe Limited, Company Registration No. 3387/89Tadiwanashe ChikoworeNo ratings yet

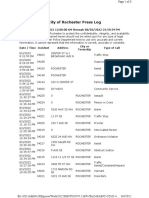

- RPD Daily Incident Report 8/3/22Document8 pagesRPD Daily Incident Report 8/3/22inforumdocsNo ratings yet

- Apostolic Fathers & Spiritual BastardsDocument78 pagesApostolic Fathers & Spiritual Bastardsanon_472617452100% (2)

- Order 3520227869817Document3 pagesOrder 3520227869817Malik Imran Khaliq AwanNo ratings yet

- ICICI Bank StatementDocument15 pagesICICI Bank StatementManish Menghani0% (1)

- MMT Bus E-Ticket - NU25147918137876 - Pune-HyderabadDocument1 pageMMT Bus E-Ticket - NU25147918137876 - Pune-HyderabadRajesh pvkNo ratings yet

- Entry of AppearanceDocument3 pagesEntry of AppearanceConrad Briones100% (1)

- Stark County Area Transportation Study 2022 Crash ReportDocument148 pagesStark County Area Transportation Study 2022 Crash ReportRick ArmonNo ratings yet

- Soler v. Combank oral contract perfectionDocument1 pageSoler v. Combank oral contract perfectionSarah Jane UsopNo ratings yet

- ECG-CE Comen PDFDocument3 pagesECG-CE Comen PDFTehoptimed SA0% (1)

- Raymond ReddingtonDocument3 pagesRaymond Reddingtonapi-480760579No ratings yet

- Step by Step Sap SD Configuration DocumentDocument109 pagesStep by Step Sap SD Configuration DocumentS JgNo ratings yet

- Labour Case For JGLSDocument4 pagesLabour Case For JGLSJGLS studentNo ratings yet

- Gned 09 Module 09Document6 pagesGned 09 Module 09Maria Angela CapuzNo ratings yet

- TPDDL Case StudyDocument92 pagesTPDDL Case StudySachin BhardwajNo ratings yet

- Invoice PDFDocument1 pageInvoice PDFLovely ZaidiNo ratings yet

- CopyofbillcreatorDocument2 pagesCopyofbillcreatorapi-336685023No ratings yet

- Cher Calls For Laws To Control Men's Bodies - Must Be Circumcised, & Show Papers or Penis'Document39 pagesCher Calls For Laws To Control Men's Bodies - Must Be Circumcised, & Show Papers or Penis'k_m_4000No ratings yet

- Rise of Modern-West 2 Assignment: Enlightened Despotism or Enlightened Absolutism, Are Terms Use ToDocument8 pagesRise of Modern-West 2 Assignment: Enlightened Despotism or Enlightened Absolutism, Are Terms Use ToRitikNo ratings yet

- TOT Power Control v. AppleDocument28 pagesTOT Power Control v. AppleMikey CampbellNo ratings yet

- NAstran Simple Problems Getting StartedDocument62 pagesNAstran Simple Problems Getting StartedAvinash KshirsagarNo ratings yet