Professional Documents

Culture Documents

CB

Uploaded by

Shweta SawantCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CB

Uploaded by

Shweta SawantCopyright:

Available Formats

INDEX:

SR.NO TOPIC

1 INTRODUCTION

2 HISTORY

3 PROPECTS

4 PURPOSE

5 OBJECTIVES

6 FUNCTIONS

7 RECENT EVOLUTION OF BUSINESS

8 INVESTMENT BANKERS

9 BARCLAYS INVESTMENT BANKING

10 CORPORTAE INVESTMENT BNAKING

11 TD SECURITIES IN INVESTMENT BANKING

12 CASE STUDY

13 RESEARCH ARES

14 CONCLUSION

15 BIBLIOGRAPHY

INTRODUCTION:

An investment bank is nothing like the corner institution you're used to dealing with to get a

business loan or deposit your paycheck. Instead, an investment bank is a special type of financial

institution that works primarily in higher finance by helping company access the capital markets

(stock market and bond market, for instance) to raise money for expansion or other needs. If

Coca-Cola Enterprises wanted to sell $10 billion worth of bonds to build new bottling plants in

Asia, an investment bank would help them find buyers for the bonds and handle the paperwork,

along with a team of lawyers and accountants.

Activities of a Typical Investment Bank:

A typical investment bank will engage in some or all of the following activities:

Raise equity capital (e.g., helping launch an IPO or creating a special class of preferred

stock that can be placed with sophisticated investors such as insurance companies or

banks)

Raise debt capital (e.g., issuing bonds to help raise money for a factory expansion)

Insure bonds or launching new products (e.g., such as credit default swaps)

Engage in proprietary trading where teams of in-house money managers invests or trades

the company's own money for its private account (e.g., the investment bank believes gold

will rise so they speculate in gold futures, acquire call options on gold mining firms, or

purchase gold bullion outright for storage in secure vaults).

Investment banks are often divided into two camps: the buy side and the sell side. Many

investment banks offer both buy side and sell side services. The sell side typically refers

to selling shares of newly issued IPOs, placing new bond issues, engaging in market

making services, or helping clients facilitate transactions. The buy side, in contrast,

worked with pension funds, mutual funds, hedge funds, and the investing public to help

them maximize their returns when trading or investing in securities such as stocks and

bonds.

Up until ten years ago, investment banks in the United States were not allowed to be part of a

larger commercial bank because the activities, although extremely profitable if managed well,

posed far more risk than the traditional lending of money done by commercial banks. This was

not the case in the rest of the world. Countries such as Switzerland, in fact, often boasted asset

management accounts that allowed investors to manage their entire financial life from a single

account that combined banking, brokerage, cash management, and credit needs.

Most of the problems are about as part of the credit crisis and massive bank failures were caused

by the internal investment banks speculating heavily with leverage on collateralized debt

obligations (CDOs). These losses had to be covered by the parent bank holding companies,

causing huge write-downs and the need for dilutive equity issuances, in some cases nearly

wiping out regular stockholders. A perfect example is the venerable Union Bank of Switzerland,

or UBS, which reported losses in excess of 21 billion CHF (Swiss Francs), most of which

originated in the investment bank. The legendary institution was forced to issue shares as well as

mandatory convertible securities, diluting the existing stockholders, to replace the more than

60% of shareholder equity that was obliterated during the meltdown.

RISK MANAGEMENT:

Risk management involves analyzing the market and credit risk that an investment bank or its

clients take onto their balance sheet during transactions or trades. Credit risk focuses around

capital markets activities, such as loan syndication, bond issuance, restructuring, and leveraged

finance. Market risk conducts review of sales and trading activities utilizing the VaR model and

provides hedge-fund solutions to portfolio managers. Other risk groups include country risk,

operational risk, and counterparty risks which may or may not exist on a bank to bank basis.

Credit risk solutions are key part of capital market transactions, involving debt structuring, exit

financing, loan amendment, project finance, leveraged buy-outs, and sometimes portfolio

hedging. Front office market risk activities provide service to investors via derivative solutions,

portfolio management, portfolio consulting, and risk advisory.

Many investment banks are divided into three categories that deal with front office, back

office, or middle office services.

Front Office Investment Bank Services: Front office services typically consist of

investment banking such as helping companies in mergers and acquisitions, corporate

finance (such as issuing billions of dollars in commercial paper to help fund day-to-day

operations, professional investment management for institutions or high net worth

individuals, merchant banking (which is just a fancy word for private equity where the

bank puts money into companies that are not publicly traded in exchange for ownership),

investment and capital market research reports prepared by professional analysts either

for in-house use or for use for a group of highly selective clients, and strategy

formulation including parameters such as asset allocation and risk limits.

Middle Office Investment Bank Services: Middle office investment banking services

include compliance with government regulations and restrictions for professional clients

such as banks, insurance companies, finance divisions, etc. This is sometimes considered

a back office function. It also includes capital flows. These are the people that watch

money coming into and out of the firm to determine the amount of liquidity the company

needs to keep on hand so that it doesn't get into financial trouble. The team in charge of

capital flows can use that information to restrict trades by reducing the buying / trading

power available for other divisions.

Back Office Investment Bank Services: The back office services include the nuts and

bolts of the investment bank. It handles things such as trade confirmations, ensuring that

the correct securities are bought, sold, and settled for the correct amounts, the software

and technology platforms that allow traders to do their job are state-of-the-art and

functional, the creation of new trading algorithms, and more. The back office jobs are

often considered unglamorous and some investment banks outsource to specialty shops

such as custodial companies. Nevertheless, they allow the whole thing to run. Without

them, nothing else would be possible.

HISTORY:

Philadelphia financier Jay Cooke established the first modern American investment bank

during the Civil War era. However, private banks had been providing investment banking

functions since the beginning of the 19th century and many of these evolved into investment

banks in the post-bellum era. However, the evolution of firms into investment banks did not

follow a single trajectory. For example, some currency brokers such as Prime, Ward and

King and John E. Thayer and Brother moved from foreign exchange operations to become

private banks, taking on some investment bank functions. Other investment banks evolved

from mercantile firms such as Thomas Biddle and Co. and Alexander Brothers.

Late 19th century:

From the Panic of 1873 until the 1900s (decade), the private investment banking industry was

dominated by two distinct groups: the German-Jewish immigrant bankers and the so-called

"Yankee houses". Despite this ostensible ethnic difference, the two groups shared a similar

economic structure. With one exception, the Yankee houses had ties with expatriate Americans

who had become merchant bankers in London. Similarly, almost all of the German-Jewish

houses had ties with German-Jewish merchant bankers in London. The one exception was Kuhn,

Loeb which was tied to European sources of capital through the German investment banking

community. Several major banks were started following the mid-19th century by Jews, including

Goldman Sachs (founded by Samuel Sachs and Marcus Goldman), Kuhn Loeb (Solomon Loeb

and Jacob H. Schiff), Lehman Brothers (Henry Lehman), Salomon Brothers, and Bache &

Co.(founded by Jules Bache).

We aspire to be the leading trusted advisor and financier to our clients, which include

corporations, financial institutions, financial sponsors, governments and public authorities and

boards of directors and special committees.

Jewish investment banks:

Jewish banking houses were instrumental to the process of capital formation in the United States

in the late 19th and early 20th century

.

Modern banking in Europe and the United States was

influenced by Jewish financiers, such as the Rothschild family and Warburg family, and Jews

were major contributors to the establishment of important investment banks on Wall Street.

In the middle of the 19th century, a number of German Jews founded investment banking firms

which later became mainstays of the industry. Most prominent Jewish banks in the United States

were investment banks, rather than commercial banks. Onathan Knee postulates that Jews were

forced to focus on the development of investment banks because they were excluded from the

commercial banking sector

.

In many cases, the efforts of Jewish immigrants to start banks were

enabled due to the substantial support of their Jewish banking connections in Europe.

In the late 1860s, The Seligman family transitioned from merchandising to banking, setting up

operations in New York, St. Louis, and Philadelphia as well as Frankfurt, Germany, London and

Paris that gave European investors an opportunity to buy American government and railroad

bonds. In the 1880s the firm provided financing for French efforts to build a canal in Panama as

well as the subsequent American endeavor. In the 1890s J.& W. Seligman & Co. Inc. underwrote

the securities of newly formed trusts, participated in stock and bond issues in the railroad and

steel and wire industries, and invested in Russia and Peru, and in American in shipbuilding,

bridges, bicycles, mining, and other enterprises. In 1910 William C. Durant of the fledgling

General Motors Corporation gave control of his company to the Seligmans and Lee, Higginson

& Co. in return for underwriting $15 million worth of corporate notes. Lehman Brothers entered

investment banking in the 1880s, becoming a member of the Coffee Exchange as early as 1883

and finally the New York Stock Exchange in 1887

.

Early 20th century:

During the period from 18901925, the investment banking industry was highly concentrated

and dominated by an oligopoly that consisted of JP Morgan & Co.; Kuhn, Loeb & Co.; Brown

Brothers; and Kidder, Peabody & Co. There was no legal requirement to separate the operations

of commercial and investment banks; as a result deposits from the commercial banking side of

the business constituted an in-house supply of capital that could be used to fund the underwriting

business of the investment banking side.

The Panic of 1907 and the Pujo Committee:

In 1913, the Pujo Committee unanimously determined that a small cabal of financiers had gained

consolidated control of numerous industries through the abuse of the public trust in the United

States. The chair of the House Committee on Banking and Currency, Representative Arsenal

Pujo, (DLa. 7th) convened a special committee to investigate a "money trust", the de facto

monopoly of Morgan and New York's other most powerful bankers. The committee issued a

scathing report on the banking trade, and found that the officers of J.P. Morgan & Co. also sat on

the boards of directors of 112 corporations with a market capitalization of $22.5 billion (the total

capitalization of the New York Stock Exchange was then estimated at $26.5 billion).

Attorney Samuel Untermeyer who headed the 1913 Pujo Money Trust Investigation Committee

to investigate money trusts defined a money trust to George Baker during the Pujo hearings; "We

define a money trust as an established identity and community of interest between a few leaders

of finance, which has been created and is held together through stock-holding, interlocking

directorates, and other forms of domination over banks, trust companies, railroads, public service

and industrial corporations, and which has resulted in vast and growing concentration and

control.

PROSPECTS:

An investment bank is a financial institution that assists individuals, corporations, and

governments in raising capital by underwriting and/or acting as the client's agent in the issuance

of securities. An investment bank may also assist companies involved in mergers and

acquisitions and provide ancillary services such as market making, trading of derivatives and

equity securities, and FICC services (fixed income instruments, currencies, and commodities).

Unlike commercial banks and retail banks, investment banks do not take deposits. From 1933

(GlassSteagall Act) until 1999 (GrammLeachBliley Act), the United States maintained a

separation between investment banking and commercial banks. Other industrialized countries,

including G8 countries, have historically not maintained such a separation. As part of the Dodd-

Frank Act 2010, Volcker Rule asserts full institutional separation of investment banking services

from commercial banking.

There are two main lines of business in investment banking. Trading securities for cash or for

other securities (i.e. facilitating transactions, market-making), or the promotion of securities (i.e.

underwriting, research, etc.) is the "sell side", while buy side is a term used to refer to advising

institutions concerned with buying investment services. Private equity funds, mutual funds, life

insurance companies, unit trusts, and hedge funds are the most common types of buy side

entities.

An investment bank can also be split into private and public functions with an information

barrier which separates the two to prevent information from crossing. The private areas of the

bank deal with private insider information that may not be publicly disclosed, while the public

areas such as stock analysis deal with public information.

Organizational structure:

Investment banking is split into front office, middle office, and back office activities. While large

service investment banks offer all lines of business, both sell side and buy side, smaller sell-side

investment firms such as boutique investment banks and small broker-dealers focus on

investment banking and sales/trading/research, respectively.

Investment banks offer services to both corporations issuing securities and investors buying

securities. For corporations, investment bankers offer information on when and how to place

their securities on the open market, an activity very important to an investment bank's reputation.

Therefore, investment bankers play a very important role in issuing new security offerings.

Core investment banking activities:

Investment banking has changed over the years, beginning as a partnership form focused on

underwriting security issuance (initial public offerings and secondary offerings), brokerage, and

mergers and acquisitions and evolving into a "full-service" range including sell-side research,

proprietary trading, and investment management. In the modern 21st century, the SEC filings of

the major independent investment banks such as Goldman Sachs and Morgan Stanley reflect

three product segments: (1) investment banking (fees for M&A advisory services and securities

underwriting); (2) asset management (fees for sponsored investment funds), and (3) trading and

principal investments (broker-dealer activities including proprietary trading ("dealer"

transactions) and brokerage trading ("broker" transactions).

There are various trade associations throughout the world which represent the industry in

lobbying, facilitate industry standards, and publish statistics. The International Council of

Securities Associations (ICSA) is a global group of trade associations.

In the United States, the Securities Industry and Financial Markets Association (SIFMA) is likely

the most significant; however, several of the large investment banks are members of the

American Bankers Association Securities Association (ABASA) while small investment banks

are members of the National Investment Banking Association (NIBA).

Sales and trading:

On behalf of the bank and its clients, a large investment bank's primary function is buying and

selling products. In market making, traders will buy and sell financial products with the goal of

making money on each trade. Sales is the term for the investment bank's sales force, whose

primary job is to call on institutional and high-net-worth investors to suggest trading ideas (on a

caveat emptor basis) and take orders. Sales desks then communicate their clients' orders to the

appropriate trading desks, which can price and execute trades, or structure new products that fit a

specific need. Structuring has been a relatively recent activity as derivatives have come into play,

with highly technical and numerate employees working on creating complex structured products

which typically offer much greater margins and returns than underlying cash securities. In 2010,

investment banks came under pressure as a result of selling complex derivatives contracts to

local municipalities in Europe and the US. Strategists advise external as well as internal clients

on the strategies that can be adopted in various markets. Ranging from derivatives to specific

industries, strategists place companies and industries in a quantitative framework with full

consideration of the macroeconomic scene. This strategy often affects the way the firm will

operate in the market, the direction it would like to take in terms of its proprietary and flow

positions, the suggestions salespersons give to clients, as well as the way structures create new

products. Banks also undertake risk through proprietary trading, performed by a special set of

traders who do not interface with clients and through "principal risk"risk undertaken by a

trader after he buys or sells a product to a client and does not hedge his total exposure. Banks

seek to maximize profitability for a given amount of risk on their balance sheet.

In Europe, the European Forum of Securities Associations was formed in 2007 by various

European trade associations. Several European trade associations (principally the London

Investment Banking Association and the European SIFMA affiliate) combined in 2009 to form

Association for Financial Markets in Europe (AFME).

In the securities industry in China (particularly mainland China), the Securities Association of

China is a self-regulatory organization whose members are largely investment bank.

Research:

The equity research division reviews companies and writes reports about their prospects, often

with "buy" or "sell" ratings. Investment banks typically have sell-side analysts which cover

various industries. Their sponsored funds or proprietary trading offices will also have buy-side

research. While the research division may or may not generate revenue (based on policies at

different banks), its resources are used to assist traders in trading, the sales force in suggesting

ideas to customers, and investment bankers by covering their clients. Research also serves

outside clients with investment advice (such as institutional investors and high net worth

individuals) in the hopes that these clients will execute suggested trade ideas through the sales

and trading division of the bank, and thereby generate revenue for the firm. Research also covers

credit research; fixed income research, macroeconomic research, and quantitative analysis, all of

which are used internally and externally to advice clients but do not directly affect revenue. All

research groups, nonetheless, provide a key service in terms of advisory and strategy. There is a

potential conflict of interest between the investment bank and its analysis, in that published

analysis can affect the bank's profits. Hence in recent years the relationship between investment

banking and research has become highly regulated, requiring a Chinese wall between public and

private functions.

Global investment banking revenue increased for the fifth year running in 2007, to a record

US$84.3 billion, which was up 22% on the previous year and more than double the level in 2003.

Subsequent to their exposure to United States sub-prime securities investments, many investment

banks have experienced losses. As of late 2012, global revenues for investment banks were

estimated at $240 billion, down about a third from 2009, as companies pursued less deals and

traded less. Differences in total revenue are likely due to different ways of classifying investment

banking revenue, such as subtracting proprietary trading revenue.

In terms of total revenue, SEC filings of the major independent investment banks in the United

States show that investment banking (defined as M&A advisory services and security

underwriting) only made up about 15-20% of total revenue for these banks from 1996 to 2006,

with the majority of revenue (60+% in some years) brought in by "trading".

PURPOSE:

Nearly everyone is familiar with commercial banks such as Wells Fargo and Bank of

America. These banks exist to provide saving and lending services to private citizens;

including but not limited to mortgage and auto loans, checking and savings services and

retirement accounts. Its likely that most of you deal with at least one commercial bank. An

investment bank on the other hand exists to provide services to private and public

companies. This includes raising capital through the issuance and sale of both securities and

bonds, assisting in mergers and acquisitions and providing guidance and advisory services

for other corporate financial transactions.

In the beginning the purpose of an investment bank was to help companies raise capital

through equity offerings and debt issuance and to advise and assist with mergers and

acquisitions. Since then the role of the investment bank has evolved and expanded

dramatically. These days investment banks are involved with their original purposes, but

they are also performing much more diversified activities. These banks now offer brokerage

services to both corporate and individual investors, they underwrite and sell new equity

issues, they provide financial and security advice to corporate clients and they provide

financial research to all types of clients. In addition, they have become involved in creating

many of the leveraged instruments that have caused so much financial trauma, they deal with

foreign exchange (another leveraged area) and they provide private banking for high net

worth individuals.

An investment bank often has a broad network of contacts within the financial industry. This

network extends globally and includes insurance, foreign exchange, legal and corporate

contacts. A good investment bank will be able to use this network to provide detailed market

knowledge and guidance, legal advice and investment opportunities on a global, countrywide

or regional level. For this reason investment banks are highly regarded for helping to create a

competitive advantage to the clients they advise.

OBJECTIVE:

The financial goal or goals of an investor. An investor may wish to maximize current income,

maximize capital gains, or set a middle course of current income with some appreciation of

capital. Defining investment objectives helps to determine the investments an individual should

select.

Investment banks help companies and governments and their agencies to raise money

by issuing and selling securities in the primary market. They assist public and private

corporations in raising funds in the capital markets (both equity and debt),

Investment banks also act as intermediaries in trading for clients. Investment banks

differ from commercial banks, which take deposits and make commercial and retail

loans.

In recent years, however, the lines between the two types of structures have blurred,

especially as commercial banks have offered more investment banking services.

Investment banks may also differ from brokerages, which in general assist in the

purchase and sale of stocks, bonds, and mutual funds. However some firms operate as

both brokerages and investment banks; this includes some of the best known financial

services firms in the world.

More commonly used today to characterize what was traditionally termed "investment

banking is sells side." This is trading securities for cash or securities (i.e., facilitating

transactions, market-making), or the promotion of securities (i.e. underwriting, research,

etc.).

In the strictest definition, investment banking is the raising of funds, both in debt and

equity, and the division handling this in an investment bank is often called the

"Investment Banking Division" (IBD).

The professional management of various securities (shares, bonds etc) and other assets

(e.g. real estate), to meet specified investment goals for the benefit of the investors.

Investors may be institutions (insurance companies, pension funds, corporations etc.)

FUNCTIONS:

The primary function of an investment bank is buying and selling products both on

behalf of the bank's clients and also for the bank itself. Banks undertake risk through

proprietary trading, done by a special set of traders who do not interface with clients and

through Principal Risk.

Risk undertaken by a trader after he or she buys or sells a product to a client and does

not hedge his or her total exposure. Banks seek to maximize profitability for a given

amount of risk on their balance sheet.

When helping a company to raise money, an investment bank provides three primary

functions for its clients:

1. Investigation

A company that desires to raise money will approach an investment banking firm for its

assistance. From that point on, that investment banking firm is known as the manager or lead

investment bank in the process. The manager will provide two investigations, or type of

analyses, for its client:

A. Legal Analysis - Since a security is being sold, the security must first be created. Most of

us think of a bond or a common stock is being merely a certificate. In reality, the certificates

are evidence of a legal document that defines the rights of the security holder and the rights

of the company. A bond contract, for example, may easily be 100 pages or longer. The

investment bank's staff attorneys will construct the bond or stock agreement and submit it to

the Securities Exchange Commission (SEC) for its approval. The SEC will ensure that all

relevant financial details are being disclosed to prospective investors and will authorize the

issue for sale.

B. Market Analysis - The investment banker will then determine the fair price to be placed on

the securities. In the case of bonds, the investment banker will recommend an interest rate

that must be paid in order to achieve an acceptable trade-off: a rate high enough to attract

investors and low enough to be in the company's best interest.

2. Underwriting

To underwrite something means "to assume the risk of loss". In this case, the company that is

issuing new shares needs to be assured that it will raise the amount of money necessary. It

does not want to take the chance that only part of the available shares will be sold and the

company will raise only part of the necessary funds. The investment banker assumes this risk

by underwriting the securities offering. In a typical underwriting, the investment banker

underwrites the issue by buying the entire block of securities at a discounted price from the

company. The investment bank will then mark-up the securities to the full retail price and try

to sell the securities to the investing public.

Investment banking firms will place their own capital at risk by using their own money to

buy the issue. In addition, it will frequently borrow money from commercial banks to raise

part of the funds necessary for the purchase. Even then though, the investment bank may not

have enough money to bad the entire issue or, perhaps, the bank may not want to assume this

much risk. After all, if stock prices fall during the period of the sale, the investment bank will

be forced to sell the stock at the lower price, perhaps even taking a loss on the transaction. So

the investment bank may reduce its risk by inviting other investment banks to participate in

the underwriting. Let's assume that four other investment banks are invited to participate in

the process by buying part of the securities from the issuing firm. These four firms plus the

manager are referred to as the underwriting syndicate.

3. Selling

Each of the investment banks will likely have its own sales force. However, additional

brokerage firms may be invited to help sell the issue in return for a commission on the sale.

These firms may easily number in the dozens for a large issue. Collectively, these brokerage

firms are known as the selling group.

RECENT EVOLUTION OF THE BUSINESS

Investment banking is one of the most global industries and is hence continuously

challenged to respond to new developments and innovation in the global financial

markets. Throughout the history of investment banking,

Many have theorized that all investment banking products and services would be

commoditized.

New products with higher margins are constantly invented and manufactured by bankers

in hopes of winning over clients and developing trading know-how in new markets.

However, since these can usually not be patented or copyrighted, they are very often

copied quickly by competing banks, pushing down trading margins.

For example, trading bonds and equities for customers is not a commodity business, but

structuring and trading derivatives is highly profitable. Each OTC contract has to be

uniquely structured and could involve complex pay-off and risk profiles.

Listed option contracts are traded through major exchanges, such as the CBOE, and are

almost as commoditized as general equity securities.

Investment banking is a particular banking system that allows customers to invest their money

directly or indirectly and also helps companies, government and individual raise fund by means

of bond selling, security sales, mergers and acquisitions and issuing of IPO. Investment banking

gives both the learned and the novice in the investment industry the opportunity to maximize

better dividend of their business or property by way of mergers and acquisitions.

Investment banking helps to boost the economy of the commercial sections of the society in

other words they create more opportunity for both the employed and unemployed ones to raise

capital and make profit.

They also help boost the financial security of a country from possible financial drop down. Every

economy that wants to have a growing financial status must require the services of an investment

banking.

POSSIBLE CONFLICTS OF INTERESTS

Potential conflicts of interest may arise between different parts of a bank, creating the

potential for financial movements that could be market manipulation. Authorities that

regulate investment banking require that banks impose a Chinese wall which

Prohibits communication between investment banking on one side and research and

equities on the other.

Many investment banks also own retail brokerages. Also during the 1990s, some retail

brokerages sold consumers securities which did not meet their stated risk profile.

This behavior may have led to investment banking business or even sales of surplus

shares during a public offering to keep public perception of the stock favorable.

Since investment banks engage heavily in trading for their own account, there is always

the temptation or possibility that they might engage in some form of front running.

Investment banks are social institutions. They are custodians and trustees of the publics money

and promoting national interestsstrengthening the sovereignty of our state technological up-

gradation and reduction of asset distributional inequitiesmust be explicit objectives of their

business strategy.

These objectives will not be unintentionally, automatically achieved by profit maximization. A

strategy has to be crafted which deliberately synthesizes financial viability and profitability

concerns with the concern for safeguarding national sovereignty and promoting national

development.

The investment bank is a financial institution that helps corporate organizations, company and

individual persons to raise enough capital to invest in their projects. Investment banking is all

about money and security trading, turning the paper works into real money. They also helps to

advice you on the proper kind of investment to invest your money into at the right time, in other

words they give professional advice on when to issue a sell or buy request for stocks, bonds and

securities, or better still invest the money for you if given the veto power.

List of investment banks

Standard Bank

Societe Generale

Noble Bank

HSBC

Piper Jaffray

Lincoln Partners

Royal bank Of Canada

Toronto Dominion

Robertson Stephens

OCBC

Bank of Montreal

Bank of Nova Scotia

Close Brothers Group

Fidelity International

Investment banking Duties.

Invest your money: Unlike the commercial banks that helps you to invest your money directly

where you deposit and withdraw money; the investment banks indirectly helps you invest your

money in a chosen market, though this may not be done directly but you would surely get a

maximum returns on your securities. After Gramm-Leach-Bliley Act in 1999, the investment

bank and commercial bank in the US can be incorporated thereby giving them more rooms for

many services. Though the major duties of the investment bank is to offer viable and reliable

advice on how to invest your money properly, buying and selling of acquisitions and trading on

stocks and bonds.

Sales of company stocks: Another duty of investment banking is the sales of company shares

and bond in order to raise funds and capital for government, corporations, companies and

individuals. This is to aid the corporation to raise enough capital funds for the executions of

projects and acquire more property for business.

Buy securities: They also help corporate bodies to buy shares which they believe have a good

value and have a ready and standby buyer whom would make a higher bargain. They act more or

less like the stock broker when it comes to buying and selling of shares. These securities when

traded could help the company in raising more capital.

Managing assets and investment portfolios: Investment banking also helps to manage your

assets. As a corporate body or even a business man, you need the services of an investment bank

to help you in the management of your assets, properties and finance. In a growing business

where more of the finance comes from either the public or banks, there is a higher need of an

investment banks to do the proper management of both the assets and finance.

Offer good financial advice: One of the functions of a good investment banker is to offer a

good and profitable financial advice to clients. This professional advice requires proper research

on when to issue shares to the public in order to raise funds, when not to issue public shares and

also when to acquire a merger. All these and more are the professional duties of an investment

banker. Though there is no 100% assurance that with an investment bank you would get the best

deal, but they would actually help to aid you in getting a better and fairer deal especially on

merger acquisitions.

Employment opportunity in investment banks:

There are so many job opportunities in the investment banks industry due to its wide range of

services and product. You can apply to any investment bank around you if you have the

required qualifications. This includes the following:

Education: The investment industry is a very competitive field of and anyone who wish to get a

job as an investment banker or other job positions in the investment must at least have university

degree, this will give you added advantage over other persons pursuing the same carrier

opportunity.

Good with mathematics: Another added would be having additional knowledge of statistics

and mathematics to secure a job in the investment banking industry.

Know your spreadsheet: This would be very important especially if you are not a degree

holder, but it would be advisable to get an MBA certificate after your internship in the industry.

Be ready to move to NY: If youre considering a carrier in the investment bank and you are

residing in America, be ready to move to NY as most of the major investment banks are in NY.

Experience: Having an experience at least with any other financial institutions would be a great

advantage. Most of the big names in the investment banking sectors prefer to offer job post to

people whom they think are already trained in the financial sector.

Skills: Most investment banking jobs would take a substantial amount of your time and effort,

so a proficient skills knowing what youre doing and liking what you do would take you a long

way in the sector.

Communications: Having strong communication ability is another skill that the investment

banks do look out for when hiring someone for an employment.

Carrier as an investment banker could be very lucrative if the economy is on the good side, but

you could be unemployed if there is a slum in the economy. But this is actually a very good

carrier to pursue because it pays high.

INVESTMENT BANKER

Investment bankers advise their clients on high level issues of financial organization. They

manage the issuance of bonds, recommend and execute strategies for taking over and merging

with other companies, and handle selling a companys stock to the public. The work thus

involves lots of financial analysis, and a strong background in finance and economics is a

necessity. Personal and strategic skills are vital to investment bankers as well, for they serve as

strategists for their clients, helping them develop their financial plans as well as implement them.

At the professions highest level, investment bankers serve as crucial figures in the shaping of

the American and world economies, managing mergers of multibillion-dollar corporations and

handling the privatization of government assets around the world. All this is time consuming,

and investment bankers work long hours. Work weeks of 70 hours or more are common, and all

night sessions before deals close are the rule rather than the exception. Still, the work is

extremely interesting, and those who stay in the profession report high levels of job satisfaction.

Investment bankers spend large amounts of time traveling, to pitch ideas to prospective and

current clients or to examine the facilities of companies being purchased by their clients. In the

office, they spend their time developing strategies to pitch to clients, preparing financial analyses

and documents, or working with the sales forces of their banks in selling the bonds and stocks

which are created by the investment-banking departments activities.

Most commonly, investment bankers who leave the profession go on to financial jobs in-house

with a client of their former banking firm, as financial officers and analysts. It is also not

uncommon for bankers to move on to management consulting, a field which demands many

similar skills. Some bankers get law degrees and become specialists in financial and corporate

law, while lawyers sometimes leave their firms to become investment bankers. Bankers, who

have become sufficiently established, with clients who trust them and reputations for expertise in

their fields, can become entrepreneurs, leaving their firms to set up their own investment banks.

Credit Suisse

In its Investment Banking business, Credit Suisse offers securities products and financial

advisory services to corporations, governments and institutional investors.

Client Offering

We bridge the gap between ideas and action:

We offer a comprehensive suite of products and services managed by accomplished

professionals who exchange ideas and insights on our clients behalf. Many of the worlds

preeminent institutions, businesses, asset managers, hedge funds and governments have

benefited from our expertise. Our investment banking specialists can help you solve your

most challenging problems and capture new opportunities wherever you are in the world.

Research

Research is at the heart of Credit Suisses client offering, and our commitment to exceptional

thought leadership and truly global coverage has never wavered. Our market-leading teams

include strategists, economists, fixed income product analysts and equity sector analysts. Our

macro teams offer insightful top-down forecasting and analysis, while our product and sector

teams provide proprietary insights across asset classes. These groups work in tandem to

provide clients with unique investment intelligence and seamless access to our global views.

Credit Suisse Research Institute

The Credit Suisse Research Institute identifies and provides insights on global themes and

trends. The objective of the Research Institute is to provide our clients with leading-edge

insights by leveraging internal and external expertise, thus reinforcing our integrated global

bank approach.

Investment Solutions

Credit Suisses Investment Solutions Group provides clients with tools and consultative

services to enhance their investment processes. A co-ordinate approach to our proprietary,

market-leading data and analytics products allows us to add value and provide scale in many

areas, including fundamental and quantitative analysis, portfolio reviews, as well as pre- and

post-trade analytics.

Credit Suisse PLUS Analytics

EDGE

HOLT

RAVE

PEERS

Quantitative Services

Global Indices

Credit Suisse provides a comprehensive family of cross-asset tradable indices that give our

clients access to algorithmic and customized strategies as well as a set of benchmark indices

that allow investors to perform relative value analysis and track market performance.

We cover a range of asset classes, including regional and global Equity, Fixed Income,

Commodities, Hybrids and FX. Combined with the power and flexibility of our web-based

analytical tools, we can help our clients more effectively scrutinize the markets.

Macro Research

Credit Suisses Street-leading macro research team offers high-level insights and thematic trends

across world markets as well as timely commentary about political events in an ever-changing

world. Our macro analysts are recognized for their detailed and thoughtful analysis of economic

indicators, the accuracy of their forecasts, as well as their insights into the implications of

government policies.

BARCLAYS INVESTMENT BANKING

Investment Banking provides comprehensive financial advisory, capital raising, financing and

risk management services to corporations, governments and financial institutions worldwide.

It takes an integrated approach to client coverage, providing you with access to bankers who

have industry and geography specific expertise across all investment banking products.

Corporate Finance

Corporate Finance creates sophisticated strategies for clients corporate finance needs. Our

banking structure leverages the expertise of bankers with industry specific and geographic

expertise across all of Barclays' products to provide clients with the most informed strategic

advice and comprehensive financial solutions. Our industry coverage groups include:

Communications

Consumer

Financial Institutions

Financial Sponsors

Healthcare

Industrial

Media

Natural Resources

Power

Real Estate

Retail

Technology

Structured Trade and Export Finance.

Global Finance and Risk Solutions:

Equity Capital Markets

Barclays provides you with a full range of capabilities from IPOs to private equity transactions.

We work with bankers to originate, structure and market equity and equity-linked securities.

Debt Capital Markets

Ranking among the top underwriters of fixed income securities, we develop tailored solutions to

your specific issues, and excel at guiding issuers and investors through difficult markets.

Leveraged Finance

We are a lead arranger and underwriter of debt capital in international and high yield markets

providing you with all aspects of debt financing.

Loans

Providing you with the coverage of a variety of specialist industry sectors, spanning corporate,

financial sponsors, project finance, structured trade, export finance and financial institutions.

Syndicated Lending

Barclays is a leader in the global syndicated loan market. We work alongside our investment

banking team to originate and execute a wide variety of financings.

Mergers & Acquitions.

Barclays global Mergers and Acquisitions (M&A) group delivers strategic advisory services

to companies worldwide. Our capabilities cover the entire spectrum of strategic alternatives

available to clients, including acquisitions, pestitures, restructurings, leveraged buyouts,

takeover defence, special committee assignments and exclusive sales.

Corporate investment banker

Corporate investment bankers provide a range of financial services to companies, institutions

and governments. They manage corporate, strategic and financial opportunities, including

mergers, acquisitions, bonds and shares, lending, privatizations, and initial public offerings

(IPOs). Corporate investment bankers also advise and lead management buyouts, raise

capital, provide strategic advice to clients, and identify and secure new deals.

Investment banking is frequently used as a catch-all term. In reality, banks are made up of

many divisions and investment bankers perform a range of different functions within them.

Traditionally, investment banking encompasses corporate finance, as well as mergers and

acquisitions (M&A). The definition has blurred in recent years and may also include trading

bonds and shares.

Typical work activities:

The main role of a corporate investment banker is to advise companies, institutions and

governments on how to achieve their financial goals and implement long and short-term

financial plans. Corporate investment bankers work in dedicated teams, focusing on specific

transactions or market sectors. They also work alongside other related professionals such as

lawyers and accountants. A typical corporate finance deal involves two stages:

Origination: assessing a deal's desirability, which is sometimes an innovative idea from the

bank rather than the client. Financial models are used to simulate possible outcomes. This

requires a deep understanding of a sector.

Execution: structuring and negotiating the detailed terms of a deal, often in liaison with

other professionals.

Typical activities on a day-to-day basis include:

Thoroughly researching market conditions and developments.

Identifying new business opportunities.

Many investment banks deal in three main areas:

Mergers and acquisitions: assisting clients with expansion to increase profitability,

safeguard market position, diversify, and so on. Corporate investment bankers manage the

transaction process, assessing the target organization and the impact of the deal. This

involves knowledge of legal and regulatory issues, in addition to sound financial knowledge

and an in-depth understanding of the client's industry.

Debt capital markets: working with lenders such as financial institutions, agencies and

public and private companies to support client debt. This includes restructuring debt,

refinancing debt and raising new debt.

Equity capital markets: advising clients on how much capital to raise, from where and

when.

Although dealing with different, specific business areas, project teams liaise with one another

during the two phases of a deal in order to obtain relevant specialist information and market

intelligence.

Investment Banking is the leading Nordic Merger & Acquisitions (M&A) advisor. We advise on

mergers, acquisitions, divestments, spin-offs and public offers. We handle transactions in a

diverse range of industries and have sector experts to provide our customers with deep industry

insight.

Our M&A service offerings include:

Analysis and evaluation of businesses for sale

Identification and screening of potential buyers or target companies

Fairness opinions

Advice on shareholder value enhancement initiatives and other strategic advice

Management of the entire transaction process from initial analysis to final payment

Advice regarding transaction structure

Deal and negotiation tactics.

TD Securities in Investment Banking

Investment Banking provides a full range of financial advisory and capital-raising services to

corporate and institutional clients on transactions with a North American component. We work

closely with our clients to understand their needs. Then we work as an integrated team to bring

unique solutions to bear on complex issues over time. We excel at building long-term client

relationships and executing flawlessly.

Investment Banking is organized into areas of expertise: product, regional and industry.

Each area is critical to ensuring our clients receive the right strategic advice and the capital they

need to realize their objectives.

The Equity Capital Markets Group at TD Securities Inc. is a leader in the origination, structuring,

marketing and execution of all equity and equity-related products. The team works closely with

Investment Banking, Institutional Sales and Trading and Research professionals to deliver

tailored solutions for our clients.

Product Expertise

TD Securities Inc. has book run transactions in a wide range of sectors and products with

underwriting activities ranging from initial public offerings and follow-on offerings to

monetizations and private placements.

Areas of product expertise include:

Common equity and income trust financings

Convertible securities and exchangeable debentures

Warrants and other equity derivatives

Preferred shares

Structured retail products

TD Securities is a leading arranger and underwriter of corporate credit products in the Canadian

and U.S. credit capital markets.

Corporate and Investment Banking

Societe General Corporate & Investment Banking, one of the three pillar businesses of the

Societe General Group, is present in all major markets, with close to 10,000 employees in more

than 34 countries across Europe, the Americas and Asia-Pacific. It is centred on the sound

principles of serving the long-term needs of our clients, sustaining growth by building on our key

strengths, and applying rigorous risk management across our activities.

Investment Banking

Providing clients with strategic advisory and capital raising solutions

Building on our strategic dialogue with clients and on strong relationships based on trust, we

offer a global advisory approach from M&A to capital management. We house top-tier debt and

equity capital market access under one roof and provide integrated and tailor-made capital

raising solutions to accompany our clients strategy, drawing on our leading positions in Debt

and Equity Capital Markets.

Investment and risk management solutions for investors

Our integrated cross-asset platform provides seamless access to global markets across all asset

classes (equities, fixed income & currencies, commodities and alternative investments - from

cash to derivatives). We develop advisory, investment and risk management solutions for the

specific needs of each investor, supported by our number one worldwide equity derivatives

franchise and leading positions in fixed income, commodities and research.

Integrated capital raising, financing and hedging solutions for issuers

Our global financing solutions for issuers encompass debt to equity capital raising, market

leading expertise in structured finance (acquisitions, export, natural resources, infrastructure &

asset based, media & telecom, real estate & lodging).

CASE STUDY

Samriddhi Investment in Gramco Infratech

In August 2013, Intellecaps investment banking practice announced the successful closure of

Series A funding for Gramco Infratech Private Limited. As sole advisors for this transaction,

Intellecap raised INR 15 Cr from the Samriddhi Fund, an impact investor focused on low

income states of India.

Gramco, a company based in Indore, aims to improve farmer incomes through improved

warehousing infrastructure, better financing solutions and stronger market linkages. It offers

a complete bouquet of services to farmers that include storage facilities for agri-commodities,

supply of agri-inputs, commodity financing, contract farming/seed production, fully

automated handling/cleaning/grading and procurement of agri-commodities.

Gramco, incorporated in 2010, currently owns two multi service agri-warehousing facilities

near Indore, and plans to set-up 11 more by FY 2015. It aims to increase the number of

farmers served from around 700 to 10,000 by 2015.

Intellecap worked with the senior management of the Company to help evolve their business

plan in the rapidly changing agri-commodity supply chain industry. Gramco has been able to

devise a growth strategy focused on building the right mix of owned and leased warehouses

to support a variety of business verticals. It balances tight operational controls, geographical

scale, financing constraints and a commitment to serve customers.

The investor outreach process managed by Intellecap culminated in the deal with Samridhi

Fund. The Samridhi Fund was launched as a private sector development programme by

Department for International Development (DFID) of UK Government in partnership with

Small Industries Development Bank of India (SIDBI). The structured transaction will bring

on board an investor who is aligned with the Companys mission and is cognizant of the

challenges that early stage companies face, especially in Indias agribusiness sector.

Norwest Investment in Nationwide Primary Healthcare

Nationwide Primary Healthcare provides personalised General Practitioner (GP) services and

paediatric care to individuals, families, and corporate groups in India. The Company's primary

focus is on proactive management of every day ailments and effectively managing chronic

conditions. The Company plans to open 1,500 clinics across India over the next 5 years,

revolutionising primary healthcare in the country.

In August 2012, Intellecap facilitated an investment of USD 5 million from Norwest Venture

Partners into NationWide. A major part of the current investment will be utilized to rapidly expand

operations over the next 18 months and set up a total of 120 clinics in Bangalore. Norwest is a

prominent Venture Capital firm headquartered in the U.S.

The raising of this capital for Nationwide was particularly challenging and innovatine since the GP

model is a new business model in India. Nationwide was also a Sankalp 2012 finalist in the

Healthcare, Water & Sanitation segment.

Europes debt crisis risks putting investment banks out of business.

Europes failure to resolve its sovereign-debt crisis will force investment-banking chiefs in the

region to consider shuttering entire businesses rather than rely on piecemeal job reductions to

revive profit.

Deal making fees may drop 25% this year from 2009, when the crisis began in Greece, research

firm Freeman & Co. estimates. European banks, including UBS AG and Barclays Plc, have cut

about 172,000 positions since then, according to data compiled by Bloomberg, the same strategy

they used after Lehman Brothers Holdings Inc. collapsed in 2008.

Investment banks have to shrink and do more than cut a little bit here and there

The game plan wont work again as rising capital requirements and declining business alter the

investment-banking landscape, investors and analysts say. New rules will reduce return on equity

by 6 percentage points from about 14% in the first half of 2011, according to consulting firm

Bain & Co. Banks that relied on record low interest rates and a flood of cheap funding from the

European Central Bank to delay deciding which units to close will be compelled to make

choices.

Investment banks have to shrink and do more than cut a little bit here and there, said Lutz

Roehmeyer, who helps oversee 10-billion euros (US$12.5-billion) at Landesbank Berlin

Investment in Berlin. Theres too much politics and too little economics going on. They want to

keep certain businesses for as long as possible.

Some firms are cutting deeper. UBS, Switzerlands largest lender, is reducing its fixed-income

operations to focus on wealth management because of stricter capital requirements imposed by

regulators and a weak revenue outlook linked to the continuing debt crisis. Still, even for all the

job cuts, most European investment banks havent made significant changes since the upheaval

that accompanied the collapse of Lehman Brothers, said Joao Soars, a partner at Bain in London.

RESEARCH AREAS

Most major investment banks employ a research staff that performs the risk, economic, and

financial analysis used to support internal operations, from acquisitions and mergers to

formulating trading positions in world, US, and regional markets. The profitability of an

investment bank is directly related to the quality of its research analysis. Researchers in

investment banking usually have strong math skills in stochastic calculus, differential equations,

or other advanced mathematical fields. They have also taken classes in advanced financial theory

like bond valuation and options pricing.

Investment banking is an area of finance in which banks assist various companies and

governmental entities with their financial needs. Investment banks assemble and supply the

capital needed by business to expand, merge and acquire other businesses. They are

intermediaries between corporations issuing new debt and equity securities and investors that

buy the securities. They may also create markets for new securities, facilitate trades between

buyers and sellers or perform other financial services, such as market and acquisition advice and

market analysis. The major areas of investment banking include corporate finance, sales, trading,

and research. A large part of investment banking is simply developing the relationships with

potential buyers of new securities and with corporations or governments that want to issue new

securities or acquire other companies. The larger investment banks work on a global level with a

number of foreign investment banks that participate in the US market.

Investment banks are well known for the long hours they require from their entry-level workers

as well as a somewhat stressful work environment. They are often under great pressure to meet

deadlines and generate new business. This is often balanced, however, by large salaries. Some

jobs require extensive travel, especially in corporate finance and mergers and acquisitions

departments. Most investment banks strongly emphasize teamwork, and as such they often

promote socialization among the staff members. Because customer relations are so important,

investment bankers often get to take their clients to exclusive restaurants, sporting events, and

other exclusive places.

CONCLUSION

Producing a gargantuan report into the prospects for the investment banking industry seems to be

the de facto thing to do this year. J.P Morgans research team has done so, as has SocGens and

now German bank Berenberg has produced a 128-page report after initiating coverage of UBS,

Credit Suisse and Deutsche Bank.

Investment banks, have expanded into too big to fail behemoths, hard-wired into the financial

system and cover as many product areas and asset classes as they possibly can. This is a mistake;

the all things to all people strategy is paralysing the banks, says Berenberg. In an ideal world,

those investment banks that are part of a larger financial group should separate, while others

need to focus on their core competencies. Unfortunately, neither of these seems likely.

1. Investment banks need to separate, or shrink, but are terrified to do so

2. Revenues will be capped at 2005 levels

3. Premier League syndrome means that comp ratios will stay high

4. Investment banks employees have been the main beneficiaries of growth

5. Bonuses should be used as the first buffer in the event of a loss

6. OTC derivatives reform could hit revenues by 25%

7. There are three options for reducing costs by 30% none of them are good

8. J.P Morgan and Deutsche Bank have the most productive employees.

BIBLIOGRAPHY

Books Referred:

Investment Banking, by Michael Fluorite

Investment Banks & Private Equity, by David Stowell

Dictionary of Finance, Investment and Banking, by Erik Banks

The Business of Investment Banking: A Comprehensive Overview, by K

Thomas Law.

Websites Referred:

WWW.google.com

WWW.Yahoo.com

WWW.Investmentbanking.com

You might also like

- Depository Final ProjectDocument44 pagesDepository Final ProjectShweta Sawant100% (1)

- Custumer Expectation From Insurance Policy at HdfcslicDocument105 pagesCustumer Expectation From Insurance Policy at HdfcslicManoj JuyalNo ratings yet

- ICICI Lombard Project ReportDocument92 pagesICICI Lombard Project ReportShweta SawantNo ratings yet

- Mcom Derivatives.Document40 pagesMcom Derivatives.Shweta Sawant0% (1)

- RM ProjectDocument46 pagesRM ProjectShweta SawantNo ratings yet

- MortgageDocument8 pagesMortgageShweta SawantNo ratings yet

- Original Eco..Document37 pagesOriginal Eco..Shweta SawantNo ratings yet

- Mergers and AmalgmationsDocument38 pagesMergers and AmalgmationsShweta SawantNo ratings yet

- Study On Performace of Imf With Special Reference To Other International OrganizationDocument51 pagesStudy On Performace of Imf With Special Reference To Other International OrganizationShweta SawantNo ratings yet

- Investment Management Part 2Document44 pagesInvestment Management Part 2Shweta SawantNo ratings yet

- Study On Performace of Imf With Special Reference To Other International OrganizationDocument51 pagesStudy On Performace of Imf With Special Reference To Other International OrganizationShweta SawantNo ratings yet

- Derivatives .Document91 pagesDerivatives .Shweta SawantNo ratings yet

- Regulators in Fs-OriginalDocument54 pagesRegulators in Fs-OriginalShweta SawantNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- ILO and Social Security (GROUP B)Document13 pagesILO and Social Security (GROUP B)Dhiren VairagadeNo ratings yet

- Golin Grammar-Texts-Dictionary (New Guinean Language)Document225 pagesGolin Grammar-Texts-Dictionary (New Guinean Language)amoyil422No ratings yet

- Science 10-2nd Periodical Test 2018-19Document2 pagesScience 10-2nd Periodical Test 2018-19Emiliano Dela Cruz100% (3)

- Sigma Chi Foundation - 2016 Annual ReportDocument35 pagesSigma Chi Foundation - 2016 Annual ReportWes HoltsclawNo ratings yet

- Explaining ADHD To TeachersDocument1 pageExplaining ADHD To TeachersChris100% (2)

- Tes 1 KunciDocument5 pagesTes 1 Kuncieko riyadiNo ratings yet

- My PDSDocument16 pagesMy PDSRosielyn Fano CatubigNo ratings yet

- Communication Tourism PDFDocument2 pagesCommunication Tourism PDFShane0% (1)

- Improve Your Social Skills With Soft And Hard TechniquesDocument26 pagesImprove Your Social Skills With Soft And Hard TechniquesEarlkenneth NavarroNo ratings yet

- BCIC General Holiday List 2011Document4 pagesBCIC General Holiday List 2011Srikanth DLNo ratings yet

- GCSE Bearings: Measuring Bearings Test Your UnderstandingDocument5 pagesGCSE Bearings: Measuring Bearings Test Your UnderstandingSamuel KalemboNo ratings yet

- Secondary Sources Works CitedDocument7 pagesSecondary Sources Works CitedJacquelineNo ratings yet

- Aladdin and the magical lampDocument4 pagesAladdin and the magical lampMargie Roselle Opay0% (1)

- BICON Prysmian Cable Cleats Selection ChartDocument1 pageBICON Prysmian Cable Cleats Selection ChartMacobNo ratings yet

- 4AD15ME053Document25 pages4AD15ME053Yàshánk GøwdàNo ratings yet

- Abbreviations (Kısaltmalar)Document4 pagesAbbreviations (Kısaltmalar)ozguncrl1No ratings yet

- Page 17 - Word Connection, LiaisonsDocument2 pagesPage 17 - Word Connection, Liaisonsstarskyhutch0% (1)

- Architectural PlateDocument3 pagesArchitectural PlateRiza CorpuzNo ratings yet

- The Insanity DefenseDocument3 pagesThe Insanity DefenseDr. Celeste Fabrie100% (2)

- Offer Letter for Tele Sales ExecutiveDocument3 pagesOffer Letter for Tele Sales Executivemamatha vemulaNo ratings yet

- Microeconomics Study Guide for CA-CMA-CS ExamDocument14 pagesMicroeconomics Study Guide for CA-CMA-CS ExamCA Suman Gadamsetti75% (4)

- Legal validity of minor's contracts under Indian lawDocument8 pagesLegal validity of minor's contracts under Indian lawLakshmi Narayan RNo ratings yet

- Cost Allocation Methods & Activity-Based Costing ExplainedDocument53 pagesCost Allocation Methods & Activity-Based Costing ExplainedNitish SharmaNo ratings yet

- McLeod Architecture or RevolutionDocument17 pagesMcLeod Architecture or RevolutionBen Tucker100% (1)

- 1120 Assessment 1A - Self-Assessment and Life GoalDocument3 pages1120 Assessment 1A - Self-Assessment and Life GoalLia LeNo ratings yet

- How To Use This Engine Repair Manual: General InformationDocument3 pagesHow To Use This Engine Repair Manual: General InformationHenry SilvaNo ratings yet

- Digi-Notes-Maths - Number-System-14-04-2017 PDFDocument9 pagesDigi-Notes-Maths - Number-System-14-04-2017 PDFMayank kumarNo ratings yet

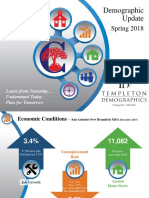

- Comal ISD ReportDocument26 pagesComal ISD ReportMariah MedinaNo ratings yet

- 2013 Gerber CatalogDocument84 pages2013 Gerber CatalogMario LopezNo ratings yet

- Full Discography List at Wrathem (Dot) ComDocument38 pagesFull Discography List at Wrathem (Dot) ComwrathemNo ratings yet